The ins and outs of the "Iron Bank tearing Alpha Homora" incident

Recently, the "deadlock" between Iron Bank and Alpha Homora over $30 million in bad debts has sparked widespread discussion in the DeFi circle.

Iron Bank is the predecessor of Cream v2, which is a part-collateralized (or even unsecured) lending market jointly launched by Cream Finance and Yearn Finance, while Alpha Homora is a leverage agreement designed to provide yield farming efficiency. In early 2021, Alpha Homora launched the v2 version and began to use the liquidity of Cream v2 to provide users with leverage services.

In short, the relationship between the two parties is:Cream v2 serves as the underlying lending market to provide Alpha Homora v2 users with the liquidity required for leverage operations. Alpha Homora v2, as an upper-layer application, provides users with access to Cream v2 based on its own front-end, and improves Cream v2 by enlarging borrowing needs. Interest rate income for depositors.

The contradiction between the two can be traced back to a hacking incident in early 2021. At that time, hackers used Alpha Homora's code loopholes to borrow funds from Cream v2 to carry out a flash loan attack, which eventually caused a loss of $37.5 million. (For details, please refer to the "Cream Finance was stolen with 37.5 million US dollars, and the disadvantages of the rough and fast DeFi development method are beginning to appear》)

afterwards,Both parties constrain the unrecoverable part of the loss as Alpha Homora's debt to Cream v2, and Alpha Homora needs to pay 20% of the agreement income monthly for repayment in the future, and needs to provide sufficient mortgage assets to guarantee repayment— by locking 50 million ALPHA (about $60 million at the time) in an escrow contract controlled by Cream v2. (For details, please refer to the "Follow-up to the theft of Cream: Alpha Finance repays the monthly reserve fund and mortgages 50 million tokens for custody》)

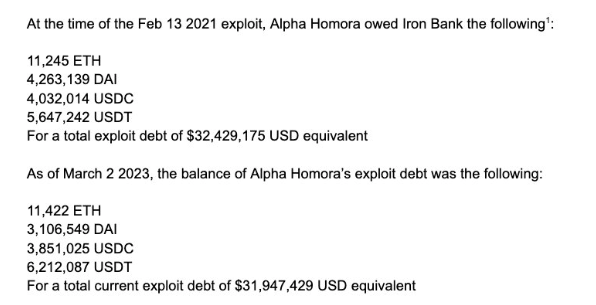

According to recent disclosures by the now-rebranded Iron Bank,At the time of the theft, the details of Alpha Homora's debt to Iron Bank were 11245 ETH + 4263139 DAI + 4032014 USDC + 5647242 USDT, a total of 32.429 million US dollars; as of March 2, 2023, the debt details were 11422 ETH + 3106549 DAI + 385102 5 USDC + 6212087 USDT, a total of 31.947 million USD.

If all goes well, Alpha Homora may be able to gradually pay off its debt to Iron Bank, but due to the bearish market, Alpha Homora's business data has declined severely, and the ALPHA token itself has also fallen sharply. Today's situation is that Alpha Homora can only repay $5,000 a month through agreement income, and ALPHA's mortgage assets, which were originally worth $60 million, have dropped to nearly $6 million.

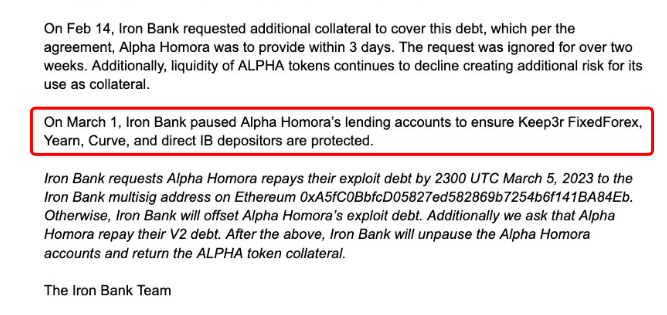

The slowdown in repayment progress and the shortfall in collateral have raised concerns about whether Iron Bank can successfully recover the debt.On March 2, Iron Bank issued an open letter to Alpha Homora, stating that the agreement had requested Alpha Homora to replenish mortgage assets on February 14, and Alpha Homora also proposed a solution within three days, but the matter passed two days. Zhou still hasn't seen any action.In order to ensure the safety of itself and other related agreements, Iron Bank suspended the loan function of Alpha Homora-related accounts on March 1,——As mentioned earlier, Alpha Homora uses its own front-end to provide users with access to Cream v2, which has temporarily prevented these users from withdrawing funds deposited in Iron Bank.

Iron Bank also emphasized in a tweet,If Alpha Homora still does not replenish the mortgage funds on March 5, it will reserve the right to use the funds in this part of the account to offset the debt.

After Iron Bank offered its "killer weapon", Alpha Homora, which was facing a crisis of user funds, finally couldn't sit still. Since March 2, the Alpha Homora team has sent three open letters to Iron Bank in response to the incident.

First open letter:https://blog.alphaventuredao.io/an-open-letter-to-iron-bank/

Second open letter:https://blog.alphaventuredao.io/second-open-letter-to-iron-bank/

The third open letter:https://blog.alphaventuredao.io/third-open-letter-to-iron-bank/

In the first open letter, Alpha Homora explained that he did not sit idly by, but that it would take more time to submit a solution. The Alpha Homora team had submitted a meeting request to Iron Bank, but was ignored by the other party. at the same time,Alpha Homora Emphasizes Iron Bank Has No Right to Freeze User Funds Regardless of Concerns, and called on Iron Bank to immediately release user funds and return to normal discussions.

In the second open letter, Alpha Homora once again asked Iron Bank to release user funds, saying that if Iron Bank does not do so, it will no longer fulfill the agreed repayment obligations in 2021 and will not replenish mortgage funds. also,Alpha Homora also 'threatened' to consider legal action until someone on Iron Bank's anonymous team was identified. Alpha Homora also mentioned that if an extreme situation occurs, it will bear the loss of users' funds.

In the third open letter, Alpha Homora once again asked Iron Bank to release user funds,And accuse Iron Bank of being a centralized platform that willfully changes protocol rules. And this time, Alpha Homora finally made a preliminary proposal, as follows:

Iron Bank needs to return customer funds on chains other than Ethereum;

Of the approximately $41 million on the Ethereum chain, Iron Bank needs to return $11 million;

As for the remaining approximately $30 million, Alpha Homora will share with the community details on how it will proceed within a week of Iron Bank agreeing to the aforementioned settlement.

In short, this initial recommendation is "You return the excess first, and we will discuss what to do with the rest”。

As of the publication, Iron Bank has not yet responded to Alpha Homora's proposal through official channels, but the situation that has not been solved for a long time has had a negative impact on both parties.

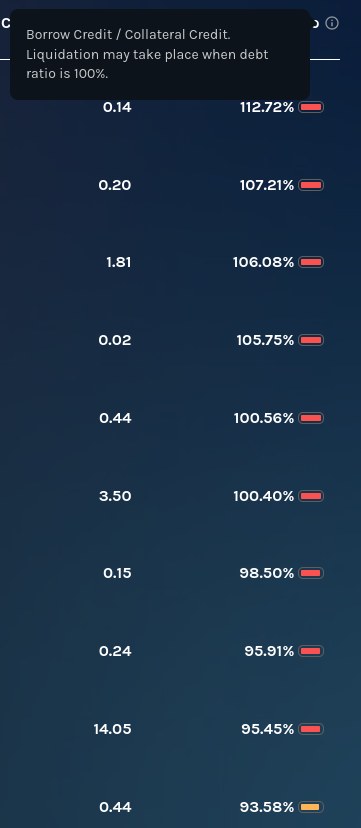

On social media, Iron Bank’s practice of freezing user funds has been criticized a lot, and many Twitter users have accused the move of being tantamount to a crime; while on Alpha Homora’s side, some Twitter users found that the balance of funds may have been affected, Some positions in the platform that should have been liquidated have not been effectively liquidated, or have threatened the security of the protocol.

This morning, Alpha Homora tweeted: "We have been negotiating with Iron Bank to promote the release of users' funds. Discussions are close to a resolution, details are being worked out, please be patient, Alpha Homora will never allow Iron Bank Banks take user funds."

So far, that's about the ins and outs of the story. As for how it will develop in the future, Odaily will continue to follow up and report, so please stay tuned.