Polygon DeGens Event Participation Guidelines

Original author: TokenInsight

Ethereum expansion planPolygonannouncedPolygon DeGensEvents to showcase DeFi opportunities on Polygon and raise awareness within the Polygon DeFi community.

This activity andGalxewait.Uniswap、Stargate、Multichain、Celer Networkwait.

Users who participate in the activity must first pay attention toPolygon DeFiTwitter and retweet this event, and then complete the specific tasks specified in the following items. Users who have completed the task can claim the corresponding NFT on Galxe before 0:00 on April 1, 2023, Beijing time.

Participate in projects & tasks

Top priority: pay attentionPolygon DeFiTwitter and retweetsecondary title

Item 1:Uniswap

Uniswap is the largest spot AMM DEX, its investors includeParadigm, Delphi Digital, etc. $UNI is the governance token of the protocol.

Task(Choose one): 1. InUniswaphereherelearn more. After completing the purchase, fill in your public wallet addressThis Google Sheetsecondary title

Item 2:Stargate

Stargate is built onLayerZeroUpCross-chain DEX, whose investors include a16z,Sequoia Capitalwait. $STG is the protocol's native token.

Stargate will open on March 15, 2023Reissue $STG, and take a snapshot of all users' balances on that day. The new $STG will be airdropped to holders of the old token at a ratio of 1:1.

Item 3:Multichain

Launched on July 20, 2020, Multichain (formerly known as Anyswap) is an infrastructure developed for cross-chain asset interoperability, providing services such as cross-chain bridges and cross-chain routing.

Investors in Multichain include Binance Labs, DeFiance Capital, HashKey, etc. $MULTI is the governance token of the protocol.

Task: 1. passMultichainBridge to Polygon at least $20 2. FollowMultichainsecondary titleMultiDAODiscord

Item 4:Li.Fi

Li.Fi is a cross-chain liquidity aggregator designed to calculate the best solution for cross-chain Swap. Investors in Li.Fi include Dragonfly Capital, Coinbase Venture, 1kx, etc. At present, the agreement has not yet issued a pass.

Task: 1. Provided by Li.FiTransfertoBridge to Polygon $20 2. FollowLi.FiOfficial Twitter and joinLi.FiDiscord 3. Likesecondary title

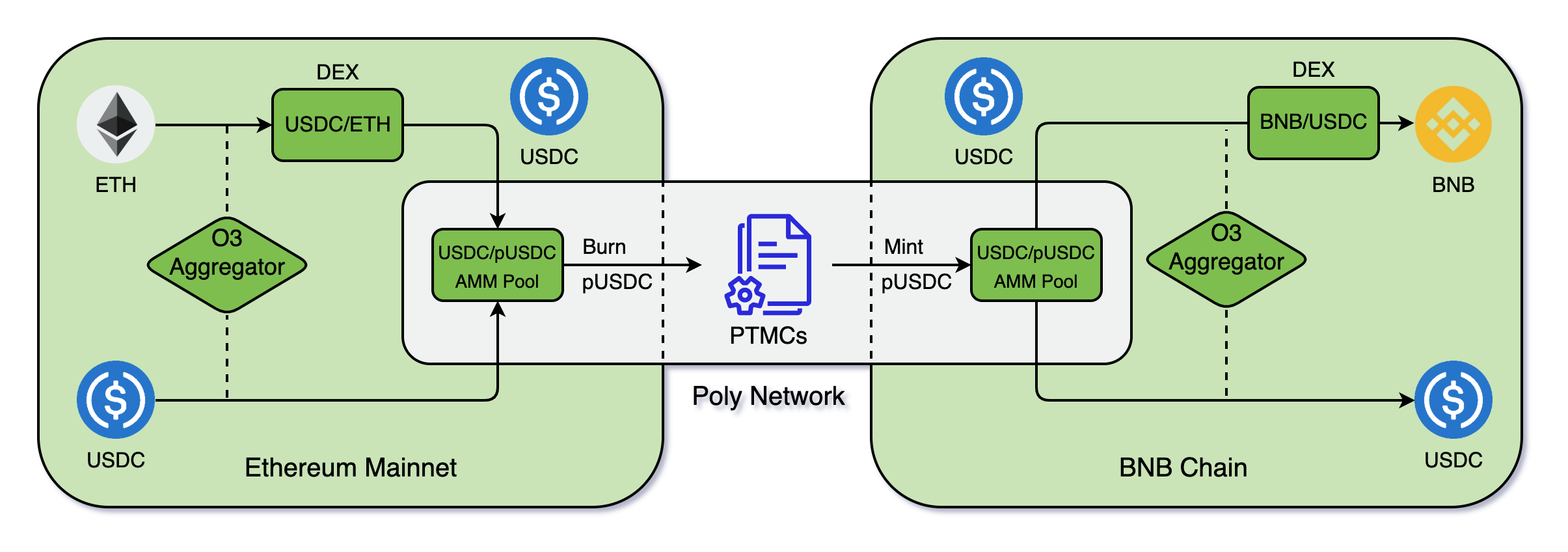

Item 5:O 3 Swap

O 3 Swap is a cross-chain aggregation protocol. Its v2 version supports the aggregation of DEX on the source chain and the target chain. In addition to bridging the same tokens on different chains, the service provided can also Swap different digital assets.

Investors of O 3 Swap include SevenX Ventures, FBG Capital, Titans Ventures, etc. $O 3 is the protocol's native token.

Task: 1. passO 3 SwapSwap at least $100 worth of tokens to Polygon cross-chain. (Do not move the amount of cross-chain tokens until the event ends. The address is updated weekly.) 2. JoinO 3 LabsDiscord 3. LikeEvent Tweets

secondary title

Item 6:Celer Network

Celer Network is a blockchain interoperability protocol that enables a one-click user experience to access tokens, DeFi, GameFi, NFTs, governance, and more across multiple chains. Developers can use the Celer inter-chain messaging framework (SDK) to build inter-chain native DSpp.

Investors in Celer Network include Pantera Capital, Binance Labs, IOSG Ventures, NGC Ventures, etc. $CELR is the protocol's native token.

Task: 1. UsecBridgeBridge to Polygon with assets worth at least $200 2. FollowCelerDiscord 3. Likesecondary title

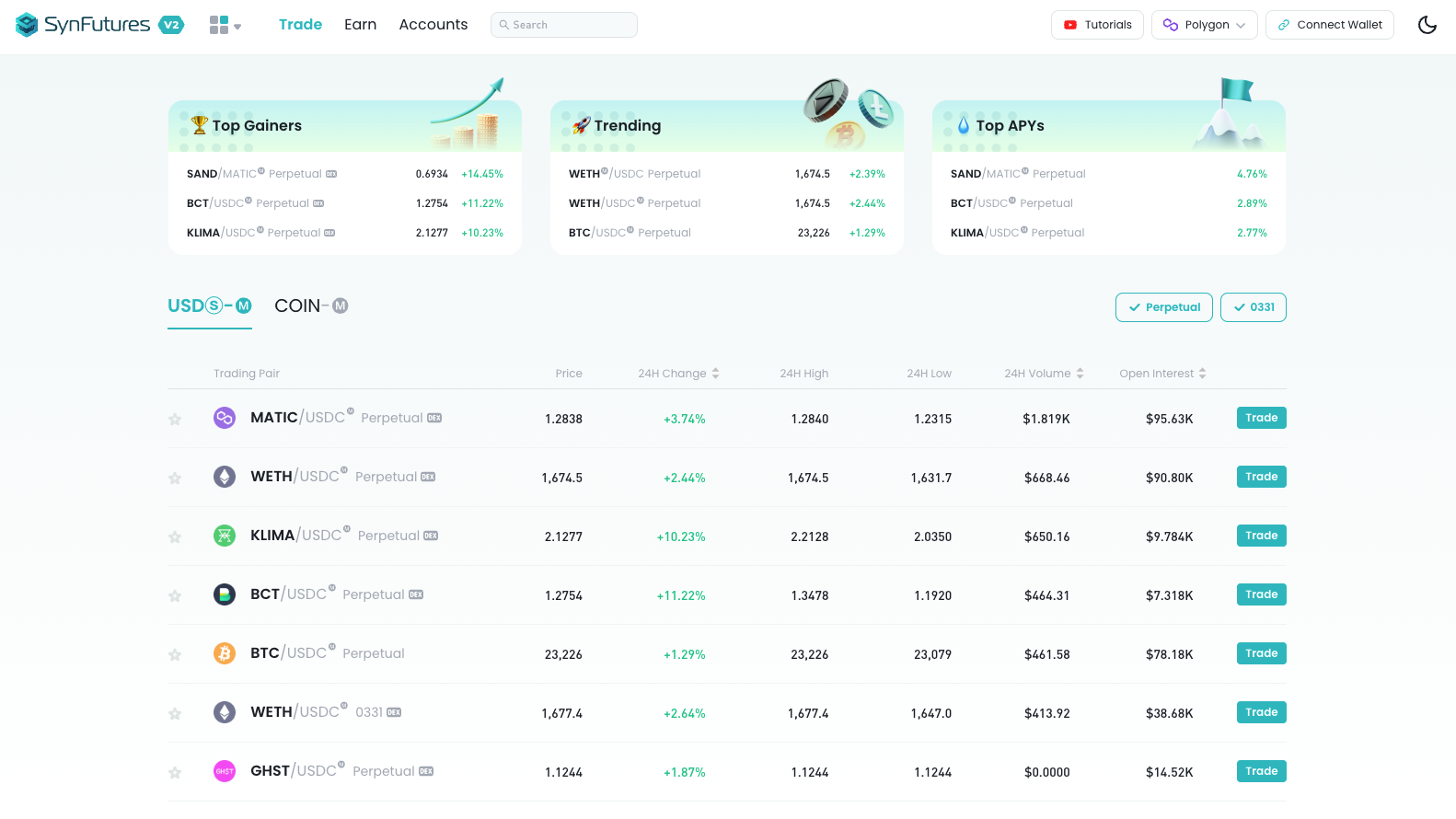

Item 7:SynFutures

SynFutures is a decentralized derivatives trading platform. Its v1 version is deployed on the Polygon, BSC and Arbitrum networks, mainly supporting cryptocurrency futures trading. The v2 version adds perpetual futures, DAO futures, and NFT futures to enrich product types. Currently, the SynFutures v2 version is in the closed Alpha testing stage and only supports the Polygon network.

Investors in SynFutures include Dragonfly, Polychain, Pantera Capital, etc. At present, the agreement has not yet issued a pass.

Task: 1. Connect the wallet to the Polygon networkSynFutures V2 dAppAnd make at least one transaction 2. FollowSynFuturesOfficial Twitter and joinSynFuturesDiscord 3. Register asNFTuresUser 4. Likesecondary title

Item 8:QuickSwap

QuickSwap is a fork of Uniswap that runs on the Polygon network. Compared to the Ethereum mainnet, Polygon has lower transaction fees, enabling QuickSwap to facilitate token swaps at a lower cost relative to exchanges such as Uniswap v2. $QUICK is the protocol's native token.

Task: 1. In QuickswapSupported Gamma V3 Trading PairsProvide at least USD 250 in liquidity 2. Pledge LP Token worth USD 250 in QuickswapSupported Gamma V3 farmsand hold LP Token in the farm for at least 3 weeks (21 days).

secondary title

Item 9:ApeSwap

ApeSwap is a DEX built on BNB Chain and Polygon, and also a decentralized autonomous organization (DAO), providing a complete set of DeFi tools to help users explore and participate in decentralized financial opportunities. $BANANA is the protocol's native token.

Task: 1. passGenkiSwap any token on the Polygon network 2. FollowApeSwapOfficial Twitter

secondary title

Item 10:Clipper DEX

ClipperIt is a DEX designed based on Ethereum to provide optimal transaction fees for small traders. Although the agreement has not yet issued a certificate, it says that the final protocol governance will be decentralized through governance certificates.

Clipper's investors include Divergence Ventures, Robot Ventures and LD Capital, among others.

Task: 1. toPolygon Core PoolDeposit more than $10 worth of tokens in the pool and Swap more than $10 worth of tokens in the pool 2. FollowClipper DEXOfficial Twitter and joinClipper DEXDiscord gets Clipper Community role 3. By readingthis articleLearn about Clipper 4. Likesecondary title

Item 11:QiDao

QiDaois an over-collateralized stablecoin protocol based on Polygon. Loans are disbursed and repaid in $MAI, a soft USD-pegged stablecoin. $QI is its governance token.

Task: 1. atQiDaoOfficial Twitter 6. Likesecondary title

Item 12:Timeswap Labs

Timeswap is a fixed-income lending protocol for ERC-20 tokens built on Ethereum. Investors in Timeswap include Multicoin Capital, Mechanism Capital, and DeFiance Capital. Time Token is the governance token of the protocol and has not yet been issued.

Taskfluidityfluidity2. From any active pool on Timeswapborrow or lendAt least $50 worth 3. FollowTimeswap LabsOfficial Twitter 4. Likesecondary title

Item 13:0 VIX Protocol

0 VIX Protocol is a DeFi lending protocol built on Polygon. $VIX is the protocol's native token and is currently unissued.

Task: 1. Offer at least $100 in0 VIX2. Follow any asset on0 vixProtocolOfficial Twitter and join0 VIXDiscord 3. Likesecondary title

Item 14:Atlendis

Atlendis is a non-custodial decentralized DeFi lending agreement, and its investors include DeFiance Capital, DCG, ParaFi Capital, etc. At present, the agreement has not yet issued a pass.

Task: 1. toAtlendis poolDeposit at least $10 in (Atlendis ProtocolBorrowing TutorialandAtlendis LabsandAtlendis InternTwitter 3. JoinAtlendisDiscord and get the Lendie role 4. QuoteEvent Tweetssecondary title

Item 15:Gains Network

Gains Network is a DeFi ecosystem on Polygon. The protocol's first product, gTrade, is a cryptocurrency derivatives platform on Polygon that offers leveraged trading based on real-world stock prices. $GNS is the utility token for this ecosystem.

PWN is a peer-to-peer lending protocol built on Ethereum and Polygon, and the protocol has not yet issued a certificate.

Task: 1. Any existing loan request to PWN on the Polygon networkmake an offer, the minimum amount is $50, and the terms are set by you (interest, tokens offered, term, offer expiration date). 2. FollowPWN DAOsecondary title

Item 17:PoolTogether

PoolTogetherIt is a DeFi reward savings protocol that allows users to deposit $USDC and participate in daily lottery activities to obtain bonuses. Its investors include Dragonfly, ParaFi Capital, Huobi Global, etc. $POOL is the protocol's native governance token.

Task: Deposit at least $20 before the campaign endsPoolTogethersecondary title

Item 18:StaderPolygon

Stader is a multi-chain liquidity staking protocol that currently supports Polygon, NEAR, Fantom, BNB Chain, Hedera and Terra 2.0. Investors in Stader include Pantera Capital, Coinbase Ventures, Animoca Brands, Jump Capital, and more. $SD is the governance token of the protocol.

Stader MaticX is a liquid mortgage derivative launched by Stader for Matic.

TaskpledgepledgeOne week 2. FollowStader Polygonsecondary title

Item 19:ClayStack

ClayStack is a decentralized liquidity staking protocol that provides liquidity staking tokens (csTokens) for PoS chains. The protocol has not yet issued a token.

Task: 1. Pledge 10 $MATIC inClayStake2. Deposit at least 5 $MATIC and 5 csMATIC intoBalancer pool3. FollowClayStackOfficial Twitter, joinClayStackTelegram group and joinClayStacksecondary titleClayStack MATIC v2tweets

Item 20:InsurAce

InsurAce is a decentralized insurance protocol designed to provide safe and reliable risk protection services for DeFi users. InsurAce's investors include ParaFi Capital, Huobi Capital, DeFiance Capital, etc. $INSUR is the protocol's native token.

Task: 1. InInsurAceBuy Smart Contract Cover or Stablecoin De-Peg Cover on 2. FollowInsurAceOfficial Twitter 3. QuoteInsurAcesecondary title

Item 21:Tetu

Tetu is a Polygon-based Web3 asset management protocol. $TETU is the protocol's native token.

Task: 1. Deposit funds intoTetu Vaultand earn revenue2. InTetusecondary title

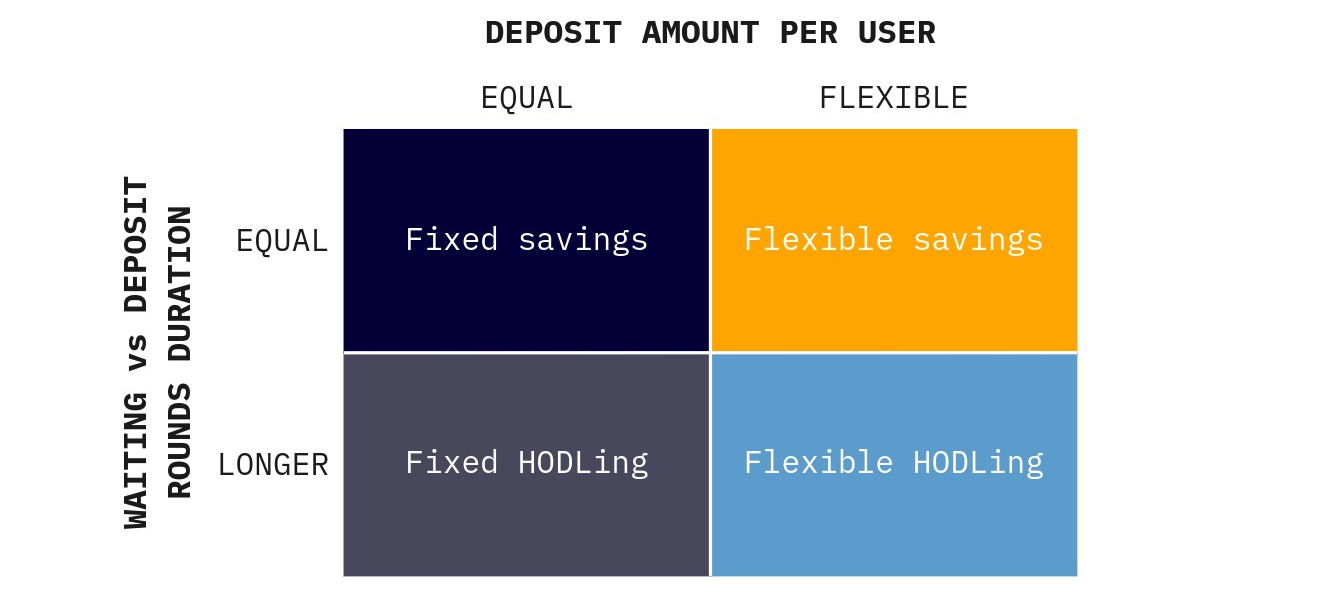

Item 22:GoodGhosting

GoodGhosting is a decentralized savings platform whose first product is a social savings game that uses blockchain technology to reward users for reaching savings goals. The protocol has not yet issued a token.

GoodGhosting v2 provides 4 types of savings pools, corresponding to 4 game types, namely fixed savings, flexible savings, fixed positions and flexible positions.

Task: 1. Deposit at least $10 on GoodGhosting by March 25, 2023"Polygon Quest" Savings ChallengeMedium 2. FollowGoodGhostingOfficial Twitter

NOTE: Your first deposit requires at least 10 $DAI or $10 worth of $WETH and is made in GoodGhosting's upcoming "Polygon Quest" savings challenge. After the challenge is over, you will get your full deposit back and any additional rewards.

secondary title

Item 23:Teller Protocol

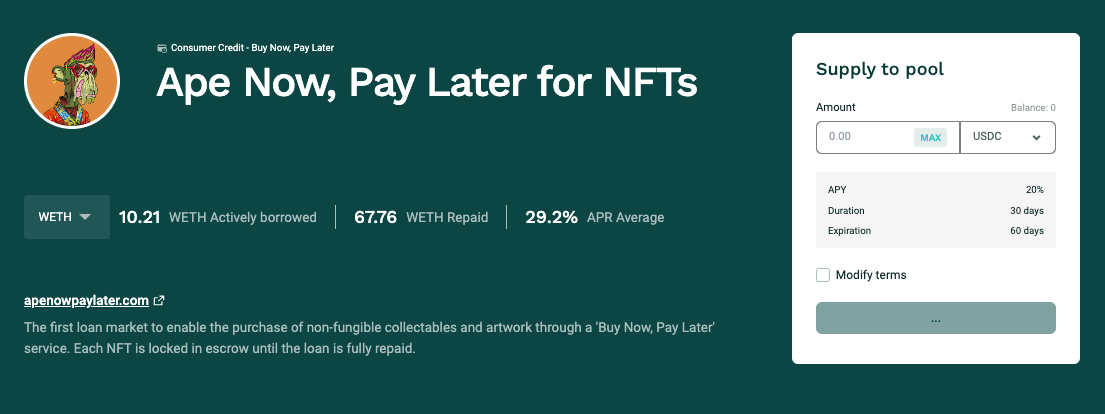

Teller Protocol is a DeFi lending protocol deployed on Ethereum and Polygon, and provides NFT buy-before-pay function on the Ethereum network, supporting BAYC, MAYC, Doodles and other projects.

Teller's investors include Blockchain Capital, ParaFi Capital, Framework and others. The protocol has not yet issued a token.

Task: 1. On the Polygon networkTeller Personal Loan poolApply for a $USDC loan for at least 7 days - up to $50 (0 interest rate) (collateral requirements for loans: 1. 150% LTV,Cred Scoreless than 800; 2. 100% LTV,Cred Scoreover 800). 2. To the Polygon networkTeller Personal Loan poolProvide at least $100 in $USDC with a loan term of at least 7 days. 3. FollowTeller ProtocolOfficial Twitter and joinTellerDiscord gets Alpha Tester role 4. LikeEvent Tweets