Does Musk, who is in charge of Twitter, really care about cryptocurrencies?

Note: The original author is Jeff Morris Jr, the founder of Chapter One, and a seed investor in Dapper Labs, Compound Finance, The Graph, and Dharma Labs (acquiring OpenSea). Chapter One is an early-stage fund backed by Sequoia Capital, Marc Andreessen and Chris Dixon. The original text was compiled by the Baize Research Institute.

Twitter and cryptocurrencies have always had an awkward relationship.The crypto community loves chatting on Twitter, but Twitter's leadership doesn't seem to care.

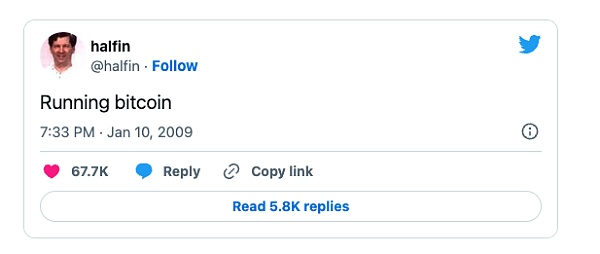

Since the birth of Bitcoin, and Hal Finney's first post mentioning it on January 10, 2009, Twitter has been the most important information distribution channel for the cryptocurrency industry. Hal is famous for receiving Satoshi Nakamoto's first bitcoin transaction and being one of the first contributors to the bitcoin code. His tweet was succinct: "Run Bitcoin."

Hal's tweet comes shortly after Jack Dorsey's first term as Twitter CEO (2006-2008), and also during Evan Williams' time as Twitter CEO (2008-2010 )Published.

After multiple CEO changes over 16 years (Dick Costolo, Jack Dorsey's second term, Parag Agrawal, Elon Musk), Twitter is not taking cryptocurrency and Web3 seriously.

For my research, I spoke to Twitter insiders who are familiar with Twitter's roadmap, Elon's stance on cryptocurrencies, and they confirmed that the current Twitter leadership under Elon doesn't care about cryptocurrencies because it's at their core Product is irrelevant.

this is the truth.

About 2 years ago, Twitter seemed to finally realize that it was ignoring the fact that a multi-trillion-dollar industry relied heavily on its platform. Despite this, Twitter is still unable to respond to the encryption community at the product level.

In 2021, Twitter built an internal cryptocurrency team led by Tess Lynnelson, but this situation has changed in the bear market of 2022. According to reports, the team has disbanded, and Nielsen will leave the company in November 2022.

Twitter's stock has struggled since it went public at $26 in November 2013, and while other "consumer internet properties," including cryptocurrencies, have grown in interest, the company never figured out how to Expand beyond advertising revenue.

When I was the VP of social platform Tinder, I was invited to a friendly visit on Twitter by a senior product executive in 2017, and we talked about adding feeds to the product.

It was during "Jack Dorsey's second term" - as we were having a nice lunch, the senior product executive told me that Jack would never allow a feed to be added on Twitter because he thought all information All must be free.

I didn't know what Twitter's roadmap was like at the time, but I was struck by Jack's stubbornness about the business model, because in Tinder, if you have the ability to create unique value or content, consumers will pay subscription fees to access.

5% of Tinder's active users are paid subscribers, and we're approaching $1 billion in recurring revenue, while Twitter's monthly active user base is much larger.

Why isn't a struggling public consumer internet company considering adding subscriptions?

I sometimes think, if Twitter had put more emphasis on recurring revenue and subscriptions in 2017, would the company be owned by Elon today?

This got me thinking about cryptocurrencies and Web3.

Potential monetization opportunities that Twitter explored were cryptocurrencies and Web3, especially during the 2017 cryptocurrency bull run.

Life in 2017 was complicated for all consumer internet companies, including Facebook and Twitter. Both platforms are under scrutiny by the U.S. Congress for their role in possible Russian interference in the 2016 presidential election.

Because of Jack's focus on free speech, Twitter was also struggling with spam and abuse at the time.

At a time when Twitter is already vulnerable, adding cryptocurrency payments to a platform that has problems with spam and abuse increases risks such as fraud. There have been persistent rumors that Twitter might take advantage of encryption, but so far there have been no new products to push the trend.

It’s 2023, and the relationship between Twitter products and cryptocurrencies is still awkward, even though most of the social discourse on cryptocurrencies happens on Crypto Twitter.

Twitter has become a place for cryptocurrency investors to spot early speculative opportunities, where NFT owners can change their profile picture to a verified boring ape, but the company still has no direct revenue from cryptocurrency or Web3.

So why doesn't Crypto Twitter leave Twitter entirely? Or do Web3 developers create a product that embraces the crypto community in a more direct way?

In fact, distribution is important, and Twitter still has the advantage of distribution rights.

New social products will reduce the value of encrypted Twitter, but it will take many years, and Twitter will not feel threatened.

But Twitter does need more recurring revenue. So, why not embrace cryptocurrency and Web3 and then become the most important Web2 platform for the cryptocurrency and Web3 industry, or at least pretend to care?

Under Elon's leadership, people continued to want Twitter to be a cryptocurrency-friendly company (he loved Dogecoin), but Elon's early monetization efforts focused on subscriptions.

This is the right priority in a bear market, but their revenue roadmap needs more creativity, or a better Twitter Blue (subscription product).

If you talk to smart people who understand Web2 and Web3, they will tell you that the easiest monetization opportunities are to focus on NFT and cryptocurrency transactions. But neither appears to be on Twitter's roadmap.

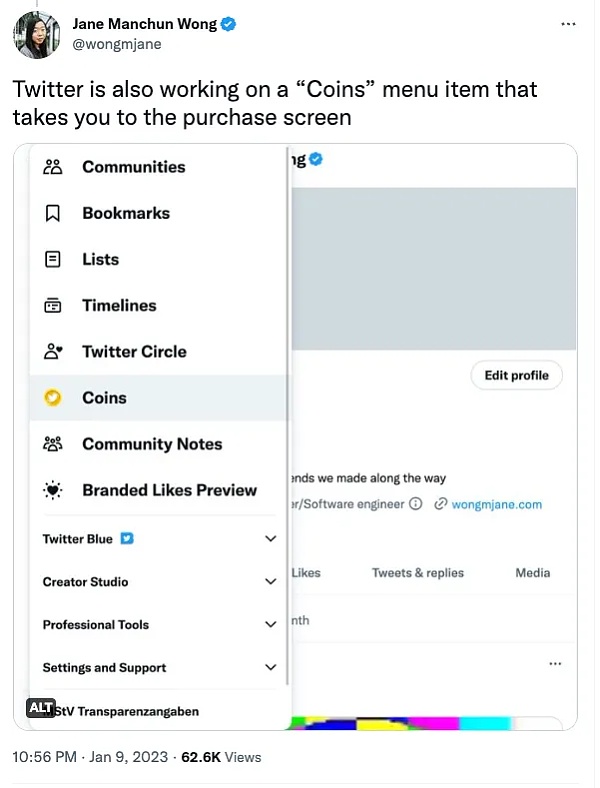

Last week, it was revealed that Twitter was working on a feature called Coins that would allow users to support creators on the platform. While Twitter Coins will be purchased through payment platform Stripe, which also accepts cryptocurrencies as payment, this is a creator-oriented product, not a cryptocurrency-oriented product.

In April 2022, Stripe tested a product feature that would allow a select group of creators to receive payments in USDC, the dollar-pegged stablecoin.

In the case of Twitter Coins, users may never interact with USDC when purchasing and sending to creators.

USDC may help with payments, but most creator-centric products we know have said that creators prefer old-fashioned fiat currencies, so all cryptocurrencies are passed away.

Twitter recently rolled out a small feature. If you search for cryptocurrencies or stocks, you'll get price charts and links to buy the asset.

For example, I searched for The Graph ($GRT) on Twitter and got a price chart for The Graph and a link to Robinhood.

To be clear, this feature also applies to searches for stocks like Amazon ($AMZN), so this is not a cryptocurrency-centric product.

While the business details of the partnership are unclear, the Robinhood link won't have a material impact on Twitter's direct revenue. Robinhood has 14 million monthly active users, compared to Twitter's 450 million monthly active users, so there may only be a small percentage of Twitter users who can use the feature without signing up for Robinhood.

Also, there may be overlap with Crypto Twitter users who have Robinhood accounts, so this feature won't have a significant impact on Twitter's revenue.

Elon will reportedly be more eager to find immediate income in 2023, as the first installment of his "looming interest payment" on $13 billion in debt is due at the end of January.

Just last week, The Information shared Twitter's revenue figures for the first quarter of 2023:

Twitter's revenue in the fourth quarter of 2022 will drop about 35% to $1.025 billion. That's 72% of Twitter's internal target for the quarter. On Tuesday night, a senior Twitter manager told employees that the company's daily revenue on Tuesday was down 40% from the same day a year ago.

When it comes to subscriptions, even if you're not an expert, Twitter Blue is a half-baked feature that won't appeal to mainstream users.

However, Twitter has continued to increase subscription prices, and Twitter Blue now costs $11 per month. They may have attracted a small group of relatively price-insensitive subscribers (i.e. Twitter minnows and whales). But the pricing test will only take the revenue team so far, and subscribers will feel "betrayed" if they keep raising prices.

Maybe one day Twitter will embrace and become the most dominant Web2 social company in cryptocurrency and Web3— and building exclusive products for the Web3 revolution that has existed on his platform since Hal Finney's first Bitcoin-related tweet in 2009.

But before that, Twitter was already in an awkward relationship with cryptocurrencies.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.