New Project | Solidly: AC old project, new to Ethereum, the next generation of Curve?

The Liquid Stake Derivatives (LSD) track is booming with the upcoming Ethereum Shanghai upgrade. For all staking protocols, Curve is still the main battlefield for them to compete for liquidity. crvUSD has not yet been released. Once it is officially launched, it is very likely that a new round of governance competition will be involved and the Token War will start. As a result, there have been more posts about the war between LSD and CRV recently.

Today, Odaily will introduce a new competitor in the field of liquidity that is considered to be based on the improvement of the Curve model-Solidly.

Solidly was originally launched by AC on Fantom last February, and it quickly became a hit. Due to the large number of participants, the transaction volume of the Fantom chain has soared, causing severe network congestion. What's even crazier is that in just a few days, the TVL of the Fantom ecosystem has risen by more than 40%, reaching 13 billion US dollars at one point, making it the fourth public chain in terms of TVL. However, the good times did not last long. Affected by AC's announcement of withdrawing from the encryption industry in March, Solidly TVL dropped by 40.17%, and the price of the token SOLID also dropped by 50% within an hour. AC said that it would no longer participate in the development of the project. But there are still teams who want to continue developing Solidly and refactor Solidly as much as possible while improving its core aspects. One of the main developers on the team has also worked as a core developer at Yearn Finance.

On September 1 last year, Solidly officially migrated and upgraded, completing a migration rate of 92.91%, which also shows that the community has high hopes for Solidly. Immediately afterwards, Solidly launched on Ethereum in early January this year.

Solidly is a "self-optimizing" decentralized exchange that combines Uniswap's AMM mechanism with Curve's custody and stable pool innovations to attract liquidity. Compared to Uniswap which returns 0% fees to UNI or Curve which returns 50% fees to veCRV,Solidly allocates 100% of its fees to its governance token, SOLID. At the same time, liquidity providers earn 100% token rewards and LP bribe rewards.

Users can consider directly providing liquidity on Solidly and receiving SOLID in return; they can also choose to bribe voters to vote for the transaction pairs of the agreement, or bribe LPs to obtain additional income.

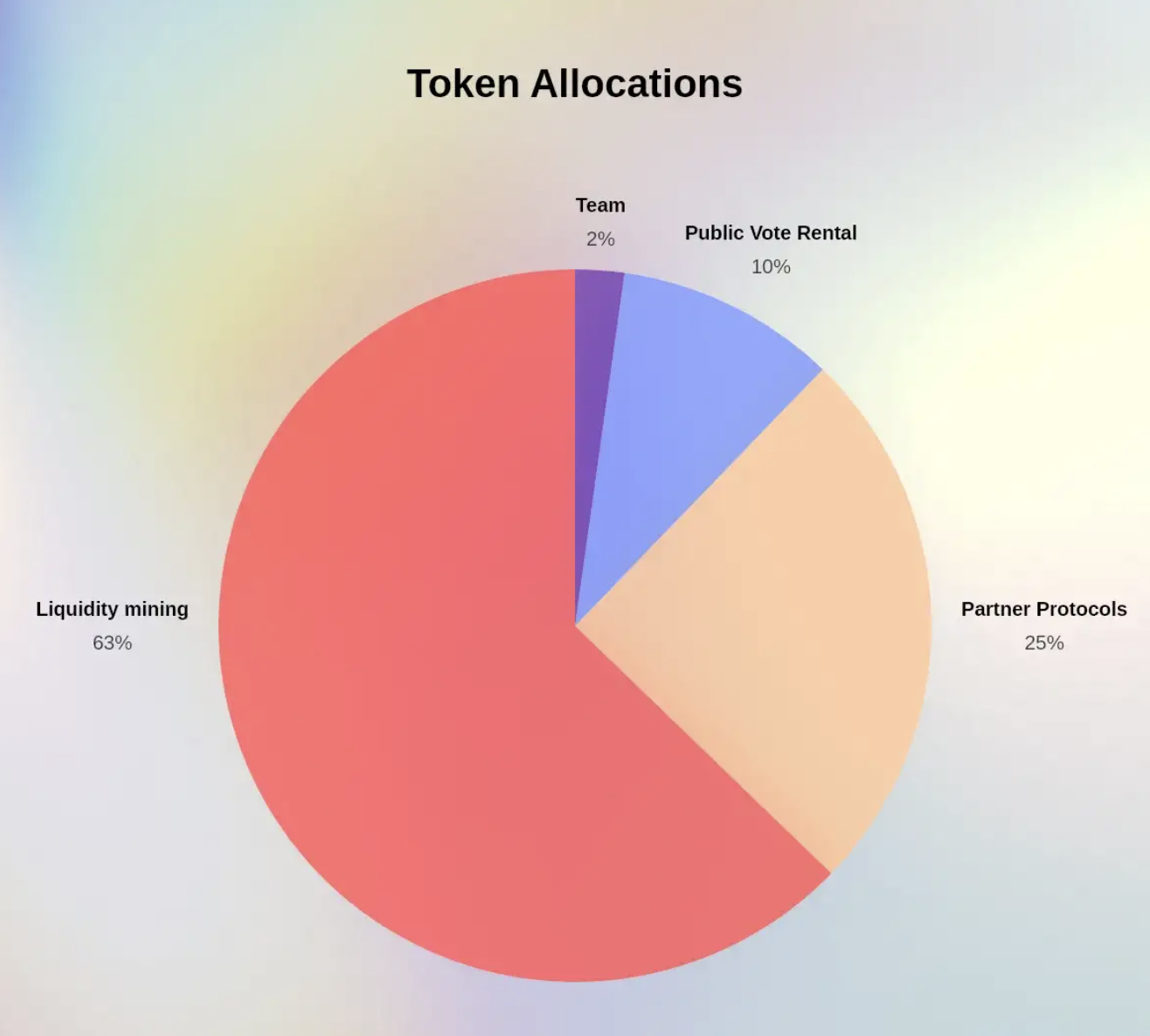

In terms of tokens, 63% of the tokens are allocated to liquidity mining, 25% are allocated to strategic partner agreements, they will help Solidly guide initial liquidity; 2% are allocated to the team, and the team is considering locking veSOLID for 4 years form to Solidly Labs to maintain long-term operations. In addition, 10% is allocated to public voting lease contracts.

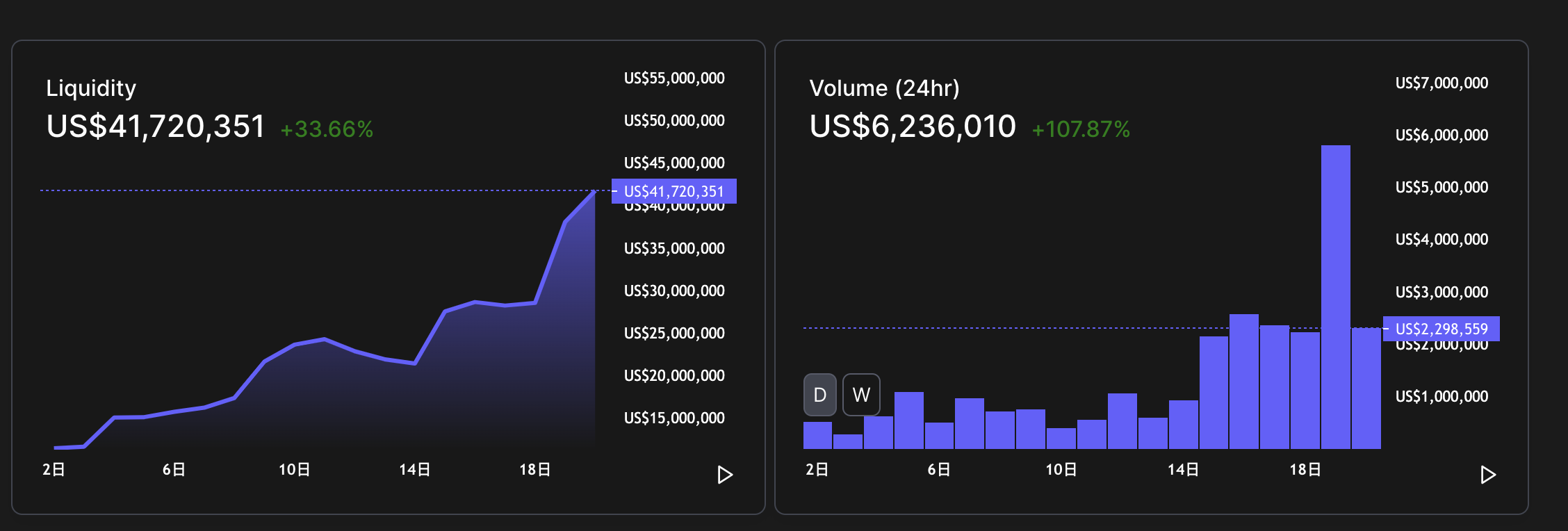

Currently, SOLID only has 4% of the circulating supply, but its TVL is steadily increasing. At present, its liquidity has exceeded 40 million US dollars, and its 24-hour trading volume has exceeded 6 million US dollars, an increase of 107%.

How to get the most rewards early on? encryptionKOL Robin Hood RichesInterpretation of the Solidly gameplay.

Robin Hood Riches learned from the CRV and CVX transactions to start by looking for a Convex-like aggregator, such as Monolith, where LP providers get the most out of it, and moSOLID stakers get both regular SOLID rewards and Portion of LP supplier revenue. SOLID is now trading at $4.01 and moSOLID is trading at $1.09 (available athttps://solidly.com/swapbuy moSOLID on ).

In future developments, Solidly will also explore the idea of building layer 2 on-chain leveraged contract products on Solidly.

Friends who are interested in the latest progress of Solidly can follow the project's officialTwitterOdaily's [New Projects] column aims to help early Web3 projects gain market exposure opportunities. If you are also a Web3 entrepreneur, please follow the official Twitter @OdailyChina, private message [seeking reports], send your project introduction and contact information, we Will communicate with you as soon as possible.official website。

Odaily's [New Projects] column aims to help early Web3 projects gain market exposure opportunities. If you are also a Web3 entrepreneur, please follow the official Twitter @OdailyChina, private message [seeking reports], send your project introduction and contact information, we Will communicate with you as soon as possible.