The Metamorphosis of "Digital Gold": Analysis of 3 Application Expansion Schemes of Bitcoin

Original source: Okey Cloud Chain Research Institute

Original source: Okey Cloud Chain Research Institute

Original Author: Jiang Zhaosheng

However, compared with the many subversive application narratives brought about by Ethereum, Bitcoin's narrative in the encryption field is simple and unimaginative. But this situation is changing now: Since the launch of the Bitcoin NFT protocol Ordinals on December 14, 2022, the Bitcoin network has generated more than 300,000 NFTs in just a few months. The popularity of Ordinals NFT has given Bitcoin more practical use cases in addition to the payment storage function, and it has also drawn attention to the Bitcoin Layer 2 network that is expected to carry more applications. Like the real world, the Bitcoin application narrative seems to be ushering in its spring.

The Reasons and Basis for Bitcoin’s New Narrative

Today, it may be difficult for us to tell the cycle of the encryption industry, but its development is indeed clear. All crypto narratives start with Bitcoin. When the mysterious Satoshi Nakamoto released "Bitcoin: A Peer-to-Peer Electronic Cash System" in the cryptography mail group, the era of encryption enlightenment quietly started: the public began to get in touch with Bitcoin and gradually recognized the technical status of Bitcoin, and more Many people try to participate in this "social experiment" on cryptocurrencies and explore more possibilities beyond Bitcoin. It was at this stage that Bitcoin was given the title of "digital gold", making it a symbol of value in the encrypted world.

image description

Image source: Internet

Subsequently, whether it is Ethereum and smart contracts, which are different from Bitcoin in terms of creativity and productivity, they triggered the encryption industrial revolution from 2016 to 2019, rapidly expanding the scale of the industry, and more and more practitioners joined; or since 2020, accompanied by With the entry of institutional-level funds and the loose monetary policy on a global scale, on-chain innovations such as DeFi and NFT have broken the dimensional wall between the encrypted world and traditional finance. In the era, Bitcoin has always been the lowest and most solid source of consensus in the entire encryption world. The attribute of Bitcoin "digital gold" has also been repeatedly strengthened in this process, becoming an inescapable label.

Referring to Bitcoin as "digital gold" only clarifies its function of storing value, but ignores the possibility that it still has other scalable uses as a program. In fact, there are always people in the encryption world who are exploring the use cases of Bitcoin outside of payment storage scenarios.

1) Build new applications on the original Bitcoin chain. Due to the limitations of the scripting language, Bitcoin itself is not easy to program, nor can it run smart contracts, but some people still find a way to create applications on the Bitcoin main network. Whether it is Rare Pepes that appeared in 2016 or Ordinals today, it has proved to a certain extent the feasibility of building NFT and other applications on the original Bitcoin chain. However, Bitcoin NFT is like carving art on digital gold. It seems infinitely beautiful, but the problem of transaction lag and congestion caused by the limited space of Bitcoin blocks and insufficient scalability has not yet been resolved. The basic contradictions of building applications on the original Bitcoin chain still exist.

image description

Image source: ordinals.market

2) Enrich use cases by creating derivative bitcoin assets. In the past few years, developers have tried to transmit the high-quality liquidity of Bitcoin to other blockchain networks by creating derivative assets such as wBTC and renBTC, and have widely used them in many scenarios in the DeFi ecosystem. These derivative Bitcoin assets have indeed brought meaningful innovation traction in some cases, allowing Bitcoin's value influence to radiate to other blockchain networks, but these derivative assets are not real Bitcoin, nor are they in Bitcoin. Settlement is carried out in the network, so many people have concerns about its security and degree of decentralization.

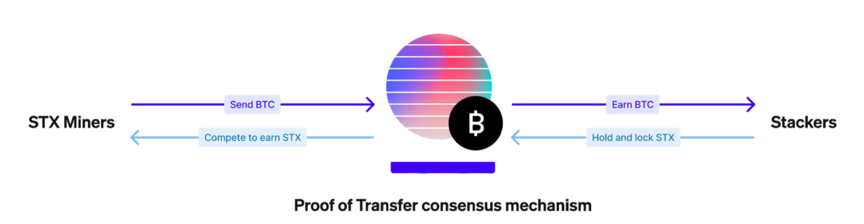

Currently the hottest Bitcoin Layer 2 solution is Stacks. Unlike the Lightning Network, which aims to help Bitcoin solve payment transaction problems, Stacks, which hopes to bring new use cases to Bitcoin through smart contracts, is not a real Bitcoin Layer 2 solution. Because the blockchain state of Stacks is different from the Bitcoin network, it is completely maintained by self-operated nodes, and all Stacks transactions are separate from Bitcoin transactions, and Bitcoin cannot provide security for it. Stacks uses only the Bitcoin blockchain as a reliable storage and broadcast medium for recording the collection of all Stacks blocks ever generated.

image description

Whether it is the transfer of liquidity to other ecology through the derivative assets mapped by Bitcoin in the past, or the upsurge of discussion on Bitcoin NFT and Bitcoin Layer 2, it proves the market's expectation for the new narrative of Bitcoin application.

The Reasons and Basis for Bitcoin’s New Narrative

text

There are two solutions to the defect. One is to directly modify the Bitcoin code to abolish the Bitcoin issuance cap or the halving cycle, but this obviously goes against the original intention of Bitcoin and will completely destroy the foundation of its existence and development. Another way is to increase Bitcoin fee income. Satoshi Nakamoto once said that when block rewards almost disappear in a few decades, transaction fees will be the main source of income for nodes. The most direct way to increase Bitcoin fee income is to expand the actual use cases of Bitcoin. Before the original Bitcoin chain changes, expanding applications through Bitcoin Layer 2 has become the most feasible solution. If Bitcoin Layer 2 succeeds, it will not only solve the inherent flaws of the Bitcoin halving narrative, but also better release the liquidity value of Bitcoin and enrich the narrative level of Bitcoin.

image description

Image source: Internet media

This also brings up another question: Why can't Bitcoin carry the new narrative of expanding applications now?

Same as before, as the largest encrypted asset by market value, Bitcoin still has the strongest consensus in the encrypted world, and its security, liquidity and stability far exceed other currencies.

On the other hand, the inherent technical environment of Bitcoin applications is also changing. The SegWit upgrade in 2017 and the subsequent Taproot upgrade laid the foundation for the expansion of Bitcoin applications, while the innovative development of the Ethereum Layer 2 ecosystem has allowed the market to see more possibilities for building a two-layer network outside the original Bitcoin chain.

first level title

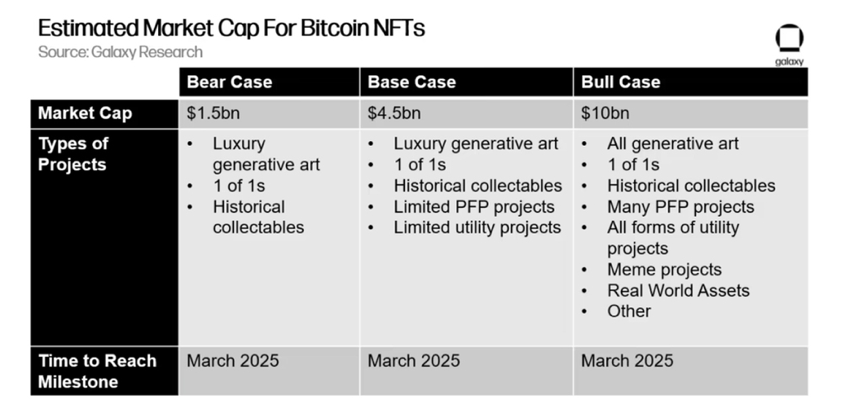

The Prospects and Challenges of Bitcoin’s New Narrative

However, if Bitcoin can fully unlock the application narrative, with its advantages in market recognition and network security, it is entirely possible to break Ethereum's monopoly in blockchain applications in the future. Although this may be a long-term process, because Ethereum has already accumulated some first-mover advantages in blockchain application innovation, but compared with other new generation blockchains, the application value of Bitcoin may be more worth looking forward to. The research department of cryptocurrency investment bank Galaxy Digital recently predicted that the Bitcoin NFT market will reach a market value of $4.5 billion by 2025.

image description

Image source: Galaxy Research

However, the challenges of Bitcoin's new narrative also exist. First of all, the market has not yet reached a complete consensus on the expansion of Bitcoin use cases. Many opponents believe that other use cases, including Bitcoin NFT, will only make Bitcoin deviate from Satoshi Nakamoto's vision of using it as a peer-to-peer cash system, and will greatly increase the burden on the Bitcoin network and push up transaction costs, which is not conducive to promoting Wider crypto adoption. How to resolve these disputes and make Bitcoin more usable and practical while being accepted and recognized by more people is the fundamental problem that Bitcoin application expansion needs to solve.