Why is CurveFinance a better DeFi core protocol than Uniswap?

Original source:

Original source:Twitter

first level title

TL; DR

1. Curve, the token economic protection of $CRV, has established high competition barriers [1-13].

2. Curve's "Liquidity as a Service" - the function of solving liquidity needs on the chain [14-19].

3. Uni V3 loses pricing power due to the following factors: (i) Does not work well in extreme markets as liquidity dries up outside of LP's various price ranges [20-22]. (ii) Increase the threshold of liquidity management when establishing a long-tail asset pool for new projects [ 23-26 ] & (iii) Instigate competition among LPs, thus (a) bring additional liquidity to new projects Difficulties [27-32] & (b) put V3 itself at risk of being surpassed [32-34].

background

background

1. Since 2 weeks into my Curve vs Uniswap discussion, a lot of great points and rebuttals have been distilled to make the comparison more convincing. The fruitful discussions shed light on where DeFi is headed next.

2. $CRV tokenomics protects by unifying interests of LPs, projects and Curve itself@CurveFinanceunaffected by competitors. How?#CurveWars in the race for yield(APR) and minting rights, release most of $CRV into $veCRV (most locked for 4 years).

3. What is minting?

The action/process of minting when it comes to cryptocurrencies it refers to the ability to mint more of the pegged asset relative to its underlying. The risk of depreciation is imminent when (i) the underlying asset is not immediately convertible into its underlying and (ii)…

4.......The circulating supply exceeds the on-chain liquidity, that is, the liquidity available for exchange on DEX (such as UST-LUNA). imagine if@CurveFinance$stETH pool size is too small, what will happen? Since $stETH cannot be immediately redeemed for $ETH, holders may try to get ahead of themselves by…

5.......Sell stETH directly to the Curve pool in exchange for $ETH, especially when the Curve pool is shallow enough to cause panic. This is why, for pegged assets like LSD, minting is important for them to stay pegged as they scale (even after the Shanghai update; discussed later in the LSD topic).

6. Most LPs and projects that create pools on Curve have locked $CRV to compete for minting rights. LPs can benefit from projects competing for minting rights, while asset-linked projects need minting rights to expand their business scale. If there is a new stablecoin DEX, it will be difficult to compete with Curve...

7. ...because to attract LPs, it must give rewards that are at least higher than the rate of return LPs get from locking up $CRV.$veCRVAPR = Transaction Fees ($99.8M over 3 years in 3 CRV) + Increased Incentives ($CRV) and/or Bribes ($243M since September 21, 2021 only by@ConvexFinance$veCRV capture).

8. In addition, in order to avoid the dispersion of liquidity, the project prefers to put all the liquidity in one place, and is unwilling to compete for minting rights in the new agreement, otherwise it needs to maintain the peg at a higher liquidity cost. So for a new stablecoin DEX, it is difficult to attract liquidity

9. This is why Curve has few competitors in the stablecoin/pegged asset space; the $CRV token economy ensures that LPs and projects stand with Curve. The main criticisms of the $CRV token mechanism are: (i) $CRV is hyperinflationary; (ii) the cost of releasing $CRV exceeds transaction fees.

10. Regarding (i), critics tend to ignore the bribe when referring to $CRV's inflation rate of 28%, which is actually the main source of proceeds. With the bribe, the $CRV APR is ~40%, offset the inflation rate. Capital efficiency can also be achieved when a $1 bribe can be unlocked with >$1 CRV.

11. For (ii), $CRV release is not a cost because it is prepaid before release. how could be? The release of $CRV is determined by gauge weight voting. In order to vote, people can either (i) buy more $CRV and lock it up for $veCRV, or (ii) bribe $veCRV holders to vote. Either way, $CRV is paid to bootstrap voting.

12. The project directly purchases $CRV or bribes voters to obtain the release of $CRV to obtain minting rights that can strengthen the peg by deepening on-chain liquidity. Otherwise, the inflationary $CRV volume will dwarf the project’s influence on guiding the release of $CRV, and on-chain liquidity will shrink.

13. Since the release of each $CRV is prepaid by the project party as the cost of liquidity, the release of $CRV is the cost of the project to maintain the liquidity on the chain, not the cost of Curve itself!@CurveFinanceUnique positioning and ve token model make $CRV different from other high inflation tokens

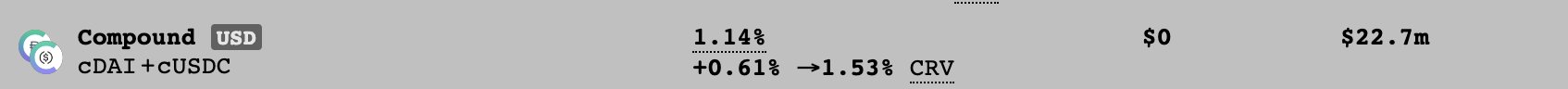

14. There are other functions, but few people know about it. Issue: Before Curve launched the lending pool, lenders holding cUSDC might not be able to get their USDC back if the relevant lending pool was exhausted; the same goes for cDAI holders who want to get their DAI back.

15. Solve the lender's exit problem in the event that the pool on the lending agreement is drained. How to solve? When people lend USDC or DAI to a lending pool on Curve, they send@compoundfinanceLending USD, their cTokens will be sent as LPs to the lending pool on Curve.

16. Loan pools serve as exit liquidity for lenders and help rebalance loan pools on the lending protocol. How to do it? For example, if the $USDC pool on Compound is drained, $cUSDC holders can go to@CurveFinanceThe lending pool swaps $cDAI for $cUSDC, then converts $cDAI into $DAI on Compound.

17. Curve has made itself essential in DeFi and the crypto industry as a whole, positioning it as a liquidity reserve where i.) LPs are incentivized by good APR and projects lock up $CRV or $ CVX's ve-model, aligning their interests with Curve, thus gaining minting power to expand business...

18. ...thus, they tend to work with Curve against competitors (cf.@SushiSwapOnce a case of gaining some DEX market share by forking Uni V2) ii.) Bribing the market (vital but often overlooked by@AndreCronjeTechInvention) allows the $CRV cost to be prepaid prior to release.

19. iii.) at@CurveFinanceor@AaveAaveor@compoundfinanceThe same is true when the above pool is depleted. This level of composability and the low cost of gathering on-chain liquidity is what makes Curve a source of liquidity among cryptocurrencies.

20. In addition to efficient ve-tokenomics,@CurveFinanceIn a better position as Uni V3 has lost pricing power over long-tail assets due to (i) inability to handle extreme market conditions (ii) raising the threshold for liquidity management (iii) sparking fierce tension among LPs compete

21. For (i), LPs on Uni V3 act like range orders: when the market is pumped/sold, LPs need to re-range the price range, otherwise they cannot earn any transaction fees. Screenshot (Jan 14th) showing most LPs not adjusting in time, causing liquidity to dry up In contrast, Curve v2 has no downtime

22. The above phenomenon is not uncommon, since"normal price range"liquidity crunch outside. In fact, during the UST crisis, Uni V3 was not functioning properly because $LUNA was constantly at"no man's land". How can a DEX have pricing power if its price information is unreliable in extreme markets?

23. For ii, new projects find it difficult to manage v3 liquidity If the price falls out of the selected range, Uni V3 LP will either (i) suffer impermanent loss IL and choose a new price range, or (ii) wait for the price to fall back to The range (not guaranteed) during which LPs do not earn transaction fees

24. For (i), IL accumulates each time LP rebalances its position. In extreme markets, LPs can suffer a death sentence. For (ii), LPs incur a huge opportunity cost in addition to IL: since the capital in Uni V3 is idle, they do not earn transaction fees because they do not want to suffer IL.

25. The threshold for liquidity management of Uni V3 has been raised, and for new projects, the threshold for launching long-tail asset pools there has become too high. Here's some feedback from some of the new project leads:https://twitter.com/gmdSaul/status/1611928353090711554? s= 20&t=svA 0 Fsd 67 E 40 i Q3 4 Bn 9 Crg…

Conclusion: Few projects choose to launch new tokens on Uni V3.

26. This is not conducive to Uni V3's goal of becoming an indispensable link in DeFi/web3, because its positioning is initially a DEX, in addition to complementing CEX, it allows users to trade long-tail assets, because new projects can be without permission Launch tokens.

27. Because, as stated in [20], Uni V3 provokes competition among LPs, whereas Curve V2 prevents it by making LPs' positions fungible. In Uni V3, passive LPs are being competed by active LPs, because even LPs choose to provide a full range of liquidity for any asset at any price...

28. ...there must be some LPs that provide liquidity within a narrower price range, so LPs that provide liquidity across the board earn much less than LPs that just happen to provide liquidity within that range . Concentrated liquidity is a leverage: higher transaction fees + higher impermanent loss IL.