The "highway" of the multi-chain world: an article to understand the evolution and future of cross-chain protocols

Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

As we find ourselves in the midst of another “crypto winter” — fueled in large part by a string of project bankruptcies, regulatory crackdowns, and macro bearishness — it’s important that we don’t lose sight of what will enable the next A bull market for technological breakthroughs and reintroducing the spirit of decentralization to the masses.

One of the themes of the previous cycle that remains at the forefront of discussions among industry players is the rise of interoperability. As a frequently discussed topic in the 2017-2018 1C0 era, with the arrival of cross-chain infrastructure, communication between multiple independent blockchains has become a reality in this cycle.

Today, there are many who question the viability of native cross-chain applications—most notably Ethereum co-founder Vitalik Buterin, who stated earlier this year: “While I am optimistic about the multi-chain blockchain ecosystem , but I am pessimistic about cross-chain applications, cross-chain security restrictions are a key reason...".

While the answers to the debate on this topic are far from binary, we agree with Buterin. We believe that unsustainable incentives across chains lead to overestimated demand for cross-chain dApps while underestimating potential security risks.

There is no doubt that cross-chain infrastructure has played an important role in facilitating the multi-chain landscape. However, the continued growth of the multi-chain landscape does not necessarily mean that cross-chain infrastructure has endless utility.

Our thesis is that the current general cross-chain protocol built between heterogeneous chains may act as a "highway" in the multi-chain ecosystem structure by optimizing inter-chain communication.

The purpose of this paper is to fully explore our argument by addressing the following questions:

Evolution of cross-chain bridges

Current status of cross-chain bridges

The current excitement around cross-chains is misguided?

first level title

in conclusion

Evolution of cross-chain bridges

Note: For those already familiar with the cross-chain landscape, we recommend skipping this section and start with "The Current State of Cross-Chain Bridges".

Specific types of cross-chain bridges: assets, applications, and public chains

Asset specific:

Cross-chain bridges are the simplest system to support the transfer of value between independent blockchains.

The first centralized cross-chain bridges came in the form of centralized cryptocurrency exchanges (CEXs), which used a "notary scheme" to enable users to exchange assets between multiple independent networks. More on-chain cross-chain solutions started to emerge shortly after, with BitGo, Kyber and Ren collaborating to port Bitcoin (BTC) onto the Ethereum network in the form of Wrapped Bitcoin (WBTC). In simple terms, BitGo acts as a BTC custodian, storing users' bitcoins, and then issuing synthetic assets representing bitcoins (ie WBTC) on Ethereum. BitGo is regularly audited for its token supply by members of the WBTC DAO (i.e. Gnosis, Maker, Aave, Wintermute, etc.).

The efforts of WBTC and its partners allow us to get a first look at the additional possibilities of asset-specific cross-chain infrastructure unlocked in adjacent networks. Since the birth of WBTC, we have seen more development teams innovating on this asset-specific cross-chain bridge, with the goal of minimizing the trust factor in the asset migration process. For example, Interlay, a parachain of the Polkadot network, their flagship product is intBTC. intBTC uses a trust-minimized design to facilitate asset interoperability. To summarize, intBTC is a BTC synthetic asset backed by BTC and other collateral held by a custodian. If custodians lose or choose to steal escrowed BTC, the Interlay Network's incentive system deters them from engaging in malicious behavior by slashing their collateral.

These game-theoretic mechanisms create stronger, decentralized alternatives to asset cross-chain bridges for market participants to participate in cross-chain activities more securely.

Application specific:

After the asset-specific cross-chain bridge, there is an application-specific cross-chain infrastructure, which can also be understood as a cross-chain bridge whose function is limited to providing services for a single application.

Thorchain, a decentralized cross-chain liquidity protocol originally conceived in 2018 and launched in 2021, is an early example of this type of cross-chain bridge. Thorchain built an L1 network using the Cosmos SDK, allowing users to exchange native assets of different networks in a trust-minimized and permissionless manner, thereby replacing traditional exchange methods (ie, CEX).

Similar to developer activity for asset-specific cross-chain bridges, we see more teams of developers continuing to explore novel architectural designs for application-specific interoperability. One well-known name is Chainflip, a Substrate-based cross-chain decentralized exchange that aims to reduce the friction and centralization that currently exists when exchanging different web-native assets. As an L1 network, Chainflip utilizes network validators to maintain each "vault", creating a "decentralized settlement layer". The accounting layer paired with the settlement layer exists on the statechain, an intermediate blockchain that runs Aura's proof-of-stake consensus system. The state chain keeps track of user balances, event processing, and execution instructions. In a nutshell, Chainflip observes activity on the L1 it supports by running a full or light node of each network, and performs asset swaps using multi-party computation (MPC) after the validators of the state chain reach consensus.

Specific to the public chain:

While asset-specific cross-chain bridges are often considered the earliest instances of value movement between independent networks, with the advent of public-chain-specific cross-chain infrastructure, we are starting to see a dramatic acceleration in cross-chain activity. Examples include Avalanche Bridge, Polygon Bridge, and Rainbow Bridge, among others, which have proven indispensable in transferring value across different networks for developers and users.

Limitations of cross-chain bridges:

Over the past year, we have become more and more aware of the security issues of cross-chain solutions. We have witnessed consensus breaches across chain bridges, loss of user funds, and death spirals.

The Wormhole hack of February 2022 is a classic case study. Wormhole lost 120,000 Wrapped ETH (WETH) due to attackers exploiting a vulnerability in outdated code in Wormhole's design. The attackers bypassed signature verification and created fake "instruction sysvars" to get validator operations approved, allowing them to forge signature passes and successfully steal 120,000 WETH.

Note: Even the most sophisticated development teams in the crypto industry are not immune to such vulnerabilities. To the surprise of many, the Binance cross-chain bridge was attacked on October 6, 2022, with 2 million BNB ($566 million) stolen. While network validators quickly halted the network, preventing $430 million worth of BNB from being transferred off-chain, we were again reminded of the risks of cross-chain bridge infrastructure.

These unfortunate events show very clearly that cross-chain bridges, despite their contributions thus far and undeniable promise, are still in their infancy.

The Rise of Universal Cross-Chain Infrastructure:

As stated at the beginning of this section, the first era of interoperability was primarily concerned with the transfer of value between independent blockchain networks. Although these cross-chain bridges are inherently value-added, these cross-chain bridges only scratch the surface of cross-chain usage (think cross-chain contract calls, data aggregation, unified liquidity, etc.).

This brings us to what many consider the cross-chain “endgame”: general purpose cross-chain messaging.

The Universal Cross-Chain Messaging Protocol is a trust-minimized network that facilitates the transfer of complex information between endpoints on two or more blockchains. Developers can leverage these interoperability networks as an abstraction layer to seamlessly interact across multiple networks.

It should be noted that each method of general cross-chain messaging is different, and development teams will make different designs based on security, latency, consensus, and messaging costs. Teams like Layer Zero, Axelar, Nomad, and Hyperlane (formerly Abacus) demonstrate a variety of security architectures.

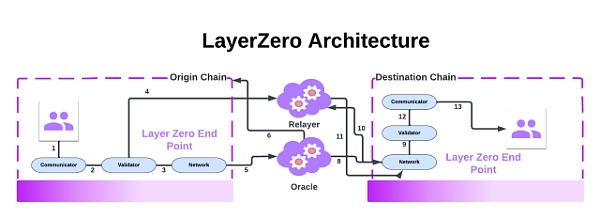

Layer Zero is one of the universal interoperability solutions and the first cross-chain protocol without its own native consensus system. The "Omnichain" network functions by connecting established endpoints, or smart contracts, on different chains using two separate entities: oracles and relayers. The oracle is a third-party service responsible for obtaining block information from the source chain (chain A) and broadcasting these information on the target chain (chain B). The relayer is an off-chain entity (which can be managed by the developer itself), responsible for passing transaction proofs between chains A and B to ensure the validity of the transaction. This model of separating relayers from oracles makes the protocol vulnerable to malicious activity only when the two parties collude.

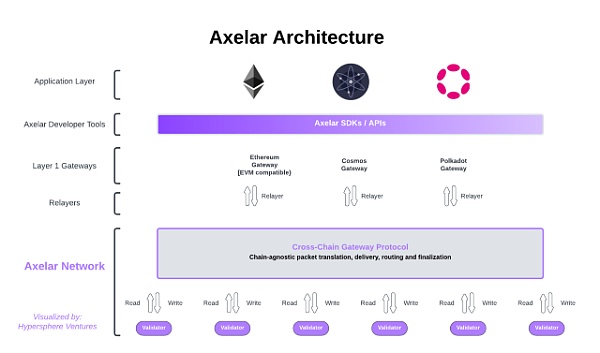

Compared to Layer Zero, which assumes the security of off-chain entities (relayers), Axelar is another general-purpose interoperability protocol that enables trust-minimized messaging through a PoS network built with the Cosmos SDK. At the heart of Axelar's messaging design is its gateway smart contract, which exists on every chain supported by the protocol (currently the EVM chain and the Cosmos chain ecosystem), and is secured by validators on the Axelar network (note: Axelar validators are also responsible for maintaining validators for each supported chain).

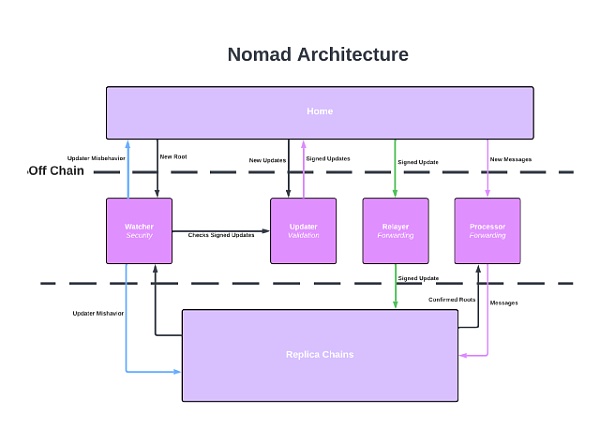

Nomad proposes another approach to facilitate trust-minimized cross-chain messaging, using a design known as an "Optimistic Validation Mechanism". This mechanism eliminates the risk of light clients while relying on fraud proofs and release proofs to prevent channel failures—this model may cause relatively high network latency, but improves Gas efficiency and greatly reduces the risk of cross-chain bridge vulnerabilities .

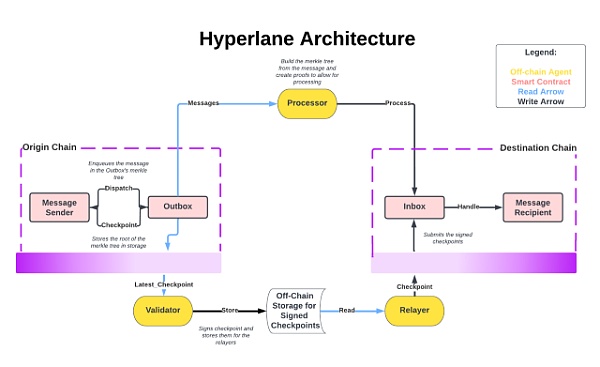

Since security is an important factor in cross-chain protocols, this finally leads us to one of the newest entrants in the cross-chain track, Hyperlane. Hyperlane is a general-purpose cross-chain messaging layer, drawing inspiration from Cosmos' IBC, enabling developers to pass information between heterogeneous networks while enabling applications to share state. The protocol's messaging API allows sending and receiving inter-chain messages, which use a "sovereign consensus" of an inbox-outbox structure secured by two systems: a PoS network built by the Cosmos SDK and application-specific validation Set composition. Sovereign consensus allows application developers discretion over the messages received by the inbox contract, allowing developers to isolate their respective inboxes from any potentially malicious messages that might be transmitted by a compromised validator set.

first level title

Current status of cross-chain bridges

We have established that cross-chain bridges are integral to the flow of value between independent blockchains, and with the rise of general-purpose cross-chain networks, more complex cross-chain interactions are on the horizon.

Now that we have aligned on the types of cross-chain infrastructure and the scope of current and future capabilities, we turn our attention to the data surrounding cross-chain messaging protocols to better understand their primary use cases and trend.

Note: There are currently few metrics and data platforms available to track cross-chain activity. In an ideal world, the most effective way to measure cross-chain is not only to track TVL indicators, but also to include indicators such as the number of cross-chain contract calls, vertical call distribution, and inter-chain dependencies. Since we have not yet reached that maturity, we have to rely on existing simple metrics, such as the number of cross-chain depositors and TVL distribution, to measure the cross-chain landscape today.

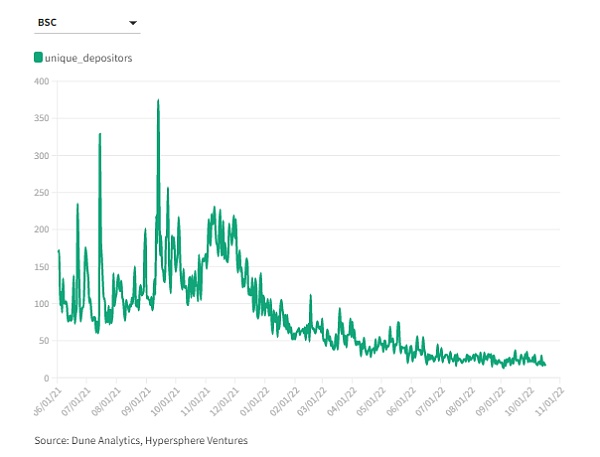

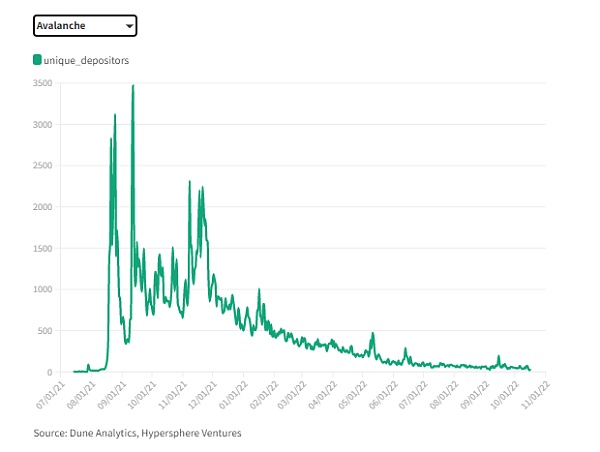

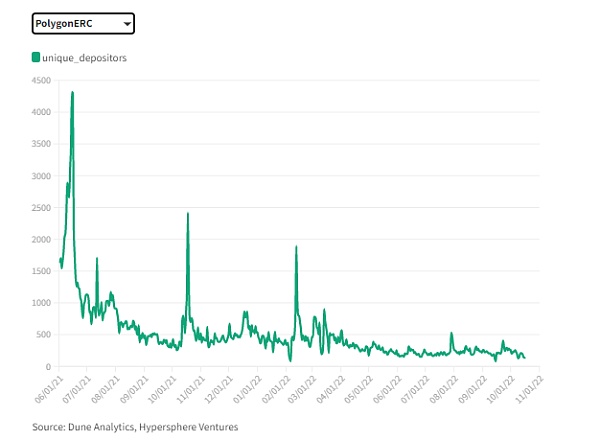

From the chart above, we know that the number of cross-chain depositors has been trending downward since November 2021. The most successful alternatives in the industry, L1 Polygon, BSC, and Avalanche, saw monthly depositor reductions of approximately 42%, 86%, and 95%, respectively, compared to on-chain analysis in August 2022.

What's fascinating about this trend, however, is its limited impact on activity within each network. While cross-chain deposits have declined during this period, we have seen only a slight decrease in the number of active wallets on these networks.

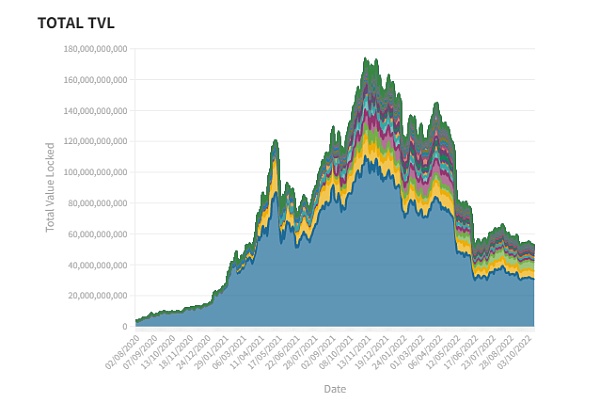

A second metric worth considering is the distribution of TVL across different networks. We stress that considering only TVL paints a rather misleading picture when measuring cross-chain activity, simply because the overall market has experienced a massive decline since its November 2021 high. It is important not to over-extrapolate from TVL, but there is still some information about cross-chain activity worth thinking about.

The graph above shows that TVL distribution has largely flowed back into the Ethereum ecosystem over the past few months after Ethereum network dominance hit a low of 50% in April 2022.

While we acknowledge that the collapse of Terra played an important role in bringing Ethereum back to dominance, we are more interested in the role played by temporary incentives and the corresponding flow of liquidity to other ecosystems. Here, we review Avalanche's and Fantom's incentive schemes, the corresponding increase in ecosystem dominance, and the consequences of each.

Compared to before the 2021 "Avalanche Rush" (announcement of a $180 million DeFi incentive plan), Avalanche's share of TVL is now about 16 times higher. However, Avalanche's dominance is still down about 50% relative to its all-time high in February.

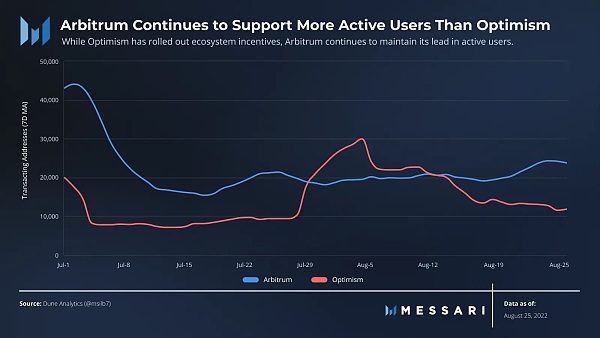

Certain L2s performed slightly better than the alternative L1s, with Arbitrum and Optimism maintaining TVL shares of around 1.67% and 1.50%. As impressive as it is, we can't ignore the impact potential incentive programs could have on its current performance. Optimism has launched a native token that steers user activity, and then also maintains incentives strategically, such as allocating an additional 14% of supply for future airdrops. Meanwhile, speculation surrounding a potential airdrop of Arbitrum tokens has sparked countless twitter threads about how best to interact to get more token airdrops.

Now, what really matters is not teams incentivizing user participation, but the ability of these ecosystems to retain users without incentives. With the launch of the incentive program, Optimism active users spiked around the end of July and temporarily surpassed Arbitrum user counts. Evidence provided by blockchain data analytics platform Messari suggests that the growth of Optimism users has been largely inorganic, as the number of transaction addresses has decreased following the launch of the ecosystem incentive program.

first level title

The current excitement around cross-chains is misguided?

We (as a community) seem to buy into the belief that applications must be natively cross-chain in order to solve key pain points around the user experience on-chain. While there may be some truth to this view, we must also address another reality presented in the data above:So far, there appears to be very limited non-incentivized cross-chain activity outside of asset-type-specific (e.g. BTC). The artificial incentives used to attract liquidity largely determine the flow of value across chains and appear to be the main motivating factor for users of cross-chain infrastructure. In other words, cross-chain solutions simply achieve product-market fit by acting as a medium for emerging blockchain networks to guide liquidity and employ capital for speculative behavior.

When we think about it through this lens, we have to think about whether these incentivized cross-chain infrastructures will continue to function as the industry continues to mature, if alternatives to attract liquidity emerge, or will they gradually disappear? Interoperability as the final layer of abstraction is often what crypto enthusiasts refer to as the “end game,” but as the data shows, a multi-chain world doesn’t necessarily mean cross-chains are required.

One could argue that cross-chain infrastructure plays a key role in enabling more equal network access, and that cross-chain dApps will be critical to addressing financial barriers to “user access to congested networks like Ethereum.” This is certainly fair, but the more obvious counterargument is that this shouldn't be a problem once we see the inevitable migration of transactional activity from inefficient, low-throughput L1s to L2s and eventually to fractal-scaled L3s. Assuming this is the case, how would cross-chain dApps justify the potential security concerns that come with creating highly interdependent systems?

We are not denying the possibility of native cross-chain dApps, nor the potential of an interoperable network as an abstraction layer.

first level title

The role of cross-chain infrastructure

Now that we've laid out our ideas around interoperability, let's delve into the use cases of a common cross-chain infrastructure that we think is feasible in dApps.

There are a few categories that make sense for cross-chain dApps, including DeFi, governance, NFTs (related to artwork and collectibles), gaming, and identity.

NFTs (art, collectibles and games)

governance

governance

Consistent with our skepticism about cross-chain NFTs, we hold a similar view on governance. Intuition tells us that cross-chain governance may be limited to native cross-chain dApps. Furthermore, even in native cross-chain dApps, cross-chain voting does not seem to be that important if we assume that most protocols will tend towards minimal governance in the long run.

identity

identity

Decentralized Finance (DeFi)

Decentralized Finance (DeFi)

Beyond identity, we're seeing some instances of DeFi being well-suited to cross-chain (despite the risks). Given that users may interact with multiple independent networks, permissionless access to L1-native assets is critical to creating an optimal on-chain experience. Native cross-chain token swaps and cross-chain liquidity protocols can solve this pain point and allow users to seamlessly shuttle between adjacent blockchain ecosystems without relying on trusted intermediaries for access.

We also saw the potential for yield aggregators to meet the requirements mentioned in our previous framework. Cross-chain revenue aggregators will host rich revenue opportunities, making the risks associated with cross-chain activities worthwhile for stakeholders.

Another value driver for cross-chain infrastructure

A less frequently discussed topic is that cross-chain messaging can serve as the infrastructure for the coming era of blockchain modularity.

The advent of Rollups has democratized on-chain activity on Ethereum, with transaction activity on Arbitrum and Optimism alone accounting for over 50% of Ethereum transaction volume in October. This data clearly suggests that a massive migration of user activity to specific execution networks may be inevitable. Application-specific Rollups will be the next stage in this evolution as activity on these networks increases and developers demand greater sovereignty and configurability of their execution environments.

The current general-purpose cross-chain protocol built between heterogeneous chains may act as a "highway" in a multi-chain ecosystem by optimizing inter-chain communication.

However, when the discussion turns to maintaining composability across multiple Rollups, issues arise around the modular ecosystem. The execution layer on Ethereum is inherently asynchronous due to the lack of a native communication protocol. Rollups do not share state, and applications "living" in various environments cannot interact with each other. While the general consensus seems to be that "Ethereum's modularity is the ultimate goal," fragmentation of the network layer will likely be a non-negligible problem and will negatively impact the developer and end-user experience. In fact, we may even see exponential adoption of application-specific Rollups (i.e. L2 and L3) on Ethereum greatly hindered by the lack of composability.

To guarantee the composability of their respective Rollups, blockchains with multiple execution layers need to deploy communication protocols that may be missing in their native design. This is where we see cross-chain infrastructure, and universal messaging in particular, making the greatest risk-adjusted contribution to our industry over the next few years.

Beyond that, an interesting way to unify the execution environment might be to let the common messaging protocol inherit the security assumptions of the underlying L1 itself, thereby establishing a fully consistent modular stack between the settlement layer, the interoperability protocol, and the execution environment. From what we understand, the Eigen Layer is building the solution needed to make this happen, and they plan to use a new mechanism called "restaking" to build Ethereum's trust layer. By enabling shared security, we are able to eradicate third-party trust assumptions associated with existing general-purpose messaging networks. This breakthrough in cryptoeconomic security will likely lead to Ethereum's first quasi-native communication protocol.

in conclusion

in conclusion

Despite the unprecedented development and growth we’ve seen in past cycles, the role of blockchain interoperability remains relatively murky during this period. Cross-chain infrastructure benefits a multi-chain world, but much remains to be discovered around the future state of interoperability protocols and the extent to which these protocols serve as the ultimate abstraction layer for users.

The lack of connectivity between L1s limits user adoption of distributed networks, but it may not be safe to think of cross-chain bridges as connection points between different independent networks.

We believe that a more practical application of cross-chain infrastructure should be to repurpose these networks to act as "composability-preserving networks" in modular blockchains. Different execution environments are inevitable for us, but we'll see the levels of scalability and throughput needed to achieve further adoption, and for that to really happen, the native communication protocols that tie these networks together will is essential.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.