How to Profit in the New Crypto Ponzi

Original compilation: Block unicorn

Original compilation: Block unicorn

First of all, Blcok unicorn declares that this article is not any investment advice.

One of the best ways to make money in cryptocurrencies is to learn about crypto-cult speculative crazes before they happen, and then sell crypto-cult speculative tokens ahead of time when Ponzi schemes are about to hit zero.

first level title

Crypto Cult Identification 101

understand the market they are dealing with"mass desire"and silent despair.

Look for the confluence of psychological biases and triggers (fundamentals + psychological conditions + monetary conditions) that can attract large numbers of men to invest in projects.

Women are not the primary investors in this space, and women have different psychological triggers than men.

Know how men behave, and you'll start to gain a deeper understanding of this market.

Finding the ideal cult leader who can convince the market, build a belief system, set goals for people to follow him and get people to invest their life savings in a dubious token is the magic of a cult leader.

When driving a Ponzi scheme, adding fuel and flame to a cult project, and finding that the cult project cannot continue to be sustained, it is time to brake (Bitconnect, Strongnodes, OHM, TIME, Layer-1 Ghostchains, Move 2 Earn, Play 2 Earn, ride Euthanasia roller coaster, as GCR puts it).

first level title

How Cults Are Formed

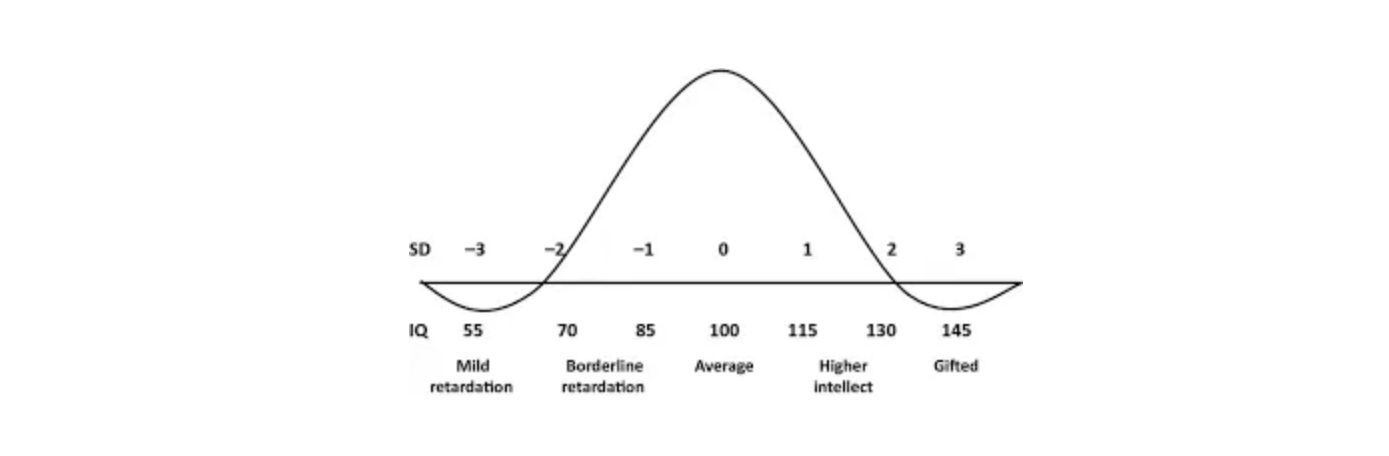

Cults exist due to the way humans are genetically coded, and our tendency to follow leaders and movements in certain traits. First, understand the bell curve:

The inherent reason for the bell curve, why 99% of market participants lose all the money the market gave them - very few are stupid enough to cash out at the top, and very few are smart enough to do so. Most people always believe that prices will go up or down, depending on whether the market is bullish or bearish.

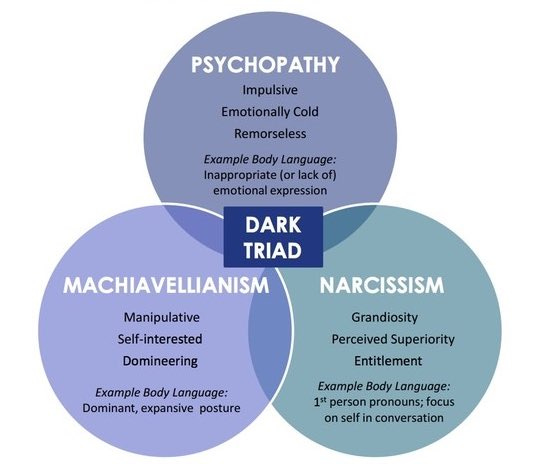

Below is the dark trinity of personality traits that our algorithms and social media platforms are incentivized to promote:

Algorithms are specifically designed to elicit user engagement, anger, and ongoing emotional addiction. For some reason, psychopaths tend to be the best at exploiting these algorithms to gain fame on YouTube, TikTok, social media, Twitter, and even various elite social circles (eg: Theranos,SBF、Anna Sorokin)。

For most of history, human beings did not live under a democratic system, nor did they live under the illusion of human rights.

History is littered with countless devastations, wars, genocides, slavery, serfdom and those who have survived these transformations are middle powers who cling to whatever leaders are in power and are not far from them too far.

The earth's soil is splattered with the blood of humanity's past, and they fight at the beck and call of their leader. But it's the 21st century, so just use their possessions instead of their bodies.

The point is - you need to understand your competition in this market. In order for a speculative bubble to form, a large number of people need to buy a certain stock or token, hoping that its price will rise to the point they want to buy, which is a Ponzi scheme, but it is also a profitable one.

In order for a bubble to form, the project or token must have a certain technical foundation, or have an innovation that justifies the formation of the bubble.

On this basis, crowd psychology, psychopathic leaders, and reflexivity push bubbles to unimaginable heights. The right mix of self-aggrandizement, manipulation, and psychopathy is what mid-curves are naturally attracted to.

If you want to continue to make money in this asset class, you must embrace the perverted founder, who said: Your size is not your size (Three Arrows Capital said this when it was about to collapse).

Discover these people and projects before others. When the public thinks that this is a wealth that cannot be missed in a lifetime, and the house is mortgaged at any cost, you have to set the selling action, otherwise you will only be desperate.

secondary title

Let us understand this problem with a real example

based on"Fundamentals", Polkadot is considered to be one of the most worthwhile tokens to invest in before the peak of the bull market in 2021, running from the range of $4-6 to $55 at the peak.

But Gavin Wood (Chinese name Lin Jiawen, packaged as God G in China, leading everyone to think it is the same symbol as Vitalik Buterin, because Vitalik Buterin is called V God by the Chinese community), although Gavin Wood has a British accent and a handsome appearance, Charisma and deception are not as good as Richard Heart (the founder of HEX, this project has always been considered a Ponzi scheme), Andre Cronje (the founder of YFI, the industry calls him the Godfather of DeFi, also referred to as AC).

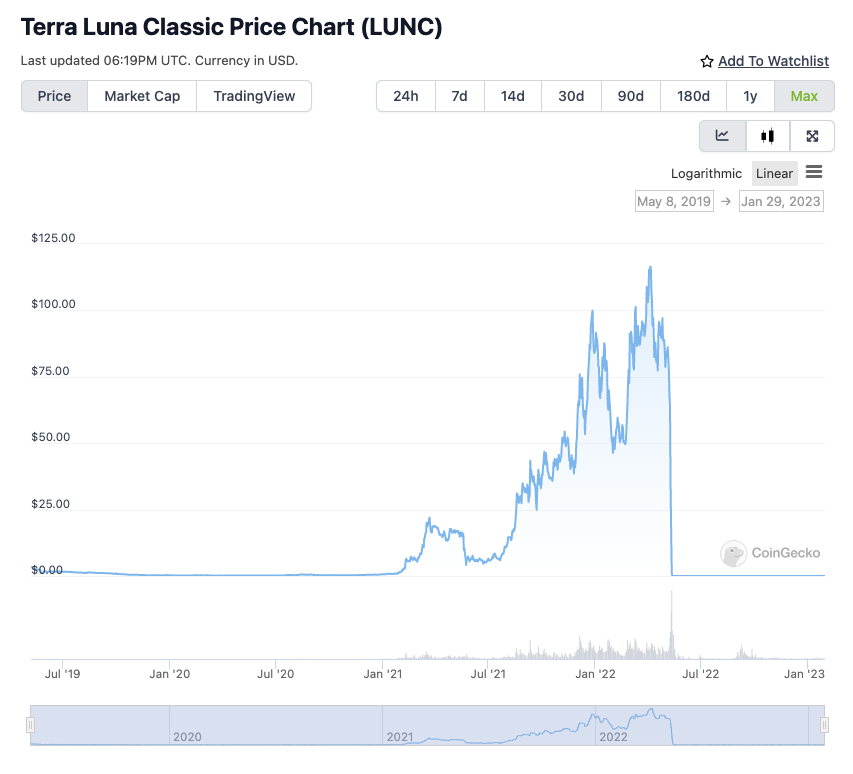

At the same time, before LUNA faces the death spiral of the end of the bull market in May 2021, in order to maintain the normal operation of the system, LUNA has been relying on attracting new users to enter the market, and finally succumbed to Soros-style attacks and fell in 2022.

It rose from $0.50 for early holders to nearly 300x to an all-time high of $120, fueled by the leverage of the second wave of the “bull market” fake. Arguably helping drive the price of LUNA up is a psychopathic founder who is dead set on conquering the industry and building a cult of "fanatics" who will destroy the impact of any form of FUD or negative press.

Likewise, Fantom's scaling technology never really worked. At the peak of L1 (layer 1 blockchain), the chain was unstable, and almost every project was a developer blatantly robbing retail investors of cash for liquidity. However, crypto players are attracted by Andre Cronje, Dani Sestagali (founder of MIM, TIME), and by other crypto movements, causing token prices to keep rising.

Before January 2021, the FTM token price was hovering at 0.01-0.02, and then rose to a peak of $3.4. It is one of the best-performing tokens in the market cycle, except for Matic, LUNA, Cardano (ADA).

Let's look at these graphs:

See how DOT is surpassed by all of them? (Don’t be angry DOT guys, I know some of your ecosystem tokens have gone up 10-50x, maybe 100x, but the liquidity may not be enough to cash out the full value of the position)

first level title

3 Essential Tips

1. Do not simply invest or trade based on technical fundamentals, but conduct fundamental speculation based on human psychology and a little technology

We love a good hero story, but we also love turning heroes into villains. We buy their cryptocurrency before they rise, and sell when they turn villainous. Messi tweeted a few months before the peak cycle in 2021: "Dani Sestagali (founder of MIM, TIME) is the Steve Jobs of DeFi and Crypto." This is the earliest call for everyone to buy SPELL , ICE and TIME one of the people, ahead of the average person. Now, there are fundamental innovations at the foundation of both SPELL and TIME.

"With SPELL, you have a meme-magic internet currency that can easily be leveraged in a wild bull market, and with TIME tokens, you have OHM tokens (at its core a A repricing Ponzi scheme), cheaper gas, higher yield, simple as that.”

Based on these fundamental innovations + cults = huge price increases

You can buy based on the fundamentals, or you can buy based on the level of mania, price increases, enough technological innovation - the choice is yours. There are many such psychopaths in our unique asset class such as Richard Heart (founder of HEX), Dani Sestagali, Tetranode (supposedly a billionaire), Do Kwon (founder of LUNA), Zhu Su (founder of Three Arrow Capital founder), CZ (Changpeng Zhao) and others. Build a framework for identifying the right psychological inclinations of founders, and when you find a brand new coin that no one else has discovered - that's the time to slide the button east and get in fast.

When making every investment decision, just ask yourself: "What will make it go up? What are the fundamental factors manipulating the market?" It doesn't have to be complicated to understand.

Based on these basic innovations + cults + fandom = buy in

How to identify a good cult leader? They are usually:

Narcissistic

mental illness

Machiavellianism

Guys, I gave you a chart at the top of the article, please use this chart.

You're looking for someone who is willing to speak out, is willing to take risks, and likes to show off. Charles Hoskinson (Charles Hoskinson is the founder of ADA) is not the technology, but his ability to stop his investors from selling with another live broadcast about morality and peace.

2. Don’t get too confident about your Ponzi scheme when you can buy drugs (Ponzi tokens)

You put your life savings into ponzi tokens, the tokens are going up, your net worth is skyrocketing, your eyes are on fire, you've made a lot of money in your pockets, your heart is burning and you want to end your hard work Work.

But these are not your money, only when you sell the tokens and exchange them for stable coins, it is your money. The money is either converted into stable coins and stored in your cold wallet, or in your bank account, Either on some fixed assets (houses, etc.), these assets are shrinking, and these fixed assets cannot be easily cashed out.

Countless men believe that unrealized green profit (PnL) on screen is their future, it's not your future, fool. If you want to profit from your Ponzi gambling, cash out/sell in time, and cash out/sell in batches.

Simple strategy:

Sell your initial holdings at 2-2.5x the price, and continue to sell for some profit (if it's a high-risk position) as the price rises.

If after you sell your initial investment and take a profit, the price breaks through the underlying support and falls, sell the entire position to protect the gain, sometimes simple chart lines can do the trick. If you sold all your BTC when it lost the $50,000 mark but rallied back up, you might at least keep some gains depending on your entry.

Enjoy the excitement of rising prices, but understand that the market gives and the market takes back. Profit from the market before the tide goes out or you'll be swimming naked while Caroline (Alameda CEO) will suck your bankroll dry, take your money for entertainment, and relentlessly chase after you on a jet ski, This is not good, not good.

If you are not good at winning money, don’t instigate a bad investment decision in the telegram group, it’s better to lie on the sofa and light a cigarette, eat a bucket of fried chicken, then watch funny videos, drink Coke, this kind of pleasure Also more comfortable.

3. There will always be new cults (inflation), always

If you missed the latest hype/hotspot, don’t create a Fomo of missing out because fear of missing out can lead you to make blind decisions.

For example: no one in America anticipated the cult phenomenon that Americans would go crazy over the Beatles, nor could they have anticipated the psychological tactics of the CIA in Laurel Canyon, which became a huge cult and Through endless TikTok, it still torments the eardrums of Gen Z today.

You can't predict the future, we predicted nuclear fission airships and floating cities in the 1920s, but all we have today is Elon Ma.

But in that time there have been countless cults, pumps, crashes, bubbles, manias, and speculative hype seasons for any good speculator to take advantage of. A lot of crypto OGs in 2014 didn't predict the rise of Ethereum, especially when there was only Bitcoin at the time. A lot of 2017 OGs didn't predict DOGE or SHIB. Also, many newcomers to 2021 did not predict the latest echo bubble.

The point is:

If you miss the cult and skyrocketing, just keep looking for the next one, and there will always be an opportunity for the next speculative frenzy. When considering speculating on a cryptocurrency or NFT, be sure to put together a checklist:

🔺What is the basic market value?

🔺How many holders are there?

🔺How is the allocation? (tokens, supply, unlock, etc.)

🔺How stupid are the holders, will they sell at a certain point of gain, or will they hold on to zero?

first level title

4. Don't forget, you can play cults in two ways

First of all, you can go long cult on spot or you can go long with leverage, depending on what tokens, chains and mechanisms you can use to hype it in this market. Second, you can short the cult with leverage if you allow it.

secondary title

Do not have fanatical cult beliefs, pursue profit maximization

See a speculative boom forming around metaverse tokens like SAND, MANA, GALA, etc.? Get in before they reach the top and sell to those eager to buy tokens. Take short trades when sentiment peaks and shifts, don't get liquidated in a scam.

To wrap up this post, let's briefly summarize the main points, with some additional notes:

Understand the "mass desire" and silent desperation in the market you touch, e.g. many people who will never drive a Bugatti, or sleep with Romanian "very beautiful women", but will pay for OnlyFans videos. Many people won't live with hundreds of millions of dollars, but the desire will drive them to invest their wage savings in an investment opportunity.

Look for the combination of psychological biases and triggers (fundamentals + psychological conditions + monetary conditions) that can attract large numbers of men to invest in a project.

🔺Fundamentals: new forms of innovation, spark interest and participation in the market.

🔺Psychological Conditioning: There is a space and void within the market that requires a narrative, persuasive hook that pushes the minds of participants to function, say

Convince them to inject liquidity into an asset class, forming a rebound bubble (Block unicorn Note: Echo bubble refers to when the price of an asset rises rapidly in a short period of time, but this rise is not caused by changes in fundamentals , but due to the emotions and psychological expectations of market participants, forming a bubble phenomenon).

🔺 Monetary Conditions: Participants have enough money to actually participate, simple as that.

secondary title

Understand the mechanics that drive a Ponzi scheme, and when it breaks down

🔺The success of $LUNA comes from income, $FTM is because of cheap and small scale, $STRONG is because of stable income, $CRV is because of DeFi’s stable liquidity, etc.

🔺Knowing why they are rising, you can see when those reasons start to lose strength, and then use the gains gained to exit in time.

Riding, fueling and sparking the speculative mania of a Ponzi scheme (sell it, you fool), dumping it when it finds the Ponzi scheme unsustainable (e.g. BitconnectStrongnodes, Ohm, Time, Layer-1 Ghostchains, Move 2 Earn, Play 2 Earn, GCR states).

Actual Technical Analysis - Always sell a break/bounce from that fundamental support level before it's too late. If the basic support level of a parabolic trend is broken, it is likely that it has ended. Hurry up and leave with the proceeds, and wait for the next easy skyrocketing opportunity!

Speculating on cryptocurrencies is not that simple, and now, when it comes to actually making money, that's a whole different issue. But this article should have given you some insights that you can use in your next playthrough.