One-week financing express | 24 projects have been invested; the total disclosed financing is about 6.58 billion US dollars (3.13-3.19)

According to Odaily’s incomplete statistics, a total of 24 domestic and overseas blockchain financing incidents were announced from March 13 to March 19, a decrease from last week’s data. There is a significant increase. The main reason is that the payment giant Stripe completed the I round of financing of US$6.5 billion at a valuation of US$50 billion, and the total financing of the remaining projects was about US$80 million.

The following are specific financing events (Note: 1. Ranked according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

The following are specific financing events (Note: 1. Ranked according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

On March 16, according to official news, the payment giant Stripe announced the completion of a US$6.5 billion Series I financing at a valuation of US$50 billion, a16z, Baillie Gifford, Founders Fund, General Catalyst, MSD Partners, Thrive Capital, GIC, Goldman Sachs, Temasek, etc. Participate in voting. Goldman Sachs acted as the exclusive placement agent for the transaction and JPMorgan Chase served as financial advisor. The financing is valued at about 47% below its 2021 high of $95 billion.

Stripe said the funding round will be used to provide liquidity to former and current employees and to resolve employee withholding tax obligations related to equity incentives. Stripe does not need this capital to operate its business.

Web3 digital banking and payments company Ibanera closes $18.5 million in funding

On March 15, Ibanera, a digital bank and payment company focused on providing embedded payment services for the Web3 platform, announced that it had completed a financing of US$18.5 million at a discounted valuation of US$195 million. European payment company Emerchantpay Limited participated in the investment. Ibanera's payment architecture can effectively support the next generation of financial services based on distributed ledger technology, mainly covering cross-border payment, currency exchange, mobile banking and merchant services, providing security support for enterprises engaged in digital assets and NFT business, while also eliminating the need for Web3 complexity. It is reported that Ibanera launched a digital banking and payment platform in the fourth quarter of last year, which can be used to support banking services such as account funds, payment distribution and collection. (woodtv)

Digital fashion company DressX closes $15 million Series A round led by Greenfield

On March 14, digital fashion company DressX completed a US$15 million Series A financing, led by crypto venture capital firm Greenfield, with participation from Slow Ventures, The Artemis Fund, Red Dao, and Warner Music. This round of financing ended at the end of February.

The funding will be used in part to improve the interoperability of its digital fashion assets, as well as improve the performance of its app and NFT marketplace. DressX, which focuses on off-chain digital fashion pieces that can be showcased on platforms like Roblox and Instagram, launched its NFT marketplace and partnership with Crypto.com last March. NFTs sold on its marketplace can be digitally worn in augmented reality through the DressX app. (The Block)

Stablecoin issuer CNHC Group completes US$10 million A+ round of financing, led by KuCoin Ventures

On March 15, CNHC Group, the issuer of the stablecoin CNHC, completed a US$10 million A+ round of financing, led by KuCoin Ventures, with participation from Circle and IDG Capital. CNHC plans to use the proceeds to expand the use of its stablecoin, especially in the Asia-Pacific region. To achieve this goal, the company is moving its headquarters from the Cayman Islands to Hong Kong, China.

CNHC co-founder Joy Cham said that CNHC wants to be “part of the foundation and infrastructure of Hong Kong’s Web3 ecosystem” and will seek to list its stablecoin on more exchanges, including CEX and DEX, and expand its deposit and withdrawal services. To achieve this goal, CNHC also plans to hire more staff in departments such as operations, compliance and business development, Cham said. (The Block)

Web3 Game Studio Jungle Closes $6M Seed Round Co-led by Bitkraft and Framework Ventures

On March 13, Jungle, a Brazilian Web3 game studio, completed a $6 million seed round of financing, co-led by Bitkraft and Framework Ventures, Delphi Digital, Karatage, Fourth Revolution Capital, Monoceros, 32-Bit Ventures, Stateless Ventures, Snackclub and Norte Ventures and others participated in the investment. (The Block)

On March 15, Metalink, an NFT portfolio management and social platform, completed a $6 million seed round of financing. Guy Oseary, Gary Vaynerchuk, MoonPay CEO Ivan Soto-Wright, The Sandbox founder Sebastien Borget, and former Coinbase Chief Technology Officer Balaji Srinivasan , DJ Justin Blau, Social Capital, Arrington Capital, Sound Ventures, Gemini Frontier Fund, Dapper Labs' venture capital arm BallerVC and Genies' Human Ventures participated.

Metalink has also launched its mobile app, creating a purported token-gated space where NFT collectors can interact, aggregate announcements and track their portfolio performance. The app also plans to launch a trading feature later this year so users can buy, sell and exchange digital assets. (CoinDesk)

On March 13, South Korea's "virtual K-pop" metaverse company Afun Interactive announced the completion of a 7 billion won (approximately US$5.3 million) A-round bridge financing, with Shinhan Asset Management participating in the investment. It raised 10 billion won (about $7.6 million) from investors including CJ Investment, Company K Partners and CJ ENM.

Afun Interactive's goal is to become the leading metaverse company in South Korea. Its CEO, Dokyun Kwon, is passionate about virtual entertainment and the metaverse market. He hopes to use 3D content production technology to build a "virtual K-pop" with character IP. Currently, it has launched Virtual stars such as "Apoki" and "Lesha". (Techtimes)

On March 18, creator economy startup GigaStar completed a $4.8 million seed round of financing, with participation from DV Crypto VC, Tomsic Holdings, Nameless Ventures and Belvedere Strategic Capital.

It is reported that GigaStar uses blockchain technology to allow creators to obtain more innovative interactive methods, including fan incentives, potential long-term royalties, etc. Currently, GigaStar mainly supports YouTube creators and helps channels earn income by launching channel revenue tokens (CRT).

Blockchain insurtech startup Vitraya raises $4.1M Series A with participation from Xceedance

On March 15, blockchain insurtech startup Vitraya announced the completion of a $4.1 million Series A funding round, with participation from Xceedance and an unnamed investment consortium. Vitraya mainly uses artificial intelligence and blockchain technology to automate payment integrity, medical procedures and benefit management for insurance companies, helping hospitals/health care service providers, and insurance companies that provide health insurance products for consumers and businesses to achieve Real-time payments and claims settlement. (entrackr)

Startup Soul Wallet Closes $3M Seed Funding Round, Struck Crypto Participates

On March 16, Soul Wallet, a start-up company owned by the former product manager of ByteDance, completed a $3 million seed round of financing. Struck Crypto participated in the investment and will launch an online self-hosted Ethereum wallet based on ERC-4337. It is currently undergoing internal testing and is scheduled to go live in Q3 or Q4.

It is reported that Soul Wallet has participated in the Ethereum Research Grant (ETH Research Grant).

Bitcoin Decentralized Exchange Alex Completes $2.5M Funding, Trust Machines Participates

On March 14, Bitcoin decentralized exchange Alex completed a strategic round of financing of US$2.5 million, with Trust Machines and Gossamer Capital participating. In addition to decentralized exchanges, Alex also provides staking, yield farming, and launchpad services. Funds raised this time will be used to continue building decentralized finance within the Bitcoin ecosystem and grow the user community.

As previously reported, Alex raised a $5.8 million seed round in 2021, led by White Star Capital. Other backers include Cultur 3 and SeaX.

Infrastructure platform TeleportDAO completes $2.5 million seed round led by AppWorks and DefinanceX

On March 16, the Canadian blockchain infrastructure TeleportDAO announced the completion of a $2.5 million seed round of financing, led by AppWorks and DefinanceX, with participation from Quantstamp, Coinlist, Candaq Fintech Group, SNZ Holding Limited and Gate Labs. This round of financing will be used for product development and expanding the team.

Founded in February 2022, TeleportDAO is a decentralized infrastructure that connects blockchains together, helping developers build cross-chain applications. Currently, it has created a fully decentralized Bitcoin wrapper teleBTC and a trading platform TeleSwap on Polygon. TeleportDAO aims to scale to multiple EVM and non-EVM chains to become a trusted infrastructure for secure cross-chain interactions. (finsmes.com)

Blockchain infrastructure startup Smooth Labs closes $2M seed round led by NGC Ventures

On March 14, blockchain infrastructure startup Smooth Labs completed a $2 million seed round of financing, led by NGC Ventures, with participation from Cogitent Ventures, ArkStream Capital, and Ian Balina's Token Metrics.

The Smooth Network is currently under development and will launch a testnet in Q3. (The Block)

Web3 Networking Platform Entre Completes $1.6 Million Seed Round Led by Octane Fund

On March 14, Entre, a community-centric Web3 network platform, announced the completion of a $1.6 million seed round of financing, led by Octane Fund, Service Provider Capital, CreatorLed Ventures, Kube VC, Umami Capital, Dharmesh Shah (CTO of Hubspot) and some other angel investors. (streetinsider)

On March 14, Web3 start-up company Nealthy completed a pre-seed round of financing of US$1.3 million, with participation from DonGeraldo and others.

It is reported that Nealthy provides index tokens, which replicate the structure of classic trading platform trading funds (ETFs) by storing multiple digital assets on the chain, aiming to provide accessible and diversified exposure to digital assets, such as NFT blue chips ( The top ten NFT series by market capitalization) index token NFTS.

On March 17, Composable Corp, the development company behind the DeFi strategy protocol Blueberry Protocol, completed a $1.2 million seed round of financing, with participation from Ashbury Ventures, Alchemix, Multisig Ventures, and Pirata Capital. Composable key members said the funds will be used to grow the team and infrastructure.

Staging Labs Completes $1.1 Million Pre-Seed Funding, NGC Ventures and Others Participate

On March 15, Staging Labs, a provider of encrypted transaction security solutions, announced the completion of a $1.1 million Pre seed round of financing, The General Partnership, Flourish Ventures, NGC Ventures, AlphaGrep, Gangels, Kleiner Perkins, Greylock, and ConsensSys, Coinbase, Anchorage Digital , Chainalysis, Quicknode, Merkle Science, etc. participated in the investment. The company hopes to establish the same supervision and system protection in the traditional financial field in the encrypted world to resist fraud and fraud. (TechCrunch)

ShowMeta metaverse platform completes $ 840,000 in financing

On March 16, the ShowMeta metaverse platform announced on the social media platform that it has completed the first round of financing of US$840,000. The ShowMeta metaverse platform will enter the final round of testing to ensure the reliability and performance of the platform. Users who participate in the test will be rewarded with 100,000 tokens.

It is reported that the ShowMeta metaverse platform aims to provide users with a seamless game world.

Merit Circle Invests $750,000 in Web3 Game Platform Walker World

On March 14, Merit Circle, the blockchain game association, announced a partnership with the large-scale open world adventure and multiplayer game Walker World, and invested $750,000 in Walker World.

It is reported that Walker World is powered by Unreal Engine 5, which can provide a dynamic gaming experience through stunning high-definition graphics. The team is committed to providing games that integrate technologies such as AR, VR and blockchain.

Crypto wallet infrastructure startup Capsule completes undisclosed funding, led by a16z and Geometry

On March 14, crypto wallet infrastructure startup Capsule completed an undisclosed amount of financing, co-led by Andreessen Horowitz (through its accelerator Crypto Startup School) and Geometry, Spice Capital, Anchorage co-founder Diogo Monica and Nathan McCauley, Celo co-founder Rene Reinsberg and Marek Olszewski and Sommelier Finance co-founder Zaki Manian also participated. a16z’s CSS Accelerator program typically invests $500,000 in participating startups in exchange for a 7% equity stake. (The Block)

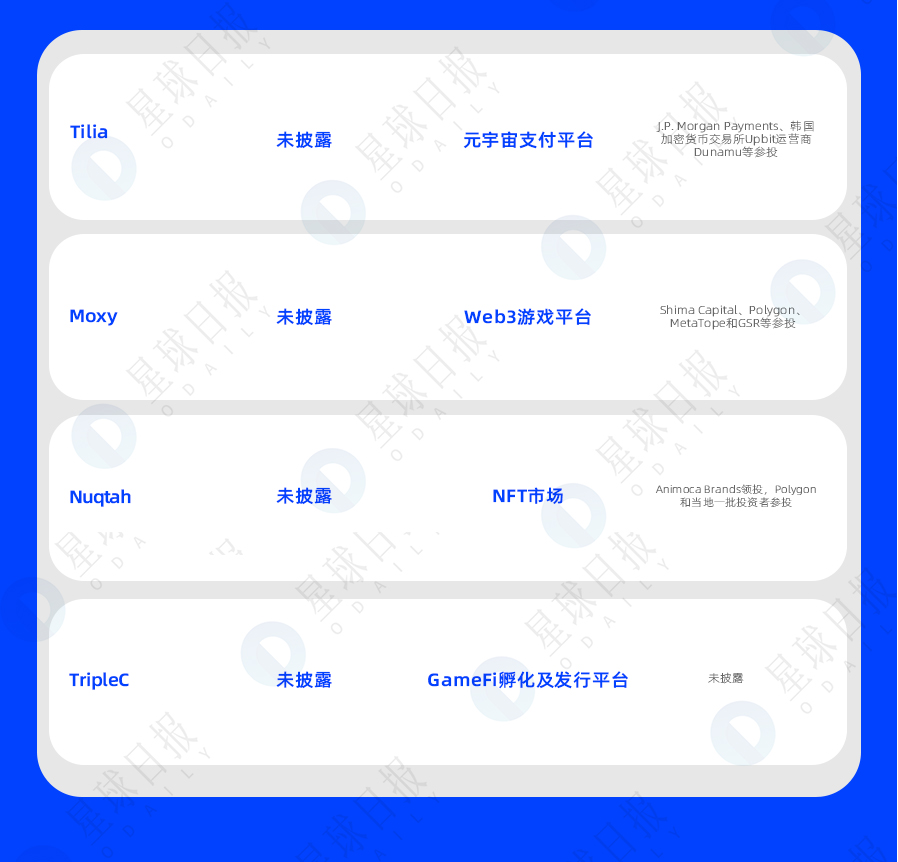

On March 14, Metaverse payment platform Tilia completed strategic financing, with participation from JP Morgan Payments, South Korean cryptocurrency exchange Upbit operator Dunamu, and others. It brings Tilia’s total funding to $22 million since it spun off from creator LindenLab in 2022. Tilia is working with JP Morgan Payments to enhance the capabilities of its entire processing platform, including offering more payments and payment methods, expanding payment currencies and supporting services. (TechCrunch)

On March 13, Moxy, a Web3 game platform, announced that it has completed over US$10 million in financing, with participation from Shima Capital, Polygon, MetaTope, and GSR.

Moxy is a Web3 game platform based on the FLOW blockchain. It helps e-sports players and other players to participate in the game and get incentives in a decentralized, secure and stable way. It also allows game developers to seamlessly create games based on game assets. NFT is used to promote the popularization of e-sports. In addition, Moxy also uses a unified digital wallet to participate in the game ecosystem to allow players to store cryptocurrencies and NFT.

Nolan Bushnell (founder of Atari), Lawrence Siegel (president of Sega Europe), and Tony Bickley (head of games for Sega Europe) have reportedly joined the Moxy team. (Blockonomi)

Saudi Arabian NFT marketplace Nuqtah completes seed round, led by Animoca Brands

On March 16, Nuqtah, Saudi Arabia’s first NFT market, announced the completion of its seed round of financing, led by Animoca Brands, and Polygon and a group of local investors participated in the investment, but the specific financing amount has not yet been disclosed. The company will use the new funds to expand its operations in product development, marketing, talent acquisition and other areas of the business over the next 12 months.

Nuqtah is the first NFT marketplace licensed by the Saudi Ministry of Communications and Information Technology and the Ministry of Investment. , business and user empowerment to unlock the Web3 market and open new opportunities for the region. (Animoca Brands)

On March 18, TripleC, the GameFi incubation and distribution platform, announced the completion of a new round of financing. The specific financing amount has not yet been disclosed.

It is reported that TripleC aims to incubate and publish Web 3 games, provide support for players through a one-stop platform integrating games, wallets, NFT trading markets, and SBT, and reward players in the form of digital assets. TripleC has signed cooperation agreements with world-renowned game development companies such as Century Games and Crystal Labs, and has also reached strategic cooperation with well-known cultural and entertainment companies such as Tezukasha and Tokyo Film.