Talking about the narratives worthy of attention in the fourth quarter of the encryption market

Original title: "Some trends for Quarter 4》

Original title: "

Original author: The DeFi Edge

Original compilation: Captain Hiro

We finally have the fourth quarter of 2022.

Because Halloween is approaching in the West, you can feel the scent of pumpkins in the air when you walk on the street, and many stores have already started selling Christmas-related products.

Looking at the Bitcoin monthly return table below, you can find that compared with other months, Bitcoin has risen to a certain extent every October in history (except for 14 and 18 years).

image description

Bitcoin monthly returns

I hope that the cryptocurrency market can go up in October as much as other veterans. Of course, I will be very cautious about it.

This article I wrote today will mainly cover the following:

What are the narratives of the fourth quarter in the cryptocurrency market. This includes some of the things I'm looking at.

transaction flow. There was $2 billion in funding last week. Let's see where these go.

and some news. Including Kim K being fined for selling tokens, Solana's network experiencing yet another outage, and more.

Let's take a closer look at today's content.

If investing is for fun, if you're having fun investing, then you're probably not making any money. Good investing is boring. —George Soros

Some trends and narratives in Q4 in the crypto space

We always need to stay on top of the narratives and technologies that are developing in the field. That way you can start to find your own opportunity out of it and plant the seeds instead of trying to chase new narratives in the next bull market.

The following are some new narratives in the currency circle that I am currently researching and paying attention to.

Please note: None of the content below is investment advice. Just sharing with you my personal research and the various trends I'm monitoring. I'll focus on some of the narratives in this post, but you must do your own research and take responsibility for your own investing decisions.

world cup is coming

The World Cup is the largest sporting event in the world and is expected to be watched by more than 5 billion people. The World Cup will attract the attention of people all over the world!

(This year the World Cup will be held from November 20th to December 18th. I obviously don't pay enough attention to this because I always thought that the World Cup will be held in the summer as usual).

What projects in the cryptocurrency space would benefit from this?

Algorand, a layer 1 blockchain, will be the official blockchain partner of the World Cup.

FIFA makes history in the digital realm with the launch of FIFAPlusCollect powered by Algorand! Fans around the world will now have the opportunity to own football's greatest moments at an affordable price!

FIFA is working with Algorand to release a series of NFT collectibles, which will highlight a series of classic moments in the history of the World Cup. What I care about is whether there will be an NFT of Maradona's goal of the century (Hand of God).

Algorand is one of the few layer-1 blockchain projects whose total value locked has been rising in recent months.

image description

Algorand blockchain total locked amount chart

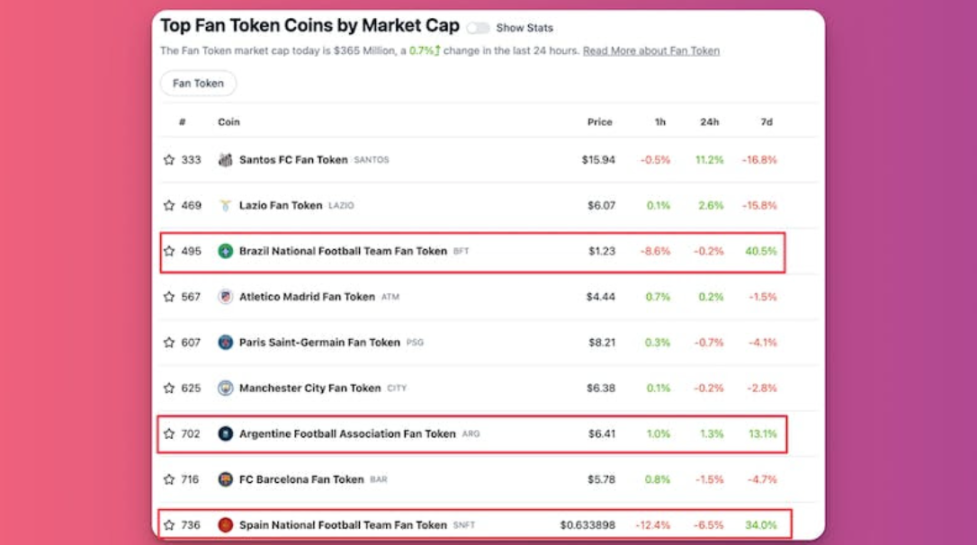

Fan Tokens and Chiliz

Fan tokens are an area of growing interest, and the World Cup could help it reach new heights.

Let’s briefly talk about what is a fan token:

Fan Tokens are convertible tokens issued by football teams. The current main market for fan tokens is some football clubs.

Fan tokens offer a range of low-impact benefits. If you hold tokens, you can vote on some club decisions. Granted, the utility of fan tokens is not too impressive right now, but what matters is that the potential is there. I am now very curious to know when we will see the first football team run 100% by fans voting on the blockchain.

While current fan tokens are scattered across different platforms, Chiliz (CHZ) holds the largest market share. Some centralized exchanges such as Binance and Matcha are also creating their own tokens and partnerships.

With the World Cup coming up, I predict a nice price boost for national team fan tokens.

However, this also introduces a new risk. Do you guys remember Germany's surprise 7-1 win over Brazil a few years ago? You can imagine, if there were fan tokens at that time, what would happen to the price of the Brazilian team’s fan tokens?

Berachain - A DeFi-focused blockchain on Cosmos

When I first heard about Berachain a few months ago, I wasn't sure if it was a serious project. Maybe that's what makes them interesting: they don't take themselves too seriously, and they go out of their way to create memes.

However, what I'm trying to say is that underneath all this stupid stuff (meme) is a very serious project.

Berachain is a layer-1 blockchain compatible with the Ethereum Virtual Machine (EVM) built on Cosmos.

Maybe people will laugh when they see this piece of iron, how is it a first-layer blockchain compatible with the Ethereum virtual machine? I would say that Berachain will launch in 3-4 months and it has already built a large community of believers.

So what exactly makes this blockchain so interesting:

Liquidity Proof of Consensus. The formula allows users to stake assets such as Bitcoin, Ethereum, and stablecoins to validators.

multiple tokens

Bera - the gas used for transactions

GT - an NFT governance token

Honey — Overcollateralized Stablecoin

And partnerships with Redacted Cartel, Synapse, CrocSwap, and more

There is not much official information about Berachain released at the moment, however, a lightweight white paper should appear on the website soon.

Cosmos 2.0

This is definitely a project I'll be keeping a close eye on in the near future.I'm not going to go into too much detail on this topic, because in last week'sThis topic has been highlighted in .

Decentralized stable currency

Decentralized stable currency

With the collapse of UST, USDC sanctioned some users who had used Tornado Cash. At this stage, DeFi needs decentralized stablecoins more than before.

There are currently several emerging decentralized stablecoins on the market, such as:

Aave's GHO

Curve's crvUSD

USK issued by Kujira on Cosmos

Silk by Shade Protocol. It has privacy properties built in and is pegged to a basket of commodities (rather than just the dollar).

The combination of DeFi and NFT

Aside from the occasional PFP (profile picture) we see people use as their Twitter avatar, NFTs don't seem to have much utility yet. However, we have slowly started to see an interesting intersection between DeFi and NFT, the main utility of which is that NFT can be used as collateral to borrow assets such as stablecoins.

In the past few months, the transaction volume on the NFT market has dropped sharply. But I also believe that NFT can break the highest value of this bull market again in the next cycle.

BendDao

SudoSwap

NFTfi

Arcade

Some interesting protocols:

Layer 2 Networking on Ethereum

Optimistic rpllups such as Optimistim and Arbitrum have been dominating for the past few quarters.

But we haven't seen the full power of zero-knowledge proof rollups yet. I'm personally excited about Starknet, zkSync, and Polygon Hermez.L2 beatsTip: Ties can use

Let's focus on the adoption of the second layer network.

(If you don't know the difference between an Optimistic rollup and a Zero-Knowledge Proof Rollup, I promise it's worth going down the rabbit hole.)

New venture capital-backed layer-one blockchain

In the last cycle, we have seen many blockchains claiming to be "Ethereum killers". We're actually going to run into something like that again.

The latest blockchains to catch everyone's attention are Aptos and Sui:

These two layer-one blockchains have raised a ton of money. They have respectively obtained more than US$300 million in financing from top venture capital such as FTX and a16 Z

Strong team: Two blockchain project leaders have served on the team with Meta's Diem project

Decentralized applications are already being built on these platforms

Both blockchains use their own version of the Move programming language

The above content is not a complete list of narratives, I just selected a few narratives that I think are interesting to present to you.

News and Events Related to Cryptocurrencies

Kim Kardashian, who was charged by the SEC, has agreed to pay $1.26 million to settle the charges and to abstain from promoting crypto assets for the next three years.

Solana is experiencing another major outage. On October 1st, Solana was down for at least 6 hours due to a misconfigured node. This is the blockchain's fourth outage since January 2022.

Uniswap Labs seeks $100 million in funding at a $1 billion valuation. To that end, they have already hired a number of investors, including Polychain. This round of deliberations is not yet in its final stages, so the terms of the deal could still change.

Cardano launched a $200 million ecosystem fund. The funds will be used to fund projects building on the Cardano network over the next three years.

Circle announces its cross-chain transfer protocol. The protocol is expected to be live on the Ethereum and Avalanche mainnets by the end of the year, and integrations with partners including Allbridge, Axelar, BitGo and others will continue.

SushiSwap has elected a new leader after months of gestation. After two weeks of debate, Jared Gray was selected as the new head from among the top five contenders.

Ribbon's loan products are already live. It currently offers 9 percent annual interest and allows investors to lend money to trading firms Folkvang and Wintermute. Investors can invest funds with zero lock-up period and can withdraw them flexibly at any time.

Abracadabra's strategy for LUSD is flexible. LUSD degenbox built on Abracadabra will reward its users with higher yield and 0% management fee.

Say goodbye to the era of high APRs for Olympus. The organization has reduced its annual deposit yield percentage to 7.35%, while its rewards have also been reduced following the DAO's approval of OIP-119.

Safe launches safeDAO and SAFE token. The SAFE token will be used to ensure the decentralized governance of SafeDAO. Safe has acquired approximately $40 billion in self-custodial accounts to date.

Some big funding rounds in the Web3 space

In the past week alone, the entire Web 3.0 ecosystem raised over $2 billion for new funds and projects.

Here are the deals worth noting:

1. NYDIG: Institutional investment services firm NYDIG has raised approximately $720 million to date for its Bitcoin fund. It received the funds from 59 investors, according to its SEC filings. It's unclear when the fundraising will stop, or when they will deploy the funds.

In December 2021, NYDIG was valued at $7 billion. The company plans to expand its institutional-grade services to Lightning Network payments, smart contracts and asset tokenization.

NYDIG is a subsidiary of Stone Ridge Holdings Group, a multi-billion dollar asset management business.

2. Cardano/Emurgo: Emurgo, the founding entity behind Cardano, will invest over $200 million to support the growth of the Cardano ecosystem over the next three years. In particular, Emurgo will help with protocol and product development.

These funds come directly from Emurgo's own capital. According to the company’s initiative, $100 million will be used for investments in Africa to promote the use of cryptocurrencies in everyday life.

3. Strike: Chicago-based bitcoin payments provider has raised $80 million in Series B funding led by Ten31. The funds will be used to improve Strike's payment network for merchants and consumers.

Some e-commerce companies, such as Shopify and Blackhawk, already use Strike's app on their platforms.

Strike leverages the Bitcoin Lightning Network to quickly scale and help merchants complete the payment process without first waiting for block confirmations on the Bitcoin blockchain.

Additionally, there are three other high-profile funding rounds in the works:

Uniswap is seeking more than $100 million in funding at a $1 billion valuation.

Pantera Capital is seeking $1.25 billion for its second blockchain fund.

DeFiance Capital is seeking $100 million in funding to invest in liquidity tokens.

Marco's interpretation: Although private market activity seems to be going very well, there is no doubt that we will need some capital to flow into the public cryptocurrency market to rejuvenate the industry.