This article explains in detail the investment characteristics and preferences of crypto VC in 2022

Original author:2022: Crypto VC Comes Down to Earth

first level title

Introduction

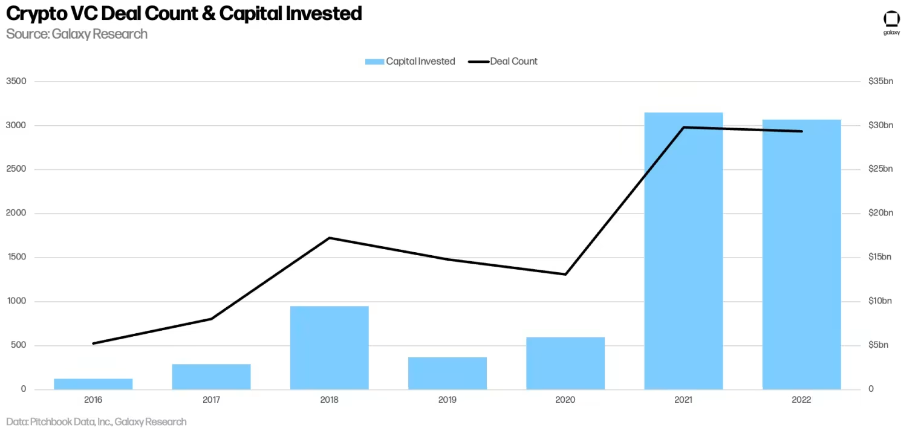

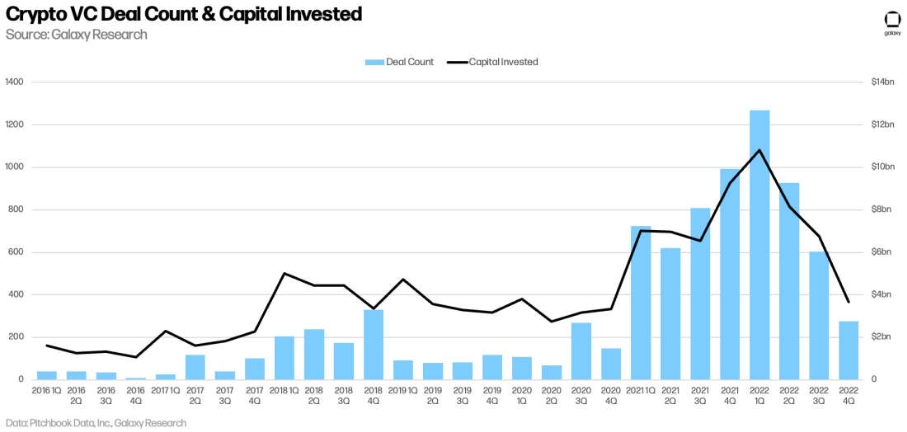

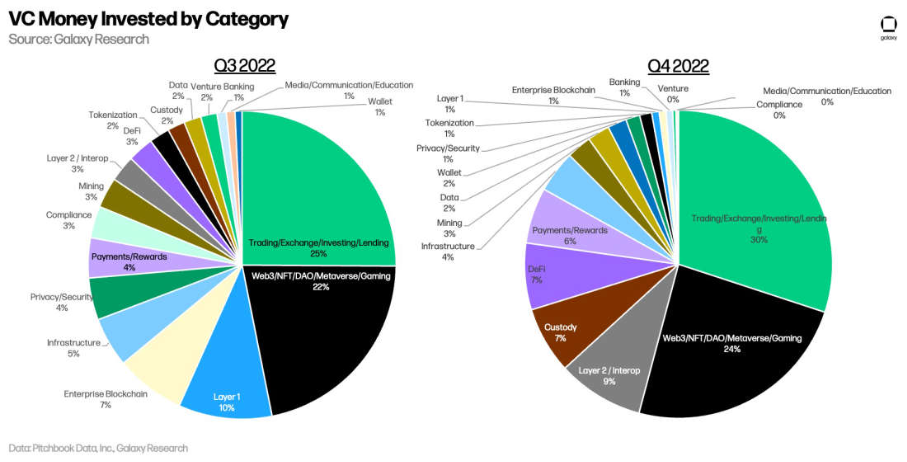

In 2022, crypto VCs invested a total of $30 billion in crypto startups, which is very close to the $31 billion in 2021. Among them, most of the investment records occurred in the first half of this year. Because of the poor performance of the macro environment and the encryption market in the second half of the year, the investment records in Q3 and Q4 were greatly reduced. Even in the fourth quarter, the number and amount of VC investments both doubled. hit a new low in the past two years. In the new investment trend, more and more institutions prefer to invest in late-stage companies, while the investment record before the seed round continues the downward trend for many years. In the investment landscape, the number of companies in the Web3 category accounted for the largest number, and companies involved in the construction of trading and investment tools raised the most funds.

secondary title

Number of VC investments and investment amount

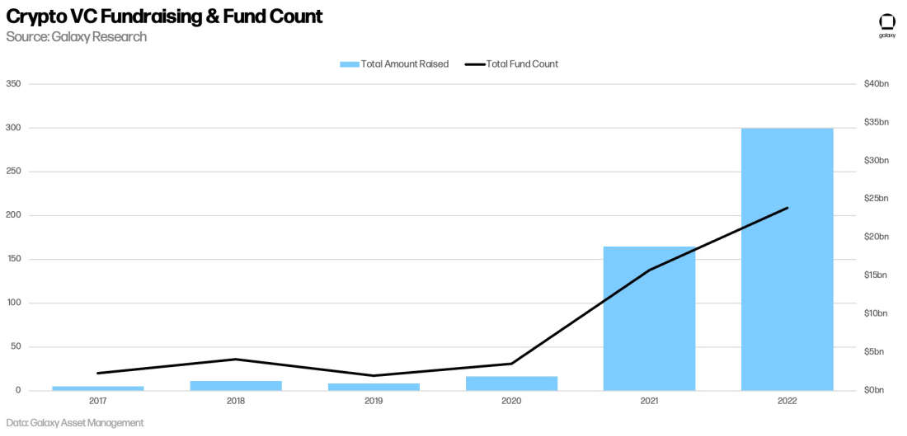

In terms of the number and amount of investment transactions, 2022 ranks second in the history of cryptocurrency VC, second only to 2021.

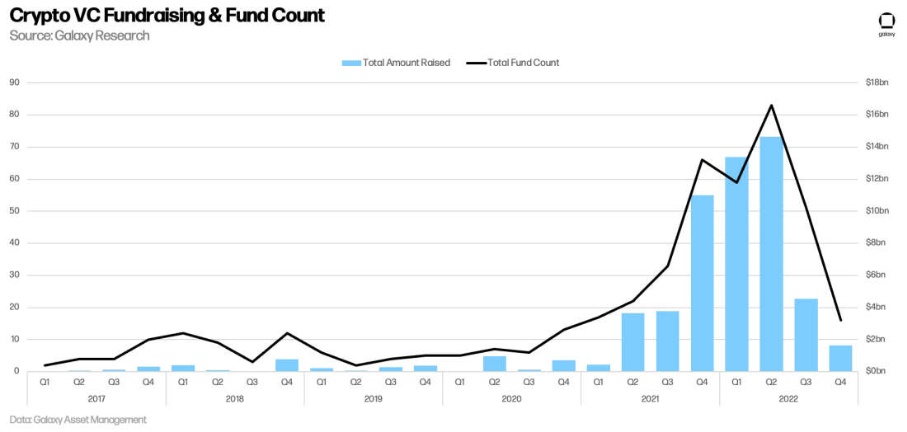

In the first quarter of 2022, the crypto VC industry hit a record high of US$13 billion in investment and 1,100 transactions. Later, with the rise in US interest rates, the deterioration of the macroeconomic environment, and the turmoil in the capital market, investors’ interest in the cryptocurrency field Investment interest has decreased significantly, and the number of Crypto VC transactions and investment amount have also begun to decline continuously. The performance of the Crypto VC market in the fourth quarter of 2022 is even lower than the level of the same period in 2018.

secondary title

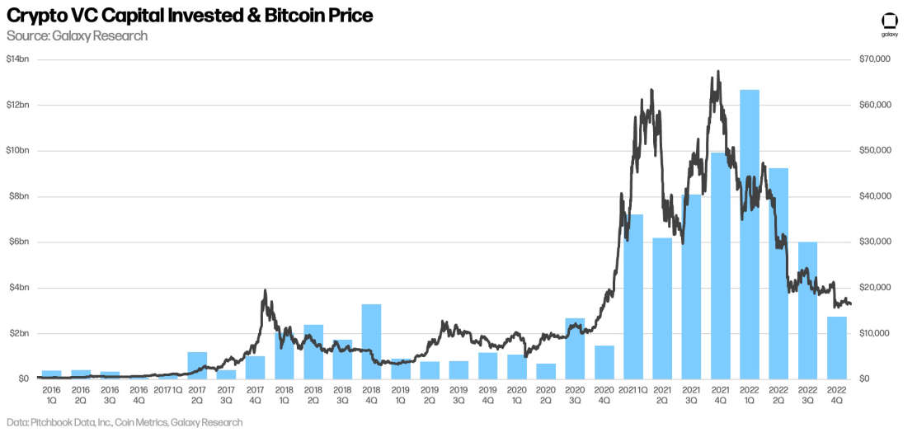

The development trend of venture capital continues to follow the price performance of Bitcoin. The price of Bitcoin hit a low in recent years in the fourth quarter of 2022, and VC investment also hit a low in the fourth quarter.

secondary title

VC investment stage

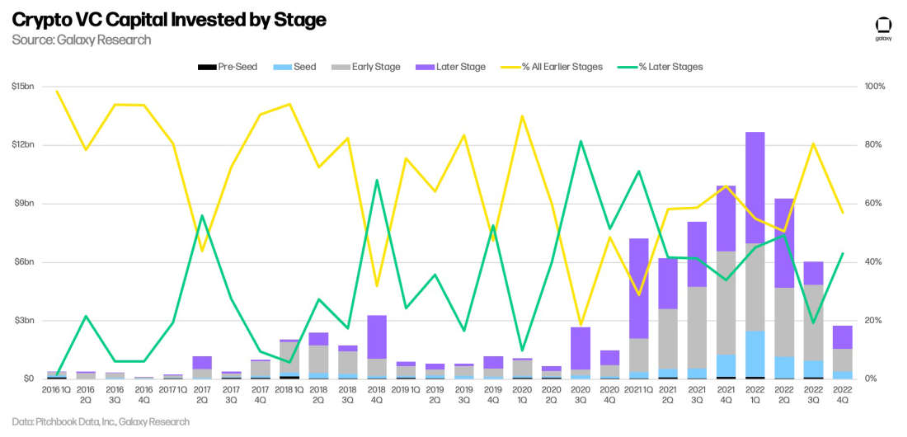

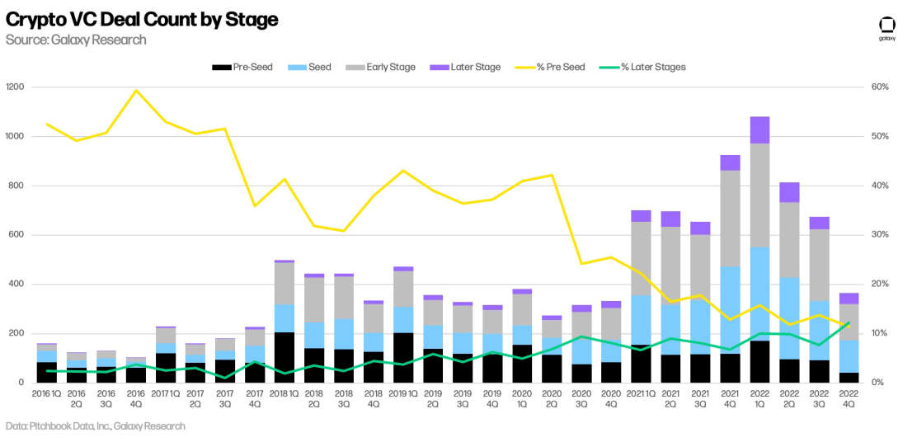

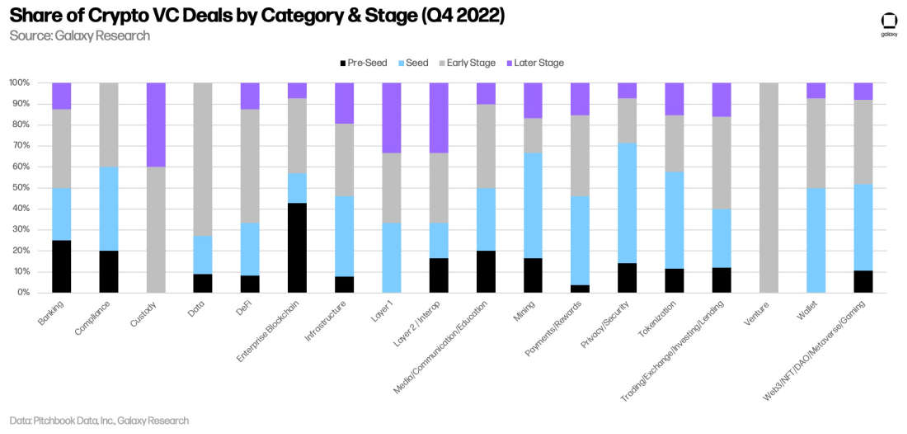

When examining the number of investments by stage of development, the decline in investment deals involving early-stage development is particularly pronounced, with Q4 2022 the first quarter on record to see more late-stage deals than pre-seed deals.

secondary title

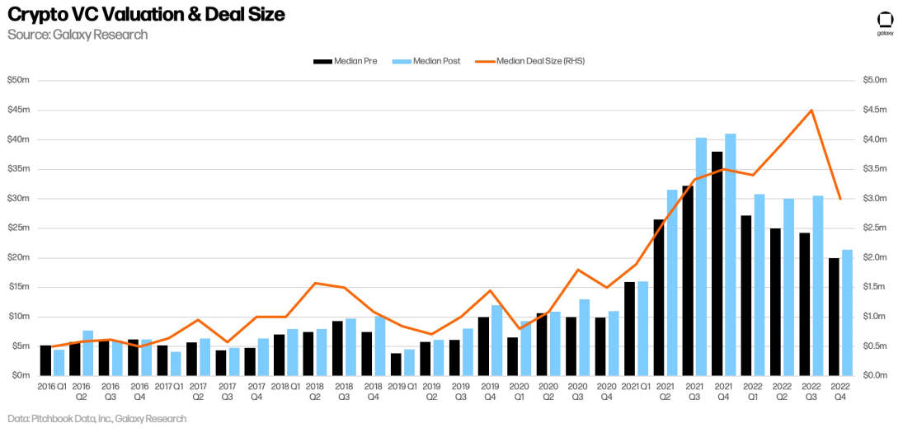

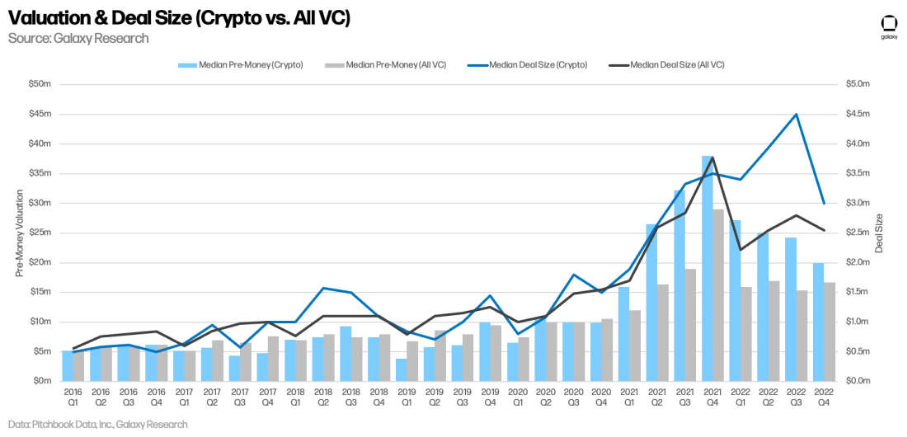

Valuation and deal size

While the valuations of crypto companies fell in the fourth quarter, the valuations of the overall venture capital market rose slightly.

secondary title

Investment territory

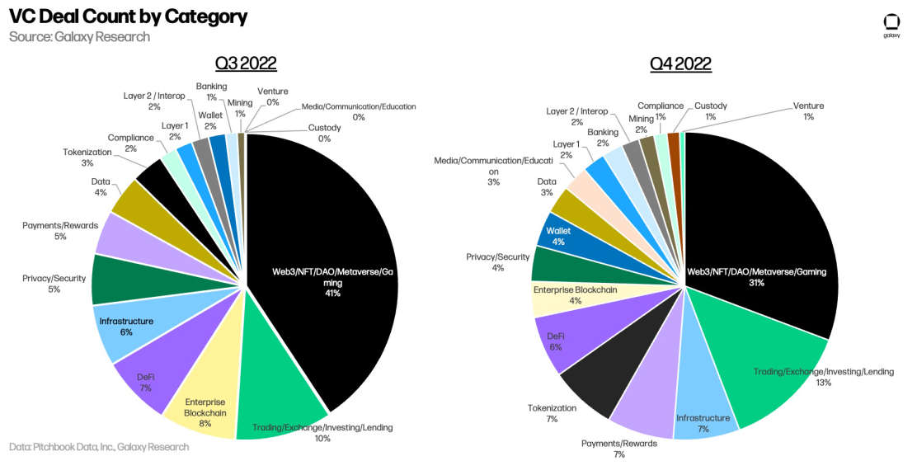

However, in terms of the amount of investment, startups involved in "deals" received the largest amount of investment, compared with the smaller and earlier stage of investment in the Web3 category, which shows that the emerging industry segment of Web3 and the Narrative is in its infancy.

secondary title

Investment Stage and Category

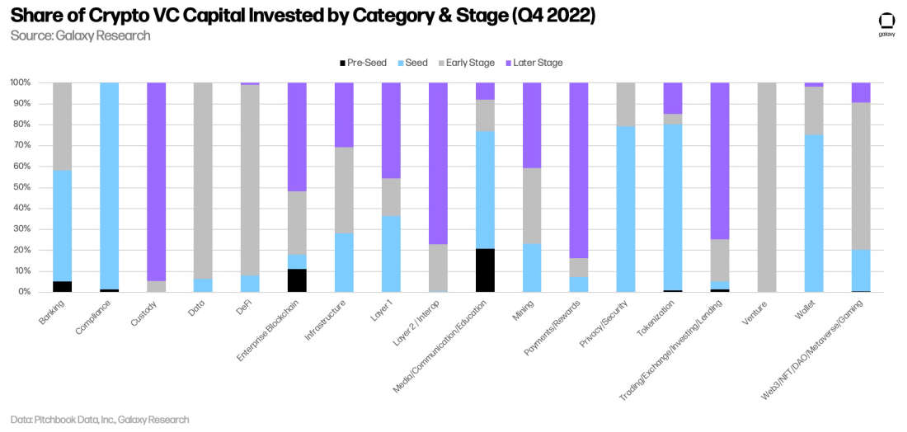

When we divide the investment transactions by industry category and development stage, we can find that most of the investment is invested in Web3 companies in the early development stage. More than 50% of investments in Web3, Wallet, Privacy/Security, Compliance, and Mining were in seed and pre-seed, and 60% of investments in transactions and data were in Round A and beyond.

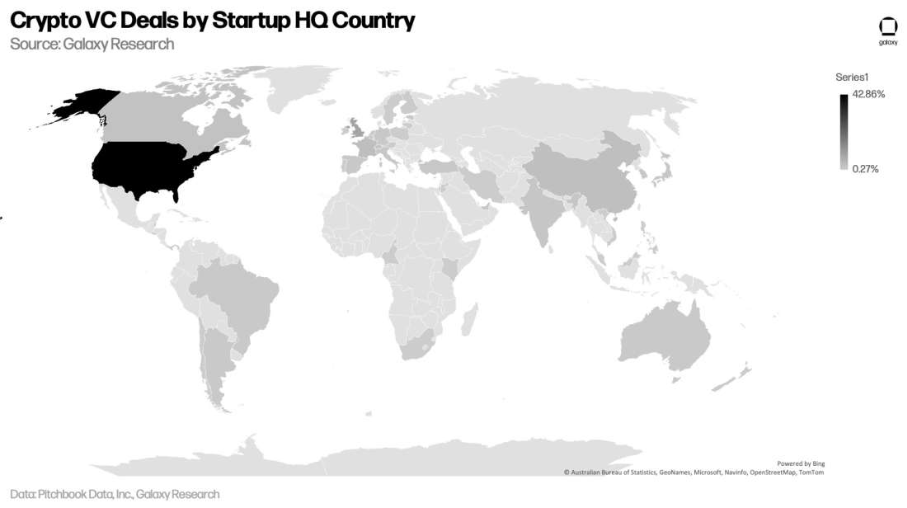

The US continues to dominate the Crypto VC market, with over 40% of investment deals going to US-based startups.

secondary title

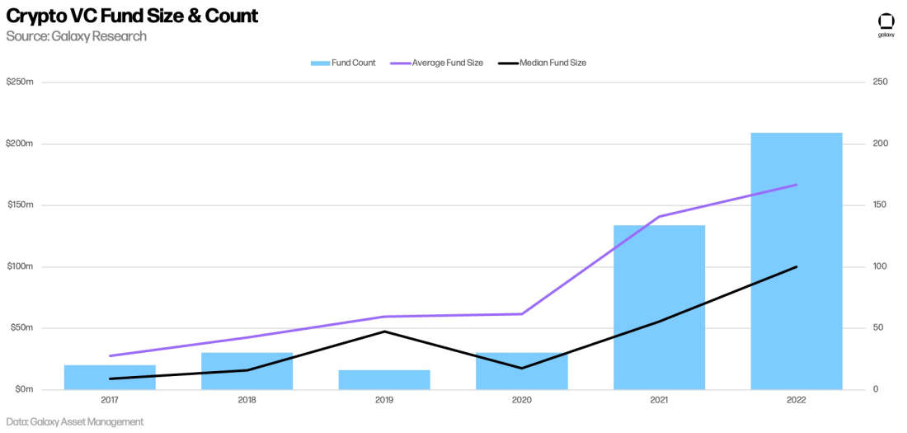

Crypto VC Fund

In the current macro environment, it is difficult for investment institutions to raise funds due to investors’ reconsideration of investment risks or direct withdrawal of funds, especially with the decline in encrypted asset prices and market turmoil, which has further exacerbated this situation. In the Q4 quarter of 2022, both the number of encrypted VC funds and the total amount of funds raised by encrypted funds hit a new low in the past two years.

first level title

key points

key points

2022 is a big year for crypto VCs, and while investment interest has declined throughout the year, the VC market’s performance throughout 2022 remains on par with the explosive 2021, suggesting that while asset prices generally fell, but continued the momentum of prosperity in 2021. That said, the continued decline in the number of deals, investment values and fund raising bodes well for a difficult period ahead for all parties involved.

The environment in the crypto VC industry has become very difficult for project founders and investors. Due to the collapse of asset prices and some infrastructure, the entire encrypted asset market has been severely disrupted. At the same time, the macroeconomic shift and monetary policy uncertainty have inhibited the allocation of encrypted venture capital funds. Risks in the fourth quarter of 2022 Investment hit its lowest level in nearly two years. The reduction in capital flow to crypto VCs has led to a reduction in investment in start-ups. This tightening of capital has led to lower project valuations and stricter investor requirements. These factors have combined to make the funding environment for crypto entrepreneurs more difficult. In 2023, startups should focus on fundamentals, control operating expenses, and increase revenue.

Pre-seed investment deals have been on a multi-year decline. In the fourth quarter of 2022, the number of late-stage investment transactions exceeded the number of pre-seed transactions for the first time. This trend highlights the maturity of the crypto industry, but it also indicates that there will be fewer new companies and fewer new products in the future.

The investment in the Web3 field accounts for the majority, and the amount of investment related to "transactions" accounts for a higher proportion. Financing in the Web3 space continues to lead VC investment, accounting for more than 30% of all completed deals in Q4 2022, and a large number of early-stage companies are building in the Web3 space, especially in the NFT subfield. Additionally, companies building platforms and tools for trading and investing continue to dominate in terms of funding amounts, demonstrating the importance and growing maturity of market infrastructure in the crypto ecosystem.