RWA (Real World Assets): Bridging from DeFi to TradFi

This article comes from thetieThis article comes from

, the original author: Vaish Puri, compiled by Odaily translator Katie Ku.

Against the backdrop of rising interest rates, falling DeFi demand, and a sluggish global economy, the opportunity cost of moving value on-chain is at its highest level in cryptocurrency history. Real World Assets (RWA) both provide a unique opportunity for DeFi investors with diminishing returns to access more off-chain lending markets, and allow TradFi institutions to issue tokenized debt/assets without geographic restrictions.

secondary title

What is a Real World Asset (RWA)?

RWA is a token that can be traded on the chain and represents real assets. Examples include real estate (sales and leases), loans, contracts and guarantees, etc. RWA removes many of the limitations of traditional finance.

Regardless of geographic location, RWA enables economic growth and companies can maintain long-term stability by raising capital through digital or traditional means.

secondary title

Why choose RWA?

Take the success story of securitization in the 1990s. Securitization is a system for creating, aggregating, storing and diversifying risk, increasing liquidity and lending by providing benchmarks (length of time, risk, etc.) that assets must meet. Back then, mortgages, business loans, and consumer loans were institutionalized and deployed through securitization, providing consumers, companies, and homebuyers with more affordable financing options.Securitization 30 years later is pretty much the same. Financial markets have not yet evolved to adapt to the Internet age.A network of investment banks, custodians, rating agencies, servicers, etc. makes borrowing more expensive than it should be, and most assets cannot be securitized. Most companies still do not have access to international financing markets. Basic resources such as insurance are still hard to come by in parts of Africa and Asia. This raises a question:What does the digital capital market need to do to cross TradFi's moat?

secondary title

asset custody

asset custody

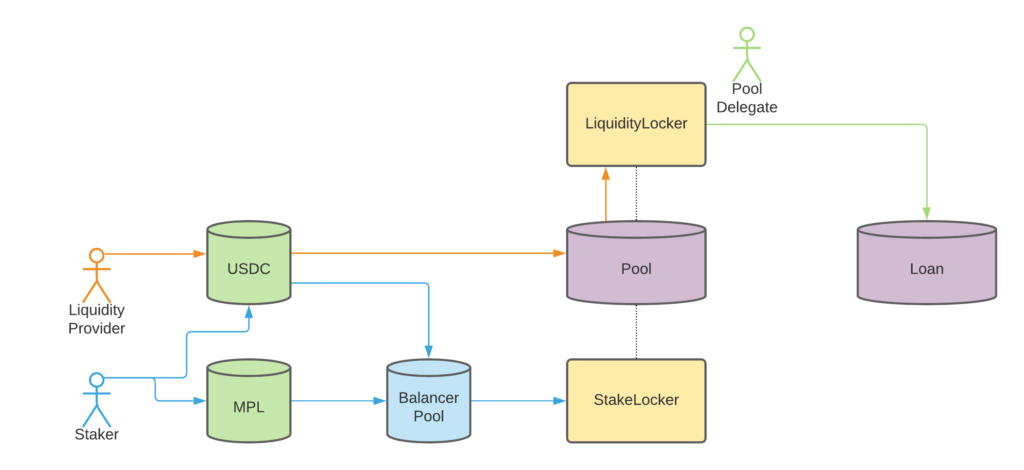

Due to the surge of digital assets and the influx of new institutions, it is even more important for stable institutions to manage digital assets. Trust-free DeFi custody services like Anchorage Digital and Copper have proliferated over the past few years. Some credit protocols, such as Maple, also offer collateral in tokens on platforms that serve institutions.

secondary title

fluidity

fluidity

In addition, the protocol can also collaborate with DeFi applications such as Balancer and Curve to create liquidity. A representative example is Goldfinch, whose members created a liquidity pool on Curve with FIDU (FIDU is a token that represents LP deposits to premium pools). This enables Curve LP positions on FIDU and USDC trading pairs to earn GFI liquidity mining rewards.

secondary title

credit agreement

One of the biggest reasons why DeFi is causing institutional panic is the lack of a standardized reputation system, such as credit scoring. DeFi protocols are forced to require liquid tokens as collateral because repayments cannot be enforced in case of default. This excludes credit risk, but also limits the type and number of financial products available. Credit protocols are taking complementary strategies to provide reputation for lending. Some strive to bring off-chain reputation to the on-chain world, while others work to create on-chain reputation systems.

1、Goldfinch

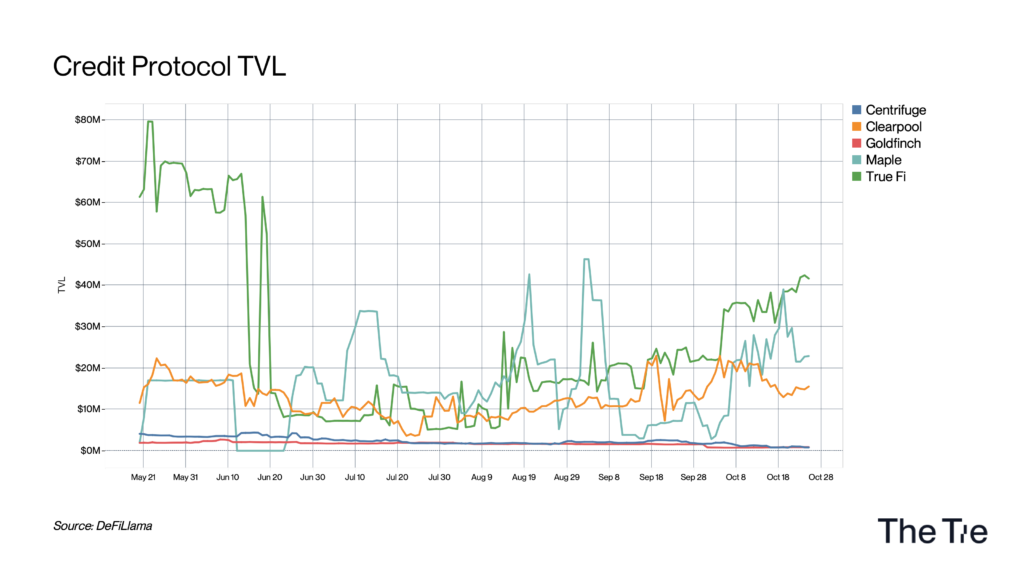

While specific examples vary, this is exactly what major credit protocols like Maple, TrueFi, Goldfinch, Centrifuge, and Clearpool aim for.

Goldfinch is developing a decentralized loan underwriting protocol that will allow anyone to issue loans on-chain as an underwriter. Its foundation is built on two fundamental principles:

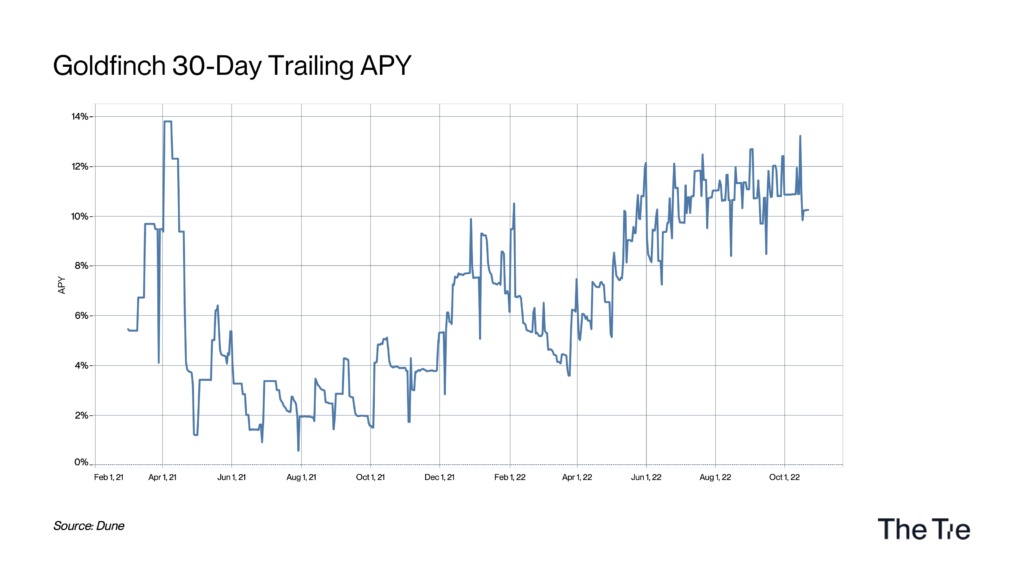

Over the next decade, investors will demand new investment opportunities due to the overall transparency and efficiency of DeFi, as well as the prevailing low interest rate environment (which is currently changing). Investors will also demand higher yield opportunities than traditional banks and institutions are offering.

Global economic activity will move on-chain, making every transaction transparent, creating a new public good: an immutable, public credit history, and a reduction in the significant transaction costs associated with banking.

Its goal is to collect information in real life and the Internet to establish user credit that can be used for on-chain applications. As with any credit institution, the system is not without risk. The system protects the interests of lenders, including preventing defaults, or repaying lenders as much as possible in the event of defaults.

2、Centrifuge

Goldfinch relies on its backers (investors who provide USDC to the pool of borrowers) to monitor the health of the pool and provide liquidity. Because in case of default, backers' liquidity is lost first. Similar to TrueFi, Goldfinch offers smart contract insurance through Nexus Mutual.

Centrifuge is a protocol that provides fast, cheap funding to small businesses and steady income to investors. Centrifuge connects real-world assets with DeFi, lowers the cost of capital for small and medium-sized enterprises, and provides DeFi investors with a stable source of income independent of volatile crypto assets. Centrifuge relies on asset originators and issuers to provide low-default, stable loans. Investors in Centrifuge subordinated bonds are the first to bear losses in the event of default.

3、TrueFi

Tinlake is their first user-facing product, offering companies an easy way to access DeFi liquidity. For investors, these assets will bring safe and consistent returns on their investments, independent of crypto market volatility. Their native token CFG uses PoS consensus, and validators are incentivized for staking. Through on-chain governance, CFG stakers can facilitate the development of Centrifuge.

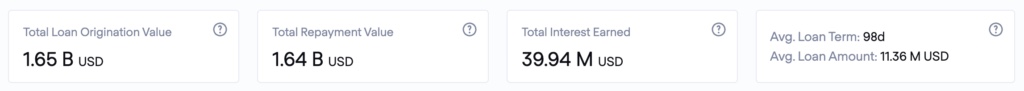

TrueFi is a credit protocol that provides a wealth of real-world and crypto-native financial options for on-chain capital markets. As of writing, TrueFi has taken over $1.7 billion in unsecured loans and paid out $35 million to lenders. Through a gradual decentralization approach, TrueFi is now owned and managed by TRU token holders, run by the TrueFi DAO or independent investment managers.

4、Maple

TrueFi core contributor Archblock (formerly TrustToken) originally started using RWA in 2018, launching the stablecoin TUSD. From early 2022, TrueFi goes further into RWA, allowing traditional funds to adjust their loan portfolios on-chain. Today, TrueFi's portfolio facilitates Latin American fintech, emerging markets, and crypto-collateralized lending.

secondary title

Summarize

Summarize

As the crypto industry grows, capital efficiency will increase to the next order of magnitude. This evolution will be driven by a credit model that continuously assesses each borrower's risk of default. In the future, capital is immediately allocated to projects with the highest risk-reward ratio. Credit protocols such as TrueFi, Centrifuge, and Goldfinch will play an important role in guiding the convergence of DeFi and TradFi.