RAI: The Decentralized Stablecoin "Ideal Type" in V God's Eyes

foreword

foreword

With the US Securities and Exchange Commission (SEC)’s securities charges against BUSD and Binance’s launch of the decentralized stablecoin protocol Liquity’s “governance” token LQTY, decentralized stablecoins have once again become a market hotspot.

The decentralized stablecoin track is a track that Mint Ventures has been paying attention to for a long time. We have carried out timely and comprehensive coverage of the relatively good decentralized stablecoin projects. The research reports we have produced include "From currency protocol to DeFi matrix, analyze Frax.finance from multiple angles》、《Liquity: A rising star in the stablecoin market》、《Academic Stablecoin Rookie: Angle Protocol》、《Can Celo, a good student on the stablecoin track, replicate Terra's rise? ", for Luna/UST, which rose rapidly and fell like a meteor, we also haveTerra: The Rise of the Stablecoin Legion》、《Behind the tens of millions of dollars in gambling: Is Luna a Ponzi scheme?"The two analyzes will help readers understand the leading projects of various decentralized stablecoins.

Regulatory issues are always the sword of Damocles hanging over the stablecoin project, and it is also the biggest opportunity for the development of decentralized stablecoin projects. We also always pay attention to regulatory trends: "The regulatory storm opens a window of opportunity. Which decentralized stablecoins deserve attention?》、《The thunder of regulation has finally come, is the spring of decentralized stablecoins coming?"In the two articles, we analyzed the decentralized stablecoin projects that deserve more attention, as well as the opportunities and worries of the development of decentralized stablecoins.

In this research report, we will focus on Reflexer Finance, the most extreme decentralized stablecoin project in terms of decentralization/trustlessness. The "stablecoin" RAI issued by it does not rely on any centralized currency, or even fed.

This article was written by the author based on the project information and market background at the time of writing. Limited by the author's cognition and information limitations, the content of the article may contain errors in data, facts, and analysis and deduction. We welcome peer exchanges and corrections. All content in this article does not constitute investment advice.

1.1 Core investment logic

1.1 Core investment logic

RAI has the ultimate trustless characteristics of illegal currency anchoring, complete decentralization, and minimal governance. It is one of the most decentralized stablecoins on the Ethereum network. It is also called by Vitalik, the founder of Ethereum, "only by The purely ideal type of collateralized automated stablecoin backed by ETH".

1.2 Main Risks

1.2 Main Risks

Risks of RAI include:

PMF risk: Low acceptance of non-fiat currency-anchored stablecoins on the user side

There are many resistance factors in marketing:

Only using ETH as collateral will affect the promotion of RAI on the user side

The concept of minimal governance makes the team's operations less grasping

The circulation of the governance token FLX has exceeded 67%, and the subsequent incentives for use case promotion may be insufficient

Team risk: Nearly a year after co-founder Stefan left, the team’s progress in use case expansion and marketing is relatively general. RAI’s risks include:

1.3 Valuation

1.3 Valuation

From the perspective of P/S, compared with Liquity, which is also a fully decentralized stablecoin on the Ethereum network, Reflexer's valuation is lower; and from the perspective of stablecoin scale, Reflexer is relatively overvalued.

See 4.2 Valuation Level for details.

2.1 Project business scope

2.1 Project business scope

Reflexer Finance's sole business is "stablecoins", developed and operated by Reflexer Labs.

Its core business process is relatively simple: users over-mortgage ETH to generate stable currency RAI, and users can continue to use RAI by paying 2% annual interest. Users can redeem ETH by repaying RAI and paying loan interest. System governance is currently carried out by token holders of the governance token FLX, who hope to achieve "no governance" in the long run.

Unlike DAI and most other stablecoins, RAI does not anchor any legal currency or physical objects, but automatically adjusts the target price by market supply and demand, and finally achieves its goal of "ETH-based low-volatility assets". Specifically, we will expand in Section 2.3 Business Details.

2.2 Project History and Roadmap

The history of Reflexer Finance is as follows:

In terms of the roadmap, in addition to the minimal governance that will be described in detail below, RAI is also considering whether to expand the collateral to decentralized assets such as stETH. Vitalik also raised a discussion on the Reflexer Governance ForumHow the RAI system supports LSDdiscuss.

2.3 Business Details

For stablecoins, the first thing we need to examine is its core product mechanism. A set of self-consistent core product mechanisms including supply control mechanisms, liquidation mechanisms, and bad debt handling mechanisms are the cornerstone of the long-term development of stablecoin projects. The reason why algorithmic stablecoins such as ESD/BAC died out quickly, and the reason why UST spiraled upwards and collapsed epically is that its core product mechanism is not sustainable for a long time.

2.3.1 Supply control mechanism

For stablecoins and even any currency, the supply control mechanism is the most important part of its design. Since the overall market demand is unpredictable (although various means can also be used to stimulate demand, the stimulation of the demand side is very important for price regulation. One goal is indirect, and the stimulus on the demand side is not derived from the mechanism, but from incentives), so the core mechanism for stable currency price stability mainly depends on supply control. A supply control mechanism that can flexibly respond to the market while maintaining the underlying stability is what every stablecoin project hopes to build.

The Reflexer system allows users to generate RAI at any time according to the redemption price (that is, the target price, for the convenience of understanding below, we refer to it as the redemption price), and at the same time allows users to repay the RAI according to the redemption price of the system and get back Staked ETH.

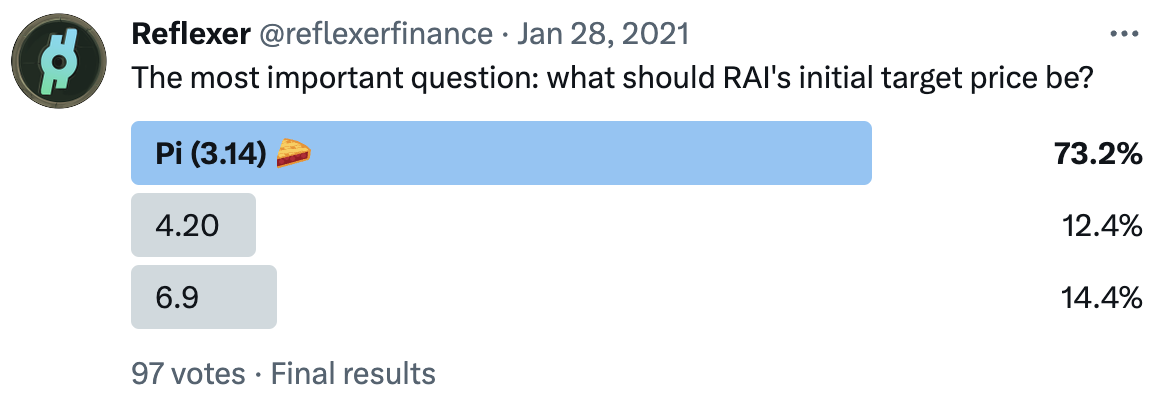

The core of the supply control of the Reflexer system is that when there is an imbalance between supply and demand in the market, Reflexer will actively adjust the redemption price of RAI, and guide the market price close to the redemption price by incentivizing users' arbitrage behavior, so as to achieve a new balance between supply and demand. The redemption price of RAI is initially set at 3.14 (pi), which is then adjusted by the code according to the market price.

There are two types of roles in Reflexer's system: net debtors to RAI (borrowers of the RAI system) and net holders of RAI assets (lenders of the RAI system). Borrowers of the RAI system usually refer to users who mortgage ETH to generate RAI and use RAI for other purposes. They have net liabilities to RAI and need to purchase RAI from the market for repayment.

The Reflexer system affects the marginal behavior of the above two groups of people by controlling the redemption price, thereby realizing active control of the RAI supply. in particular:

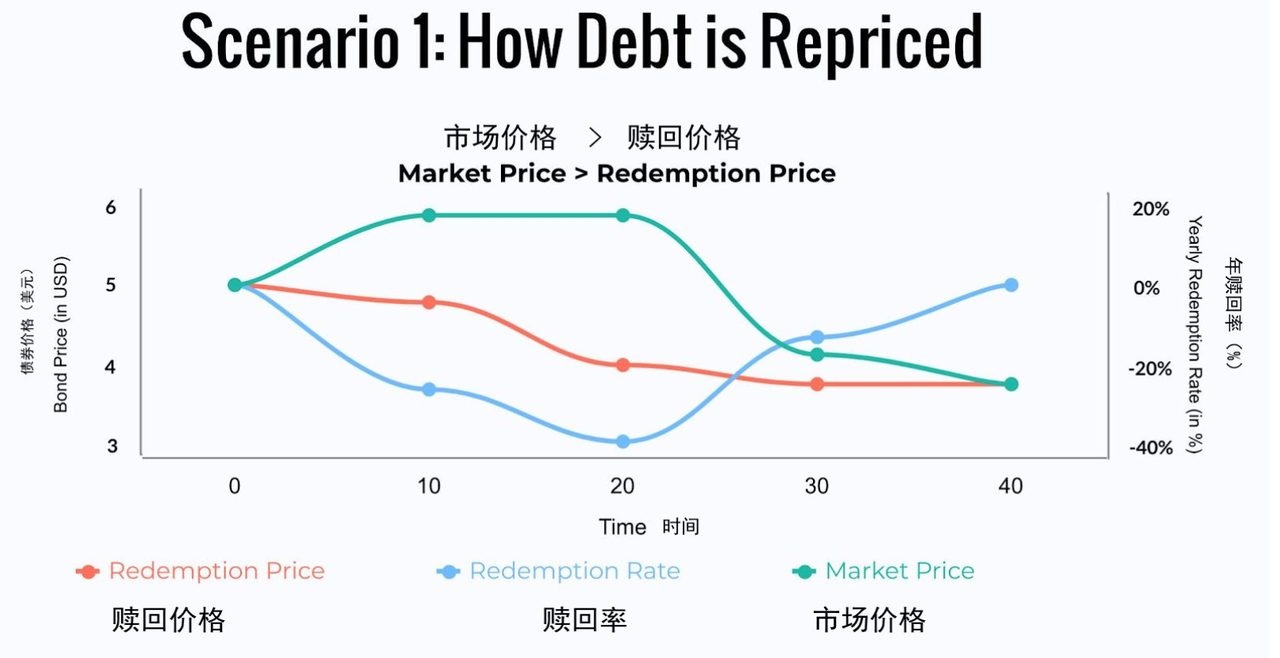

Image Source:

Image Source:RAI Chinese White Paper

0 is the initial state;

10 points, the market price of RAI increases (green line), and the market price is higher than the redemption price (red line). At this time, some arbitrageurs have begun to mint new RAI to sell to the market for arbitrage. The redemption rate of the system (blue line) is negative (net casting);

20 points, the system further reduces the redemption price of RAI, the arbitrage space increases, and the casting rate further increases;

After 40 minutes, the system reaches a stable state again.

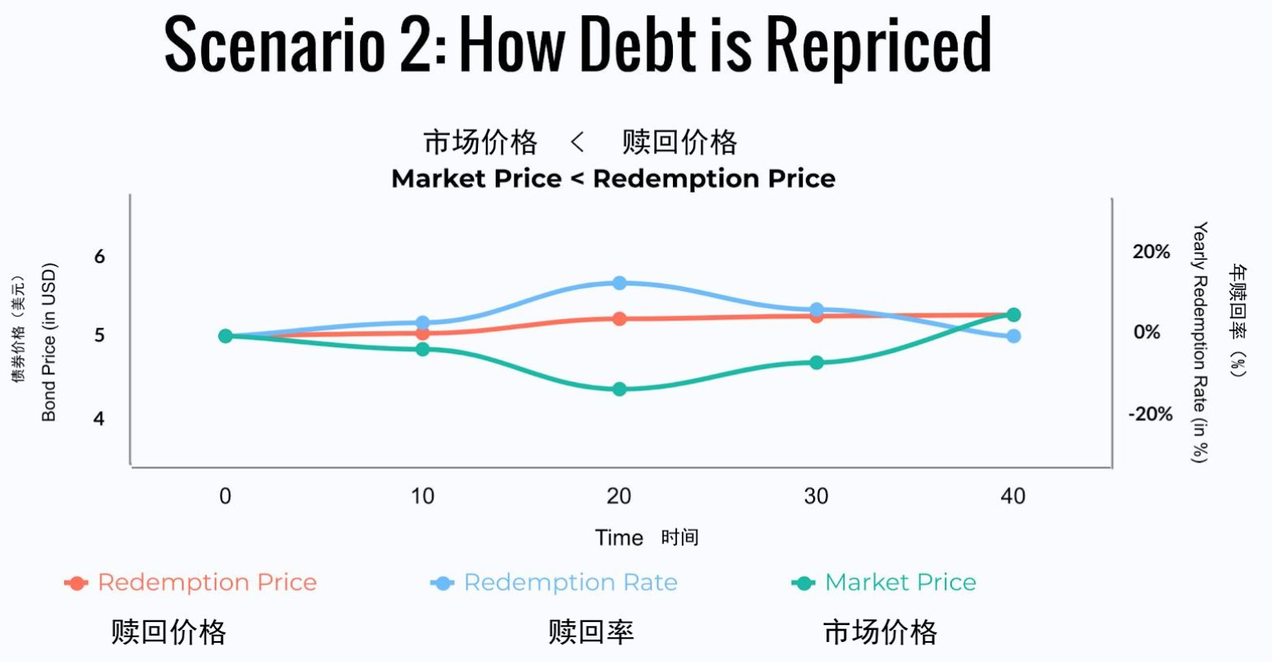

Image Source:

Image Source:RAI Chinese White Paper

0 is the initial state;

10 points, the market price of RAI is reduced (green line), the market price is lower than the redemption price (red line), the net borrower of RAI can buy RAI from the market and repay it to the system for arbitrage, and other participating players in the market can also expect Buy RAI down, so that the system's redemption rate (blue line) increases;

20 points, the system will further increase the redemption price of RAI, the arbitrage space will increase, and the redemption rate will further increase;

After 40 minutes, the system reaches a stable state again.

In terms of specific implementation, the RAI system adopts a mechanism based on PID control (Proportional–Integral–Derivative controller, proportional-integral-derivative controller, widely used in feedback control in industrial design), using a series of parameters to adjust the above control process. in particular:

The proportional parameter (P parameter) is mainly used to adjust the deviation of the system, and its adjustment is based on the "proportion" of the deviation, that is to say, the larger the deviation ratio, the greater the adjustment range. In the example of RAI, when the market price is inconsistent with the redemption price, the proportional parameter mainly drives the change of the redemption price: if the market price rises, the redemption price will decrease; if the market price continues to rise, the redemption price will continue to decrease ; The P parameter has existed since the RAI went online and is the basis of the entire system. It is this parameter that makes the RAI system have what founder Ameen Soleimani called a "spring" feature: "The farther the market price of RAI is from the redemption price, the greater the motivation to bring RAI back to balance."

The adjustment of the integral parameter (I parameter) is based on the "integral" item of the deviation. The integral item takes the time factor into account. The larger the integral item of the deviation, the greater the adjustment range. In the example of RAI, when there is a continuous gap between the market price and the redemption price, the integral parameter will gradually increase, driving more drastic changes in the redemption price. Within the RAI system, the I parameter will go live in February 2022.

The adjustment of the differential parameter (D parameter) is based on the "differential" item of the deviation, the greater the differential item of the deviation (the more severe the deviation), the greater the adjustment range. The D parameter is currently not live in the RAI system.

Readers who are interested in the theory and practice of PID control of RAI can go toReflexer Official Documentation、as well asas well asArticle by founder AmeenCome to know more details.

image description

Figure: Reflexer Twitter vote to determine initial target price

This set of mechanisms of the RAI system is exactly in line with what the founder of monetarism and Nobel laureate in economics, Milton Friedman, ideally expected for the Federal Reserve. Friedman argues that the Federal Reserve's job is sufficient to be replaced by a computer:

Abolish the FED, replace it with a computer.

Abolish the Federal Reserve and replace it with computers.

(This is also an important Meme in the Reflexer community)

2.3.2 Clearing Mechanism

RAI is an over-collateralized stablecoin. Like other stablecoin agreements or lending agreements that adopt the over-collateralized model, when the ratio of someone’s collateral value to the value of the loan is below a certain threshold, in order to ensure the safety of the agreement If healthy, liquidation will be triggered. At this time, the liquidator obtains the liquidated person's collateral (ETH) through a fixed discount auction, and at the same time repays the liquidated person's debt (RAI). This process is called "collateral liquidation" and is also the first guarantee of protocol security;

The stability fee (interest) usually charged by the agreement will be included in the "surplus buffer". When the collateral liquidation cannot deal with all bad debts, the agreement will first use the funds in the surplus buffer to liquidate the bad debts. This is the second guarantee for the safety of the agreement (The amount accumulated in the surplus buffer exceeds a certain amount or a period of time, and will be used to repurchase FLX through DAO voting and destroyed);

If the surplus buffer is unable to deal with bad debts, the agreement will enter a "debt auction". The debt auction is the system to issue more FLX tokens in exchange for RAI in the market to complete debt processing. This is the third guarantee of protocol security, and it also corresponds to the "lender of last resort" function in FLX tokens.

From the entire liquidation system, we can see that "collateral liquidation" is the permanent line of defense of the system. Collateral liquidation is carried out at a fixed discount, which can also effectively improve liquidation efficiency and avoid systemic risks caused by low liquidation efficiency under extreme market conditions (such as what MakerDAO encountered on 312 in 2020). And assuming that the market conditions are extreme and the collateral liquidation mechanism temporarily fails, there are also "surplus buffer redemption" and "debt auction" to maintain the security of the entire system. In fact, the liquidations that have occurred since the launch of RAI are all collateral liquidations, and surplus buffer redemption and debt auctions have not been used.

image description

RAI's market price, redemption price (red line) and liquidity data sources https://dune.com/HggqX/Reflexer-RAI

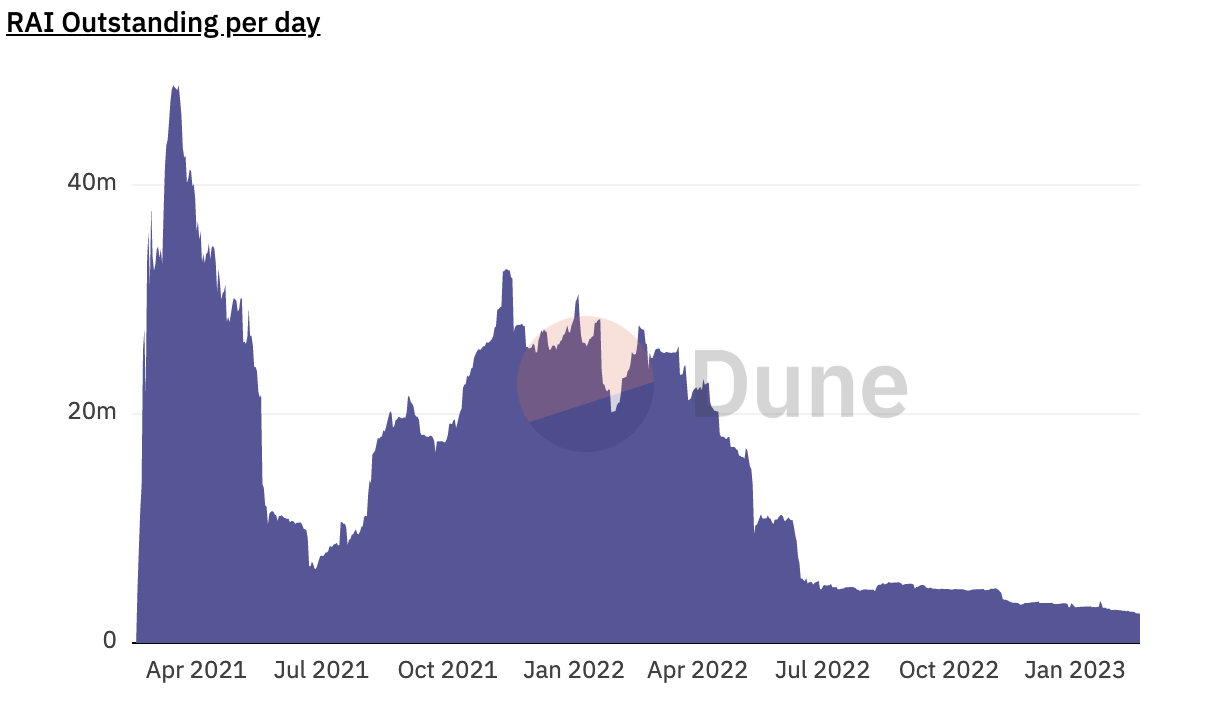

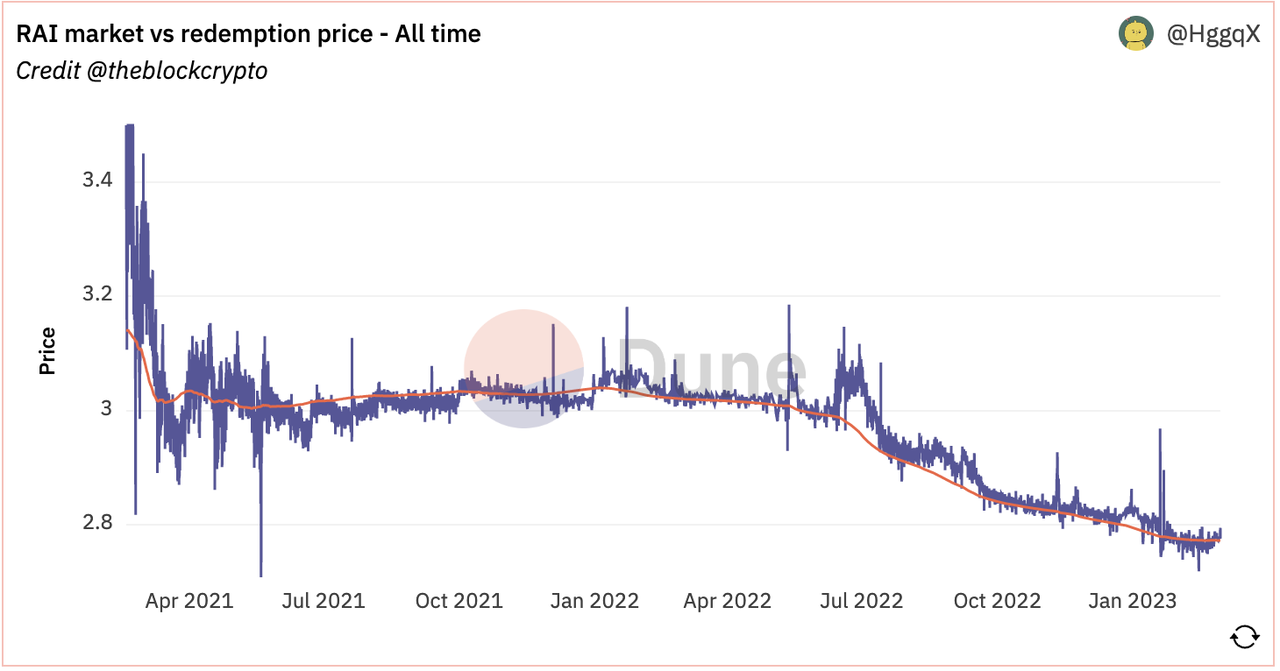

From the above figure, we can see that since it went online with a redemption price of 3.14 in February 2021, the market price and redemption price of RAI have been in a good fit. After the initial market volatility, the redemption price of RAI has been fluctuating within a narrow range of 3.01 to 3.04 US dollars until May 2022. During this period, RAI's underlying asset ETH fluctuated greatly, 4,000 US dollars- >$1750 -> $4800 -> $1800, the circulation of the same RAI fluctuates greatly, its circulation is 50 million pieces -> 6.5 million pieces -> 30 million pieces -> 16 million pieces. Under such violent fluctuations, RAI has accomplished its goal of "ETH-based low-volatility assets".

From May to July 2022, starting from Luna, 3AC, Celsius, and Voyager collapsed one after another, and the ETH of the lending platform reached the large liquidation line one after another. At the same time, the entire market experienced a liquidity crisis and demand for decentralized stablecoins. The narrative of the track has hit, and for the holders of RAI, their collateral ETH is also facing the risk of liquidation as the value of their collateral ETH continues to depreciate. Against this backdrop, RAI borrowers rushed to repay, and the circulation of RAI dropped from 17 million on May 6 to 5.2 million on June 20. Borrowers' strong demand for RAI repayment drives up the price of RAI. At that time, there were not enough players in the market to carry out the arbitrage of "minting RAI and selling RAI to the market", which made the market price of RAI higher than the redemption price of USD 0.08 (approx. 3%) around. Under the mechanism of the I parameter we mentioned above, the redemption price of RAI continued to decrease, and finally dropped to about $2.7.

In general, RAI has been online for 2 years, which also coincides with the time when the price of Ethereum fluctuates violently. During this period, the price of RAI fluctuates between 2.75 and 3.05 most of the time, and no liquidation accidents or other security issues occurred. Risk events, its core product mechanism has been verified.

Data Sources:

Data Sources: https://stats.reflexer.finance/

In terms of use case expansion, RAI has also achieved certain results:

Lending market: RAI gained integrations from Aave, Euler, Rari, Cream;

In terms of centralized exchanges: RAI successfully launched Coinbase;

In addition, RAI has also completed integrations with payment platforms Uphold, Eidoo, and Mover.

Among them, the integration of Aave and Coinbase shows their impressive bd capabilities. However, due to the small scale of RAI, neither of the two use cases of RAI has taken shape.

2.4 Financing and team situation

2.4.1 Financing situation

Reflexer Finance has raised 3 rounds in total:

In April 2020, MetaCartel Ventures announced Reflexer Finance as its first investment for an undisclosed amount. MetaCartel is an incubating Venture DAO whose members are basically active project parties and VCs in the Ethereum community.

In August 2020, Reflexer announced the completion of a $1.68 million (ETH current price around $400) seed round of financing led by Paradigm, with participants including Standard Crypto, Compound founder Robert, and Variant Fund.

On the eve of the launch of the product mainnet in February 2021, Reflexer announced that it had completed a financing of US$4.14 million, led by Pantera and Lemniscap, followed by MetaCartel, TheLAO, Aave founder Stani, and Synthetix founder Kain.

Generally speaking, Reflexer’s financing amount is not large, but its supporters are generally active VCs, DAOs and project parties in the Ethereum community, which shows the support of the Ethereum community for Reflexer.

2.4.2 Team situation

Reflexer Finance was founded by Ameen Soleimani and Stefan Ionescu.

image description

Photo: Ameen Soleimani

Stefan Ionescu's original role was more similar to the founder and CTO, but he announced on March 25, 22 that he had withdrawn from most of Reflexer's affairs, only providing consulting services for DAO in the technical field, and locked his own tokens for 4 years . In addition to the two founders, on the eve of the mainnet launch in January 2021, Ameen disclosed on Twitter that there are 7 development engineers (including the two founders) in the Reflexer team.

In May 2022, after self-recommendation and community discussion and voting, Bacon became the new head of DAO, and 0x-Kingfish became the head of integration, mainly responsible for the integration of RAI and other protocols. In August, Bacon left and Reza joined the DAO as community leader.

0x-Kingfish and Reza are the two currently active in Reflexer's daily work besides Ameen. The two remain anonymous. 0x-Kingfish mentioned in his election proposal that he has 10 years of investment experience in the financial secondary market and entered the cryptocurrency industry in 2020; Reza has entered the industry since 17 years and was in charge of the market and community in the encryption project akoin Work, also issued NFT series by itself, and is currently also the BD of encrypted media Decrypt.

Also, in the MetaCartel investment, they disclosed that Reflexer was advised by Nikolai Mushegian. Nikolai is an early active developer in the Ethereum community, co-founder and architect of MakerDAO, and co-founder of Balancer. However, Nikolai passed away in November 2022.

Overall, Reflexer's team is not large, especially after Stefan Ionescu, one of the founders, left, the team as a whole appears to be more "Buddhist", of course, this is also related to the "minimized governance" that Reflexer pursues.

3.1 Industry space and potential

3.1 Industry space and potential

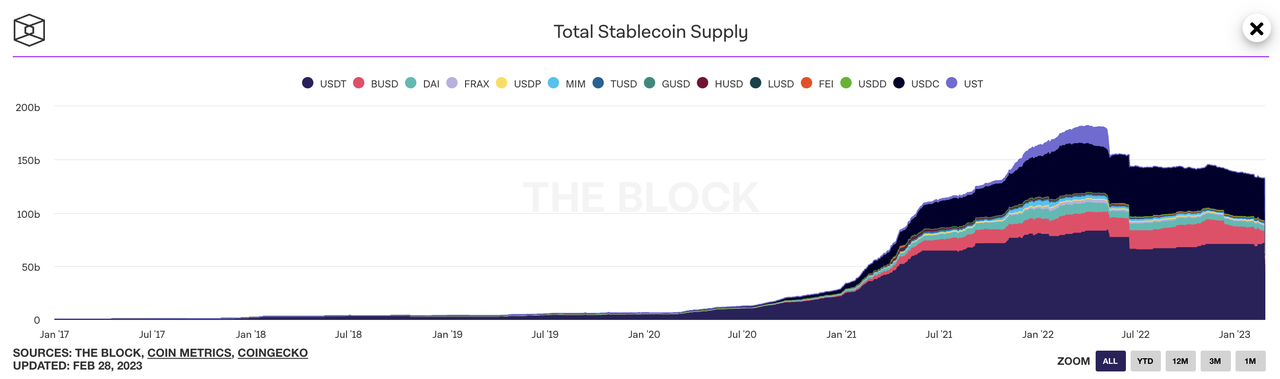

Stablecoins have outperformed the crypto market average in the past round of crypto cycles. Even after a year of crypto bear market and the collapse of the important project UST, the stable currency still has more than 135 billion in circulation, and the decline rate is only about 27% compared with the peak value of more than 180 billion, which is much lower than that of BTC or ETH. price drop.

The settlement currency for most project parties and venture capital institutions to conduct investment and financing activities

Base settlement currency for spot transactions

The settlement currency of new derivatives such as perpetual contracts, which are very popular in the market

The settlement currency for most project parties and venture capital institutions to conduct investment and financing activities

In the last cycle, the profit-making effect brought about by the rapid rise in prices under the background of global currency over-issuance, and the continuous emergence of new projects on the chain have also attracted more compliance institutions and wider participation due to their high yields or novel mechanisms. Or, the positioning of stablecoins as the basic settlement currency of cryptocurrencies has been firmly established in the minds of all market participants, and its market size will at least develop synchronously with the overall size of cryptocurrencies, and there is still a huge room for development.

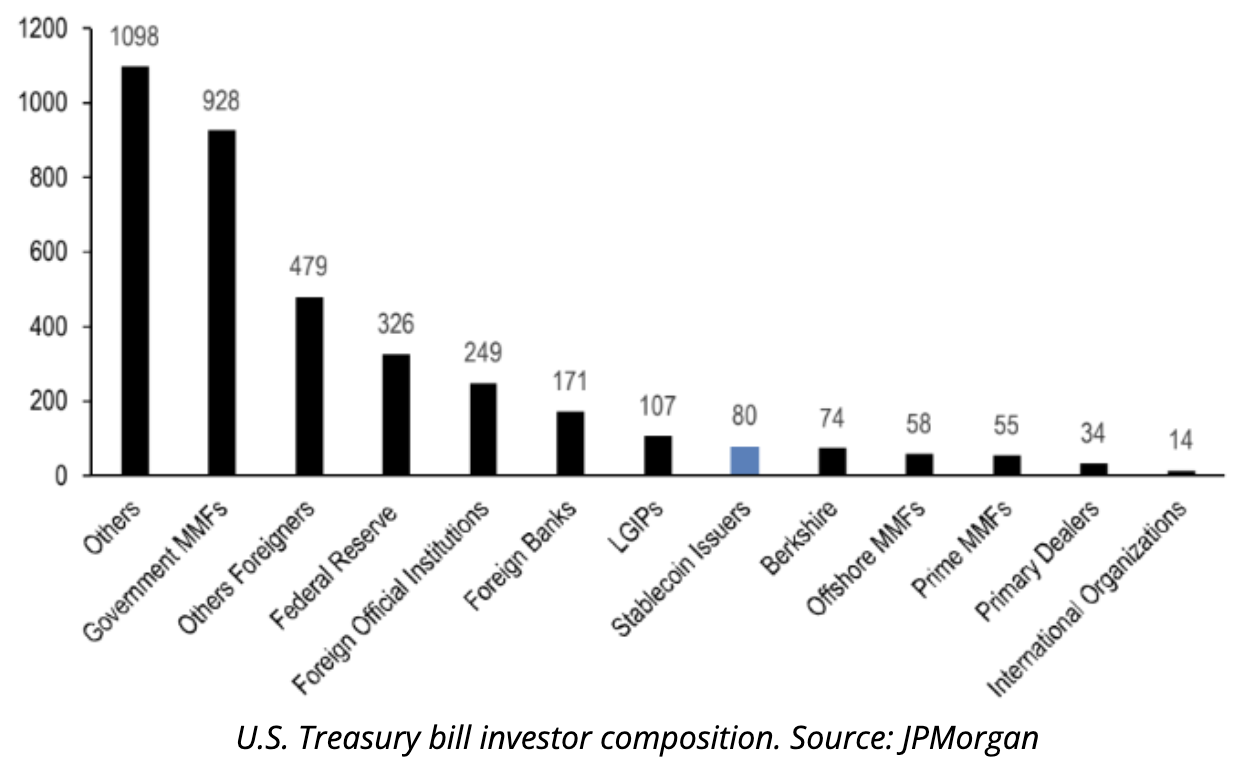

Accompanied by the short-term U.S. Treasury bonds held by the stablecoin issuer accounted for more than 2% of the market (May 2022), even surpassing Berkshire Hathaway, an investment company owned by "Stock God" Buffett, and algorithmic stablecoins The far-reaching impact of the collapse of UST, regulatory authorities are gradually increasing the supervision of the encryption market, especially stablecoins.

In the past six months, different regulatory authorities in various countries have continuously discussed the regulation of the encryption market and stablecoins, and actual regulatory measures have also occurred from time to time. Among them, the two most controversial ones are:

In August 2022, the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) decided to sanction Tornado Cash, a coin mixer on the Ethereum network. After the incident, Circle, the issuer of USDC, quickly froze the USDC in the addresses on the OFAC list, all of which interacted with the Tornado Cash contract. This incident caused a huge sensation in the Ethereum community, and the good-for-nothing even sent ETH to the on-chain addresses of celebrities in the encryption world through Tornado Cash for "poisoning".

In February 2023, the New York Department of Financial Services (NYDFS), the regulator of the stablecoin issuer Paxos, asked it to stop the issuance of BUSD. Paxos also received a "Wells Notice" from the US Securities and Exchange Commission (SEC) due to BUSD-related issues. Or will face charges of illegal securities issuance by the SEC.

The two events have a long-term and far-reaching impact on stablecoin holders and the entire industry.

For any ordinary person in the encryption world, if a certain DeFi project that he has participated in interacting with offends the US Treasury, then the USDC on his own chain may be frozen. The worries caused by this absurd uncertainty will be extremely It greatly affects people's confidence in holding encrypted assets, and it is completely contrary to the anti-censorship, permissionless, and decentralization advocated in the encrypted world. Within 3 months after this incident, the circulation of USDC decreased by 10 billion pieces, while the circulation of USDT, which did not cooperate with OFAC sanctions, increased by 5 billion pieces (As mentioned above, MakerDAO also started discussing after this incident Possibility of DAI depegging from USD).

After the SEC accused the Paxos incident, Binance, in the eye of the storm, immediately began to look for potential legal currency-collateralized stablecoin issuance partners around the world, and also paid attention to decentralized stablecoin projects. Liquity's token LQTY.

Paxos announced on February 21 that it would stop issuing new BUSD, and the market capitalization of BUSD dropped from more than $16 billion on February 13 to $10.5 billion (as of March 1). BUSD, which once entered the top ten cryptocurrency market capitalization, may "return to zero" within a year under regulatory pressure. Regarding the SEC's allegations against Paxos, Messari founder Ryan Selkis spoke fiercely: "My new goal in life is to end the political career of Gary Gensler (SEC Chairman) and make him the reason for Biden's re-election failure...I will spend what I have Every ounce of energy, money, and political capital to fight the morally immoral and corrupt enemies of cryptocurrency."

Although logically unlikely, if BUSD is indeed recognized as a security by the SEC, it will be a huge blow to the entire encryption industry.

Both of the above events have driven the market's attention to decentralized stablecoins. However, compared with the prosperity and development of centralized stablecoins, decentralized stablecoins have been more bumpy in this cycle. Although they once reached the peak, they fell into the "Valley of Despair" with the collapse of UST. The development status of RAI is far inferior to that of centralized stablecoins. We will compare RAI and other decentralized stablecoins in detail in 3.2 project competition landscape.

To sum up, we believe that the stablecoin business has a solid foundation, broad space, and still has great potential. In the stablecoin subdivision track, with the recent regulatory pressure on stablecoins, the decentralized stablecoin track where RAI is located is more in line with the mainstream narrative of the encrypted world that is anti-censorship and trustless, and the current The degree of development is lower, and it has a broader development prospect.

3.2 Project Competitive Advantages

RAI is a decentralized stablecoin. In this section, we will focus on analyzing the competitive landscape of decentralized stablecoins.

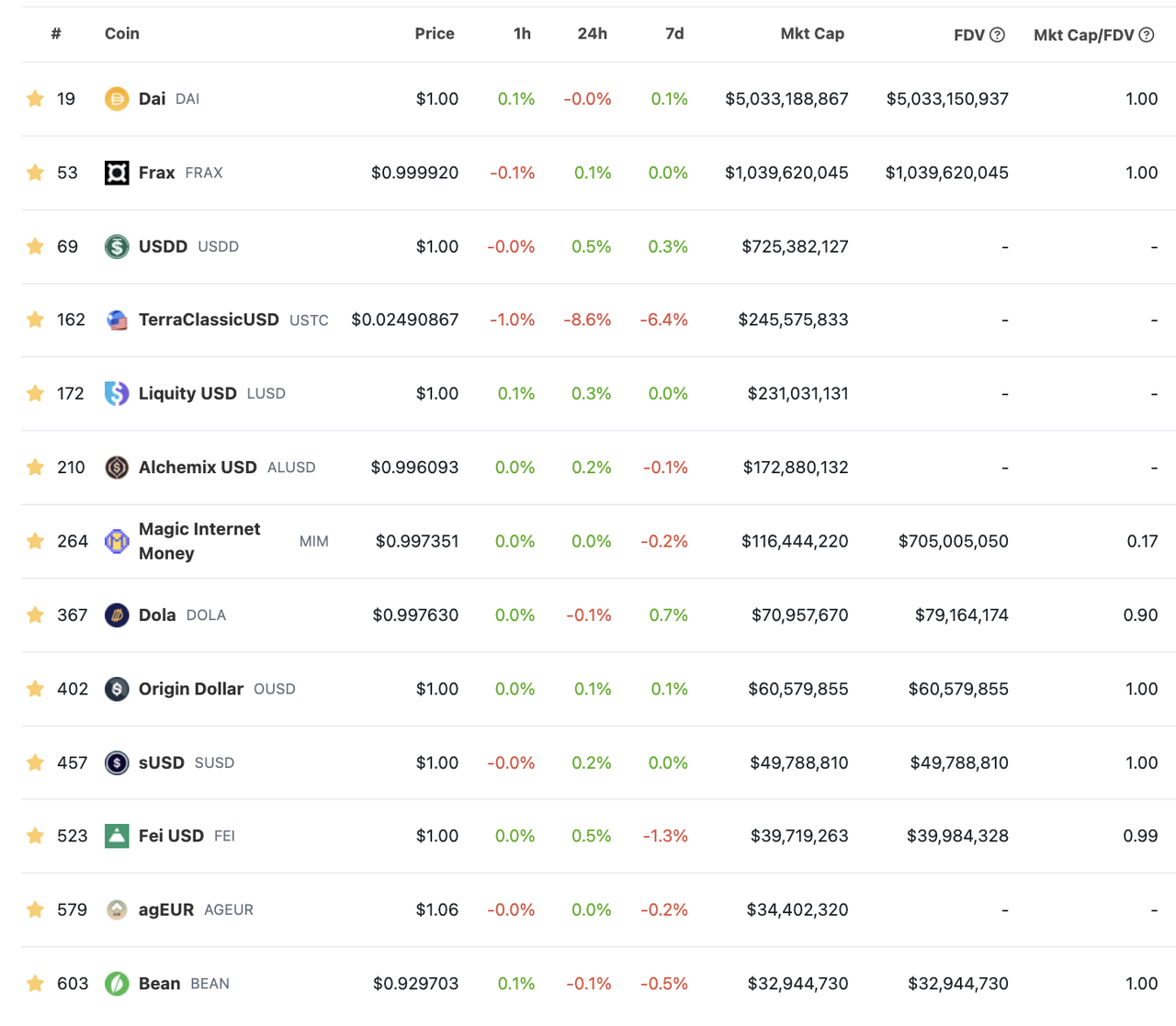

The following are the decentralized stablecoins currently listed by Coingecko with a circulation of more than $30 million.

The circulation market value of RAI is less than 10 million U.S. dollars, and the important indicators for measuring the development of stable coins, such as the number of currency holders, TVL, and the number of transfers, are far inferior to the above projects. Although the business data is comprehensively lagging behind, the author still believes that RAI has a good competitive advantage, which is reflected in:

Non-currency anchor

fully decentralized

3.2.1 Non-currency anchoring

In the section 2.31. "Supply Control Mechanism", we can find that, unlike most stablecoins, RAI's price is not anchored to legal currency or some kind of physical object, but anchors the market's demand for RAI in a roundabout way. need.

This is very rare in the entire stablecoin market. In my impression, only Float Protocol, which was launched roughly at the same time as RAI, has a similar design (Olympus and its Fork cannot be defined as stablecoins in my opinion). The author believes that this design that does not anchor legal currency is very precious to the entire encryption market.

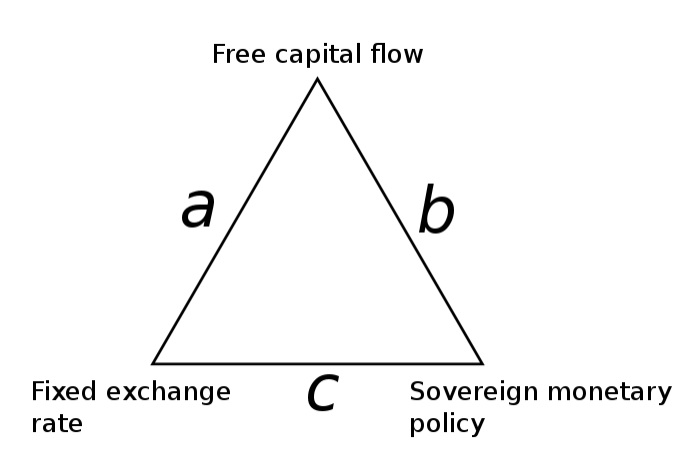

To understand the importance of this design, we may first review a concept of international economics.

source:

source:https://en.wikipedia.org/wiki/Impossible_trinity

In practice, Hong Kong, for example, chooses a stable exchange rate pegged to the U.S. dollar and free capital flows, and completely abandons its own monetary policy; North Korea, for example, chooses an independent monetary policy and a stable exchange rate, and implements complete capital controls. Of course, the vast majority of other countries choose to make a compromise among the above three.

If we think about the current encrypted world from this perspective, and use the combination of all current stablecoins as the "currency" in the encrypted ecosystem, we will find that the encrypted world is very similar to Hong Kong: capital flows out completely freely, and almost completely A 1:1 stable exchange rate policy pegged to the U.S. dollar while completely abandoning its own monetary policy.

In fact, in the above impossible triangle, free capital flow is a natural choice for the entire encryption market, and if you choose the stability of the exchange rate relative to the US dollar, although you can gain promotion and many conveniences, you will lose the currency of the encrypted world Policy independence. At present, the stable currency, which is the cornerstone of the operation of the encrypted world, has become a "puppet" of the US dollar. From this perspective, encrypted currency is not a super-sovereign currency, but a sub-sovereign currency. This runs counter to the concept of anti-inflation and trustless when cryptocurrencies were born. The crypto world may also be plagued by inflation if the Federal Reserve conducts unrestrained currency oversupply. This is also a huge hidden worry in the current encryption world: the foundations under the tall buildings still have the shadow of Fed inflation.

If we think that becoming Hong Kong is not the goal of the encrypted world, and if we recognize the super-sovereign nature of the encrypted currency, then the common currency in the encrypted world should have its own independent monetary policy, superimposed on the natural capital free flow attribute of the encrypted market, then this kind of Currency should avoid being pegged to any real-world fiat currency (abandoning the fixed exchange rate), otherwise it will become a vassal of the fiat currency.

From this perspective, Reflexer operates a pure central bank business, while Circle/Tether or MakerDAO operates nothing more than a commercial bank within the Federal Reserve (ECB) system. The difference between MakerDAO and Circle is that MakerDAO Supports the use of ETH or other encrypted native assets as collateral for loans.

This point has also been recognized by more and more stablecoin project parties. After Tornado Cash was sanctioned,MakerDAO is also considering taking DAI out of USD, this incident also triggered the participation of Ethereum founder Vitalik in the discussion. However, judging from the fact that more than 60% of DAI is currently supported by centralized stablecoins anchored to the US dollar, the probability of MakerDAO achieving this decoupling is very small. Even if it can be achieved, the process will be very bumpy and long.

To sum up, since the vast majority of users have never been exposed to the concept of fiat currency-anchored stablecoins, this of course has caused many obstacles to the promotion of RAI use cases. However, it is easy to anchor the dollar, but it is difficult to build a stable system that is not anchored to the dollar. Abandoning the peg to the US dollar allows Reflexer to completely detach from US regulation and isolate the impact of US monetary policy on its stablecoin RAI. At the same time, this feature is also a rare fault-tolerant mechanism for stablecoins in the entire encrypted world.

3.2.2 Complete decentralization

RAI is completely decentralized, and the only collateral supported by the system is ETH. And decentralization comes at a price.

Similar to Mundell's Trilemma mentioned above, in the encryption world, some people have also proposed aboutThe Trilemma of Crypto Stablecoins, that is, the capital efficiency, price stability, and decentralization of stablecoins cannot exist at the same time. The author believes that this classification also makes sense, and ESD/BAC/UST that tried to obtain the three at the same time eventually went to extinction.

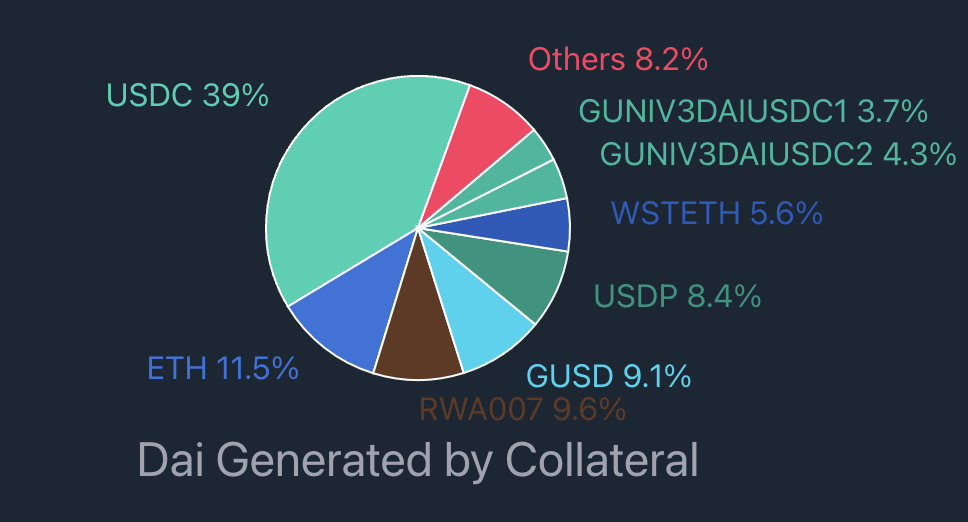

And the development process of the oldest decentralized stablecoin DAI can also reflect this well:

image description

DAI historical price trend data source Coingecko

In order to solve these problems, MakerDAO began to propose to expand the collateral source (but initially did not include USDC). In the 312 incident in 20 years, due to the high gas and low liquidity on the chain, MakerDAO's liquidation system could not operate normally, which eventually left the agreement with a loss of more than 6 million US dollars. It is against this background that Stablecoin Vaults, which supports USDC collateral to generate DAI, is launched.

image description

Origin of DAI:https://daistats.com/#/

From the example of DAI, we can see that introducing other stablecoins that have been widely circulated as collateral for their own stablecoins will effectively improve the liquidity of the protocol’s stablecoins, thereby achieving good price stability; at the same time, due to the collateral Both items and loans are stable coins, and the over-collateralization rate of the system will also be reduced, thereby improving the overall capital utilization efficiency of the protocol; in addition, introducing other stable coins as collateral can also help the decentralized stable coin protocol more effectively Perform a cold start and subsequent expansion. Among the stablecoins in our picture above, there are not a few stablecoins that adopt this mechanism. for example:

The centralized stablecoin assets of FRAX's collateral account for more than 75% (according to the Decentraliazition ratio given by Frax). With the innovative and proactive AMO mechanism in the stablecoin protocol, FRAX also has a very high capital efficiency and price stability;

Decentralized stablecoins such as MIM, alUSD, DOLA, agEUR, and more than half of their collateral composition come from other stablecoins (USDT, USDC, DAI) or stablecoins’ income certificates in other DeFi protocols. In this way, Their business scale is growing relatively rapidly, and their stablecoin prices are usually relatively stable.

OUSD and FEI (latest versions) are generated entirely from other stablecoins;

However, since the widely circulated stablecoins are all centralized stablecoins (DAI also has 60% dependence on centralized stablecoins), choosing to introduce them is actually giving up the insistence on decentralization. If USDC decides to ban the accounts of some of the above agreements, or ban the accounts of DAI, it will have a very serious blow to the above stablecoin agreements.

UST and many other companies that have collapsed choose the ultimate capital efficiency. They allow users to use decentralized assets to generate stable coins. During the market bull market cycle, this method is easier to promote business progress. But the price is that the price of stablecoins cannot be stabilized during the market bear market cycle, which leads to the collapse of the entire system.

Another old-fashioned decentralized stablecoin, sUSD issued by Synthetix, chooses price stability. Most of the time, the price fluctuation range of sUSD fluctuates within 1% of $1, but The price is extremely low capital utilization efficiency (the mortgage rate exceeds 500% all the year round).

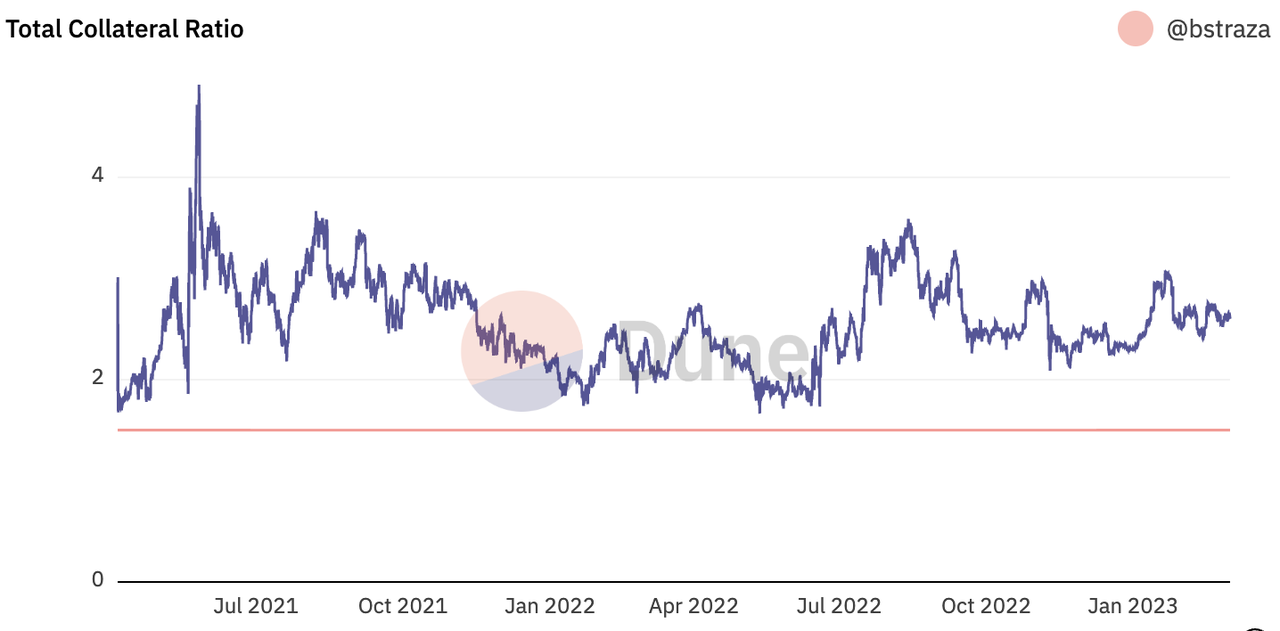

LUSD, which was launched in April 21, uses a novel mechanism (for the Liquity mechanism, please refer toLiquity: A rising star in the stablecoin marketimage description

image description

The source of changes in the mortgage rate of the Liquity system https://dune.com/bstraza/Liquity-Protocol

The RAI we focus on in this article is similar to LUSD. With its excellent mechanism, the price of RAI has achieved a relatively stable price within a wide range; its over-collateralization rate also fluctuates at 300% to 400% all year round.

For decentralized stablecoins, it is easy to choose to introduce more centralized assets, but it is difficult to build a stablecoin system based on complete decentralization. Forgoing greater capital efficiency and more stable prices is the price Reflexer pays for decentralization and censorship resistance.

3.2.3 Minimal Governance

The most essential feature of RAI is decentralization/trustlessness.

At present, the common "governance" function of DeFi protocol tokens is still a kind of "rule of man" in essence. Judging from the actual governance process of these projects with governance tokens, in addition to the extremely low governance participation of token holders, the inevitable oligarchy of governance is also a major problem in the current governance model (this point is discussed in the Uniswap community on cross-chain It is fully reflected in the governance discussion on which cross-chain bridge should be selected for the BNB Chain).

In mechanism design, RAI does not trust the Federal Reserve, nor does it trust any "people". One of its core guiding principles is the idea of minimal governance. RAI believes that it should be as automated and self-sufficient as possible, free from external dependencies. Its ultimate goal is to go governance-free like another stablecoin project, Liquity.

Each module in the Reflexer protocol has detailedMinimal Governance Roadmap, with a view to realizing the automation and governance-free of RAI in the next few years. RAI eventually hopes to reach a state where the governance layer will not control or upgrade most of RAI's core contracts.

In August of last year, RAI's minimal governance had reachedthe second phase of its goal. RAI's governance token, FLX, will gradually reduce its own power over time until its primary function becomes: acting as the system's lender of last resort in the event of bankruptcy (i.e. keeping the "debt auction" going).

summary

summary

To sum up, we believe that, although in terms of indicators to measure the development level of stable currency business such as the market value of stable currency, the number of currency holders, and transaction volume, RAI is far behind DAI and FRAX, which are currently the top decentralized stablecoins. , but with the characteristics of non-legal currency anchoring, complete decentralization and the concept of minimal governance, RAI has some unique advantages over these leading stable currency projects.

As Ethereum founder Vitalik puts it, “RAI better embodies the pure “ideal type” of a collateralized automated stablecoin backed only by ETH.

RAI better exemplifies the pure “ideal type” of a collateralized automated stablecoin, backed by ETH only.

RAI better embodies the "ideal type" of an ETH-only, over-collateralized automated stablecoin

The future that RAI hopes to achieve is "a peer-to-peer electronic currency system without trusting any third party", which is the biggest narrative in the entire encryption market.

3.3 Token Model Analysis

3.3.1 Token Function

The governance token of Reflexer is FLX, which has two main use cases:

RAI's Buffer: Similar to MakerDAO, the RAI system will conduct surplus and debt auctions. If the system loses money, the system will automatically mint and auction FLX to maintain the interests of RAI holders. When there is a surplus in the system, the surplus RAI can also be auctioned at a discount through FLX, and the FLX consumed by the auction will be destroyed. The cumulative number of FLX burned so far is 25,057.

Governance: Although in Reflexer Finance's vision, the goal of RAI is to minimize governance, there are still many things that require human participation during the protocol development process (especially in the early stages), and FLX holders will assume governance functions.

3.3.2 Token distribution and unlocking

The total amount of FLX is 1 million, and its distribution is as follows:

35% of FLX is allocated to the foundation, and its FLX will be mainly used for protocol development, such as liquidity mining rewards to stimulate the liquidity and security of RAI, various grant programs (Grants), etc.

0.687% of the total FLX was allocated to addresses that interacted with Proto RAI earlier.

Airdrops to early RAI minters and RAI-ETH LP will also be paid out of these tokens.

A total of 35.69% of FLX is allocated to investors/early backers:

21% of FLX will be allocated to early backers. Tokens are locked for 1 year and released linearly within the following 1 year.

11.3% of FLX is allocated to Reflexer Labs investors, tokens are locked for 1 year and released linearly over the next 1 year.

3.39% of FLX will be allocated to the DAO that incubates Reflexer, and the tokens will be locked for 1 year and released linearly within the next 1 year.

A total of 29.31% of the tokens are allocated to the team:

20% of FLX is allocated to the team and consultants, and the tokens are locked for 1 year and released linearly within the next 1 year.

9.31% of FLX will be allocated directly to Reflexer Labs without lock-up restrictions.

(Note: The above lock-up time is calculated from April 15, 2021)

So far, according to Coingecko data, the total circulation of FLX is 653,309 pieces, accounting for 67% of the circulation; the cumulative number of FLX destroyed is 25,057 pieces.

3.4 Risks

Risks of RAI include:

PMF risk: Low acceptance of non-fiat currency-anchored stablecoins on the user side

There are many resistance factors in marketing:

Only using ETH as collateral will affect the promotion of RAI on the user side

The concept of minimal governance makes the team's operations less grasping

The number of FLX tokens reserved for protocol incentives is only 160,000. According to the current price of less than 2 million US dollars, the incentives for subsequent use case promotion may be insufficient

Team risk: Nearly a year after co-founder Stefan left, the team’s progress in use case expansion and marketing is relatively mediocre

Code risk: The RAI mechanism is novel and the on-chain control system based on the PID concept is unprecedented. Although it has experienced two years of safe operation and audit by code audit agencies, this risk cannot be eliminated

4. Preliminary value assessment

What operating cycle is the project in? Is it a mature stage, or an early and middle stage of development?

What operating cycle is the project in? Is it a mature stage, or an early and middle stage of development?

Does the project have a solid competitive advantage? Where does this competitive advantage come from?

Does the project have a solid competitive advantage? Where does this competitive advantage come from?

The project does not have a solid competitive advantage, and its business data also lags behind Liquity, the leading decentralized stablecoin project in the track.

Is the long-term investment logic of the project clear? Is it in line with the general trend of the industry?

Is the long-term investment logic of the project clear? Is it in line with the general trend of the industry?

What are the main variables in the operation of the project? Is this factor easy to quantify and measure?

What are the main variables in the operation of the project? Is this factor easy to quantify and measure?

How will the project be managed and governed? How is the DAO level?

How will the project be managed and governed? How is the DAO level?

4.2 Valuation level

4.2 Valuation level

Among the projects we listed in Section 3.2, stable coins that can be fully decentralized include sUSD and LUSD, but the goal of sUSD issued by Synthetix is not to become a general-purpose stable currency, but to become a stablecoin in its derivatives trading system. Settlement currency, and soon Synthetix will issue a new stable currency snxUSD in its latest v3 version to abandon sUSD, so we only choose Liqutiy as the valuation comparison of Reflexer. In addition to Liquity, we also choose MakerDAO, currently the most influential decentralized stablecoin protocol, as a reference.

In fact, Liquity and Reflexer have many similarities. In addition to only choosing the most widely decentralized asset ETH as collateral, they also believe in the concept of no governance/minimal governance, thereby reducing the impact of human governance on decentralization. , representing the purest decentralized stablecoin on the Ethereum network.

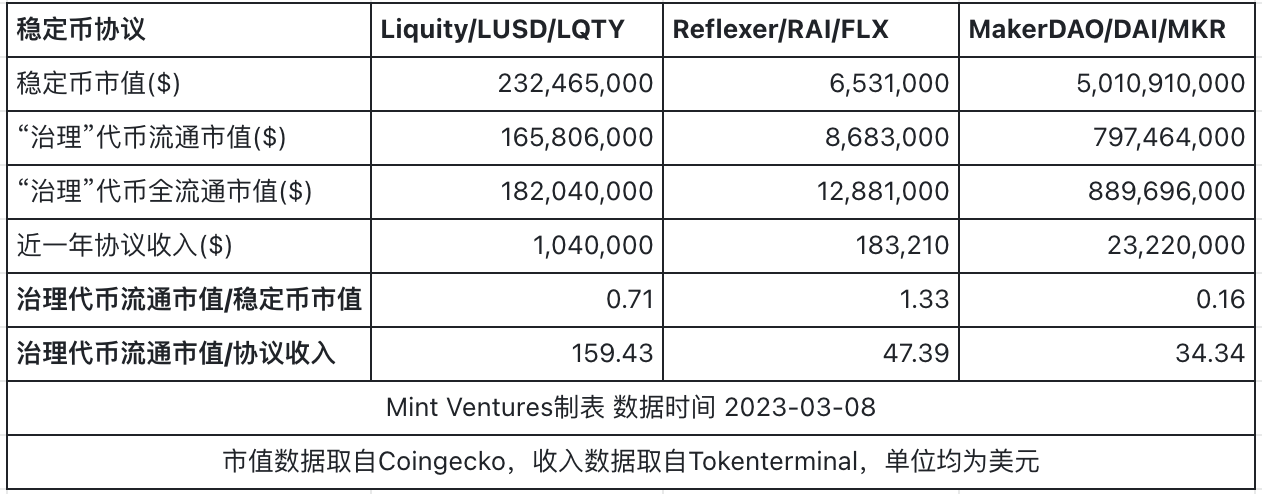

In terms of valuation comparison, on the one hand, we examine the market value relationship between "governance" tokens and stablecoins to measure the scale of stablecoins that their "governance" tokens can "govern"; on the other hand, because LQTY, FLX and MKR may capture protocol revenue, and we can easily examine the P/S-like concept of governance token circulation market value/protocol revenue to compare their revenue capture capabilities. The comparison results are shown in the figure below:

From the perspective of stable currency scale, the valuation of FLX is higher than that of LQTY, and the current market value of FLX is much higher than that of RAI. In addition, regardless of FLX or LQTY, the valuation on this indicator is much higher than that of MKR, which also shows the premium that the market places on fully decentralized stablecoins.

From the perspective of revenue capture capability, the P/S valuation of FLX is much lower than that of LQTY, and is close to the valuation of MKR.

The relative overvaluation of LQTY, in addition to the liquidity premium brought by Binance, is also related to the fee structure of LQTY. LQTY cannot benefit from the scale of LUSD, but can only benefit from the new minting and redemption of LUSD benefit from.

In addition, it needs to be considered that although the MakerDAO agreement has generated a lot of "income", its "expenses" remain high due to its high operating expenses, and its actual "profit" is negative. Holders of MKR. In other words, although its P/S is low, its P/E is negative, which also explains to some extent the undervaluation of MKR from the perspective of P/S.

In summary, we conclude that from the perspective of P/S, Reflexer has a lower valuation than Liquity, which is also a fully decentralized stablecoin on the Ethereum network; and from the perspective of stablecoin scale, Reflexer is Relatively overrated.

5. Reference content

In addition to the references already listed in the article, this article also refers to the content of the following articles:

Ameen Soleimani:Announcing MetaCoin — The Governance-Minimized Decentralized Stablecoin

https://ethresear.ch/t/announcing-metacoin-the-governance-minimized-decentralized-stablecoin/6897

Ameen Soleimani:a-money-god-raises-rai-is-live-on-ethereum-mainnet

https://ameensol.medium.com/a-money-god-raises-rai-is-live-on-ethereum-mainnet-f 9 aff 2b 1 d 331

Adam Cochran:Why MetaCartel Ventures is investing in Reflexer Labs

Vitalik :Two thought experiments to evaluate automated stablecoins

https://vitalik.eth.limo/general/2022/05/25/stable.html

Dankrad Feist:RAI — one of the coolest experiments in crypto

https://dankradfeist.de/ethereum/2023/01/31/rai-crypto-experiment.html

The stablecoin trillema https://stablecoins.wtf/resources/the-stablecoin-trillema

https://community.reflexer.finance/t/dao-integrations-lead-proposal/282