Bit.com's launch of U-margined options, can it disrupt the crypto derivatives track?

Options, one of the crypto derivatives, have received much attention in the past two years.

On the one hand, encrypted trading platforms led by Binance and OKX, and traditional financial institutions led by CME (Chicago Mercantile Exchange) and Goldman Sachs have successively opened option trading; on the other hand, emerging decentralized exchanges represented by Hegic and Opyn The protocol aims at the option track on the chain and launches various structured DeFi option products. All forces are chasing after each other, driving the trading volume and open interest of encrypted options to continue to rise, setting new historical records one after another.

Bit.com, an encrypted trading platform under Jihan Wu's company Matrixport, is also a strong participant in the options market. The platform focused on institutional-level options products in the early days, and launched currency-based options for mainstream currencies such as BTC and ETH. Recently, Bit.com began to promote the retail trading market, and upgraded options trading, introducing U-standard and implied volatility (IV) quotations on the basis of traditional currency-based quotations to meet the diverse needs of the market.

secondary title

1. Options: hedging risks and resisting extreme market conditions

What are options? Options (Options) is a right that can be exercised at a certain time in the future. After the buyer of the option pays a certain amount of option premium to the seller, he can obtain this right: buy or sell at a certain price in a certain time in the future Issue a certain amount of underlying assets.

As a derivative transaction, options, like futures, also have leverage. Compared with futures, options can provide multi-dimensional risk hedging and non-linear risk returns, and have irreplaceable financial product attributes.More importantly, options are more risk-resistant than futures under extreme market conditions and volatile market conditions.

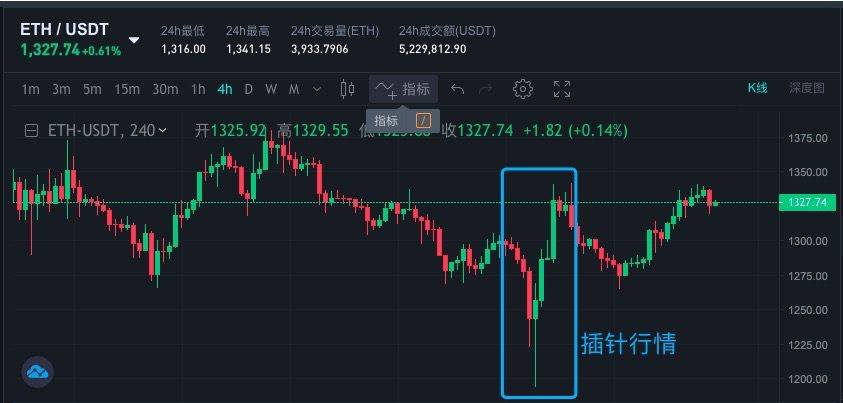

Taking the market on October 13 as an example, the U.S. Department of Labor announced the consumer price index (CPI) for September in the evening of the same day, which was higher than market expectations, and the encryption market plummeted. Among them, Ethereum fell below $1,200, and the lowest fell to 1,190 The U.S. dollar fell nearly 9 percent in one hour. However, after only two hours, Ethereum quickly rebounded to above $1,250, recovered the lost ground, and quickly rose by 8% in the next 12 hours, leaving a long shadow line.

Assuming that user Xiaoqin opened a long position in cross-margin futures with 20 times leverage at $1,300 on the same day, the position will be liquidated in the first hour when the market falls, and the subsequent rise will have nothing to do with it; Buy a weekly ETH call option with a strike price of $1,200 on .com. Even if the price of ETH falls by 90% on the day, as long as it rebounds to above $1,200 before the expiration date, user Xiaoqin can still get benefits.

Because of this, many popular sciences in the market claim that options are "futures without liquidation", saying that they have "limited losses and unlimited gains".Introduction to the basic principles of options, recommended reading""Options are futures that will not liquidate", is this true? "。

For users who are currently in a bear market, options can be used as an effective way to hedge risks. Here are several trading strategies for reference:

One is to purchase structured option products.Such products have a common feature, that is, they usually integrate options, futures and fixed income strategies to help users obtain stable income even in a bear market, without having to predict the market direction; users only need to invest funds in related products, and the agreement will run automatically . Currently, such products are popular in the market, such as the multi-chain DeFi option vault (DOV) protocol Ribbon Finance, which currently has accumulated a TVL (Total Locked Value) worth $75 million. From this, it can be seen that structured products can stand out even in difficult times.

The second is to use forward options to hedge risks while holding the spot.For example, before the merger of Ethereum in September this year, many traders wanted to get the tokens of the forked network, so they could only hoard the tokens in advance; but at the same time, they also opened ETH put options on various options platforms to trade Hedging, which also caused the open interest of ETH options to hit record highs one month before the fork, and the trading volume once exceeded that of BTC options.

The third is to go directly to the options platform as a seller,secondary title

2. Guide you to play with encrypted options

Previously, Bit.com has launched BTC and ETH options, providing crypto users with a new way to hedge risks.Recently, Bit.com has upgraded its option products, adding USD standard options on the basis of the original currency standard options.

After that, users can directly recharge US dollars and use US dollars or USDC for pricing and settlement during option transactions, without converting stablecoin assets into BTC or ETH, thereby reducing investment risks. Of course, more importantly, USD standard options are more attractive to non-Crypto native users and traditional institutional investors, and can bring incremental funds to the market.

"With the market continuing to fluctuate, users need an efficient and flexible trading service that lowers their access to multiple encrypted assets and hedges risks when necessary. That's why we launched USD options - in the Red Ocean Market Stand out from the crowd and help our users beat the bear market." Bit.com co-founder Lan said, "As the size of this type of options market expands, it will prompt more institutional investors to enter the market, and there will be more peers Start offering this service. We believe that the trading volume will increase by 10 times in 2023, it will become a trend and promote small currency options trading.”

Below, we introduce the specific gameplay and related use cases in combination with Bit.com options.

The user first clicks to enter the Bit.com options page, (1) select "coin-based options" or "USD-based options" in the top navigation bar; (2) select the option product you want to trade, BTC/ETH/other; (3) Select the expiration date. Bit.com currently supports eight types of options in total: current date option, next date option, current cycle option, sub-cycle option, second-sub-cycle option, current month option, current quarter option and second quarter option; (4) choose The option product you want to trade (BTC/ETH/other); (5) Select the strike price and option type, call option on the left/put option on the right; (6) Select the order type (limit order/market order), Enter the order quantity, select buy or sell, and complete the order.

All options on Bit.com adopt a T-shaped quotation list. Click the corresponding expiration date to enter the corresponding option product page, as shown in the figure below:

For example, assuming that the current price of ETH is 1335 US dollars, user Xiao Qin is optimistic about the future trend of ETH, and buys a call option with an expiration date of October 28 and an exercise price of 1450 US dollars. At this time, Xiao Qin The option fee paid is 0.0035 ETH (sell one price); when the expiration date comes, the following situations will occur:

(1) If the price is lower than USD 1450, the call option will be invalidated, and Xiaoqin will directly lose the option fee of 0.021 ETH;

(2) The price of ETH rose by more than $1,450, even reaching $1,600. At this time, the mark price of the call option rose to 0.1044 ETH (the actual purchase price was 0.085 ETH). Xiao Qin chose to sell ahead of time, and the profit at this time was (0.085- 0.0035)/0.00035=2328%; the spot price rose by 19.8% during the same period, while the futures return of 10 times leverage was 198%.

secondary title

3. Encrypted options are promising

Bit.com is not the only player in the crypto options market.

In the past two years, encrypted native trading platforms led by Binance and OKX and traditional financial institutions led by CME (Chicago Mercantile Exchange) and Goldman Sachs have successively opened option trading; in addition, emerging decentralized protocols led by Hegic and Opyn Aiming at the option track on the chain, various structured DeFi option products are launched.

Why are all parties so enthusiastic about crypto options trading? The core behind it is that the development potential of options is huge, enough to create a leading trading platform comparable to Binance in the derivatives track.

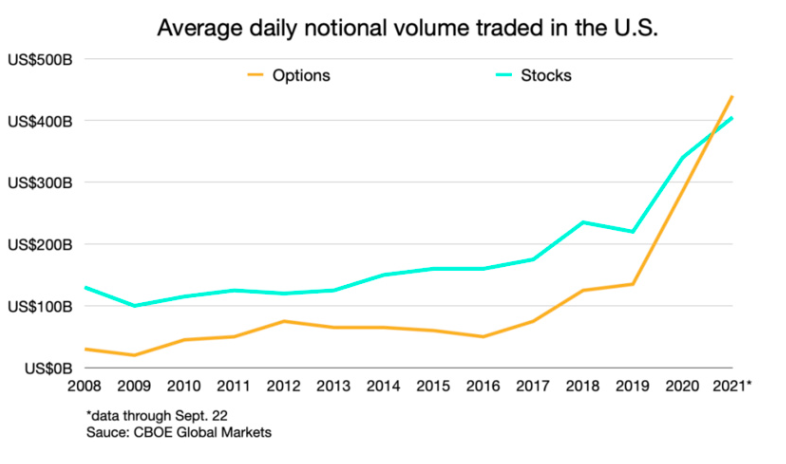

Compared with traditional finance, the market size of options is on par with futures. Data show that in 2020, the total volume of global futures and options transactions will reach 46.77 billion lots, of which options account for 45%, and the volume of options transactions has hit a record high for three consecutive years. Taking the US market as an example, the trading volume of CBOE options exceeded US$400 billion last year, surpassing spot trading for the first time, as shown below:

In the encrypted financial market, in the past two years, the trading volume and open interest of encrypted options have continued to rise, setting new historical records one after another. Among them, the BTC option position has increased by up to 30 times, and the Ethereum option position has increased by nearly 200 times. According to The Block data, the monthly trading volume of Deribit's BTC options in 2020-2021 once exceeded US$30 billion, and the monthly trading volume of ETH options once approached US$15 billion. The ever-increasing data confirm that the options market is in high demand, and encrypted options will surely become a major trend in the future market.

Especially when the market is going down and the market is volatile, traders' enthusiasm for spot trading has plummeted, and their interest in derivatives such as options has begun to rise. According to Coinbase's report, the company's trading volume fell in the second quarter, mainly due to traders shifting to platforms that focus on derivatives such as options and futures, which is the weakest link of spot platforms such as Coinbase.

Although encrypted options trading has greatly improved compared to two years ago, there is still a lot of room for improvement.According to structured products provider Enhanced Digital Group (EDG), bitcoin options trading accounts for just 2% of public derivatives contracts on cryptocurrency exchanges, with a market capitalization of about $462 billion.

Compared with traditional market options, the development of encrypted options is not sufficient. There are two main reasons behind it: one is that the development time is still short, and user education is insufficient; It discourages many traders.

In response to the above problems, the encrypted options market has also continuously strengthened user learning in the past two years, helping users establish trading strategies through various option courses, and at the same time, it is constantly self-iterating on the product side. For example, the traditional option paradigm adopts T-shaped quotations, while Binance has launched a simple version of options. The user experience is basically the same as that of futures. There is no need to select the strike price, but only the expiration time; OKX has also launched the simple selection function of options. It is expected to reduce the user threshold by simplifying the operation process; Bit.com launches USD standard option quotations, users do not need to convert encrypted assets, which is simpler and more convenient...

"With the popularization of user education, technological progress, changes in market conditions, and the maturity of the futures market, the growth of options will eventually be promoted, and options will eventually account for 60% of the encrypted trading market."secondary title

4. Comprehensive Strength of Bit.com

Regarding Bit.com, many crypto players may not be familiar with it.

The platform was established in August 2020 by Matrixport, an encrypted financial services company, and has received funding from several well-known international venture capital institutions, including Lightspeed Venture Partners, Polychain, Dragonfly Capital, Paradigm, Standard Crypto, and IDG Capital. (Note: Matrixport was founded by Jihan Wu, the co-founder of Bitmain, the world's largest mining machine manufacturer. It is one of the few unicorn companies in the encryption market with a valuation exceeding US$1 billion.)

Bit.com initially focused on institutional clients, but has only recently shifted its focus to the retail market. "The platform is gradually being optimized, and more promotions are being launched to attract new customers." Today's Bit.com has developed into a comprehensive trading platform integrating spot products, perpetual contracts, futures, options and wealth management products:

Spot: Launch USDT and USDC currency pairs, and currently 200 trading pairs will be launched by the end of 2022;

Futures: BTC, ETH and BCH perpetual contracts; BTC and ETH futures contracts;

Options: BTC, ETH;

Financial management: BTC, ETH, BCH, SOL, Doge, LINK, DOT and other 20+ mainstream products;

In addition, because Bit.com has many institutional and professional clients, they also provide futures and options bulk transactions and API transactions; existing Matrixport users can log in to Bit.com with the same account.

Like top platforms such as OKX, Bit.com is also onlineunified account. In the unified trading account, customers can trade options, spot, perpetual contracts and futures products at the same time, without the need for fund transfer, which is convenient and fast; all assets in the account will be directly converted into USD to denominate, and a unified margin is provided for the position. Similarly, the profit and loss of multiple positions held by the user will be calculated together, and the profit and loss will offset each other, which is very suitable for both long and short positions.

For derivatives users,The most concerned thing is the portfolio margin (PM for short).Bit.com's PM tool assesses the risk of a portfolio by calculating the most likely loss that could occur to the portfolio, based on a series of hypothetical market scenarios (33 scenarios) and some parameters set by the risk management team; The PM approach tends to reward hedgers by providing greater margin returns for well-maintained low-risk portfolios than the conventional margin approach to margin. In addition, in order to ensure the lowest risk coverage of all possible instrument combinations, Bit.com has set a lower limit margin for both outright transactions and options, which helps to reduce the margin pro-cyclicality of low-risk portfolios to a certain extent.

Of course, the core element of an encrypted platform is security. Bit.com currently uses Cactus Custody, a digital asset custody system independently developed by Matrixport, to protect user funds from three levels: system, physics and governance. In addition, Bit.com also invested capital to set up an insurance fund to settle claims for possible security incidents in the future. The current fund size has reached 201.4072 BTC, 2,507.8675 ETH and 3,018.2201 BCH.

The encrypted options market is still in the early stages of development, and transactions are basically concentrated on centralized platforms. We also expect more platforms like Bit.com to join in, strengthen market investment and user education, and constantly introduce new ones to promote encrypted options. stage of development.