Where are we in the market under the macro and inflation narrative?

Original Author: Jerry Shang

preamble

preamble

Under the obvious easing and tightening cycle, the pricing logic of the encrypted asset market not only has a stronger correlation with the macro market, but also is particularly sensitive to the liquidity preference of the overall financial environment. To understand which stage the macro-financial market is in, it is necessary to understand the variables that affect market expectations and pricing.

first level title

person who manages the pool

How to understand the relationship between money and the market, the monetary school represented by Friedman once put forward The quantity theory of money, which believes that there is a causal relationship between changes in the amount of money and changes in prices and currency values. Assuming other factors remain unchanged, the fluctuation of commodity price level is directly proportional to the quantity of money, that is, the more money supply, the higher the price level.

Imagine that the market is a reservoir, and currency is like water poured into the pool, and the price of assets corresponds to the level of the water. Simple variables include the opening and closing of faucets and drains, which are managed by the central banks of major countries (led by the Federal Reserve).

image description

(Fed’s total assets, unit/million USD)

With the overseas epidemic subsiding and the employment data booming, controlling inflation has become the top priority of the Federal Reserve. The score of this task will also pave the way for the mid-term elections at the end of the year. The Fed’s main means of controlling inflation is to lower the water level by stopping money printing, raising interest rates, and shrinking its balance sheet. The US dollar benchmark interest rate has rapidly changed from 0-0.25% at the beginning of the year to 3%-3.25% today.

first level title

Is inflation priced in?

image description

(US core inflation rate, 1963 to present)

On the 13th, the U.S. CPI data once again exceeded market expectations. The core CPI in September was adjusted 6.7% year-on-year. According to the FedWatch Tool of the Chicago Mercantile Exchange (CME), the probability of a 75BP rate hike expected by the market in November has further increased To 97.4%, that is to rise to 3.75%-4% of the US dollar interest rate.

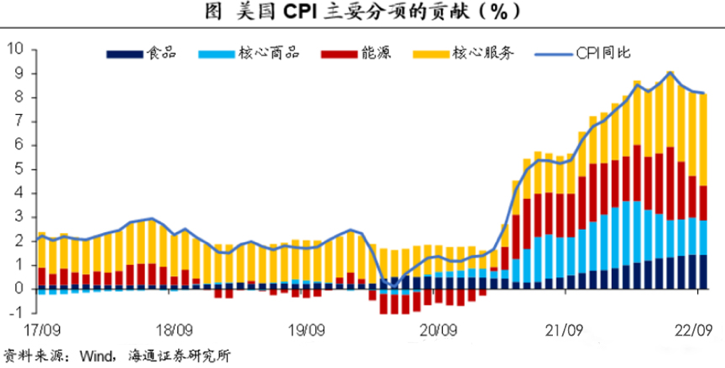

When the core inflation rate hit a 40-year high in this round, if the sub-items of the core inflation rate are disassembled, it can be concluded that the turning point of inflation may appear at the end of the year. This is also the day when the CPI data is released, Nasda The reaction given by the market such as grams from the sharp drop and the rapid rebound of 5%——image description

(Main sub-items of US CPI, sourced from Haitong Securities)

The composition of the U.S. CPI is divided into several major items: energy, food, core commodities and services: in terms of energy, cloth oil has dropped from US$120 at the beginning of the year to US$89; The supply chain is gradually recovering, and the import index and the growth rate of household spending are expected to be significantly lower. Analyzing the reasons for the current high inflation in the United States, rent and service items are the main driving forces for the upward trend of core inflation in the United States.

first level title

politician's choice

With the implementation of multiple interest rate hikes, the S&P's -25% decline this year has ranked third in history (since 1932), and the market's panic about recession has intensified. Starting from 2019, the Federal Reserve is faced with the double consideration of balancing inflation and market recession pressure, and the top officials of the institution have repeatedly stated that it will be a "struggle" to strike a delicate balance between suppressing inflation without triggering a recession .

The key point of how to choose this "struggle" will be revealed after the midterm elections in the United States. After the dust of voter competition settles, whether to continue to firmly control inflation and return to 2% attitude, or to muddle along and choose to provide economic support and go steadily End of term? At this moment when the independence of the Fed's policy is gradually lost, facing the risk of recession for several years and the huge debt repayment interest, the determination and cost required to repeat the "Volcker moment" are far higher than before.

Summarize

Summarize

In summary, it is the mainstream narrative in the market that the stock of money determines asset prices, while inflation and employment are the main factors affecting monetary policy. Data and macro analysis show that US inflation will peak at the end of the year, and the Fed will continue to raise interest rates under high pressure after the mid-term elections The continuity of the policy is questionable.

On this basis, paying attention to the numerical trend of the main indicators that affect inflation listed in the article, whether the Fed’s balance sheet has rebounded, and the market value changes of USDT, USDC and other capital media will be to observe the Fed’s policy shift and expect liquidity to improve. And it is an efficient indicator to improve the fault tolerance rate for the bottom intervention market.

【Reference】

[1] Federal Reserve Economic Data fred.stlouisfed.org

[2] CME FED observation tool cmegroup.com

[3] Zillow Data Index zillow.com/research

[4] China Merchants Macro cmschina.com

Original link