A comprehensive interpretation of the Ethereum pledge track: factors affecting the rate of return and ecological projects

Original author:@shuquanOriginal author:

, Taihe Researcher

The Ethereum staking track emerged and gradually matured with the launch of the Beacon Chain in December 2020. This article will briefly introduce relevant information about the staking track.

1. Why do you pay attention to the Ethereum pledge track?

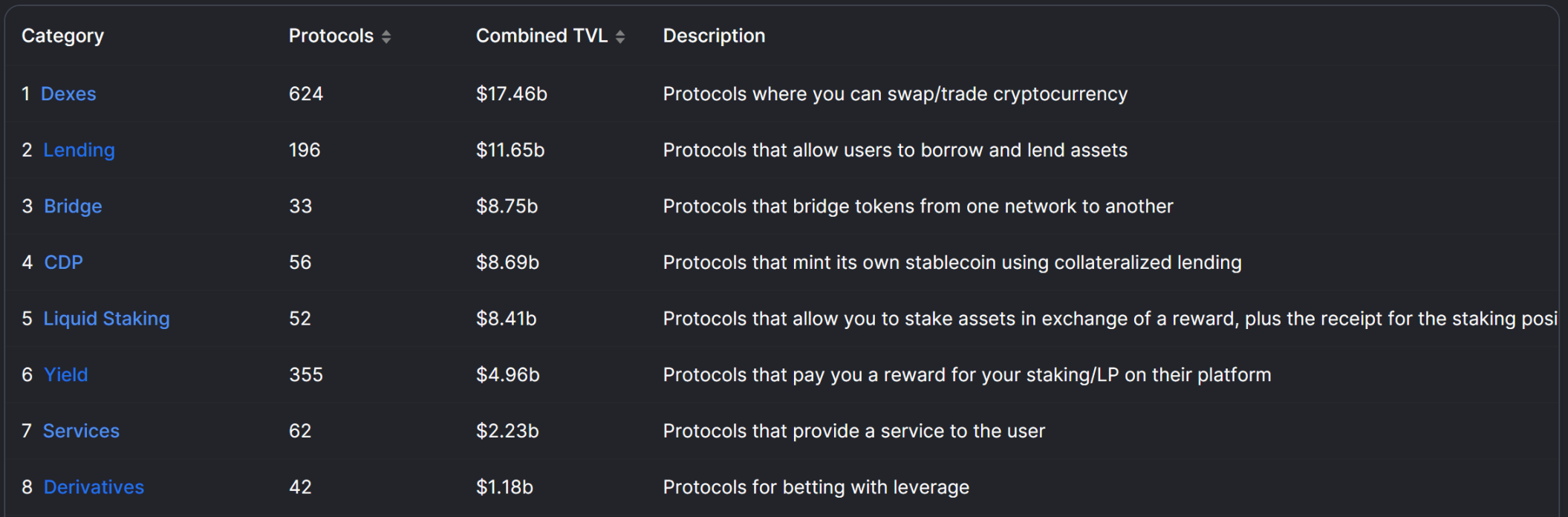

DEX: Some time ago, I saw the news that UniV 3 ETH-USDC LP lost 100 million US dollars, which shows that DEX is very complicated and innovation is not easy, but it would be great if $UNI can be empowered.

Lending: Because it is an industry infrastructure, it has been developing in a regular manner, and it is also very introverted, making innovation difficult.

Brdige: The public chains are falling down one by one. If all the chains are unified into one Ethereum, is there still a need for a bridge? The bridge is so unsafe. The bridge should be a product of the era of the explosion of the new public chain, but if the new public chain is gone, then the bridge will naturally be gone.

CDP: Most of them are over-collateralized stablecoins, which have basically remained unchanged in the past two years. Since $UST, the most developed and potential, died, no matter whether it is over-collateralized or not, the opportunities for stablecoins are becoming less and less up.

Liquidity Staking: This article mainly discusses the liquidity staking track in Ethereum staking.

Yield: Taking LP Token as a fuss, it can be regarded as a derivative product attached to the DEX track.

Service: I have never understood where these things work.

Derivatives: In fact, with the thunder of many CEXs, decentralized derivatives should have potential, but I don’t know who can get this market share, maybe dydx?

The above is the current status of DeFi. If we say that the track with a very large incremental space in the future may only be Liquidity Staking and Derivatives. FTX is thundering, these market shares either flow into other CEXs, or flow into the chain, but there needs to be a place with good enough infrastructure and liquidity on the chain to accept these users, so I think the derivatives track can be properly paid attention to when it goes online next year dydx v4.

1.1 Ethereum pledge, why is there a very large incremental space?

The figure above shows the token pledge ratio of the major public chains. The pledge ratio is mostly distributed around 60%-80%, except for ETH, which is only about 12%. Why is there such a big gap? Presumably, the high pledge rate of public chain tokens is related to its own ecological prosperity. In other words, holding the public chain token, except for POS pledge, you can’t find a place with higher APY and better income, so you can only choose to pledge in POS.

In contrast to Ethereum, many people think that after the merger of POS and the upgrade of Shanghai, the pledged ETH will increase. "Free exit" will indeed increase the attractiveness, so it is reasonable to expect that the proportion of Ethereum pledged in the future will increase. As for how much it will rise to, it is difficult to guess, but it will certainly not rise to 70% or 80% like other public chains.

According to the annual inflation of about 600,000 ETH, it can be estimated that the pledge track is a market with an annual interest of about 600 million US dollars (calculated as ETH=$1000), and the benefits are fully distributed to the participants of the entire track. Ethereum POS creates a very stable cash flow unlike other Crypto projects. Is it the same for other POS public chains? Take a look at the two largest public chains, Solana and Terra, both of which have collapsed. Relatively speaking, the certainty and stability of Ethereum POS are much higher than other public chains.

1.2 Will the Staking Ratio increase?

If there is no better opportunity to make money in the market, ETH POS APY as the risk-free rate of the industry is the best choice. If ETH POS APY is 8 now, the risk-free rate is 8, and if it is 5 in the future, the risk-free rate is 5. This situation will not be broken until an interest rate comparable to ETH POS appears in terms of security and reliability. Of course, it is unlikely that there will be an interest rate better than ETH POS in a short time. At the same time, we can compare the US 1-year treasury bond. The current yield of the treasury bond is about 4.4%. Therefore, the interest rate higher than the treasury bond is more attractive.

On the other hand, ETH before POS was only used as an asset as collateral, and after ETH is transformed into an interest-bearing asset, ETH on DeFi may gradually enter POS staking and become a basic income of the industry. If derivatives like stETH can replace part of WETH's role in DeFi in the future, then the overall DeFi rate of return in the future will be superimposed with a POS rate of return on the original rate of return, thereby attracting more users.

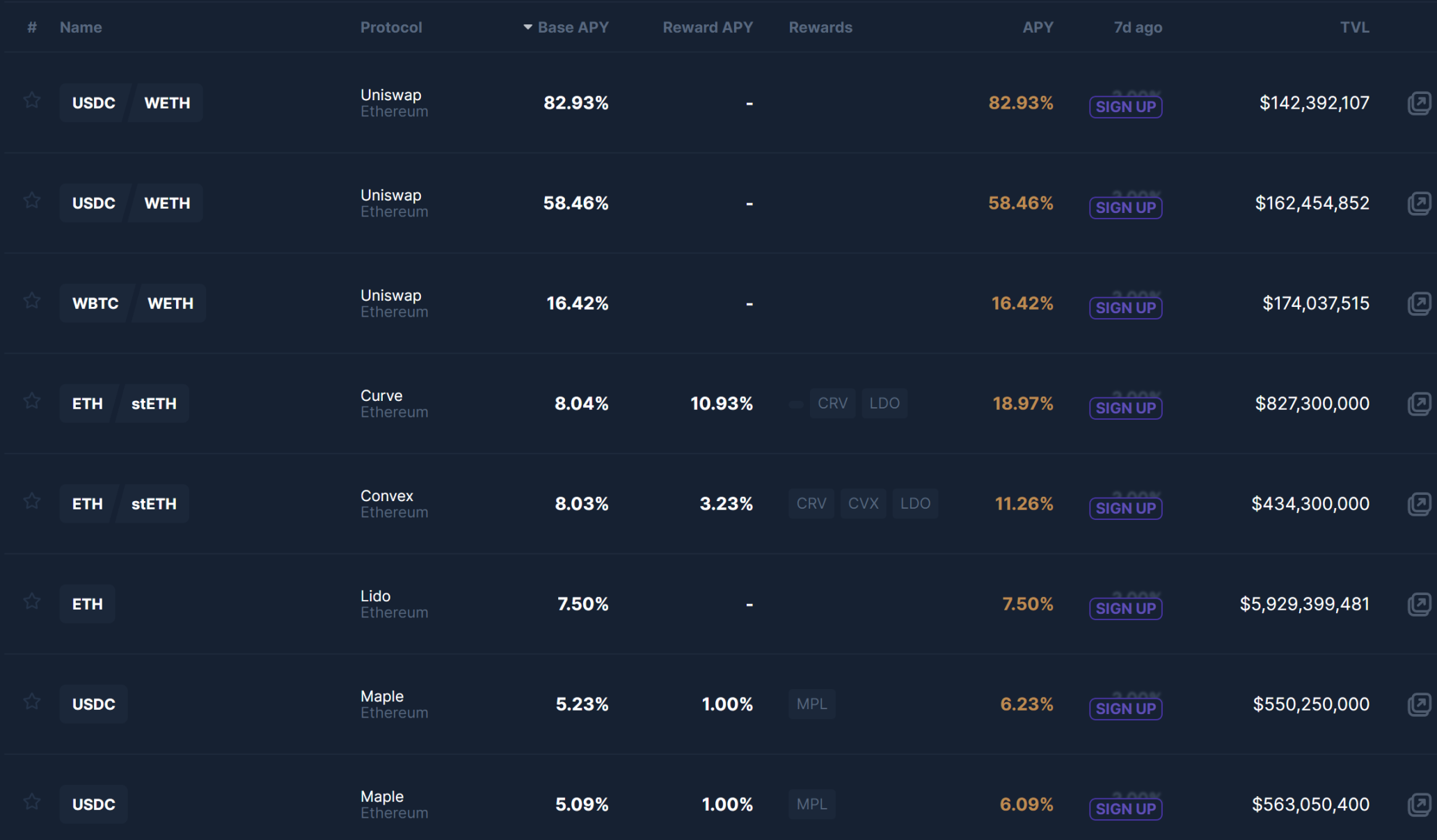

As shown in the figure below, the yields of TVL>100 M on Ethereum ranked by APY from large to small, the top three are Uni LP. But don’t forget that as mentioned at the beginning of the article, most Uni LPs are losing money. As for the APY of Lido, there are not many places in the market that can provide a higher and more stable APY than ETH staking, so there is reason to believe that if you are looking for a stable rate of return, ETH staking is indeed the best place to go. Curve ETH-stETH is also a derivative product of this track, and Maple below is an unsecured loan. Think about how dangerous this track is in a market environment where thunderstorms are frequent.

2. Calculation and influencing factors of Ethereum pledge rate of return

The rate of return of Ethereum consists of two parts: consensus rewards & execution rewards: consensus rewards and execution rewards.

2.1 Consensus rewards

Validators are rewarded through proposals or proofs:

Base reward is the benchmark for calculating consensus rewards, where Effective Balance is the effective balance, and the official setting is 32 ETH, and rewards will not be calculated for the excess.

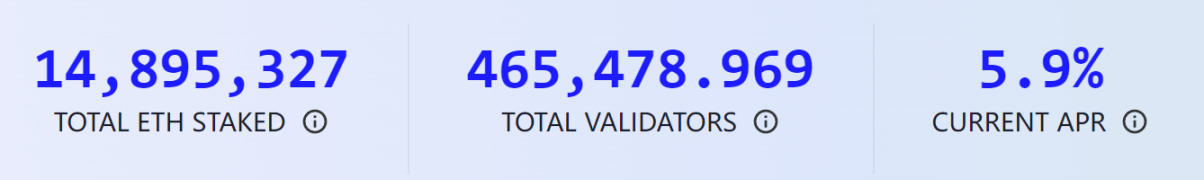

The picture above shows the total pledge data on the official website of Ethereum. Total ETH Staked/Total Validator = 14, 895, 327 ⁄ 465, 478.969 = 32, which is exactly equal to 32.

Secondly, the consensus rewards are divided into five parts as shown in the figure above. The first three are rewards for provers, and the last two are rewards for synchronization committees and proposers. The weight of each part is in the brackets, and the sum of the weights is 64. Since the validator is usually not a block proposer, the maximum reward for each validator is: base reward * (14 + 26 + 14 + 2) / 64 = 7 ⁄ 8 * base reward. For details, you can go to the official website of Ethereum.

So in short, it can be seen from the formula that only Active Balance is a variable in the formula, that is to say, the more effective balances of all validators, the less Base Reward, and the reward that falls on each validator is less. less.

2.2 Execution rewards

Execution rewards are more predictable than consensus rewards. The execution rewards section includes Tips and MEV. Tips is the base fee adjusted during the EIP 1559 upgrade + the tip of the tip mode. The tip is the fee for rewarding miners to speed up the transaction and make their own transactions significantly ahead of schedule. The base fee accounts for about 70% and all are destroyed, which means that it can now cause ETH deflation s reason.

MEV, on the other hand, is a fee with a relatively larger fluctuation range. Miners are rewarded for their ability to include, exclude, and reorder in the production process. For example, various forms of MEV such as common Front-running and sandwich attacks. Since 2020, the cumulative value of MEV withdrawn is about 670 million US dollars. In other words, in the past two years, users have caused losses of about 670 million US dollars due to MEV. Of course, part of the money has been earned by MEV bots, and part of it has been earned by miners.

So simply put, execution rewards largely depend on network activity. The more active the network, the higher the Tips, and the more arbitrage opportunities such as MEV, which will lead to an increase in the overall gas and an increase in execution rewards.

Due to the low network activity in the bear market, there will be relatively low Ethereum pledged APY. The bull market is full of opportunities to make money, and Ethereum staking APY will rise but is relatively unattractive. Because there will be more places with high risks and high returns. But people often belatedly pledge Ethereum at a high market level or withdraw from the market at a low level.

3. Pledge track ecology

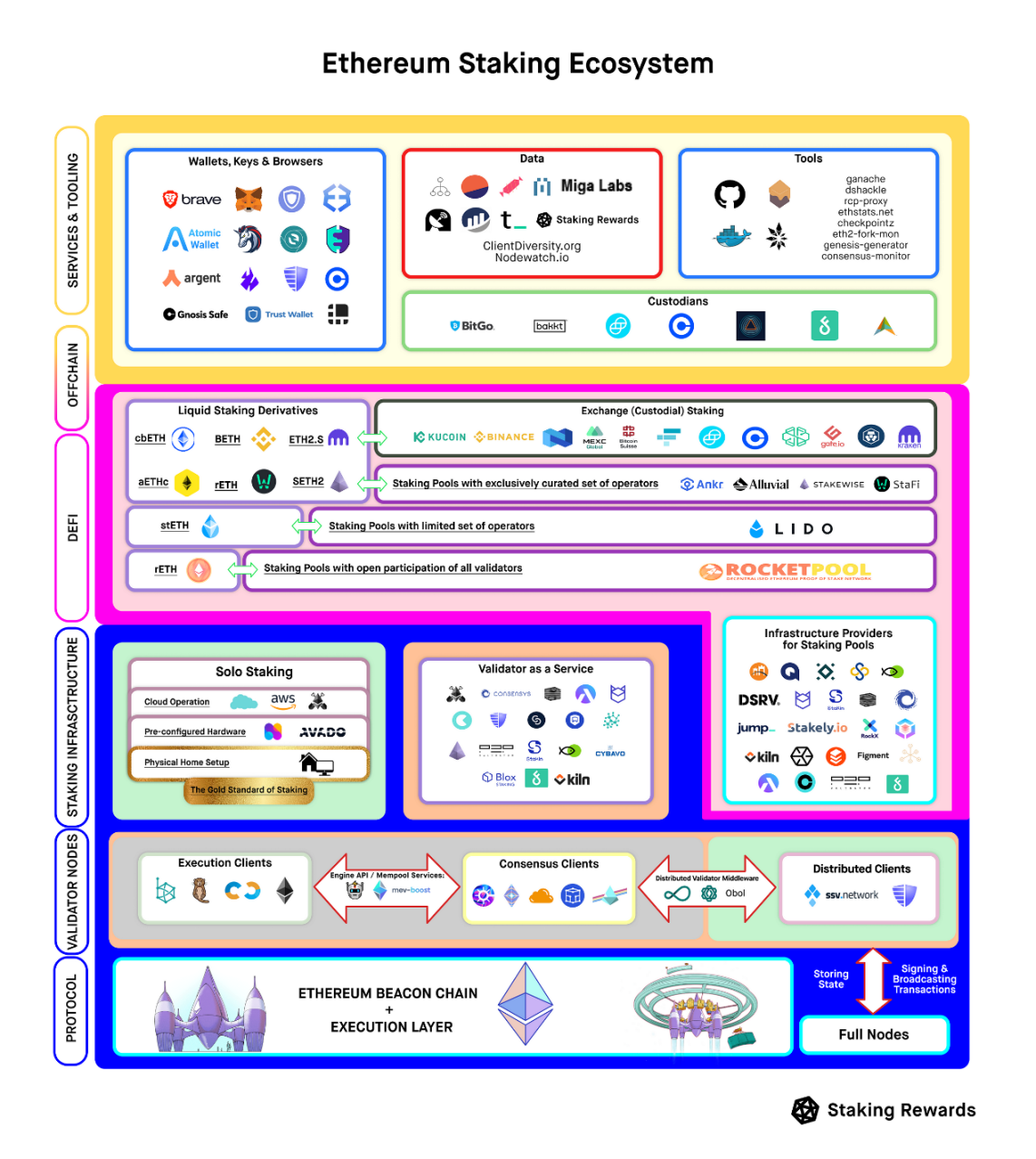

Borrowing a very detailed diagram made by Staking Rewards, it looks very complicated, but in fact there are not so many things that really need to be paid attention to.

There are three ways to participate in pledge:

Solo Staking: To put it simply, run the consensus client and execution client by yourself, and pledge 32 ETH to become a validator. The advantage is that you can get full rewards, and the disadvantage is various risk of forfeiture.

Staking as a service: There will be a service provider specializing in staking services to build a client for you, which greatly reduces the risk of being fined and confiscated. But the service provider will charge, and you need to trust the assumption because you need to hand over the private key to the pledge service provider, which also requires 32 ETH.

Pooled Staking: You basically don’t need to do anything, and you don’t need 32 ETHs. The minimum is about 0.01 ETHs, and this is the only way to withdraw at any time because Pool Staking will give users 1:1 derivative tokens. However, in addition to the trust assumption here, there is also a risk of smart contracts because most of Pool Staking is an on-chain project, and secondly, there are fees. Pledge service providers charge fees, and liquidity services also charge fees.

For specific information, you can check the official staking page of Ethereum and choose a plan that suits you.

Going back to the picture above, in Solo Staking, for example, Amazon Cloud is mostly not a Crypto project, and will not issue Tokens; VAAS is similar, and most of them belong to the ranks of infrastructure and do not issue Tokens. And the Staking Pool is something we need to pay attention to.

The top row of Service & Tooling in the above picture includes wallets, data analysis and other tools, not limited to the pledge track. The next line of Defi liquidity staking, such as decentralized Lido and centralized CEX, will give you 1:1 derivative tokens to release liquidity. Behind the Staking Infrastructure is the infrastructure or hardware of the Saking Pool, most of which do not issue Tokens. The SSV in the node service will be mentioned below. Therefore, the pledge track project that needs to be paid attention to in the whole picture is basically the Staking Pool plus an SSV.

4. Pledge track project

4.1 Lido

In the pledge track, I will briefly introduce the two projects Lido and SSV, as well as the corresponding evaluation and outlook.

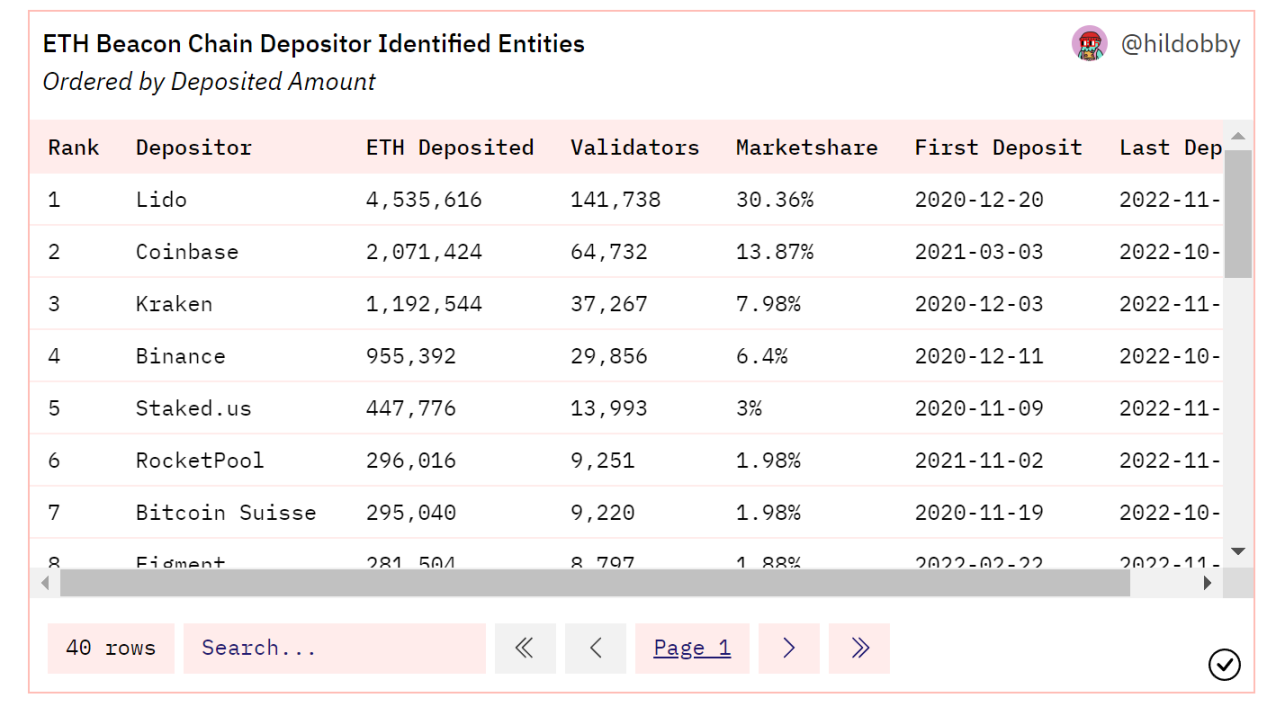

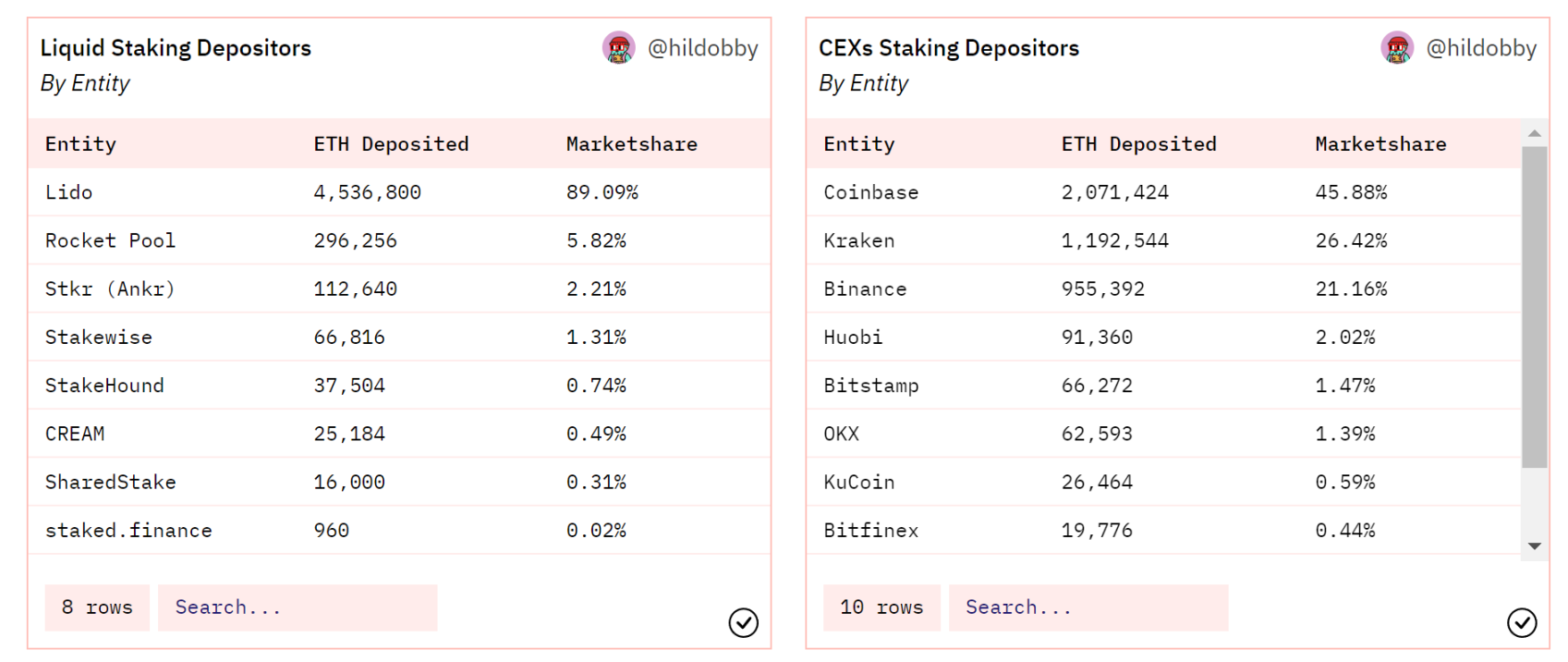

Lido’s pledge accounted for a full 30.36% of the total pledged amount of Ethereum, pledged about 4.53 million ETH (the total pledged amount of Ethereum was 15 million ETH), the second place Coinbase accounted for 13.87%, pledged about 2 million ETH, Lido It is more than double the lead of the second place. And Lido's pledge amount is equivalent to the sum of the three CEXs of Coinbase, Kraken, and Binance (4.21 million ETH), and more.

Lido’s staking volume accounts for as much as 89% of the total Ethereum decentralized staking volume, and the staking volume is about 15 times that of the second-ranked Rocket Pool. It can be seen that other projects on the decentralized pledge track are almost uncompetitive, and Lido has already monopolized the market.

Why can liquidity staking attract users?

Personally, I think it boils down to two things:

Simple operation and no threshold

Liquidity release

And the release of liquidity can be three points: the depth, use and anchoring of derivative products.

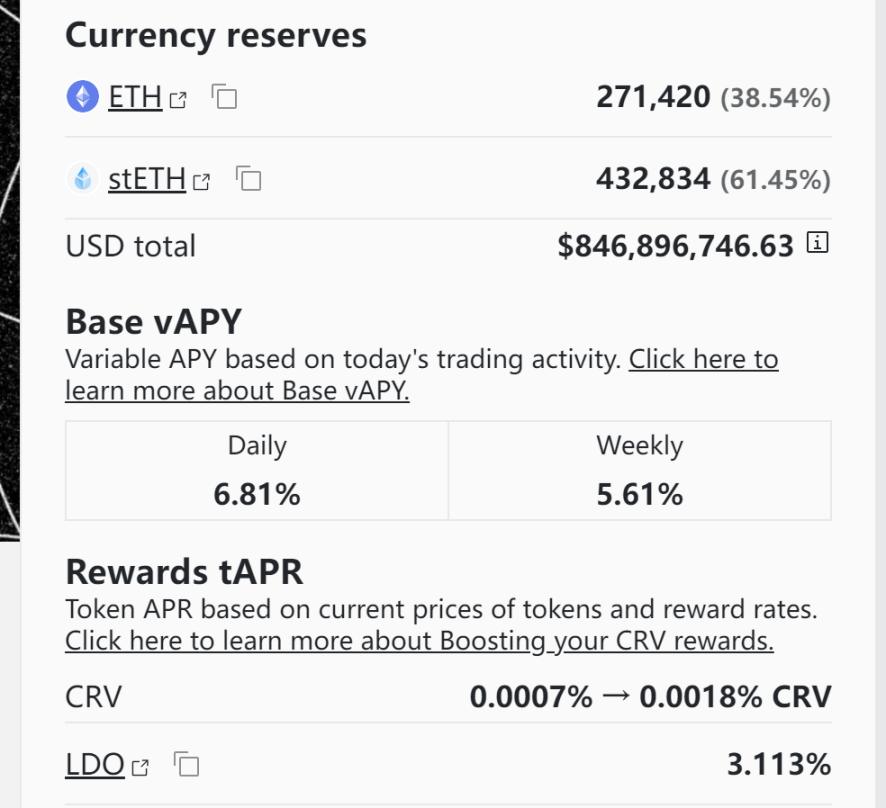

For example, Lido's stETH has 800 million US dollars in Curve ETH-stETH TVL, which is the deepest pool on Curve, larger than the 3 stablecoin pool of 3 Pool, with an APY of 6.81%. At present, almost all mainstream Defi protocols support stETH. Users who choose Lido for the sake of simple operation and no threshold may be snatched away by other projects, but users who choose Lido for the purpose of liquidity release will most likely not leave, because they may not find another in-depth use that can A project comparable to stETH. These factors make more and more people choose Lido.

Since the volume of Lido is roughly the same as that of the three CEXs, it is conceivable that Lido will gain support from many people for the purpose of decentralization and resistance to censorship. CEX will always be a black box, and since 2022, there are not a few CEXs that have experienced thunderstorms. As large as front-line institutions such as FTX, Alameda, and 3 AC, thunderstorms can happen overnight. It seems that Crypto’s centralized entity holding too many user assets is not a good thing. GBTC also caused BlockFi and 3 AC to lose a lot of money in the bull market. Thunder. Therefore, Lido, as a representative of transparency on the chain and anti-centralization and anti-censorship, plays a vital role.

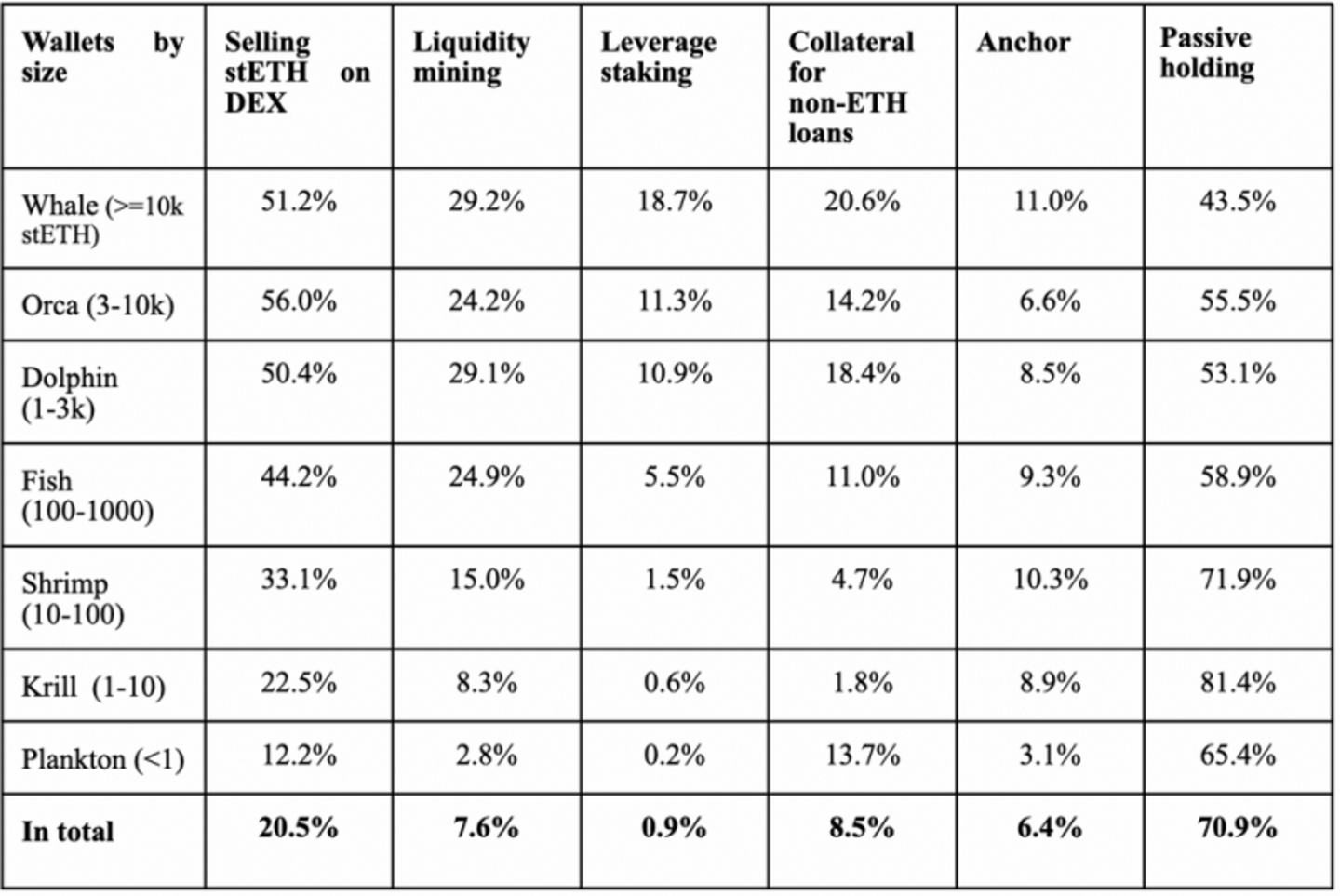

The usage of stETH is as follows:

The picture above shows the use of stETH according to Lido's official statistics. It can be seen that the number of people holding passive holding is the largest, about 70%. For giant whales, it is relatively more widely used. In addition to selling on DEX, they will also participate in some leveraged mining and leveraged pledges to increase profits. On the other hand, addresses with fewer positions are more inclined to pure Holding. This actually reflects the importance of the wide range of derivatives for liquid pledges to the project.

It is not difficult to see from this picture that most people are Passive Holding, so in fact, for them, the depth and use of stETH are not very important, because they will not use stETH for anything. Rather than saying that these users are users who may be lost in the future, it is better to say that the use of stETH has not been fully tapped by Lido stakers.

So, is stETH afraid of decoupling?

I am afraid that any savings-absorbing institution is afraid of a run. Anchor, FTX and other large-scale institutions all ran out of panic and went bankrupt in just a few days. stETH has also been decoupled many times, and any stable currency including USDT has been decoupled many times, but consensus determines the speed of return, and a successful return will confirm everyone's confidence. stETH usually returns quickly, but because it cannot be withdrawn before the Shanghai upgrade, it has been at a negative premium for a long time.

According to Lido official statistics, about 49% of the stETH addresses with positions >100 stETH are purchased from DEX, perhaps because Smart Money is more inclined to buy stETH at a discount, and is expected to sell arbitrage when the discount is smoothed out after the Shanghai upgrade. Now that it has been successfully merged and withdrawal is a function that the core developers will deploy in the next step, the risk of decoupling of stETH is not great.

The fact that the market share of a single pledge agreement should not be too high has been the point of view of many people including Vitalik. Will Lido stop growing due to this reason? If the proportion of Ethereum pledged will rise as expected in the future, then Lido will naturally be one of the beneficiaries. It will be difficult to surpass the leading position in a short period of time, but it is likely to increase in proportion. Does Lido have any technology? It seems not, is there any moat? It seems that there is nothing but the endorsement of large institutions and the ecology of stETH. I think Lido is just a front-end to absorb user deposits. After Terra, 3 AC, and FTX can disappear in such a short period of time, can you still think that large-scale institutions must have strong anti-risk capabilities?

4.2 SSV

The future Lido is more like a big beta, and its performance may be better than Ethereum, but it may not be the project with the largest future space in the pledge track. On the one hand, Lido is already very large, and the increase in Ethereum pledged by Lido throughout 2022 is quite insignificant; on the other hand, centralized governance, high market share, etc. are all problems that need to be solved urgently. And if the ratio of Ethereum pledges increases regularly in the future, some new opportunities will naturally emerge.

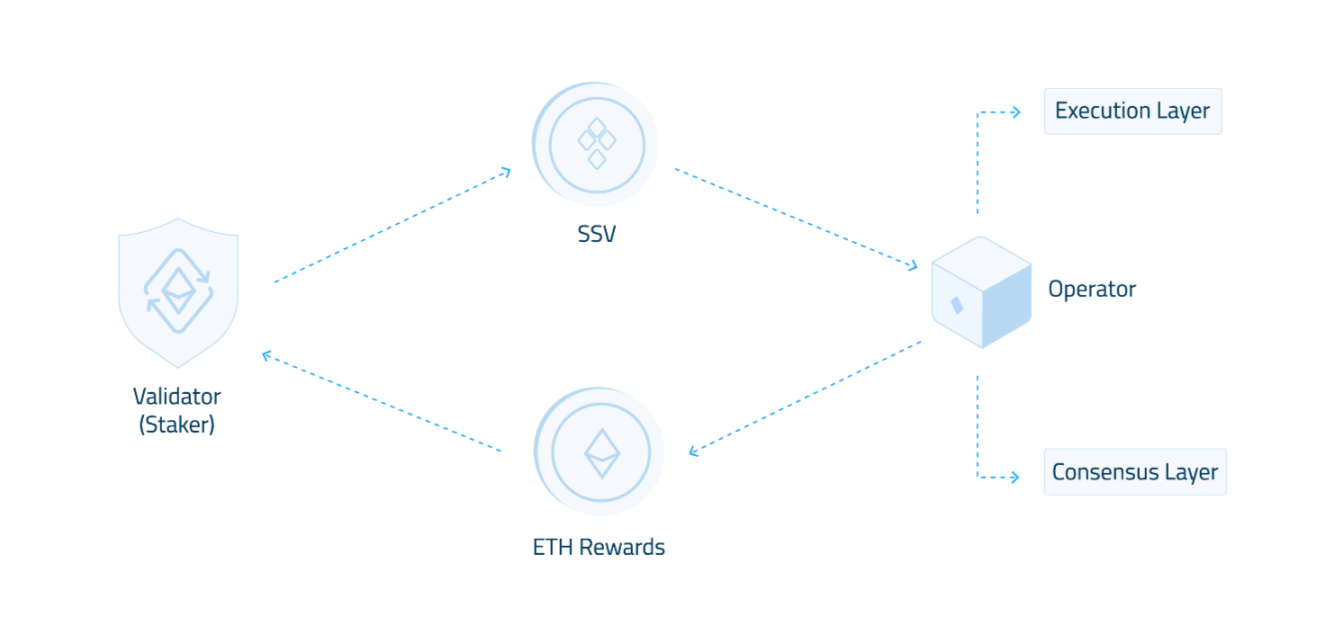

The vision of SSV is to become a fundamental part of the Ethereum ecosystem, ensuring that control of the Ethereum chain remains decentralized, pledgers do not give up control of their ETH, and any future pledge service can integrate SSV. Network is used as staking infrastructure.

Stakers

4.2.1 Three roles of SSV: Stakers, Operators, SSV Holders

Operators

The target users are quite extensive, such as staking pools, staking service providers, Solo Stakers, etc. I think the real target users of SSV are pledge service providers with a certain scale, such as Blockscape, P 2 P.ORG, Staking Facilities, etc. chosen by Lido, as well as some large ETH holders. In other words, SSV should be to B.

Operators are responsible for providing the hardware infrastructure. Anyone can register as SSV Operators, and a small number of operators will become Validated Operators through DAO voting.

Operators receive Staker's SSV Token as a reward to produce ETH and return it to Staker. It can be seen that the value of SSV will be strongly bound to the size of the entire project. Staker will need to hoard a large amount of SSV, otherwise there will be a risk of liquidation, and it is not that traditional Defi Gov Token is useless.

SSV Holder

There are more than 686 Operators and 4624 Validators in the current network.

SSV Token Holder can vote on various things such as Operator rating and Network Fee.

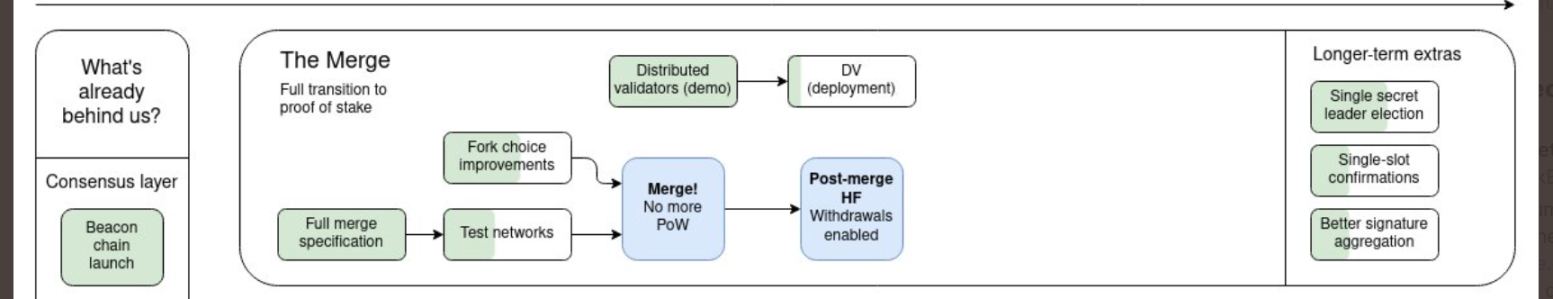

4.2.2 Ethereum Merge stage

4.2.3 Distributed Validators Technology

Among the five stages of Ethereum upgrade released by Vitalik at the end of 2021, Distributed Validators Technology is mentioned in the middle of The Merge section. In POS, whenever a validator needs to propose or prove a new block, the data is signed with the validator key, and this happens approximately once every epoch (6.4 m), except for users running the validator client themselves All need to hand over the validator key to the pledge service provider. Perhaps this is another reason why the staking ratio of Ethereum is still too low. People are unwilling to trust any third party, especially in the case of many front-line organizations in 2022. This kind of thinking is exacerbated, "Not your key, not your Coin.”Distributed Key GenerationDistributed Validators Technology, Chinese called distributed verification technology, will pass the keyShamir Secret Sharing, Multi Party Computation, and Istanbul Byzantine Fault Tolerance ConsensusEncrypted and split into multiple Key shares, these Key shares will be distributed among the four untrusted nodes running by the operator, if a single key share goes offline, the rest of the key shares will pass

and other technologies work together to perform their duties, so a certain number of failures can be tolerated without causing slashing.

Therefore, SSV is not actually a competitor of Lido, but the relationship between the two is upstream and downstream. SSV is equivalent to the middleware between the Ethereum consensus layer and the verification node. Any node operator may choose SSV for the purpose of decentralization and reducing trust assumptions. In other words, DVT technology is almost a product that can potentially serve the entire Ethereum staking ecosystem. For example, Lido conducted an integration test with SSV on the Goerli testnet last month. After years of development, SSV has not yet launched the main network, and its market value is slightly lower. It is a promising staking track project.

4.2.4 Potential issues with SSV

Since it is the middleware between the staker and the operator, the SSV can be understood as serving various stakers. The larger the Staker, the more beneficial it is to the SSV, so it can actually be understood as a To B product, and the product’s The core barrier is DVT technology.

First, does the B-side have to choose SSV? Personally, I think it's okay to wait for a replacement or not use SSV at all as it has always been. Second, the value of Token does not have many usage scenarios other than voting and payment. In other words, since SSV is a To B product, it may not have any impact if it does not issue Token. Many pledge service providers can outsource this requirement. Therefore, if SSV can take advantage of the first-mover advantage, then attracting as many verifiers as possible to form a moat is the key to be invincible in the future. Otherwise, once the technology matures and many alternatives appear, it may no longer have an advantage.

Original link

Reference:

https://newsletter.stakingrewards.com/p/mapping-the-ethereum-staking-ecosystem

https://newsletter.stakingrewards.com/p/exploring-the-liquid-lands-of-staking

https://ethereum.org/en/developers/docs/consensus-mechanisms/pos/rewards-and-penalties/

https://blog.bitmex.com/ethereums-proof-of-stake-system-calculating-penalties-rewards/

https://consensys.net/blog/codefi/rewards-and-penalties-on-ethereum- 20 -phase- 0 /

https://coinshares.com/research/ethereum-staking-yields

https://research.nansen.ai/article/ 174 /the-merge-a-deep-dive-with-nansen