SBF intends to submit testimony to Congress, saying it was pressured to file for bankruptcy protection

On the afternoon of December 12, Sam Bankman-Fried was arrested by Bahamian authorities and is expected to be extradited to the United States. Forbes obtained a full draft of SBF's testimony before the US House Financial Services Committee on Dec. 13. The following is the complete SBFdraft testimonyThe 11 most exciting parts of , compiled and compiled by Odaily.

1. Bankman-Fried was targeted by FTX court-appointed CEO John Ray III.

"I have sent five emails to Mr Ray. Mr Ray has not responded, nor has he reached out to me in any other way to communicate."

(Odaily Note: Through John Ray III's public testimony in advance, we can see the B side of the story: "Highlights of FTX's new CEO's Congressional testimony》。)

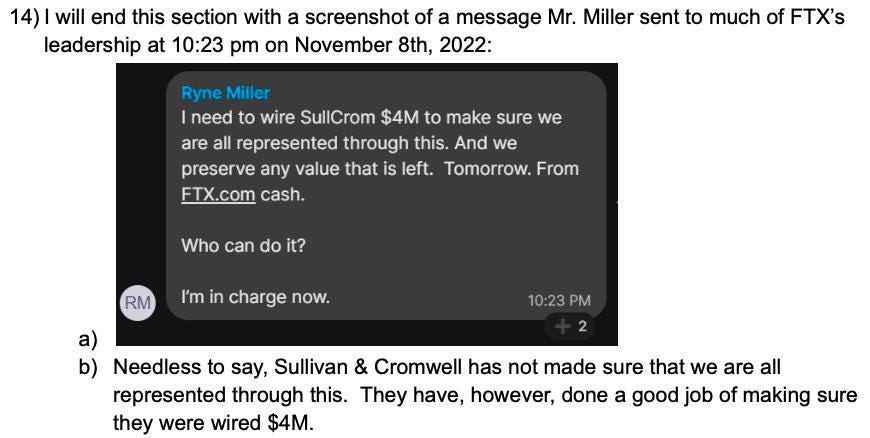

2. SBF says that FTX.US general counsel and former Sullivan & Cromwell partner Ryne Miller put enormous pressure on Bankman-Fried and others to rush into Chapter 11 bankruptcy.

“I have 19 pages of screenshots of chats from ex-Sullivan & Cromwell partner Ryne Miller and other people who were pressuring me, all within two days of asking me to file for bankruptcy quickly. They also called my Many friends, colleagues, and family members, and pressured them to dissuade me. Some of them cried to me because they were emotionally hurt by the stress.

3. SBF believes that John Ray and the law firms managing the bankruptcy, including Sullivan & Cromwell, are repeating the mistakes of Enron and trying to obtain huge fees from FTX's bankruptcy.

image description

Bankman-Fried accuses Ryne Miller of forcing him to resign, SBF drafts testimony

4. The Chapter 11 team (Odaily Note: The team leading FTX to file for bankruptcy under the US Chapter 11 bankruptcy law) does not get along well with foreign regulators.

"I've heard complaints that Chapter 11 teams are refusing to respond to regulatory inquiries from foreign regulators, sometimes risking employees being jailed. I've also heard complaints about Chapter 11 teams freezing or otherwise interfering with various operations belonging to FTX International Entity’s Funding Complaint.”

5. SBF believes that John Ray and the U.S. Bankruptcy Court are bullying the Bahamian government and overstepping its right to be the main place of registration of FTX International.

"They assume without evidence that other races, cultures, and governments are malicious and incompetent, which would be viewed as deeply offensive if targeting minorities in the United States. It's equally offensive when targeting citizens of other countries disgusted, let alone their regulators. Meanwhile, seizing assets regulated by other governments is a centuries-old practice.”

6. SBF spends seven pages in a section he calls "misrepresentations" detailing instances in which John Ray and his team spread false and inaccurate information about the company he founded.

“I believe US regulators may have been told materially misleading information about FTX US, including claims that FTX US is not solvent. I believe it is solvent.”

7. FTX does not have a risk management team.

“While FTX International has a team dedicated to finance, as well as many other areas of the business, it does not have a team dedicated to risk management or monitoring user positions.”

8. SBF claims that potential investors signed a letter of intent (LOI) to recapitalize the exchange.

“As of today, I am still aware of multi-billion dollar financing proposals, including signed letters of intent: billions of dollars in funding that have the potential to lead to significant amounts of capital for clients. However, I believe all of these are based on FTX as an exchange It is conditional on a relaunch. I sincerely hope that all global teams working on FTX seriously consider this possibility, as I believe it will bring substantial value to customers and creditors."

9. Binance CEO Changpeng Zhao orchestrated a negative PR campaign to bring down FTX.

“I think the negative PR for FTX lasted for a month, mainly driven by Binance.”

10. After eliminating FTX as its largest global competitor, Binance now averages about 70% of global cryptocurrency trading volume.

“There’s a lot to be said about Binance, its role in the cryptocurrency ecosystem, and its relationship to FTX, but this is neither the place nor the time to discuss it.”

11. SBF wants to clear up false reports about bingeing at FTX and his own drug use. He said he had never had a drink in his life and had been taking antidepressants for the past decade.

"The past few months have been tough enough for everyone, and I feel ordinary in comparison, but I need to have my presence in the official Congressional record and in my adult life. Part of the time, I was sad."