Multi-case analysis of token economy design ideas

Original Author: Murph@THUBA Core Member

Summary

Summary

Token is a measure used to manage and motivate encrypted assets, which can promote the distribution of project benefits, influence user behavior expectations, and promote ecological development. This article explores the ideas of token economy design through the analysis of multiple cases. The article structure is as follows:

Assess the business value and choose the appropriate north star indicator

Design incentives, use Tokenomics to motivate and punish corresponding behaviors

Choose single-token vs. multi-token, usually Multi-token can help separate different purposes such as governance and games

Choose the realization model and consider whether it is a homogeneous commodity

To solve the flow rate problem, improve the token Holdability

Design unlocking plan and token distribution

Tips: Issuing tokens needs to consider compliance and the intrinsic value of tokens; tokens are not zero-cost, so don’t overdraw costs prematurely; match expenditure and income reasonably to avoid leaving only speculators in the end.

1. Business evaluation

1.1 Project value

The Product

What products and services are offered to help meet basic customer needs?

What ancillary products and services help customers function?

Are products and services tangible, digital/virtual, intangible or financial?

The Pain Reliever

Does the product make customers feel better?

Did it solve the customer's difficulties?

Has customer risk been eliminated?

Are common mistakes made by customers limited or eliminated? (e.g. usage errors, ...)

Have barriers to customer adoption of the solution been removed?

The Gain Creator

Did the results meet or exceed customer expectations?

Is it better than current solutions that satisfy customers?

Does it make the customer's work or life easier?

1.2 Develop North Star Metrics

North Star Metric (North Star Metric), also known as the only key indicator (One Martric That Matter, OMTM). The reason why it is named after the Polaris is that after it is established, it guides the whole company in this direction like the Polaris.

A good north star indicator can achieve a balance between business goals and user value, while taking into account the long-term and short-term development of the enterprise.

The essence of a business is to make money, so is it okay to directly choose revenue or profit as the North Star indicator?

In theory, it’s not impossible, but revenue is not a good North Star indicator. Because revenue has a strong lag; if revenue is considered one-sidedly, user experience may be ignored; if the company does not have a clear revenue model in the growth stage, it is impossible to directly set revenue or profit as the North Star indicator.

Web2

Uber: rides per week

Not the number of users or the number of cars on the road, but the number of matches that actually occurred

Hubspot: Number of active teams per week

More than just keeping users on the platform, the most sticky users come from teams, so metrics revolve around collaboration

Spotify: Total minutes of music listened to by users

Amazon: transaction order volume; Spotify: how many minutes of music the user listened to in total

Airbnb: Number of nights booked

Not the number of properties listed, the number of people looking for a listing, but the number of actual connections

Web3

Uniswap: Daily Active Users

Coinbase: monthly transacting users

Algorand: Total weekly on-chain transactions

2. Incentive design

2.1 Develop behaviors that require incentives

text

2.1.1 Helium——Project Introduction

text

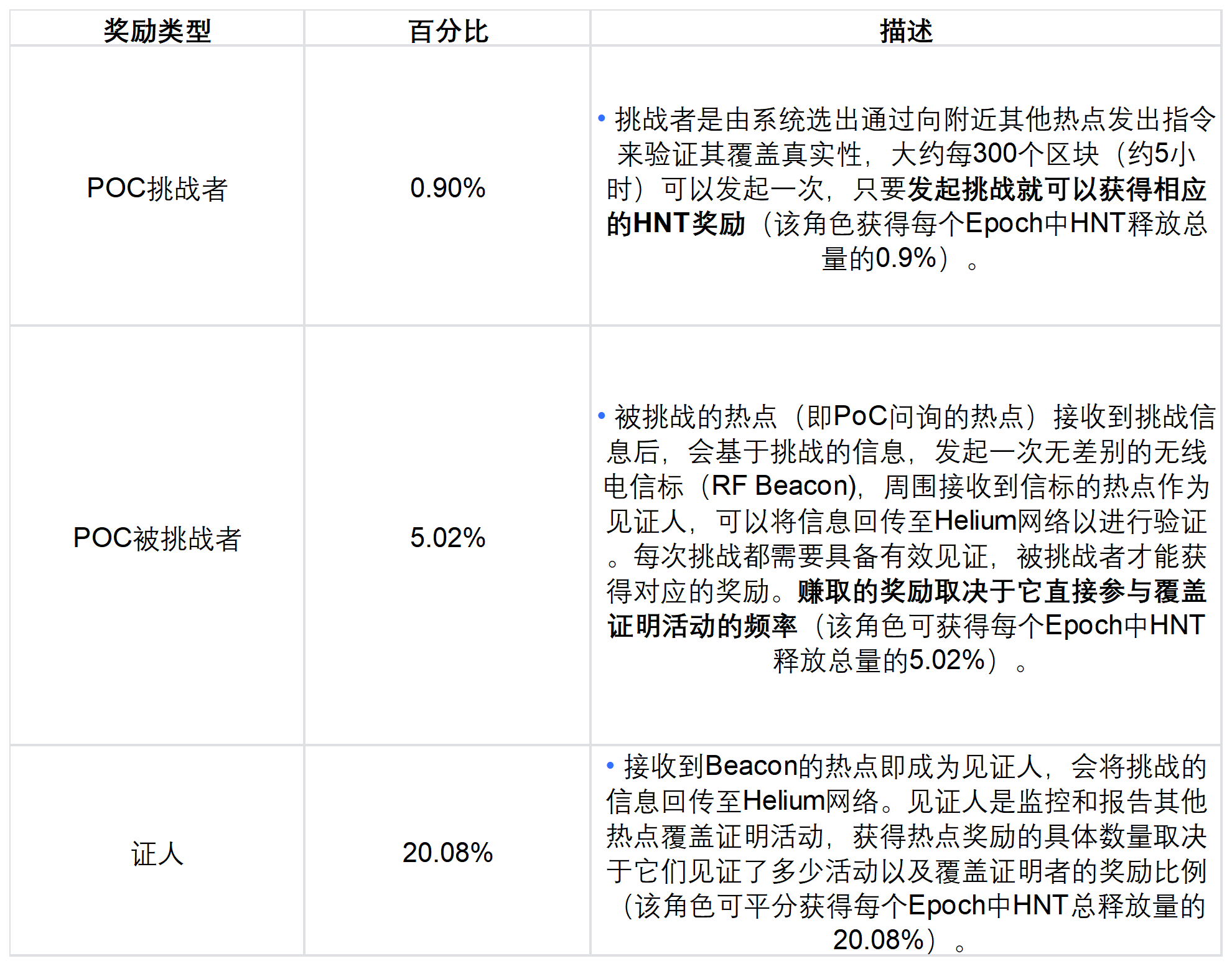

2.1.1 Helium - Motivating Behavior

text

2.1.1 Helium - specific measures

text

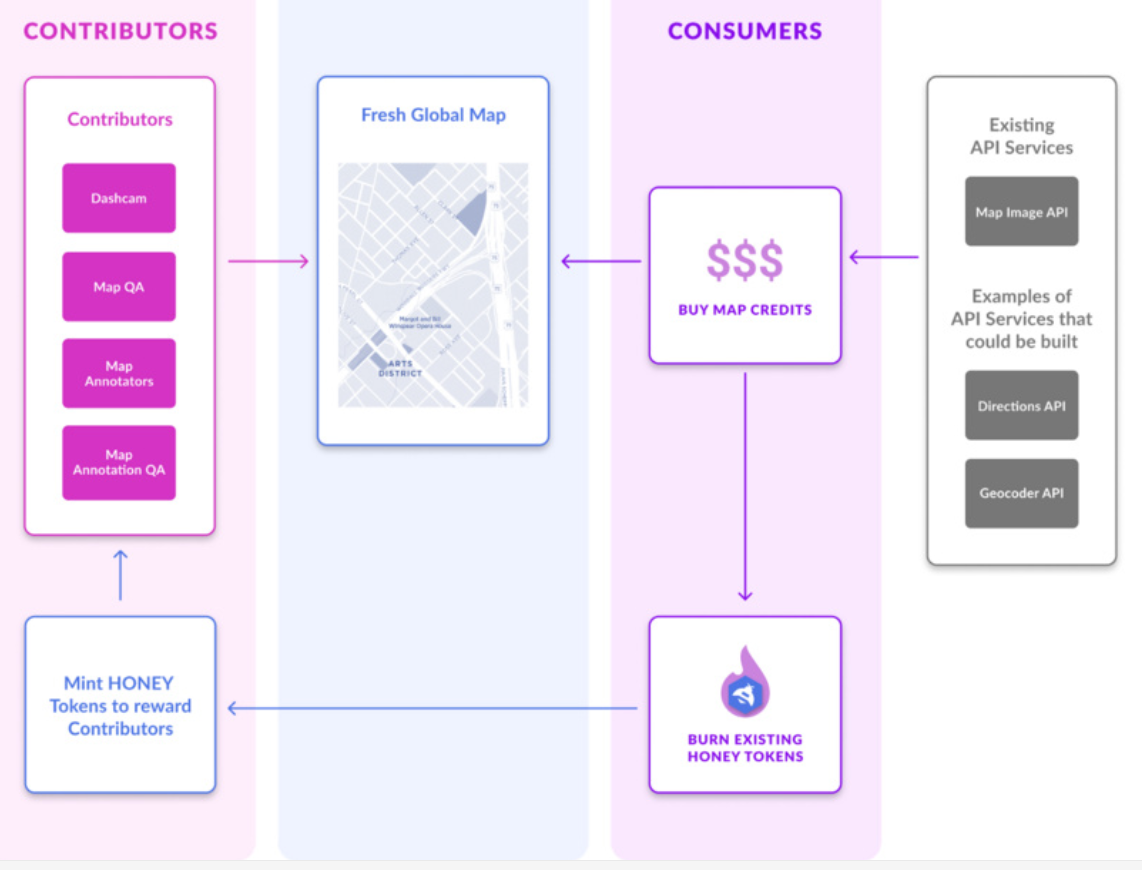

2.1.2 Hive Mapper——Project Introduction

Hivemapper is a blockchain-based map network that wants to create a decentralized global map that rewards contributors. Contributors can collect data by installing Hivemapper's driving recorder, and can earn local Token HONEY as a reward. The Hivemapper network mapped more than 1.67 million kilometers of roads in 10 months, covering nine regional markets.

text

2.1.2 Hive Mapper - incentive behavior

text

2.1.3 Hive Mapper - specific measures

Quality: The project creates a reputation score driven by the quality of uploaded data. For example, users can install a camera in the car, and the uploaded photos will cause glare, and the network will obtain the data, but give these data less rewards. Higher reputation scores can be earned when users mount the camera outside the car to capture higher quality images. At the same time, the rewards obtained by users are linked to their reputation scores, and their reputation rolling average is higher, resulting in higher rewards.

Timeliness: Data only needs to be obtained again when the road changes. To ensure street information is up to date, the project creates what it calls a freshness score. They essentially create a function that increments over time intervals, say a user drives around and collects data on the streets in January, and then no one collects data for a full year. The next person to try and upload new data gets a higher multiplier. The freshness of the data on the map is thus facilitated.

secondary title

text

2.2.1 File Coin——Project Introduction

text

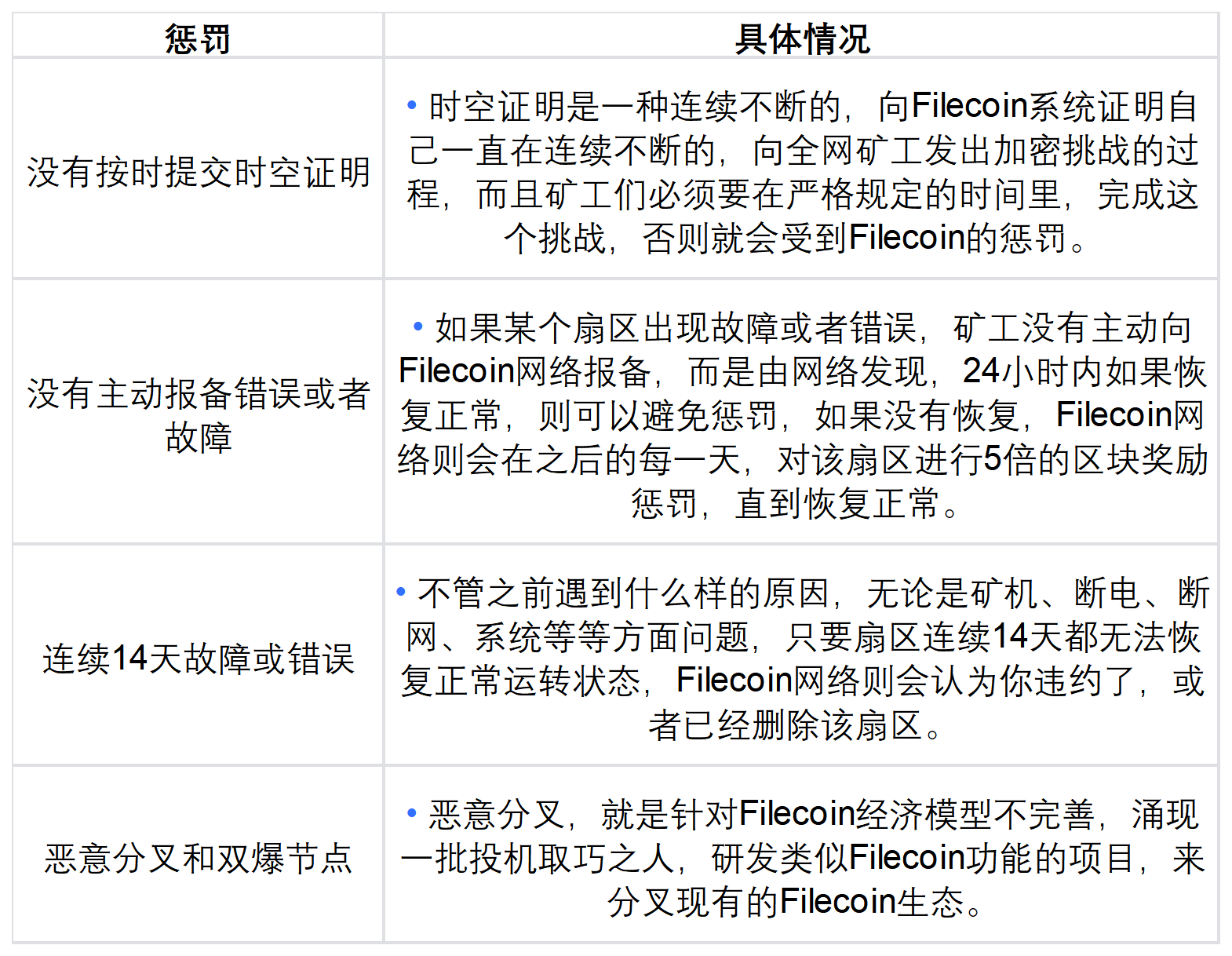

2.2.1 File Coin——Behavior that needs to be punished

text

2.2.1 File Coin——Specific Measures

text

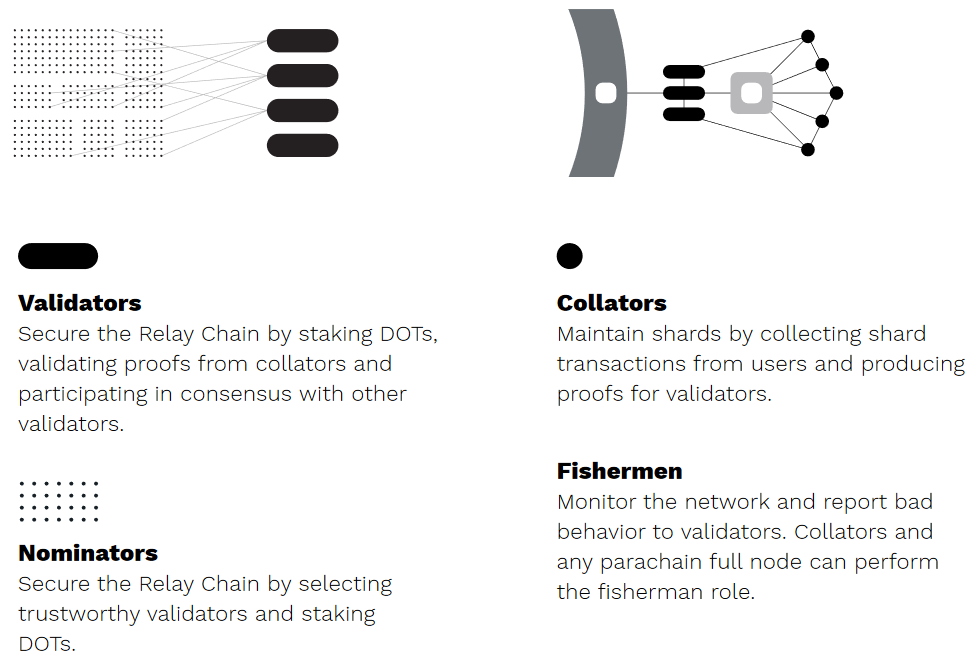

2.2.2 Polkadot - Project Introduction

Polkadot is a scalable heterogeneous multi-chain system. It does not provide any internal functional applications. Polkadot is the underlying foundation. Various public chains are built on top of it, and various applications are built on top of it.

text

2.2.2 Polkadot - Behavior that needs to be punished

text

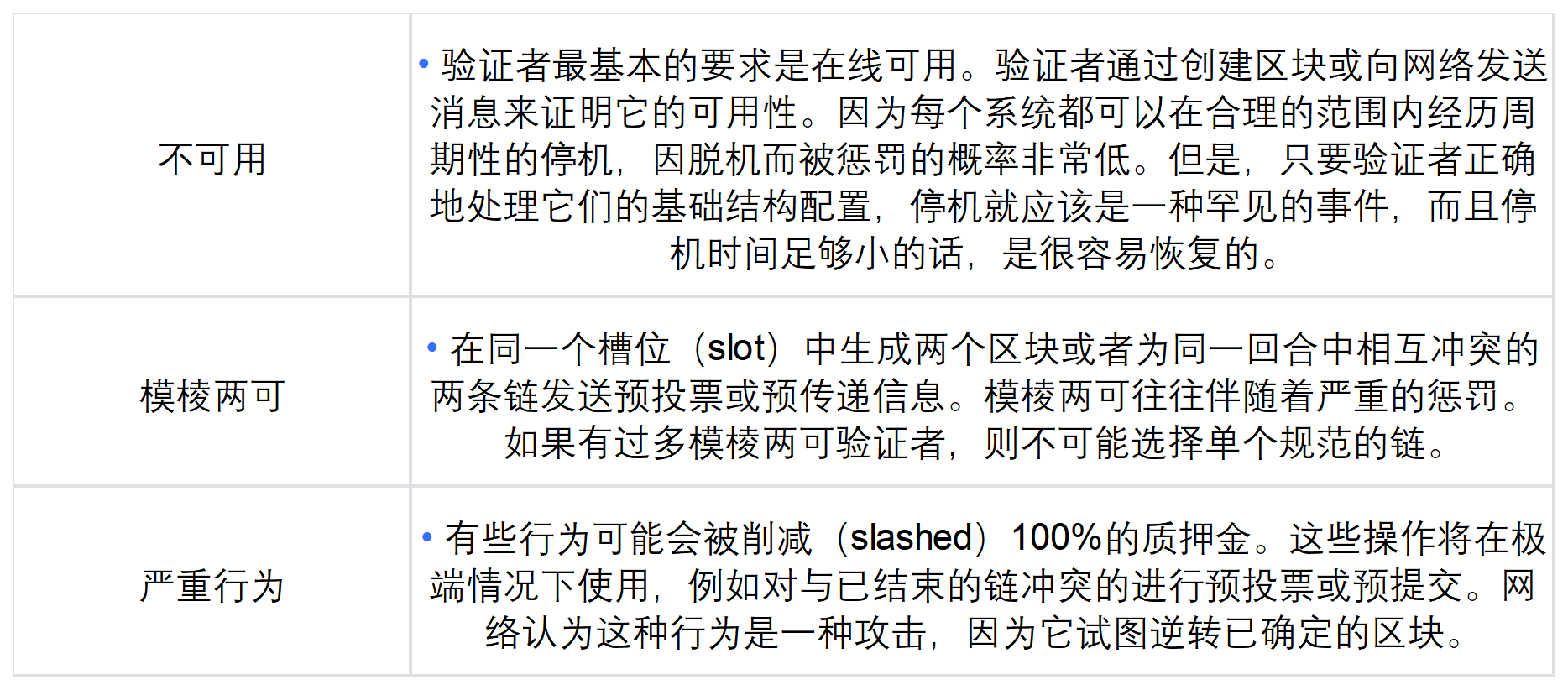

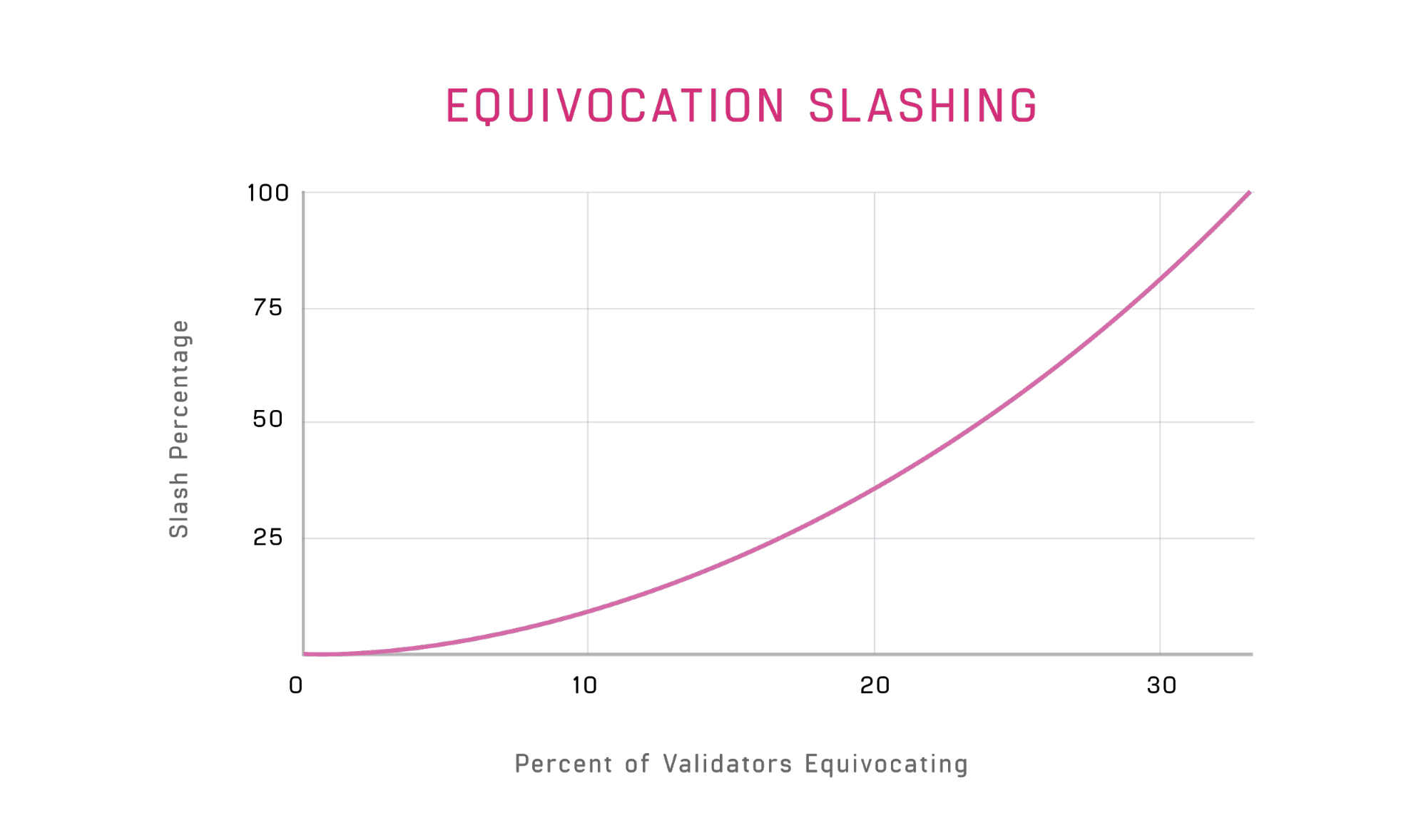

2.2.2 Polkadot - specific measures

Slashing is a punishment for those who do not follow the rules. The security of the network requires that the penalties for attempted attackers be large enough to prevent attacks from occurring.

first level title

3. Single currency vs. multi-currency

Advantage:

Advantage:

It is easier to understand for users, investors, and the market, and it is easier to finance or similar to market promotion

Disadvantages:

Almost impossible to optimize for all possible use case situations

Advantage:

Advantage:

Professionals can leverage multi-tokens to decouple different functions such as governance, spending power

For example: separate speculation from the game economy ecology. When launching any product in the cryptocurrency world, people tend to speculate on it in order to get outstanding returns as soon as possible. Separating speculative and gaming tokens prevents investment surges from triggering price spikes in the in-game economy.

Users have unlimited creativity, and the system can have hundreds of tokens

Disadvantages:

Project Introduction

3.1 StepN

Project Introduction

text

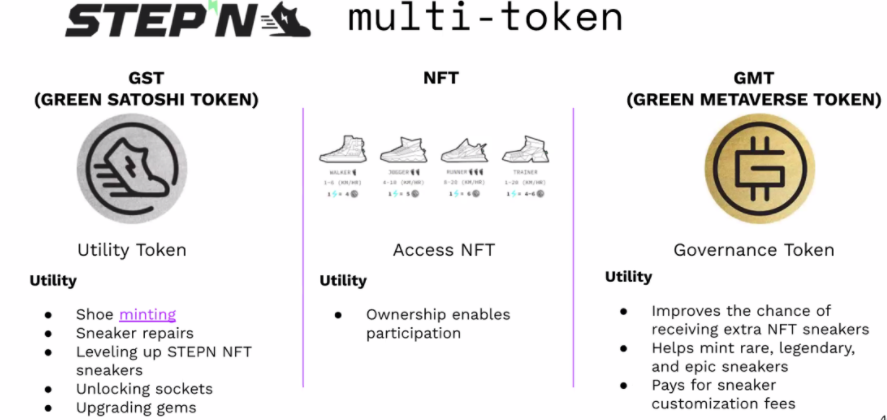

token design

Entry NFT: Before entering the game, users need to use SOL to buy or rent a pair of sneakers. Of course, this is not a pair of real shoes, but an NFT. Each pair of sneakers has four attributes: efficiency, luck, comfort, and elasticity, which correspond to GST income, drop of the mystery box, GMT income, and the decay rate of durability.

GMT: Governance token, primarily used for voting, but also improves chances of getting additional NFT sneakers, including rare and rare ones.

GST: Trading tokens for shoemaking, sneaker repairs, stepn NFT sneaker upgrades, unlocks and upgrades.

Project Introduction

3.1 Maker Dao

Project Introduction

text

token design

Maker is a smart contract system on Ethereum that provides the first decentralized basic stable currency Dai (which can be simply understood as the dollar on Ethereum) and a derivative financial system. Dai is issued through full mortgage guarantee of digital assets, 1 Dai = 1 US dollar. Dai has been pegged to the U.S. dollar since its launch in 2017.

first level title

secondary title

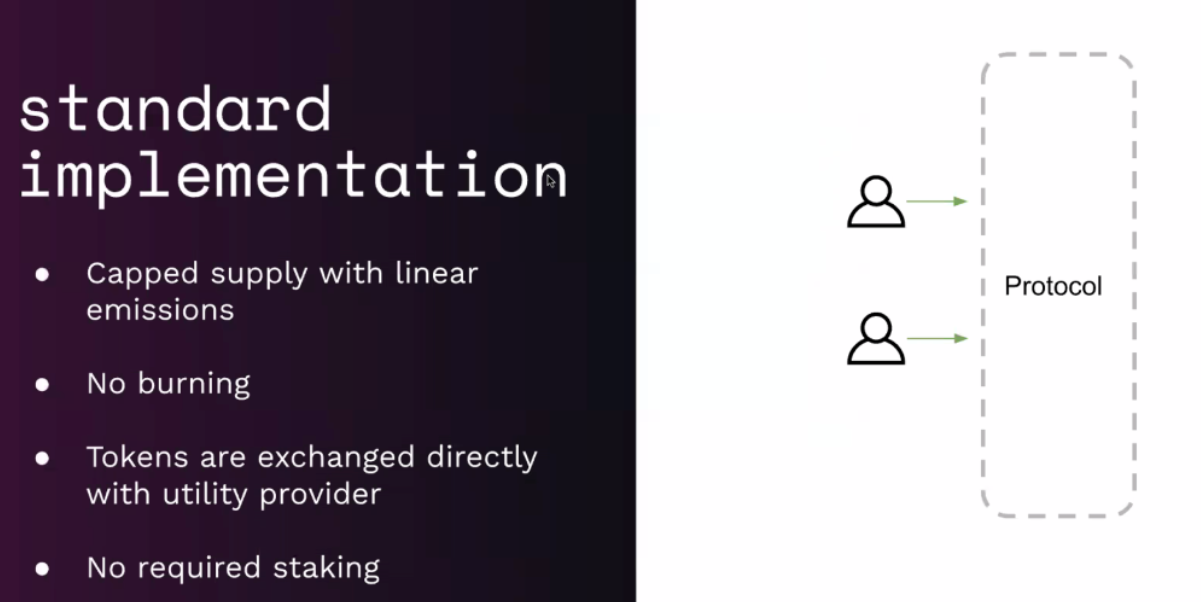

4.1 Standard implementation

secondary title

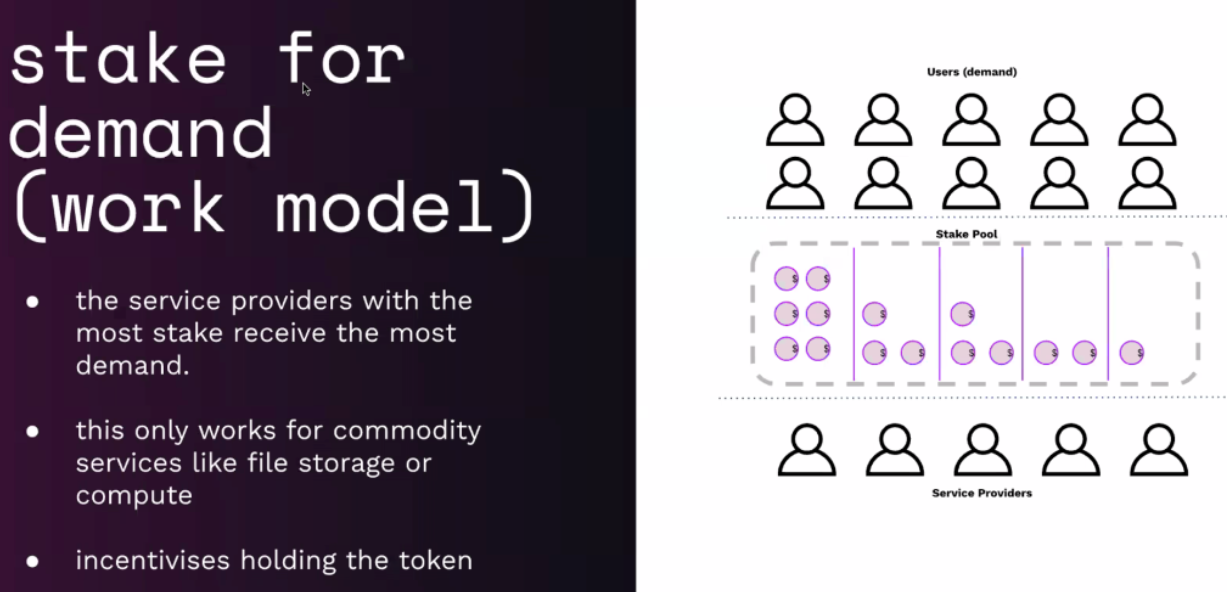

4.2 Stake for Demand

Using File Coin as an example, assume that everyone provides basic file storage commodity services. The users with the most stake have the right to get the most demand, so they are entitled to the most earning power, so if a user is willing to hold the most tokens, he will get the most business.

secondary title

4.3 Minting and Burning

A user burns X tokens for a service, and the protocol mints Y new tokens and distributes these tokens to service providers.

The Burn and Mint Equilibrium (BME) model uses two token systems: payment tokens and value-added tradable tokens. Factom pioneered the BME model, where users must burn "seeking value" tokens in order to receive "payment" tokens.

Unlike the work token model, in the BME model, tokens are the payment currency for ownership. But unlike traditional title payment currencies, consumers who want to use a service do not pay each other (i.e. the service provider) directly to use the service. Instead, consumers burn tokens.

Independently of the token burning process, the protocol should create X new tokens per time period, and these tokens can be distributed proportionally to service providers: if during token generation, of the 50 tokens burned There is 1 for service provider A, then service provider A should get 2% of newly minted tokens. Note that X is not necessarily static. It is mutable, as long as X is not a function of tokens being burnt (which would create infinite loop logic and ultimately invalidate the assumptions of the BME model).

Assuming no market speculators:

Tokens minted per month: 10,000

Cost price of tokens (measured in USD): $10

Unit Service Cost: $0.001

The system is assumed to be in balance - meaning that if 10,000 tokens are burned every month, the number of tokens in circulation remains constant. Since the cost of using the service is $.001, the system will be in balance if the service is used (10,000 * 10 )/0.001 = 100,000,000 times per month. If usage increases and 15,000 tokens are burned in a month, the total supply will decrease, causing upward price pressure. This upward price pressure means that fewer tokens need to be burned in order to buy the same amount of services from the network, bringing the system back into balance.

first level title

5. Velocity problem

secondary title

5.1 Trade vs. Hold?

secondary title

5.2 How to improve holdability?

Some examples are providing long-term holders with access to specific features, such as access to premium communities. Higher-yielding long-term holders are also available if there is a premium return.

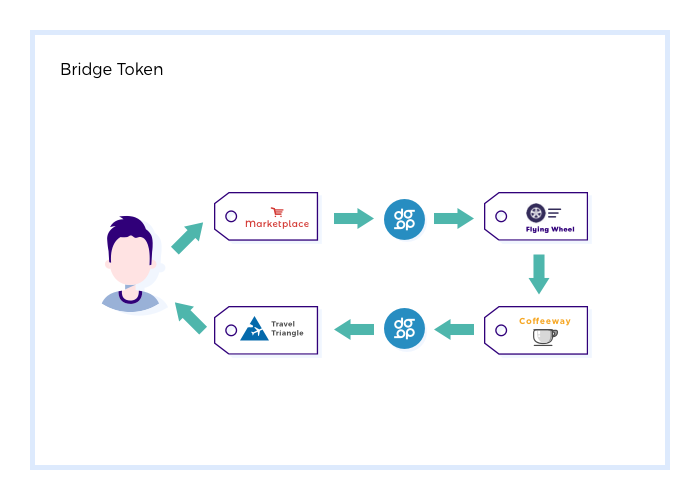

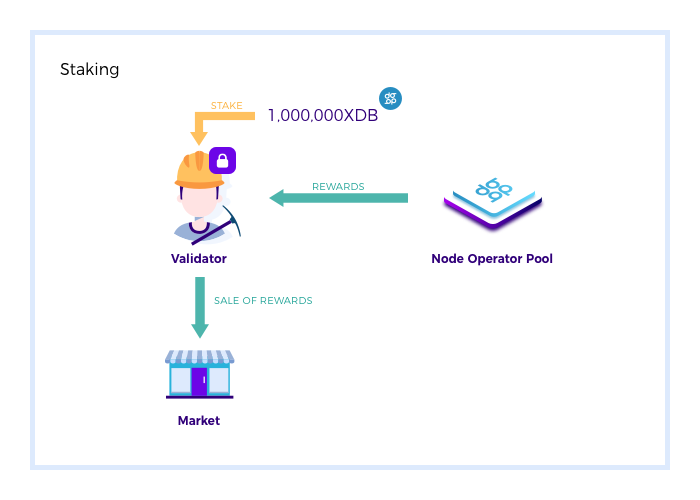

Example: XDB

Protective Security Feature (Anti-Spam)

A minimum of 20 XDB needs to be pledged to activate an account, and tokens cannot be moved while the account holds them, removed from the circulating supply. This can slow down tokens and reduce the active supply of tokens.

Bridge Token

As a bridge token, XDB is able to interact with many different token assets.

More brands available on the DigitalBits network will eventually lead to more accounts, all of which require XDB staked per account to activate.

Node Operator Program

first level title

secondary title

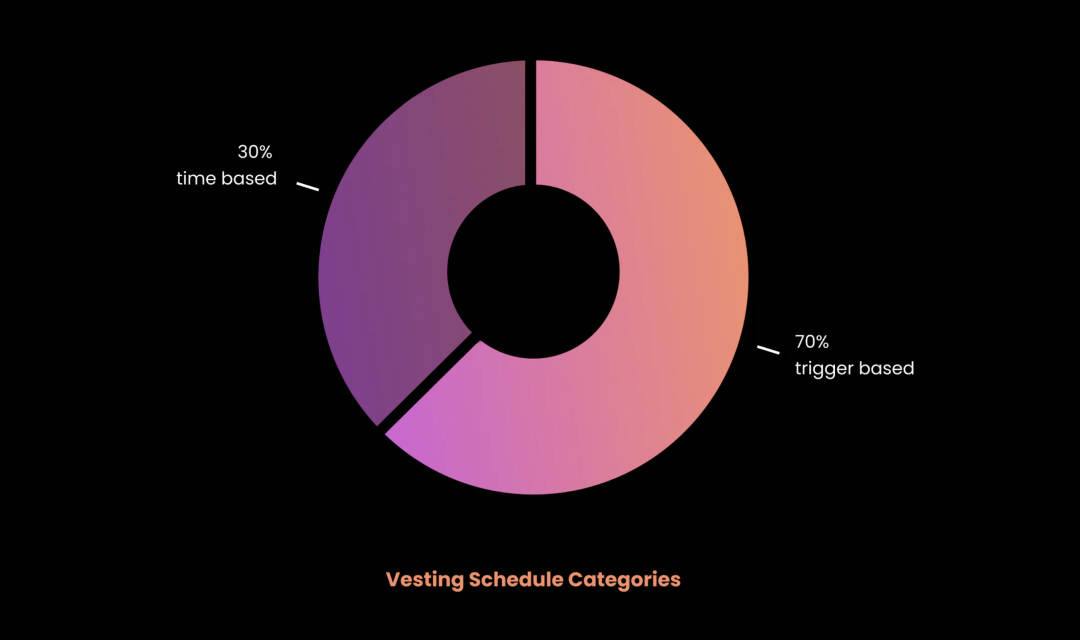

6.1 Unlock Type

Unlock schedules can be divided into two different types: time-based and trigger event-based.

secondary title

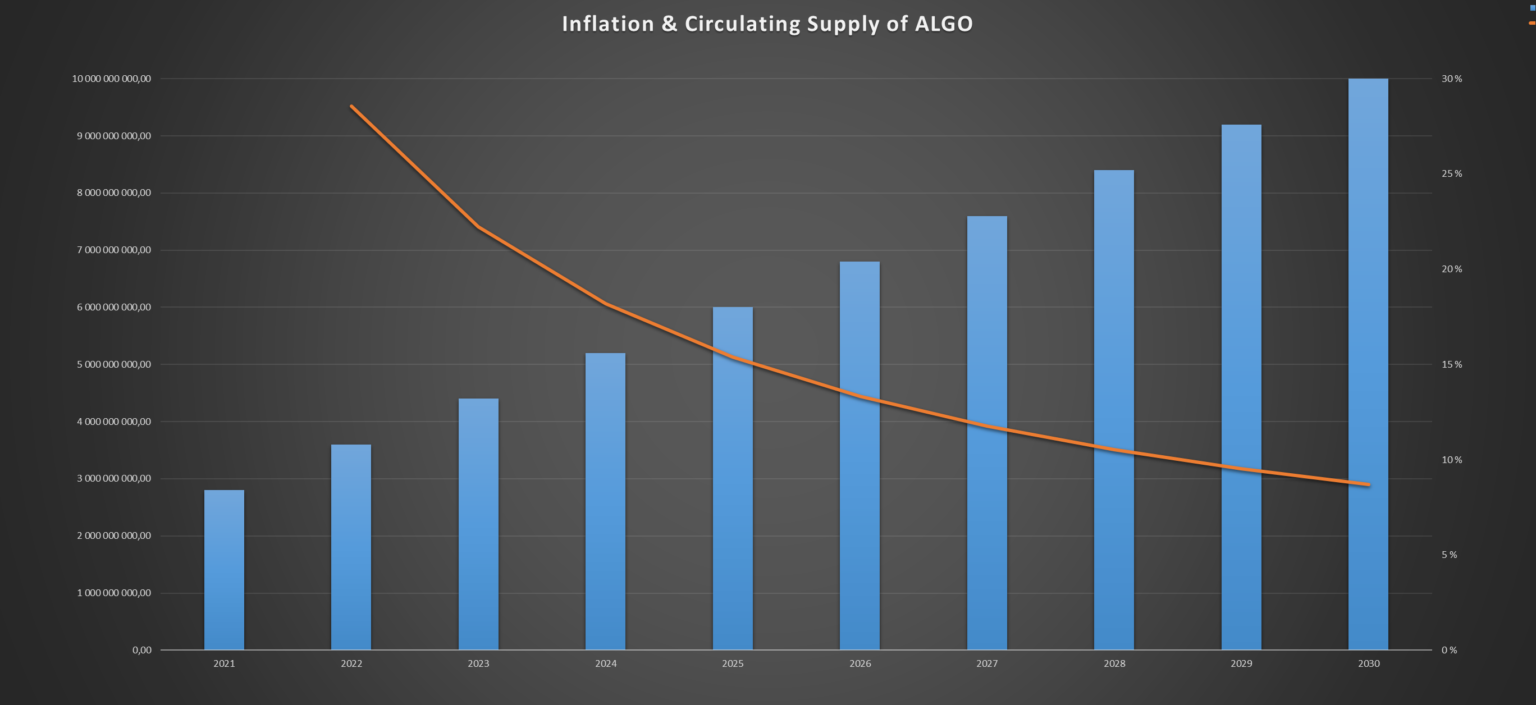

Unlock Type - Linear Unlock

Representative: Alogorand

secondary title

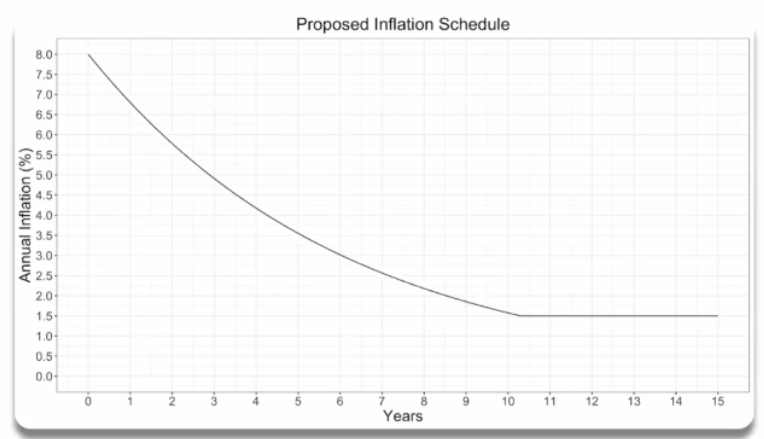

Unlock Type - Decreasing Inflation Rate

Representative: Solana

secondary title

Unlock Type - Permanent Inflation Rate

Representative: Uniswap

secondary title

6.2 Is there an optimal unlocking time

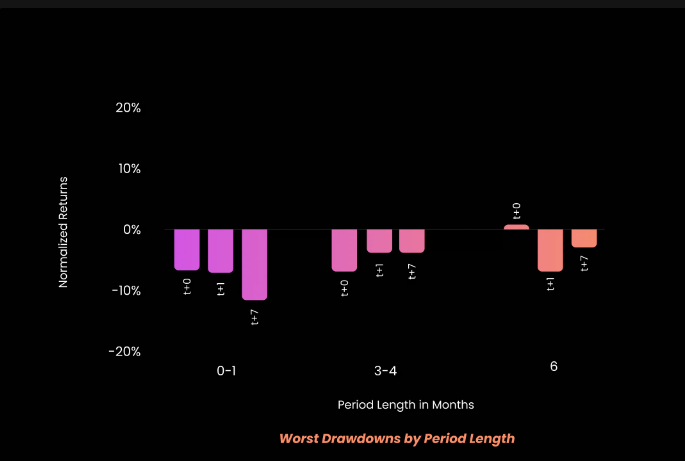

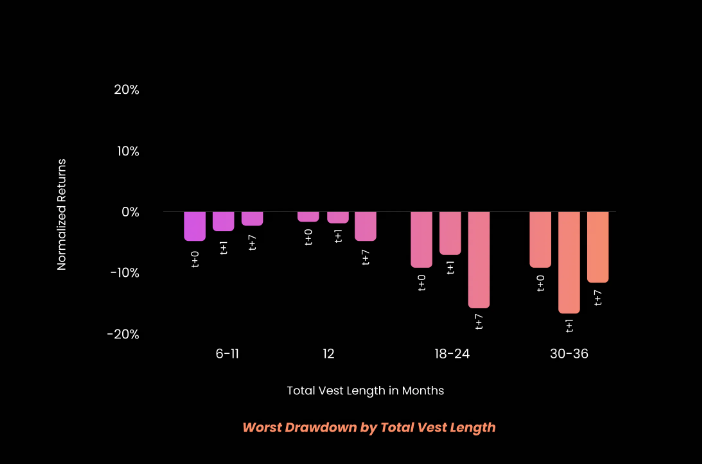

The "optimum" defined here means: the Token volatility during the unlocking period is the least, and at the same time, the negative impact of the unlocking date on the Token price is the least. Of course, there may be other factors that affect these, including: milestones in development, the achievement of decentralization, and regulatory factors (which may cause the unlocking conditions in the United States to be somewhat different).

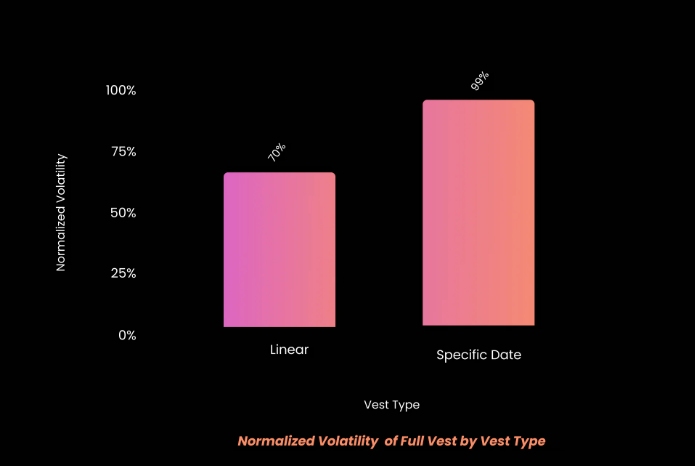

Compare linear unlocking with specific date unlocking:

Assumption A: The volatility of linear unlocking during unlocking is higher than specific date unlocking;

Assumption B: Linear unlocking is less volatile during unlocking than specific date unlocking.

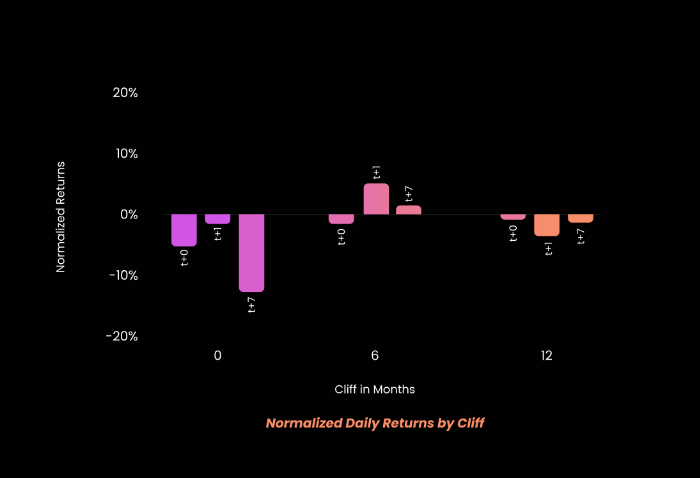

Specific date unlock comparison:

Hypothesis C: Due to the expectation of potential Token dumping, the higher the cliff unlocking ratio, the smaller the impact on Token prices;

Hypothesis D: Projects with more unlocks per epoch (and thus fewer total unlock days) will experience a smoother maximum drawdown than projects with fewer unlocks but more total unlock days;

Hypothesis E: Projects with a longer total lock-up period are more severely affected by the price of tokens than projects with a shorter total lock-up period.

conclusion as below:

For specific date unlocking, a 6-month lock-up period is better than a 1-year or no lock-up period.

The larger the initial unlocking, the smaller the negative impact on the Token price.

The longer the unlocking interval (up to 6 months), the greater the unlocking amount, and the shorter the total lock-up period, the higher the "worst return" of the Token.

Linear unlocking is less volatile during the unlocking period than specific date unlocking.

Linear unlocks are more price-friendly after the initial unlock event than date-specific unlocks.

calculation process

Earnings Standardization

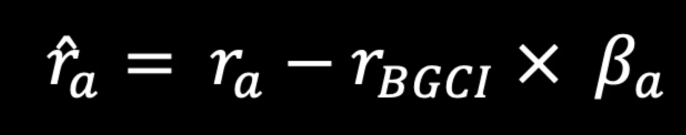

Calculate the token beta value during the unlocking period, and subtract BGCI's daily income times the token beta value from the token income to adapt to different market conditions (in other words, normalize the token alpha value)

Assuming that A/BToken is first divided into linear and specific date unlocking, then the normalized volatility of Token over the entire unlocking period is evaluated. This is to evaluate the assumption that linear unlocking may lead to more continuous volatility of tokens over time.

The result is that, ceteris paribus, linear unlocking has no appreciable long-term volatility impact compared to date-specific unlocking; in fact, linear unlocking is less volatile than date-specific unlocking. Confirms the hypothesis that linear unlocking has a smaller impact on returns to initial unlocking events than specific date unlocking.

Assumption C

Next, we compared date-specific unlocks. First, we evaluated the impact of the length of the lockup period and the initial unlocked amount on the day of, after, and a week after the initial unlock event. Our results show that a lockup period of 6 months is better than a lockup period of 1 year or no lockup period. This is somewhat counterintuitive, it is better to unlock a higher percentage of tokens after the lockup period ends (assumption C). To explain this, we assume that projects with smaller unlocked volumes have some awareness of possible “dumping” by their early investors and hope to minimize selling pressure by unlocking fewer tokens.

Suppose D/E

Finally, the impact of the number of unlocks on each unlock date after the initial unlock, the interval between unlock days and the total lock period on the Token price is studied. To do this we look at each unlock event after the initial unlock and record the worst daily normalized return on the day of the unlock event, the day after, and the week after.

first level title

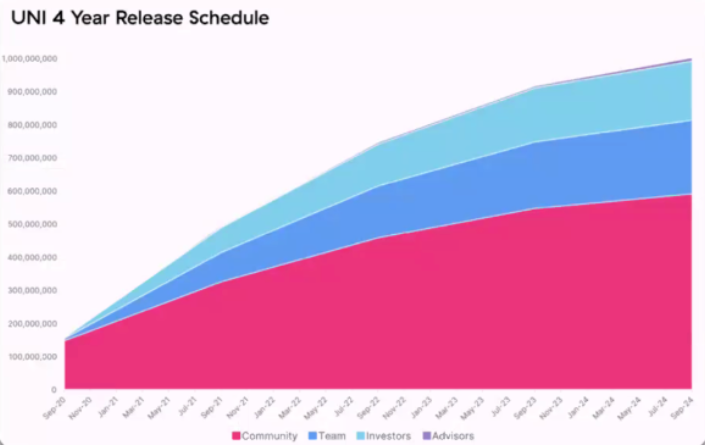

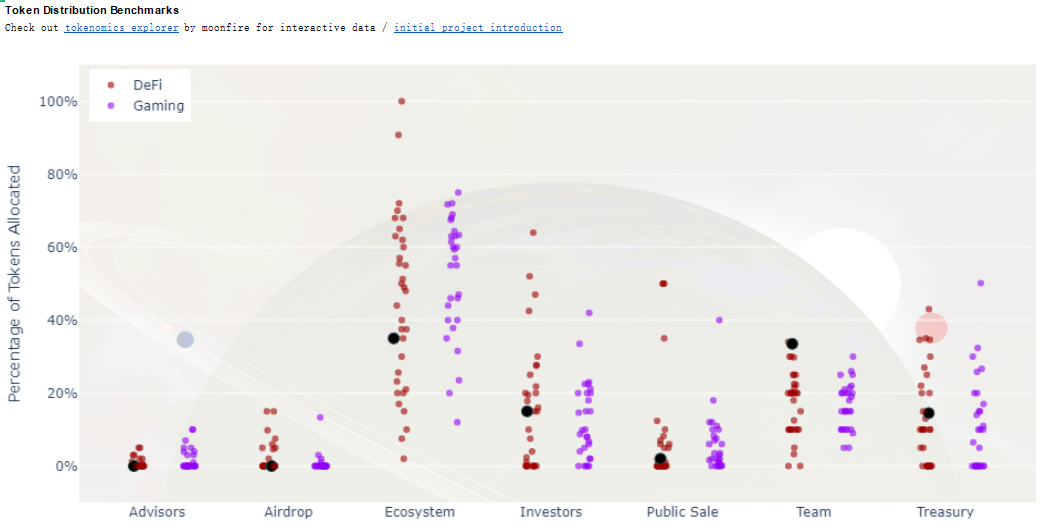

7. Token Distribution

Token distribution can be divided into 6 main parts: Community Treasury, Core Team, Private Investors, Ecosystem Incentives, Airdrops, Public Sale.

About 10% to 25% of tokens are allocated to the team, investors hold about 10% to 30% equity, foundations hold 12% to 18%, and the community and ecosystem hold 20% to 70%.

Assignment and Unlocking Simulation.xlsx - View Attachment

8. Summary

The importance of the token economy lies in:

Token is a measure used to manage and motivate encrypted assets, which can promote the distribution of project benefits, influence user behavior expectations, and promote ecological development.

The main steps in designing a token economy include:

Assess the business value and choose the appropriate north star indicator

Design incentives, use tokenomics to motivate and punish corresponding behaviors

Choose single-token vs. multi-token, usually Multi-token can help separate different purposes such as governance and games

Choose the realization model and consider whether it is a homogeneous commodity

To solve the flow rate problem, improve the token Holdability

Design unlocking plan and token distribution

Tips:

Issuing tokens needs to consider compliance and the intrinsic value of tokens

Token is not zero-cost, don’t overdraw the cost prematurely

Reasonably match expenses and income, so as not to end up with only speculators