A look back at the rise and fall of the Avalanche ecosystem in 2022

Original Author: Caesar

Compilation of the original text: Bai Ze Research Institute

Avalanche is one of the most promising L1 public chains in the crypto industry. It was created by Ava Labs in 2020 and has since become a popular choice among DeFi developers due to its high transaction throughput and low transaction fees.

In terms of development, 2022 is a year to remember. While new L1 public chains continue to emerge, Avalanche has a high adaptation rate and a growing user base.

first level title

2022 Avalanche Ecosystem Overview

Avalanche is an emerging ecosystem in 2022. Many projects have been launched on Avalanche, all of which have had a huge impact on the ecosystem. Thanks to the emergence of these projects, we have witnessed Avalanche gradually become the innovation center of DeFi. On the other hand, although several promising games and NFT projects have appeared on Avalanche, we have yet to see large-scale development in these areas.

Trader Joe, BENQI, Platypus, Avascan, Avalaunch, Pangolin, GMX, Degis, Hashflow, Yield Yak, Vector Finance, and Colony have contributed significantly to the Avalanche ecosystem. It should be noted that Trader Joe's leads the entire ecosystem in terms of innovation, engagement, and community.

On the other hand, there are also several relatively good DeFi projects that are developing rapidly, such as Savvy DeFi, DeltaPrime, CIAN Protocol, Enclave Markets, Steakhut Finance, Dexalot and Hubble Exchange.

It is worth noting that in the near future, we will see more native projects such as Trader Joe and Pangolin become multi-chain projects. Not only is this a great development for the projects, it's also good for Avalanche if these projects also attract users to the Avalanche ecosystem. However, this trend could also be dangerous for Avalanche's future.

Due to the rise of L2 protocols, Avalanche’s share of TVL in the overall crypto industry has dropped to 2% from around 6% last year. Although TVL is an old concept and does not cover all situations, it is still an important parameter to consider. The reason for the drop in TVL this year may be the lack of games and NFT items on Avalanche.

Unfortunately, the Avalanche ecosystem was also affected by the Terra/LUNA debacle and 3 AC's bankruptcy, as there was significant FUD (panic, uncertainty, and doubt) surrounding the ecosystem.

Looking back through 2022, while the daily active users of the Avalanche ecosystem have dropped significantly due to the intensifying bear market, the daily transaction volume has increased significantly, which is a good sign for future growth. Additionally, the number of smart contracts being deployed will skyrocket in 2022, a testament to developers’ trust in Avalanche.

By 2022, Avalanche has processed 500 million transactions while burning 2 million AVAX.

Next, let's talk about it in detail.

DeFi Ecosystem

Avalanche has one of the best DeFi ecosystems in the crypto industry. With the rise of several projects, we saw the real development of Avalanche in the DeFi space.

I think one of the main reasons for this is that Ava Labs' vision for the future of Avalanche is to beat Wall Street. This means that Avalanche's goal is to become a competitor on Wall Street, rather than other L1s. Therefore, DeFi has become the focus of Ava Labs.

Through the Avalanche Rush program, several well-known projects have joined the Avalanche ecosystem, and native projects have emerged. Avalanche has DeFi products with a wide range of use cases, such as revolutionary AMM, FEX (full encryption exchange), CLOB (central limit order book), liquidity pledge, perpetual contract, incubation agreement, insurance, mortgage loan, non-clearing loan, DeFi automation tools, yield aggregators, and more.

I believe that at this point, Avalanche's DeFi ecosystem is superior to all L1s except Ethereum. However, the main potential of the Avalanche DeFi ecosystem is that it can grow exponentially in terms of "regulation compliance" compared to other chains, because Avalanche's unique subnet technology allows for the establishment of permissioned dApp-specific chains, so those who want to be in compliance Regulations can be easily developed by institutions using blockchain technology.

However, Avalanche still needs to attract more option agreements to improve the DeFi ecosystem. Also, one of the main considerations for the Ava Labs team should be maintaining native project satisfaction, as a few native projects have contributed to Avalanche's success so far, so without them this success probably wouldn't be long-term and sustainable.

game ecosystem

Gaming is one of the key areas where the crypto industry can attract millions of people to join. However, until now, the general public chain has not been able to develop solid and sustainable game projects. One of the main problems with crypto games is high transaction fees. However, due to Avalanche's subnet technology, game items can be lowered to lower costs, and users can also use subnet tokens as Gas fees. Therefore, Avalanche has the ability to create an economically sustainable gaming experience for users. I believe that although Avalanche's game ecosystem is still in its infancy, the subnet will be a "game changer" that can attract the migration of more existing projects and the emergence of native projects.

Also, since Avalanche aims to attract institutions to run DeFi, this can also be applied to gaming. Several triple-A game studios have partnered with Avalanche to develop their games on the Avalanche network, such as Shrapnel.

On the other hand,Avalanche also has something like

Avalanche is undervalued and under-explored as a "crypto game center", but with the rise of subnets and more reliable projects, it can lead the development of the crypto game industry.

NFT ecosystem

Unfortunately, the Avalanche NFT ecosystem is weak compared to other chains because Avalanche cannot attract large mature NFT projects. Although there are already some native projects like Chikn NFT or Joepegs Studio like Smol Joes and Rich Peon Poor Peon, it is safe to say that Avalanche lacks innovation in the NFT space.

However, in the past few months, with the launch of Plague Game and PONZ, a noteworthy innovation has occurred in the Avalanche NFT ecosystem-NFTs that utilize NFTs for gambling and user games. Therefore, I believe that if more such projects enter Avalanche, then Avalanche's NFT ecology may flourish.

first level title

2022 Avalanche Key Results

It's been a great year for Avalanche in terms of accomplishments and partnerships enabled by the Avalanche ecosystem.

List of achievements:

Platypus Finance Launches Stablecoin Swap Protocol on Avalanche

1inch Network deployed on Avalanche

GMX deployment to Avalanche

Hashflow extended to Avalanche

3 A first-person shooter Shrapnel is in development on Avalanche

Avalanche Launches Multiverse Incentive Program to Accelerate Subnet Adoption and Growth

Wallet Core was introduced to the Avalanche community

Yeti Finance launches on Avalanche

DeFi Kingdom and Crabada Launch Subnets

Avalanche Bridge adds support for Bitcoin

Digital asset securities firm Securitize has launched a fund on Avalanche to tokenize interests in KKR's Healthcare Strategic Growth Fund II ("HCSG II").

Transfero Launches Brazilian Fiat Stablecoin $BRZ on Avalanche

Boba launches first L2 on Avalanche

Re is building a global decentralized insurance marketplace on Avalanche

Elastic Subnet Publishing

Opensea launches support for Avalanche

GREE builds Web3 games and runs nodes on Avalanche

LayerZero extends BTC.b transfers to Avalanche

Alibaba announces partnership with Avalanche

Coinbase integrates native USDC on Avalanche

Monsterra expands to Avalanche

first level title

Potential and future prospects

DeFi Ecosystem

As I have pointed out many times in this article, Avalanche's DeFi ecosystem has made great contributions to the Avalanche public chain.

Currently, Trader Joe's has a huge impact on the ecosystem and leads innovation. There are also several projects such as BENQI, Platypus, Avascan, Avalaunch, Pangolin, GMX, Degis, Hashflow, Yield Yak, Vector Finance, and Colony that are working to attract more funding for Avalanche.

However, it should be noted that most DeFi projects on Avalanche are inspired by similar projects on Ethereum. We need more innovation, Trader Joe's Liquidity Book and Platypus' veToken model are prominent examples of how Avalanche native projects are developing innovative solutions.

Options protocols, social trading protocols, decentralized hedge funds, and index funds are some of the most requested projects in the Avalanche DeFi ecosystem.

subnet

Subnet technology is a "game changer" for the Avalanche ecosystem. Subnets are independent blockchain networks that operate within the Avalanche network. They allow users to customize rules, parameters, transaction types, or desired security levels at deployment time.

Subnets can be used for a variety of purposes, including:

Deploy a custom blockchain network

Create a permissionless environment for enterprise and institutional deployments

Allow dApps to own their own blockchain infrastructure without having to compete with others

It's clear that Avalanche's subnet will be the primary alternative for most projects as the entire crypto industry sees increased demand for dApp-specific chains (appchains).

vision

first level title

shortcoming

Although I'm a big fan of Avalanche, I know there are several shortcomings that limit the growth of the Avalanche ecosystem and prevent it from reaching its potential.

Competition between L1/L2

It's always good to have competition because without it no one can succeed.

I believe that with the fall of Terra/Luna and the fading of Solana, there is a chance for Avalanche to "take it to the next level". However, there are several L1 and L2 that may be threatening Avalanche's development.

First of all, Arbitrum's DeFi ecosystem is developing rapidly. One of the biggest threats to Avalanche is the launch of Trader Joe's on Arbitrum. It is clear that with the rise of GMX, Arbitrum has attracted many well-known DeFi protocols, and it continues to grow, which may pose an existential threat to Avalanche considering that the largest part of the Avalanche ecosystem is DeFi.

On the other hand, Polkadot and Cosmos with their respective parachains could be the main threats, considering that one of the strongest parts of Avalanche is the subnet. Therefore, the Ava Labs team needs to work harder to promote the subnet and attract better markets to compete.

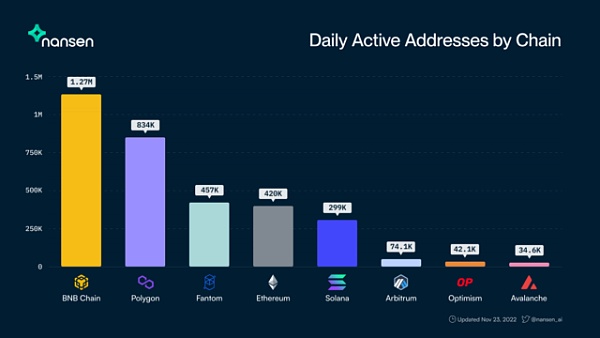

In addition, the growth of Polygon and BNB Chain is also an important threat to the Avalanche ecosystem, because they have more daily active users than Avalanche. This network effect that Polygon and BNB Chain have may harm the development of the Avalanche ecosystem.

Lack of daily active users

Nansen’s chart shows that Avalanche is not a top 5 blockchain protocol in terms of daily active addresses. While this stat isn’t everything, it’s important to consider, given that network effects can have a huge impact on the success of every project.

It should be noted that due to the lack of daily active addresses in the Avalanche ecosystem, this will hurt the gaming and NFT ecosystem.

And if the daily active users are only around 40,000, it will be difficult to attract agreements or users.

In order to increase the number of daily active addresses, we need to innovate and increase the number of successful games and NFT projects in the ecosystem.

Lack of gaming and NFT ecosystem

Obviously, Avalanche lacks competitive NFT and game projects in the ecosystem.

Although there are multiple game projects such as NFT Heroes, Shrapnel, Monsterra, Pulsar, etc., most of the game projects have not yet been launched and have not yet brought users into the Avalanche ecosystem. Considering the impact of Axie Infinity's user base at its peak, if the Avalanche ecosystem finds a project that can rival Axie Infinity, it will bring more users to the ecosystem. Therefore, we need to strongly support the game projects in the ecosystem, because they are the key to the mass adoption of Avalanche.

Also, it’s safe to say that Avalanche missed the NFT craze. Solana and Polygon have done well and created their respective NFT ecosystems on their chains. However, compared to these L1s, Avalanche's NFT ecology is very small. Also, the problem with Avalanche's NFT project is that, aside from the Plague Game and PONZ, no real innovation is happening right now.

As mentioned earlier, if the Avalanche ecosystem cannot increase daily active addresses, games and NFT projects may not be enthusiastic about building on Avalanche. However, we need solid NFT and game projects to increase daily active addresses. So this is a major problem that needs to be addressed.

need more innovation

Innovation in the DeFi ecosystem is one of the main drivers of Avalanche's development, such as Trader Joe's Liquidity Book. However, apart from DeFi, it is not easy to find real innovation at the public chain level.

I think the Avalanche ecosystem has a chance to be an innovative NFT chain. The understanding of NFT must change, because NFT is not only suitable for PFP, but they can be very effective gambling and gaming tools. In this regard, Plague Game and PONZ have shown the community a real innovation using NFTs. I truly believe that with more projects like Plague Game and PONZ, Avalanche's NFT ecosystem will thrive.

first level title

Avalanche's main narrative

Permissioned DeFi on Avalanche will grow significantly due to the need for institutions to comply with regulations. Here, Avalanche's success will benefit from subnet and Banff upgrades. Since the Banff upgrade, Avalanche allows custom subnets, and subnet developers can decide all parameters at build time.

dApp-specific chains (application chains) are one of the topics that crypto enthusiasts often talk about. Every popular project needs to develop its own dApp-specific chain. In this regard, Avalanche has an advantage over most L1s as it can provide the best dApp-specific chain experience across subnets.

Also, as always, lending will be one of the key components of DeFi, however, unsecured or non-cleared lending will be a catalyst for DeFi growth. Thanks to DeltaPrime and Savvy DeFi, the Avalanche ecosystem was able to succeed and attract more funds to come.

Additionally, as user adoption of DeFi applications increases, DeFi automation tools will gain a lot of attention as they will provide ease of use and capital efficiency, such as the CIAN protocol on the Avalanche ecosystem.

in conclusion

in conclusion

All in all, 2022 will be a very busy year for the Avalanche ecosystem as we see massive growth in DeFi, multiple partnerships and major developments. I believe Avalanche has great potential and will have a huge impact on the crypto industry in the years to come. There are several shortcomings that can be improved, especially for games and NFTs, but considering the potential of subnet technology, the vision of Ava Labs, and the innovation of the DeFi ecosystem, it is safe to say that the future of Avalanche is destined to be extraordinary.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.