In-depth analysis of subtle changes and future developments in the field of NFT transactions and aggregation

Article pdf download link: https://drive.google.com/file/d/1tX8J4w6N8ms9n5upLrV8TGxrHKo03B0z/view?usp=share_link

1.0 Introduction

In recent years, the NFT track has attracted great attention from many investors. Top CEXs, such as Binance, Coinbase, and Kraken have announced their entry into the NFT field. In the past, it only took one year for DeFi to form a series of complete ecology such as DEX, lending, stable currency, oracle machine, derivatives, cross-chain bridge, etc., and continue to move towards energy aggregation on the basis of traffic. In 2022, NFT will further accelerate the speed of ecological aggregation. At present, the track is becoming more mature. From review updates to zero-royalty reforms, brand joint names, and then to mergers and acquisitions, NFT is making multi-dimensional efforts in its own ecosystem expand.

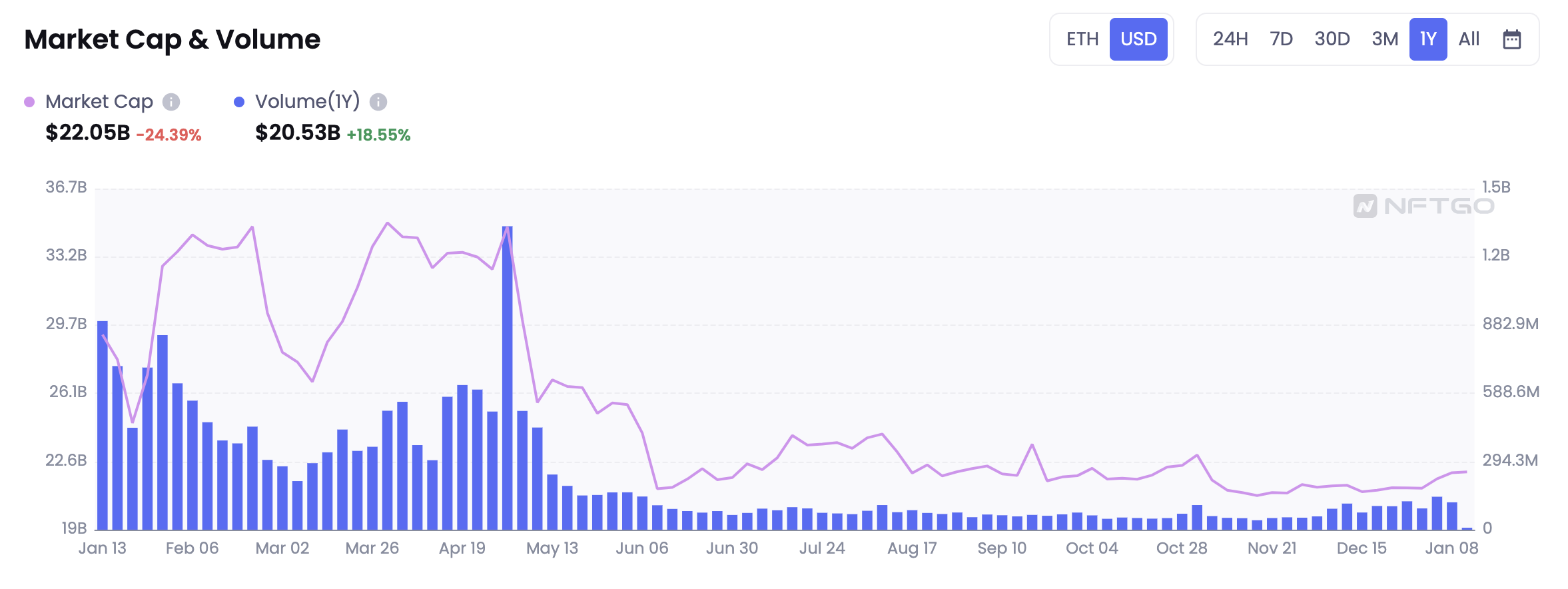

In the context of the bear market in 2022, the relevant data of NFT has fluctuated greatly. Since the second half of the year, the overall data of the NFT market has continued to decline. Therefore, there are also voices in the ecology that NFT is about to enter a recession, but in fact, the rise and fall of NFT can predict the market trend and reflect the value logic of the overall development of the industry, such as the merger and development trend of the aggregation track discussed in this article. The NFT market has now entered a period of stability and transformation, and it takes time to settle down and continue to take root.

This article will start with the discussion on the origin of NFT and the basic knowledge of the track, summarize the historical milestones of the NFT track, introduce the current situation of the NFT market, and describe it in conjunction with the recent merger activities at the transaction level; it will also summarize the latest developments of each platform Policy updates and changes in attitudes towards royalties, in-depth analysis of the latest relevant technology updates in the field, and an overview of the entire track and its future development direction.

2.0 Basic introduction to NFT

When people think of NFTs, they most often think of them as a picture, or a profile on social media (picture proof, PFP), but now NFTs in the traditional sense have appeared long before 2021 - just not How many people really understand them.

What is FT

A fungible token (FT) is a token that can be replaced, has unity, and can be split almost infinitely.

To explain homogeneity, a good example is currency - because of its homogeneity, people can easily exchange one $5 bill for another $5 bill. As a homogeneous token, the U.S. dollar can be exchanged easily, even if the serial number is different, it will not affect the replacement. If the value is the same, the denomination of the banknote will make no difference to the holder. These items are exchangeable because they are defined by value, not uniqueness.

What are NFTs

NFT is the abbreviation of non-fungible token, and non-fungible token is a distinctive feature of NFT.

Compared with homogeneous tokens, NFT cannot be replaced with each other. It is a data unit stored on the blockchain, which can represent unique encrypted assets such as artworks. Each NFT has a unique identifier that makes it different from other NFTs, which is also proof of authenticity and ownership in the digital realm.

There are several different frameworks for creating and publishing NFTs. Among the most popular frameworks are ERC-721 and ERC-1155 on the Ethereum blockchain. NFTs cannot be copied or transferred without the permission of the owner, even the issuer of the NFT.

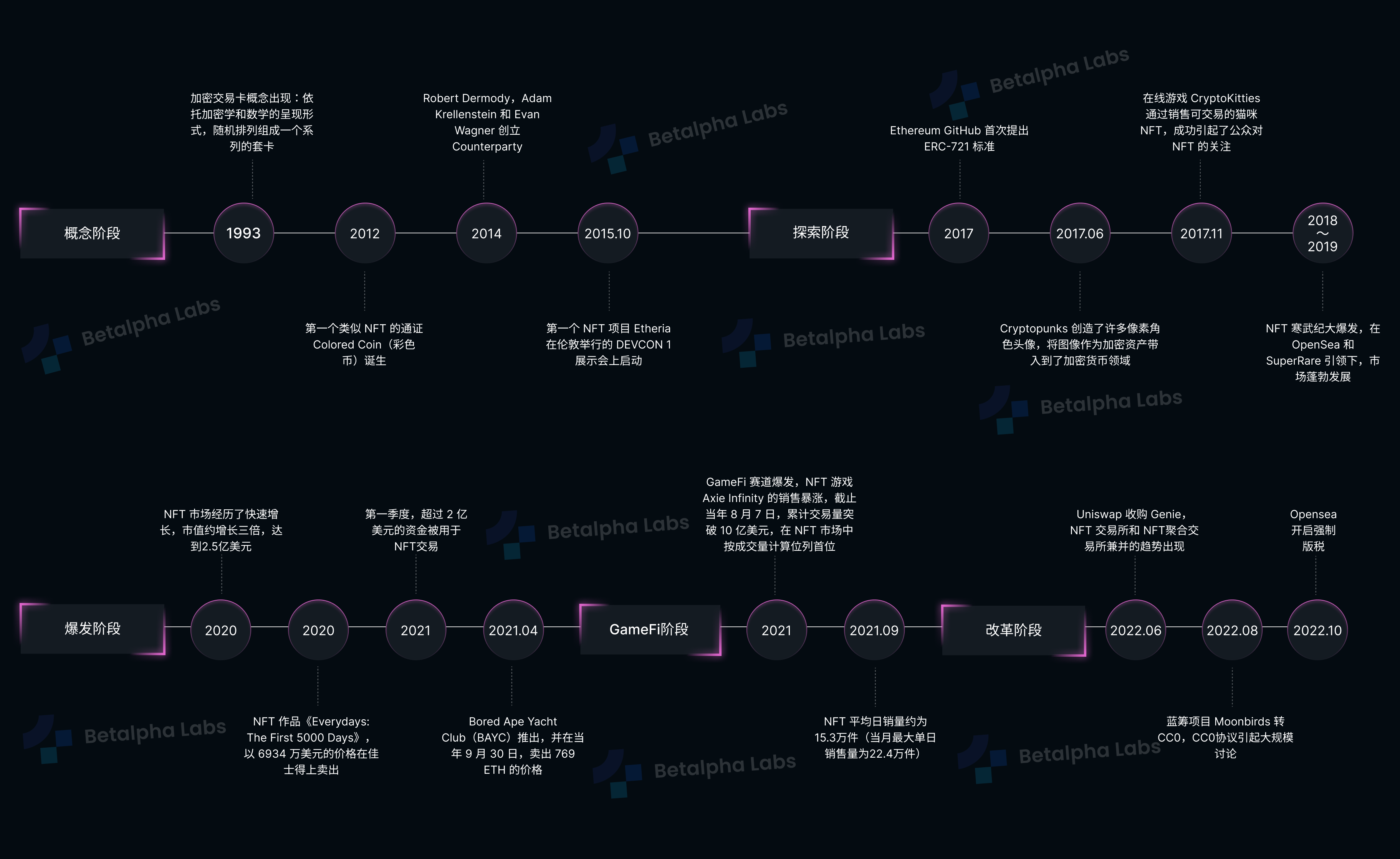

NFT development history

The concept of NFT can be traced back to "Crypto Trading Cards" in 1993 and "ColoredCoin" in 2012. "Crypto Trading Cards" proposed the idea of collecting digital cards created by trading mathematical models, and "ColoredCoin" gave Bitcoin more uses, which is an excellent experiment of off-chain asset mapping.

image description

Figure 1: NFT 5 major development events

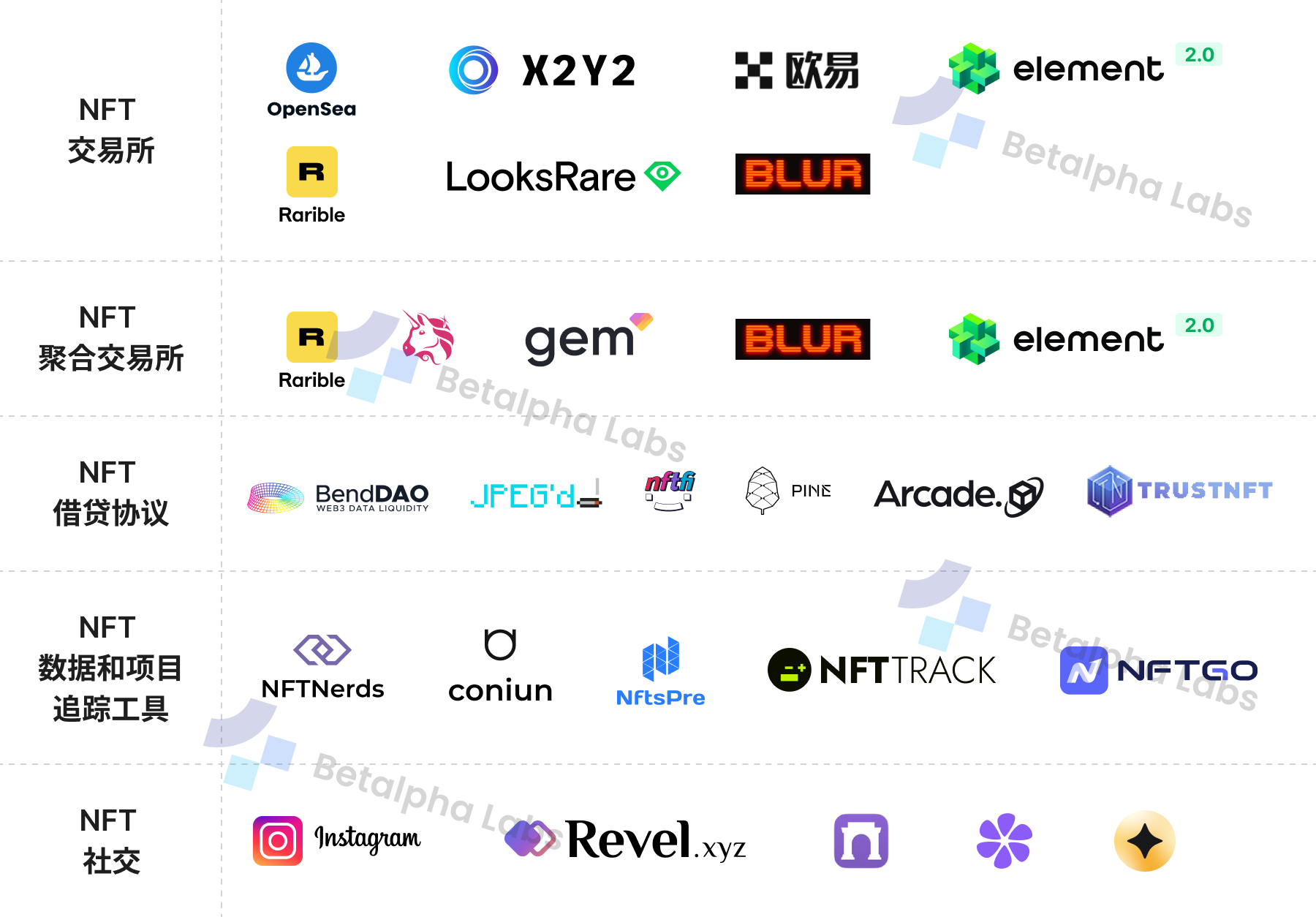

NFT track division

image description

Figure 2: NFT track division

3.0 NFT Market Situation Introduction & Policy Update

3.1 Trading Platform

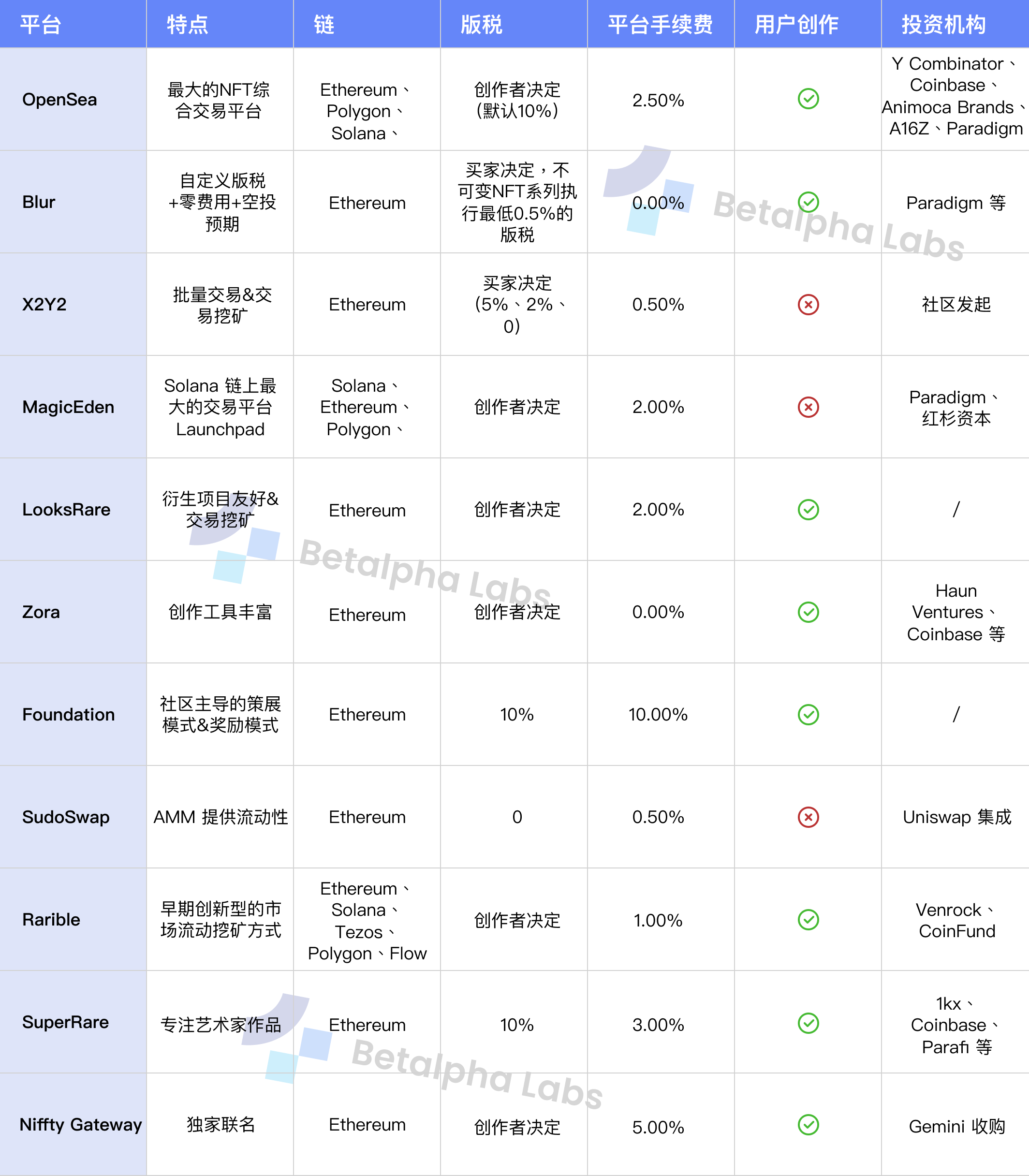

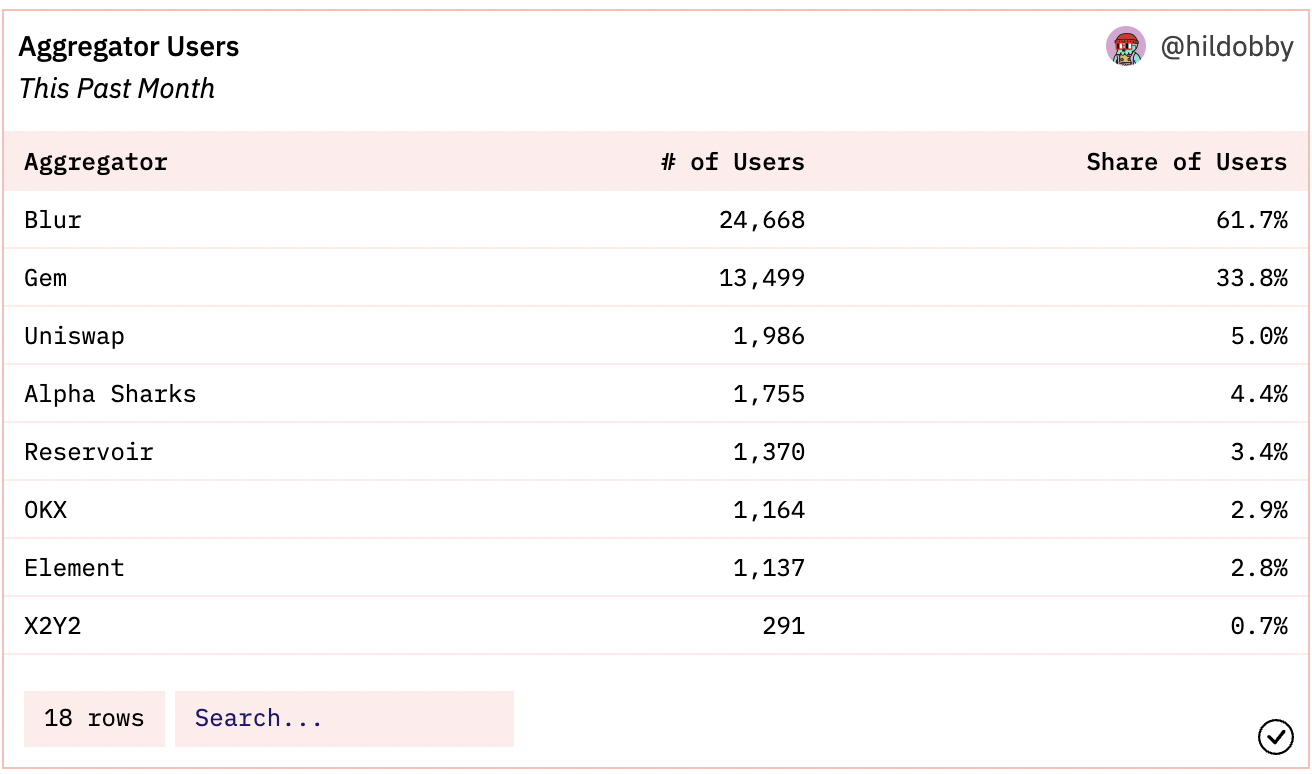

image description

Figure 3: Trading platform data

However, 2022 will be a difficult year for the NFT field. From the Luna thunderstorm at the beginning of the year to the collapse of FTX at the end of the year, although NFT is still accompanied by the birth and exploration of new projects, the downturn in the overall encryption ecology will also make NFT The market is dragged into a bear market.

image description

text

OpenSea

Founded in 2018, OpenSea is a blockchain-based global digital item buying and selling market, and has always been a leading project in the NFT trading market. OpenSea is positioned as an industry-leading decentralized exchange that provides peer-to-peer non-homogeneous token (NFT) transactions.

In 2022, OpenSea will focus on the field of copyright protection. In June, OpenSea updated the NFT copyright protection plan and launched a number of measures to continuously improve and protect the rights and interests of NFT owners. Additionally, OpenSea has introduced a new verification system that more prominently identifies real accounts and content.

In November 2022, Opensea announced that it will launch a tool for enforcing royalties on the chain. The Opensea chain-enforced royalty tool stipulates that if NFT project parties want to collect royalties normally on Opensea, they must use Opensea’s mandatory royalty contract, but this contract will block all platforms that launch custom royalties. If the NFT project party is unwilling to block other trading platforms, Opensea officials will directly reduce all royalties generated by the project party on Opensea to 0.

Magic Eden

Magic Eden, the NFT trading platform with the highest transaction volume on the Solana chain, will expand its list of supported blockchains by integrating Polygon. Gaming NFTs have been a strength of Magic Eden, which will host several Polygon-based projects on its Launchpad platform in December. According to relevant information released by Polygon, Magic Eden users will be able to use Matic to start trading NFTs after the platform's Polygon project Launchpad goes live.

Magic Eden has also been updated with royalty protection. In December, officials announced the launch of a new agreement that will charge royalties on all new collectibles that choose to use the tool. An open-source tool, the Open Creator Protocol (OCP), will give creators who post collectibles the option to protect royalties. For creators not adopting the OCP, royalties will remain optional on the platform.

Additionally, Magic Eden officially introduced a discount and rewards system that allows users to earn rewards, discounts and other perks based on their activities on the platform. Magic Eden is working with ecosystem partners to add new features like invite codes and deal research tools.

secondary title

3.2 Aggregation platform

Aggregation platforms are gradually emerging in the market. From the perspective of development process, many professionals believe that it is not a few heavyweight cryptocurrency trading platforms that change the status of the NFT market, it is not Rarible that launched the Token mechanism very early, and it is not the art market Superare and Foundation, although they are still There is good potential, but their target market is relatively small.

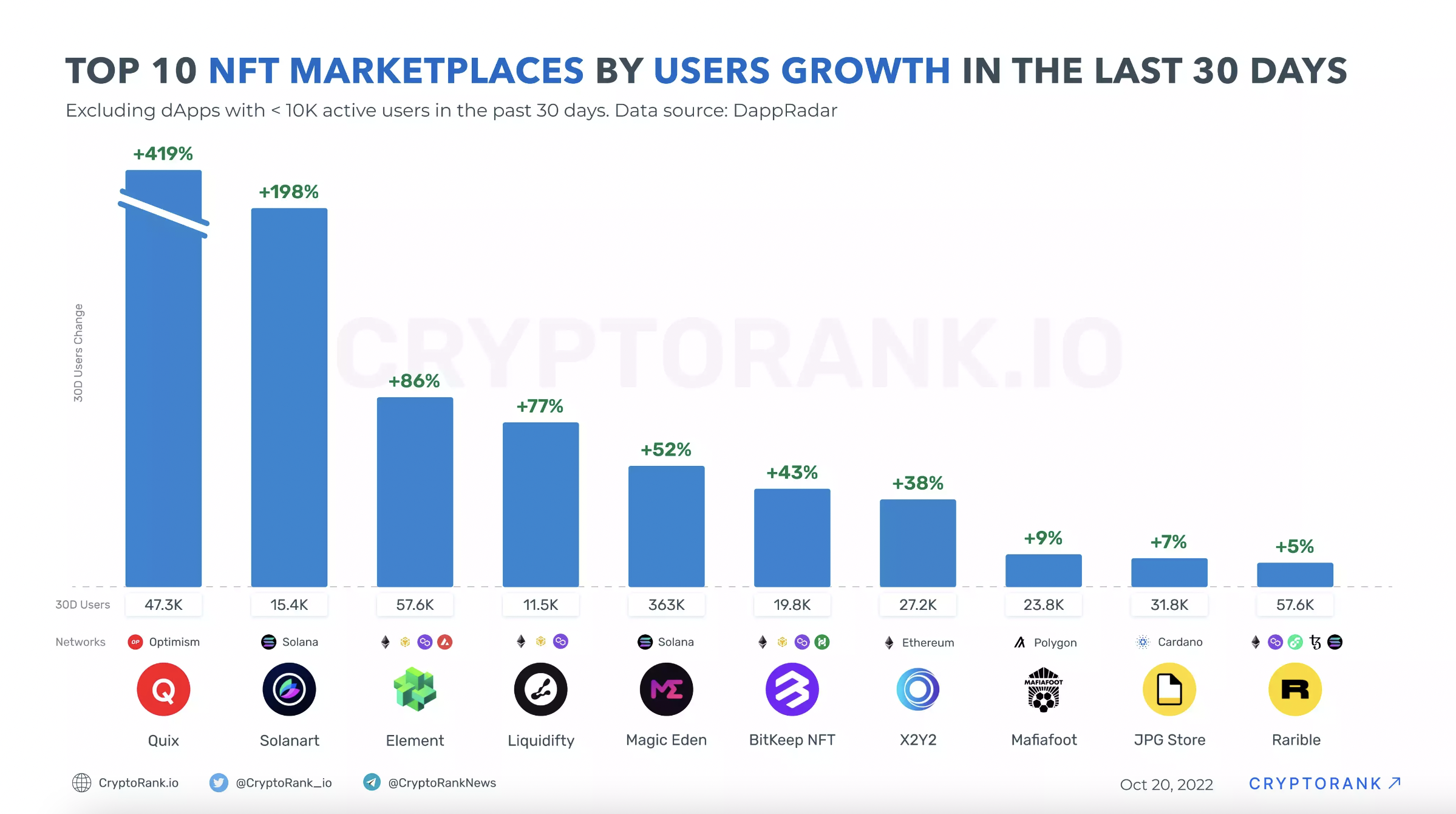

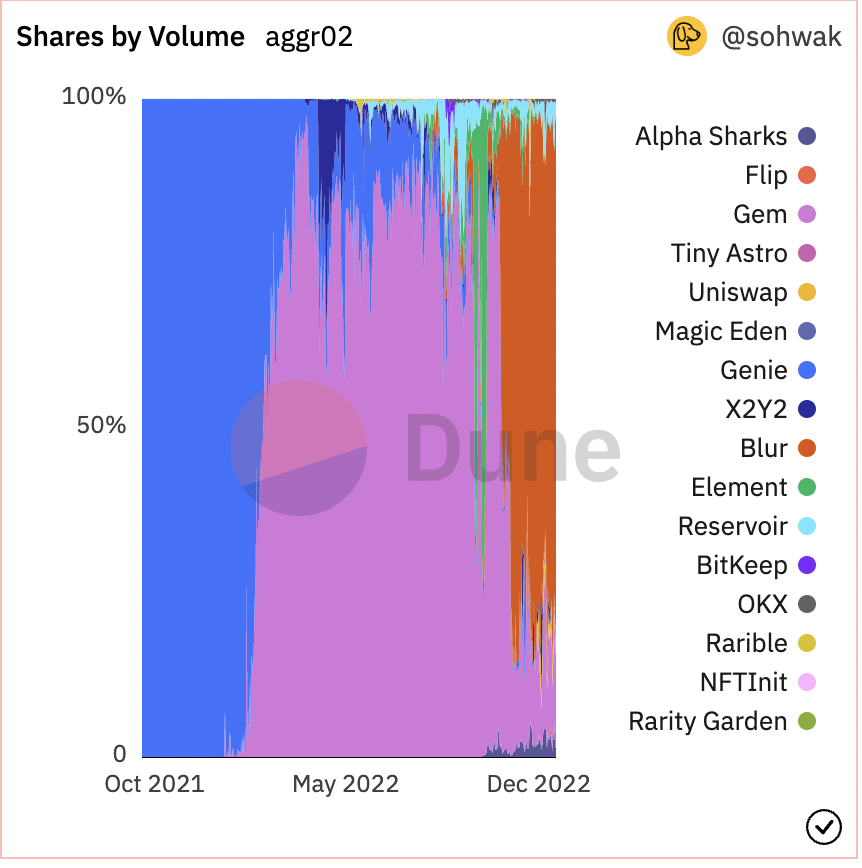

What really started to shake the OpenSea market is the team that implements Aggregator with tools and boldly adopts the Token Incentive mechanism, that is, aggregators such as GEM and Element, and a transaction reward mechanism like Looksrare, including the blockbuster Blur, which is a latecomer.

In the traditional sense, aggregators are mainly used for data aggregation. It can collect data across websites, and then classify and present information on one platform to meet the needs of different users. It's essentially a search engine that collects and compiles useful information and removes irrelevant information.

Along with the development of technology, some aggregators can also create valuable indicators through the use of machine learning, which are calculated from the processed data.

A professional NFT aggregator needs to collect all NFT transaction information from different public chains and integrate them into one platform. This provides users with a smooth trading experience and improves transaction efficiency.

NFT aggregators have some distinct advantages over traditional marketplaces, including:

High degree of information aggregation - users can view, trade and buy NFT in all markets through one platform. And you can view all NFT-related content, such as transaction volume, floor price, transaction price, quantity, top holders, top buyers, etc.

Improve transaction efficiency - users can easily browse the transaction information of all exchanges and filter out the most high-quality transaction prices.

Diversified payment methods - users can use any token they want to pay on the NFT aggregation platform (ideally), and can effectively save gas fees through packaged transactions.

Overall Market Overview of Aggregation Platforms

NFT seems to have become one of the hottest topics in the entire encrypted economy and even in the fields of financial technology and entertainment. Just like bulk transactions in traditional financial markets, the demand for buying a basket of NFT assets more conveniently, or for bulk buying and selling of NFTs is gradually expanding.

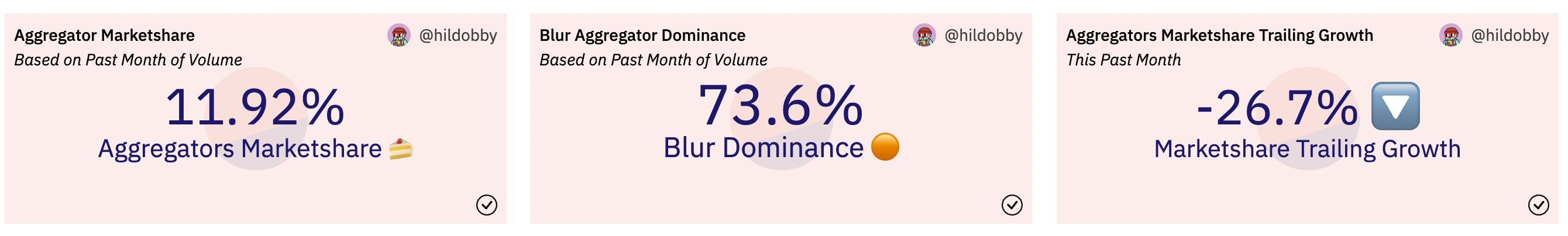

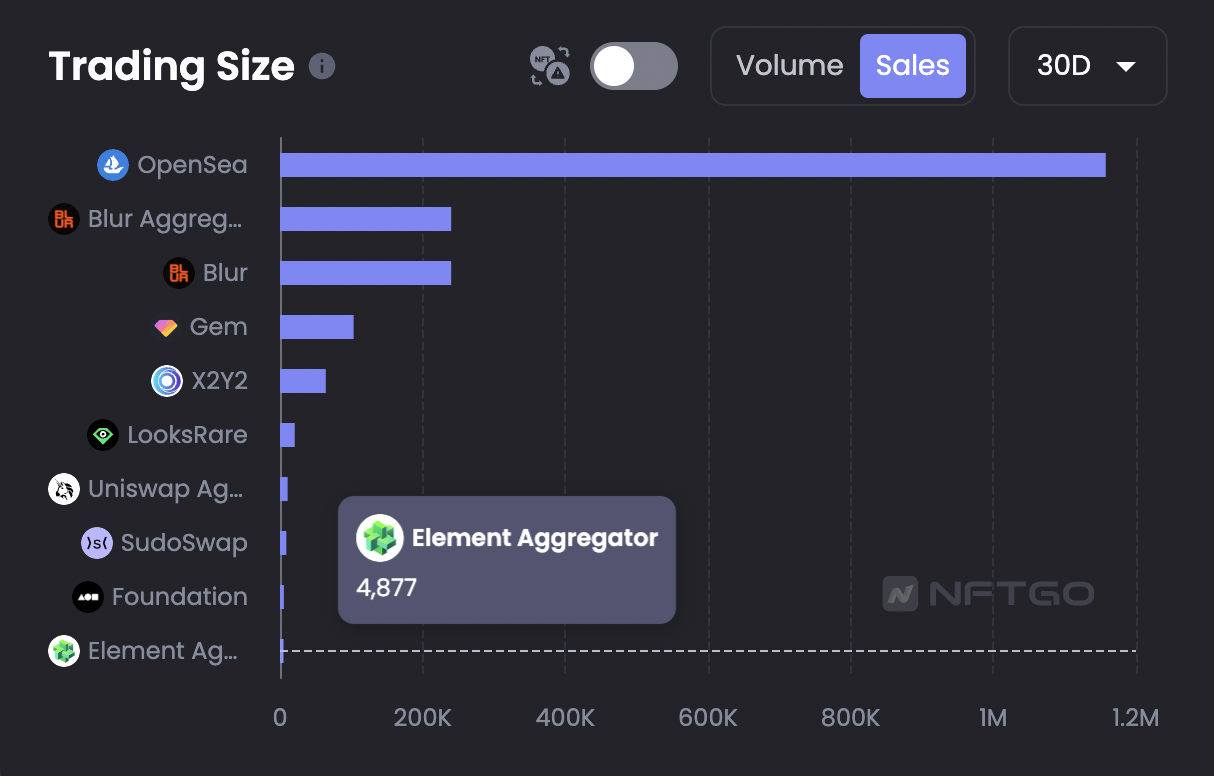

image description

Figure 5: Trending NFT Aggregator

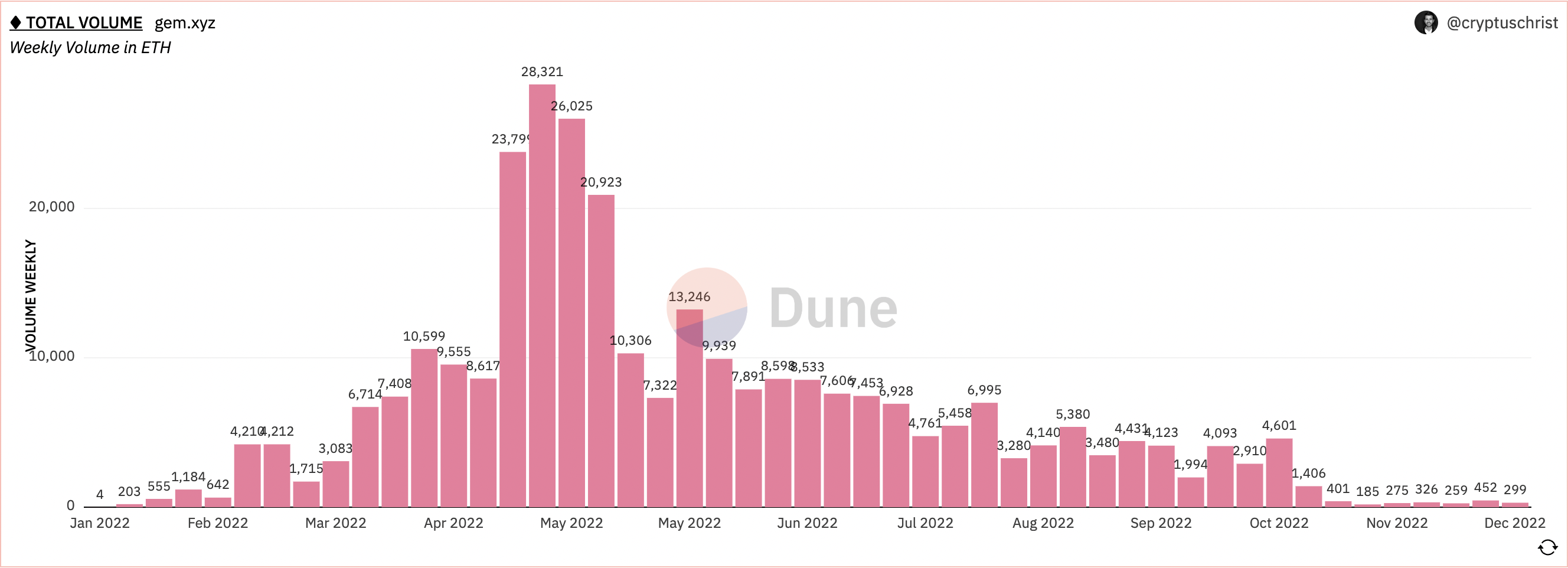

As can be seen from the data in the above figure, since Gem was launched in the Beta version on December 28, 2021, it has always had a good momentum, and its total transaction volume ranks first. The official also officially announced in April 2022 that it was acquired by OpenSea, but still maintains an independent brand for operation.

However, the birth of Blur in October 2022 broke the dominance of Gem. It has attracted a large number of users in a short period of time through the model of "custom royalties + zero fees + airdrop expectations", and has become the current chain. The NFT aggregation trading market with the largest trading volume has put unprecedented pressure on major platforms.

image description

image description

Figure 7: Aggregator Users

image description

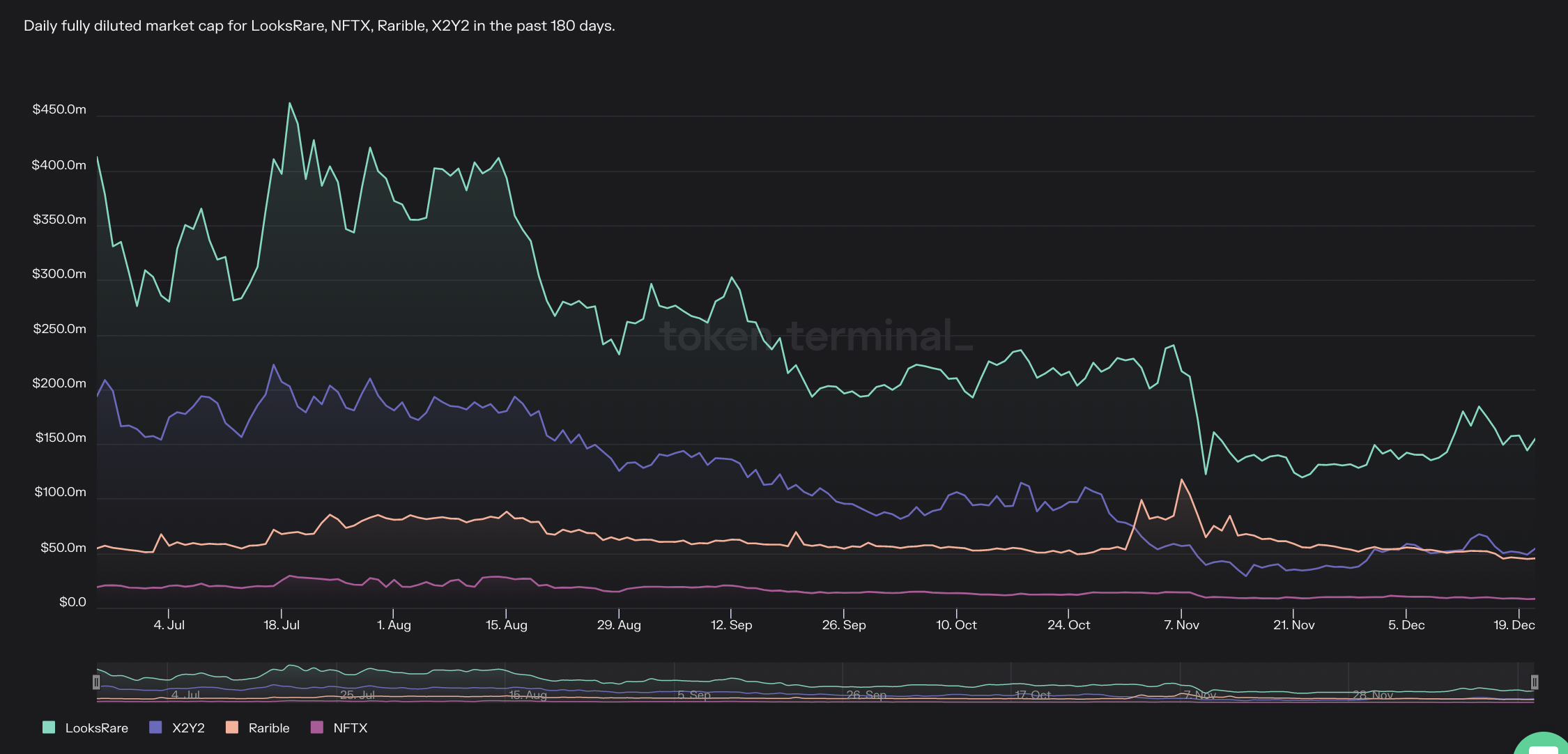

Figure 8: Daily Fully Dilted Market Cap

image description

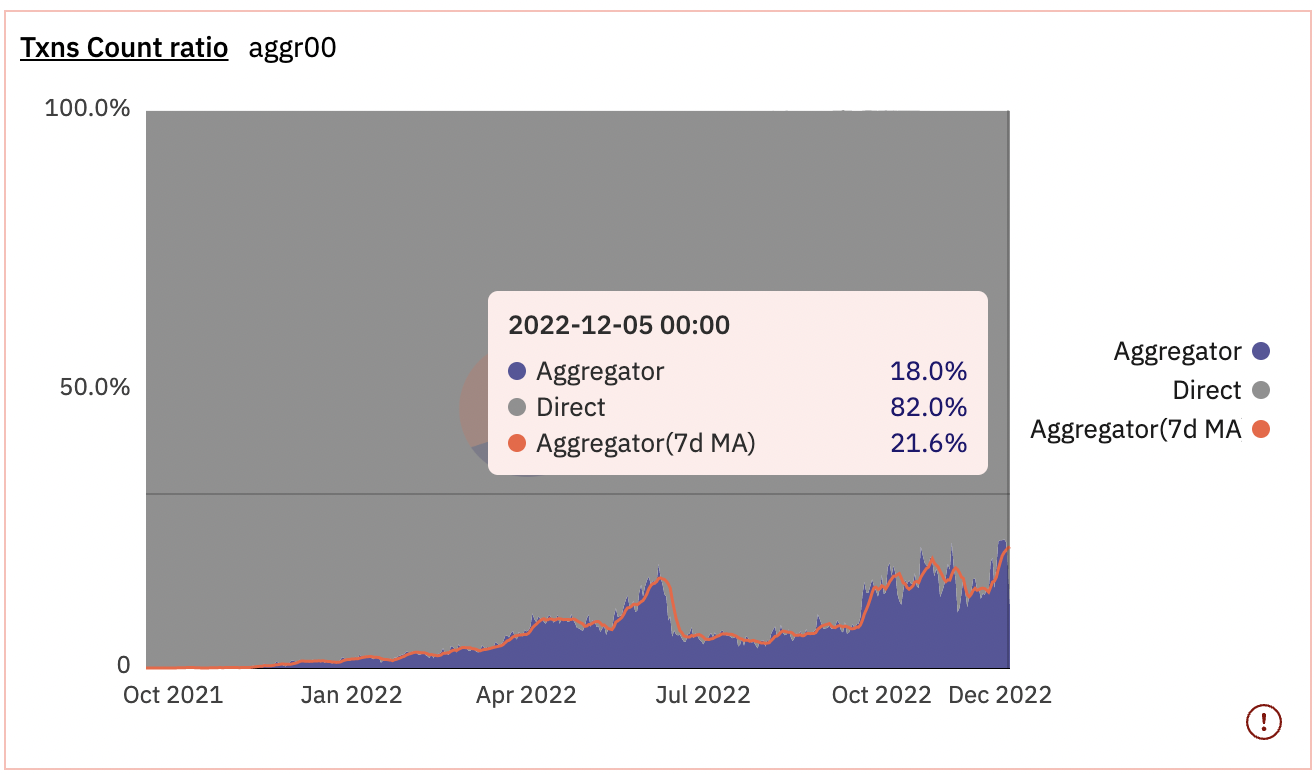

Figure 9: Txns Count Ratio

image description

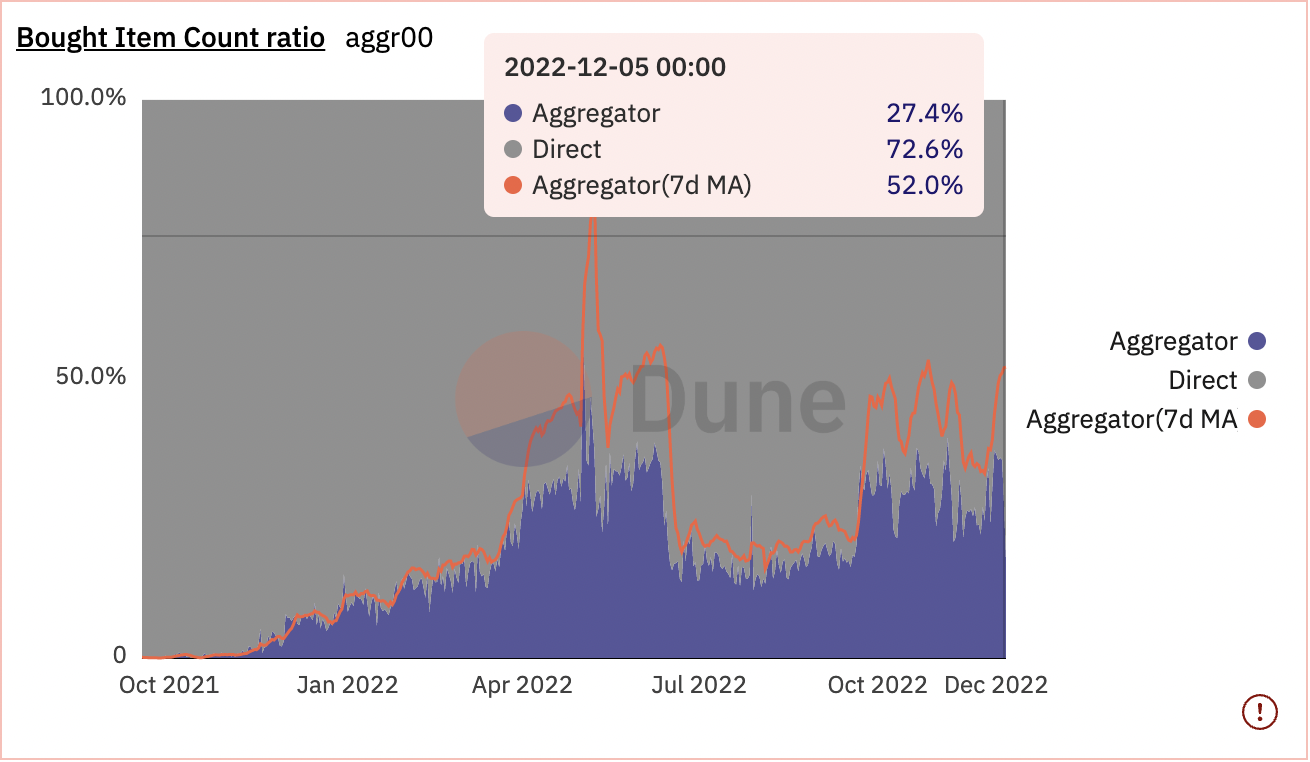

Figure 10: Bought Item Count Ratio

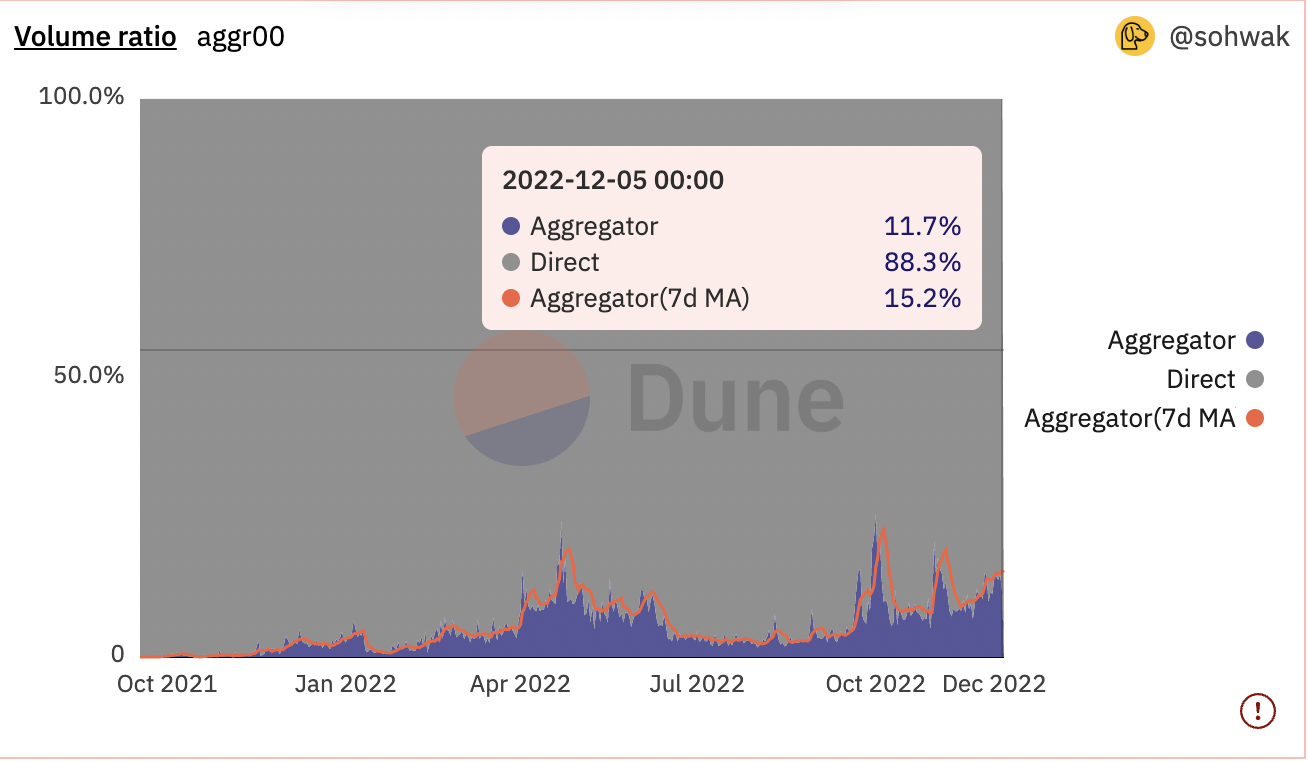

Finally, pay attention to the market transaction amount data. At present, the aggregated market transaction amount accounts for 11.7%, which is about 16% less than the previous purchase volume data (27.4%). From this we can boldly infer that most of the transaction volume in the aggregation market comes from NFTs with lower prices. , In the absence of platform activities, people will still tend to operate on trading platforms like Opensea to reduce risks.

image description

secondary title

Aggregation platform change trend segmentation

Blur

Blur is well-deserved to be the leader among the newcomers in the market. Since its launch, it has quickly and successfully occupied some market share, and has aroused extensive discussions on all major platforms. Like Uniswap, they all chose to promote in the first place, and they all claimed to have a smooth interface experience and the background strength of purchasing multiple NFTs at a time. In November, following an airdrop round, Blur accounted for around 15% of Ethereum NFT market transactions.

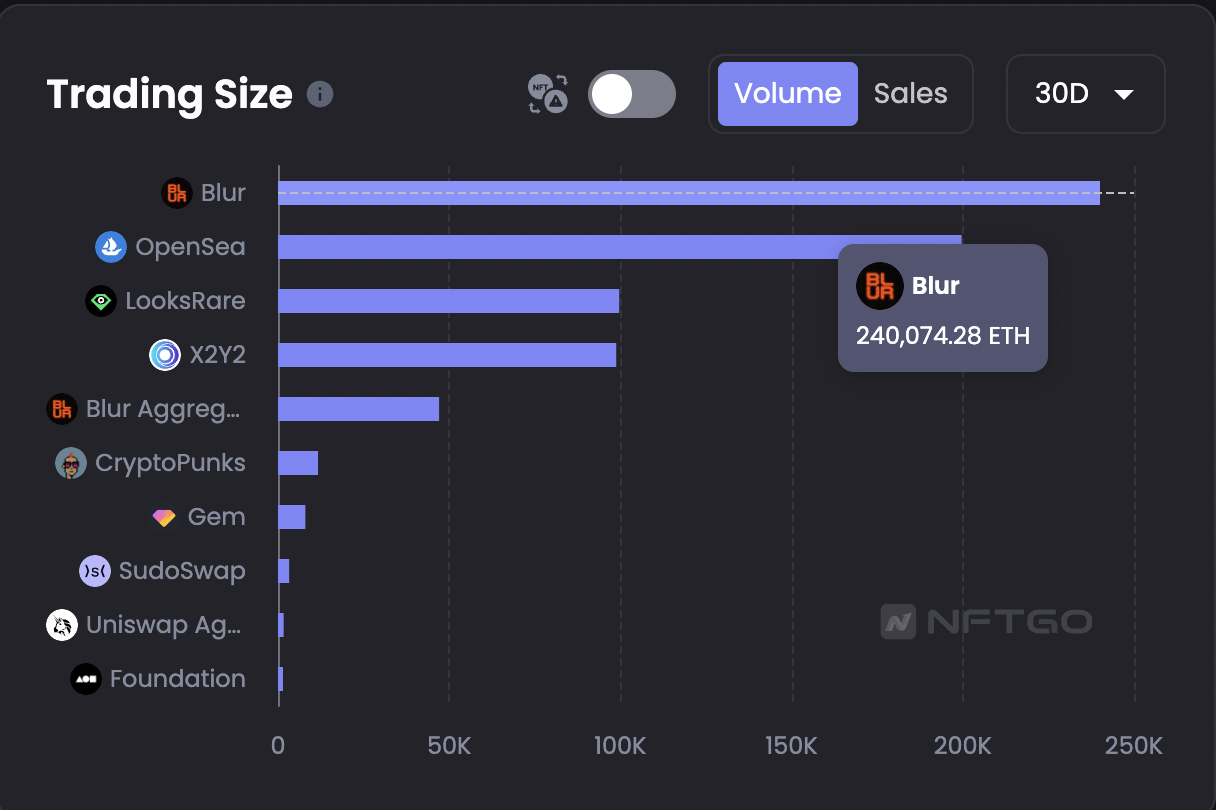

After the second round of airdrops issued in early December, as of December 19, Blur's NFT trading volume in the past month has surpassed Opensea, accounting for about 33.02% of the entire NFT market share, and has become the NFT aggregate with the largest trading volume on the chain market place.

image description

Figure 12: Trading Size

In addition, Blur also has its own unique way of operation. Most of the airdrops on the chain are to attract more traffic. It is related to user interaction on the platform, which is also the direct reason why it attracts stable user groups to place orders and trade.

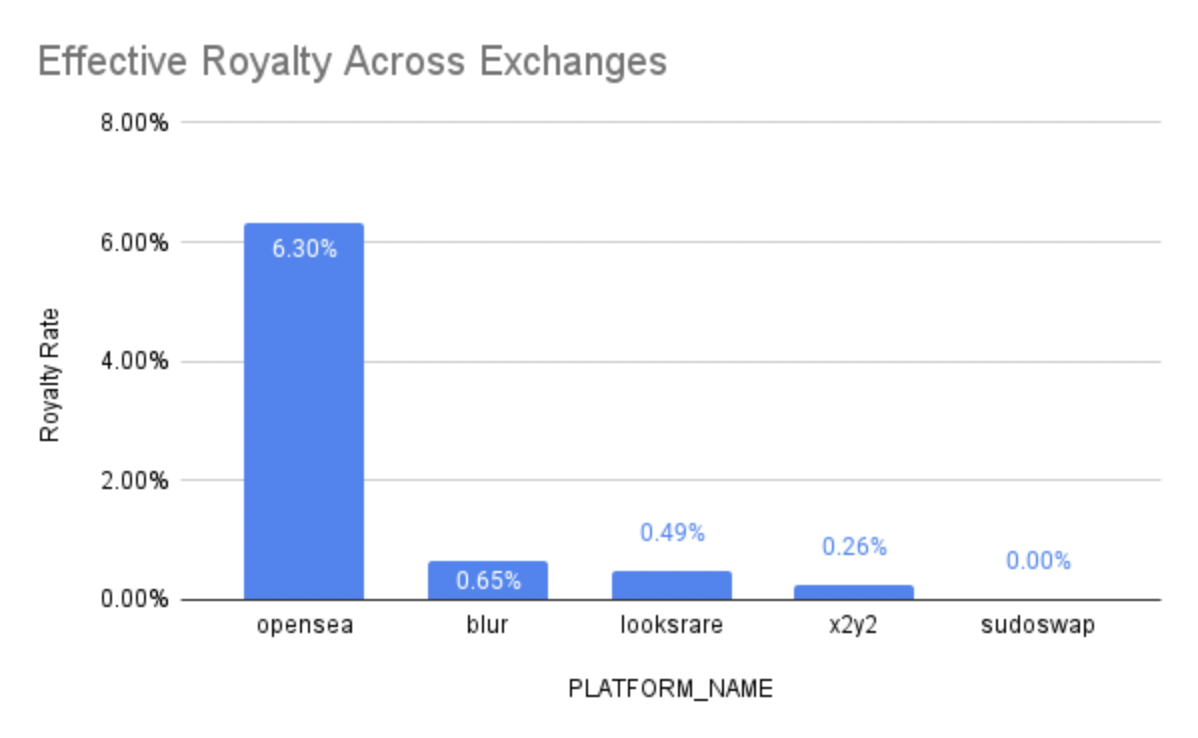

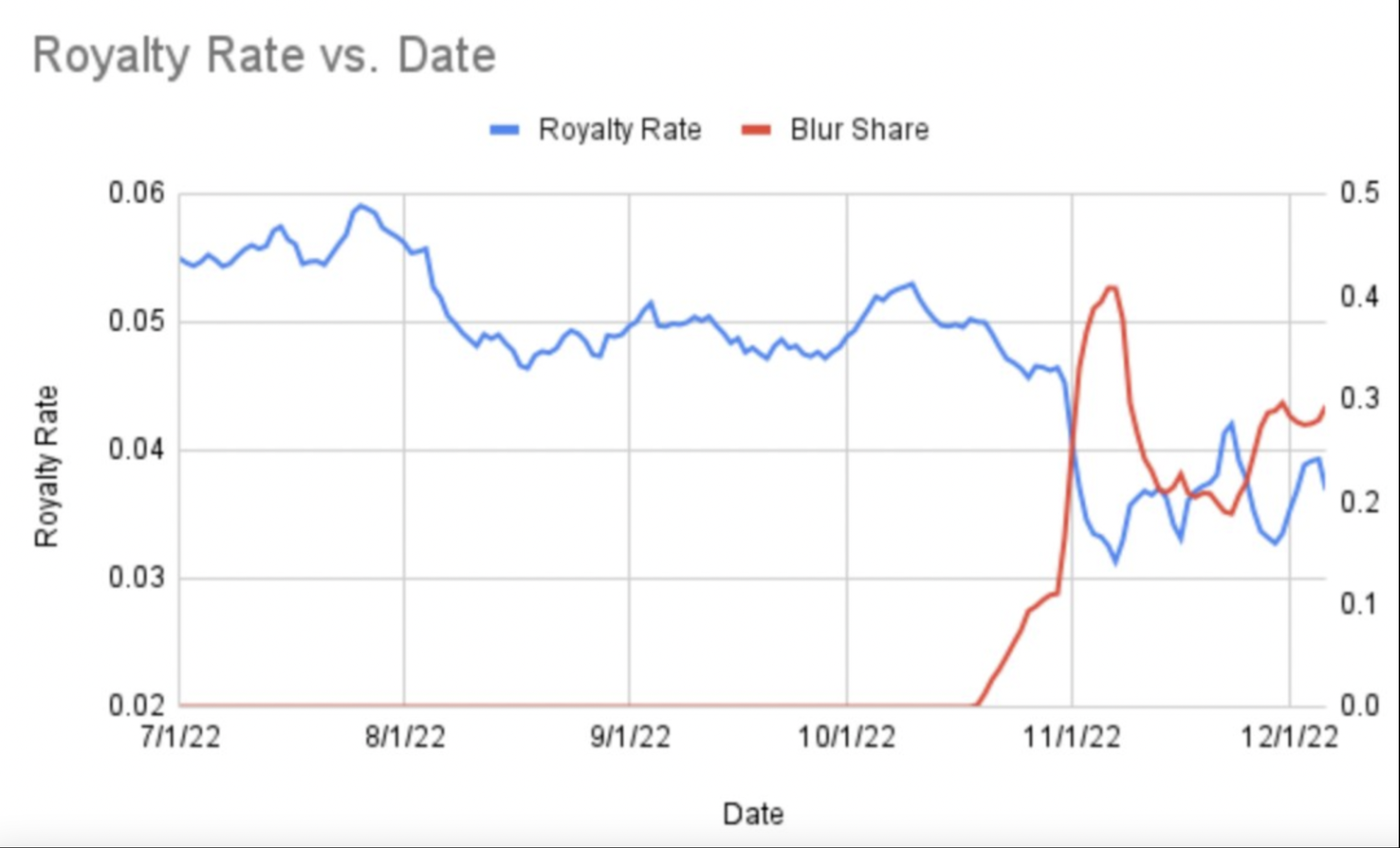

Blur's royalty mechanism is different from most NFT marketplaces. Here, NFT traders can set their own royalties. This means that they can choose not to collect royalties if desired. Therefore, the original creator of the NFT did not receive any revenue from the secondary sale. On the other hand, the incentive mechanism will reward those traders who like to use the royalties. For example, more airdrops will be given to traders who pay higher royalties.

image description

image description

Figure 14: Royalty Rate Vs. Date

As for when the "custom royalty, zero fee" model will last, Blur officially stated that it will wait for Token to go online before voting on royalties and cost specific plan decisions and discussions through community governance. Before that, Blur will not earn a penny .

The difference from Element is that the Gas cost of buying one NFT at a time and buying a batch of NFT at a time is equivalent, while Blur consumes more gas when buying more NFTs at a time, which may be why Blur buys NFT in batches There are few reasons why buying an NFT can fail.

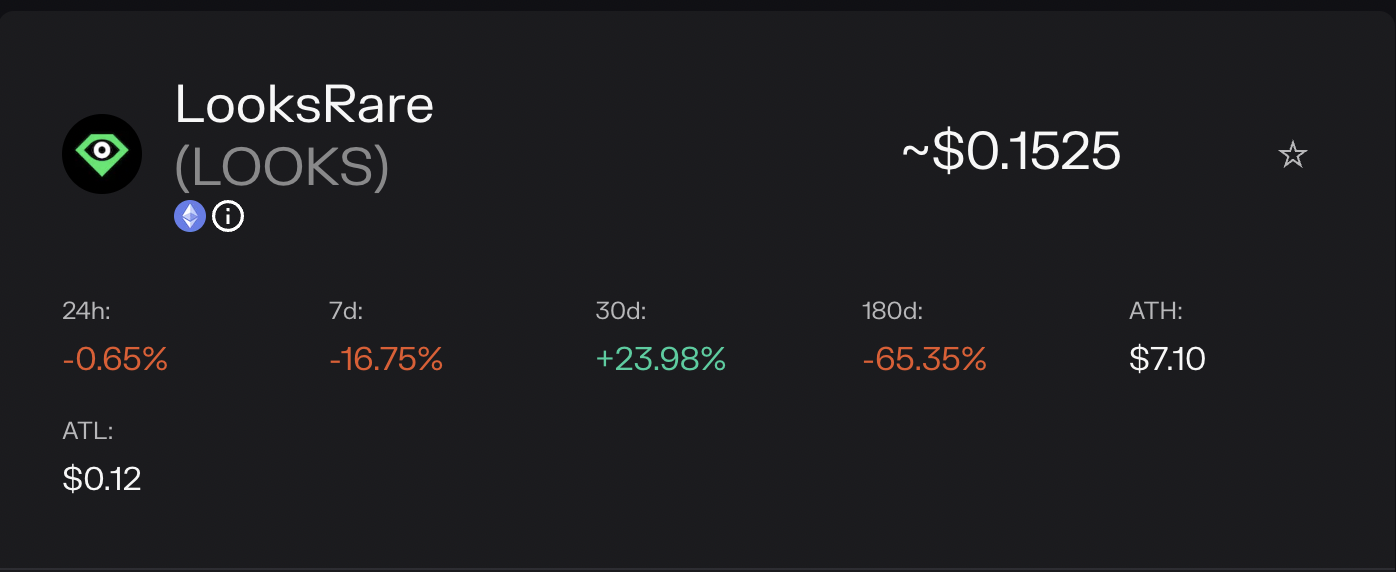

Looksrare

LooksRare is a community-centered NFT trading platform, which actively rewards all platform users. When it was first launched, it was filled with various labels - "100% transaction fees are shared by Looks token pledgers", "huge Airdrop", "By NFT people, For NFT people" and so on.

LooksRare uses its native token LOOKS as a selling point, and distributes airdrops to all NFT users who have traded at least 3 ETH on OpenSea within 6 months. The number of LOOKS tokens received will be more.

image description

Figure 15: $LOOKS

image description

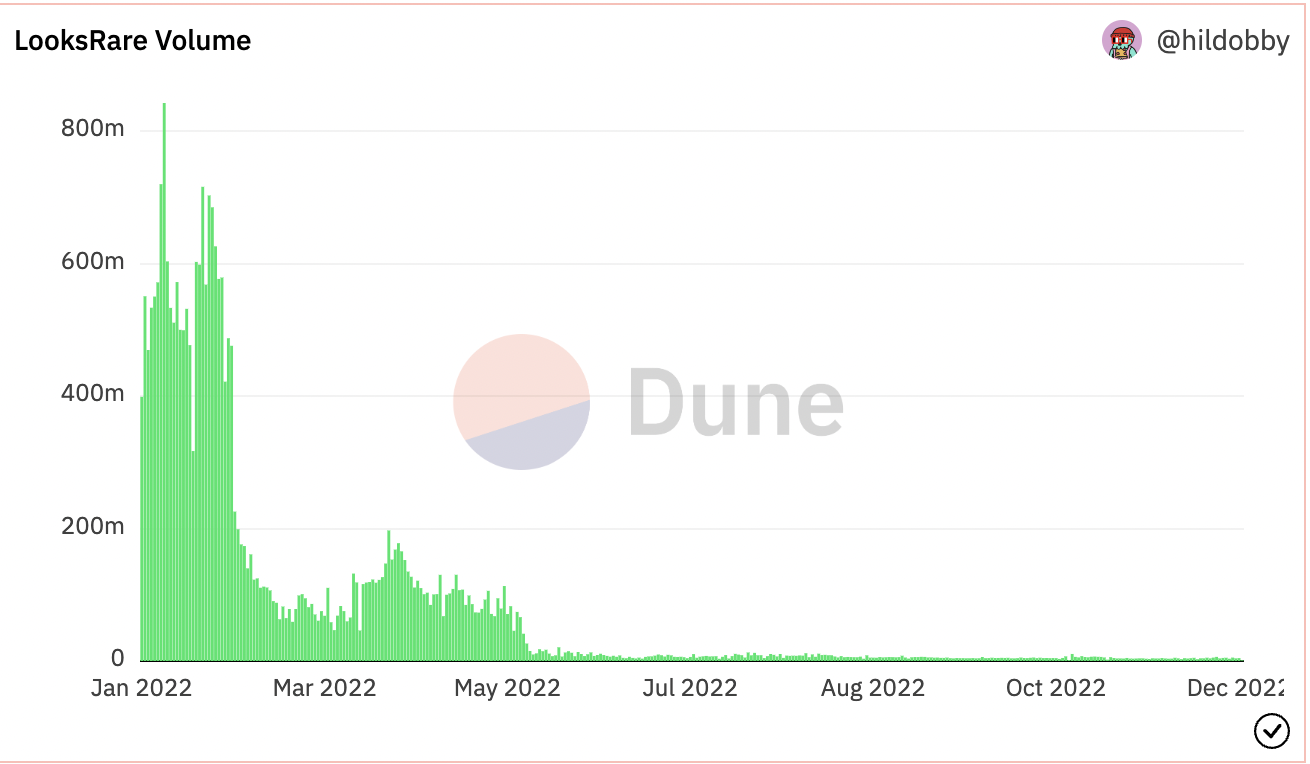

Figure 16: Looks Rare Volume

But LooksRare still distinguishes its NFT market from some important aspects, such as platform transaction fees: LooksRare transaction fees have been set at 2% since its launch at the beginning of the year, while OpenSea’s transaction fees are 2.5%, and it promises to reduce all platform fees 100% will be issued to users who pledged $LOOKS Token. This operation has ushered in everyone's active pledge in the short term after it goes online.

LooksRare’s treatment of derivative NFT projects is also different from other platforms. In other words, the position of those NFTs and LooksRare that imitated the existing NFT series products is not to remove or freeze their related derivative projects under the condition that "their actions are not malicious". Compared with OpenSea, which has the absolute right to speak in the listing of NFT projects, it has also taken off the shelves of highly-known NFT project derivatives in the past. Of course, there are bound to be many different views on derivative projects in the community. Some people think that they should not exist, and some people think that trying to prevent derivative NFTs violates the principles of Web 3.0.

X2Y2

X2Y2 is an NFT comprehensive trading market built on Ethereum. It launched a vampire attack on Opensea using token airdrops, and launched a series of pending order rewards, Gas fee refunds and transaction mining rewards to seize market share. Transaction mining is only a means of early customer acquisition and cannot form a moat. The platform charges 0.5% transaction fees and focuses on low-price strategies to attract users, but it has been questioned that there is a problem of fraudulent transactions.

image description

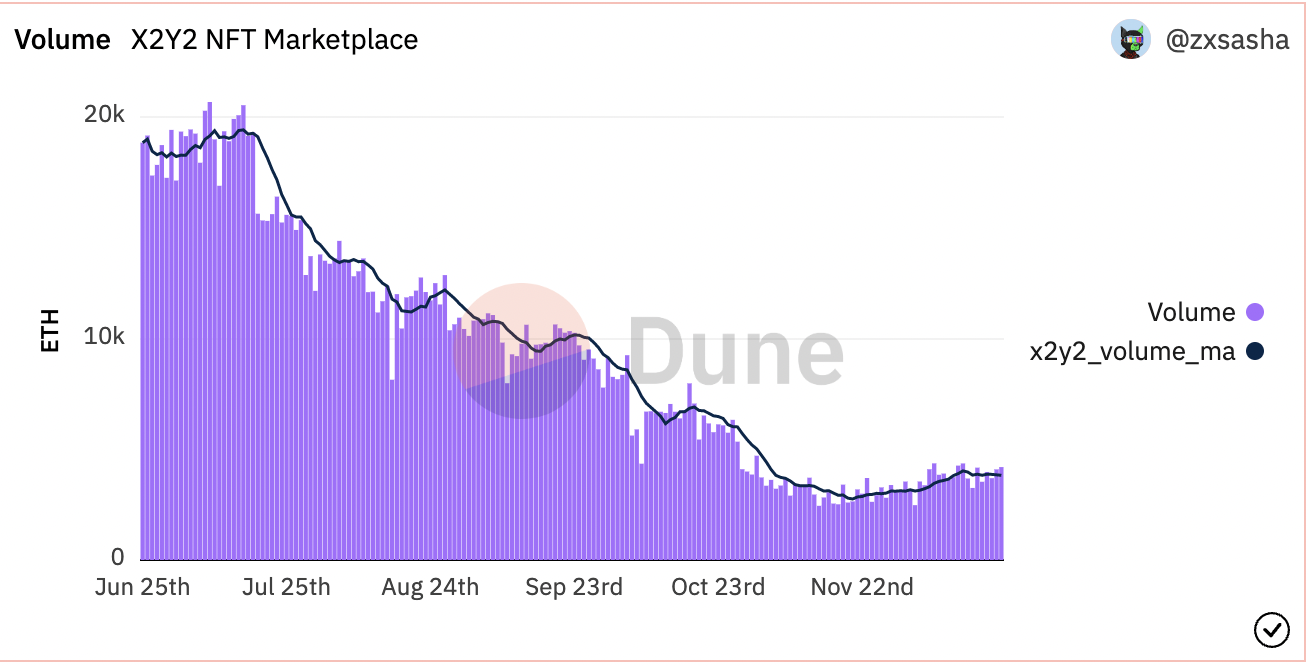

Figure 17: X2Y2 Volume

image description

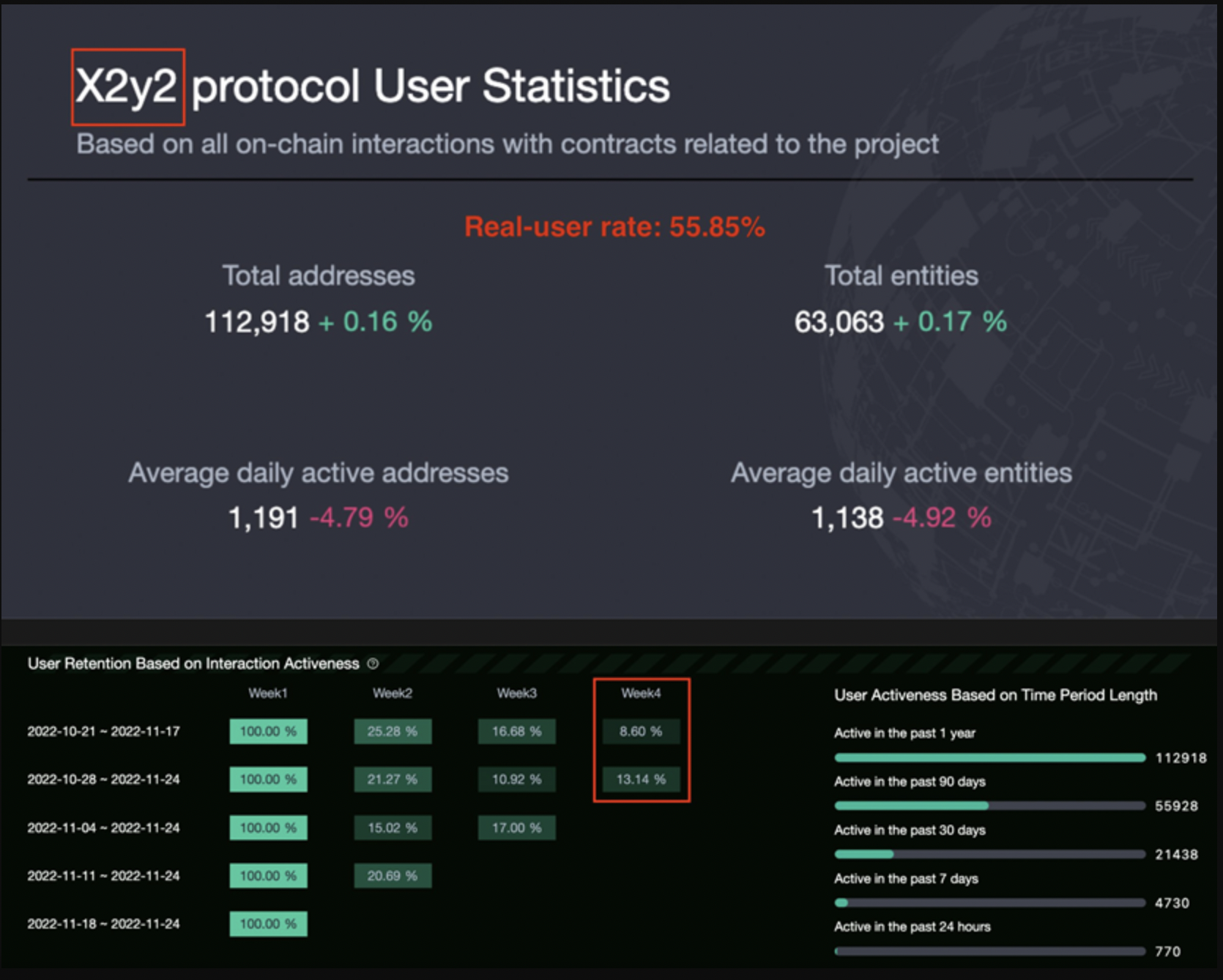

Figure 18: X2Y2 Protocol User Statistics

One way is that the user chooses an NFT with no creator’s fee, buys and sells in a left-handed and right-handed way, and completes the transaction mining to obtain rewards; the other way is the peer-to-peer transaction function launched by the platform, and the user uses this function to realize NFT in two Switch frequently between addresses to get rewards. The entire process of the two methods did not bring liquidity to the market, and also squeezed the enthusiasm of real users to participate in transactions.

From all aspects, if the situation of false swiping is not changed, the development of X2Y2 will be greatly restricted.

Rarible

Rarible will also introduce aggregation in October 2022 to better enhance the user experience. The aggregator helps users find the best prices for NFTs across markets and chains, and Rarible does not charge any additional buying and selling fees for these transactions through its platform. Rarible's aggregator also includes filters to narrow down NFT items based on several criteria. Users can browse NFTs through blockchains such as Ethereum, Solana, Tezos, Flow and Polygon, as well as layer 2 scaling solution Immutable X.

Rarible expanded its gaming NFT offering in September through a partnership with Immutable X, adding the ability to buy and sell game-related NFTs. On November 11, Rarible's proposal to build a zero-fee Apecoin market also failed. The voting results showed that the proposal received 85.65% of the votes against it. This may have been part of its territory expansion, but it has now failed.

Element

The difference between Element and other aggregation platforms is that it has its own trading market and supports multi-chain transactions.

image description

Figure 19: User Growth

But its decline is also very obvious. In the past two months, with the launch of other platforms, the trading volume of element has gradually declined, and the number of transactions within three months is not even comparable to that of the latest Uniswap Aggregator.

image description

Figure 20: Element Trading Size

4. Merger aggregation at transaction level

4.1 OpenSea & Gem

As monopolies often do, to nip threats in the bud, OpenSea's acquisition of Gem is seen by many as a very centralized approach.

While Gem will continue to operate as a standalone product, independently of OpenSea, OpenSea intends to continue integrating more Gem functionality into its NFT marketplace in the future

image description

Figure 21: Gem Total Volume

Before the acquisition of Gem, OpenSea also stated that it will pay more attention to the community experience, that is, it wants to serve more experienced professional users, and provide more flexible services and levels for users of different levels and experience in purchasing NFT. In other words, OpenSea's strategy this time is mainly for future business layout considerations, and Gem is not only an NFT market aggregation platform, but also an investment portfolio platform. It is this that meets the needs of OpenSea.

In addition, in the previous guesses, most people think that the layout of OpenSea and Uniswap is similar. But now it seems that Uniswap has obviously chosen a different track, focusing on the layout connection between FT and NFT. Gem, as a platform still operating under an independent brand, has always occupied a major share of the aggregation market, and now its main competitor is more like the menacing Blur.

image description

Figure 22: Shares By Volume

image description

Figure 23: Traders

4.2 Uniswap & Genie

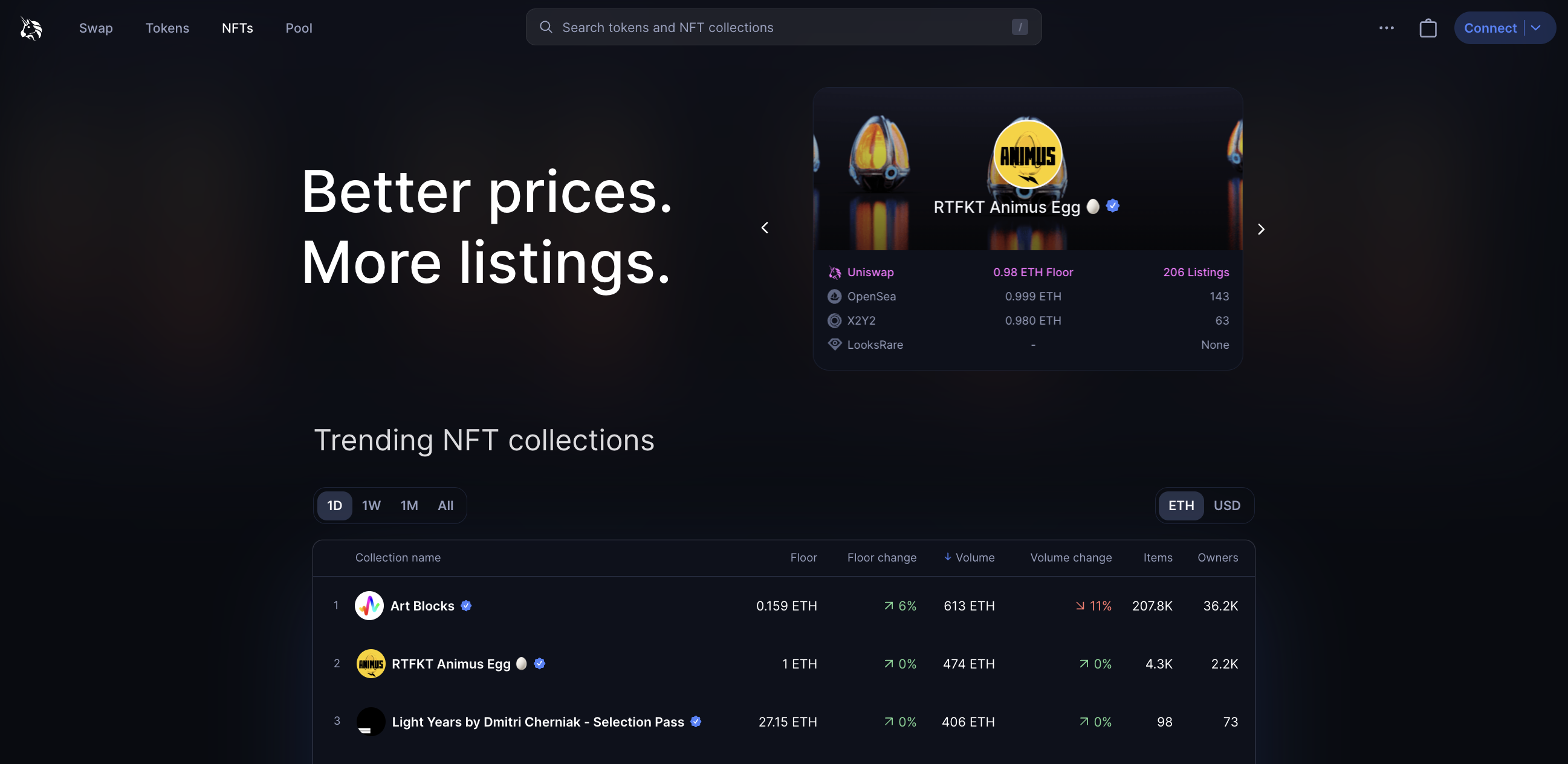

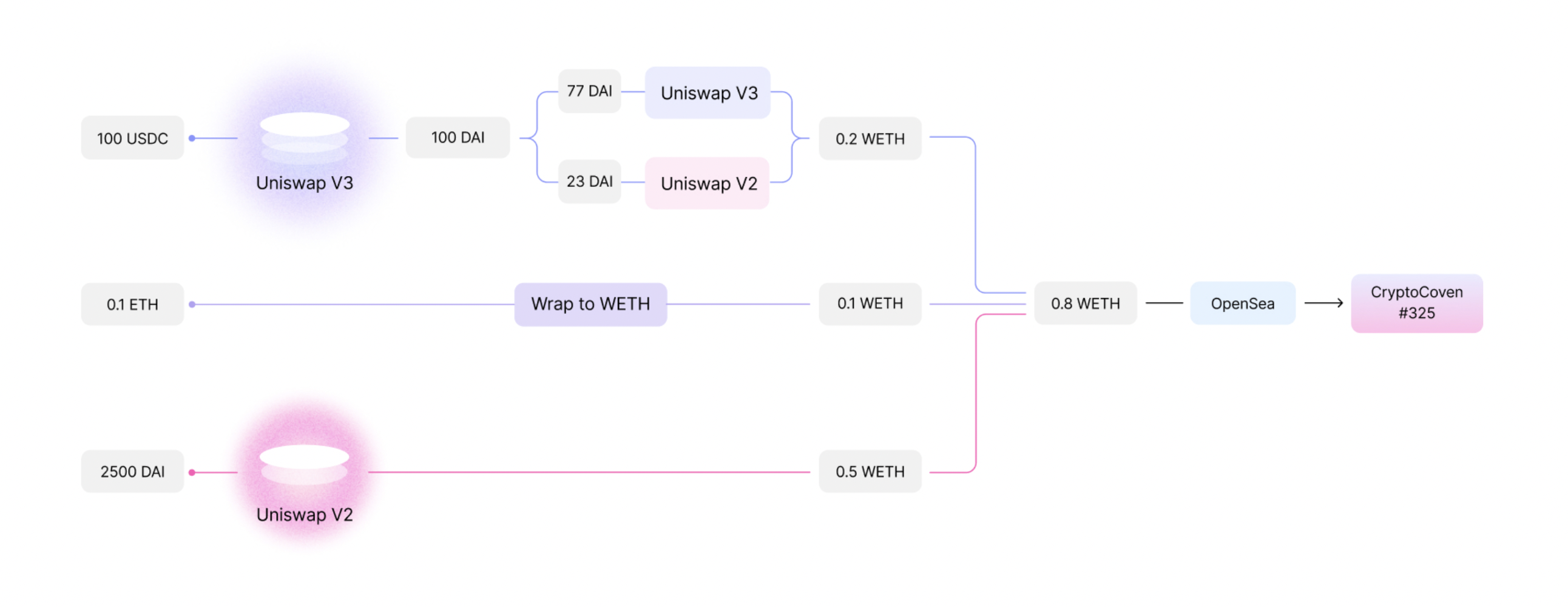

Uniswap Labs acquired the NFT aggregation market Genie in June 2022 to expand its layout, and stated early on that it would integrate NFT into Uniswap products, allowing users to purchase NFT on the market through the Uniswap web application.

image description

Figure 24: Uniswap Aggregator

The display effect of the Uniswap page is not much different from other aggregation platforms, and it contains most of the most important data indicators for user reference.

Compared with Gem, Element, or even Genie itself, Uniswap NFT does not provide relevant chart data analysis functions. Data Kanban is indispensable in other markets or aggregation platforms, but Uniswap NFT ignores this aspect The build, especially now that it has acquired Genie, is a bit insincere. In total, the home page only provides two functions of Items and Activity, which is a bit monotonous.

But these may be related to Uniswap's product layout - Uniswap's ambition will not be as simple as being an NFT aggregator. What they really want to do is an "ecosystem that can connect FT and NFT transactions".

It is not easy to connect FT and NFT transactions. NFTs and ERC-20 tokens exist largely as two separate ecosystems within cryptocurrencies, but both are essential to growing the digital economy. Launching NFTs on Uniswap is their first step towards building more interoperable experiences between the two, and for optimizing user experience.

In addition, Uniswap's new-generation routing "Universal Router" unifies ERC 20 and NFT exchanges into one exchange router. After integrating with Permit 2, users can exchange multiple tokens and NFTs in one exchange while saving gas cost.

image description

Figure 25: Flow Chart

In the past, people would subconsciously regard FT and NFT as two very independent experiences, and believed that the two were very different. However, Uniswap NFT has opened up a new perspective for the public - both are digital assets, and the goal is to bring universal ownership exchange to users. FT and NFT are just two different ways to release value in the digital world. cannot be connected.

Uniswap itself, as the leader of the decentralized exchange, can provide NFT with a better quotation option at the end of this process. The change in the positioning of the aggregator is also to improve the user experience of the majority of users and provide faster services, between FT and NFT, instead of trying to seize share in the NFT market that has been gradually lost.

In the past two months alone, Uniswap has 864 k unique addresses, which is a huge existence in the entire block universe, and the ambition of Uniswap's layout will not be as simple as an aggregator. Although Genie's latest airdrop did not reawaken the enthusiasm of the majority of users, it has also been integrated into the Uniswap ecosystem as part of the territory.

Whether there will be new FT and NFT connection forms or transaction models that break the traditional cognition in the future may become the key to the development of Uniswap NFT in this field.

5. Review update and royalty handling

5.1 Updates on anti-theft and fraud, intellectual property rights, censorship, etc.

As the NFT trading and aggregation platform continues to grow and advance, OpenSea, as the trading platform that used to sit firmly on the top, may also feel the pressure, as can be seen from the frequent official updates and adjustments this year.

In June 2022, OpenSea updated the NFT copyright protection plan and launched 4 protection measures to protect OpenSea users and NFT copyrights in technology and other fields. The specific content is:

Anti-theft and fraud prevention issues: OpenSea will automatically hide suspicious NFT transactions to reduce their visibility.

Intellectual Property Infringement on the Internet: Planning to build a proactive solution in the next quarter.

Reviewing and managing issues at scale: OpenSea has established a dedicated review team and is adding key automated detection methods for copyright issues and other fraud vectors.

Investing more in key areas of user issues reduced the average response time to less than 24 hours.

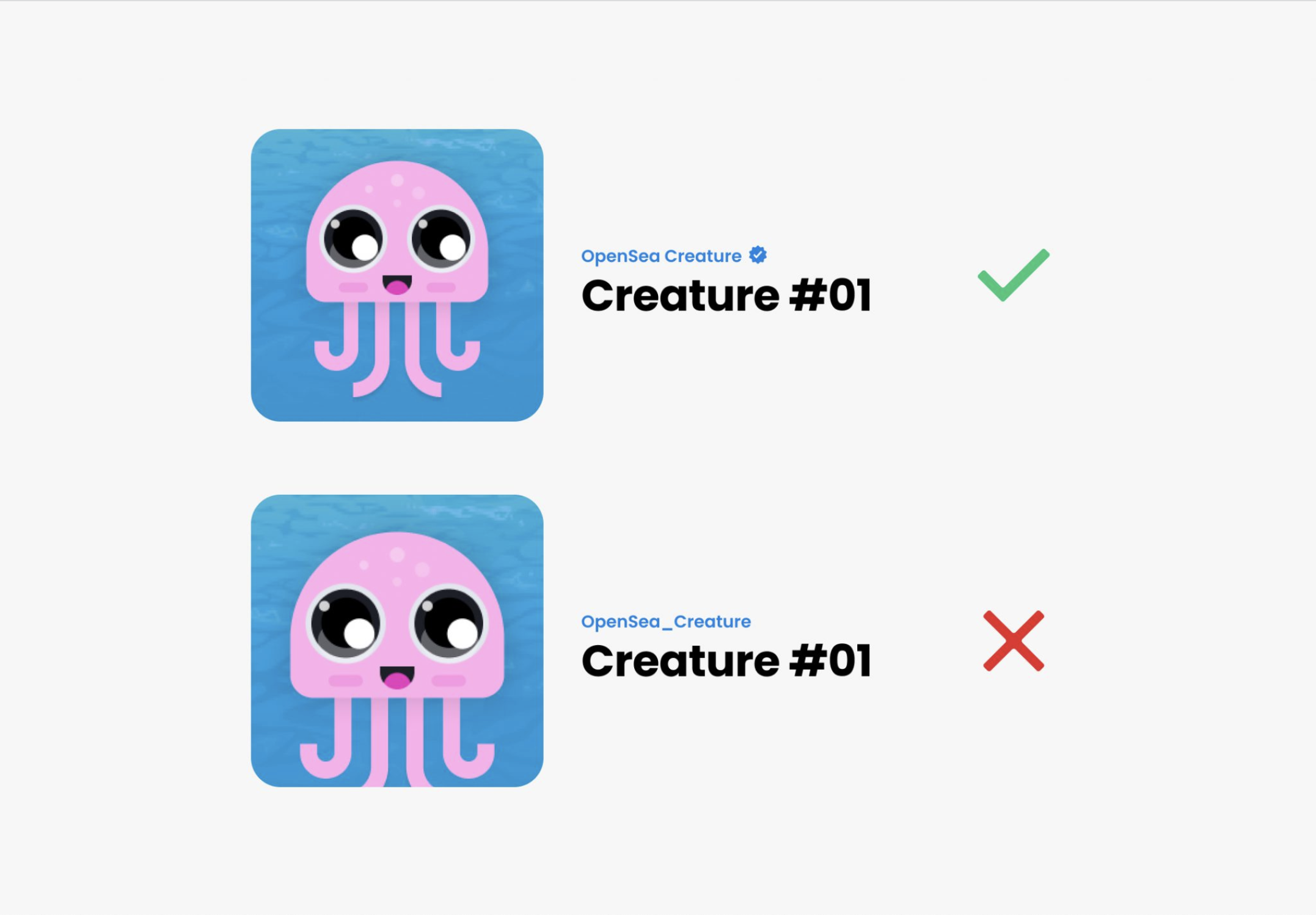

OpenSea launched a new replica detection system in November 2022 that can identify exact matches, flipped and blurred NFT replicas within seconds. And it launched an automated system in May to proactively identify and delete NFTs suspected of plagiarism, including image recognition technology and specialized manual review, aimed at improving authenticity and reducing replica changes on OpenSea.

image description

Figure 26: OpenSea Creature

5.2 Insisting on Creator Fees

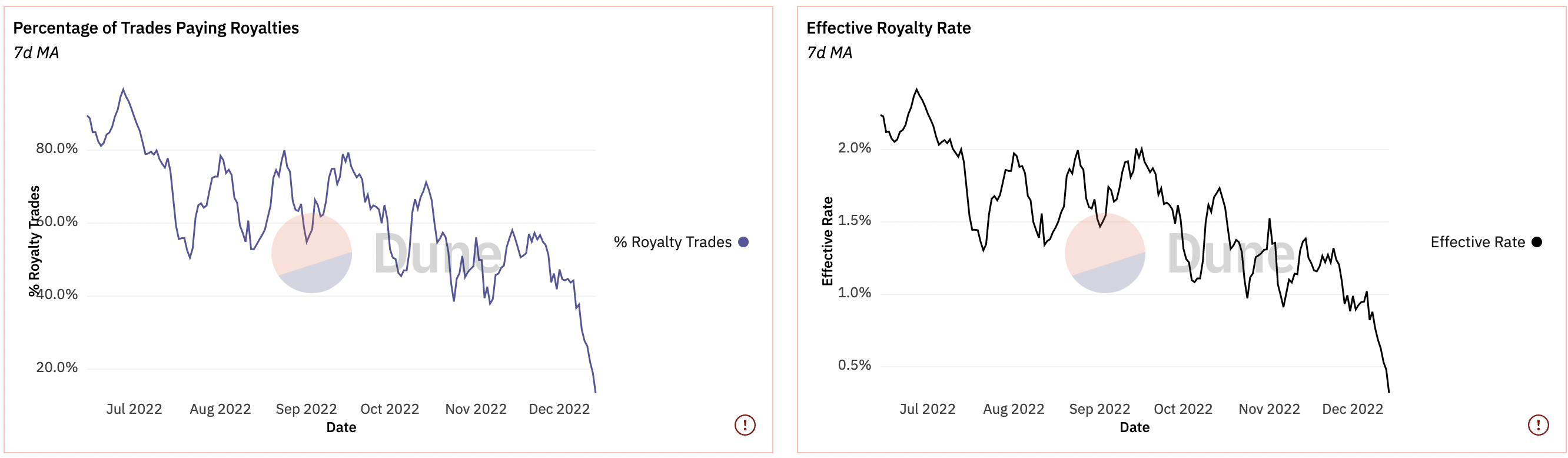

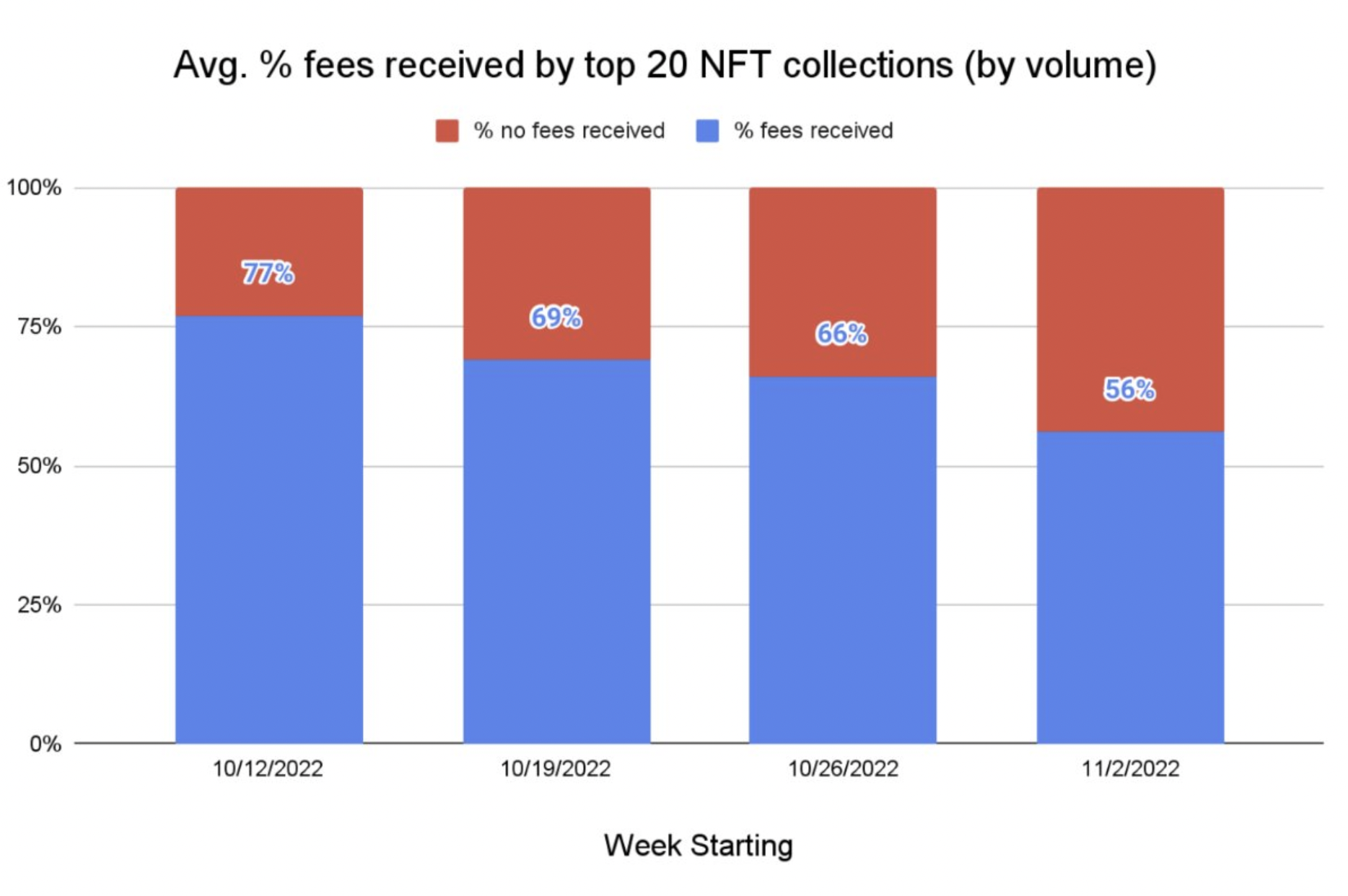

In the fierce market competition environment, after X2Y2 fired the first shot of royalty reform, many trading platforms have successively added the function of customizing royalty, giving users the right to choose royalty.

image description

Figure 27: Royalty

OpenSea has a very strong attitude towards this behavior, saying that it will continue to collect creator royalties for all existing NFT series, and will assist creators to force royalties through the on-chain mechanism. Additionally, creators are advised to create more incentives for the community and refuse to link to royalty-free NFT marketplaces from the project’s official website.

Magic Eden followed suit, announcing that it will launch a new agreement from December 2 to force royalties on all new collections that choose to use the tool.

image description

Figure 28: Fees

During the bear market, many people who hope to raise funds will want to sell NFT to relieve anxiety, so it is natural to choose to sell their NFT on the market without mandatory fees to obtain more income.

For collectors, this means that the NFTs they really want are increasingly likely to appear in markets that don't enforce creator fees. Even if these collectors say they want to pay creators, they will actually be more and more inclined to buy in these types of markets

The consequence of this ecosystem shift for creators is that the Web2 business model used by the vast majority of creators in this industry is now subject to the market's enforcement discretion, not code. And for new creators who hope to enter the Web3 field, they will find that the fees they set are not always enforceable, and the so-called creator economy has become empty talk.

OpenSea said that if the current trend continues, it is very likely that the fees paid to creators in the Web3 field will be greatly reduced, or even reduced to zero. Once such behavior occurs, it will become almost impossible to take measures to reverse the situation. impossible.

Given OpenSea and Magic Eden's role in the ecosystem, they believe they need to take a thoughtful, principled approach to this problem and will lead with a solution.

Obviously, almost all creators would like to be able to force fees on the chain, and OpenSea and Magic Eden share the same point of view in that, fundamentally speaking, they believe that most of the attributes of all works (including royalties) should be provided by the authors themselves Make a choice-instead of letting the market make decisions for them, because NFT is a product that belongs to the creators themselves, and they have the right to make their own decisions. As a result, platforms will want to balance the market as much as possible by empowering creators and equipping them with the tools to control their business models.

OpenSea and Magic Eden Launch Forced Royalty Tool

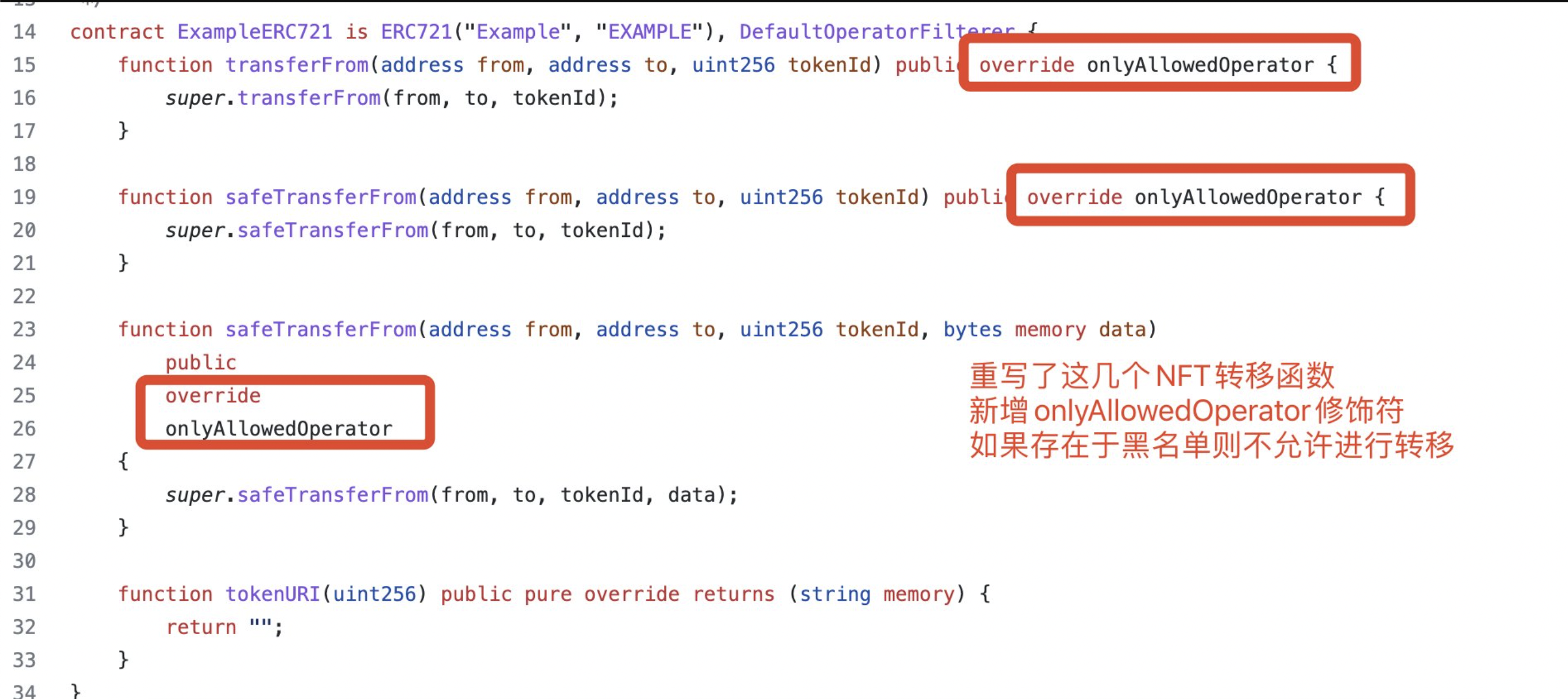

OpenSea

The first is that OpenSea officially launched a new tool for this purpose - the Operator Filter Registry, which is used to enforce the creator's fee for the new collection on the chain, which is also their first chain execution version. And committed to transfer ownership of the Operator Filter Registry, an on-chain creator royalty enforcement tool, to a multi-signature controlled by the Creator Ownership Research Institute (CORI) by January 2, 2023. (CORI) A collaborative project originally created by ZORA, OpenSea, Manifold, Foundation, SuperRare, and Nifty Gateway.

image description

image description

Figure 30: Filtering process

This is the first step made by OpenSea, but considering the difficulty of implementing on-chain charges for existing collections, it will not make any changes to the existing collections for the time being, and the subsequent choices include further selection of which existing collections From enforcing fees, allowing for discussion of optional creator fees, to other online collaborations - on-chain enforcement options for creators, these changes will all be open for discussion and even voting with the community.

Magic Eden

Magic Eden, under pressure from public opinion in mid-October, stated that it would no longer strictly honor the royalties set by creators of NFTs sold through its platform. But in the following month, its attitude towards the royalty issue took a big turn. I don’t know if it was because of OpenSea’s tough attitude. Magic Eden’s co-founder and CEO Jack Lu proposed at the Solana Breakpoint conference in Lisbon. A new NFT standard, which means that the standard will enforce royalties at the technical level.

Beginning December 2, Magic Eden launched a new agreement that will collect royalties on all new collectibles that choose to use the tool. An open-source tool, the Open Creator Protocol (OCP), will give creators who post collectibles the option to protect royalties. For creators who have not adopted OCP for their NFTs, royalties will remain optional on the platform.

Built on top of Solana's SPL token standard, the Open Creator Protocol also includes features such as dynamic royalties (changing the royalty percentage by project sales volume), freezing transactions until minting is complete, and customizable token transferability.

Upon launch, the platform will host a free "Magic Mint" for users to test the Open Creator Protocol and its capabilities.

6. Income distribution

6.1 Creator fee data

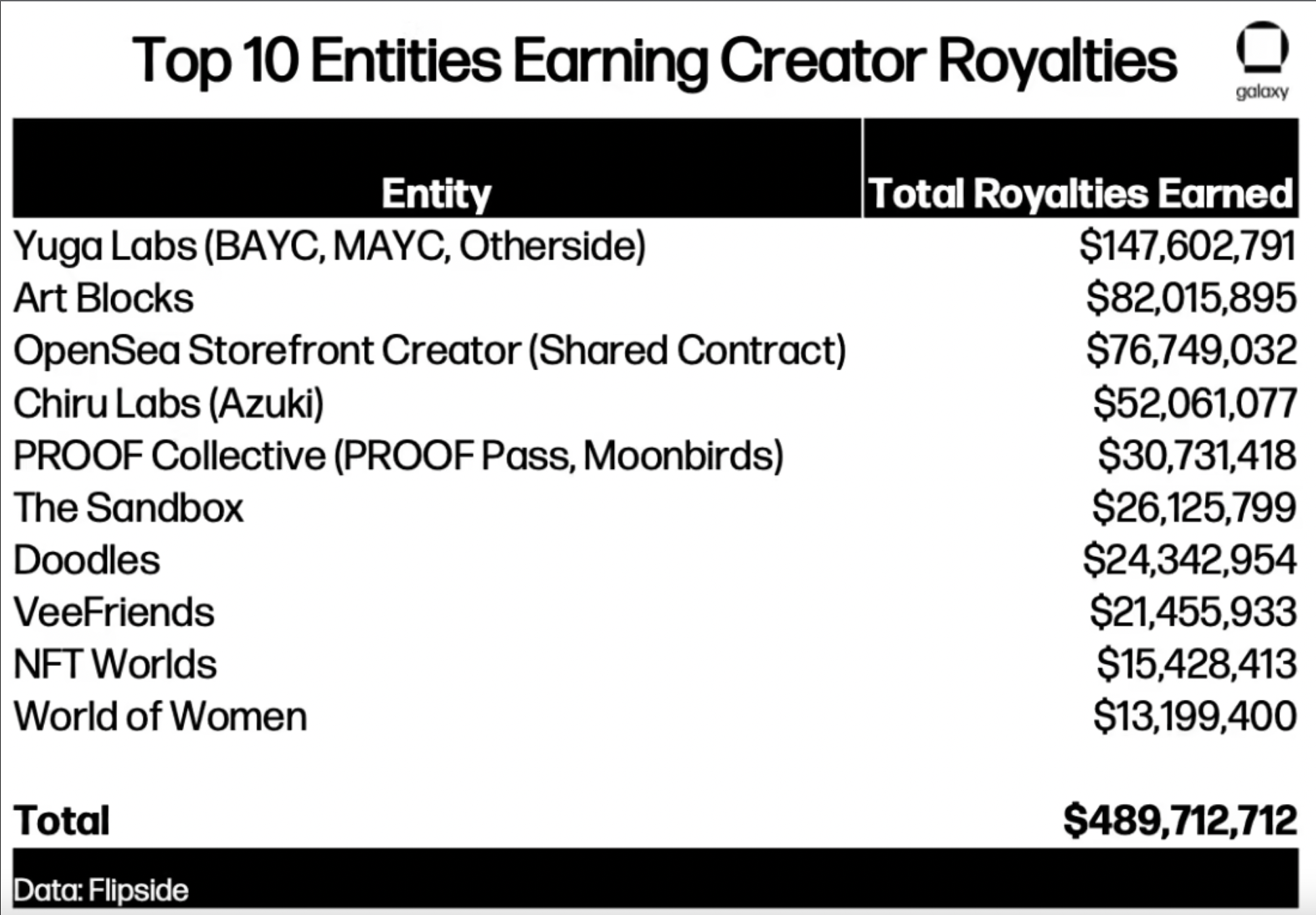

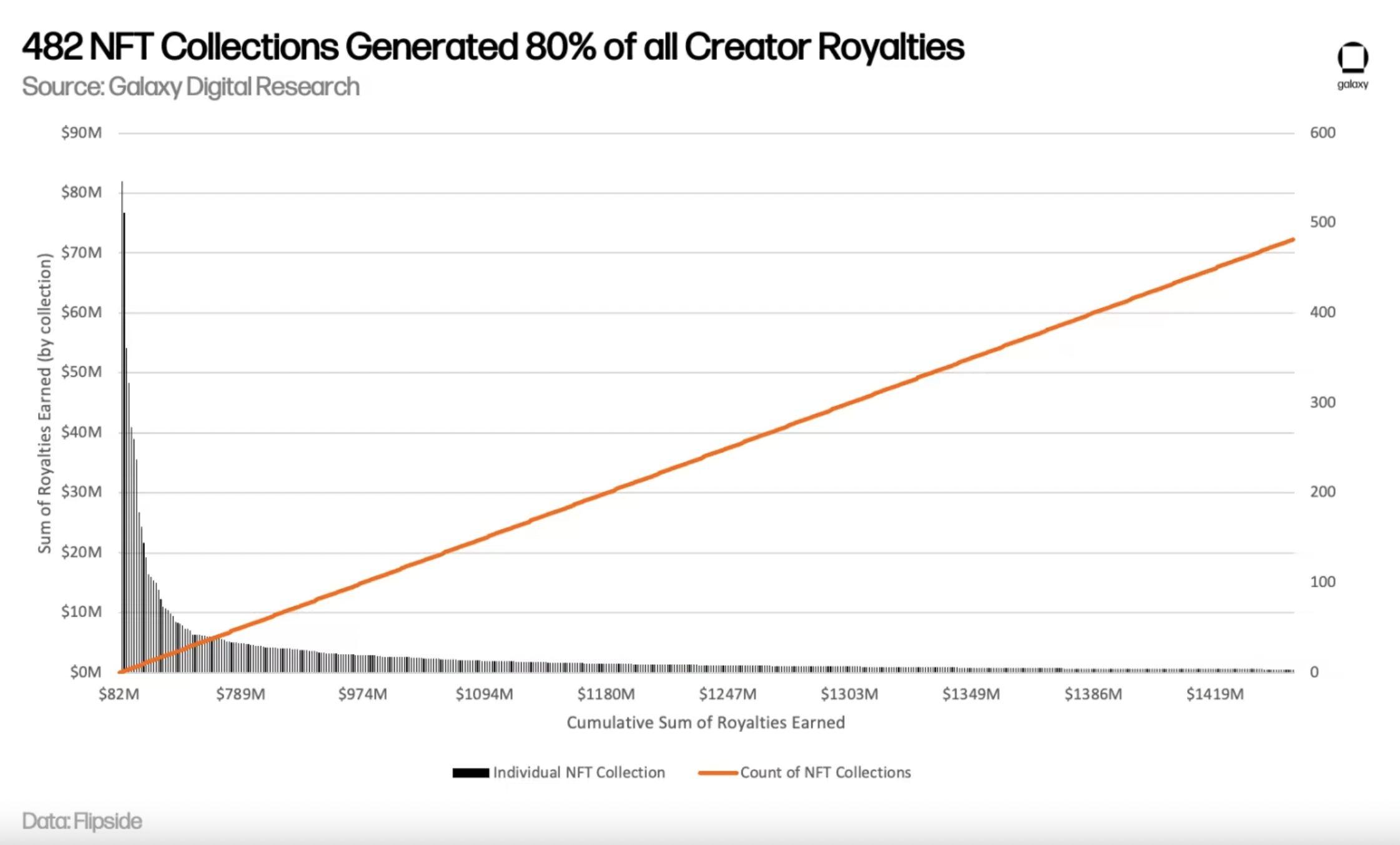

For a long time, NFT royalties have been a major selling point for independent artists and creators to embark on the Web3 wave. They can turn their hard work and efforts into income. So far, more than $1.8 billion in royalties have been paid to based Creator of Ethereum's NFT collection.

In 2022, OpenSea officially released a set of data that creators used OpenSea to earn more than $1 billion from creator fees, and these revenues do not include sponsorship revenue, participation awards, or grants. These revenues are generated directly from creator fees for reselling works and are immediately settled on-chain between buyers, sellers, and creators, with 80% of creator fee revenue going to collectibles outside the top 10.

Creator revenue comparison with established Web2 platforms:

In July 2021, Meta said it would pay out more than $1 billion to creators on Facebook and Instagram by the end of 2022.

In 2020, TikTok promised that they will pay creators about $1 billion in the next three years.

Snapchat pays some of their top creators $1 million a day, or even $365 million a year.

Patreon has paid creators a total of $3.5 billion in its nine years in business (as of 2021).

image description

image description

Figure 32: Creator Royalties

6.2 Zero Creator Royalty

In the NFT bull market, paying royalties of 8%-15% on each NFT transaction was once the norm. However, as the global market conditions deteriorated, the overall NFT transaction volume of all mainstream ecosystems has dropped significantly. Compared to an all-time weekly high of $6.1 billion in January 2022, Ethereum's weekly NFT transaction volume has dropped by more than 99% to $85.2 million. As a result, traders became less willing to pay creator royalties, opting for more cost-effective alternatives.

SudoSwap is the origin of the anti-royalty movement in the NFT space. Launched in July 2022, SudoSwap utilizes the AMM model for NFT transactions (similar to how Uniswap operates for fungible tokens). Their use of the AMM model is to increase the liquidity and market-making capabilities of NFTs while minimizing fees. Not only do SudoSwap charge a relatively low 0.5% transaction fee (compared to OpenSea’s 2.5%), but they also do not support enforcing any NFT royalties themselves. While SudoSwap's model is best suited for floor-price NFTs, their core value proposition has proven to be very popular with sellers looking to improve margins. Instead of losing as much as 12.5% on royalties and platform fees, sellers are guaranteed to only pay a maximum of 0.5% on each sale.

When SudoSwap started to become the go-to place to sell NFTs, Gem took notice. This means that Gem started including SudoSwap in its aggregator list. This small move prompted the broader NFT space to interpret the Gem's integration with SudoSwap as some sort of endorsement from OpenSea. Soon after, another NFT marketplace, x2y2, followed suit, giving both buyers and sellers the option to pay royalties. Around the same time that x2y2 removed NFT royalties on the Ethereum chain, Yawww made an announcement on NFTs on the Solana chain, making royalties optional.

While there's been a lot of talk about the possible knock-on effects of not honoring creator royalties, let's start by looking at what people are saying about this shift in market behavior. The most obvious advantage of this shift is lower costs and fees for traders actively trading NFTs. On top of removing creator royalties, many marketplaces have drastically reduced their marketplace fees to attract more volume. This provides better prices and profit margins for speculative traders, as other overhead costs such as creator royalties, platform fees, and gas fees become irrelevant.

7. Traditional industry layout NFT and new technology introduction

7.1 Web2 brand market gradually enters NFT

At the beginning of 2022, Google's search trend for NFT continued to rise. Under such a trend, many technology companies also plan to enter the NFT market. Including Facebook and Instagram, which were laid out early.

Tech companies hope to bridge the gap between Web2 and Web3 through NFTs, bringing their communities into the brand along with the technology. This is also the fastest and easiest way to enter Web3 that is easily understood and accepted by the public.

The first trendy brand to take advantage of the NFT trend is Boring Ape (BAYC), and it is currently a leader in the NFT field. Only with NFT can you become a member of them. Boring Ape is popular all over the world with its super marketing ability. Many stars own the NFT of this series and will take the initiative to display it on their personal social platforms. NBA star Stephen Curry, knight O'Neill, football star Neymar, singer Xiao Justin, Eminem, and Jay Chou in Asia, etc.

Joint brand

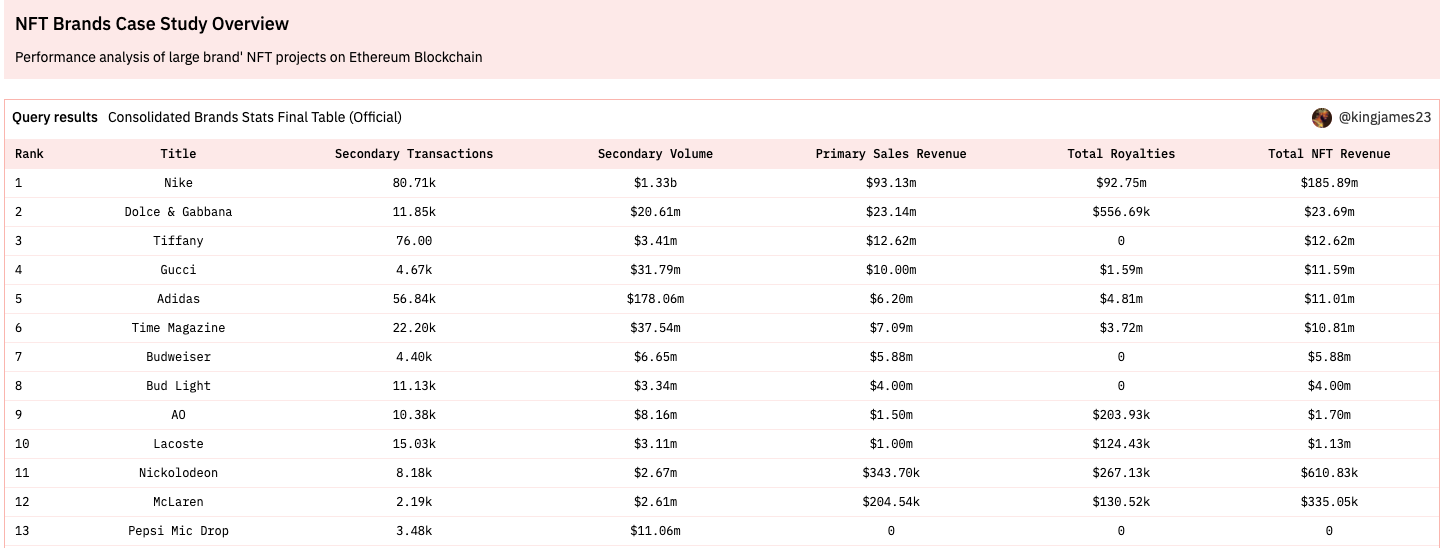

The fastest growing business under the sports brand NIKE is NFT. According to Dune Analytics, NIKE ranks first in the list of NFT brands with the highest revenue, with cumulative sales of 186 million US dollars.

image description

Figure 33: NFT Brands

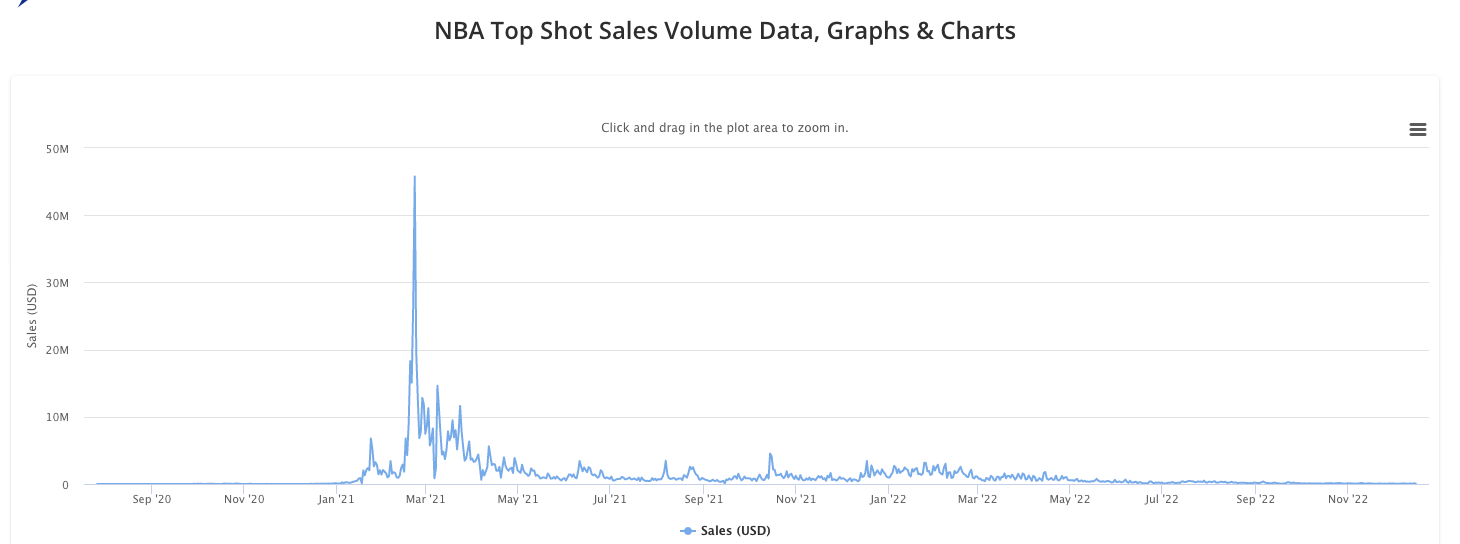

image description

Figure 34: NBA Top Shot Sales Volume

text

Technology companies enter the market

Google Enters the Digital Assets Field

Google began to form a team to focus on digital asset construction. Google wants to have blockchain influence and provide services to blockchain companies. They want to be a one-stop shop, hosting remote procedure call (RPC) nodes for developers and allowing users to deploy blockchain validators via Google Cloud with a single click. Through such cloud services, it is also possible to integrate Web3 elements such as wallets and other blockchain functions. In the future, the blockchain infrastructure may be laid out and deployed by Google to make user-friendly digital products.

Apple Announces Entry into the Metaverse

Apple will specifically expand its augmented reality business in preparation for the Metaverse opportunity. Apple VR headset will be released to compete with Facebook and Microsoft. Apple has likely been researching blockchain technology for some time, and is likely to be ready to enter the Metaverse sooner or later.

Instagram: From image-sharing platform to NFT marketplace

secondary title

7.2 AI + NFT

image description

Figure 35: Botto

For Generative AI, Gartner's definition is: through various machine learning (ML) methods to learn the components (elements) of artifacts from data, and then generate new, completely original, real artifacts (a product or item or task), These artifacts are kept similar to the training data rather than copied. Simply understood, Generative AI is the technology of creating new content from existing text, audio files, or images. Using generative AI, a computer detects basic patterns related to the input and generates similar content.

Generating graphics (Text-to-Image) is an important part of its commercial application scenarios: AI can abstract visual patterns from artworks, and then apply these patterns to virtual image reproductions that have the characteristics of the artwork. These algorithms can also transform any crude scribbles into impressive drawings that appear to have been created by professional human artists depicting the real world.

Digital representations of NFTs rely on digital formats such as images, video, text, or audio, and these representations map neatly to different AI subdisciplines — deep learning, computer vision, natural language understanding, and speech recognition.

In today's NFT ecosystem, there are three basic categories that can be instantly redefined by incorporating AI capabilities:

NFT generated by AI

AI-generated NFT technology is the first scenario to be realized, and it is also the most obvious place in the NFT ecosystem to benefit from the latest advances in AI technology. Leveraging deep learning methods in fields such as computer vision, language, and speech can enrich the experience of NFT creators to levels we have never seen before.

Embedded AI for NFTs

Embedding AI functionality into NFT is another market dimension - the intersection of AI+NFT technology trends can open new market dimensions. For example, NFTs that combine language and speech capabilities - can establish a dialogue with the user, answer questions about its meaning or interact with a specific environment.

AI-first NFT infrastructure

The value of NFT deep learning methods is not only reflected in a single NFT level, but also in the entire ecosystem. Incorporating AI capabilities into building blocks such as NFT marketplaces, oracles, or NFT data platforms can lay the groundwork for gradually realizing the entire lifecycle of NFTs.

NFT data APIs or oracles, which provide intelligent metrics extracted from on-chain datasets or NFT marketplaces, use computer vision methods to make intelligent recommendations to users. Data and smart APIs will become an important part of the NFT market.

8. Future development

aggregate trend

The batch trading of NFT has gradually become a market trend, and more trading platforms are focusing on aggregation functions, and completing further reforms through acquisitions or updates. Of course, the future of NFT is not just PFP, but more practical use cases.

In fact, there are also some projects that have a negative attitude towards aggregators, such as X2Y2. When many projects started to do NFT aggregation and opened up the NFT market at the same time, they publicly criticized it. It is an unreasonable behavior for the market to be a referee again, and it will inevitably cause a conflict of interest, and actively blocked some aggregators and prohibited access requests from Blur. However, in the latest AMA held by X2Y2, its CEO TP said that after obtaining tens of millions of financing, he may change the current economic model of the platform and develop derivatives, and his attitude eased.

However, all predictions need to be handed over to the market for answers.

royalties

OpenSea's once monopoly situation is gradually being broken, and the market is huge. When the monopoly is broken, healthy competition begins. Appropriate competition in the industry will bring a positive cycle to the ecosystem to promote development, such as the hotly discussed a16z The update of the copyright agreement, everyone's discussion on the traditional cc 0 agreement, the differences in copyright fees and tax amounts between different platforms, and the change of attitude towards the charging model (copyright fee) are all driven by competition. New try here. OpenSea has always been the vane of the industry in the field of trading platforms. The active updates during this period and the efforts made to bring users a better experience may be able to mobilize the enthusiasm of the NFT market again.

For the future development of royalties, perhaps the NFT market is at an important collective inflection point: it will be up to everyone remaining in this ecosystem to decide whether creator fees should remain.

Platforms such as OpenSea continue to hold the banner and start to firmly stand on the side of royalties from the contract level on the chain. They win over project parties, while platforms such as X2Y2 that insist on zero royalties win over traders. The interests of the two are currently very difficult. Balanced.

The creator economy is an important innovation of web3, which can help creators monetize their works in a more efficient way. But perhaps the market should not enforce business models for creators, and creators should have independent control and decision-making power over their own works. Platforms such as OpenSea also essentially hope to take the first step in this direction.

creator economy

The creator economy is growing, and NFT technology gives creators access to new, sustainable business models that can be layered on top of existing web2 revenue streams. In this new ecosystem, creators need more ownership over their projects, more control over their long-term business, more direct connection and interaction with their fans, and a new , dynamic canvas to bring their most creative ideas to life.

Cooperation and Innovation

Today, in addition to combining innovation with AI technology, there are also many projects that are investing in the research and development of technologies that make the delivery page more realistic and rich through vision, sound, and motion, enrich the current display form of NFT, and attract people through more discoverability tools. new users, creating stronger revenue streams for creators, and contributing to new standards for new revenue streams.

The trend of cooperation with Web2 enterprises is also proceeding in an orderly manner. NFT has gradually evolved into a brand bridge between traditional companies and Web3. This branding is building a strong community that supports its brand and participates in events for rewards. Brands like Apple, for example, portray themselves as drivers of innovation and design excellence, and NFTs can help and gain support from users through open interaction, taking such branding to new heights.

9. Summary

From a macro perspective, there is no doubt that the entire NFT track is emerging and gradually entering a period of transformation and stability. And as early as the end of 2021, the NFT sector has become a unicorn track with a volume of tens of billions of dollars.

But its current long-term development direction is still not clear. Since entering 2022, especially at the end of Q1 and the early stage of Q2, the rapid development of the NFT track has entered a turning stage. The increase in the number of NFT holders has gradually slowed down, while the number of traders has begun to increase.