Q3 State of Ethereum Report: Current Status, Highlights, and Future Outlook

Original source: Bankless

Compilation of the original text: Bai Ze Research Institute

Original source: Bankless

Then we'll move on to ecosystem highlights and outlook.

protocol

protocol

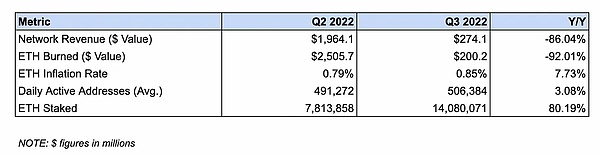

Network revenues fell 86.0% to $274 million from $1.91 billion

image description

This decline may be the result of a drop in on-chain activity due to market weakness. Against the bearish macro backdrop for the quarter, there was significantly less demand for deals.

ETH inflation rate rose from 0.79% to 0.85%, an increase of 7.7%

image description

The increase in inflation may be due to reduced user demand for transactions. As user transactions decrease, less ETH is burned via EIP-1559.

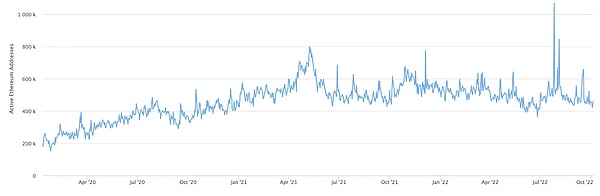

The average number of Daily Active Addresses (DAA) increased by 3.08% from 491,271 to 506,384

image description

This surge in DAA is likely due to lower gas fees despite a drop in overall speculation. This increases the ability for new users, contracts, and bots to transact on Ethereum as transaction costs fall in tandem with transaction demand.

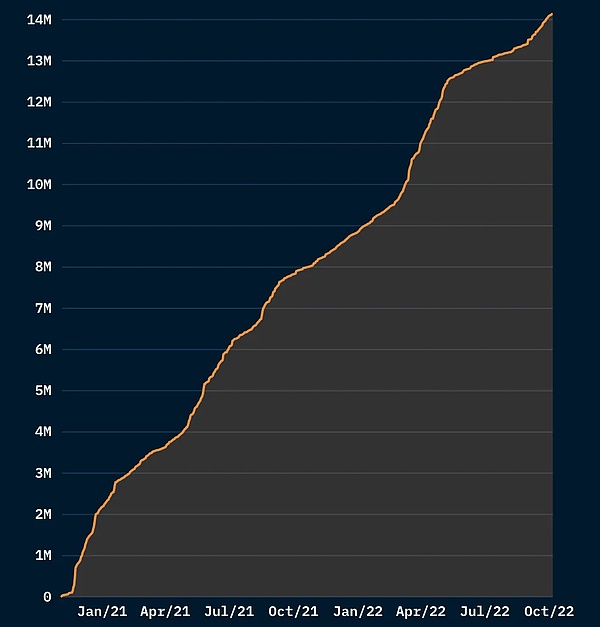

The amount of pledged ETH increased from 7.81 million to 14.08 million, an increase of 80.2%

The growth in staking is a result of users' anticipation of the merger and the adoption of liquid staking protocols, which enable users to earn staking rewards while their ETH holdings remain liquid. These protocols’ share of total Beacon Chain deposits grew from 35.3% to 46.3% year-over-year.

DeFi Ecosystem

DeFi Ecosystem

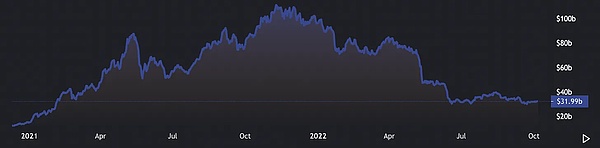

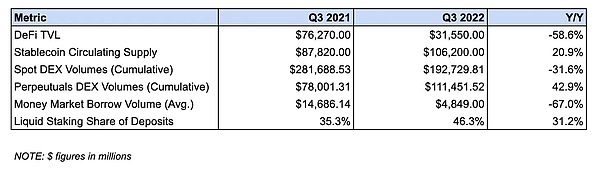

DeFi TVL dropped 58.6% from $76.27 billion to $31.55 billion

image description

This decline can be attributed to the decline in cryptocurrency prices, as the majority of assets in DeFi TVL are made up of volatile assets that have fallen in price, such as ETH and wBTC. The decline may also be due to the decline in the rate of return on the chain, which reduces the attractiveness to capital and leads to liquidity outflow.

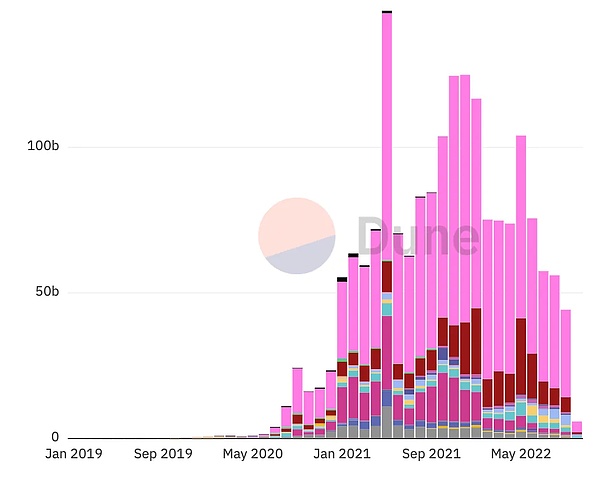

Spot DEX trading volume fell 31.6%, from $281.68 billion to $192.73 billion

image description

This drop could be attributed to the downturn in market conditions. As mentioned above, the decline in cryptocurrency prices reduces users’ trading and speculative demand, which leads to a decline in trading volumes given that trading activity is positively correlated with price action.

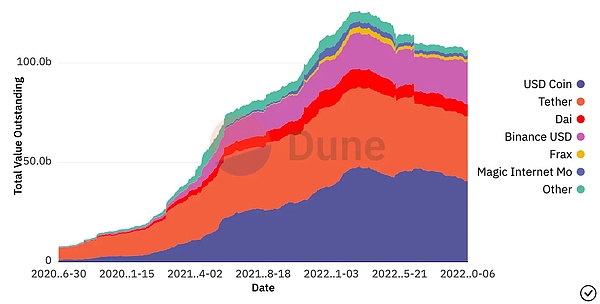

Stablecoins in circulation increased by 20.9%, from $87.82 billion to $106.2 billion

image description

This increase was driven by demand for holding stablecoins as cash positions and a $21.8 billion increase in the supply of USDC, BUSD, DAI, and MIM on Ethereum. This more than offsets a $3.6 billion reduction in circulating supply of USDT and “other” stablecoins.

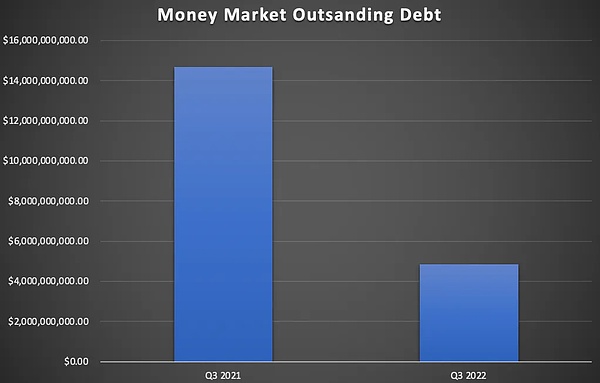

Average debt outstanding in money markets fell 67%, from $14.68 billion to $4.48 billion

The metric tracks the average outstanding debt of Ethereum-based money markets during the quarter

This decline can be attributed to the decrease in user demand for leverage due to the drop in cryptocurrency prices. Additionally, users’ willingness to borrow and borrow may remain pent up despite the rise in ETH prices due to the aftermath of deleveraging following the collapse of hedge fund Three Arrows Capital.

NFT ecosystem

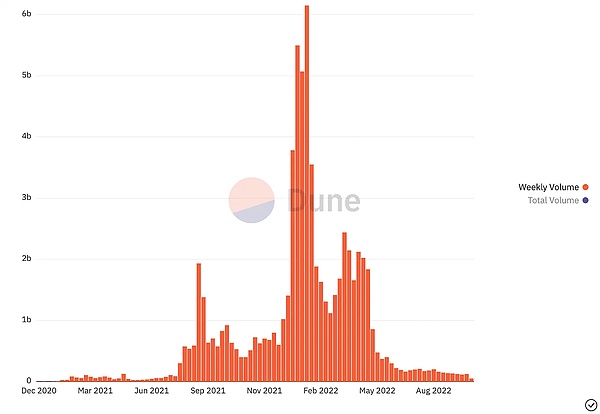

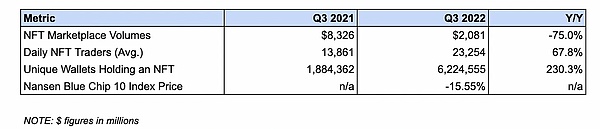

NFT market trading volume dropped 75%, from $8.32 billion to $2.08 billion

image description

This indicator measures the trading volume of NFT marketplaces such as OpenSea, LooksRare, etc.

The average number of users trading NFTs per day increased from 13,861 to 23,254

This increase may be due to wider user awareness of the NFT ecosystem and the maturing of the NFT market structure.

Nansen's Blue Chip-10 index fell 15.5 percent

Blue Chip-10 is a market capitalization weighted index that tracks the top ten collections of NFTs. This decline could be attributed to the increase in the price of ETH, which rose by 24.43% during the quarter. Almost all transactions in NFT history have performed poorly when the price of ETH is rising, because traders are less willing to give up the appreciating asset.

Layer-2 Ecosystem

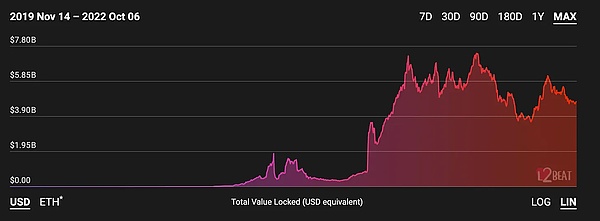

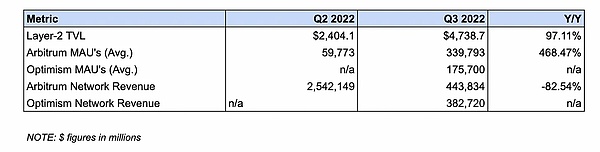

L2 TVL increased 97.1%, from $2.4 billion to $4.73 billion

image description

Much of this growth has to do with liquidity flowing into Rollups, such as Arbitrum and Optimism. The combined TVL of the two is approximately US$3.9 billion, accounting for 81.5% of the total value of the L2 network.

Arbitrum's average monthly active addresses (MAA) increased by 468.5% from 59,773 to 339,793. Optimism has an average MAA of 175,700.

image description

Arbitrum's growth can largely be attributed to the popularity of protocols such as decentralized perpetual contract trading platform GMX, which alone attracted $397.2 million in TVL while facilitating $18.9 billion in trading volume.

Arbitrum's network revenue fell 82.5% from $2.54 million to $443,000. Optimism's network revenue was $382,000.

image description

Arbitrum's revenue decline can be attributed to lower user demand for transactions. As with Ethereum, this is the result of bearish market conditions and a sharp drop in speculative activity.

first level title

Ethereum Ecosystem Highlights

secondary title

The Merger Has Finally Arrived

After years of development and anticipation, Ethereum has successfully merged from a proof-of-work (PoW) mechanism to a proof-of-stake (PoS) mechanism.

While the dust from the merger has yet to settle, we are already starting to see the impact of the most significant upgrade in the history of the Ethereum network.

First, Ethereum’s energy consumption plummeted 99.98% almost overnight, from 77.77 TWH to 0.01 TWH. Not only does this reduce the network's environmental impact, but it also helps increase ETH's appeal to institutional investors with ESG mandates.

Mergers are also starting to affect staking. Since the merger happened, the yield on staking ETH has risen from about 3.5% to 5-6%, as ETH issuance is now supplemented by transaction fees and MEV revenue.

L2 Summer

These liquidity staking protocols are likely to grow even further after the "Shanghai upgrade" that takes place over the next 6-12 months, as the upgrade will allow users to unstake and withdraw ETH.

secondary title

The two largest Optimistic Rollups, Optimism and Arbitrum, saw a significant increase in liquidity and community users this quarter.

Optimism’s DeFi TVL grew 234% in Q3, from $274.46 million to $916.97 million, driven by rising OP token prices and governance fund launch incentives, taking its market share across all L1 and L2 This quarter increased from 0.51% to 1.56%.

zkEVM is considered the holy grail of Ethereum network scaling because it combines the network effects and developer tools of the EVM with the increased transaction capacity of zkRollups. While it's unclear how exactly they will perform, the upcoming zkEVM could shake up the increasingly competitive L2 landscape.

looking to the future

first level title

looking to the future

There are many exciting developments in the Ethereum ecosystem that promise to support the network's long-term growth prospects.

At the protocol level, there is an exciting recent upgrade, EIP-4844, which will introduce proto-danksharding, the predecessor of danksharding, the first of a two-part process to introduce sharding in Ethereum. 4844, likely to be implemented in the aforementioned “Shanghai upgrade,” will introduce blob transactions, a new standard that will improve Ethereum’s capabilities as a data layer by dramatically reducing the cost of storing data on-chain.

The biggest beneficiary of EIP-4844 is L2. If it is successfully implemented, by reducing the cost of storing data on the chain, the gas cost on the L2 network will be greatly reduced, and the ability to migrate Ethereum liquidity to L2 will be improved.

Despite these positive “catalysts,” there are still several “dark clouds” hanging over the Ethereum ecosystem, the most pressing of which is regulation.

comparison chart

protocol

DeFi Ecosystem

protocol

L2 Ecosystem

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.