Decentralized Stablecoin Wars: Who Will Capture the Holy Grail of Cryptocurrencies

Author: Armonio, AC Capital Research

first level title

preface

Since 2018, countless investment institutions and media have called stablecoins the holy grail of cryptocurrencies.

The giant stablecoin project that started in 2018, Libra, has been constantly interfered by state power since its inception, and was stillborn.

According to the Wall Street Journal, on July 20, 2021, Circle allocated $1,040 to settle with the SEC.

On October 15, 2021, Tether was fined $41 million by the U.S. government for false statements.

On February 13, 2023, in order to avoid prosecution by the SEC, Paxos stopped issuing BUSD.

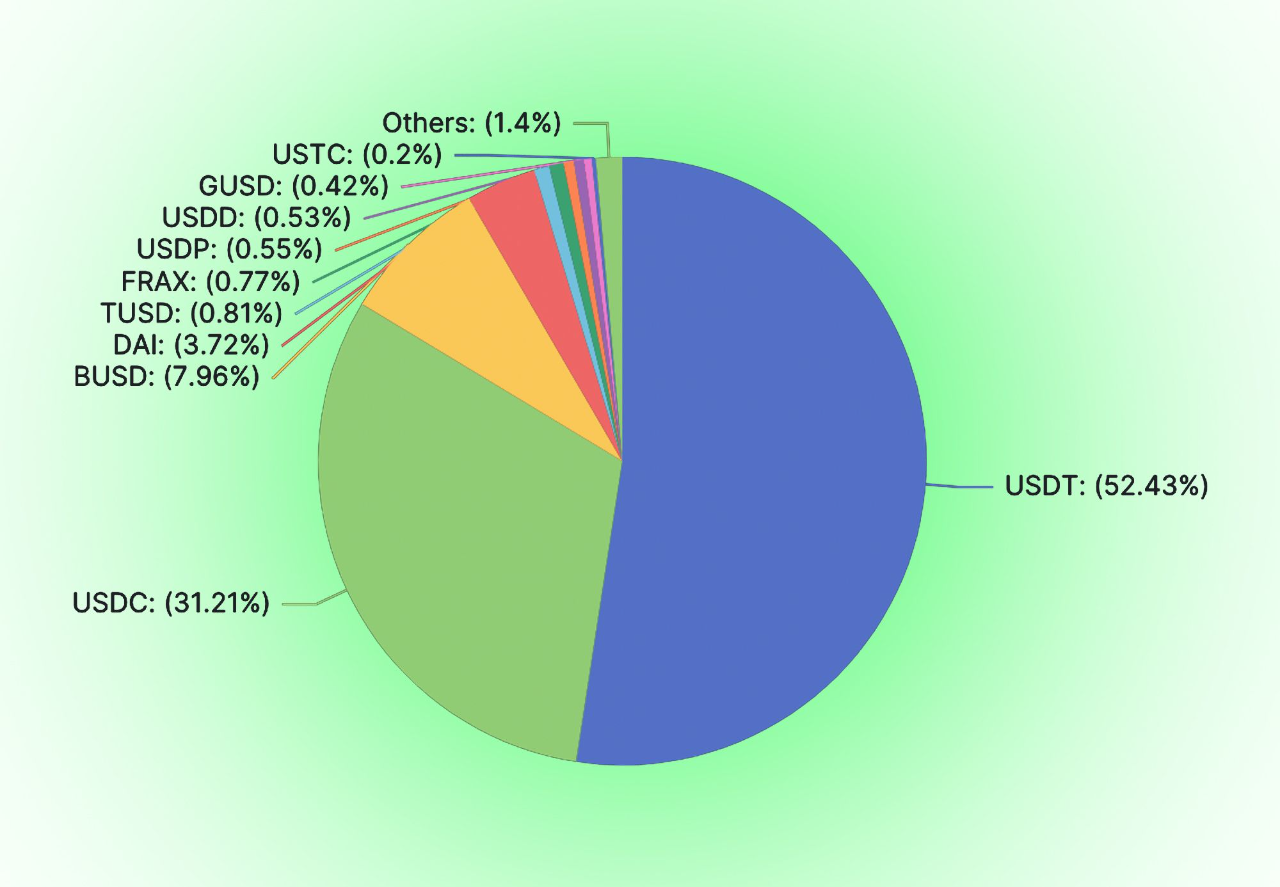

I have no intention of discussing the right and wrong of these punishments and supervision. The list of these things just shows that all centralized stablecoins face the risk of centralization. To accept centralization, one must accept centralized intervention. If the stable currency is the faucet, if the liquidity of the encrypted world is completely dependent on the centralized stable currency, then the asset pricing power in the encrypted world is not in the encrypted world. At present, on the stablecoin track, the power of decentralization is in jeopardy. No one wants the decentralized world to be held by centralized power. But the current status quo is counterproductive:

image description

[Figure 1] The stablecoin track dominated by centralized stablecoins

Risk always obeys Murphy's Law.

first level title

01 Why Stablecoins Are Decentralized

Stablecoins don't have to be decentralized. Centralized stablecoins exist and cannot be ignored. From USDC, USDT to DCEP, not only in terms of scale and cost, these centralized stablecoins will be empowered and guaranteed by the traditional world. 0x hankerster.eth believes that stablecoins can be divided into centralized stablecoins and decentralized stablecoins. In his classification, the definition of centralization and decentralization is aimed at the issuance mechanism of stable coins. The division at that time focused on the form of centralization, not the essence of facing centralization risks. This article, starting from the centralized risk exposure, divides stablecoins into centralized and decentralized.

secondary title

The Feasibility of Decentralized Currency

Decentralized money is the source of money. Currency can be decentralized. In the long river of human history, decentralized currencies have appeared. Whether it is the currency theory of barter, or the theory of debt forming currency. None of the centralized credits are involved in the currency generation process from the beginning.

Debt has historically served as a means of payment. As early as 4000 BC, on the plains of Mesopotamia, people invented clay tablets to record events. Important things will be recorded, such as debts. Debt records include the content of the debt, the means of payment for repayment of the debt, penalties for overdue repayment, and so on. And these debts can be used as a means of payment.

According to the description of anthropologist David Graber, from 3100 BC to 2686 BC, Egypt was an agricultural society, and grain loans were common. The people would return the grain at the time of the new year's harvest. Grain loan information is recorded on mudstone tablets, including the borrower, quantity, time and so on. Such tablets are called"Henu". People used such clay tablets as currency in commodity circulation.

secondary title

The need for decentralized stablecoins

The purpose of issuing coins is to increase credit, and centralized stable coins do not have the right to mint coins. What we are striving for is the alchemy of the information age, hoping to break away from centralized power and create stable credit. Crypto fundamentalists believe that the right to issue money is stolen by centralized institutions. The party with the right to issue enjoys seigniorage, and the issuer has enough motivation to issue excessive or excessive currency. Once the centralized stablecoins are issued in a decentralized network, these centers that issue stablecoins are no different from the centers that issue currencies in the traditional world. If you can't win the minting rights of the government and the central bank. The issuer of stable currency can only be reduced to a commercial financial institution that issues letters of credit.

secondary title

Decentralized stablecoins have an inherent market

first level title

02 Stablecoin: Wings of Icarus

secondary title

Stablecoins are a scale business

As a stable currency, in the long run, it must break through a certain scale limit in order to achieve a positive ecological cycle.

image description

[Table 1] Small stablecoins have no advantages

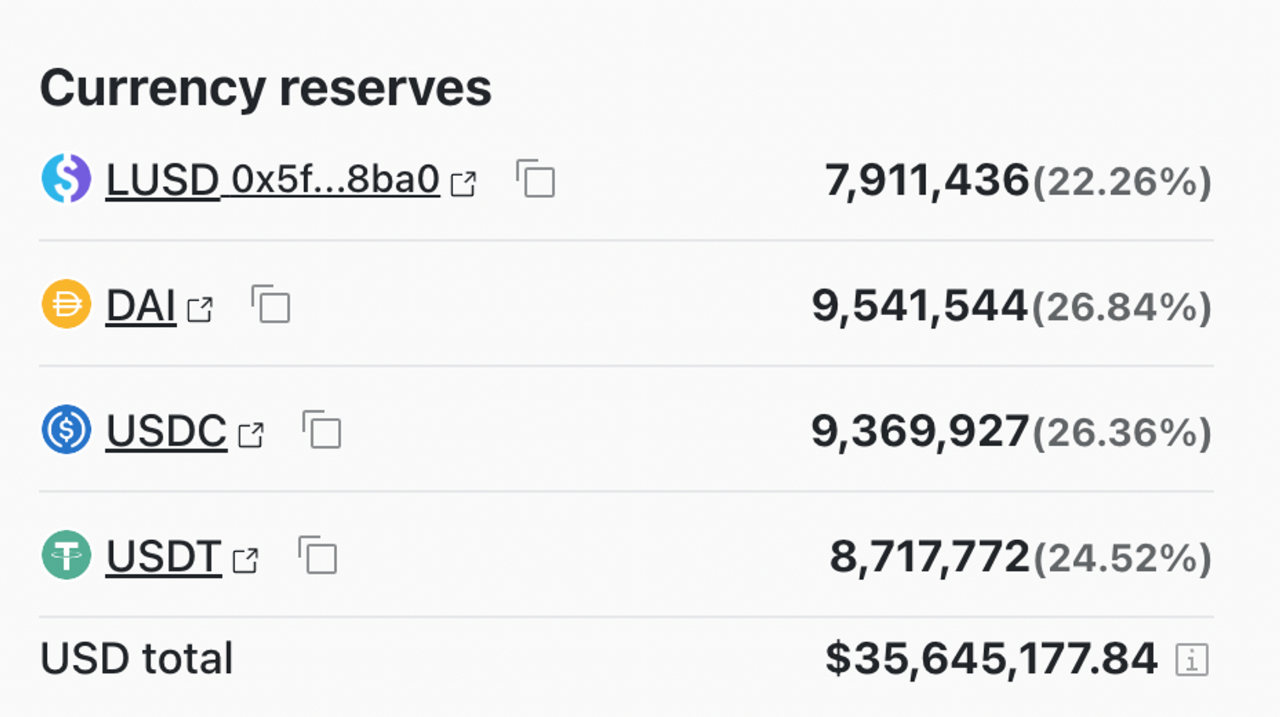

The above table already ranks 3-5 algorithmic stablecoins in terms of scale, with DAI and FRAX ranking first. As can be seen from the table, the market size of the 3rd to 5th ranked algorithmic stablecoins is only 200 million to 68 million, and some of these stablecoins must be used for circulation and cannot be fully used for the creation of trading pairs. Even when trading pairs are created, pegged trading pairs absorb a large amount of stablecoins. There are very limited credits that can be used to build directly with other risky assets. Not only are there fewer trading pairs directly connected, but high handling fees. Stablecoins with low market size will also face higher transaction slippage, which is not conducive to the entry of giant whales. Taking the exchange of various stablecoins for WETH as an example, using 1inch transaction routing, the slippage of LUSD worth 10 W is 1.78%, the slippage of FRAX is 0.36%, and the slippage of DAI is 0.2%.

These disadvantages of scale will increase the transaction costs of stablecoins. In order to offset transaction costs, the project party needs to increase project operating costs and give stablecoins a higher rate of return. Therefore, stablecoins are a business of economies of scale.

secondary title

Stable currency is a business tabooed by traditional forces

However, if decentralized stablecoins want to scale up, they will inevitably face the attention of traditional forces. However, the traditional world has always harbored ill will toward cryptocurrencies. It’s not just the U.S. government that’s stillborn Libra. The World Monetary Fund has always been hostile to cryptocurrencies. When the DCEP led by central banks enters the field, who should be wiped out? On February 23, 2023, the IMF Board of Directors stated that cryptocurrencies should not be granted legal tender status. We have no way of knowing whether the scale advantage of stablecoins is lower than that of traditional forces.

Without scale, it cannot continue to operate economically, but with scale, it faces the risk of interference from centralized power. This is the Icarus Wings of stablecoins.

first level title

03 The industrial structure of the stablecoin track

secondary title

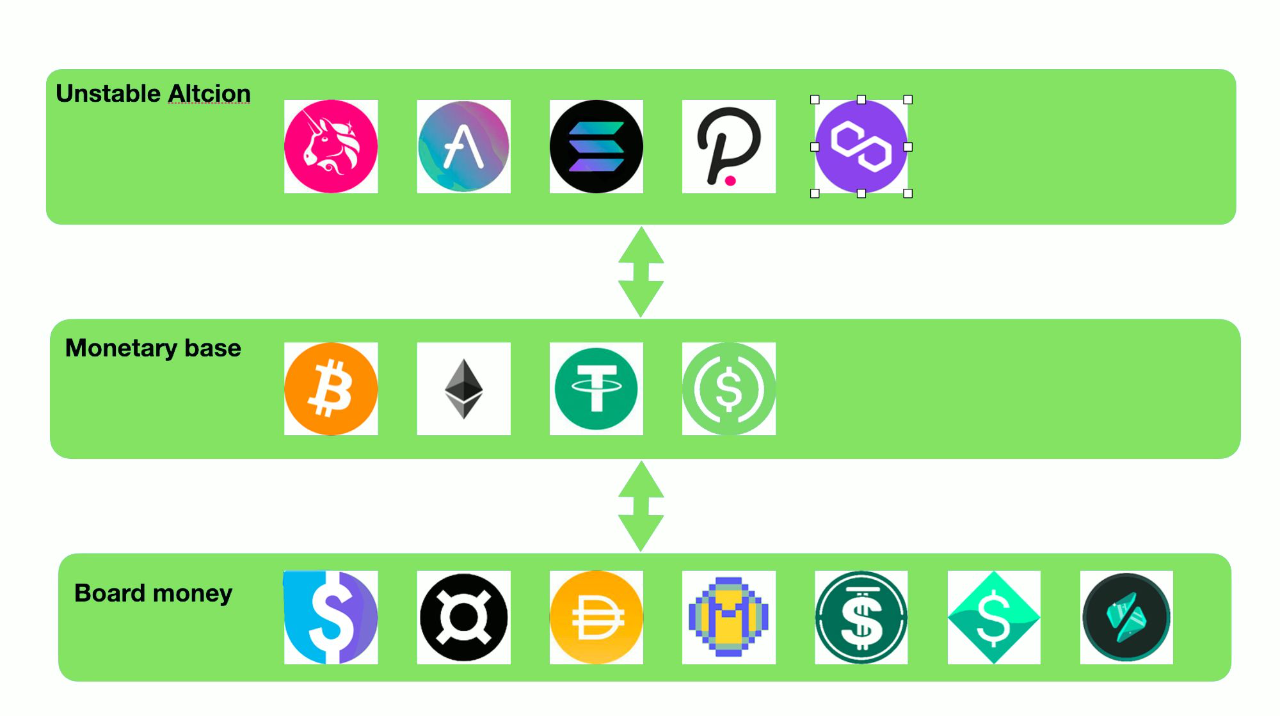

High energy money and broad money

In macroeconomics, we divide currencies into different grades from M 0 to M 3 according to their liquidity. This liquidity difference exists widely among tokens. The liquidity of the token itself is also an important part of the value of the token. Users are more willing to hold highly liquid tokens, and are willing to use highly liquid tokens as the counterparty of the transaction pair. Just imagine, as the initiator of a project, if you want to mark your own tokens, the first choice is of course USDC and DSDT. Who would use an Alt-stablecoin with few holding accounts, large slippage, and a small number of tokens as the price standard and transaction object? BTC and ETH are also more reliable than these smaller stablecoins.

The current situation is: except for USDC and USDT, most stablecoins are difficult to obtain the opportunity to "passively" establish trading pairs (here, "passive" refers to the establishment of other project parties other than the stablecoin project party to provide liquidity. properties, establishing trading pairs). Therefore, the vast majority of these stablecoins must be converted into USDT, USDC, BTC, ETH and other highly liquid tokens first, and then traded with the target tokens. This situation is like I have a time deposit in a bank and have a fixed deposit certificate. I can't directly spend with fixed deposit certificates, but I can sell the deposit certificates in the secondary market, and then use high-energy currency to consume.

image description

secondary title

Loan system?

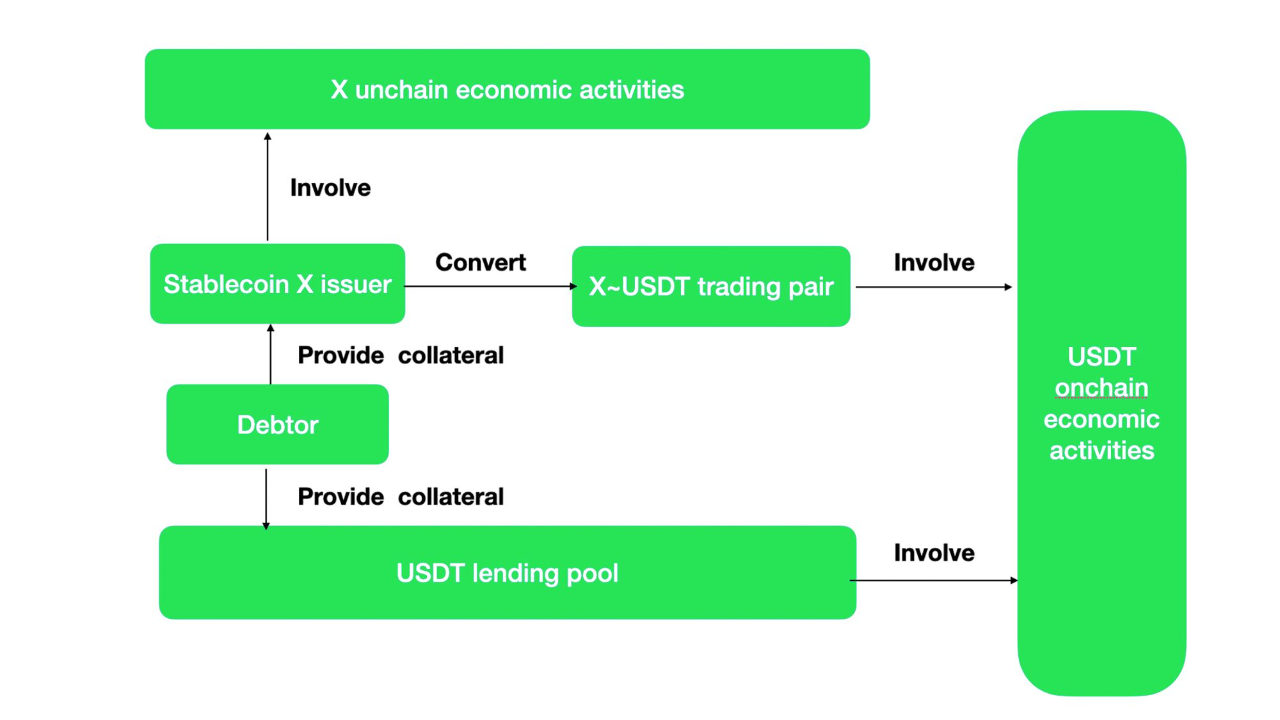

image description

[Picture 3] Stable currency/loan leads to the same goal by different routes

Assuming that stablecoins cannot create economic activities on the chain, then the X stablecoins generated by users through the stablecoin generation mechanism can only be exchanged for mainstream stablecoins with multiple on-chain activities through trading pairs, and then carry out economic activities. This process is equivalent to the mainstream stablecoin lending pool. Functionally, Alt-stablecoin generation mechanism + trading pairs = over-collateralized lending.

And if you have the unique economic activities of the X stablecoin, then X will be different from USDT and USDC. This will generate USDC, USDT for X, and the motivation to participate in economic activities.

image description

[Figure 4] Stablecoin trading asset imbalance: Deemed lending business

first level title

04 The territory of stable currency

Since the creation of USDT in the fall of 2014, the creators of stablecoins have made various stablecoin attempts.

At present, the most mainstream method is still the centralized method. One dollar is deposited into the actual designated account, and one dollar of stable currency assets are issued online. With the gradual improvement of government supervision, these centralized stablecoins are blocked from the perspective of supervision, such as random inflation or insufficient liquidity of collateral assets. The degree of disclosure has also gradually increased. 【Muse labs】【Sam bourgi】However, the risk of centralization has always been with us. Recently, due to the failure of the clearing bank Silvergate to submit a report to the SEC on time, people have once again raised concerns about whether the USDC issued by Circle will default.

secondary title

method of creating stability

There are several ways to use algorithms to create currency price stability:

rebalancing stablecoins

AmpleForth created a stablecoin that rebalances the issuance volume. Tokens have a target price, a market price. The amount of AMPL (the stable token of the AmpleForth project) will increase or decrease according to the difference between the target price and the market price. In this way, the currency price of AMPL is stabilized. For AMPL borrowers, the value is the same when borrowing and repaying. However, the assets denominated in AMPL in the user's portfolio are still subject to market risk. To this end, AmpleForth has designed layered derivatives of market risk, some derivatives bear greater risks, and some bear relatively small risks. The feedback from the market is that it failed. (There is no liquidity in Buttonwood at all.) This stability obtained through derivatives is no different from hedging market risk through futures.

The traditional rebalancing mechanism has already lost its vitality in the market. Haven't heard of new stablecoin projects continuing to use rebalancing mechanisms. However, the recent inverse (3, 3) liquidity incentive strategy, let us see some light. Liquidity incentives are what all stablecoins need to do, and token deflation can effectively support the price of a single stablecoin. Is there a possibility to lock the stablecoins either in the lending environment or flow into the liquidity pool. In other cases, stablecoins supported by deflation are not underwater.

Limited circulation of stablecoins

In 2018, cangulr 90 discussed with people in Ethresear that when the currency price is higher than the target price, users are restricted from buying tokens; when the currency price is lower than the target price, users are restricted from selling tokens. This idea was later modified and used in the FEI system. Compared with mandatory restrictions, FEI adopts a gentle method of increasing costs, and "soft knife" restricts users from buying and selling. The failure of FEI cannot be attributed solely to restricting liquidity. Franz Oppenheimer believes that FEI's incentive and punishment mechanism is against market rules. When the price of FEI is consistently lower than the target price, what penalties will cause stablecoins to lose basic demand: after all, who would own a stablecoin with insanely high transaction fees? The value of currency is reflected in circulation. Stabilizing the currency price but losing liquidity is not worth the candle. Judging from the liquidity of stablecoins such as USDC and DAI, the daily transaction volume of FEI is only about 1/8 to 1/10 of that of other stablecoins.

minted stablecoin

Uncontrolled tokens often have volatility that exceeds real assets. In order to form a relatively stable stablecoin asset price and minimize market risk, some innovations adopt asset risk stratification to replace the stablecoin system with fluctuating tokens controlled by the system. Through the linkage between the redemption of stable coins and volatile coins, the price fluctuations of stable coins due to supply and demand can be transmitted to volatile coins. There are many projects that have tried from this perspective. The most famous one is UST~Luna, which uses the destruction of the underlying Terra of the blockchain to exchange for the equivalent stable currency UST, and the equivalent of Terra can be obtained by destroying UST. There are also some projects that can buy bond coins when the stable currency is lower than the target value, and when the price of the stable currency is higher than the target value, you can use the bond currency to buy stable coins at the target value and then sell them in the market. The vast majority of such stablecoins eventually fail. In order for volatile tokens to absorb the potential fluctuations of stablecoins indefinitely, it is not easy to limit the circulation of volatile tokens. Extended volatility in volatile coins will eventually undermine confidence in stablecoins. The only remaining project is the linkage between FRAX and FXS. And FRAX is the second largest algorithmic stablecoin. Its feature is the introduction of USDC as most of the credit collateral, allowing the agreement to control the value of PCV to increase significantly.

Although the stability is poor (most of these stablecoins have returned to zero), I still think this is the most crypto stablecoin design: the value capture of issuing tokens is not through the revenue-profit model, but as a system value The medium of delivery, the value of the volatility token is positively correlated with the size of the stablecoin.

Overcollateralized Stablecoins

Over-collateralized stablecoins are currently the most mainstream and the most mature way of issuing stablecoins based on empirical theory. The over-collateralized stablecoins represented by DAI and LUSD have been operating well for a long time. At present, a new batch of potential stablecoin competitors GHO and CrvUSD are also competing to adopt the over-collateralized method. Over-collateralized stablecoin projects are often classified as lending projects in the division of DeFi. The essence is to use the user's debt as the cornerstone of stable currency issuance. Not only modern central banks use debt to issue currency, this way of issuing currency can stand the test of history.

There have always been ways to use debt as a medium of payment and circulation. As early as 4000 BC, on the plains of Mesopotamia, people invented clay tablets to record events. Important things will be recorded, such as debts. Debt records include the content of the debt, the means of payment for repayment of the debt, penalties for overdue repayment, and so on. And these debts can be used as a means of payment. According to the description of anthropologist David Graber, from 3100 BC to 2686 BC, Egypt was an agricultural society, and grain loans were common. The people would return the grain at the time of the new year's harvest. Grain loan information is recorded on mudstone tablets, including the borrower, quantity, time and so on. Such tablets are called"Henu". People used such clay tablets as currency in commodity circulation. The first paper currency issued by human beings was Jiaozi in the Song Dynasty. The origin of this kind of paper money is also that people deposit iron money into commercial banks, which creates debt certificates of commercial banks to consumers.

Debt will form the basic demand for stablecoins, allowing stablecoins to gain value anchors. In the short term, induce users to redeem and issue additional arbitrage, and use interest rates to adjust the supply and demand of stablecoins to achieve price stability. The over-collateralized stablecoin has a solid basic demand: it is impossible to get back the over-collateralized assets without repaying the stablecoin, so it has good stability.

secondary title

Anchor selection

What stablecoins should anchor is also a latitude for stablecoin exploration.

Anchored by the currencies of the traditional world

Common stablecoins are anchored in fiat currencies. The underlying assumption is that the value of mainstream fiat currency is relatively stable in the short term, which is suitable for benchmarking value. In the long run, the long-term stability of the value of stablecoin assets can be maintained only if the airdrops of symbolic interest are given enough. As the world currency of the last era, gold has also been taken out as a benchmark of value. In this way, stablecoins can directly borrow the influence of long-term development of traditional world currencies, reducing the difficulty of promotion. At present, the vast majority of stablecoins are bound to the US dollar, euro or gold, and people believe more in the stability of the value of these currencies. The pain point of this algorithmic stable currency is that it cannot do better than the centralized method. Compared with the small pond of assets on the chain, the traditional financial world can be described as a vast ocean, and a little liquidity can nourish the entire blockchain world. Ordinary defaults and fraud will disappear if the centralized powers that have long ruled the world are willing to police. The centralized stablecoin camp supported by USDT, USDC and BUSD has almost no way to survive in the same track. They are bigger, cheaper, and in most cases, better credit.

Another problem is that stablecoins anchored by traditional world currencies will lose the independence of monetary policy and become the shadow of legal tender. Borrowing Mundell's Impossible Trinity Theory, it is impossible for exchange rate, free flow of capital and independence of monetary policy to be realized at the same time. On the blockchain, except for the self-destructive practice of restricting the circulation of stablecoins, the free flow of other stablecoins is not restricted. When the stable currency has determined the free flow of capital and the exchange rate, then this stable currency can only become the shadow of the centralized legal currency in the traditional world.

custom index for anchor

first level title

secondary title

A stable track with centralization risks

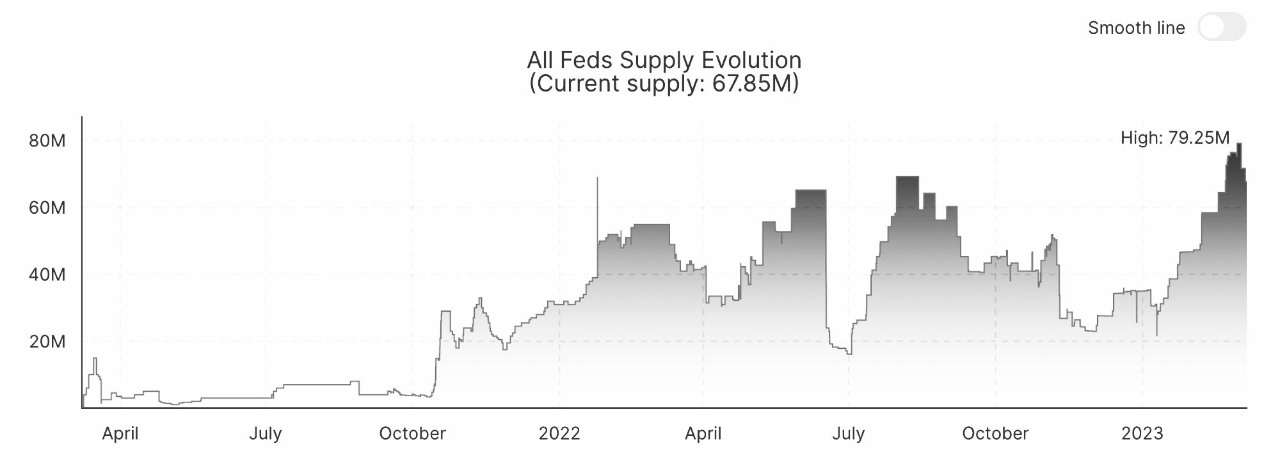

Under the pressure of the Fed to shrink its balance sheet, the cost of financing in the traditional financial world continues to rise. Capital began to exit in an orderly manner from the crypto world. The total number of stablecoins has dropped from 246.2 billion to 135.1 billion. The encryption market lacks liquidity. From AMM's centralized liquidity algorithm to margin and option trading, improving asset liquidity has always been a rigid need for on-chain assets. Stablecoins are created to provide liquidity. As the DeFi industry gradually matures, many established DeFi institutions have joined the competition with resources and brands. The catfish in the stablecoin blue ocean are Curve and AAVE.

Both Curve and AAVE themselves are kings in the DeFi industry. In the DeFi protocol, the TVL reached 502 million and 478 million respectively; from the perspective of TVL, it ranks 3rd to 4th in the DeFi protocol. At present, the stablecoins that Curve and AAVE are going to do are over-collateralized stablecoins. The two protocols have such high protocol-controlled assets, as long as they can convert 30%, they can reach the TVL scale of FRAX, the second-ranked stablecoin. In addition, it is unknown whether Curve and AAVE will separately create token incentive plans for their respective stablecoin projects. This is a condition that other stablecoin projects that have grown up in the last cycle do not have.

The advantages brought by Curve and AAVE don't stop there:

Curve itself is the largest stablecoin exchange on-chain. Curve is particularly good at building multiple stablecoins into a pool, and Curve's airdrop rights are also controlled by reCRV holders. Sufficient liquidity can be quickly established through the self-owned exchange to guide the self-owned stable currency. The core value of stablecoins is to provide liquidity. Curve is a management tool for liquidity distribution, which can directly empower CrvUSD. In addition, Curve's stablecoins will be liquidated using liquidation intervals instead of liquidation lines. As a latecomer advantage, it will reduce the losses of lenders and agreements when liquidity is insufficient, and eliminate liquidity risks. Finally, Curve will use its own oracle to quote collateral, which is more reliable than external oracle services.

Curve's business is to completely cover currency credit generation and liquidity management. Among the stablecoins that have not completely escaped the cloud of centralization threat, I am personally most optimistic about Curve's business model. It is a little more flexible than USDT and USDC, and it can handle the liquidity of other stablecoins in terms of exchanges. Because part of the pursuit of decentralization has been abandoned, the selection of collateral, the efficiency of credit generation, and the stability of tokens have certain advantages over completely decentralized stablecoins.

AAVE has the top ten active users in DeFi. Because of its long-term lending business, AAVE has a deep understanding of collateral and risks. In the traditional lending business, AAVE restricts the excessive loan amount given to the same collateral through governance. In clarifying collateral market risk, liquidity risk, etc., the AAVE committee has no difference in governance of traditional lending and stable currency creation. And AAVE can generate stable coins, which can greatly reduce the cost of AAVE. When GHO was designed, it considered generating stable coins in various ways. This broadens the channels for stablecoin credit generation. As mentioned earlier, the stablecoin track has obvious scale advantages. If the blueprint of AAVE can be realized, it will be very scary. But it can be seen from the blueprint that AAVE does not regard centralization as a risk, and its competitors will eventually be centralized stablecoins such as USDT and USDC.

Currently borrowing and lending on AAVE, AAVE needs to pay its users a cost for every token lent. AAVE only needs to pay a certain cost for liquidity. This will be a good deal. Some stablecoins only need to pay a fee of 0.5% to establish a stablecoin liquidity pool on curve, which is much lower than the current lowest 1.23%-AAVE stablecoin deposit rate. AAVE created its own stablecoin GHO, which has many advantages, such as not being afraid of liquidity runs. In the current design of AAVE on interest rates, when a token is lent in large quantities and approaches the limit, the interest rate will rise sharply. This is a barrier to prevent depositors from withdrawing without liquidity, incentivizing users to repay or deposit to provide liquidity. The self-owned stable currency lending is not limited by the size of the treasury, nor will it affect the liquidity of other people's deposits.

The veteran is considered the king, and MakerDAO is facing fierce competition. In the case of making ends meet, opening Spark to provide DAI with application scenarios such as internal lending and savings is also an attempt to actively break through the bottleneck of scale. The downside of DAI is obvious: MakerDAO involves RWA. MakerDAO has purchased real U.S. Treasuries. Whether it is restricted by the real world, or the off-chain behavior of purchasing national bonds is not restricted by the blockchain, and there is a risk of default, the DAI provided by MakerDAO, like other centralized stablecoins, is no longer a trustless stablecoin . There is no difference between the segmented users of DAI and USDT and USDC, and they are also users who are not sensitive to centralization risks. According to MakerDAO's own disclosure, the net loss for one year was 9.4 million US dollars.

The second-ranked stable brother: FRAX, the collateral assets behind it are USDC and USDC derivative assets. The centralization risk of FRAX is inherited from USDC, not only does not get rid of the centralized stable currency, but also has the same origin as USDC risk. FRAX will issue 21,720,976 FXS in 2022. If the current market price is 9.78, then FXS will raise 210 million US dollars to the market.

In contrast to fully centralized stablecoins: According to Coinbase’s fourth-quarter financial report, USDC’s profit in one quarter of 2022 will be as high as 292 million US dollars. Tether generated a profit of $700 million in the fourth quarter of 2022.

The risk of stable currency is that either the collateral cannot cover the liabilities and is completely decoupled, or the collateral can completely cover the liabilities and keep a close eye on the US dollar. As long as a stable currency does not completely remove the centralization risk, it will be completely exposed to the centralization risk. It also faces the risk of centralization. On the one hand, the centralized stable currency that does not give up the algorithm loses money at high cost every year, and it is difficult to expand its scale; The conclusion is obvious. A completely decentralized stablecoin has completely incomparable advantages in terms of efficiency and business expansion. In the long run, stable products that compete with the track have only a dead end.

image description

[Figure 5] The Impossible Triangle of Stablecoins

secondary title

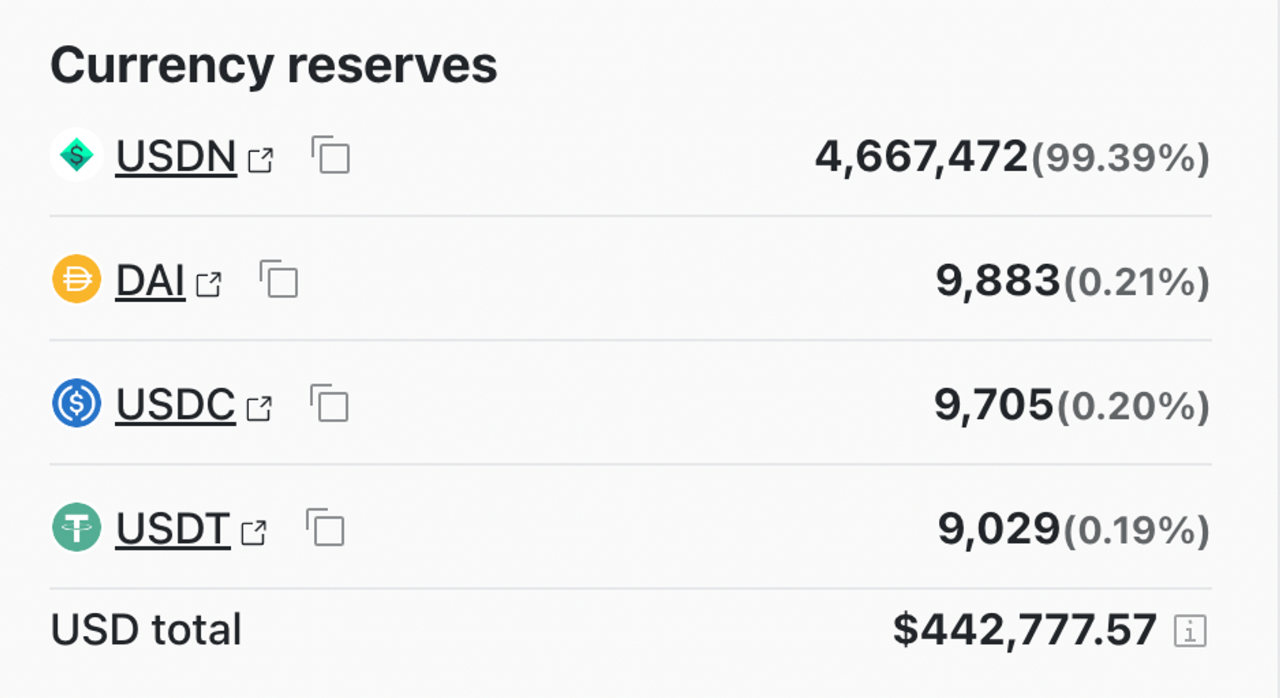

Completely decentralized and stable track

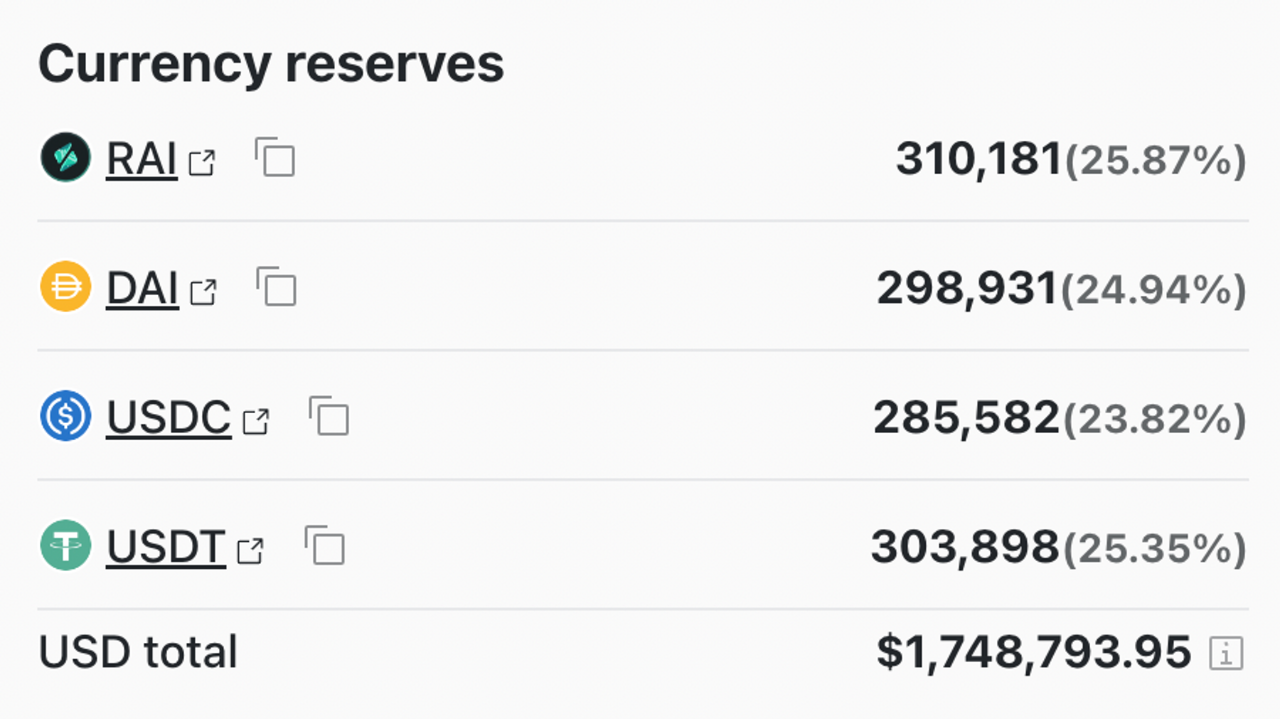

Today, most stablecoins are tainted with centralization risks. Let's take a look at the few remaining decentralized stablecoin projects:

image description

image description

[Figure 7] LUSD supply and demand are not out of balance

image description

【Table 2】LUSD Supply and Demand Scenario

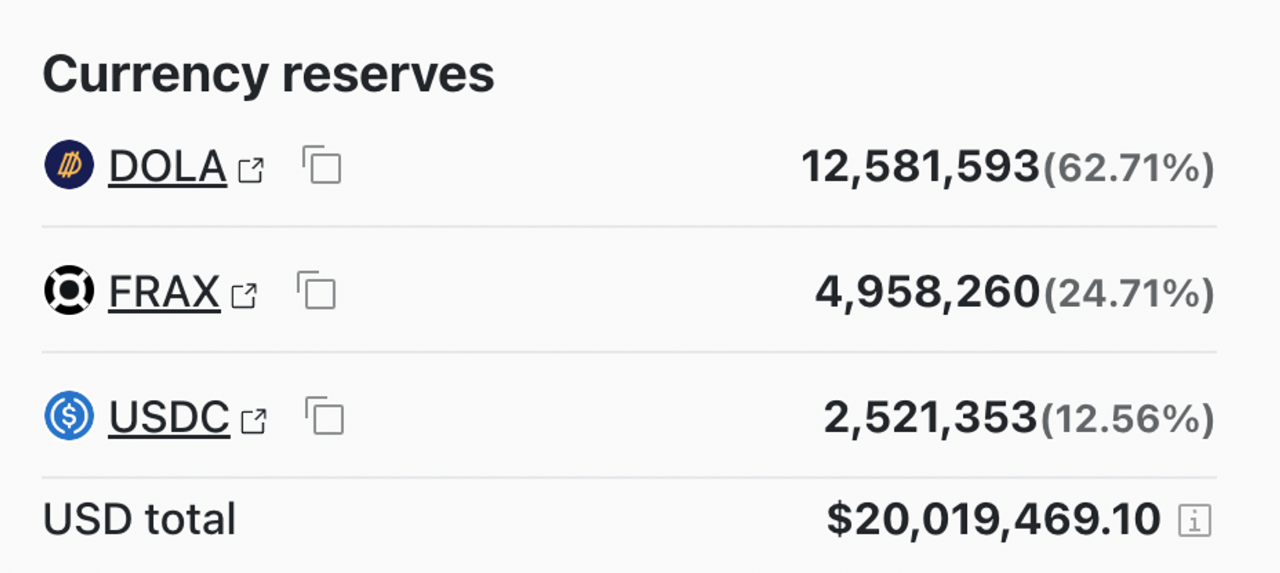

Inverse.finance, Lending USD stablecoin DOLA using ETH and OETH decentralized assets as credit collateral. The method adopted is also overcollateralization. The price stabilization mechanism still relies on arbitrage and interest rate controls. However, the DOLA minted by inverse.finance is still pegged to USD, which is the shadow of the US dollar. inverse.finance specially designed a token DBR, using DBR as a tool for interest rate settlement. The price of DBR reflects the interest rate level of DOLA. The emergence of DBR makes the lending strategy more flexible. Pay attention to the disclosure and disclosure of information in product design. This kind of consideration is often only possessed by excellent large-scale projects.

DOLA has designed a bond model, locking DOLA discounts to get INV, its platform currency.

image description

[Figure 8] The scale of Dola is gradually expanding

The disadvantage of DOLA is very obvious. Its loan interest rate is as high as 4.92%, which is far beyond the interest rate level provided by MakerDAO, and it is also higher than LUSD, which claims to be interest-free. Therefore, it is difficult to scale up.

first level title

06 Conclusion

references:

references:

https://vitalik.ca/general/2022/05/25/stable.html

https://www.forbes.com/sites/jeffreydorfman/2017/05/17/bitcoin-is-an-asset-not-a-currency/? sh= 73 beeba 42 e 5 b

https://www.tuoluo.cn/article/detail-10093593.html

https://books.google.la/books? hl=en&lr=&id=wWHvAgAAQBAJ&oi=fnd&pg=PP 1&dq=Ancient+Egyptian+Materials+and+Industries&ots=nWxhEHGfAt&sig=cmdQabDZg 8 xxO_GWoLk 8 GzOxw 5 U&redir_esc=y#v=onepage&q=Ancient Egyptian Materials and Industries&f=false

https://foresightnews.pro/article/detail/22514

https://cointelegraph.com/news/circle-discloses-full-breakdown-of-55-7 b-usdc-reserves

https://ethresear.ch/t/who-is-the-moses-parting-the-red-sea-in-algo-stablecoin-after-fei-s-dilemma-gyroscope-or-titi/10246

https://docs.liquity.org/faq/stability-pool-and-liquidations

https://news.marsbit.co/20221212213954752574.html

Money in the Late Old Kingdom: A Study of the Types and Functions of Clay Tokens Used as Money in Ancient Egypt