The "OE" model fired the first shot of the new year in the NFT market, and there are three reasons behind it

In the past month, the NFT market has shown signs of recovery.

According to data from Cryptoslam on January 30, as of now, the 24-hour trading volume in the global NFT market has increased by more than 40%, and the number of NFT buyers has increased by more than 350%. Although far from the peak of the NFT bull market, after a few months of downturn, occasional positive data is enough to stimulate the enthusiasm of NFT collectors.

Secondly, BAYC Sewer Pass and the small game Dookey Dash are launched, Blur will issue coins in February, Doodles will be migrated to Flow, and "Fat Penguin" Pudgy Penguins will cooperate with LayerZero to realize its sub-series "Lil Pudgys" cross-chain... These blue-chip The positive news has also greatly increased community sentiment, and at the same time opened up hope for the long-dormant NFT market.

In addition to the promotion of the above-mentioned old top projects, some new vitality at the conceptual and mechanism level has also been injected into the NFT field. For example, recently we have observed a batch of NFT market with the theme of "Open Edition". It seems that there is a tendency to reproduce the "Free mint" in July and August last year. There was a burst of "Open Edition" upsurge.

Why is the old concept "OE" popular again?

"Open Edition", also known as "OE", is an NFT Drop method (Drop: one or more NFTs are released at a specific time and place, implying that there is a large demand for their purchase), and it does not set NFT supply restrictions. There are currently two kinds of "OE" Drops: the most common is to allow collectors to mint any number of NFTs within a certain period of time (usually within 24, 48 or 72 hours); Home is ready for casting.

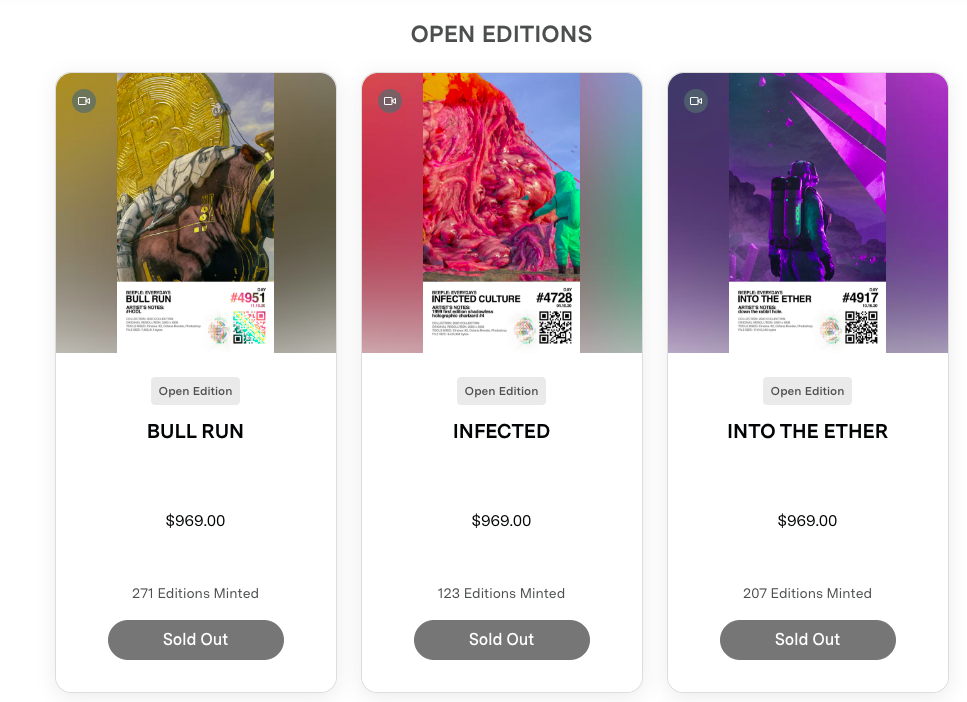

Taking a closer look at "OE", we found that it is not a new concept of NFT derived recently. As early as 2020, the famous NFT artist Beeple released three "OE" projects, but they did not cause a sensation at the time.

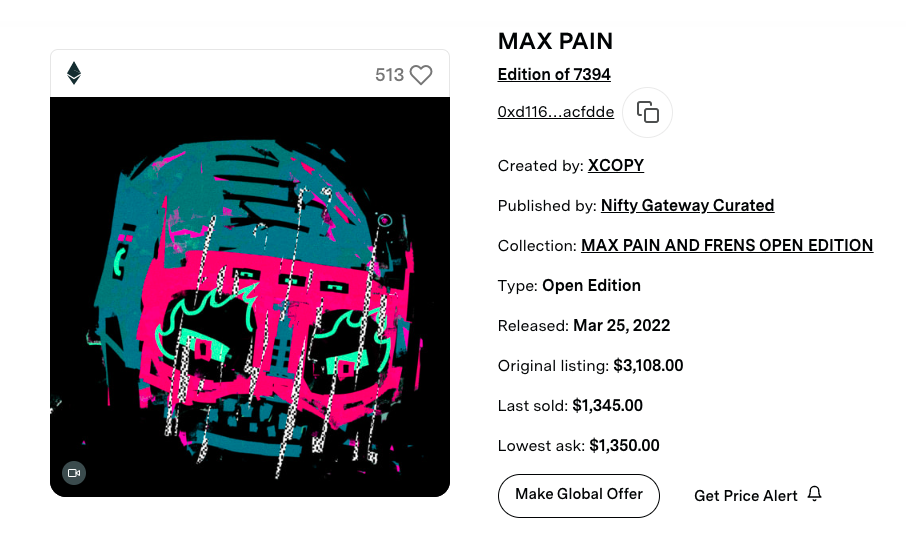

In March last year, encryption artist XCOPY released its "MAX PAIN AND FRENS" NFT series through Nifty Gateway. One of the works named "MAX PAIN" was sold in the form of "OE". Collectors only have 10 minutes to cast the NFT series. NFT, a total of 7394 "MAX PAIN" NFTs were minted within the specified time, and the price of each NFT was 3108 US dollars, and the price of ETH was also around 3000 US dollars at that time. The total revenue from the sale of the "MAX PAIN AND FRENS" NFT series is approximately US$24.4 million, of which more than US$23 million is from the "OE" series of "MAX PAIN". This also made "OE" begin to attract more artists' attention.

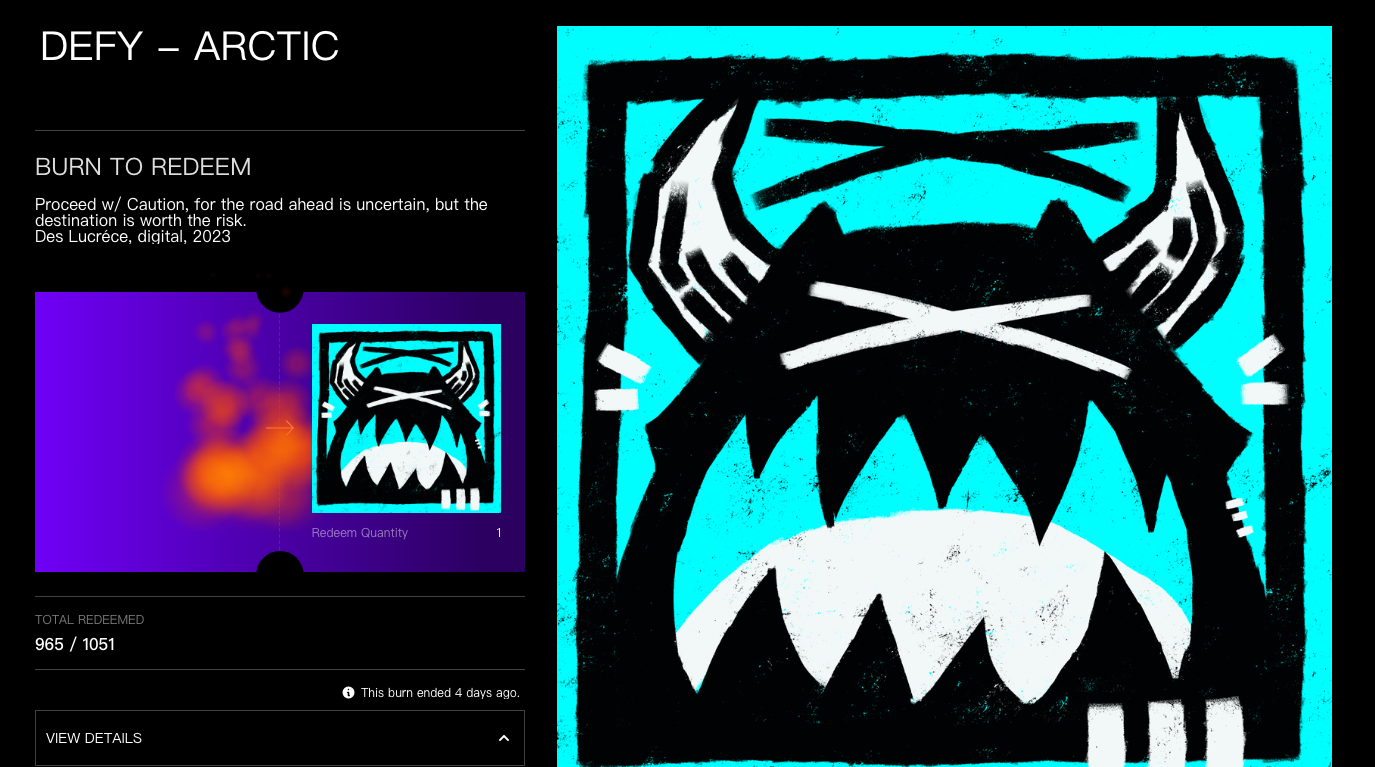

In the past month, a large number of artists have joined the "OE" craze, including Jack Butcher's Check NFT series, which was released at a price of $8 within 24 hours and successfully minted 16,031 pieces. The current floor price is 0.6 ETH. Lucréce's Proceed w/ Caution NFT series was released at a price of 0.06 ETH within 15 minutes, and the current floor price is 0.49 ETH. And Chris's NYAN BALLOON NFT was sold at a price of 0.007 ETH within 7 hours, and the floor price was as high as 0.14 ETH.

In the past month, a large number of artists have joined the "OE" craze, including Jack Butcher's Check NFT series, which was released at a price of $8 within 24 hours and successfully minted 16,031 pieces. The current floor price is 0.6 ETH. Lucréce's Proceed w/ Caution NFT series was released at a price of 0.06 ETH within 15 minutes, and the current floor price is 0.49 ETH. And Chris's NYAN BALLOON NFT was sold at a price of 0.007 ETH within 7 hours, and the floor price was as high as 0.14 ETH.

Even, NounsDAO passed the proposal and released its first "OE" series at a price of 0.05 ETH. The huge gains of these "OE" NFTs and the popularity of the community have caused artists to follow suit, and even KOLs have teased that they want to release their own "OE" series.

Why is "OE" so popular compared to other forms of NFT?

In the past year, the NFT market has gone through stages such as Free mint "three no winds", CC0 "copyright wind", Free to own "game wind" and so on. Although it promoted the market at that time, after the heat and passion cooled down, it gradually became It is a topic after gossip. It can be seen that if you want to become a leader in the NFT market, you must pay more attention to all aspects. The "OE" series of NFTs can promote the rise of the small market, mainly due to the following factors.

1. Endorsed by well-known artists, the threshold for participation is lower

Analyzing several currently popular "OE" series NFTs, I found that the authors of these NFT projects are all well-known artists. Before the release of the "OE" series, there were already high-quality NFT projects. list and other conditions. If it is traded in the secondary market, the price has been fired very high, and it is difficult for ordinary NFT collectors to own it.

The NFT prices of the "OE" series are usually lower, which can attract more NFT collectors to participate. And the condition of unlimited supply also makes NFT casting more flexible. Ordinary NFT collectors can purchase multiple NFT works by well-known artists at a lower price, which is a very attractive condition. And through later project empowerment, the value of "OE" NFT purchased by collectors will also have the opportunity to increase.

For artists, through the release of the "OE" series, artists can try different styles and techniques. They can test new ideas and concepts without the pressure of creating one-of-a-kind limited editions. In addition, some artists who have not gained attention in the NFT field can also use the "OE" craze to increase their exposure, give their works more opportunities to display, and increase the recognition and demand of their works.

From this point of view, "OE" has created a win-win situation.

2. With platform support, "OE" projects are easier to start

If you have paid attention to the "OE" series recently, you will find an NFT platform that appears frequently, Manifold.

Manifold is an NFT platform that allows creators to self-deploy contracts. After creators have deployed their own NFT contracts, Manifold will provide a set of tools to help creators customize the Drop mechanism, and without coding ability, it can be installed into your contracts with one click. And Manifold is completely free to use, without any platform fees or any sales copyrights. The point is that Manifold is invested by a16z.

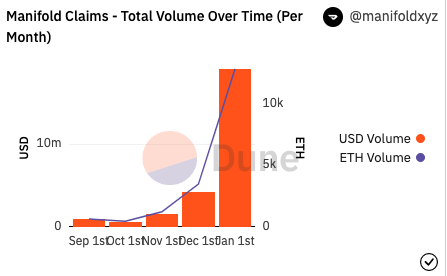

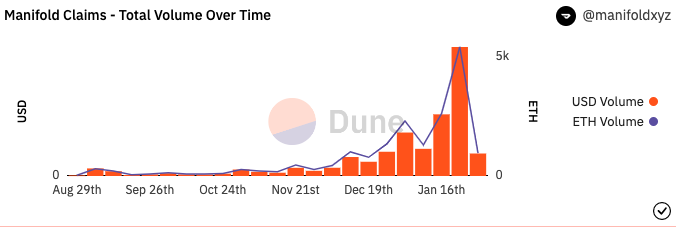

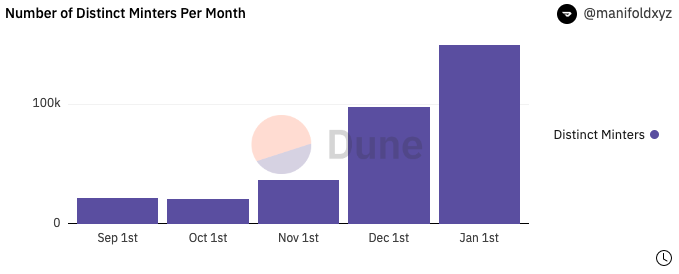

According to Dune data, the sales volume of Manifold has soared in the past month, and the overall sales volume is also on the rise.

Collectors involved in minting NFTs have also experienced huge growth.

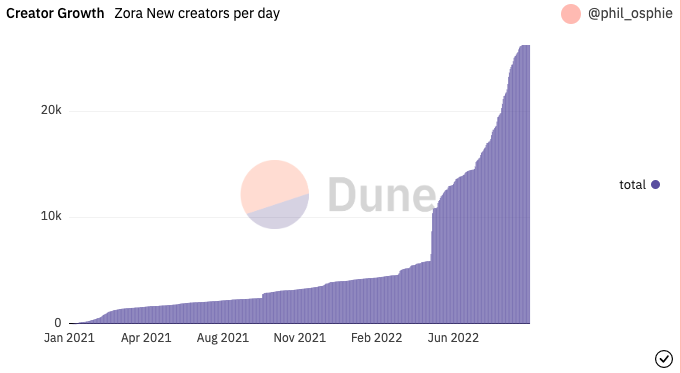

In addition, although not as popular as Manifold, Zora, an NFT platform that has also played an important role in the "OE" boom, will launch its Creator Toolkit in May 2022, which also provides artists with a code-free way to cast and drop NFT.

According to Dune data, Zora has also seen a sharp upward trend in the past month, which is reflected in the transaction volume and the number of NFT collectors participating in the minting.

In addition, marketplaces such as Nifty Gateway, uncurated, and Mint.Fun have also recently hosted "OE" NFTs, and you can find upcoming "OE" series on these platforms.

3. The burning mechanism has a novel gameplay

The "OE" series of NFTs usually has no rarity in the casting stage. The NFTs cast by all collectors are almost the same except for the different Token IDs. So how does the lack of rarity drive the value of NFT?

The burning mechanism is the main gameplay of the "OE" series, and it is also one of the ways to reflect its rarity. Artists will create a unique burning mechanism based on the characteristics of their own NFT. Let's take the three projects introduced above as an example. For example, Check NFT burns two parent NFTs to generate sub-NFTs to reduce the number of Check NFT logos to determine rarity and change the color of the logo. Proceed w/ Caution NFT utilizes the burning tool provided by Manifold, and collectors can burn the genesis blue Proceed w/ Caution NFT to other colors on the Manifold platform. Proceed w/ Caution sets the scarcity guidelines for each NFT work by setting a maximum limit on the number of each work of art, that is, the game is to collect a full set of eight different colors, so collectors need to choose which colors to cast and where Which colors to buy in the secondary market. Once a color is fully minted, its price will be determined by the market and NFT holders.

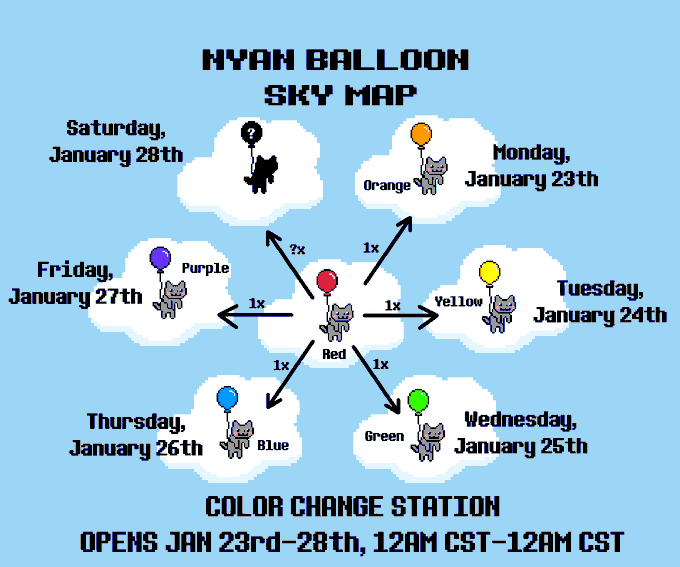

The rules of NYAN BALLOON NFT are simple. All collectors will have a 24-hour daily opportunity to exchange Genesis Red Nyan Balloon NFTs for the day's balloon color, ending with a mystery balloon that activates a supply burn.

It can also be seen from this that the "OE" series is innovative in the process, and the gameplay and value need to be jointly controlled by the artist and the holder. The performance of the artist's previous works provides collectors with "purchase guarantee", and the burning mechanism gives collectors "imagination". Collectors continue to Fomo in the process, driving more and more new collectors to enter the market, thereby promoting NFT price. The three examples mentioned above also confirm that after the burning mechanism is launched, the floor price of NFT has risen to varying degrees, realizing the purpose of driving the increase in value due to rarity.

But this play does not guarantee that all projects will be successful. For example, one of the first "OE" series to utilize the combustion mechanism was 3 LAU's FACES, of which 4934 were released. In an experiment in boosting rarity, the artist encourages holders to destroy one or more of their FACES NFTs in exchange for new, rarer NFTs. A total of 1,363 versions were destroyed in this experiment, which reduced the total supply, but after the destruction, the selling price of the NFT decreased.

It can be seen that the risks and benefits of this game coexist.

How long can the "OE" craze last?

"Value expectation" is the main factor that attracts all collectors. If the expectation is too short, there will be resistance to the later development of the project. Expecting too long will gradually wear out the patience of collectors. The popularity of most NFT projects will basically decline within 1-2 months after the release, and some times are even shorter. How long can "OE" go?

If the artist thinks carefully, knows how to use "OE", can insist on managing the combustion mechanism after releasing the "OE" series, or innovates the gameplay in the later stage, then it will be exciting enough for artists and collectors, and even the NFT market of. If the artist does not consider a specific plan in this process, he is just playing tricks. Then "OE" is dangerous for an artist's career. Because collectors buy "OE", what they buy is the artist's "past" achievements, and it is difficult for lesser-known artists to stand out in the "OE" boom.

For collectors, "OE" can be a good way to maintain a healthy balance in the NFT community, ensuring that the market is not dominated by a small number of people, while also giving collectors the opportunity to obtain valuable assets. However, judging from the current market situation, we have not experienced a complete "OE" project life cycle. Due to the influence of Fomo in the early stage, NFT prices will indeed show an upward trend, but what about the later development? Can it bring benefits to collectors in terms of practicality? We don't know. If you participate blindly at this time, you will inevitably suffer losses.

Therefore, whether it is "OE" or other new models, if they cannot be sublimated in development and eliminate the dross, then hype alone cannot pave the way for sustainable development, and the temporary heat will gradually dissipate.