Taking history as a mirror to know the ups and downs: the melody review and prospect of the changes in the blockchain track

"Using history as a mirror, you can know the ups and downs." - "Old Tang Book·Wei Zheng Chuan"

Original post by Frank Fan @Arcane Labs, Don @Arcane Labs

Original editor: Charles @Arcane Labs

The innovation and development of anything is inseparable from iterations on the basis and problems of the predecessors. This article will start from the three major cycles that the industry has experienced, and analyze the changes in the evolution direction of the industry track based on the observed industry phenomena and details. Then make predictions and judgments on the stage and popular tracks that the industry will reach in the next cycle.

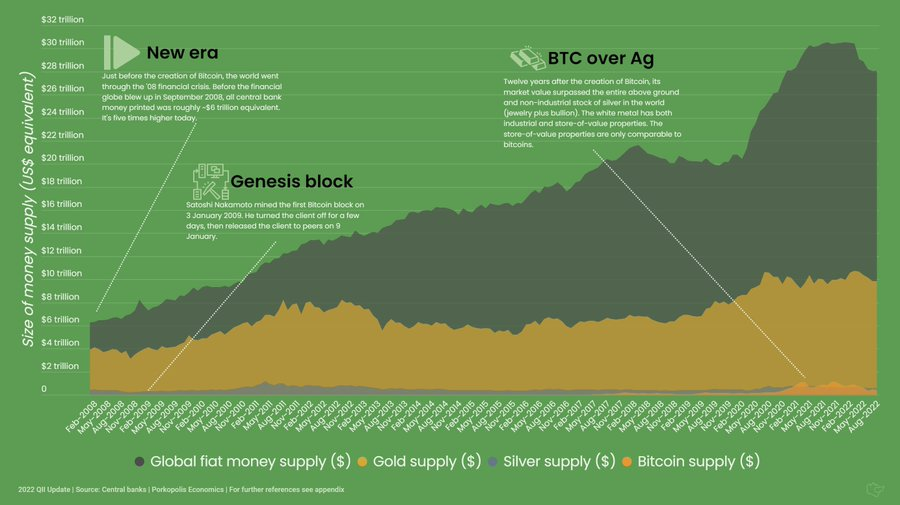

The term "blockchain" has gone through 13 years since the Bitcoin white paper was born in 2009. From an obscure noun to a well-known industry, countless luxuriant ecology and tracks have been derived. After several rounds of bull and bear changes, the industry grew from scratch, and many early players who focused on various tracks in the industry took advantage of the trend and reaped huge wealth. Looking back at the changes in various tracks in the industry in recent years, it is not difficult for us to find the hidden laws.

First of all, it is well known that the blockchain industry has always been an industry with particularly significant cyclical behavior. In the bull market cycle, the industry is extremely prosperous and constantly spawns bubbles. In the bear market cycle, the industry is very deserted and bleak, and it clears up quickly. In terms of time, the halving of Bitcoin has been used as the time node. With the frenzied influx of a large amount of funds into the market and the desolate exit of the market, an industry law of a four-year bull-bear cycle has been formed.

In each cycle, in addition to the constant narrative of Bitcoin halving, we can also find that each cycle has unique industry changes as the main line of industry development.

For example, we have experienced three times before:

For the first time, the value discovery of decentralized commodity currency led by Bitcoin;

The second time is the discovery of value from a purely decentralized currency to a decentralized smart contract platform;

image description

first level title

secondary title

1.1 Enlightenment stage of decentralized commodity currency (2010-2013)

Looking back at history, in the first encryption cycle, Bitcoin, as the originator of the entire industry, began to gradually enter people's field of vision due to its anonymity, decentralization and scarcity of fixed total amount. Its cross-border transfer, The narrative value of digital gold has gradually been recognized by more and more people. "Bit Gold, Wright Silver" was the best interpretation of the enlightenment stage of decentralized commodity currency at that time.

It is also due to the 2008 financial crisis that people's trust in traditional finance has cracked. Participants in the early stage of the cryptocurrency market are more inclined to hardcore geeks. Compared with the current capital that has extensively dabbled in the cryptocurrency market, early stage market participants have extremely high requirements and beliefs in the degree of decentralization.

secondary title

1.2 The embryonic stage of the smart contract platform (2014-2017)

In the second encryption cycle, it is mainly the value discovery of the blockchain smart contract platform represented by Ethereum in the era of initial coin issuance. From the birth of Ethereum to its financing value being discovered for the first time, followed by a number of Ethereum Killers, such as well-known projects EOS, Tron, ADA, etc., this stage is a wild period dominated by the term "blockchain" , only a small number of local currency coins of the blockchain smart contract platform have a consensus value, and there are only a very small number of applications on the platform, and the token value of the application is basically unrecognizable. coin. Moreover, the activities on each chain are extremely indifferent, and most users still take "currency trading" as their main activity on the centralized exchange. Finding a killer Dapp was the most mentioned topic by many blockchain practitioners in various industry conferences at that time.

image description

secondary title

1.3 The basis of Dapp application in the stage (2018-2021)

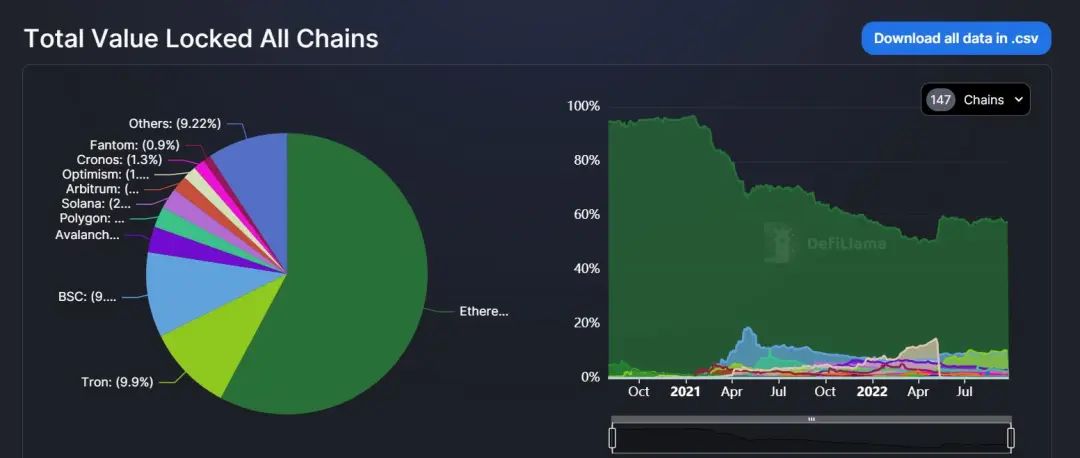

The third encryption cycle is also the closest to us. The most obvious change in the market in this round is that the ecology on the chain and the activities of users on the chain have obviously prospered. The most intuitive feeling is that many trading users, when it comes to a token they are not familiar with, they no longer ask which centralized exchange they can trade, but ask the contract address on the token chain. What sounds commonplace now was unthinkable in the last cycle.

Thanks to this cycle, some decentralized basic applications on the chain began to improve. Starting from the well-known DeFi Summer, the AMM automated market maker mechanism and liquidity mining have completely opened the era of prosperity on the DeFi chain. Everyone will still remember the subsequent stories. Throughout the year of 21, on-chain applications such as DeFi, NFT, and GameFi have taken turns becoming hot spots in the bull market. In addition, the short-lived meme craze started by Doge, Shiba, etc. and the wealth effect brought about by airdrops such as Dydx, ENS, etc. are also important drivers for the prosperity of on-chain activities in this cycle.

At this stage, the DeFi infrastructure in the chain has basically been built, and related products such as transaction circulation and lending have been born. DAO is still in the embryonic stage of a trend of thought, and the product is still immature. On the other hand, NFT is between DeFi and DAO. It has already explored a relatively mature success path of PFP avatar, but it needs to expand more successful scenarios for further development. This is the current status of what was once known as the troika of blockchain applications.

At present, the on-chain applications in this cycle have reached a bottleneck period, and most of the related applications in the future are micro-innovations and repairs based on the predecessors, and the homogenization is serious. Moreover, in the latter part of this round of encryption cycle, the hot spots of market capital hype began to tend to some more grand narrative concepts, such as Metaverse and Web 3.0, which is a typical manifestation of the lack of innovation on the product side. Of course, we are still in the early stages of the blockchain industry. If we use the analogy of a person's growth status, it is more like a teenager. Everything is still laying the foundation, but there are various subdivision paths.

image description

first level title

2. The initial stage of the full-scale explosion of blockchain applications

The next cycle will be the initial value discovery of the full application of the blockchain.

The comprehensive development of applications will make the blockchain industry more mainstream, and only continuous mainstreaming can bring exponential user growth to the industry. In the context of the current macroeconomic downturn and the disappearance of the demographic dividend in the Internet industry, with the popularity of Web 3.0, a new synonym for the blockchain industry, the industry has also received unprecedented attention from new and old capitals. In addition, some public chain platforms that have settled down in this cycle, new capital-intensive new public chains, Rollup and Danksharding after the Ethereum Merge, etc., under the birth of capital and the precipitation of technology, let us We have seen the dawn of large-scale application of blockchain in the future.

For the industry to move further towards mainstreaming, it also needs to strengthen from these three aspects:

a. More scalable blockchain underlying technology and platform to process and run more complex blockchain applications

b. Regulatory and compliance policies that are more compatible with the encryption industry bring more mainstream capital and funds

c. Further lower the threshold for newcomers to enter the encryption industry and optimize the experience of entry products to facilitate bringing more mainstream users

secondary title

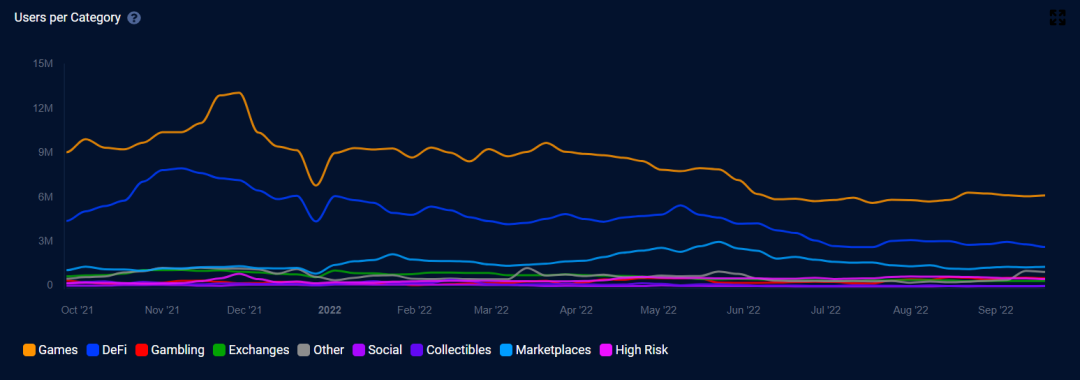

2.1 Products and concepts

Excellent explosive products are the prerequisite for the outbreak of the track, and the data showing rapid growth of the product itself is also the best story. For example, Uniswap and Compound quickly increased the TVL on the chain by an order of magnitude for DeFi; Axie Infinity for GameFi, its revenue exceeded the top Web 2 mobile game "Glory of the King" in a short period of time; Sandbox, Decentraland for Metaverse; CryptoPunk, Bored Ape Yacht Club for NFT and so on. On the other hand, many tracks have not exploded, the main reason is that there are no explosive models or products that have been verified by the market. Of course, in the bull market, liquidity is rampant, and many immature product concepts will also be hyped in turn, and the hype of the concept will actually help attract more people to participate in product development, and eventually the big waves will wash away the sand and leave more outstanding products. The product.

image description

secondary title

2.2 Applications and Infrastructure

secondary title

2.3 Issuance and circulation

The biggest difference between Web 3 and Web 2 is actually Token (that is, the essential difference between assets and information). The issuance, circulation and economic model of Token are issues that every Web 3 entrepreneur cannot avoid. During the development of the industry for so many years, the issuance and circulation of Token have also been changing. In terms of issuance, from the earliest consensus mechanism mining such as POW/POS, to the later ICO, IEO and other financing issuances, to this round of DeFi liquidity mining and GameFi gold, and various public offering platforms IDO and the popularity of airdrop token offerings. During this period, more and more venture capital capital entered, and it is almost certain that the Token issuance of the project and the company's multi-round financing and IPO listing are now almost certain, and the Token issuance methods are showing a variety of states.

At the circulation level, from the earliest decentralized OTC over-the-counter trading model, to the centralized centralized exchange matching transaction circulation, and to the current decentralized exchange, the trading model has also precipitated centralized order book transactions and de-centralized exchanges. There are two mainstreams of centralized AMM.

image description

Figure 5: PoW & PoS

first level title

secondary title

3.1 Rollup and other expansion solutions

In terms of blockchain expansion, there are many technical solutions and teams that have been building. From the separate improvement of the consensus algorithm before, to the L1 sharding scheme, and to the current layered design of L1, L2, and L3, the most mainstream of the layered schemes is Rollup. At the end of 2020, Vitalik published the article "Ethereum Roadmap Centered on Rollup". In 2022, at the ETH Shanghai Summit, he reaffirmed the development status of the Rollup route. Danksharding and other technologies are also specially prepared for Rollup. Among them, Rollup is currently divided into Optimistic Rollup and ZK Rollup.

Optimistic Rollup is easier to be compatible with EVM and supports general-purpose contracts, but it takes a long time to withdraw from the network. It can be seen that the representative projects of Optimistic Rollup, Arbitrum and Optimism, have done relatively well in their ecology, and there are many projects on them. At the same time, because of its exit feature, many third-party cross-chain bridges have a good market.

In the primary market, Zero-Knowledge Proof technology can be said to be a track where capital is rushing to invest. From a technical point of view, ZK is a verification technology. On the premise that the prover does not disclose any information other than the proof itself, the verifier can confirm that a proof is valid. ZK technology was first used for privacy and has been used for capacity expansion in recent years.

ZK Rollup exits the network much faster than Optimistic Rollup, but it is relatively poor in compatibility with EVM and support for general contracts, so the current representative projects ZkSync, StarkWare, etc. are still in the preparation stage.

In terms of performance, ZK Rollup is slightly higher than Optimistic Rollup, and in terms of ecological migration difficulty, Optimistic Rollup is easier than ZK Rollup. This also made V God publicly express that he is optimistic about Optimistic Rollup in the short term, and pays more attention to the performance of ZK Rollup in the long term.

In fact, no matter what kind of expansion platform, its ultimate goal is to provide users and developers with a better experience, so as to build a prosperous ecology on top of it. The expansion debate is far from over, which is why I define the next cycle only as the initial stage of the full-scale explosion of blockchain applications. We believe that the next-generation expansion solutions led by Rollup will continue to present a diversified pattern, and the diversified infrastructure is more conducive to the application and ecology of a variety of flowers.

image description

secondary title

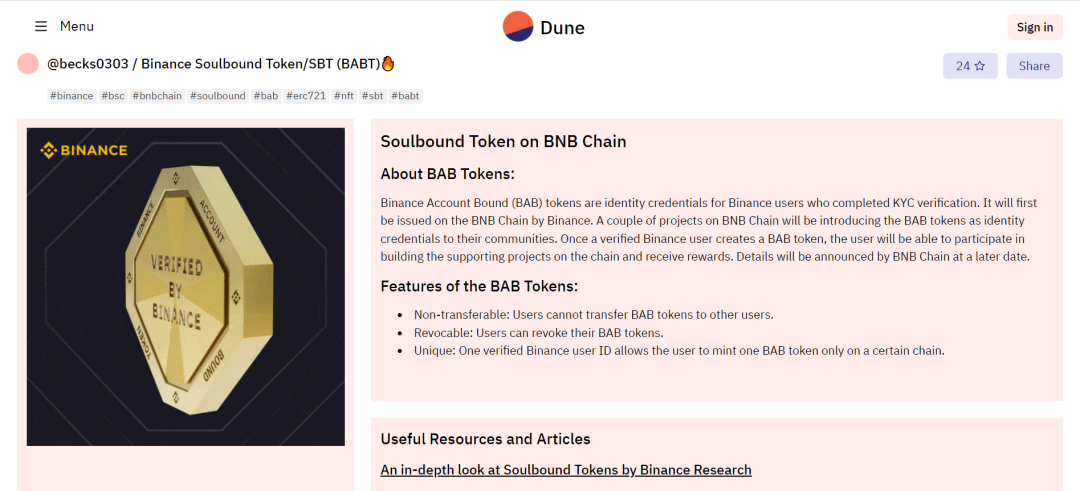

3.2 DID

DID stands for Decentralized Digital Identity. This concept has been proposed for a long time, and this year V God proposed the concept of SBT soul-bound tokens, and Binance also launched the "soul-bound token" BAB. These two events once again pushed the concept of DID to the climax of market attention.

Its characteristics will not be described in detail. From the perspective of narrative and practicality, a mature and widely used DID product may be the necessary infrastructure for the entire industry to become more mainstream in the future.

For the construction of decentralized social networking, on-chain KYC, on-chain credit system, unsecured lending and compliance with regulatory requirements, etc., it is possible to create some wonderful sparks with DID.

image description

secondary title

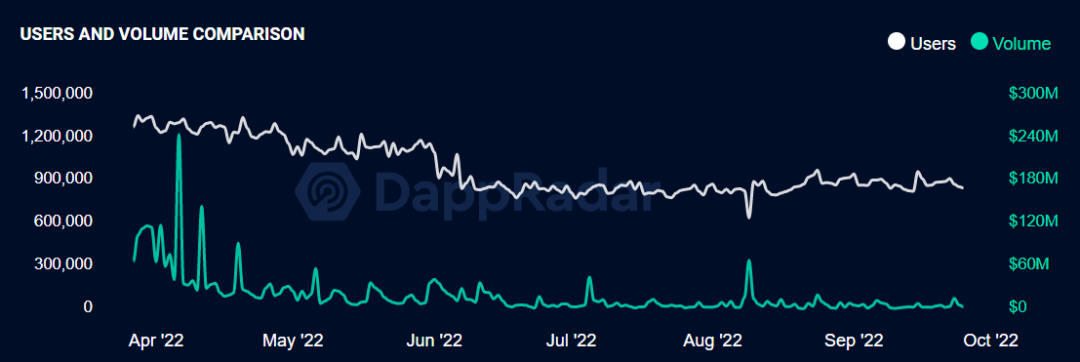

3.3 GameFi

GameFi was an extremely hot track in the second half of last year. But the good times didn't last long, and with the frenzy of retail investors, chain games have become the last stick in this round of bull market. Today, the investment in the game track has become the most controversial track in institutional investment. Looking back at chain games, everyone now knows that GameFi 1.0 is actually DeFi mining with the appearance of Game, or even ponzi. Due to the cloak of GameFi games, many of them participate in the form of guilds (which can be understood as mining pools). As a result, for many people who are not proficient in Web 3, the participation threshold of GameFi is actually lower than that of DeFi. You only need to entrust the funds to its guild. But in fact, the conflict of interests between escrow agents and investors has hurt many GameFi users.

Purely for the game industry, the essence of games is that they must be fun. This kind of fun, in addition to exquisite graphics, more importantly, through the design of complex gameplay, interesting game modes or game background stories, etc., gradually make gamers addicted or addicted to it, which involves many Game- or psychological-level methods.

image description

Figure 8: GameFi Users and Volume Comparison

This is not just a problem of certain projects, but a problem of the fragmentation of the needs and experience of Web 2 users and Web 3 users as a whole. Web 3 users pursue high financial returns, while Web 2 users pursue entertainment needs. These two groups of people are not totally unrelated. There are a large number of people who love to play games in Web 3, and Web 2 users also have the need to make money. These needs do not It is not a beautifully crafted game, and it can be satisfied with a token. In essence, it is necessary to formulate different strategies for users of different natures, break through from a certain point, and carry out organic integration.

Going back to the original intention, our recognition of the value of blockchain games is that it can solve the problem of game asset ownership and keep users’ assets in their own hands. Secondly, it can participate in governance through tokens, so that game officials can’t say a word. These are the values that blockchain can provide after a game has been approved by players. In terms of the current level of use of blockchain by Web 2 users, it is still a bit premature for this kind of blockchain reform. So when making games native to Web 3, incentives are particularly important. Therefore, the situation last year was also a necessary stage for early incentives to go to the first extreme.

And the next stage may be a stage of shaping game assets, that is, NFT. Because NFT itself is the one that best fits the attributes of the game and has the most consumption-oriented features, rather than the "mining machine" that only regards NFT as the entry threshold like GameFi 1.0. With the improvement of the gameplay of blockchain games and the development of many NFT protocols, the liquidity of NFT has been improved. NFT-based value-oriented games may be the direction of the next round of blockchain games.

epilogue

epilogue

References:

References:

1.https://twitter.com/DocumentingBTC/status/1574421976298332160

2.https://DeFillama.com/chains

3.https://dappradar.com/industry-overview

4.https://dapponline.io/dapp

5.https://twitter.com/viv_three/status/1574003545283891200

6.https://dappradar.com/topic/games

7.https://twitter.com/BMANLead/status/1520488056599457792

8.https://nova.arbitrum.io/

9.https://dune.com/becks0303/binance-soulbound-token