Bankless: An in-depth analysis of the current macro environment, is the crypto market back?

Author: Jack Inabinet

Original source:Bankless

Compilation of the original text: The Way of DeFi

Image Credit: Generated by Maze AI

Author: Jack Inabinet

Original source:

Compilation of the original text: The Way of DeFi

Image Credit: Generated by Maze AI

Markets continued to rise this week as the broader macro environment improved.

What do the CPI numbers tell us? What should we do? This article will analyze the recent cryptocurrency pump situation.

Is the cryptocurrency market back?

BTC has risen 23% to $21,100 in the past week. This leads Crypto Twitter to ask some important questions:

1. Have cryptocurrencies bottomed out?

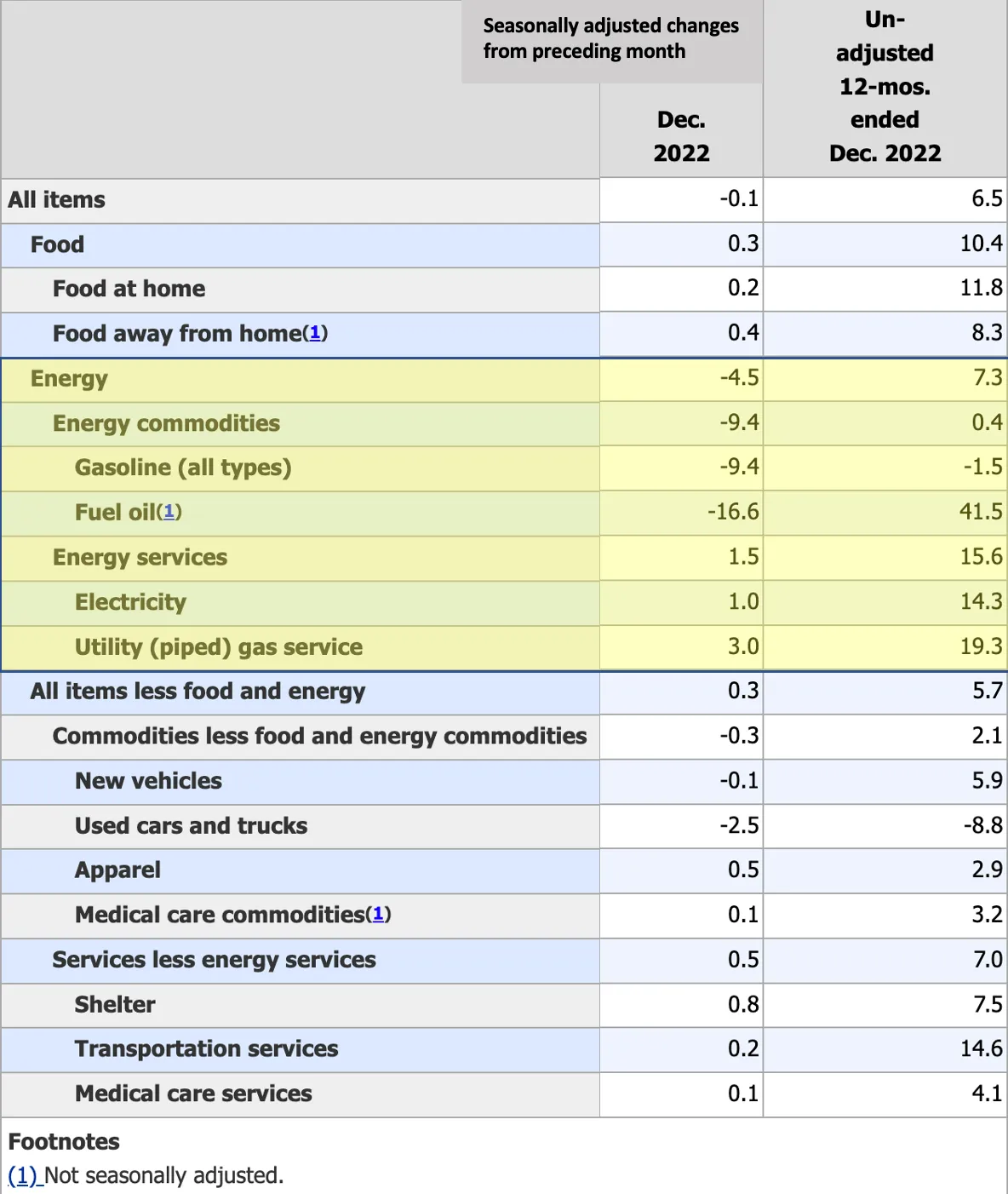

2. Is now the time to be bullish?This article will dissect the market interpretation of the US Consumer Price Index (CPI) data, examine the logic behind Thursday's choppy trading and extract some caveats from the data they don't want you to see.U.S. Bureau of Labor Statistics Thursday (January 12)

source:TradingView

December CPI data released, the ensuing trading day was as volatile as ever.image description

many macroeconomic experts

source:Seen as the beginning of CPI disinflation and possibly even a deflationary trend.

Year-on-year CPI fell to 6.5% from 7.1%, a surprise 10 basis point decline in CPI from November's measurement. The drop was largely attributable to the broader energy category, which fell 4.5% on a seasonally adjusted basis from the previous month.image descriptionsource:

, and remains elevated, up 0.5% by mark-to-market from December. As the name implies, the sticky inflation component is less volatile than the commodity-derived component of the CPI.

source:the fed

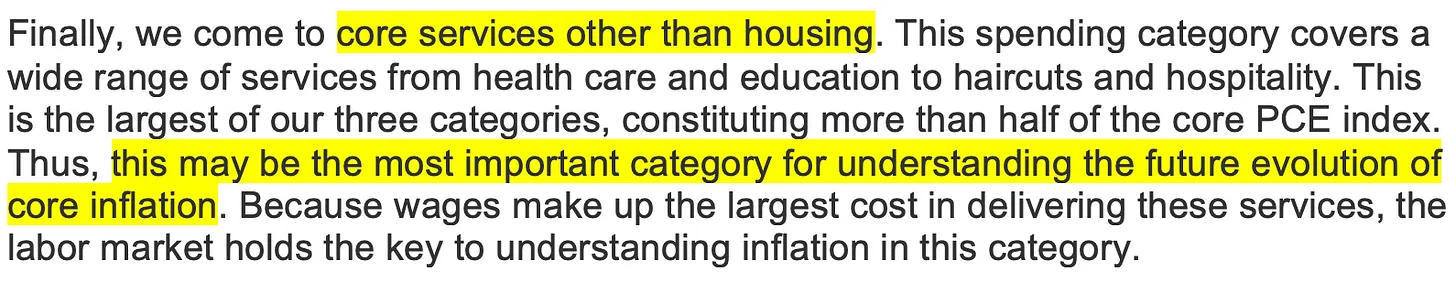

Beating sticky inflation is the Fed's top priority through 2022. As Fed Chairman Jerome Powell has noted, core service inflation is one of the most important indicators the Fed Board of Governors examines to predict the health of the economy and guide monetary policy.

image description

source:

the fed

what the fed is doingWhy does inflation matter to the Fed, and how do they use monetary policy to fight inflation? The Fed has a dual mandate of maintaining price stability and full employment.But in practice, achieving these goals simultaneously is difficult.

Inflation can be controlled by tightening economic conditions and doing so by raising interest rates. Spending slowed as the cost of capital and financing increased, putting downward pressure on inflation.

Contractionary monetary policy is a term used to describe the Federal Reserve's current efforts to slow economic activity by raising the target federal funds rate (the aggregate rate on overnight loans guaranteed between banks). Although the Federal Reserve does not lend directly in the fed funds market, it can

Markets are forward-looking -- they factor in expectations of the Fed's future monetary policy into today's borrowing costs. As markets adjust to these adjustments, changes in the market's perception of the future path of inflation are factored into yields and asset valuations.

source:FRED

Rising rates slow economic growth and often lower employment levels, forcing the Fed to balance how quickly and how much it can raise the federal funds rate without pushing the economy over a recessionary precipice.

And throughout 2022, the labor market has unexpectedly remained resilient, with the unemployment rate continuing to decline, reaching a full-year unemployment rate of 3.5%, the lowest post-COVID-19 level.

image description

source:

what does the data show

source:wall street journal

While the numbers aren't exactly rosy, given the persistent inflationary pressures of sticky categories, you'd better believe that Wall Street MBAs have undergone a bit of mental training to be optimistic, as highlighted by the WSJ:

image descriptionsource:

Inflation measures for many core commodity categories have turned deflationary, while inflation in services sectors remains stubbornly high, partly due to continued tightness in the job market and upward pressure on wages.

source:wall street journalThe Supercore inflation index excludes core goods and housing services, and some market participants have chosen to exclude health services as well.

source:pointed outwall street journal

(Gold's Super Core Inflation)

Roger Hallam, Head of Global Rates, Vanguard

pointed out

, "commodities and housing print will receive less attention in the year ahead than the situation on the services side". In addition, Hallam believes that market participants will pay more attention to the employment data.

Okay, these ideas seem complicated, but promising -- so what should you do?

remain cautiously bullish

You never want to be the clown who stayed in the crypto space throughout the bear market and missed the rally because of FOMO buying $21000 of BTC or $1550 of ETH at the top and then getting liquidated on the way to the actual bottom.

inflation is improving

However, cautious optimism is key.

source:TradingView

Those impending fund redemptions? Is it possible for them to happen now...

If there is one lesson that I have learned repeatedly and painfully throughout my time in the cryptocurrency space, it is that price action on weekends (especially three-day weekends) is usually price fraud. Bitcoin’s biggest sell-offs since August 2022 all preceded Friday’s pump and continued into the weekend (indicated by the purple box).

Subsequent trading action has brought BTC to new cycle lows each time.

source:TradingView

Liquidity dwindled with TradFi markets closed for the weekend as market makers went home for the weekend. This increases volatility and makes prices more susceptible to unusual swings, with unusually high volumes easily pushing prices to extremes in both directions.

source:

source:TradingView

Keep in mind that while BTC spot markets can be difficult for individuals or small groups to manipulate, low-circulation altcoins are certainly not immune to such behavior.

As your tokens appreciate in value, you can use them to borrow more money! Let’s say for a moment, if you’re a VC with deep pockets, just got hit with a redemption and hold a lot of tokens with low circulation. And for mortgage-level blue-chip DeFi projects like Lido, you can use their growing value as collateral to borrow funds, do long tokens you hold in a low-liquidity market, and attract hot chasers (rotatooor), so that They are involved.

image description

source:

While heavy VC selling would depress market prices, attracting fresh blood and refocusing on their shitcoins allows them to exit at more favorable prices. Remember: VCs are here to play games! Don't let them overwhelm you as they leave!

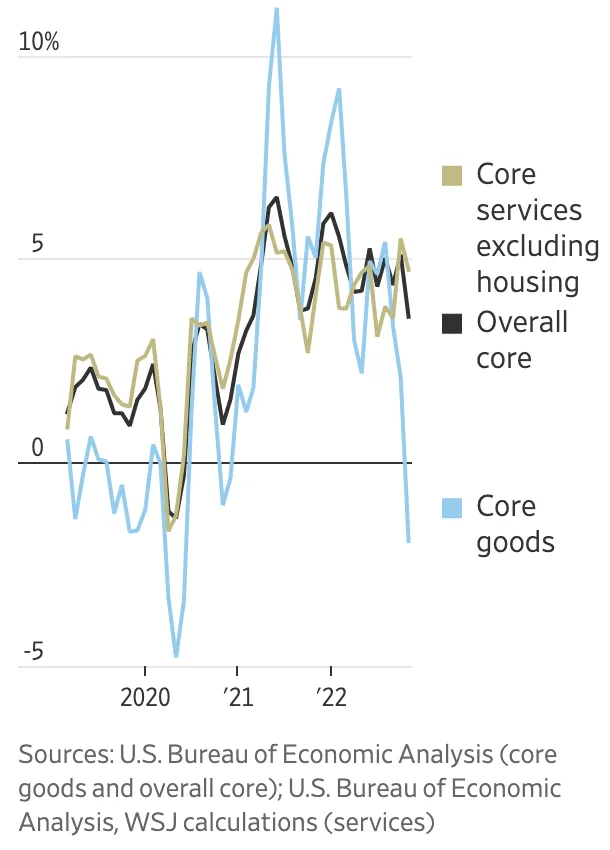

Going back to the topic of Zhu Su giving up Ethereum, does anyone know?

This tweet marks the beginning of an aggressive Alt L1 campaign by the folks at 3AC. Their efforts proved to be a huge success, with LUNA up almost 200% over the next five months!

Despite publicly announcing support for Alt L1s and predicting Ethereum’s demise in late 2021, 3AC reaped the benefits long ago.

Hedge funds and VC firms often don't publicly announce what they're actually doing! Why are they doing this? They are profit-maximizing institutions looking to extract the greatest returns from the crypto market. They play a misleading and distracting game designed to separate you from your capital.

If you've read this and are still planning to get involved in the market right now:

2. Don't have feelings for the coins you hold