Detailed explanation of the 3 models of NFT loan agreement: existing problems and solutions

Original title: "A&T View: Is there a better NFT lending agreement? Existing Problems and Solutions》

secondary title

TL; DR:

Assets encapsulated in the form of NFT were one of the major flashpoints of the last bull market, but apart from spot transactions, the development of other NFT-Fi related projects has lagged behind, especially in the lending market. On the other hand, when looking at DeFi Summer, the rise of DEX and Lending Protocol is almost synchronous.

From an absolute level, the total amount of NFT loans is not high because NFT is still a long-tail asset; from a relative level, the low penetration rate of NFT loans is not because of the lack of supply and demand in the market, but more because of the lack of adapting to the characteristics of NFT. It can efficiently match the lending agreement between supply and demand.

The loan agreement mainly solves three problems: one is to efficiently match and bring together the supply and demand of funds; the other is to safely keep the collateral; the third is to dispose of the collateral as agreed when the borrower defaults. The existing Peer-to-Pool model and Peer-to-Peer model fail to solve the first problem. Their matching efficiency is not high, either the hidden capital cost is high, or the time cost is high.

The advantage of the Peer-to-Pool model is that the time cost is low and "Instant Borrowing" can be realized. The disadvantage is that the hidden capital cost is high and it depends on the oracle machine quotation. The advantage of the Peer-to-Peer model is that the hidden capital cost is low and no oracle machine quotation is required, and the disadvantage is that the time cost is high.

Based on the lessons learned from the Peer-to-Pool mode and the Peer-to-Peer mode, a Peer-to-Orderbook mode that takes into account the advantages of both can be imagined. For example, it is possible to gather orders with the same collateral, loanable amount limit and term but different interest rates into one order book, allowing both borrowers and lenders to bid and match at different interest rates, thereby reducing hidden capital costs and time costs, Achieve higher matching efficiency.

image description

Marketcap and Trading Volume of NFT (source: nftgo.io)

So,What are the reasons for the inactivity and low penetration of NFT lending?

From an absolute level,The total amount of NFT loans is not high because NFT is still a long-tail asset. For a separate Collection, the total market value and transaction volume are not high, and the depth of immediate liquidity is insufficient;

From a relative level,The low penetration rate of NFT lending is not because of the lack of supply and demand in the market, but more because of the lack of lending agreements that adapt to the characteristics of NFT and can efficiently match supply and demand.

Compared with FT, the fact that NFT is still a long-tail asset is obvious. Even for the top projects, such as BAYC, its total market value is still fluctuating around 1 million ETH, which is less than 1.5 billion US dollars, which is even much lower than the FDV of Ape coin.

We cannot change this fact in the short term, but as Web3 investors, we have seen the potential of NFT. In the next round of bull market, there is a high probability that more types of assets will be packaged in the form of NFT, and the total market value of NFT is likely to increase. There are ten times or even a hundred times increase. Therefore, standing at the current point in time, we can dig out lending agreements with higher matching efficiency and capital utilization efficiency. Such projects will have more potential to explode in the next round of NFT bull market.

Before evaluating the model of the existing NFT lending agreement, it is advisable to sort out the nature of mortgage lending and the role played by the lending agreement.

The specific process of mortgage lending is that the borrower provides a package of assets as collateral, and after reaching a consensus with the lender on key parameters such as the upper limit of the loanable amount, interest rate, term, and liquidation conditions and methods, and then obtains liquidity from the lender, and Pay principal and interest as agreed. During the continuation of the loan relationship, if the borrower defaults or triggers the liquidation conditions, the collateral will be liquidated according to the agreed method.

In the above process, the role played by the lending agreement can be considered from three perspectives/stages:

Before the loan relationship occurs, the agreement needs to efficiently match the supply and demand of funds, that is, to match borrowers and lenders who can reach a consensus on key parameters such as collateral, loanable amount limit, interest rate, term, and liquidation conditions and methods to help both parties establish a loan relation.

During the duration of the lending relationship, the protocol needs to securely hold the collateral.

During the continuation of the loan relationship, if the borrower defaults, the agreement needs to dispose of the collateral as agreed.

After clarifying the nature of mortgage lending and the core value provided by the lending agreement, we can begin to evaluate the pros and cons of the existing model.

1. Peer-to-Pool mode:

Advantages: "Instant Borrowing" can be realized, and the time cost of matching is low

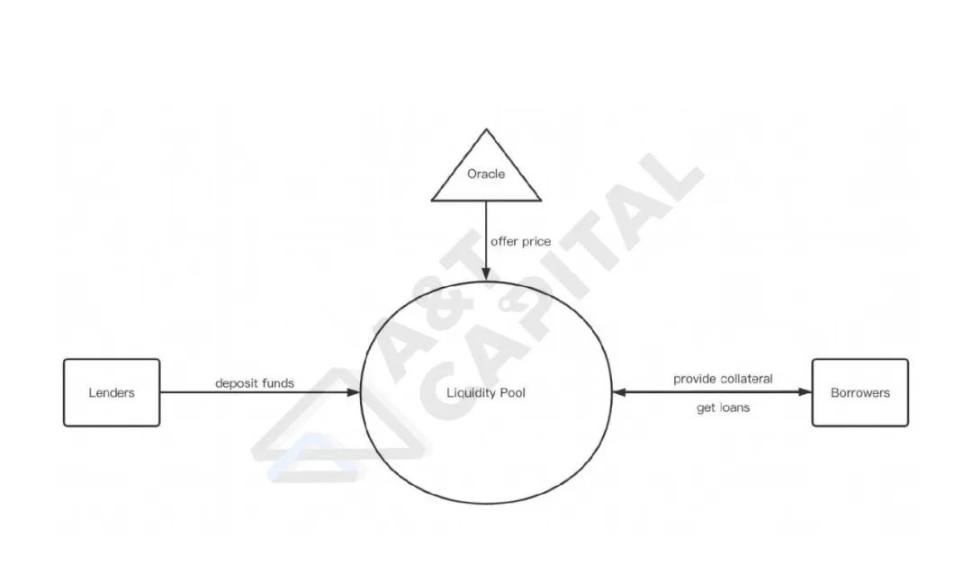

image description

Peer-to-Pool mode

The essence of this model is the imitation of AAVE. Although the AAVE model has achieved success in the FT market, it is not without shortcomings. There are three main disadvantages of the AAVE model. First, the utilization rate of funds is not high;

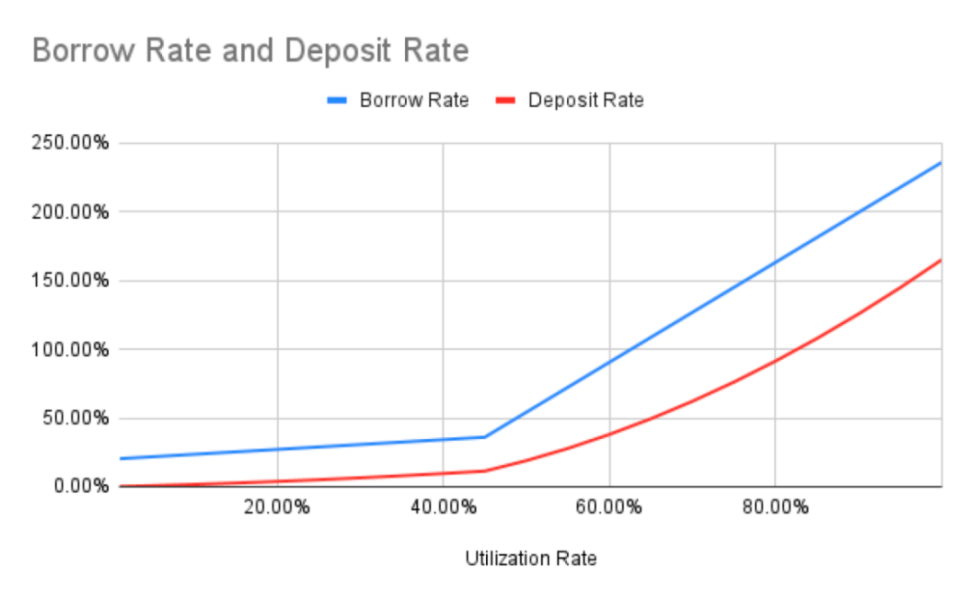

image description

BendDAO's current interest rate curve

When matching the supply and demand of funds, the agreement makes decisions on behalf of the lender. The lender cannot decide what is the collateral for the loaned funds, nor can it control the interest rate and term of the loan. Therefore, in order to control the risk of the system and protect the interests of lenders, the Peer-to-Pool model needs to introduce external oracle machine quotations to ensure that the collateral can repay the loaned funds in real time.

However, the disadvantages of relying on oracle quotes are magnified in NFT lending, as assessing fair prices for NFTs remains a major challenge. For example, the reliance on immature external oracle machines may cause the agreement to misestimate the liquidity in the market, burying the hidden danger of liquidity risk for the subsequent liquidation process.

To sum up, the current Peer-to-Pool model is not efficient, the matching cost of the implicit payment between the borrower and the lender is high, and there is a risk of relying on the oracle machine, which is not an ideal model.

2. Peer-to-Peer mode:

Advantages: no oracle machine required, low cost of capital (high capital utilization rate, small lending spread)

image description

Peer-to-Peer mode

Essentially, the reason for the various defects of the Peer-to-Pool model is that,When matching the supply and demand of funds, the agreement makes decisions on behalf of the lender.So, if the right to determine the key parameters of the contract is returned to the lender, will these problems be solved?

Indeed, in the Peer-to-Peer model represented by NFTf, the key parameters such as which NFT is accepted as collateral, the upper limit of the loan amount, the term, the interest rate, and the conditions and methods of liquidation are determined by both the borrower and the lender. It has been agreed, so how much money the lender provides, the borrower can lend as much money; the higher the interest rate the borrower pays, the higher the interest rate the lender can get. Moreover, as long as the borrower can repay the principal and interest before the due date, liquidation will not be triggered, and there is no need to rely on the oracle.

Although the Peer-to-Peer model represented by NFTfi solves the problem of the Peer-to-Pool model, this solution is also sacrificed, and it is also not a perfect solution.

The disadvantage of the Peer-to-Peer model is that,The matching process takes a long time, and it often takes several rounds of quotations to reach a consensus between the borrower and the lender; and, because it does not yet support a borrower to borrow from multiple lenders (Peer-to-multiPeer), it prevents the borrower with a small amount of funds Potential lenders enter the market.

3. Peer-to-Orderbook mode:

Based on the lessons learned from the Peer-to-Pool mode and the Peer-to-Peer mode, a Peer-to-Orderbook mode that takes into account the advantages of both can be imagined.

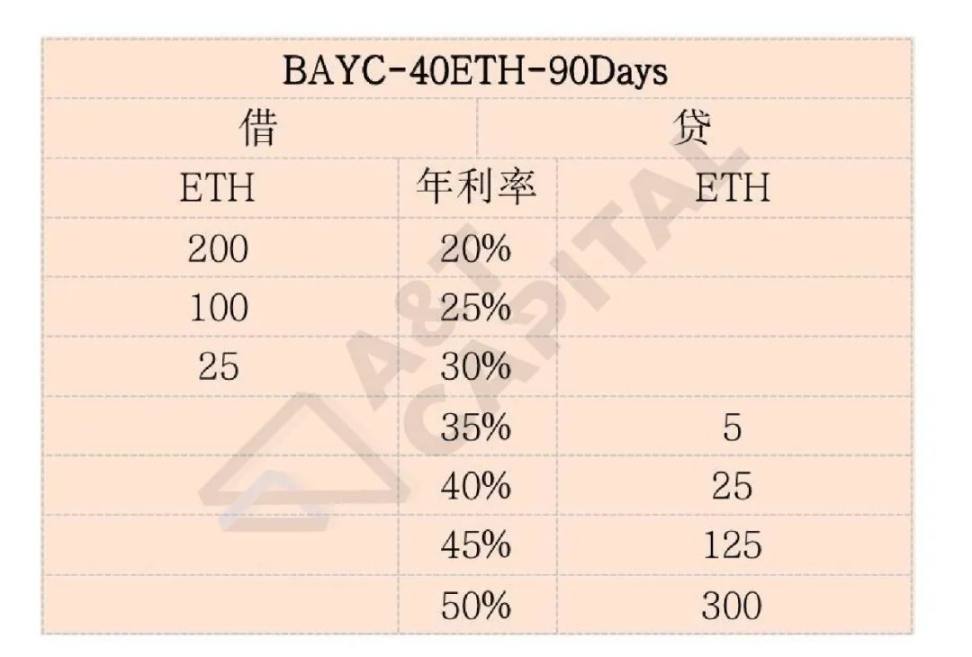

In fact, in the Peer-to-Peer model, standardized lending orders have been used:

If these scattered orders are centralized into an open order book, the time cost of matching can be reduced while retaining the advantages of the Peer-to-Peer model. Because, before lending, the two parties are looking for counterparties in a Pool (Orderbook), which has the advantages of the Peer-to-Pool model; Advantages of Peer mode. For example, orders with the same collateral, loanable amount limit, and term but with different interest rates can be aggregated into one order book, so that multiple lenders can provide liquidity at different interest rates, and borrowers can withdraw from the order book at any time. Withdraw the funds they are willing to accept, achieving the so-called "Instant Borrowing".

For example, the figure shows a possible order book. The header "BAYC-40ETH-90Days" means that the borrower in this order book can obtain a loan with a maximum loan amount of 40ETH and a term of up to 90 days for each BAYC provided as collateral (the same is true for lenders). The "Borrow" column on the left represents how much unsatisfied borrowing needs are at different interest rates; the "Loan" column on the right represents how many funds have not been lent at different interest rates.

Original link