Uniswap V3 LP turns losses into profits

Editor's Note: This article comes fromblockin.ai, the original title "UniV3's LP is struggling with continuous losses, will the migration from CeFi to DeFi become a life-saving straw for LP to turn losses into profits?" 》, reprinted and published by Odaily with authorization.

Recently, Alex published an article on the Twitter platform about the discovery that LP lost about 100 million US dollars in Uniswap V3 ETH/USDC, questioning the data service and strategy research of Uniswap V3.This articleThis article。)blockin.ai teamI have been working on the profit and loss research of LPs and POOLs in UniswapV3. This time, I will conduct further research on the profitability of the UniV3 currency pool, hoping to provide effective data proof for the proposition of whether UniV3 LPs continue to lose money.

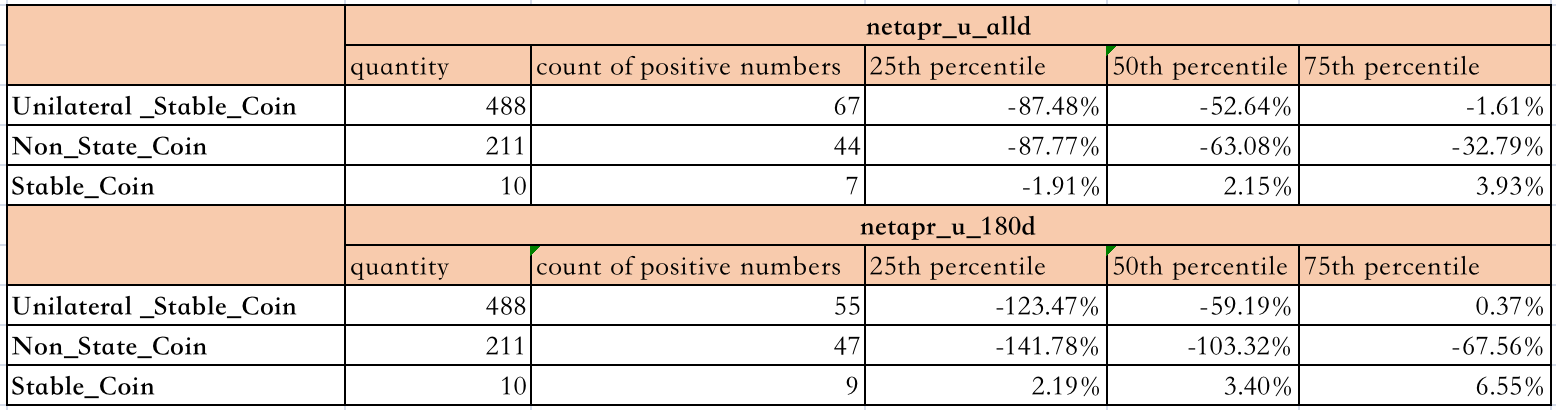

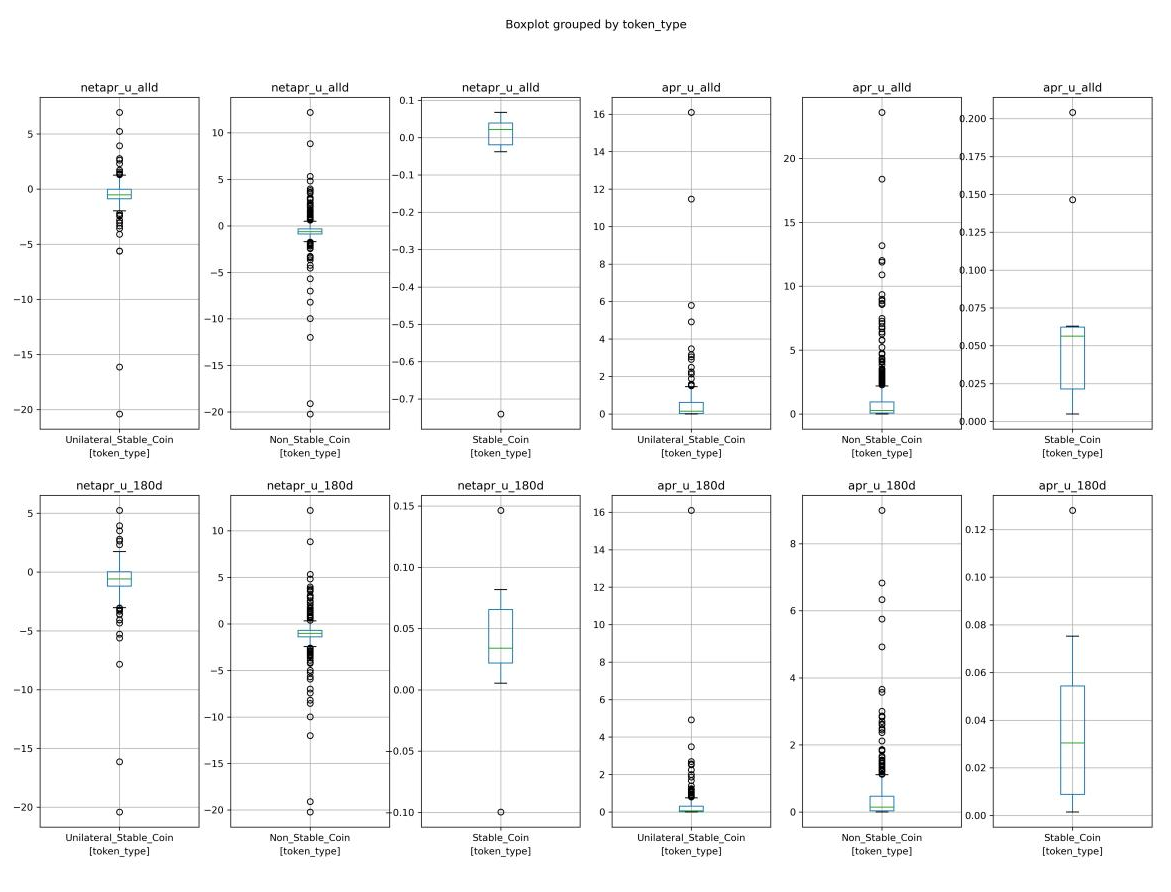

In order to understand the impact of different currency pair types on pool returns, we aggregated all position information from creation to October 26, 2022 for 709 currency pools with TVL greater than 52 ETH and more than 5 swap events. By calculating the hourly earned fees, free loss, net value, and gas of the position, the hourly rate of return of the pool can be obtained, and the overall mining annualized rate of return and net annualized rate of return of the pool since its creation and the last 6 months have been accumulated Rate.

In order to distinguish the types of currency pools (dual non-stable currency pool, single stable currency pool, and dual stable currency pool), we use DAI, USDC, USDT, and TUSD as highly recognized stable currencies, and other currencies as non-stable currencies. Coin pools are classified.

Judging from the profit and loss distribution of pools of different types of currency pairs, 86.27% of unilateral stable currency pools and 79.15% of dual non-stable currency pools have had a net annualized rate of return less than 0 since their creation, and the median net annualized rate of return has been -52.64% and 63.08%. In the past six months, the 75th percentile net annualized rate of return of dual non-stablecoins has even reached -67.56%.This shows that over a long period of time, most unilateral stablecoin pools and dual non-stablecoin pools are losing money; while the mining income of dual stablecoin pools is very low, but 70% of the overall income of dual stablecoin pools The ratio is positive, and 90% of the dual-stablecoin pools have been profitable in the past six months, although the 75th percentile of the net annualized rate of return is less than 10%.

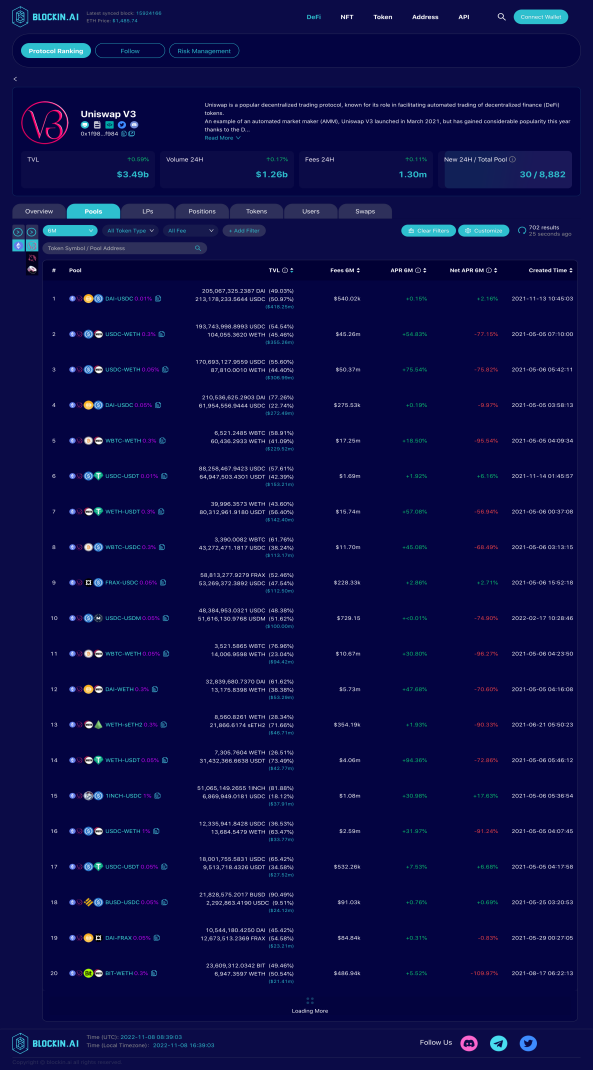

Ranking the coin pools, it was found that among the top 20 large pools by TVL, 14 pools had negative net returns in the past six months, and 12 of them had net returns lower than -50%. The net rate of return of the currency pool is positive, and the highest is less than 10%, and the net rate of return of 9 other pools is lower than -50%;

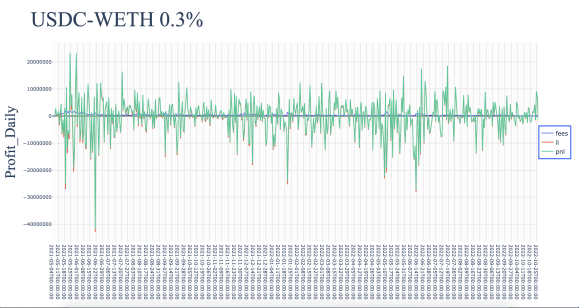

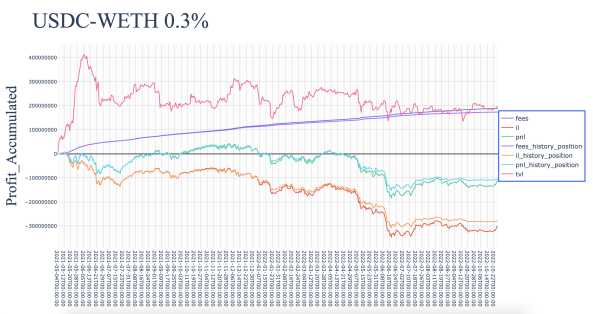

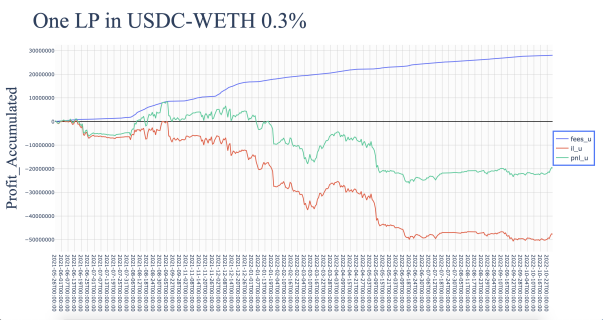

Taking the USDC-WETH 0.3% pool as an example, draw a single-day line chart and cumulative line chart of the fees, free losses, and net profit and loss of all positions and confirmed profit and loss positions from the establishment of the pool to October 26, 2022, and found that many At that time, the fees could not cover the uncompensated losses, resulting in a cumulative net profit and loss of -112.8 million US dollars. However, there are also periods of rising net profit and loss. For example, during the period from mid-June 25, 2021 to December 1, 2021, the cumulative pnl rose from -81.96 million US dollars to 42.17 million US dollars; from June 18, 2022 to October 26, 2022 Cumulative pnl rose from -$185.3 million to -$114.3 million during the period.

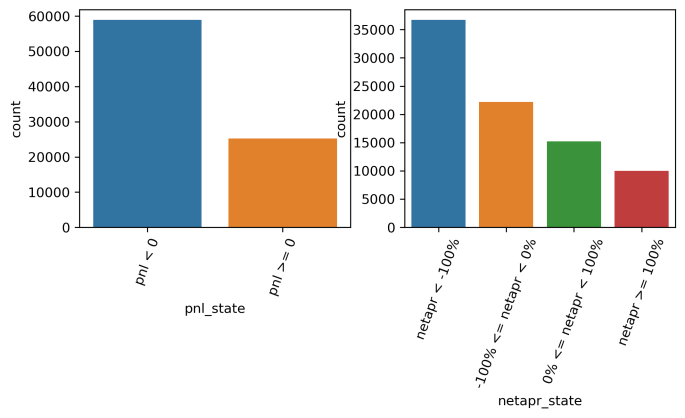

According to the statistics of 84129 LPs with mining records in Uniswap-V3,58,925 LPs are at a loss, and the loss ratio has reached 70.04%, In addition, 43.64% of LP's net annualized rate of return during mining is less than -100%, and only 11.85% of LP's net annualized rate of return is greater than 100% during mining (average mining time is 35.26 days).

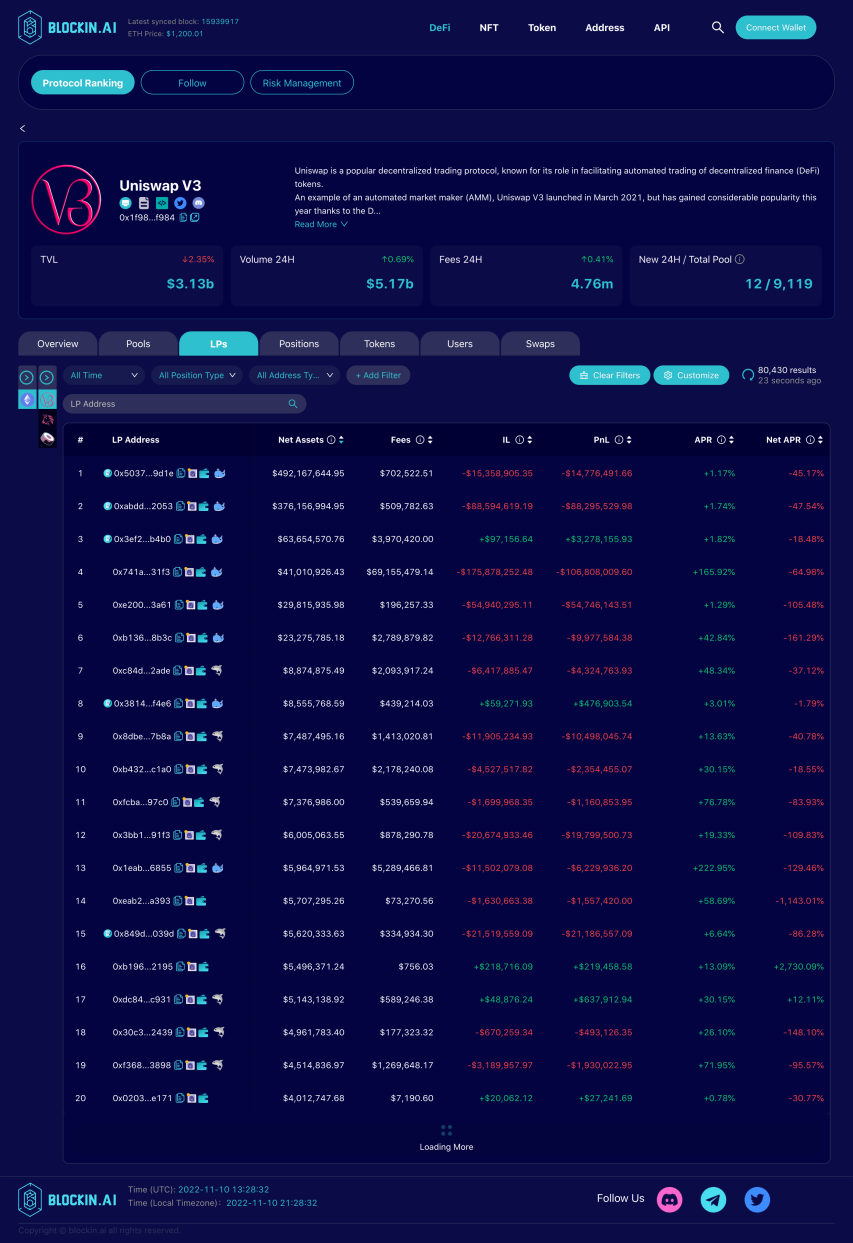

Some people think that large-scale fund institutions with professional teams may be able to resist this loss. In real time, we found that among the top 20 LP addresses with the largest total net value of positions in Uniswap-V3, only 5 LPs are profitable, and according to After estimating the net annualized rate of return per unit net value, only 2 large households have a positive net rate of return, of which only one LP netapr has reached 2730.19% (this LP actually only mines for 10 hours on November 10, 2022), and the other LP The netapr is 12.11% (the LP has actually been mining since June 16, 2022).

It is worth pondering that,What are the reasons why these LPs are still willing to mine in the Uniswap-V3 protocol despite continuous losses?

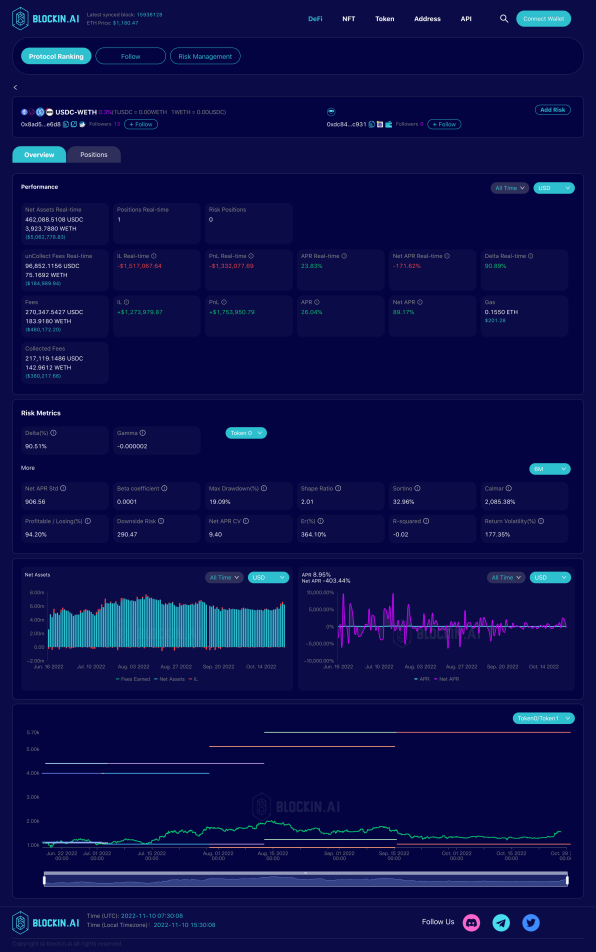

We checked the mining behavior of the LP with the largest current position net value in USDC-WETH 0.3% (LP address: 0x741aa7cfb2c7bf2a1e7d4da2e3df6a56ca4131f3). Continuously adjust positions, and have continuously adjusted strategies such as range width and frequency of position adjustments. However, from his profit and loss curve, except for a few periods of time when pnl slopes upward, losses continue to expand most of the time.Therefore, we have reason to suspect that such large investors may have hedging behaviors in other agreements to make up for losses in V3, or that V3 is used as an option hedging tool for other currency price strategies.

We also checked the ranking of LPs with the highest historical income pnl in USDC-WETH 0.3%, selected two large LP households who had mining activities in the past month, and found that they have the same characteristics. They entered from June 2022 and set super Wide range of upper and lower limits, and adjust positions or not adjust positions at a very low frequency. From the perspective of risk indicators, the sharpe values of both are higher than 2, the maximum retracement rates are 19.09% and 9.54% respectively, and the daily profit and loss ratios are 94.20% and 103.03% respectively.

The difference between the two LP strategies is that the lower range of LP1 is relatively narrow, around 1000 USDC/WETH, so the risk exposure based on USDC has reached 90.51%, and the downside risk is 290.47; the lower range of LP2 is set at about 552 USDC/WETH WETH, so the risk exposure based on USDC is 46.57%, and the downside risk is 122.48.

It is not difficult to find that the main reason for the profitability of these two LPs is that the prices have been relatively stable since June 2022 and have not fallen sharply. Even during the period of currency price fluctuations, the prices are still between the upper and lower limits, and no compensation loss has been confirmed.

LP addresses are: 0xdc848a72842d943b87926ae27ee05f1e949ec931, 0xc84def0f58df9f25f1099ed477da7b27ac422ade

The profit model of Uniswap V3 is diverse. Not all LPs use the U standard to calculate profit and loss, and some LPs also use the growth of a certain currency as their profit target. Therefore, we have counted token0 and token1 as the standard currency for each currency pool. cumulative profit and loss.

Surprisingly,From the performance of the top 20 coin pools in TVL, it is found that 13 coin pools are in a state of loss regardless of the token0 standard or token1 standard. A currency standard free loss and loss at the same time.In conventional cognition, the increase of free loss of one currency standard means the decrease of free loss of another currency standard. When the two camps lose money at the same time, it is difficult for us to guess who the actual profit target is. After all, the users who conduct exchange transactions It is also believed that they suffered losses due to slippage.

Recently, affected by the FTX run crisis, the credit issues of centralized exchanges have been questioned, which led to a sharp increase in the trading volume of decentralized exchanges within a month, of which Uniswap V3 trading volume increased by 898%. Higher transaction volume means that fees will increase when TVL remains unchanged, which brings hope to the LPs. Take the USDC-WETH 0.3% currency pool as an example. The current average daily transaction volume of this currency pool is 116.4 million US dollars, when the average daily transaction volume reaches more than 186.7 million US dollars, that is, when TVL is stable at the current level and the transaction volume reaches more than 1.6 times the current level, fees will be able to cover free losses, and most LPs will be able to achieve profitability.

As a symbolic agreement project of AMM, the trading volume of Uniswap V3 currently accounts for more than 50% of the trading volume of Ethereum DEX. If users strengthen their belief in decentralized exchanges in this incident, it will be a reversal of LP losses in Uniswap V3 Turning point for profit.