Explain in detail the reasons behind NFT wash trading

December 2022 CoinGecko and Footprint Analytics joint report

Data Source:Footprint Analytics

There is a saying in the market that the nature of transactions in the entire NFT market is fraudulent and an illusion manipulated by dishwashing traders. we often see manymedia headlinespromoting this argument. After all, why would anyone pay millions of dollars for a JPEG image?

Wash trading is the practice of traders repeatedly buying and selling the same asset in order to manipulate trading volume and/or asset price. The parties involved may consist of a single entity or multiple entities. Wash trading is illegal in traditional capital markets because the intent is usually to mislead other buyers/sellers that the asset is worth much more than it really is, and/or that there is good market liquidity for the asset.

secondary title

Wash trading behavior of price/liquidity manipulation

Heat is everything for NFTs. The NFT project party will do everything possible to attract attention and create explosive points. The easiest way to gain popularity is to appear on the front page of the NFT marketplace. OpenSea, LooksRare, Magic Eden, etc. all have an interface that showcases popular NFT projects.

Source: OpenSea

While none of the markets explicitly state how their popularity algorithm works, trading volume is clearly an important factor for inclusion in the hotlist. The mechanism of being on the hot list with high trading volume will encourage NFT founders to increase their trading volume through washing transactions, thereby increasing the chances of their projects being included in the hot list. Wash trading also gives the market an impression of false liquidity, creating false confidence that there is a lot of demand and enthusiasm for the NFT they are about to buy. Enabling unsuspecting buyers to purchase NFTs from project parties at high prices.

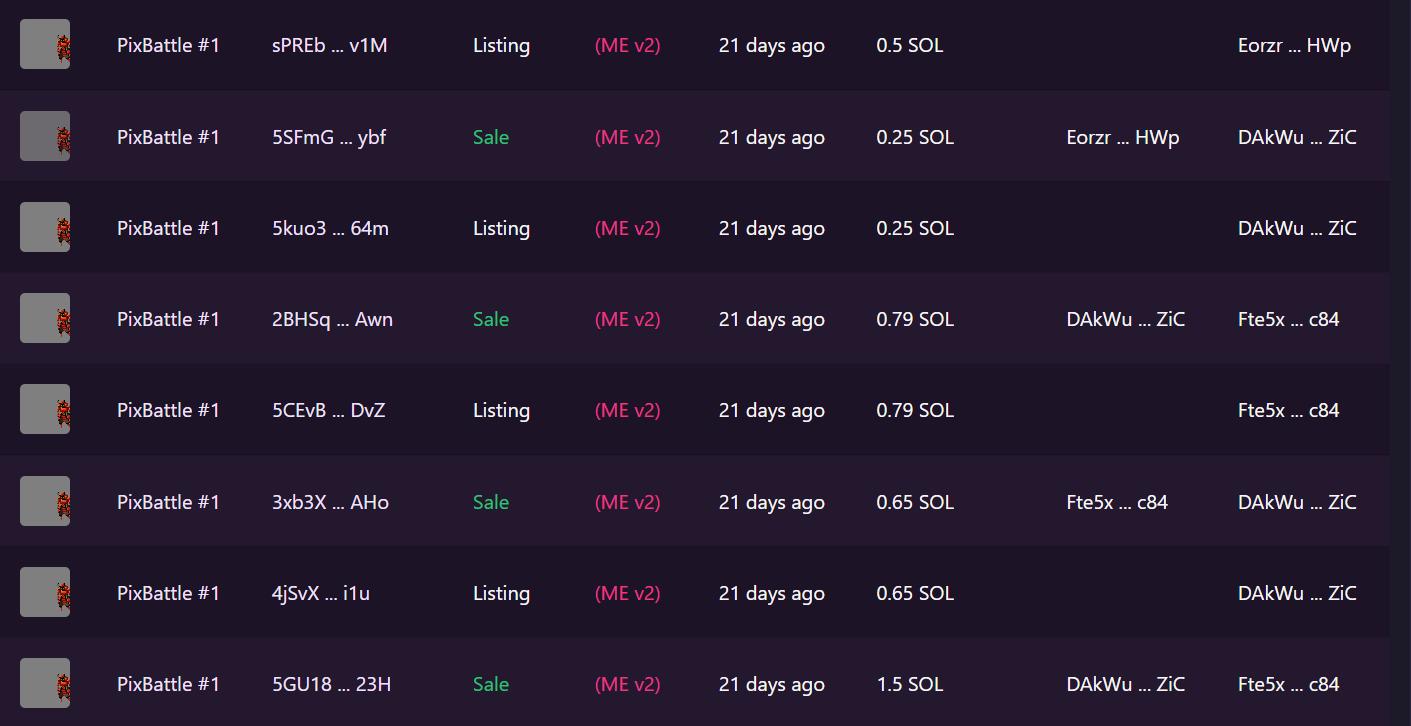

An example of a dishwashing that we have identified isPixBattle #1 image description

Source: Magic Eden

image description

Source: Magic Eden

Looking at the Magic Eden price chart, we can see that some uninformed buyers bought the top before the liquidity dried up and the price went to zero.

Identify wash trades

Because there are so many factors involved in wash trading, it is nearly impossible to identify all wash traded items. These are some common signs of dishwashing to look out for:

Collectibles trade at stable price levels (i.e. no high-priced "rare" trades).

Collectibles with high trading volume/liquidity but low popularity/poor social media metrics (e.g. low Twitter follower count)

NFTs are purchased more times than normal in a day

secondary title

Washing behavior to reduce tax payment by obtaining trading losses

Another reason for wash trading is to capture trading losses to reduce personal taxes. Jurisdictions such as the US and Europe treat NFTs as assets and impose some form of asset gains tax. This means that traders pay taxes on the gains, but they are usually able to offset the tax against investment losses in the final tax calculation. However, this only applies to trades in which the investor has realized a gain or loss. In this case, by buying NFTs at a premium, trapped buyers may actually be incentivized to sell their NFTs at a loss to realize losses and offset gains they have made on other investments. Legally, it is neither uncommon nor illegal to realize trading losses, tax breaks.

But in the NFT market, wash trading is a way to realize trading losses. Traders can achieve false "losses" by selling NFTs to another wallet they actually control. For example, set the NFT price to an amount of 1 USD, sell it to another wallet of your own, and realize a loss. Allows traders to get a tax deduction while keeping assets sold at a loss.

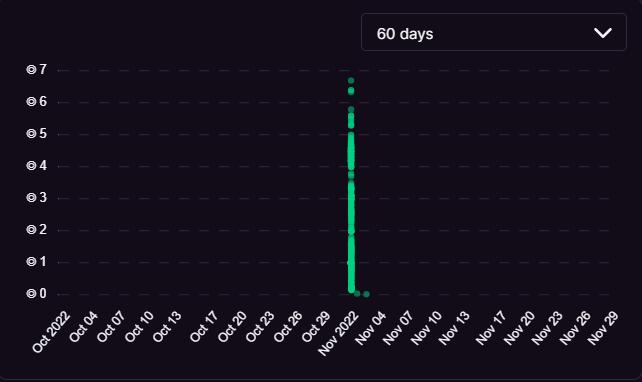

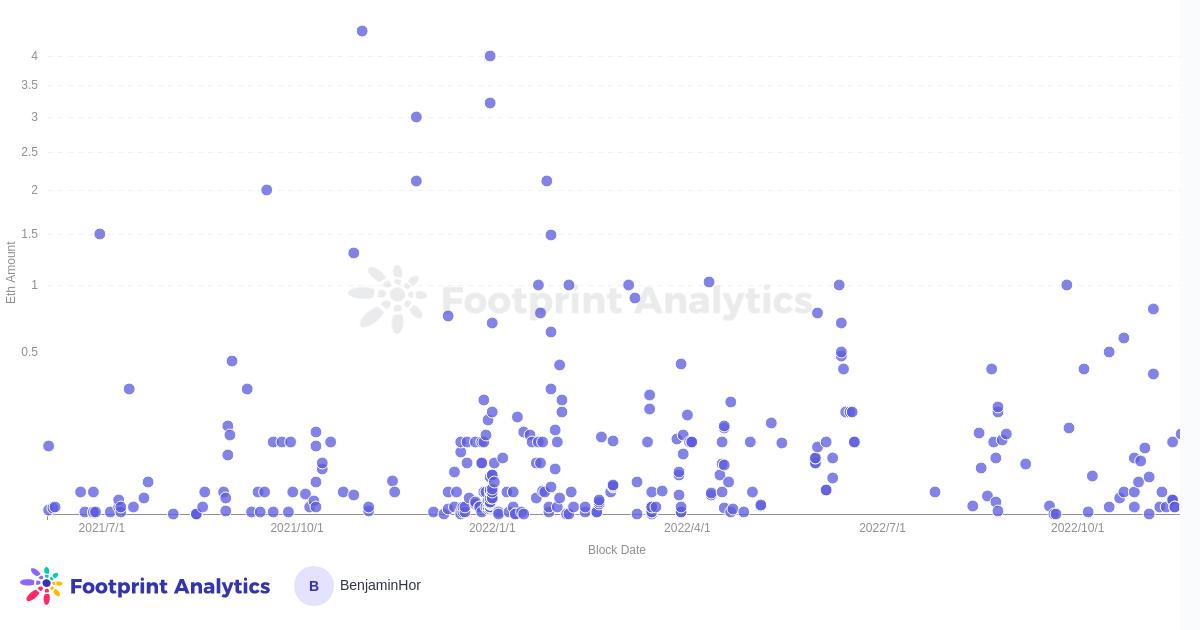

source:

source: Footprint Analytics(as of November 22, 2022)

image description

source:Footprint Analytics(as of November 22, 2022)

Among the top 10 projects, the top three most popular projects for realized trading losses areMAYC ( 117 )、 Cool Cats(74) andCloneX(61). Wash traders of these projects all appear to be selling their NFTs for extremely low prices. Below 0.5 ETH, Shenzhen is close to 0, making them obvious outliers to any on-chain observer.

secondary title

Token Wash Trading

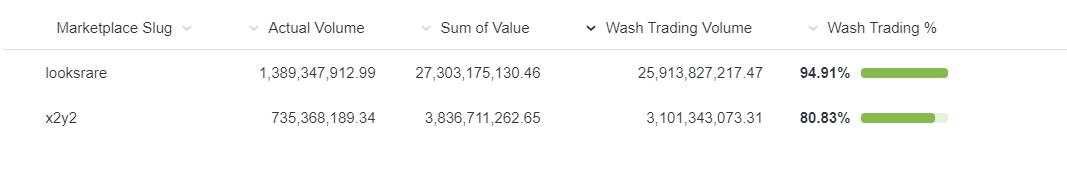

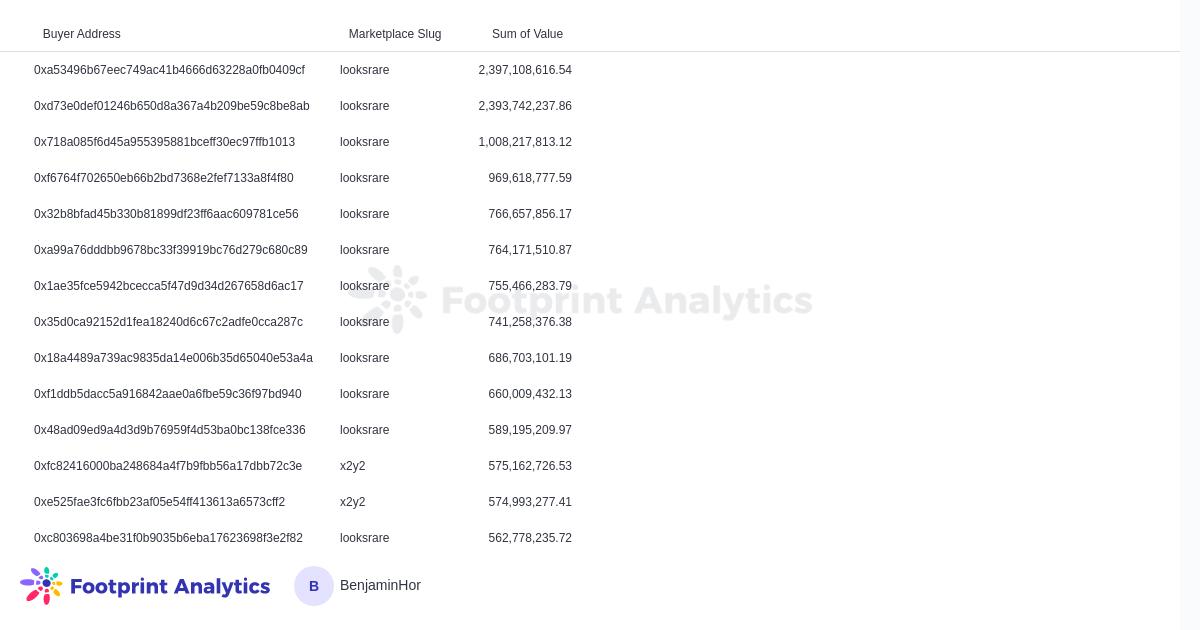

LooksRare and X2Y2 are the most famous tokenized NFT marketplaces. Platform tokens are distributed to big traders in the form of transaction rewards on the platform. Wash traders use this mechanism to maximize their return on trade rewards by trading back and forth between wallets they own, generating extremely high volumes per day. To identify these types of wash trades that earn trading rewards, we filtered the wash trades on LooksRare and X2Y2 according to the following rules:

Overpriced NFT transactions (X times the average price of OpenSea)

0% royalties on collectibles (except CryptoPunks and ENS)

The number of times in a day that NFT purchases exceed the normal amount

NFT purchased by the same buyer address in a short period of time

image description

source:Footprint Analytics(as of November 22, 2022)

image description

Source: Footprint Analytics (as of November 22, 2022)

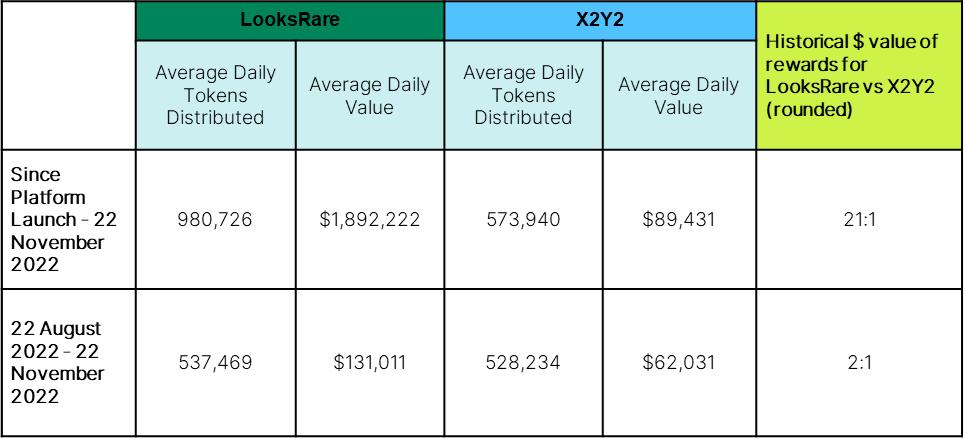

If we take historical averages, for every dollar you earn from trading rewards on X2Y2, you earn $21 more on LooksRare. However, this number is misleading because LooksRare launched about 3 months before X2Y2, when the market was still buoyant, andLOOKS(LooksRare’s token) price is much higher. After the initial heat died down and the bear market started, transaction rewards began to shrink to more even levels. Even so, LooksRare has delivered twice the dollar value of X2Y2 over the past three months.

However, these are only broad assumptions, as rewards are heavily dependent on the percentage of the platform's respective daily trading volume. If the total transaction volume is lower (thus providing sellers with a higher percentage transaction reward).

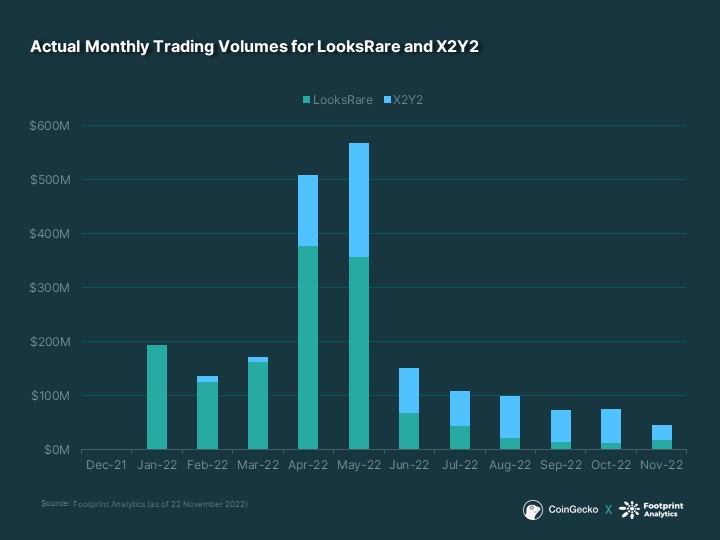

image description

source:Footprint Analytics(as of November 22, 2022)

A possible explanation for the fact that X2Y2 has more real transaction volume than Looksrare is that transaction costs are lower. X2Y2 currently charges a transaction fee of 0.5% and offers an optional royalty fee (although theFeature withdrawn on November 18, 2022), while LooksRare has a higher transaction fee ( 2.0% ). However, even if we account for the higher transaction fees on LooksRare, it will always be cheaper to trade on LooksRare after we offset the token rewards. We can only speculate that X2Y2's marketing strategy works better when human psychology prefers "discounts" to "cashbacks." As of November 22, 2022, the average token staking return of LooksRare (53.61%) is higher than that of X2Y2 (38.81%).

Gain insight into the trading patterns of LooksRare / X2Y2 wash traders.

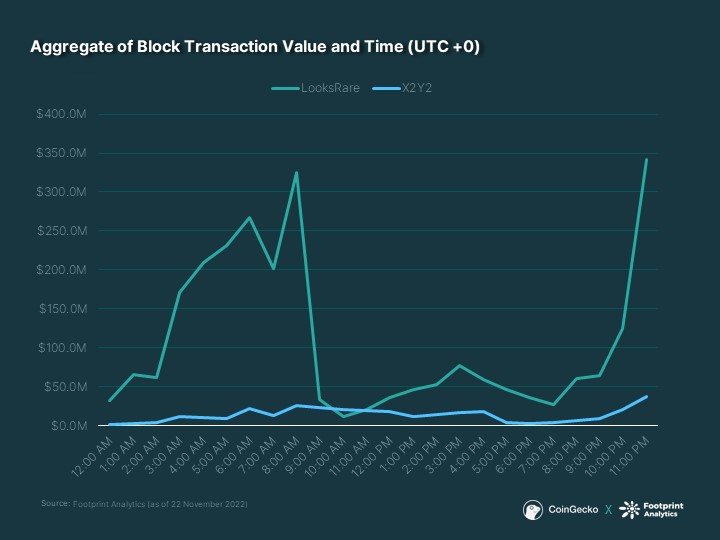

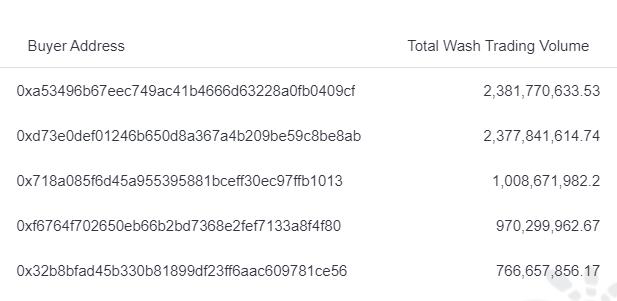

image description

source:Footprint Analytics(as of November 22, 2022)

image description

Source: Footprint Analytics (as of November 22, 2022)

There is an argument for trading before the day's close, as they may be trying to increase their share of daily volume in the market. Since trading rewards are based on a percentage of the market's total daily volume, traders wash trades as late as possible to determine the required volume to get the lion's share of the rewards. And as for the morning spike, we speculate that these traders were operating in a time zone close to midnight, which coincides with late night in the US.

In terms of the most popular items for washing dishes,Terrafroms by Mathcastlesimage description

source:Footprint Analytics(as of November 22, 2022)

image description

Source: Footprint Analytics (as of November 22, 2022)

This is likely a single whale transaction between his/her wallets, accounting for more than 1/3 of wash trade volume.

However, before Terraform NFT tops the charts, it's worth noting thatMeebitsimage description

source:Footprint Analyticsin conclusion

in conclusion

Without proper regulation and enforcement, NFT wash trading is an inevitable phenomenon in the NFT market. Manipulating prices/volumes and fraudulently obtaining tax losses are illegal in traditional markets, and this standard should apply to cryptocurrencies. On the other hand, earning token rewards through wash trading is a new type of activity unique to cryptocurrencies. While the main victim at risk here is the marketplace itself, unsuspecting users could also lose money in the course of this activity. Despite the ethical issues, old folks in the crypto space will argue that code is law. If the NFT marketplace itself doesn't impose any restrictions on reward distribution, why shouldn't users take advantage of this "loophole"?

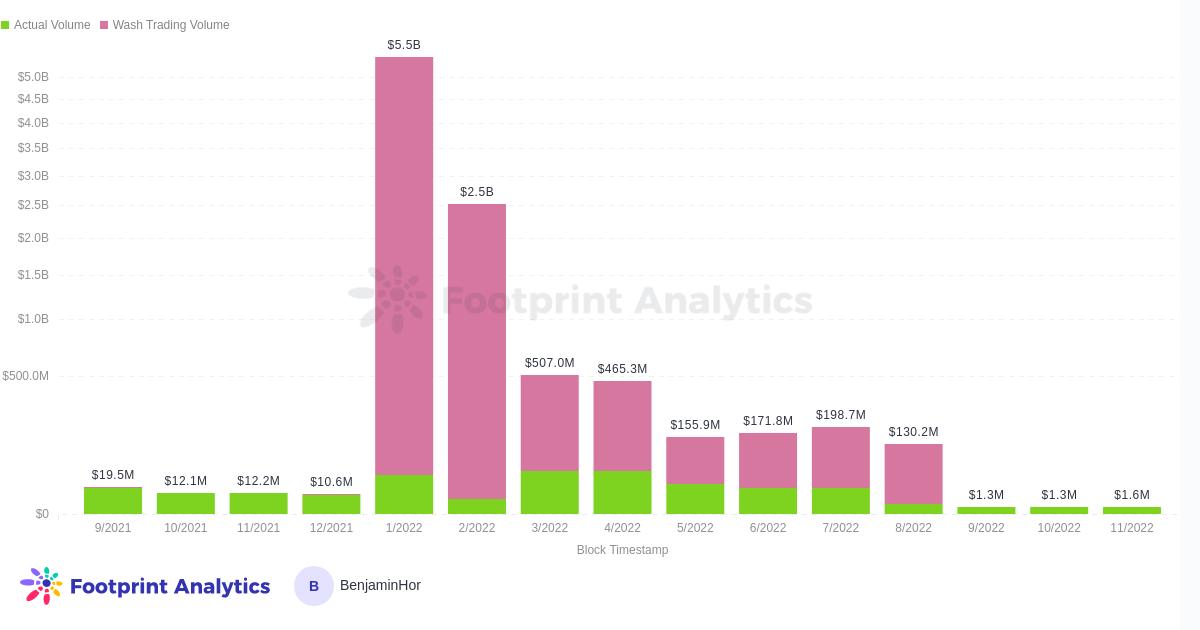

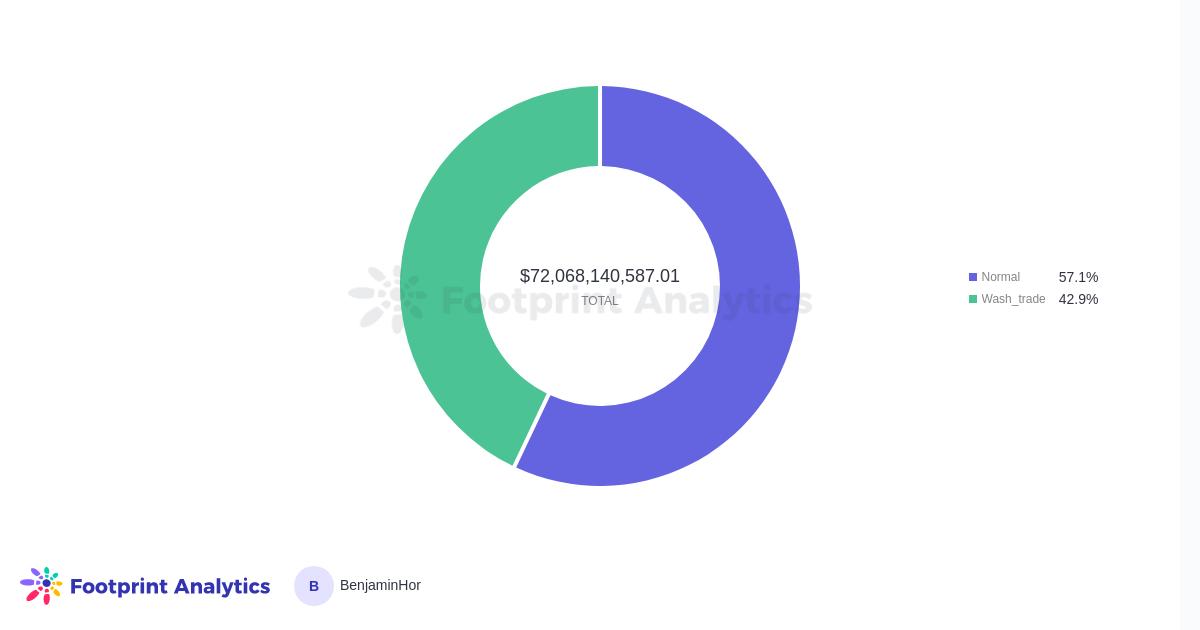

image description

Source: Footprint Analytics (as of November 22, 2022)

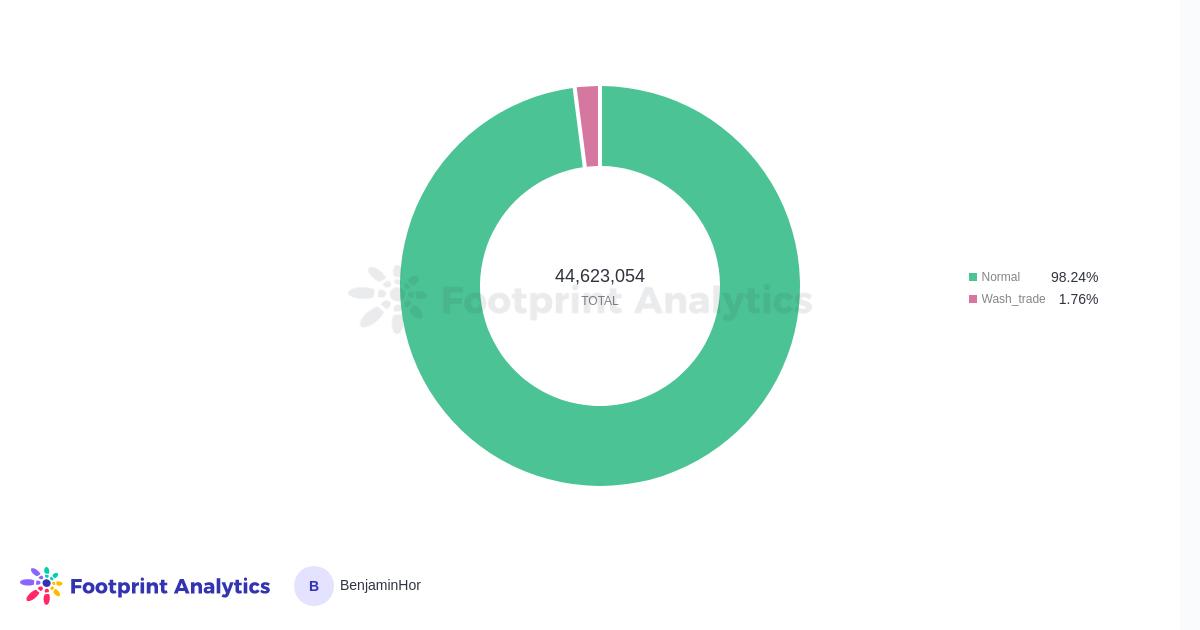

Of all volume, 42.9% is wash volume. The lurid explanation is that almost half of the market is a scam; however, a more plausible inference is that platforms like LooksRare and X2Y2 have propped up the market with fake volume. Also, this doesn't change the fact that there are genuine buyers. In fact, a very different picture emerges if we measure the market using a different metric, namely the number of trades.

More than 98% of the total trade orders are real trades. In other words, people might just like JPEGs. Research on OpenSea NFTsgroup of researchersThis argument is also supported, albeit with a different approach.

But that doesn't mean we should take it for granted. Blockchain technology makes every transaction transparent, making it easier for us to identify fake transactions and protect ourselves.

The first line of defense is education. NFT traders should learn to recognize patterns of fake wash trades before buying into lesser-known NFTs. Even so, some of the most popular collectibles, such as Meebits, may not survive the event. However, we can also expect wash traders to become more sophisticated and cover their tracks. Efforts to improve on-chain analytics and use platforms like Footprint Analytics can help users not only cut through the noise, but also make better trading decisions.

NFT trading platforms should also play a more active role in preventing wash trading, which can cause harm to actual users and themselves.