Top 5 Predictions for the Ethereum Ecosystem in 2023

Original author:neworder

Compilation of the original text: The Way of DeFi

EigenLayer will be the most important innovation of Ethereum;

The bear market is not over yet;

EigenLayer will be the most important innovation of Ethereum;

Blob transactions will not fix scalability issues;

ZK-Rollups will not see significant traction in 2023;

ZK-Rollups will not see significant traction in 2023;

Layer 3 will be the real competitor of Cosmos;

image description

Image Credit: Generated by Maze AI

1. The bear market is not over yet

2022 is destined to be an important year for crypto. With institutional capital pouring into crypto-focused projects, exciting new financial primitives being developed, and its legitimacy as an asset class growing globally, the industry appears to have shifted dramatically. Unfortunately, these narratives have been overshadowed by the main story: a spate of financial misconduct, mostly at the hands of bad actors who wield power. Exposure to this widespread fraud, coupled with tightening monetary policy globally, has led the crypto market into a relentless bear market comparable to 2018.

For crypto, 2022 is the year of dominance by profit-seeking capital – entities that act as value extractors and players move from one opportunity to another, seeking excess short-term profits but with little interest in participating in the community or building There is no interest in future infrastructure. This exists for most stakeholders in the crypto space, from end users to liquidity providers to crypto VCs — all of whom are involved in various forms of rug-and-dumping. However, these three implosions put the industry in a bind:

Do Kwon’s Terra-Luna takes an inherently flawed algorithmic stablecoin model and bribes people to use it for artificial collateral gains. The decoupling of the algorithmic stablecoin wiped out $60 billion in market cap and emptied the savings of retail investors around the world.

Finally, the FTX exchange crashed when SBF embezzled customer deposits and lent them to his trading firm, Alameda Research. Multiple lenders went bankrupt due to losses as their FTT token plummeted, resulting in billions of dollars in losses.

looking to the future

So, what does this mean for the crypto industry in 2023? First, we expect the unwinding of FTX positions and widespread bad debt to continue to negatively impact the crypto market throughout the next year. Liquidity issues and bankruptcy issues may continue to be found in CeFi and DeFi services as bankruptcy and criminal proceedings progress. Second, the breach of trust involved in this bankruptcy will seriously hinder the regulatory process, investor activity, and consumer confidence.

looking to the future

Despite severe setbacks for our industry, we are optimistic about the future of crypto in 2023. While mercenary capital has taken a toll on our credibility, our industry is also full of dedicated builders who put a lot of sweat into this thriving Web3 world. These people are what we call "visionary capital" and are still building at a time when most of the industry's speculators have left. They have put in a long-term effort to bring Web3 to the cusp of its irreversible entry into everyday life. We see 2023 as the year of visionary capital and the year that cryptocurrencies transition from speculative investments to core components of society built around Web3.

To some extent, this shift is already underway. Between DeFi protocols integrating with traditional financial systems, DAO vaults amassing real-world assets, and traditional gaming companies breaking into Web3, one of the emerging narratives today is that the lines between decentralized solutions and the real world are blurring. This process will only continue, and 2023 is likely to be the year the Web3 project enters the mainstream.

Give a few examples. In an era where data breaches are ubiquitous, companies may start adopting decentralized identity technologies that allow users to self-custody their data. Consumer-facing applications of blockchain technology will emerge in media, where marketing, storytelling, and gaming will converge to create immersive, interactive worlds. By building blockchain networks on top of existing grids, utilities will be able to integrate distributed energy into new networks of new decentralized energy sources.

While none of this is news to crypto natives, these examples represent the introduction of a massive new user base and show that the closed world we've seen over the past decade is preparing to go public. Behind these fundamental changes to our daily lives will be a wave of technological developments that will enhance the crypto's capabilities and prepare it for its central place in metaverse life. These events are unfolding in real time and our expectations are summarized below, below are our predictions for how crypto and Web3 will leap forward in 2023.

2. EigenLayer will be the most important innovation of Ethereum

One of the most notable differences in blockchain development is the degree of permissionless activity that is possible between the infrastructure layer and the application layer. Infrastructure upgrades and changes lag the application layer because application deployments are permissionless while core network upgrades are permissionless. Consensus, core, sharding, p2p, and middleware layer changes are based on democratic votes of designated parties, while applications can be freely deployed and experimented with on the core consensus logic.

Established and well-capitalized network systems require careful risk analysis prior to core upgrades or changes. This results in innovative solutions to consensus problems and core obstacles being limited, or lagging behind the market. Once the system's sovereign trust network is established, the protocol will become very rigid, and it will be less easy to innovate and upgrade. When innovative consensus mechanisms or middleware layers such as Snowman, Chainlink, or Nomad emerge, it is not possible to use existing trust layers to run new networks in a permissionless manner.

Furthermore, new networks are often constrained by unavoidable capital boundaries. In order for a decentralized network to secure core consensus logic, the cost for malicious actors to self-enforce changes or control assets needs to be prohibitively high. Therefore, it is not enough just to have breakthrough technologies. Builders also need to find a large funding base for network security, which often becomes the biggest obstacle to infrastructure innovation.

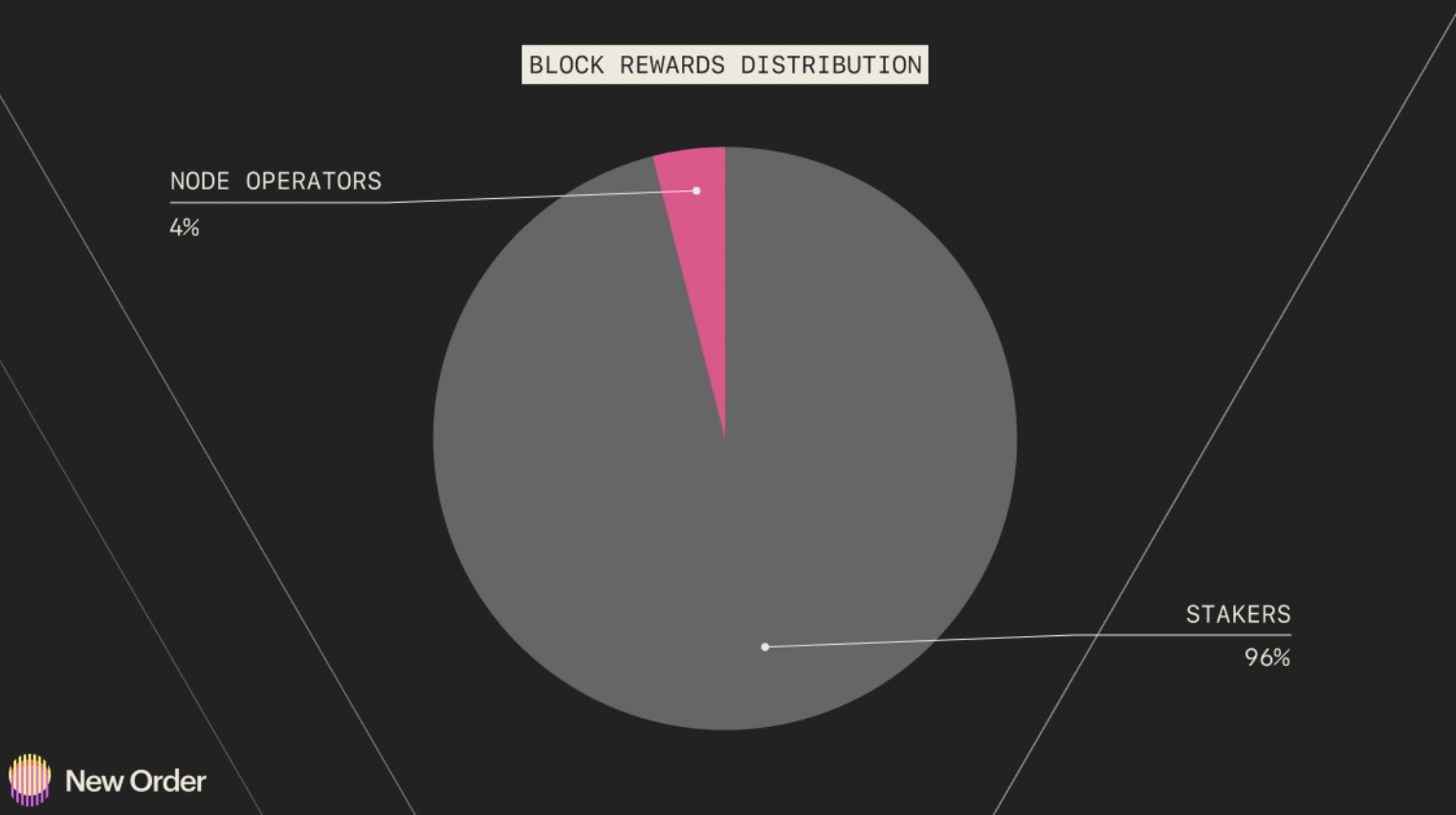

Reward distribution further highlights capitalization issues in network bootstrapping. In the Ethereum validator stack, 96% of the total rewards went to capital providers, while only 4% went to node operators. Far from being arbitrary, reward distribution reflects an implicit cost of capital in Proof-of-Stake (PoS) networks. The risks inherent in staking volatile assets for network security are fundamentally more expensive than running general-purpose nodes that can be repurposed.

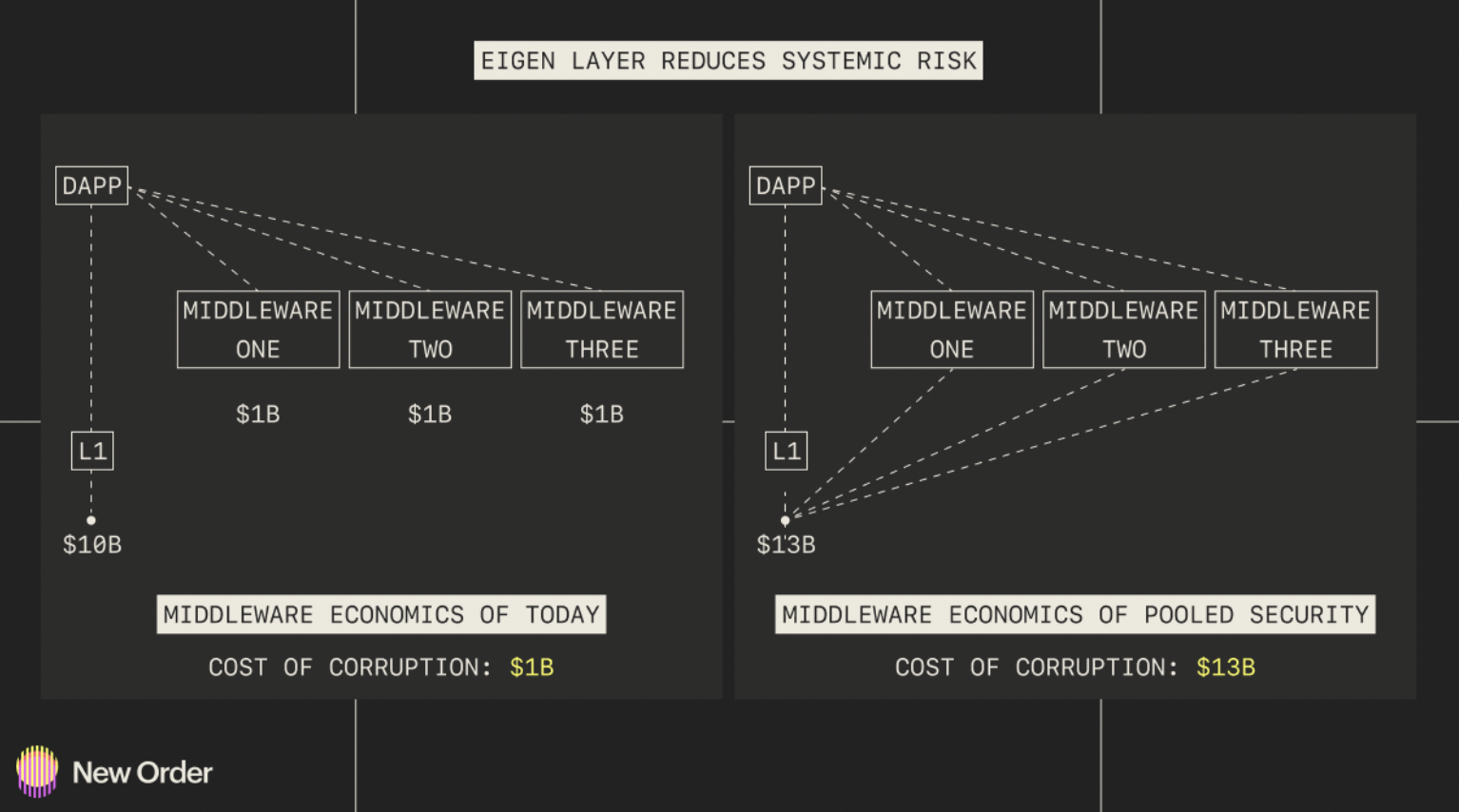

It is worth mentioning that the security of bootstrapping core infrastructure is the first consideration for decentralized networks. That being said, applications built on top of it will always be limited by the least secure denominator in their infrastructure stack. Applications that include middleware layers such as cross-chain bridges and oracles secured by their own sovereign trust network are reducing the overall security of the system down to the least secure dependencies.

In order to resolve the core divergence of innovation from the infrastructure to the application layer, EigenLayer introduces a simple but extremely effective solution to the problem of excessive capital costs: re-staking.

Methods of EigenLayer

EigenLayer is a smart contract layer on Ethereum that allows users to leverage existing trust networks to secure other core infrastructure and middleware layers through the use of restaking. At its core, re-staking is leveraging the same staked ETH used for Ethereum network validation to secure other networks. This allows ETH stakers greater flexibility in staking capital while extending the trust layer to peripheral infrastructure such as sidechains, middleware, and even other non-Ethereum networks.

EigenLayer is introducing a two-way marketplace where ETH stakers can serve networks that require a layer of trust. This enables the new network to reduce the cost of network security while gaining access to a huge pool of funds. In effect, this removes the least secure denominator problem at the application layer. The oracle and cross-chain bridge network will gain security and trust from the same infrastructure layer on which the application itself is built. EigenLayer allows for the consolidation of trust, ultimately improving the security of all networks that interact with this layer. For example, a new entrant into the field of asset cross-chain bridges can interact with EigenLayer and immediately gain access to a $18.7 billion secure foundation.

Given that ETH stakers do not incur any marginal capital cost when validating other networks, re-staking greatly increases the range of possibilities for stakers. Of course, EigenLayer does have some leverage and slashing risk, because in the event of malicious behavior, the underlying staked assets may be slashed across multiple secure networks. Whenever the same funds are used to validate multiple networks, the asset base is inherently leveraged, opening the system to potential cascading.

Forfeiture risk is complex and can lead to contagion. Losses due to malicious behavior or downtime inherently reduce the security considerations of all proven networks. If not controlled or limited, this contagion can have adverse effects on the system architecture. At launch, EigenLayer will introduce prudent leverage guidelines and limits to ensure the stability of the trust system.

EigenLayer is also developing a data availability layer for Ethereum called EigenDA. This layer is similar to the current darksharding specification and includes features such as Data Availability Sampling (DAS) and Proof of Custody. However, EigenDA is an optional middleware, not a core component of the protocol. As a middleware layer, it can be stress tested without the need for a hard fork, which offers several advantages: permissionless experimentation with the DA layer, and allowing validators to participate on an opt-in basis. If the implementation of pseudo-danksharding is successful on EigenDA, it could become the de facto DA layer for all optimistic and zk-rollups built on top of the Ethereum ecosystem ahead of the long process of Ethereum-level protocol changes.

During the protracted 2022-2023 bear market, liquidity is expected to continue to seek safety within Ethereum, further solidifying the network as a safe haven and central trust layer for crypto. The security race will further expand Ethereum's capital base, widen the gap between alt-L1s, and drive the cost of capital for new natively validating networks to prohibitive levels.

3. Blob transactions will not solve the scalability problem

image description

https://ycharts.com/indicators/ethereum_chain_full_sync_data_size

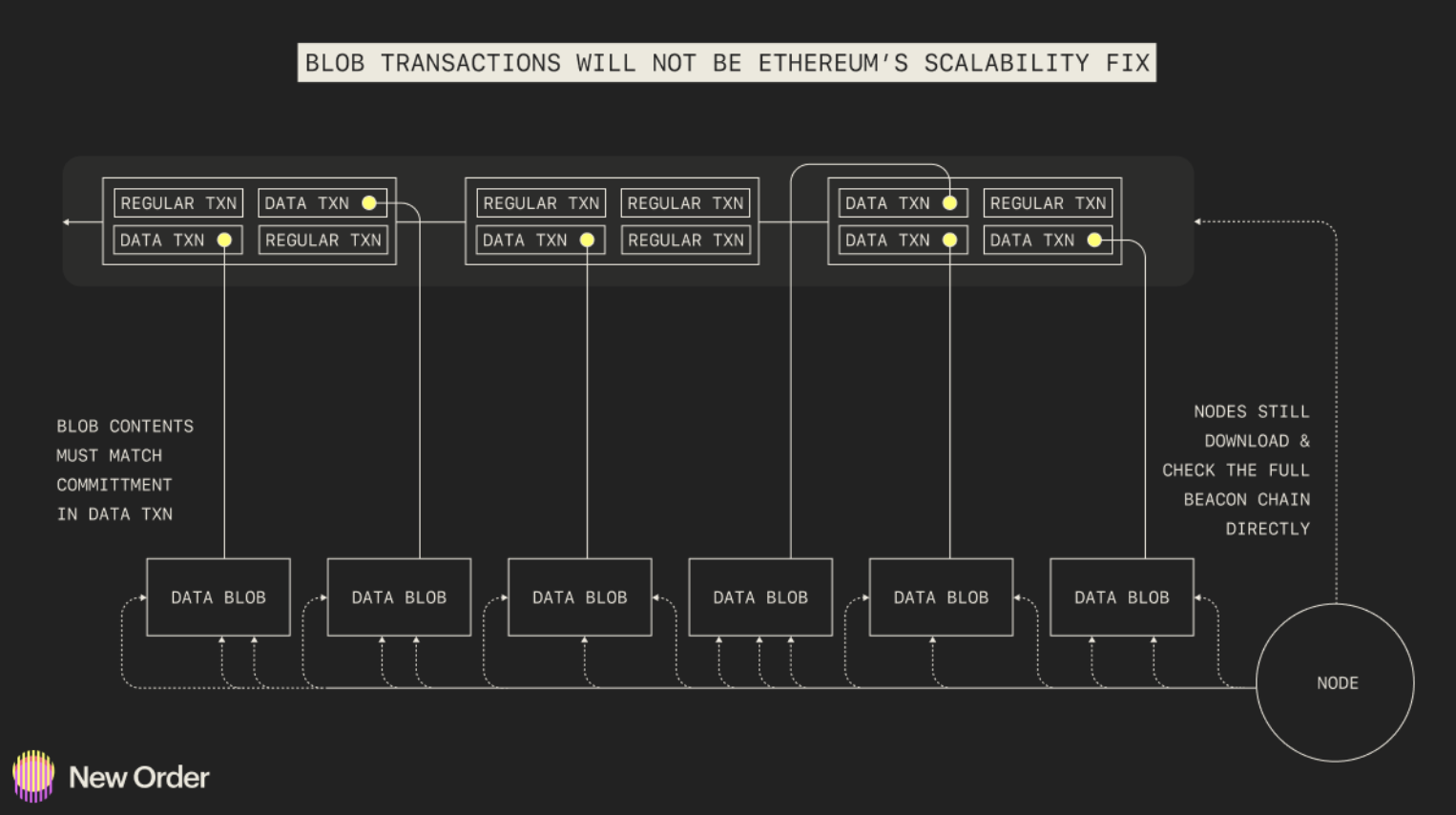

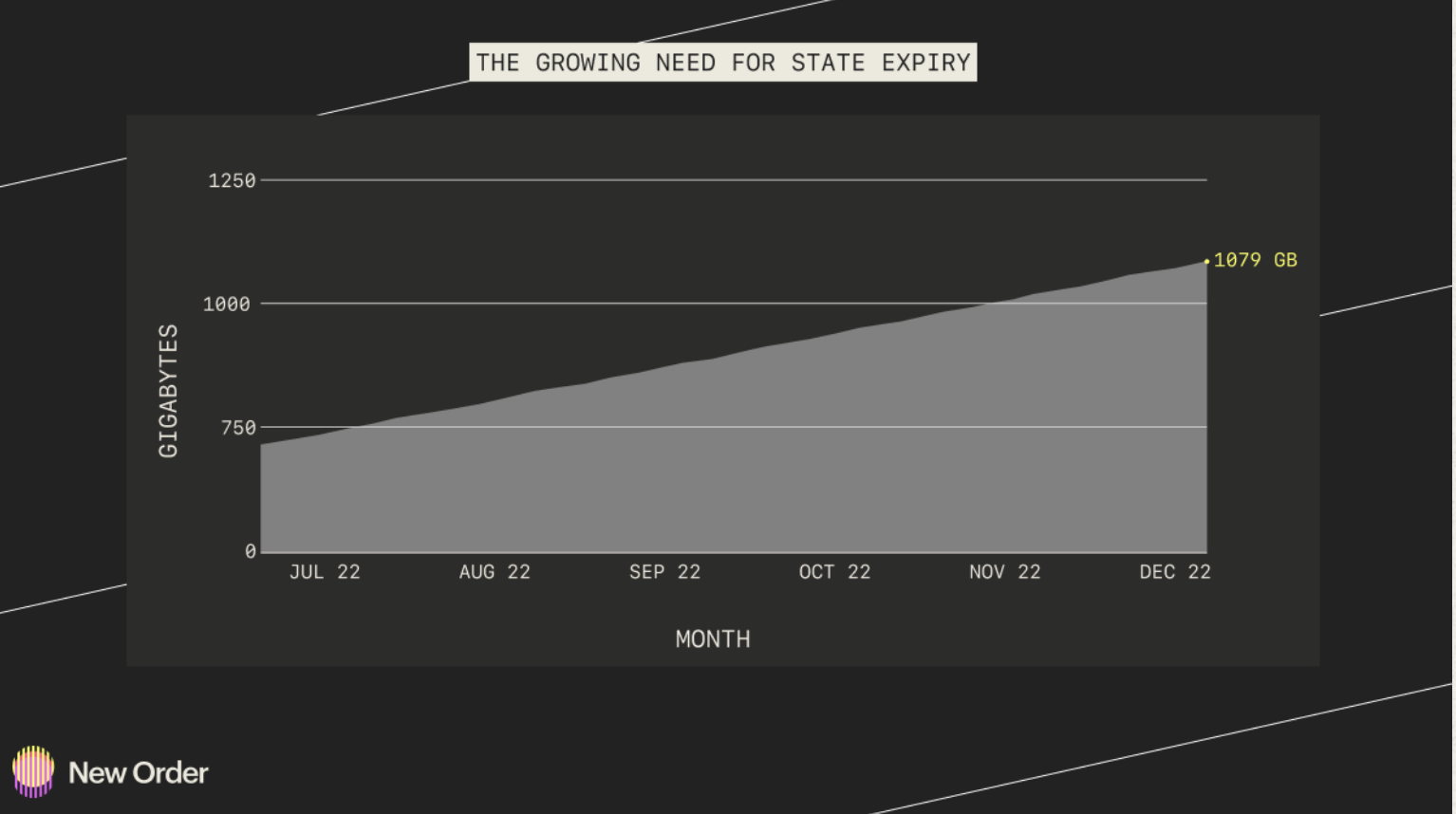

There is also the problem of actual gossiping of blob transactions on a peer-to-peer (P2P) network, since these blobs are much larger in size than anything that is currently being gossiped. This requires further research, which Paradigm is currently exploring. It will be interesting to see what happens with this, and whether the Ethereum network can handle this further state bloat and data. Regardless, state expiration is likely needed to limit the growth of the Ethereum state - currently at an insane 1079 GB for blockchain full sync, and growing daily. State expiration will be achieved through state rent, so state can be leased to off-chain storage, or by monthly or weekly deletion of state and then stored on archive nodes (unfortunately, they are very centralized at this point) .

image description

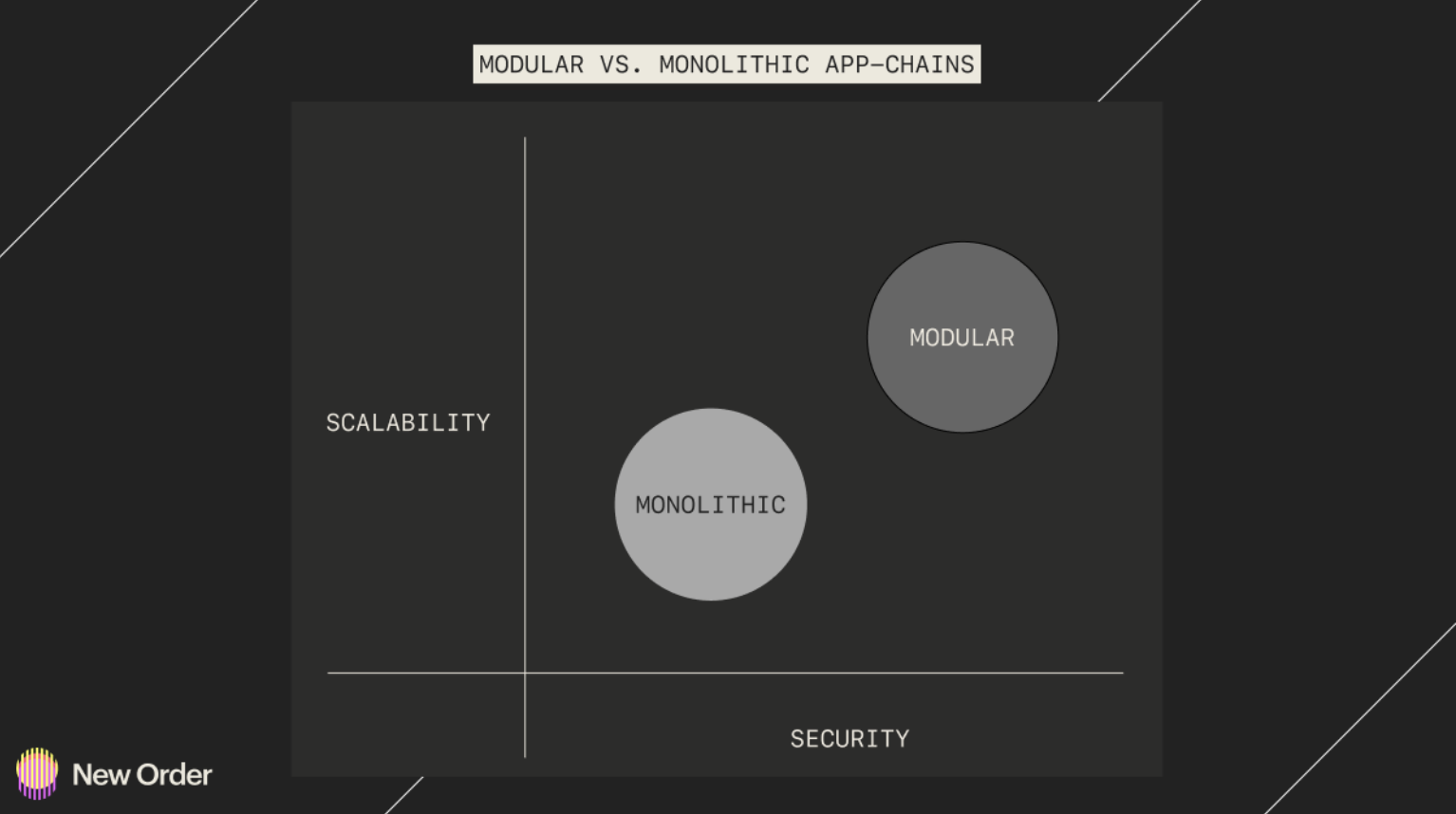

As it becomes clear where Ethereum and many L1s are positioned over the next few years, it becomes apparent that in order to remain decentralized and "fit with the times", they must move to modularity.

4. ZK-Rollups won’t see significant traction in 2023

ZK-Rollups will not gain significant traction in 2023 because they are not production ready and cannot be fully decentralized. For production readiness, we specifically mean their VMs and proof times for proof.

It is expected that many cross-chain bridges will start using ZKP for interoperability purposes, and some of them are already moving in this direction, including Wormhole, Polymer, and ZKBridge collective.

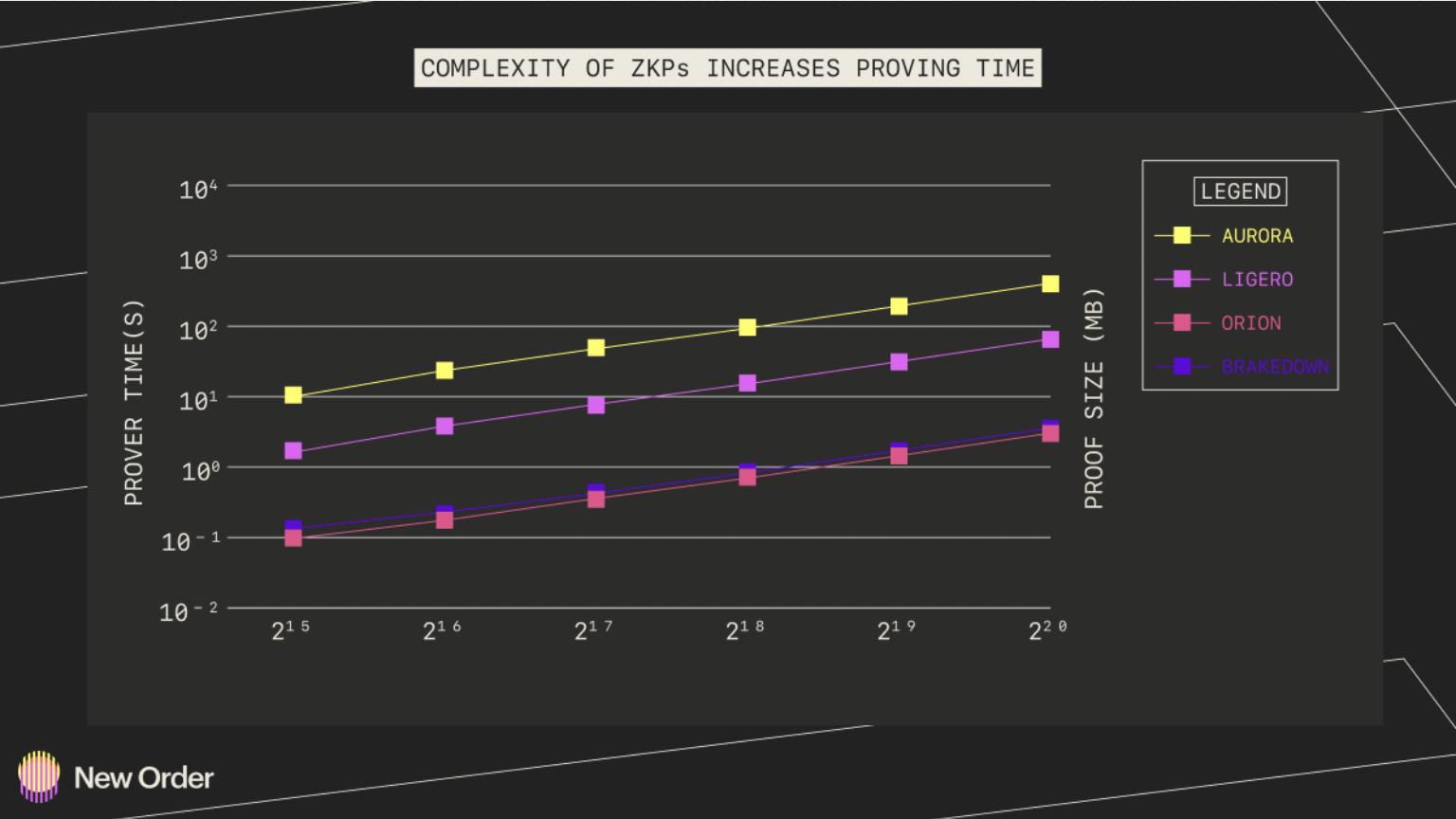

image description

https://eprint.iacr.org/2022/1010.pdf

Many existing ZK schemes and algorithms with compact proof sizes incur high overhead during proof generation time (also known as proof), which limits their efficiency and scalability. To address this, projects such as Supranational, Ingonyama, and DZK are working to improve the efficiency of proof generation. However, it is important to realize that this hardware acceleration is only part of the reason for efficient proofs. Optimization needs to be done at the algorithm level, software level and other aspects. It is also important that the described system remains sufficiently decentralized, which is difficult to achieve in practice.

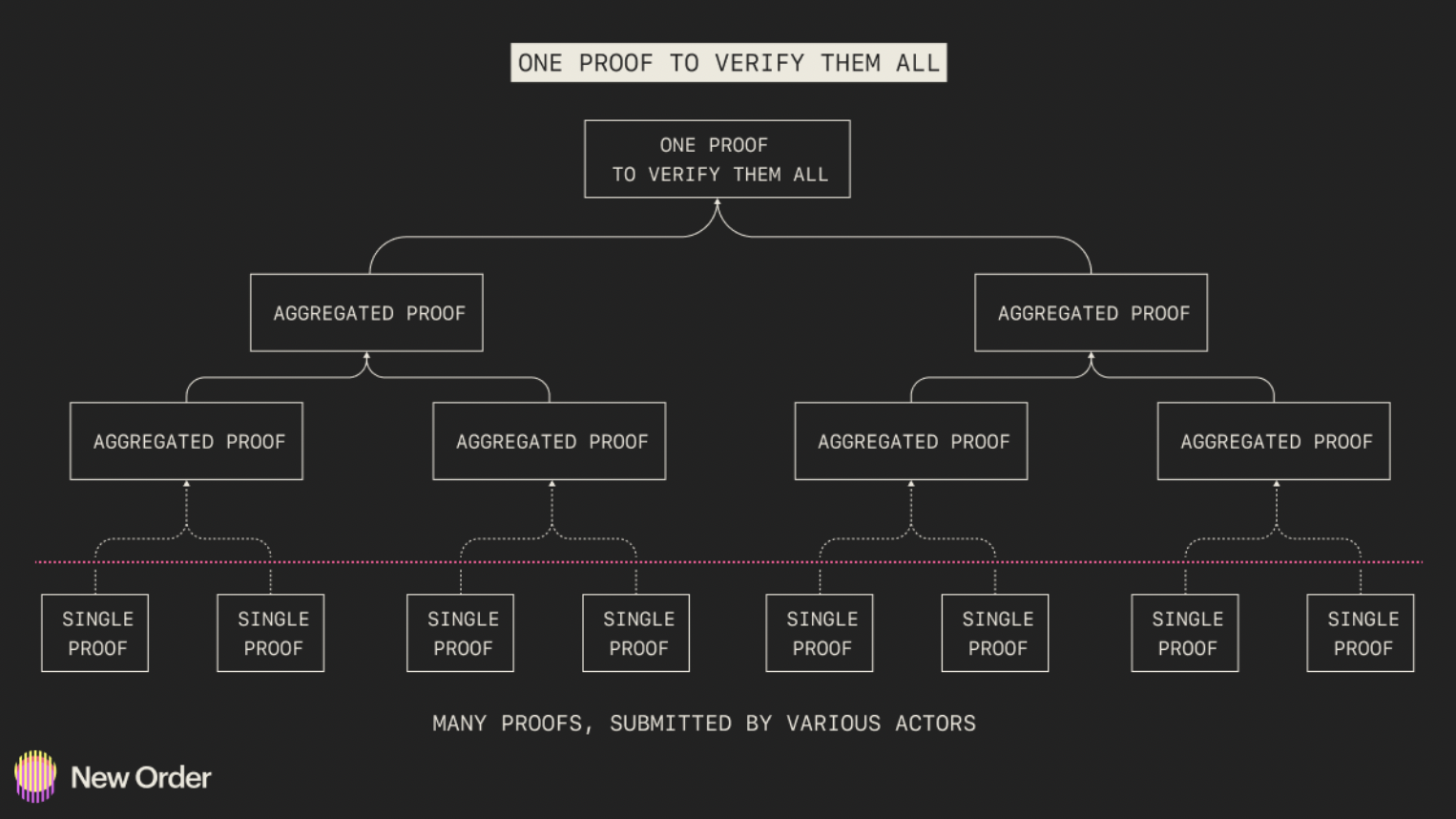

image description

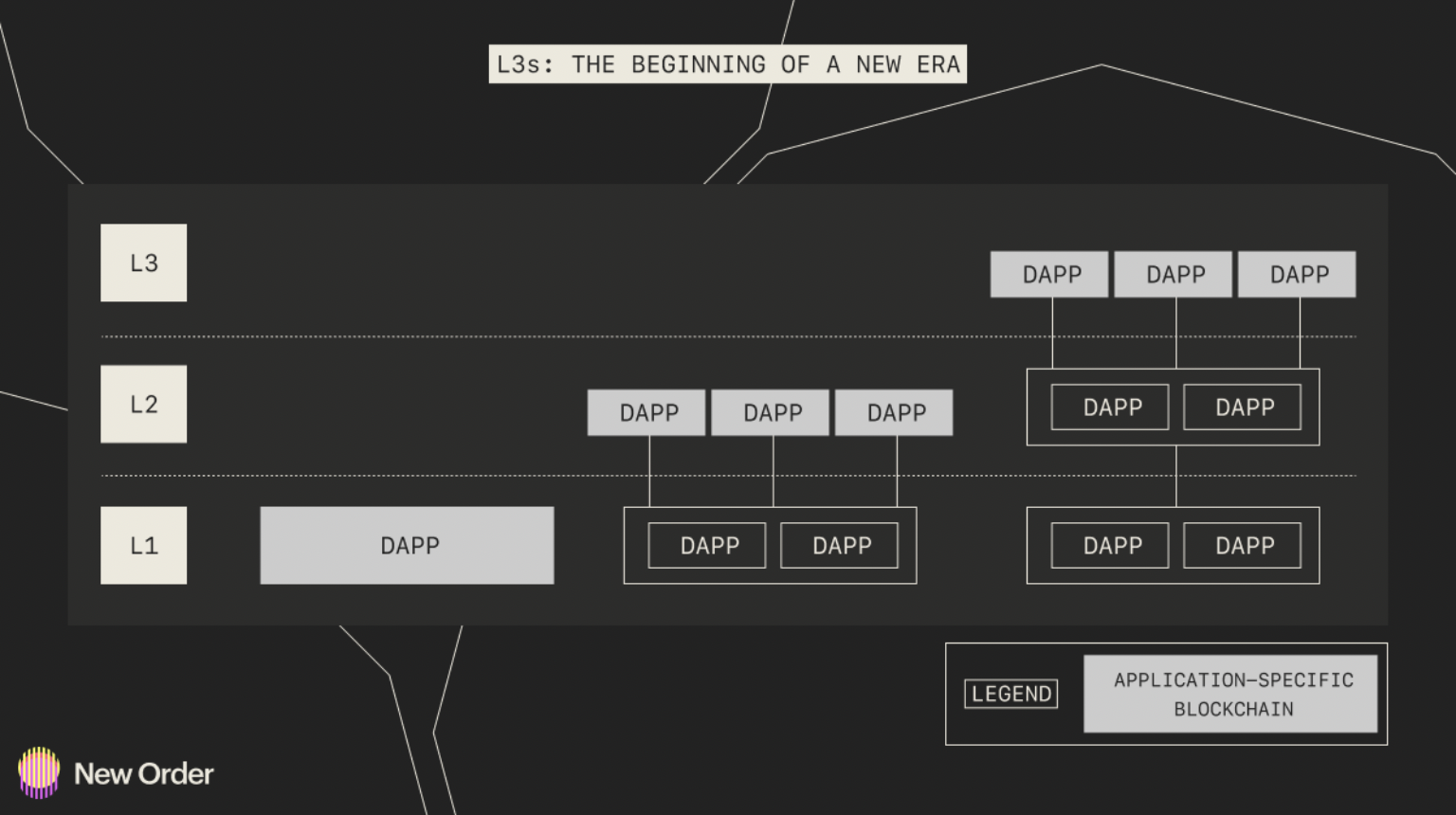

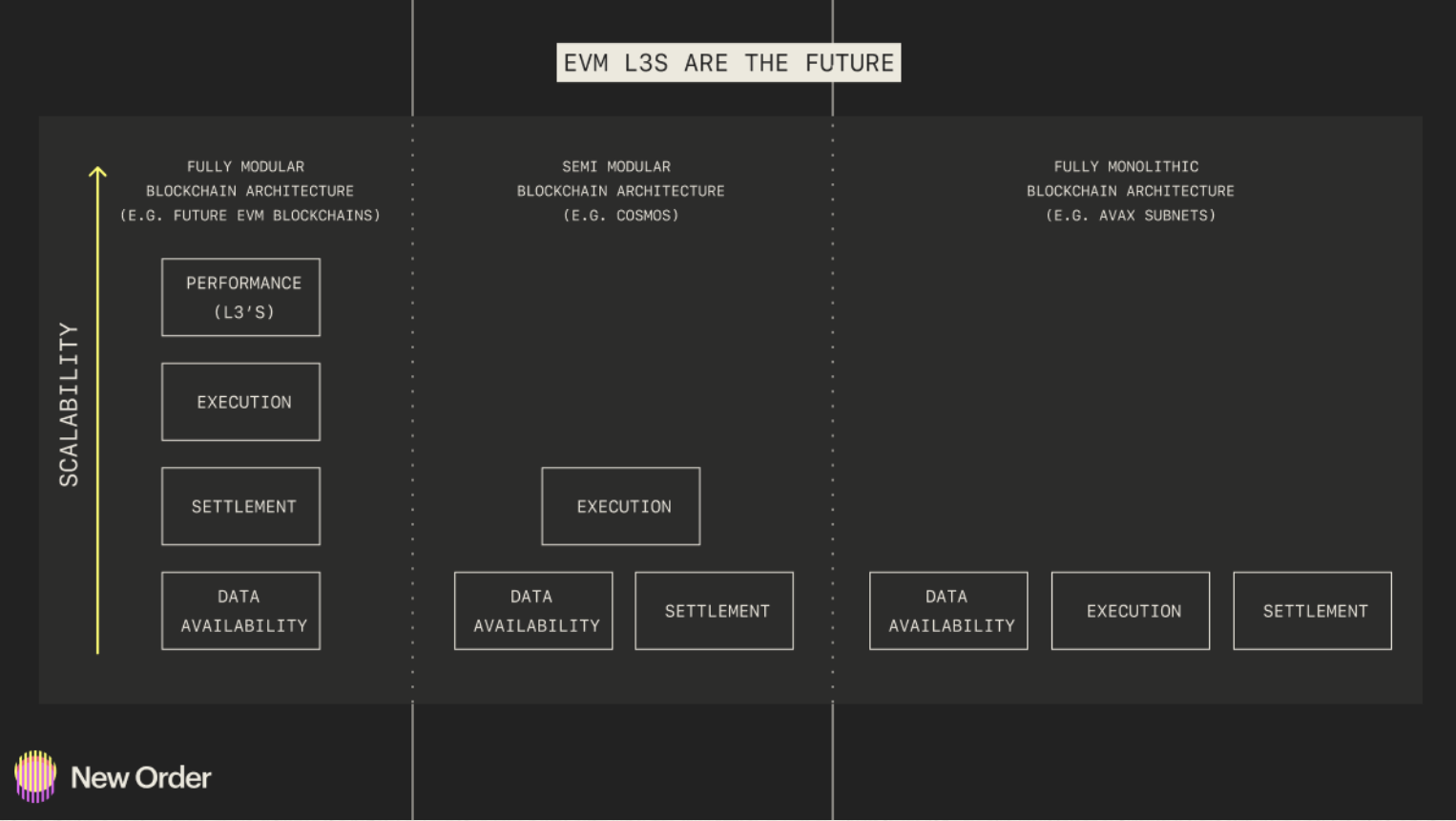

5. Layer 3 will become a real competitor of Cosmos

https://medium.com/1 kxnetwork/application-specific-blockchains-9 a 36511 c 832

Layer 2 (L2) improves the scalability of Ethereum by reducing gas fees and increasing throughput. Because of these scalability factors, and the trade-offs that exist, L2 must choose to optimize for a specific project. Layer 3 (L3) is an application-specific blockchain built on top of L2 that aims to alleviate these tradeoffs and make more improvements. They are similar to application chain environments such as Cosmos, Avalanche and Polkadot, but benefit from being built on a modular blockchain protocol stack instead of a monolithic chain protocol stack. Therefore, deploying a fully modular blockchain infrastructure stack, including a generic L2 as well as customizable L3, will mark the end of the era of monolithic appchain ecosystems and the beginning of a new era of decentralized application development.

image description

Monoliths are currently the preferred choice for many applications, as this allows them the freedom to create custom logic and smart contracts while achieving better execution. Additionally, Liskchains have their own block space, so they don't have to compete with other chains on execution. But that's not as efficient as it could be. Using monolithic blockchain architectures such as Lisks built on modular software (e.g. Cosmos) or as fully monolithic Lisks (e.g. Avax subnetworks) limits their ability to reduce transaction costs and increase computational throughput.

In contrast, Lisks built on fully modular blockchain protocols reduce unnecessary friction as they can leverage optimized blockchain layers built for specific functions. Suppose you compare a L3 built on zkSync (L2) with Celestia for data availability and Ethereum for proof of settlement and consensus with a monolithic appchain combining all or some of the layers. In this case, the only way forward is to build modularly for better scalability while preserving decentralization.

It is worth noting that the measure of these benefits exceeds what is theoretically achievable by a monolithic application chain. For example, L2 costs 100 times less than L1, and L3 costs 10,000 times less than L1. zkPorter L3, which zkSync is building, improves scalability by reducing fees by ~100x, and max TPS of 20,000+. L3 not only offers improved performance, but also the ability to be customized for specific purposes. This includes adding privacy features when using ZKPs, designing custom DA models, and enabling efficient interoperability solutions.