No one can turn a blind eye to the Web3 "enclosure movement"

Original author: Kang Shuiyue, founder of Fox Tech and Way Network, chairman of Danyang Investment

Foreword: Spring silkworms don't miss autumn silk, and summer cicadas don't see winter snow. Whether you see it or not, Web3 is right in front of your eyes.

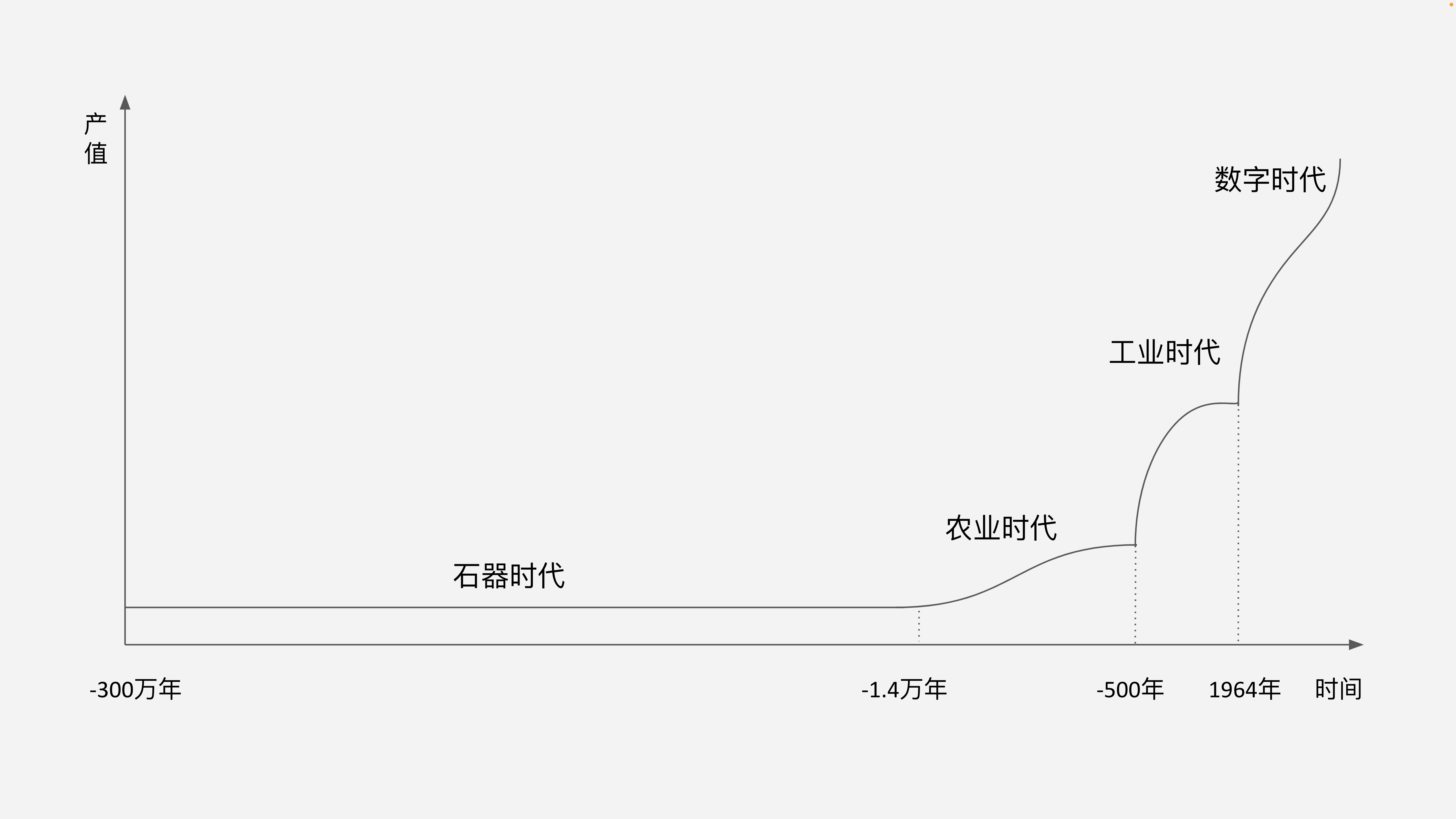

3 million years ago, at the beginning of the Paleolithic Age, apes made the earliest stone tools, and then used these stone tools to hunt and kill animals and cut meat for cooking; 20,000 years ago, at the beginning of the Mesolithic Age, humans made In addition to the richer and more diverse stone tools, stone carvings and decorations that meet the spiritual needs of users began to appear; 14,000 years ago, the Neolithic Age represented by polished stone tools began, and humans learned to sow plant fruits and raise them in captivity. Wild animals have produced agriculture and animal husbandry, which is called "the first agricultural revolution" in history. 10,000 years ago, humans learned to make bronze hoe and other bronze wares, so they began to settle down and carry out hoeing, known as the "second agricultural revolution" in history; 5,000 years ago, humans learned to make iron plows and use captive cattle as power to Plowing, while using irrigation technology to increase production, known as the "third agricultural revolution". These three "agricultural revolutions" that took place over a long period of time now seem ordinary.

image description

Figure 1: The Era of Humanity

In fact, on the eve of the first industrial revolution, the first financial revolution broke out in Europe. Although people hardly talk about the so-called "financial revolution" now, its impact on future generations may be greater than the industrial revolution itself. The first stock exchange in human history, the Amsterdam Stock Exchange, was founded in 1602, the first central bank, the Bank of England, was founded in 1694, the London Stock Exchange was established in 1773, and the New York Exchange was established in 1792. Since then, financial products such as stocks, bonds, foreign exchange, and commodities have been all over the place. The first financial revolution provided the capital fuel for the three industrial revolutions that occurred in the next 500 years, allowing capital for technology research and development and large-scale industrial production. Finance breeds technology and promotes technology to further transform economic society. Now human society has once again come to the FinTech highlight moment where technology and finance are integrated.

It took humans 3 million years to go from the Stone Age to the Agricultural Age, and 14,000 years to go from the Agricultural Age to the Industrial Age, but it took humans only 500 years to go from the Industrial Age to the Digital Age. In the past 500 years, although the gameplay of stocks, bonds, foreign exchange, and merchants has been constantly refurbished, they are all old wine in new bottles. Until the advent of Crypto represented by Bitcoin in 2009, the four major categories of stocks, bonds, foreign exchange, and merchants Since then, financial assets have added an unprecedented category of assets: programmable assets, which are commonly known as "coins". Blockchain is like a behemoth with golden horns that landed on the earth from outer space, and Crypto is like the golden horn on the head of this behemoth, panicking the traditional financial market, and future generations may call it the "second financial revolution" .

image description

Figure 2: Changes in the digital age

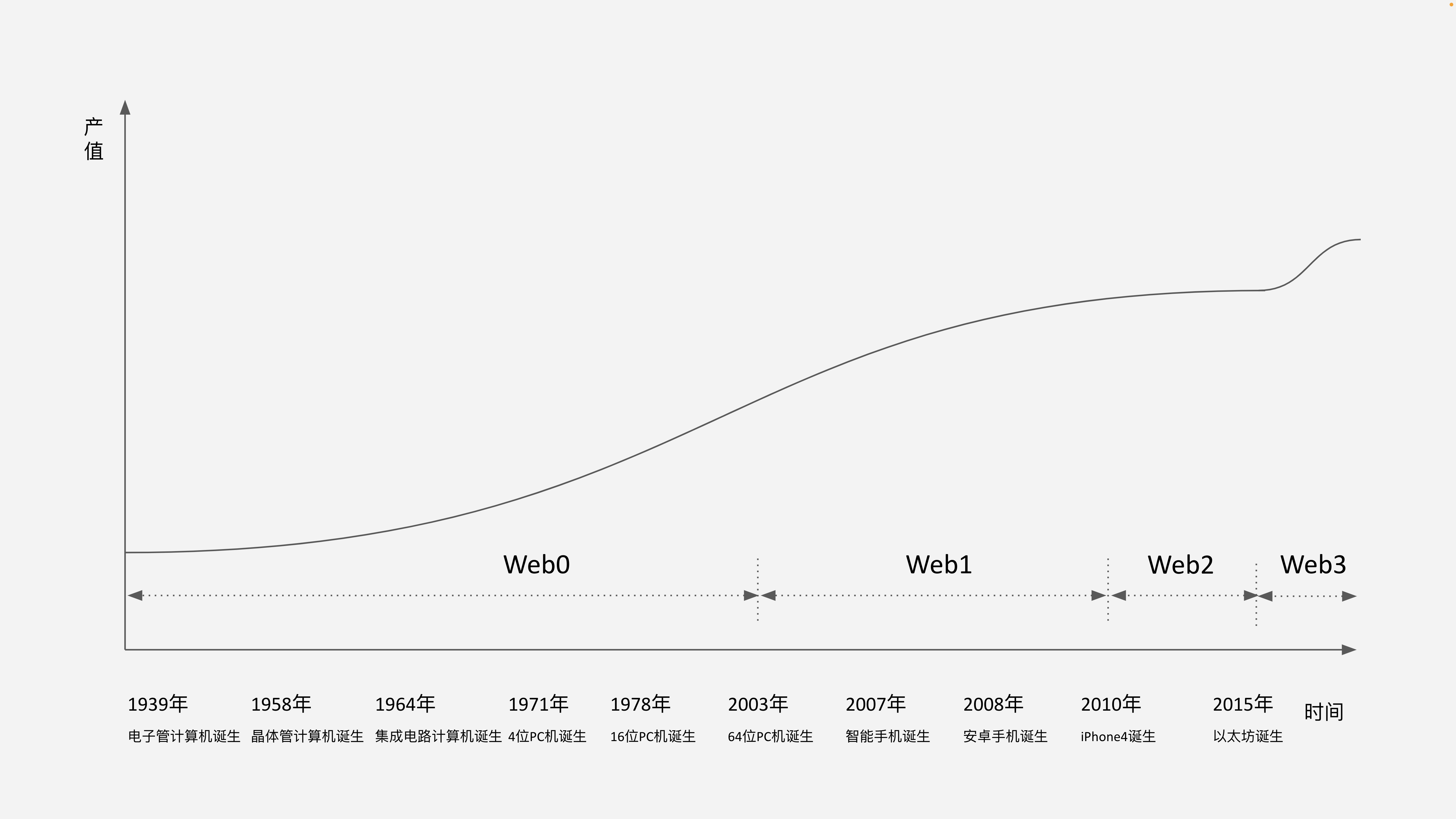

The emergence of integrated circuit computers in 1964 marked the entry of human beings into the digital age, and large-scale programming had a physical basis. The first characteristic of the digital age is that tools are programmable. Human beings use such programmable tools to transform the physical world at a speed far exceeding that of predecessors, ancients, and apes, and have profoundly changed the industrial structure in various fields.

The platform structure in the digital age is divided into front-end and back-end. The back-end includes two parts: the back-end device and the network; the front-end includes two parts: the front-end device and user interaction. Back-end equipment includes chips, operating systems, servers, data centers, and communication networks. From Web 0 in the stand-alone and LAN era, to Web1, Web2, and now Web3, this is the development process of the Internet. Front-end equipment includes computers, mobile phones, watches, glasses, head-mounted displays, cars, and smart furniture; user interaction includes graphics, voice, video, concrete space, and brain-computer interfaces.

From the perspective of the front end, the difference between Web3 and Web2 is mainly that Web3 users have more data sovereignty. Why can Web3 make ownership but it is difficult for Web2? A very important technology is to have verifiability when the data is generated. From the perspective of the back end, the important feature of Web2 is the emergence of the cloud, and the important feature of Web3 is the emergence of the blockchain. Cloud represents centralized capability output, and blockchain represents decentralized capability supply.

Web2 user data is usually stored in a central server. Although there may be several backups, these servers are all managed by some service providers. Although manufacturers can also prove ownership, the ownership of data belongs to these centralized entities precisely because of the emergence of blockchain, which allows these assets and data to have ownership. At the moment when it is on the chain, the blockchain will generate a verifiable time series, so as to determine the ownership at the consensus level.

However, the development of new things has never been smooth sailing, because there are always people who will use new things to do evil or do illegal things. Programmable financial products, as the core products of the second financial revolution, have been downgraded to commonly known as "coins" and "virtual currencies" under the heavy suppression of governments and traditional departments in the past, and "coins" have become secretive words. As the core backend of Web3, the blockchain is also experiencing bumps in its development. Some people were forced to shut down their projects, while others chose to cross the ocean and become digital nomads.

In the face of unprecedented things, man is a thinking reed. The new things of the industrial age in the past 500 years, such as steam trains, automobiles, airplanes and other new things, also caused a panic when they first appeared, and the misunderstanding was only resolved when ordinary people began to use such things. Blockchain and digital currency must also go through this stage. After all, even great thinkers such as Pythagoras, Plato, Aristotle, and Ptolemy mistakenly believed that the earth was the center of the universe, and it was even worse for ordinary people.

Because Web3 is not driven by pure technology, its development is accompanied by the second financial revolution. Therefore, the promotion of Web3 to the economy and society is not a single one, but will be superimposed on Crypto, a programmable financial product to play a role. Programmable financial products are not scourges, even "stable coins" are not scourges. Programmable financial products have never appeared in the industrial age in the past 500 years, but they will inevitably appear when financial digitization reaches certain stages. Governments of various countries are obviously not yet used to this new thing, and are still in the stages of surprise, confusion, learning, understanding, pondering, and testing.

image description

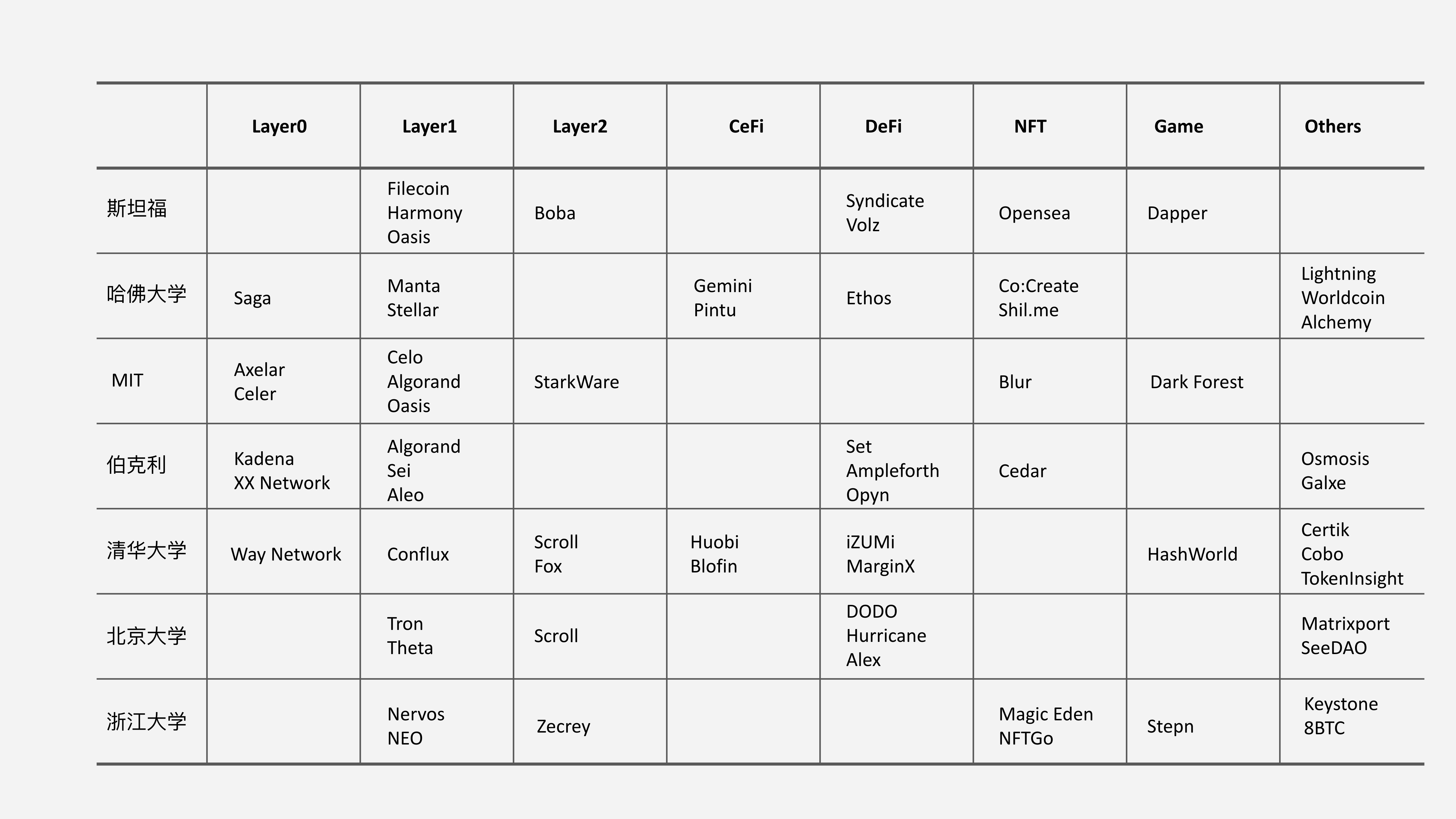

Figure 3: Universities rich in Web3 projects

More than half of the infrastructure field has been occupied by the United States; most of the CeFi field is occupied by Chinese; nearly half of the DeFi field is operated by Chinese groups; there are many players in China, the United States, and Southeast Asia in the NFT field, but the trend is still led by the United States; Gaming is particularly popular in Asia, where an estimated two-thirds of the world's players are played.

Among all the projects that have received financing, the United States has 386 projects, accounting for 35.12%; China has 109 projects, accounting for 9.92%; Singapore has 105 projects, accounting for 9.55%; India has 68 projects, accounting for 6.19%; There are 62 companies, accounting for 5.64%; 35 companies in South Korea, accounting for 3.19%; 34 companies in Canada, accounting for 3.09%; 34 companies in France, accounting for 3.09%; 26 companies in Vietnam, accounting for 2.37%. It is much more difficult for Chinese projects to obtain investment than for American projects, and the voice of Chinese Web3 capital is much lower than that of American Web3 capital.

Regarding the Web3 policy, the posture of China and the United States is the most critical. The current policy direction is that the United States is loosening before tightening and then tightening later; China is tightening before and then loosening, and then loosening later. On February 20, 2023, the Hong Kong Securities Regulatory Commission issued the "Consultation Document" on cryptocurrency transactions, marking that the Hong Kong government has liberalized the field of cryptocurrency transactions with the acquiescence of the central government. Does this mean that China may regain control in the next ten years? What about Web3 dominance?

Conclusion: In any case, there are more than 250 million Web3 users worldwide, and its penetration scope has extended from the financial field to games, social networking, content creation, communication, travel, medical care, education, shopping, supply chain, Manufacturing, finance, marketing, corporate governance and other fields. According to the current speed of this "enclosure movement", it may not take 5 years for Web3 to reach 1 billion global users, and 60% of the world's population can be covered in the fastest 10 years. In other words, it only takes a little over a decade for Web3 to eat the world. Human beings are in the steepest stage of production value climbing since the Stone Age. The world will change every generation. Are you ready?