Bitcoin price under macro liquidity modeling

Summary

first level title

Summary

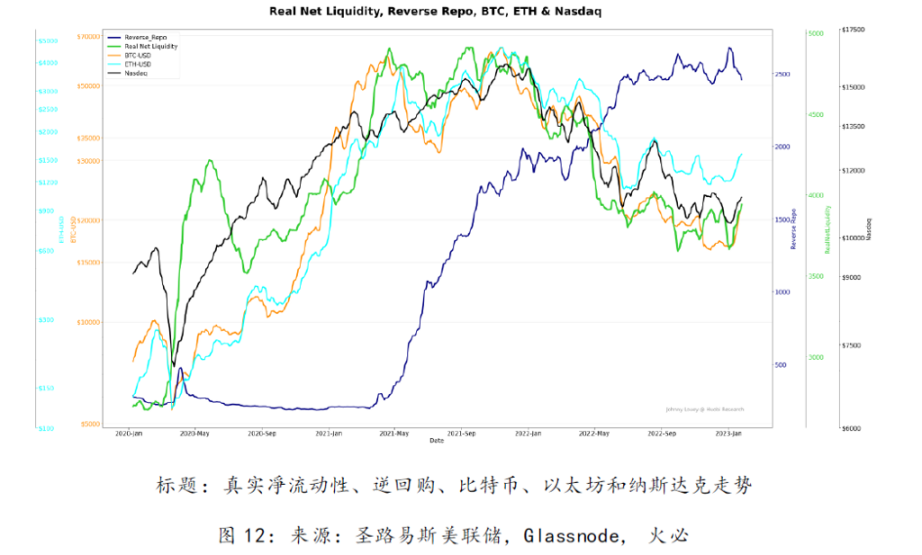

As a type of risk assets, Bitcoin and other virtual currencies will be largely affected by fluctuations in macro liquidity. This research report will analyze the main driving factors of Bitcoin and other virtual currencies based on the macro liquidity model.

first level title

Chapter 1 Correlation between source liquidity (especially the Fed’s balance sheet) and risk assets (especially virtual currency)

secondary title

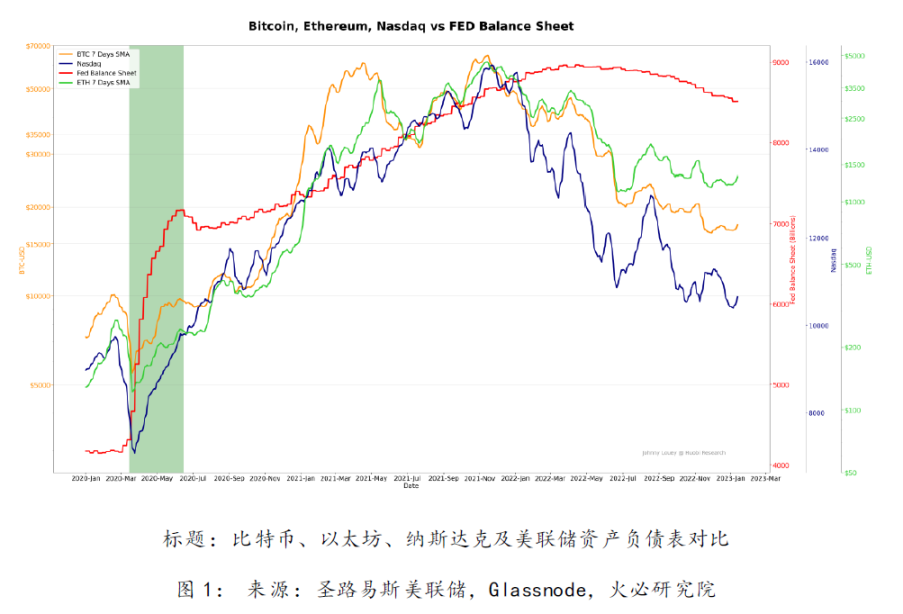

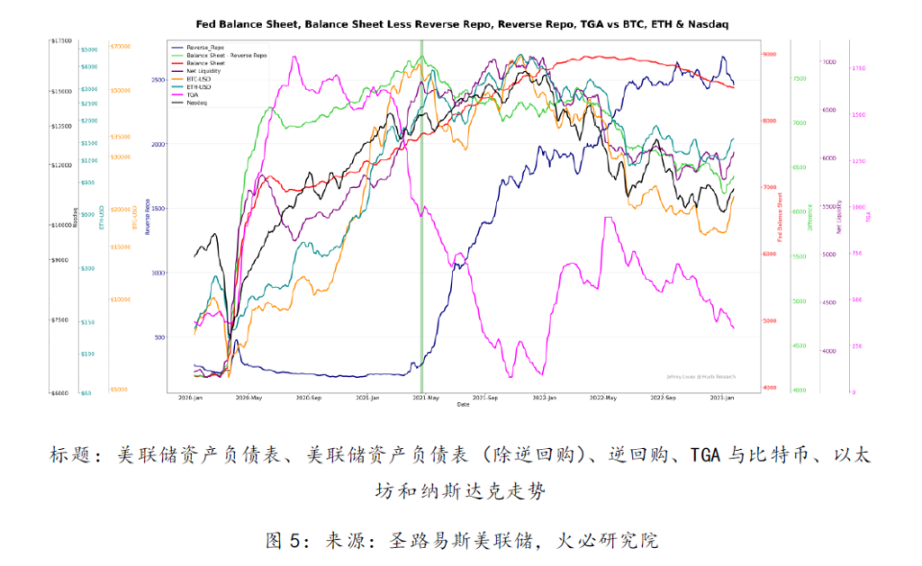

Starting from the large-scale epidemic of the new crown pneumonia in 2020, the Federal Reserve has implemented a quantitative easing policy, so the size of the Fed's balance sheet has become particularly large. The newly issued currency has flowed into various markets, and the virtual currency market is one of the risk asset markets that performs better.

The chart below depicts the correlation between risk assets and the Fed's balance sheet. The green shaded area is the period of guided growth after a large amount of liquidity has been injected.

secondary title

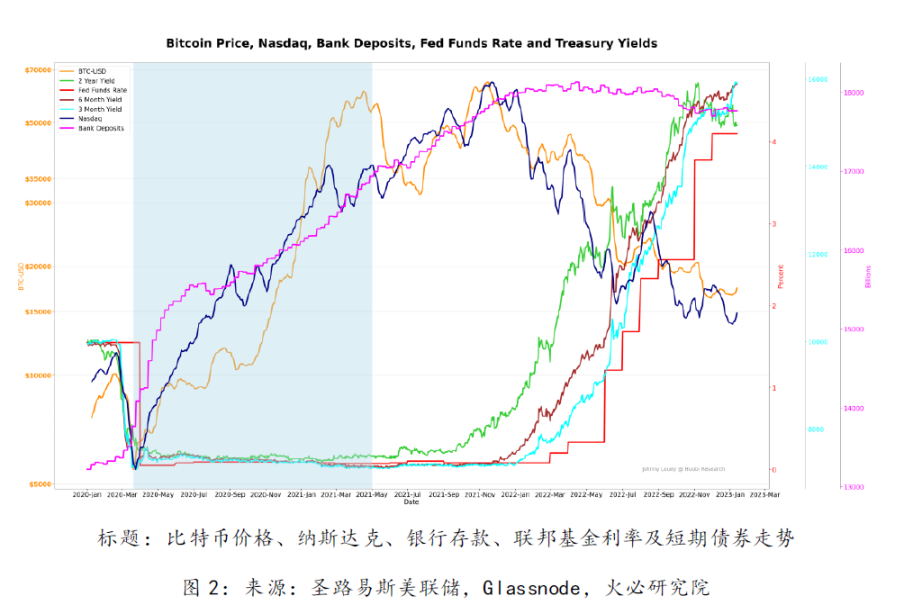

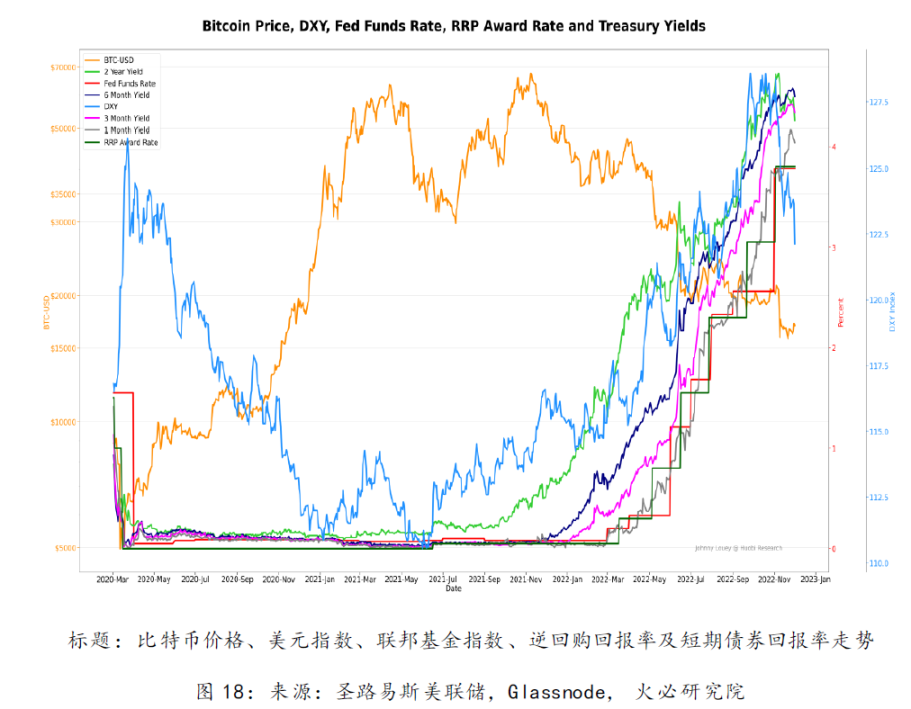

There are other contributing factors to the surge in the virtual currency market in 2020, that is, the interest rate on U.S. treasury bonds has remained at a low level for a long time, and a large amount of liquidity exists in commercial banks.

The light blue shaded area represents the timeline of low interest rates, when economic activity was stimulated. It is also worth noting that the ample liquidity of commercial banks also benefits from the Fed's continuous purchase of bonds from these banks. Because interest income cannot guarantee returns in such a low interest rate environment, hot money in the market will seek markets that can bring more lucrative returns besides the money market, such as equity products. Therefore, the prosperity of lending and investment activities has also led to the rapid growth of institutional acceptance of virtual currencies.

secondary title

1.3 Quantitative tightening has quietly started before the Fed’s official announcement

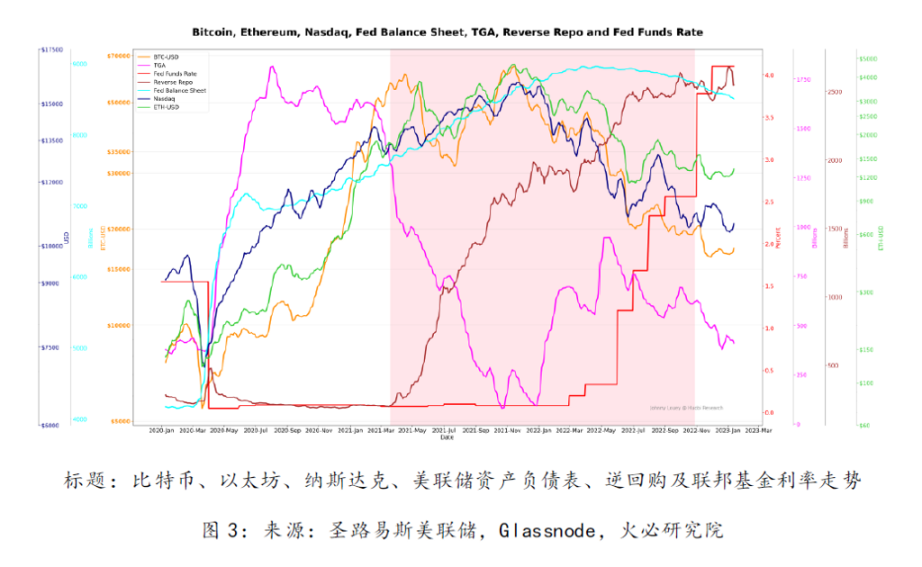

The red shaded part is the time period when the demand for reverse repo is soaring. During this time period, hot money becomes more risk-averse, while the appetite for risky assets decreases.

"Quantitative tightening has quietly started in January 2022", this expression actually aptly captures the lowest point in December 2021 when the US Treasury's general account balance reached its lowest point. Growth in the U.S. Treasury General Account (TGA) balance means lower reserves, which can have fatal effects on economic activity, especially market participation in risky assets. The driving factors will be detailed in Chapter 2.

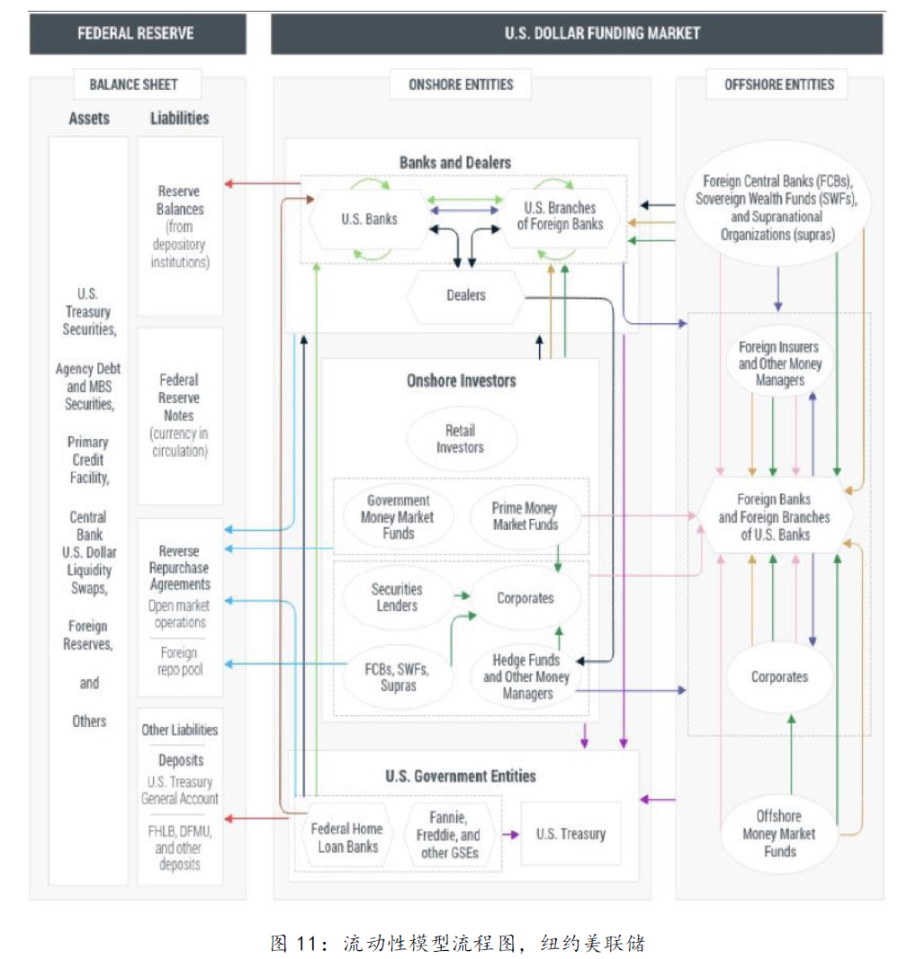

Chapter Two Analyzes the Federal Reserve's Balance Sheet and Liquidity Driving Factors

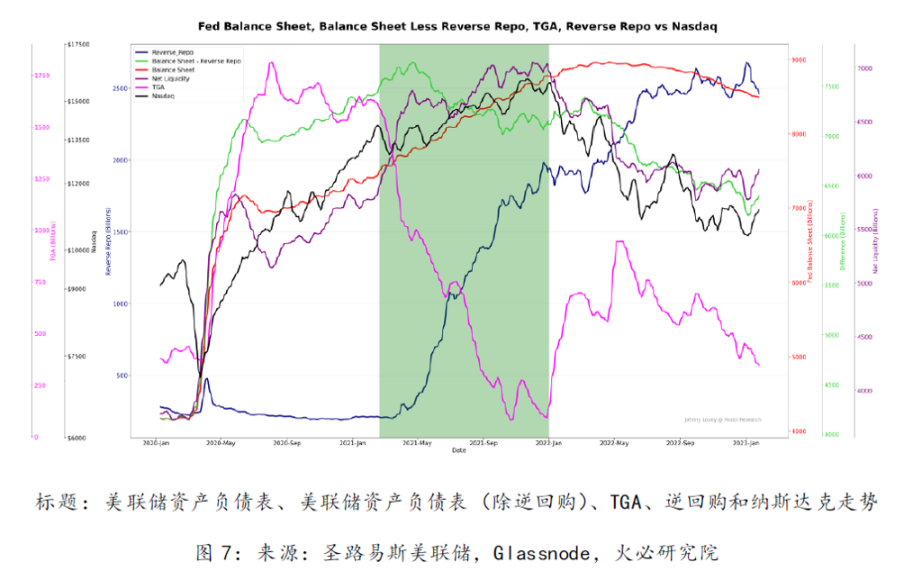

When analyzing the effective drivers of the Fed’s balance sheet, it is common to focus on three components: total assets, the U.S. Treasury General Account (TGA), and reverse repo (Reverse Repo). Understanding the mechanism by which these three components affect the market is crucial for analyzing effective drivers.

secondary title

2.1 Detailed explanation of the Fed's reverse repurchase

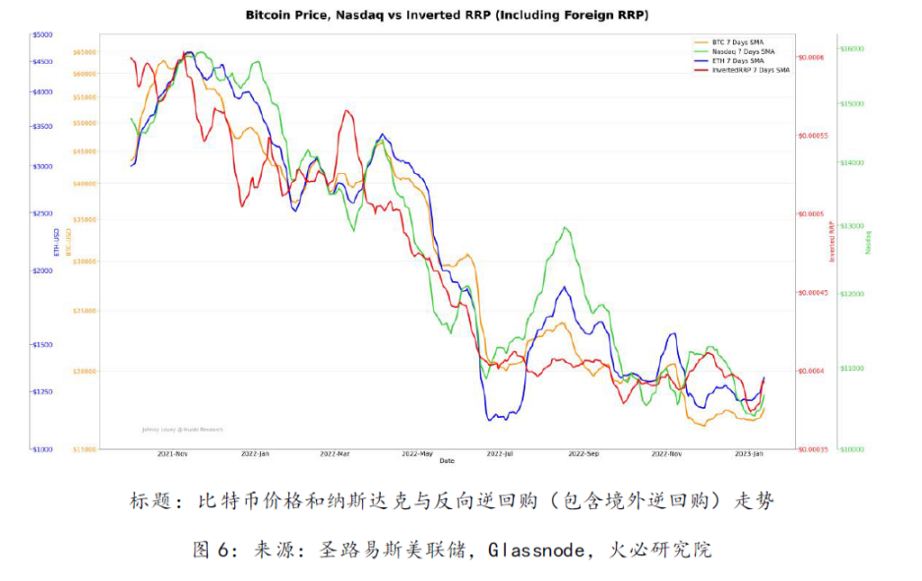

The U.S. federal reverse repurchase is a means used by the Federal Reserve to control the federal funds rate and liquidity to cool down the market. The Federal Reserve adjusts the effective federal funds rate by raising or lowering the interest rate on reverse repos and the interest rate on reserve balances.

Simply put, when the Fed raises interest rates, it increases the interest rate on reverse repos. Therefore, reverse repurchase will be more popular with hot money at that time, and a large amount of liquidity will flow into reverse repurchase transactions. For investors, no asset is less risky than this, so the Fed absorbed a lot of liquidity.https://medium.com/huobi-research/reverse-repurchase-agreements-as-an-indicator-for-btc-ca 861944289 )

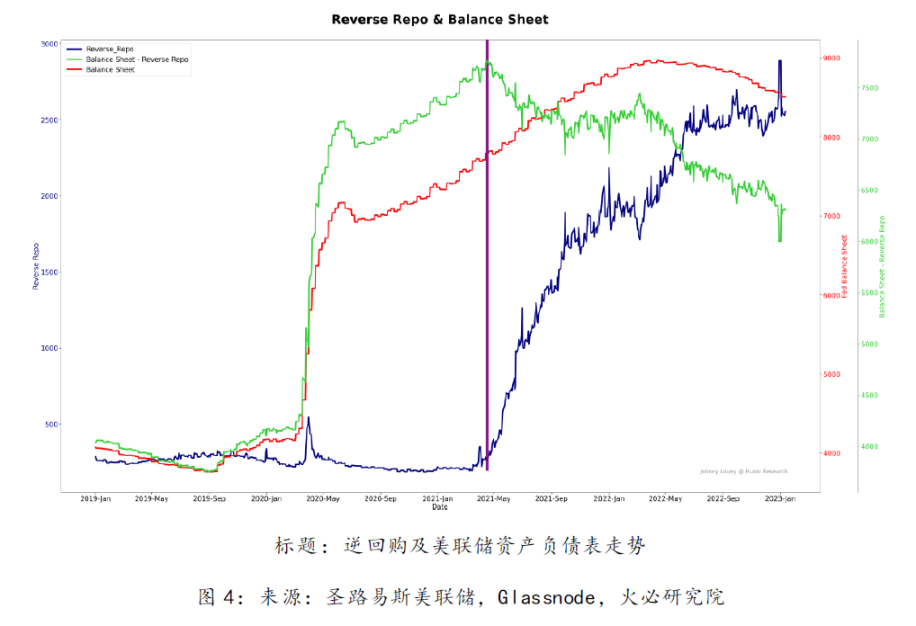

It is worth noting that despite the Fed's continued expansion of its balance sheet, the amount of reverse repos will still rise rapidly in April 2021.

(1 Please refer to the following reports for research on US federal reverse repurchase:

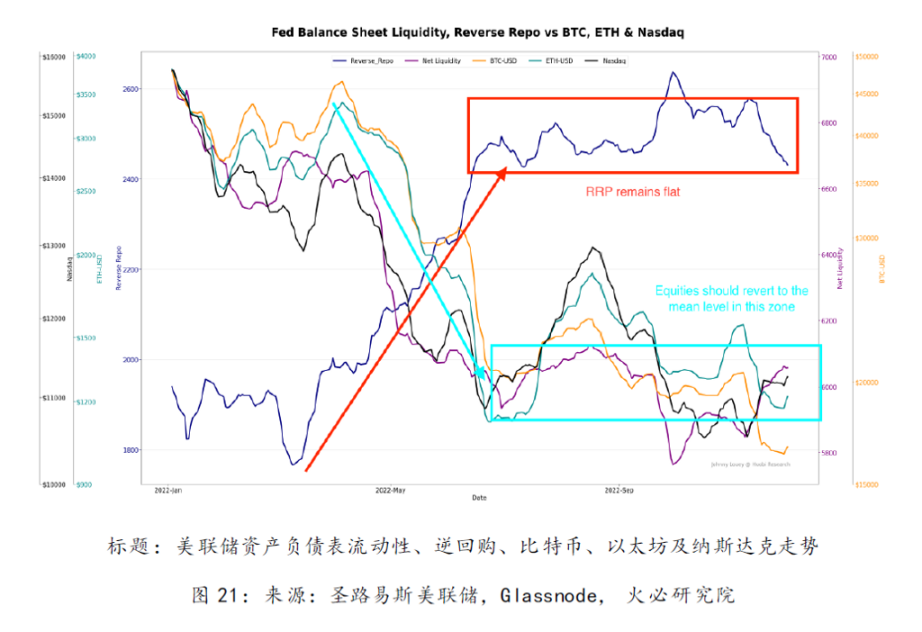

A flat reverse repo line usually means looser (less hawkish) available liquidity, and the market will react positively, creating a potential bear market.

Summary: The sudden steepening of the reverse reverse repurchase line will bring risky assets back to people's attention to a greater extent. Right now, the reverse reverse repurchase line is structurally flat, and equity assets should return to the average level within this time period.

secondary title

The U.S. Treasury General Account (TGA) is a current deposit account opened by the U.S. Treasury Department at the Federal Reserve. This account is used to store all taxes and proceeds from the sale of Treasury bonds and to pay all general and other expenditures of the U.S. government. On the Fed's balance sheet, TGA is a liability like bank bills, currency and bank reserves. Since liabilities must match assets, a decrease in TGA balances must lead to an increase in bank reserves, and vice versa. The depletion of bank reserve accounts in 2021 is overshadowed by the Fed's $3 trillion in asset purchases. As cash flows leave the TGA, bank reserve balances grow, which in part promotes lending and investment behavior in the broad economy and markets.

As shown in Figure 7, the green shaded position is the time period when the Federal Reserve spends 1.6 trillion in the TGA account to almost 0, which offsets the sudden increase in reverse repurchase and fills the net liquidity, which helps Nasdaq rise.

secondary title

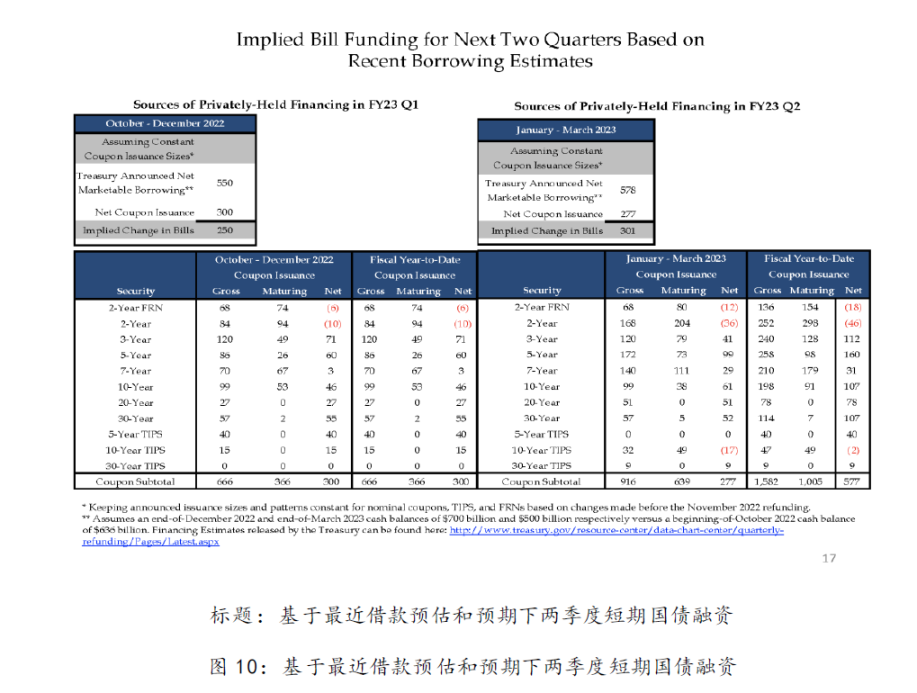

2.3 Combining short-term treasury bonds and bond issuance, as well as the liquidity forecast of the Federal Reserve's balance sheet, fiscal general account and reverse repurchase analysis

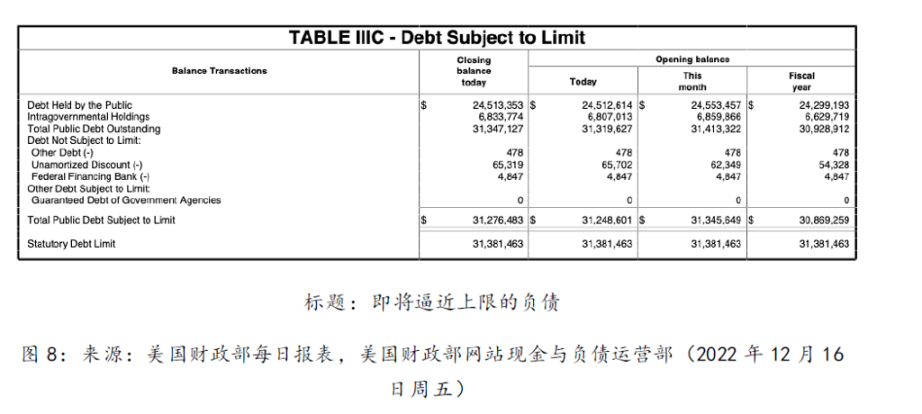

The net liquidity model worked very well for 2020-2022 until the recent Fed debt peak.

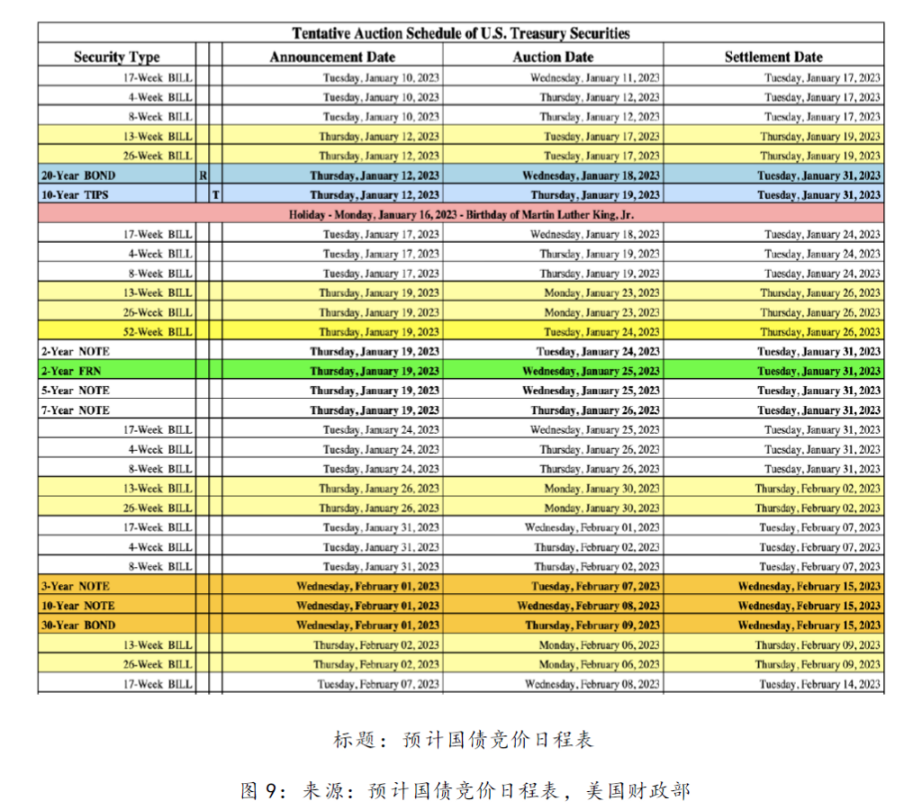

Therefore, it is necessary to focus on the issuance of short-term treasury bonds and other bond issuances in the first quarter of 2023. If the U.S. Treasury Department reduces the issuance of short-term treasury bonds, the demand for this bond will be transferred to reverse repurchase; if the U.S. Treasury Department increases the issuance of short-term treasury bonds, reverse repurchase will decrease, and other risky assets may pick up. Therefore, it is also necessary to pay attention to the degree of reverse repurchase.https://home.treasury.gov/system/files/221/Tentative-Auction-Schedule.pdf)

(2 For details, see:

2.4 Liquidity Model Basis

True Net Liquidity integrates TGA, reverse repos, and new Treasury debt issuance and is used to track the direction of risky assets.

secondary title

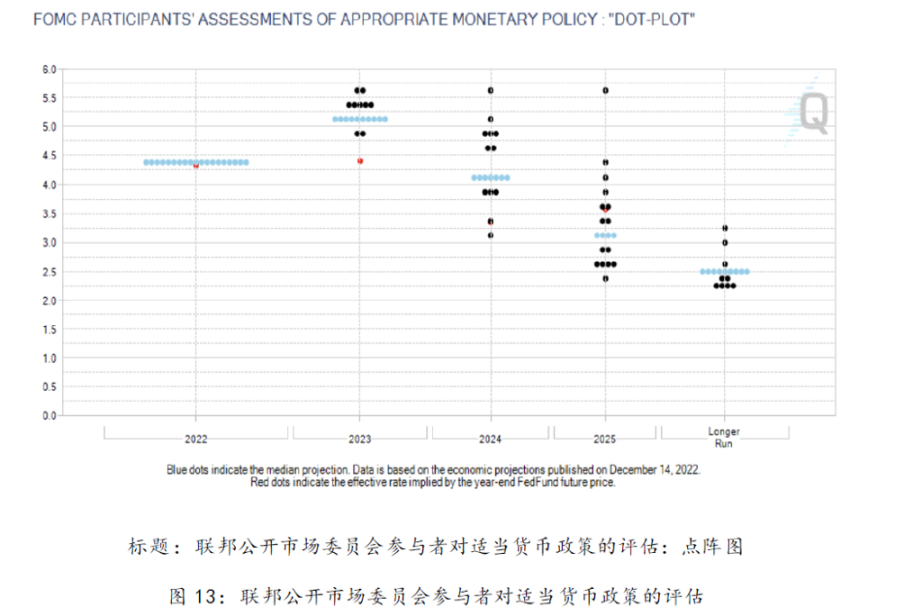

2.5 US Federal Funds Rate Forecast

Therefore, in a high interest rate environment, investment will show a decline. At this time, hot money will prefer lower-risk investment targets, so investment in risky assets will not prosper. In such an environment, it will be difficult to see the kind of prosperity seen in 2020.

first level title

Chapter 3 Bitcoin Pricing Model

3.1 Bitcoin basic holding fee model

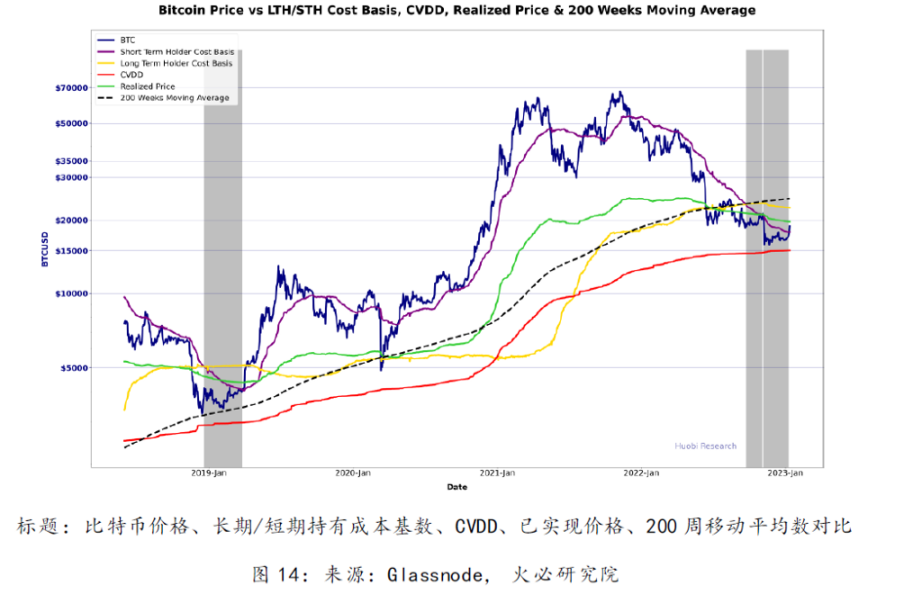

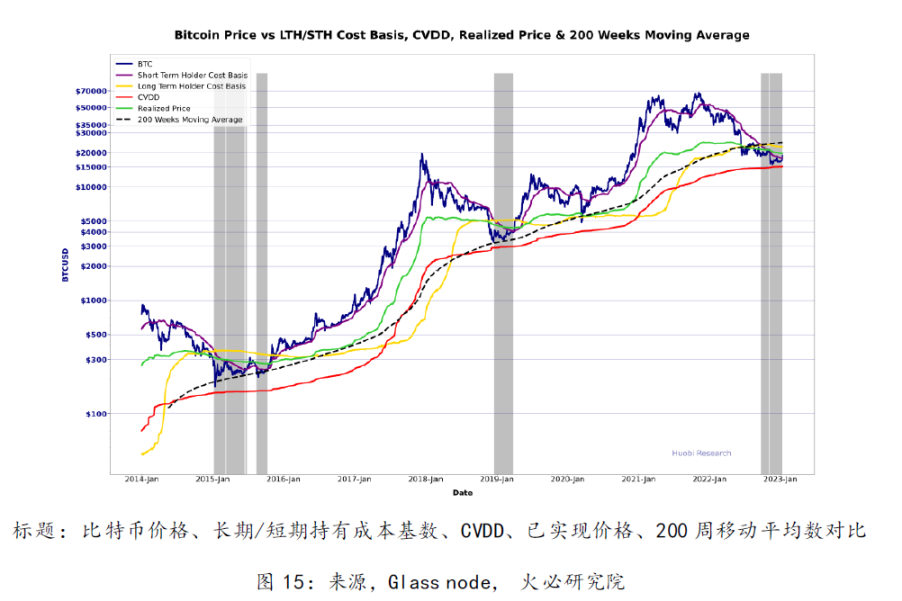

The multi-base model above reflects that the market has entered into a cyclical capitulation sell-off that occurs every four years. According to CVDD, the selling price floor price range may be $13.5K-16K. The gray shading is the time when the cost base of long-term holders is higher than that of short-term holders. This phenomenon occurs every four years, which also shows that this period is a typical period of capitulation.

3.2 Realized gains/losses

Realized losses started to wane in the most recent capitulation, and subsequent capitulations were accompanied by minimal realized losses, signaling reluctance to sell, which mostly only happens in bull markets.

3.3 Stablecoin Supply Ratio Model

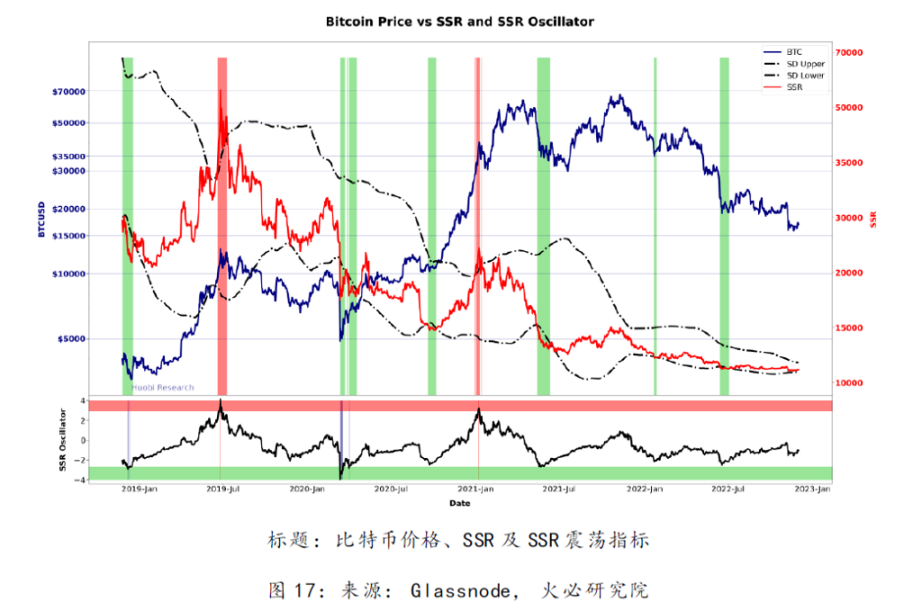

When the stablecoin supply ratio penetrates the boundary of the lower limit of the standard deviation, this is a very effective way to determine the bottom range of the market. Recently, this ratio has hovered around the border, indicating that the purchasing power of stablecoins may have reached a critical point of an upcoming rise.

3.4 Bitcoin vs bond interest income

Bond returns are still on an upward trend. The dollar index showed signs of recession. Bond returns and risky assets are negatively correlated, so when bond returns are trending downward, it is also a sign of a bull market. High bond returns will also inhibit the development of DeFi. Unless the bond return rate is lower than the current DeFi interest rate return, it will be difficult for DeFi's TVL to return to its previous level.

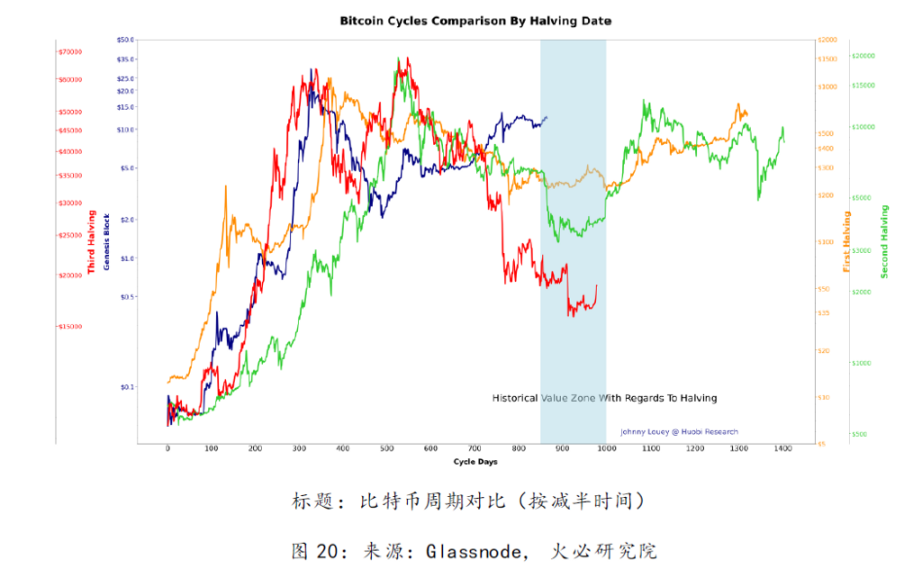

3.5 Bitcoin cycle comparison

first level title

Chapter 4 Conclusion

4.1 Bitcoin has entered a historical value range after a large number of capitulation sell-offs

All the above mentioned indicators are showing that Bitcoin price is currently undervalued. It is likely that the price of Bitcoin will return to the fair value before the FTX thunderstorm, but breaking through $30,000 and above still requires more considerable macro liquidity and more positive investment sentiment support for venture capital.

About Huobi Research Institute

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as "Huobi Research Institute") was established in April 2016. Since March 2018, it has been committed to comprehensively expanding research and exploration in various fields of blockchain, with a view to pan-blockchain As a research object, the research objectives are to accelerate the research and development of blockchain technology, promote the implementation of blockchain industry applications, and promote the ecological optimization of the blockchain industry. The main research contents include industry trends, technical paths, application innovations, Pattern Exploration, etc. In line with the principles of public welfare, rigor, and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms, and build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical foundation and trend judgment to promote the healthy and sustainable development of the entire blockchain industry.

contact us:

Huobi Blockchain Application Research Institute (referred to as "Huobi Research Institute") was established in April 2016. Since March 2018, it has been committed to comprehensively expanding research and exploration in various fields of blockchain, with a view to pan-blockchain As a research object, the research objectives are to accelerate the research and development of blockchain technology, promote the implementation of blockchain industry applications, and promote the ecological optimization of the blockchain industry. The main research contents include industry trends, technical paths, application innovations, Pattern Exploration, etc. In line with the principles of public welfare, rigor, and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms, and build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical foundation and trend judgment to promote the healthy and sustainable development of the entire blockchain industry.

3. The content of the report is for reference only, and the conclusions and opinions in the report do not constitute any investment advice on relevant digital assets. Huobi Blockchain Research Institute is not responsible for any losses caused by the use of the content of this report, unless it is clearly stipulated by laws and regulations. Readers should not make investment decisions solely based on this report, nor should they lose the ability to make independent judgments based on this report.https://research.huobi.com/

Twitter: Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

Telegram: Huobi Research

https://t.me/HuobiResearchOfficial

disclaimer

1. Huobi Blockchain Research Institute does not have any relationship with the projects or other third parties involved in this report that affect the objectivity, independence, and impartiality of the report.

2. The materials and data cited in this report come from compliant channels, and the sources of the materials and data are considered reliable by Huobi Blockchain Research Institute, and necessary verifications have been carried out for their authenticity, accuracy and completeness , but Huobi Blockchain Research Institute does not make any guarantees about its authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the conclusions and opinions in the report do not constitute any investment advice on relevant digital assets. Huobi Blockchain Research Institute is not responsible for any losses caused by the use of the content of this report, unless it is clearly stipulated by laws and regulations. Readers should not make investment decisions solely based on this report, nor should they lose the ability to make independent judgments based on this report.

4. The information, opinions and speculations contained in this report only reflect the judgment of researchers on the date of finalizing this report. In the future, based on industry changes and updates of data information, there is a possibility of updating opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you want to quote the content of this report, please indicate the source. Please let me know in advance if you need to quote a lot, and use it within the scope of permission. Under no circumstances shall any quotation, abridgement and modification contrary to the original intention be made to this report.