PlanckX x Footprint Analytics - February 2023 GameFi Research Report

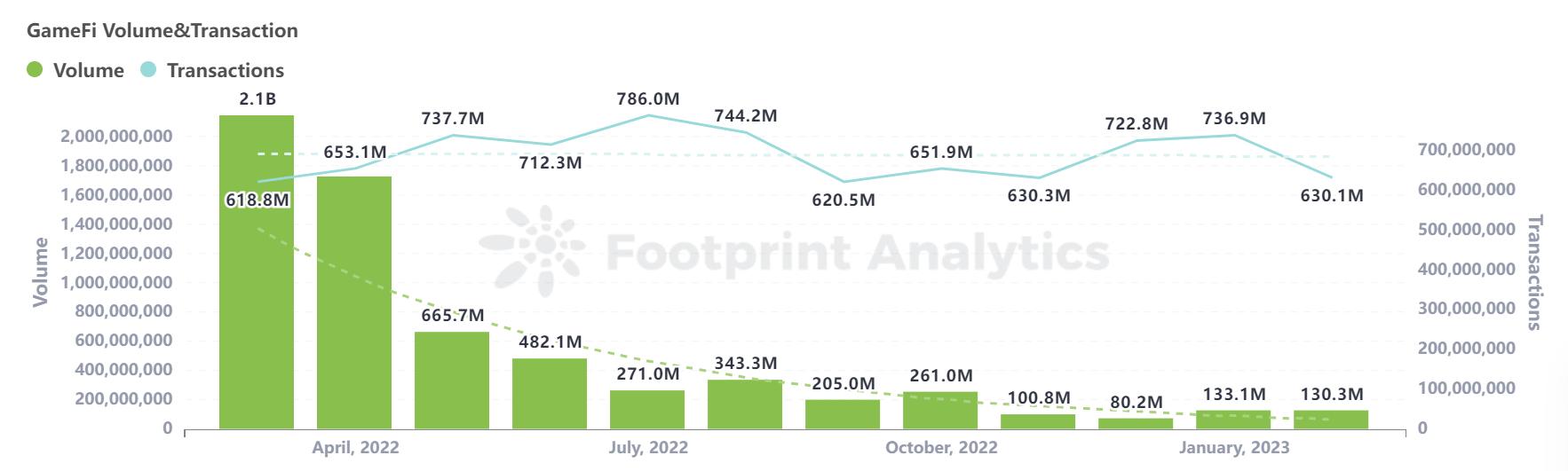

After a difficult year, the encryption market finally ushered in a turning point at the end of 2022. With the recovery of the market value of the entire market and the recovery of the market, the data in the encryption game field also showed a small rebound in January.

What is exciting is that Hong Kong's promotion of Metaverse legislation means that Asian powers, which represent Eastern forces, will once again invest more in the encryption industry, which is a positive signal for the market and has also responded in terms of market value.

The game giants Unity and MetaMask announced cross-border cooperation and interoperability with SDK, which is believed to bring a new future to blockchain games.

We predict that 2023 will be a small period of explosion in the GameFi field. The emergence of more excellent public chains will bring a more conducive ecology for development, and many game projects that have shown their prominence before will also enter the alpha and beta stages, starting from Web2 to Web3 integration. The market is still looking for the next hot chain game after Axie Infinity and stepn.

In this article, we will summarize and analyze the overall trend and follow-up trend of the GameFi market in February 2023 from the macro level based on the GameFi market performance, financing situation, and the development of different public chains and popular games in February. In addition, the chart data used in this report is provided by Footprint Analytics, an in-depth official partner of PlanckX, available atkey points。

key points

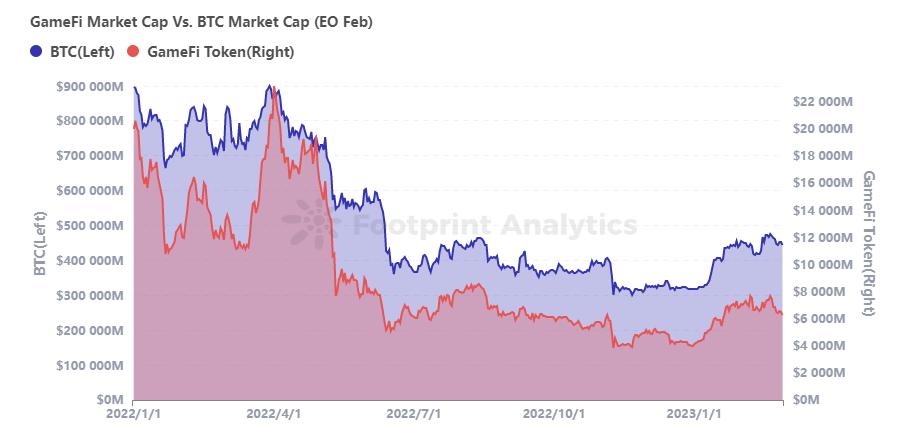

In February, as the price of BTC rebounded, the market value of GameFi also improved. In February, the total market value of GameFi was stable in the range of 6.3 billion to 7.2 billion.

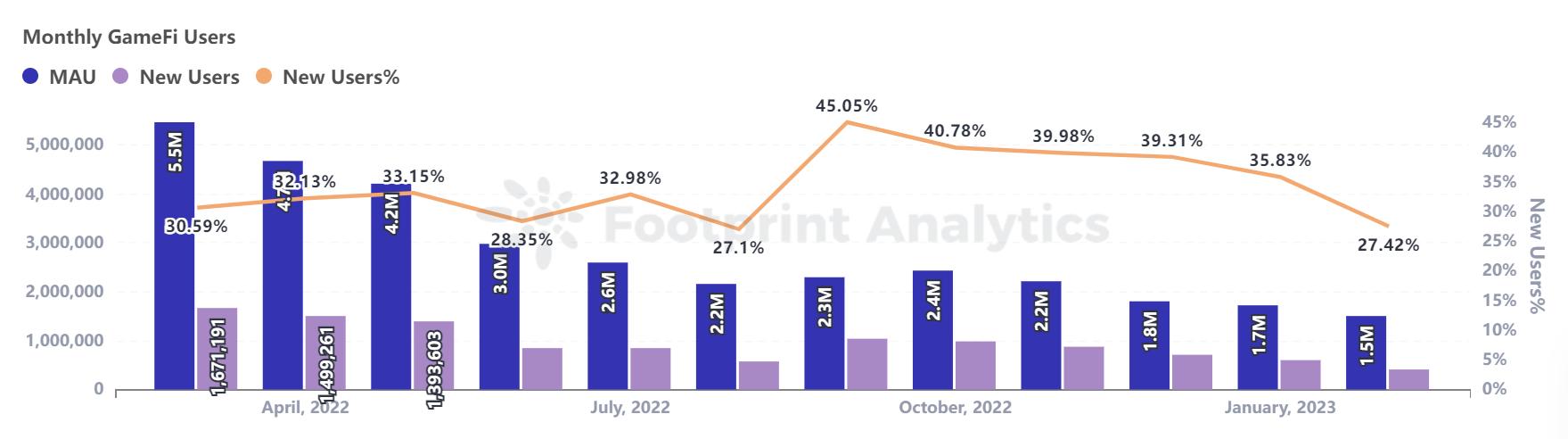

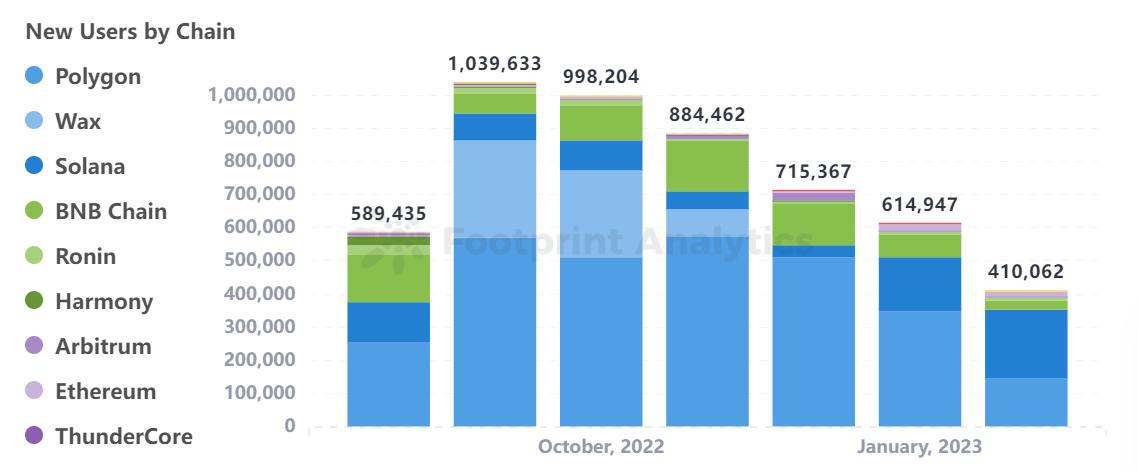

The proportion of GameFi new users to total users has dropped slightly compared to January, reaching only 27.44% of the total, which is also the lowest value since October last year.

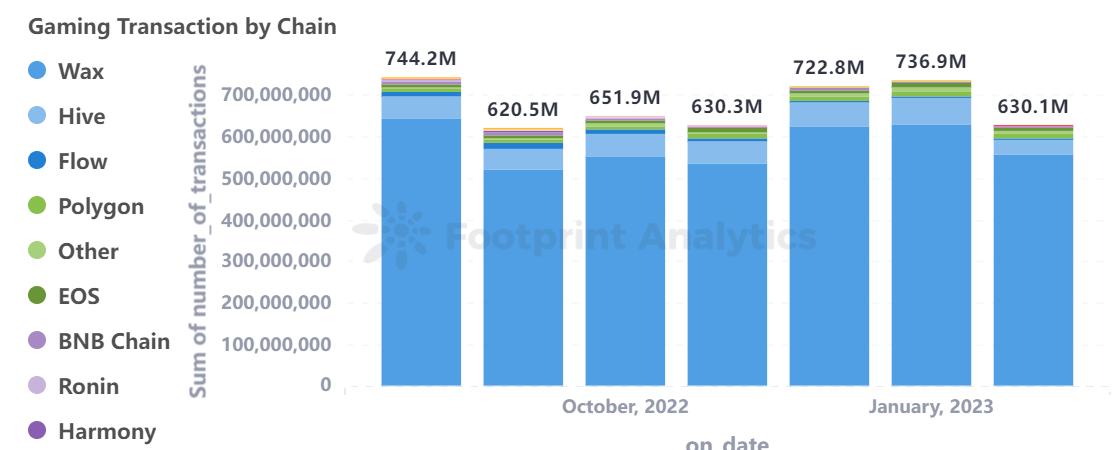

Wax is still the most active blockchain with 556 million transactions in February, accounting for 88% of the total, followed by Hive and Flow with 36.8 million and 2.9 million transactions respectively

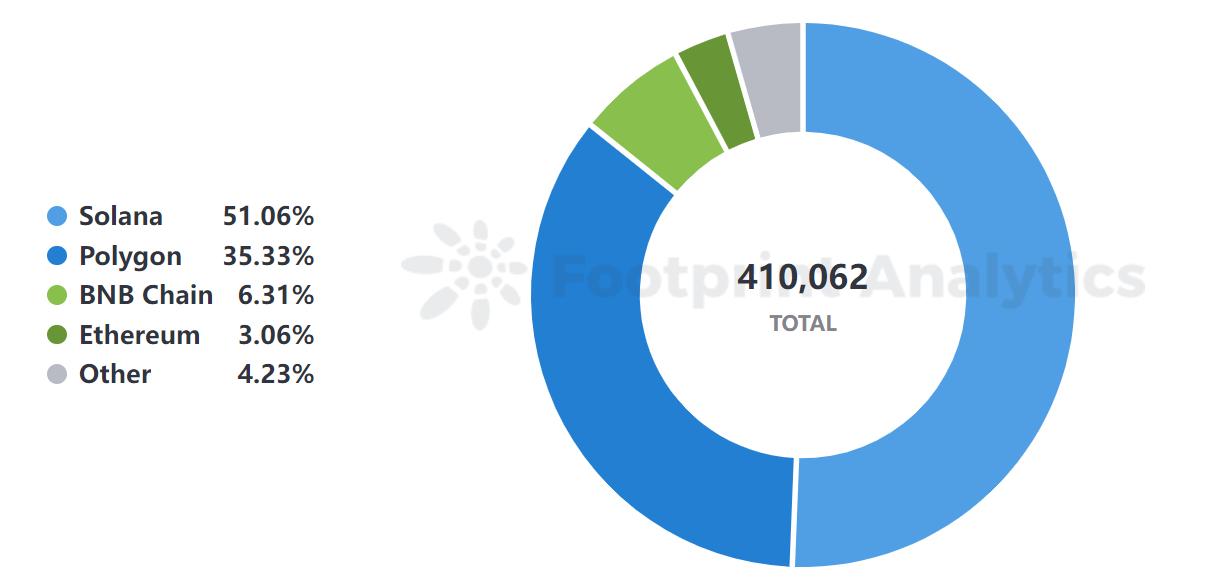

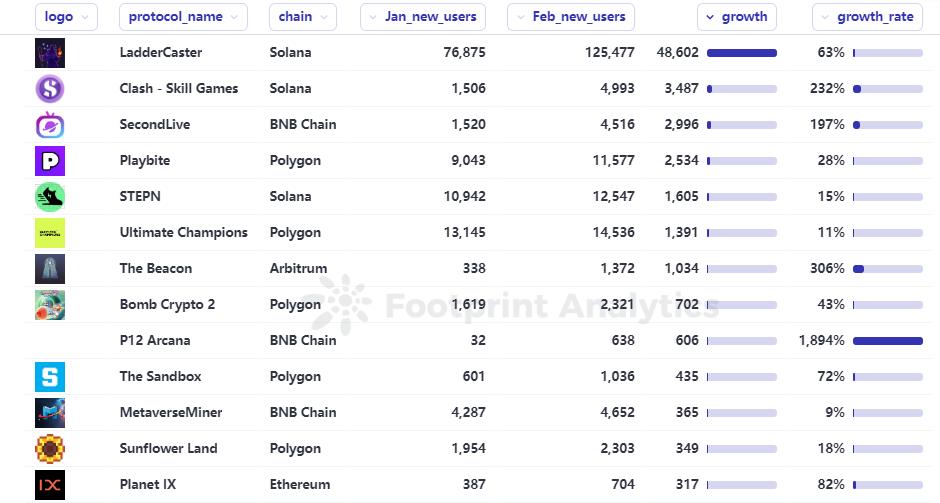

After the impact of the FTX thunderstorm subsided, Solana began to experience explosive growth in users since January. In February, the number of new users reached 209,370, accounting for 51.07% of the entire new increase; mainly because its on-chain game LadderCaster continued to maintain in February High growth, the number of new users in February reached 125,477.

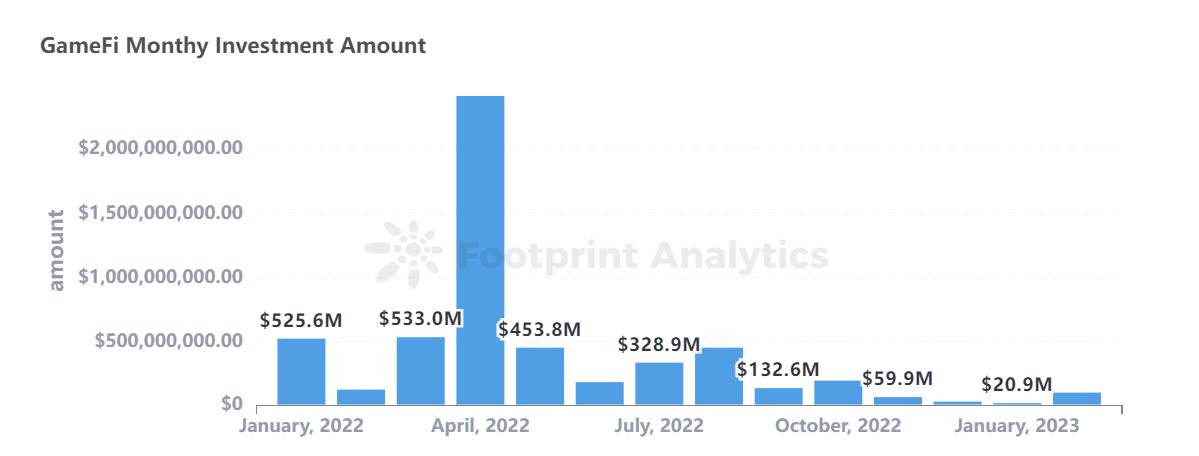

Compared with the sluggish investment in the previous few months, the total value of GameFi’s investment funds exceeded 100 million US dollars again

A total of 14 projects were funded in February

overall market performance

image description

figure 1 (GameFi Market Cap vs Total Cryptocurrency Market Cap)

image description

figure 2 (Comparison chart of GameFi market capitalization and BTC total market capitalization)

Counterfeit tokens in the cryptocurrency field have always had the characteristics of large market value bubbles and sharp rises and falls. The BTC market value has always been the reference benchmark for market investment and also acts as the actual market. As of February 28, 2023, the total market value of BTC is nearly 446.5 billion US dollars, which is 70 times the total market value of GameFi.

To sum up, the market value of GameFi's overall track has not been outstanding during this period.

image description

image 3 (The overall financing amount of the GameFi track)

image description

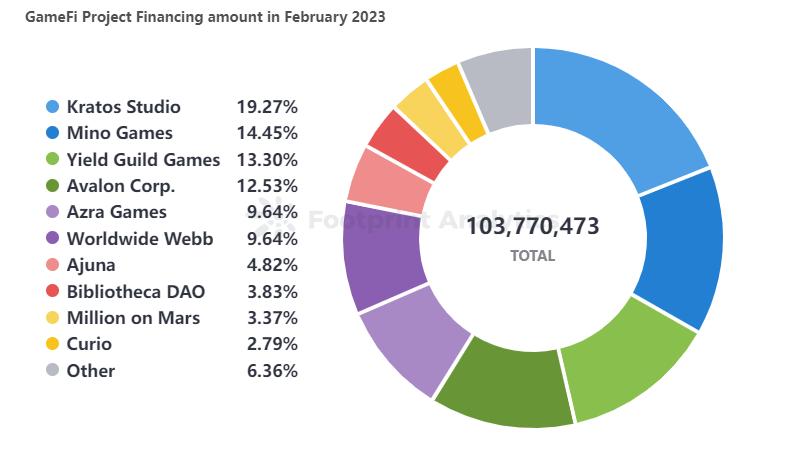

Figure 4 (Financing Specific Projects)

A total of 14 GameFi projects received funding in February, of which the top three were Kratos Studio, Mino Games, and Yield Guild Games, with a total financing of 20 million, 15 million, and 13.8 million, all of which were first-round financing.

GameFi Fundamentals Performance

image description

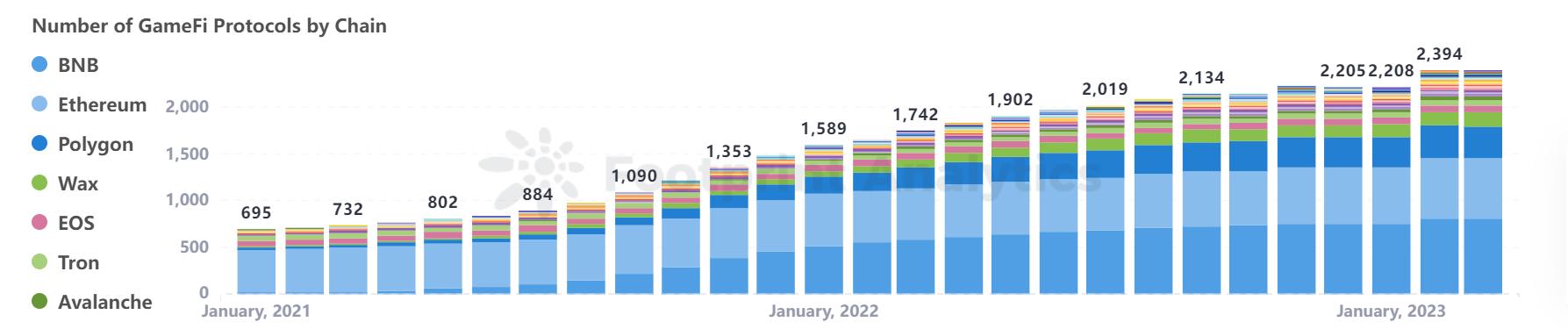

Figure five (Total amount of agreements on the chain)

The number of on-chain games in February was 2390, which was basically the same as the 2394 in January. Compared with December, there was a significant increase in the number of games in January, but there was a small decline in February, which may be related to many projects. It was announced at the beginning of the year that it was about to go online, and February entered the middle of the quarter, resulting in a stagnation of growth.

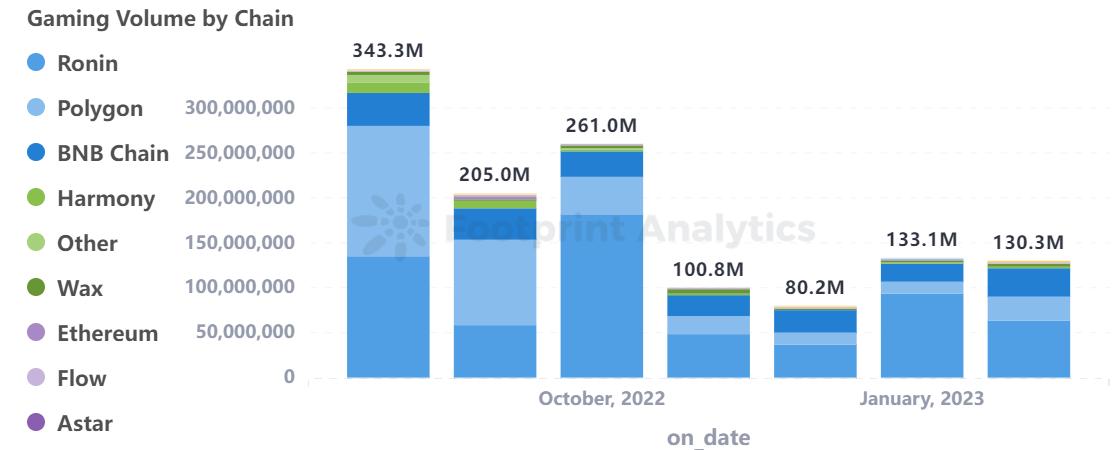

From the perspective of the distribution of protocols on the chain, BNB Chain and Ethereum are still the same as before, followed by Polygon and Wax. Since March last year, BNB Chain has been a latecomer and has gradually widened the gap with other public chains. It has been leading until now. However, whether it will become the preferred public chain for new games in the future is worth our follow-up observation.

image description

Figure siximage description

Figure sevenNumber of transactions on the chain

From the perspective of the number of transactions and transaction volume on the chain, compared with the number of transactions in January, the number of transactions has decreased, but the total amount is almost the same. Ronin still maintained a high transaction volume in February, and Wax still accounted for a large part of the number of transactions, which proves that the transaction activity on Axie Infinity and Alien Worlds is still good.

image description

Figure eightimage description

Figure 9image description

Figure tenUser growth pie chart

image description

Figure tenGameFi new user growth in February

image description

Figure Elevenimage description

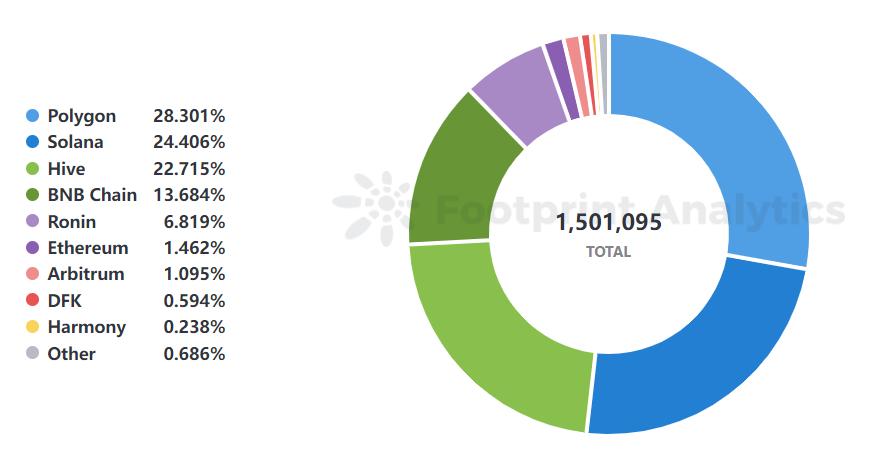

Figure 12Proportion of public chain active users on the chain in February

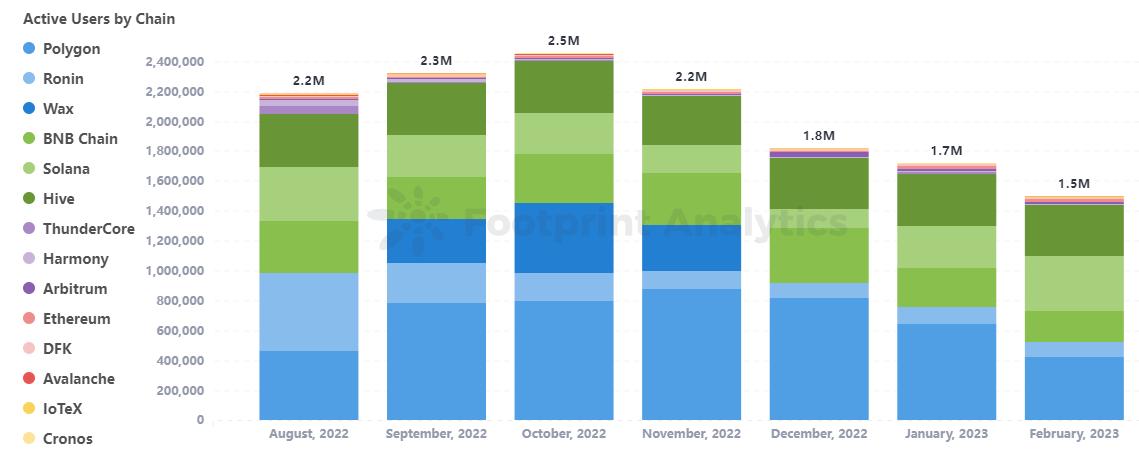

The total active users in February dropped to 1.5 million, mainly concentrated in Solana, Polygon and Hive. This data has dropped for 4 consecutive months from the high point of 2.5 million in October last year. This may be because since the end of last year, the chain There is no such thing as an explosive game like StepN in the gaming market, which cannot drive the activity of existing users.

Summary Outlook

Waiting for the dawn in the dark may be our best summary of February, and it will also be the main theme of the GameFi field in 2023. Whether the market has bottomed out or not is yet to be determined, but it can be seen that the confidence of capital has not faded.

Behind the cruel and depressed reality, there is also a turning point.

The increase in capital investment in February proves that market funds are once again invested in the game field. Unlike traditional public chains such as DeFi and NFT, which occupy the vast majority of the market share, some specialized game public chains shine in the GameFi field. In the competition with the traditional public chain, it will not fall behind. At present, the multi-chain deployment of on-chain protocols has become a trend, and more excellent protocols may be migrated to the game public chain. The public chain is the holy grail of the blockchain field and the engine of the bull-to-bear transition. After years of precipitation, some specialized game public chains may become the driving force for the outbreak of the GameFi track in the next round of bull market.

The downturn in the market will undoubtedly bring pressure to the game team, after all, the decision to release a game in a bear market needs to be more cautious. It bears repeating that game development typically takes years, and diminished upstream funding prospects could put projects that failed to raise enough capital in a bull market at risk. But for a high-quality AAA game, waiting for its development and polishing is the only way to go.

Let us look forward to the new bloom after precipitation and polishing.

This article is jointly published by PlanckX and Footprint Analytics.

PlanckX

Footprint Analytics is a structured data platform linking web2 and web3. We provide the first code-free data analysis platform in the Crypto field and a unified data API, allowing users to quickly retrieve NFT, GameFi and DeFi data from more than 24 public chain ecosystems. The Footprint Growth Analytics launched by the platform helps GameFi and other Web3 projects to carry out effective marketing and promotion.

Footprint Analytics

Footprint Analytics is a structured data platform linking web2 and web3. We provide the first code-free data analysis platform in the Crypto field and a unified data API, allowing users to quickly retrieve NFT, GameFi and DeFi data from more than 24 public chain ecosystems. The Footprint Growth Analytics launched by the platform helps GameFi and other Web3 projects to carry out effective marketing and promotion.

ABGA

The Asian Blockchain Game Alliance (ABGA) is an ecological alliance jointly established by mainstream institutions in the global blockchain industry and outstanding organizations and individuals who are full of vision and enthusiasm for blockchain games, Metaverse, and NFT. Through a wealth of online and offline activities, as well as the analysis and discussion of the latest industry information, the alliance member resources are combined to discover, invest and incubate more potential projects to promote the vigorous development of the industry.