Don't dare to spend money? Encrypted venture capital funds slow down, Q3 invests only $5.5 billion

This article comes fromBlockworkssecondary title

Odaily Translator |

![]()

Summary:

Summary:

VC funds have ample capital, but they are slow to deploy it.

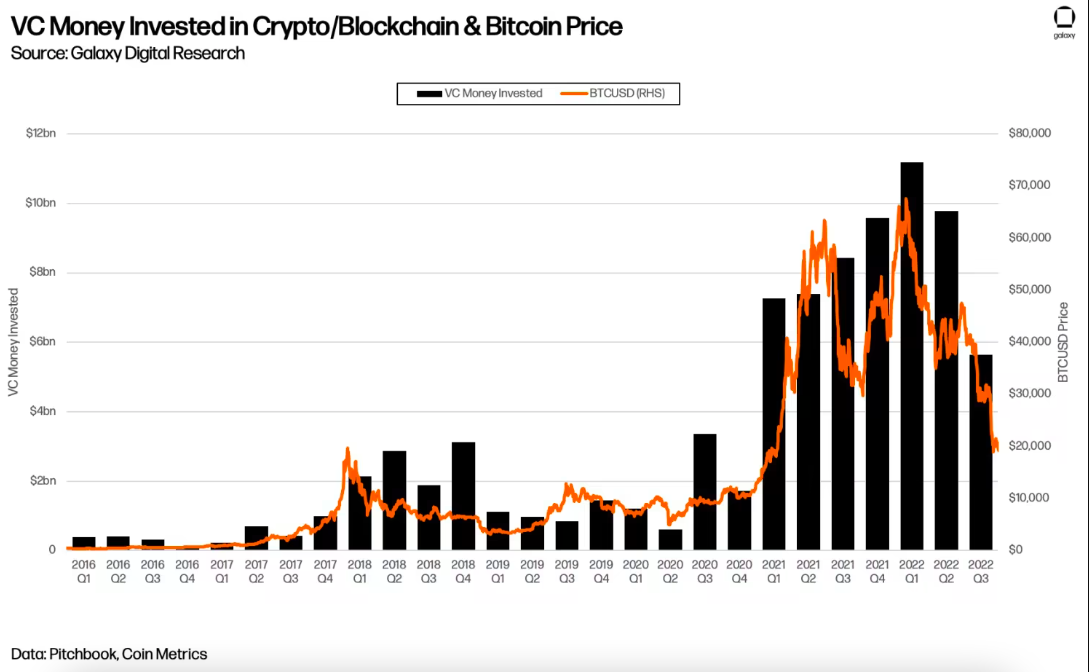

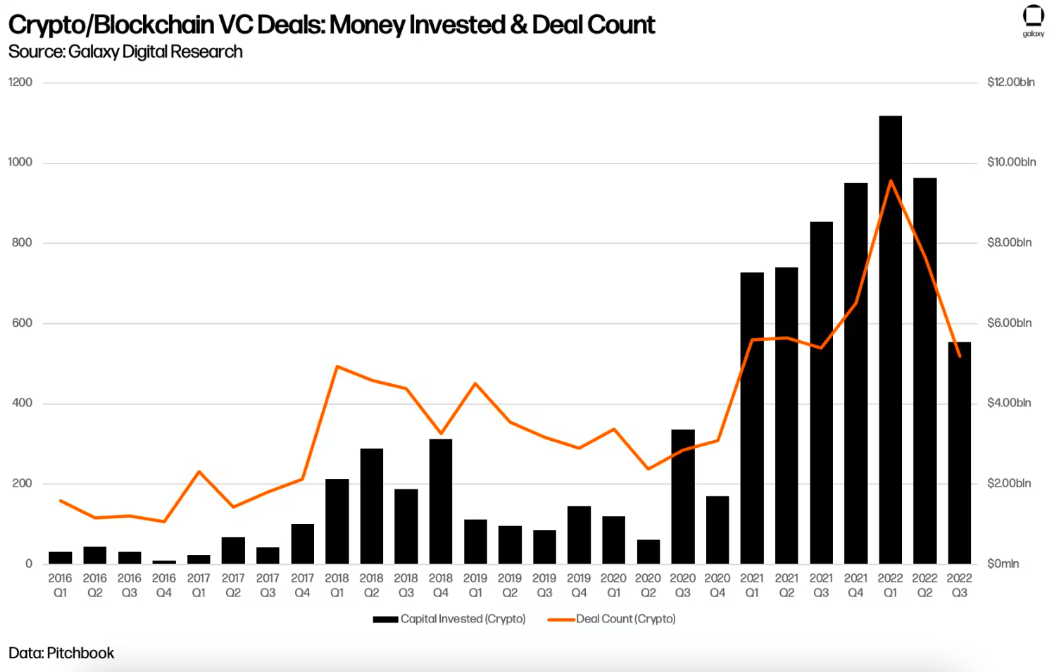

Venture investors poured more than $5.5 billion into crypto startups in the third quarter, compared with $8 billion in the second quarter., but according to research by investment agency Galaxy Digital, the decline in relevant data in the second half of the year may indicate a long-term slowdown.

according toaccording toPreviously published Q2 2022 reports from PitchBook and others

according toaccording toPreviously published Q2 2022 reports from PitchBook and others

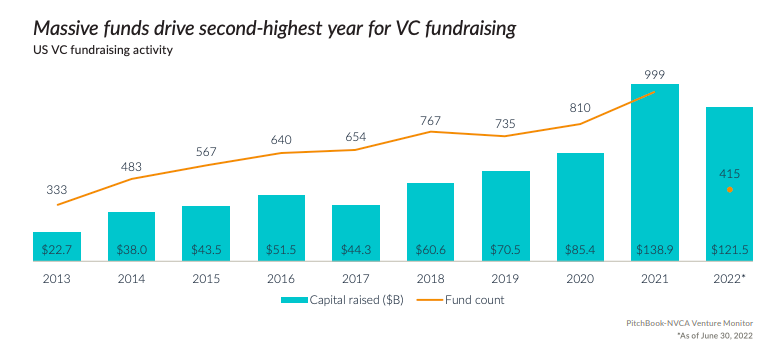

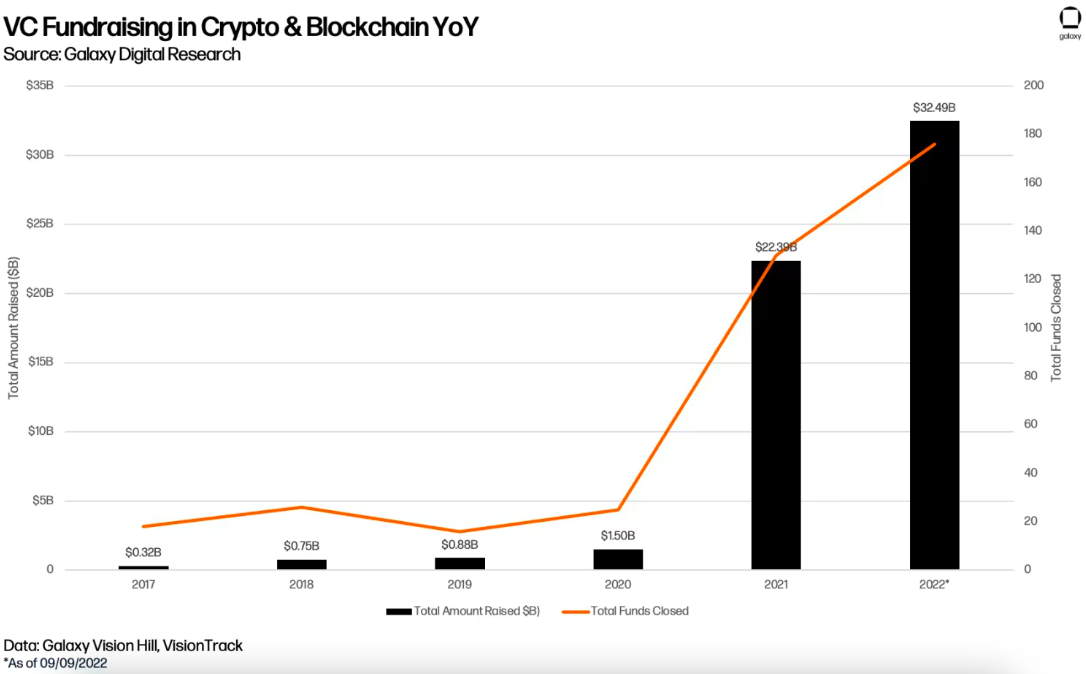

, the overall number of venture capital (VC) funds in the United States this year is lower than in 2021, and there were 999 VC funds last year. As of June 30 this year, 415 venture capital funds collectively raised more than $121 billion. According to the Galaxy Digital report, as of September 9, VCs in the blockchain/encryption field have raised more than $32 billion this year.Galaxy Digital researchers in the latest releaseThird Quarter Venture Capital Report

According to the Galaxy Digital report, as of September 9, VCs in the blockchain/encryption field have raised more than $32 billion this year.Galaxy Digital researchers in the latest releaseThird Quarter Venture Capital Report

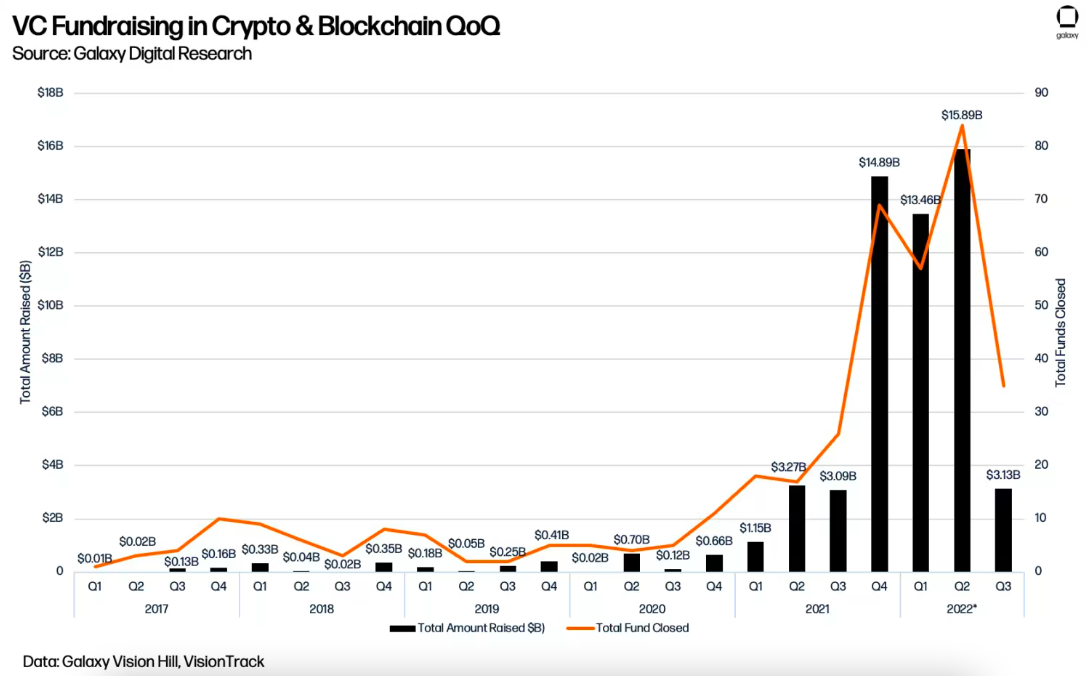

pointed out that Q3 blockchain/encryption-related VC fundraising decreased by 80% compared to Q2. “Due to the turmoil in the cryptocurrency market in May and June, some funds may postpone their autumn fundraising until the fourth quarter in order to wait for the market to readjust.”

According to Galaxy Digital, VC investors invested over $5.5 billion in blockchain/crypto startups in Q3 2022, compared to over $8 billion in Q2.Galaxy Digital at2nd Quarter Venture Capital Report

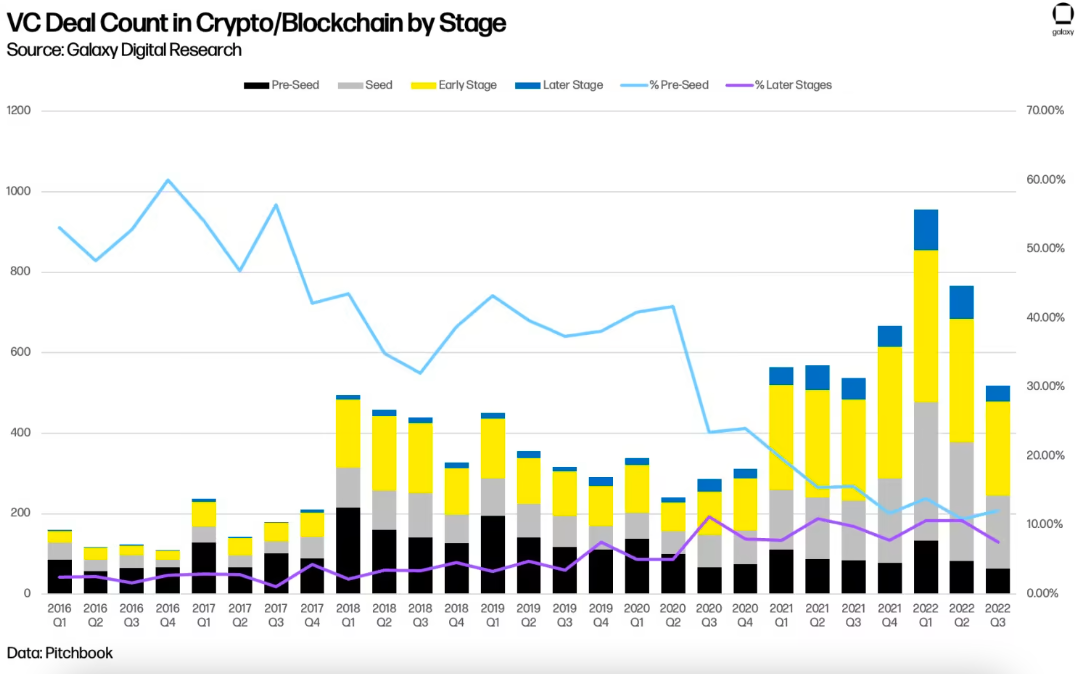

He pointed out that the second quarter of 2022 marks the beginning of waning interest from VC investors in the crypto space. According to the report, the number of pre-seed rounds of financing deals during the period was less than half of what it was in the first quarter. This downward trend continued into the third quarter.

Due to the continued volatility in the crypto market, funds have been deployed slowly by related funds. For example, BlockTower Capital has committed $20 million of its new $150 million fund.According to TechCrunch

, as of mid-October, New Form Capital, which focuses on fintech and blockchain, has only deployed about 30% of its $75 million Fund 2.

However, Galaxy Digital pointed out that VC funds have a lag in NAV reporting and that the bear market environment is having a greater impact on their allocation decisions.

“In a more stable market, the lag (in the timing of the report) would not deter allocators from continuing to make investments, but in a highly volatile market, this lag can cause problems,” Galaxy Digital said.

This has to do with allocators' investments in liquid assets such as equities and fixed income products, whose prices have declined over the past six months, necessitating rebalancing.