MakerDAO's Governance Fog: Centralization or Decentralization?

first level title

1. Development of MakerDAO

Six years after the announcement of the stablecoin DAI concept, today’s MakerDao protocol remains one of the most successful DeFi applications on the Ethereum chain.Rune Christenseand founderIntroducing eDollar, the ultimate stablecoin built on Ethereumn A long post on Ethereum Reditt in March 2015 "

”: The Maker Foundation creates a DAO on Ethereum and issues a dollar-pegged stablecoin. The foundation's main responsibility is to guide the development and management of the project, and as CEO, Rune Christensen is also constantly leading the realization of the blueprint.Maker GovernanceIn September 2018, the foundation passed the proposal; the second year MCD went online, that is, from

The stablecoin DAI is generated from various approved encrypted assets. DAI (formerly known as SAI) is a stablecoin on Ethereum and the first DAO-managed stablecoin in the crypto world.

image description

Data source: Coingecko

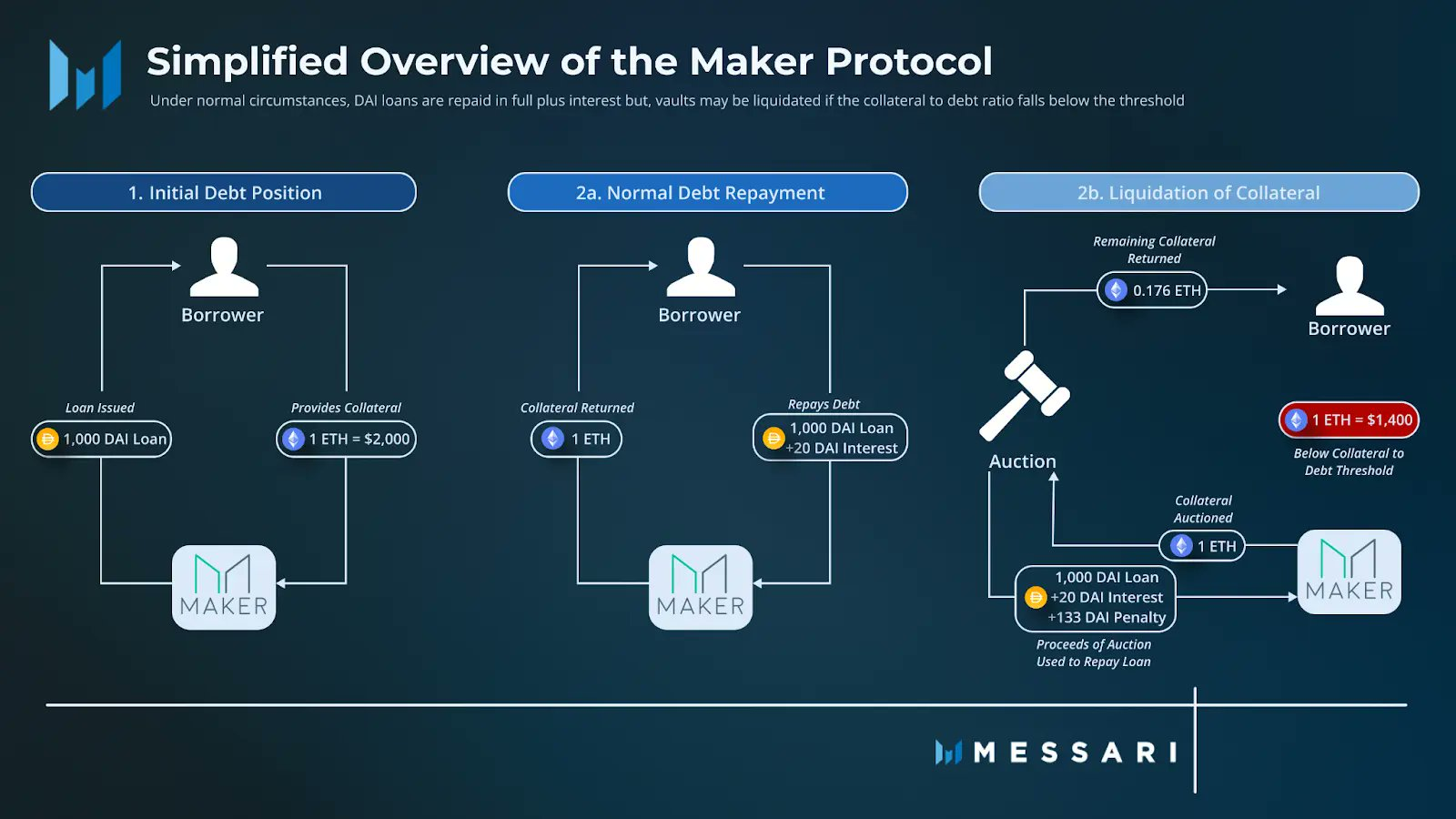

As the leading lending platform on Ethereum, MakerDAO's main purpose is to promote the democratization of finance with the lending business as an entry point. Regarding the operation process of the MakerDAO protocol, the article will not introduce too much here. Now, we focus on its governance logic.

Image Source:"MakerDAO's Dive into Real World Assets》

first level title

2. How MakerDAO is governed

Before talking about how MakerDAO is governed, let's confirm "what is governance". According to MakerDAO's description in the governance proposal, governance refers to: "how to control the organization, while describing who is accountable to the organization's stakeholders. It’s a balance between what’s actually best for the organization.”:

1)MakerDAOBetween stakeholders and the internal balance of the organization, we briefly explain the four elements of the MakerDao protocol

2)$MKR: The development of the project was initially led by the Maker Foundation and handed over to the DAO organization MakerDAO in 2018. In May 2021, the Maker Foundation, which is responsible for most of the protocol development, announced that it will dissolve the foundation, and development and governance responsibilities will gradually transition to DAO. From the perspective of the governance framework, MakerDAO is not a leader with the final decision-making power, but more like a guide for the community, ensuring that the project can run in a completely decentralized manner.: $MKR (MKR token) was launched in August 2015 and is a token with governance functions. From the perspective of the DAO model, rights are delegated to holders of MKR tokens. Holders participate in governance decisions, assume responsibility for system operation, and also assume their own "fund" trust responsibilities. $MKR is the decision maker, voting for changes such asand other governance decisions to ensure the stability of Dai; it is also a defender, defending against any proposals that run counter to the overall governance goals. The owners of $MKR form the DAO, and $MKR holders can also vote through delegates. $maker'svotevote

3)Maker ProtocolThe results grasp the future development orientation of the agreement.

: It is the on-chain smart contract that runs the MakerDAO protocol. MKR token holders vote on governance decisions, while operations are governed by

4)$DAIExecute automatically. We can understand it as the bottom pillar in the product line.: It is the core product of MakerDAO, and it is also the MakerDAO guarantee agreement to run or passNew Strategies Generate FundsFoundation Proposal V2the wrist of. DAI has grown with the protocol and is one of the core goals of governance. according to

, the five principles of Maker governance include Driving DAI Adoption. In other words, the goal of governance is to maintain the long-term stability of the project by ensuring the stability of DAI. The stable "currency" DAI was born in information technology, and MakerDAO's governance model has reshaped the definition of "currency". In the world of the MakerDAO protocol, the essence of long-term development is $DAI, and the long-term development controller is the owner of $MKR.@wkampmannTweeted that with the end of the foundation and the formation of an independent DAO team (core unit), MakerDAO achieved "complete decentralization" in 21 years. Each of these core units has its own separate twitter:MakerDAO Core Units。

Source: wkampmann'stweets

But is MakerDAO really decentralized? Is MakerDAO's DAO governance model a peaceful and stable option that can promote the long-term development of the protocol, or is it leading to a situation of intensified conflicts in the entire protocol governance?

first level title

3. MakerDAO's Practical Governance

Under the planned vision, MakerDAO has experienced several setbacks, especially in the market environment with large fluctuations. After the failure of Terra, MakerDAO revealed a management problem that tends to be "centralized" when solving "how DAO can maintain decentralization and generate the growth needed to truly reshape finance", which includes internal group organizational structure issues , MKR holders' obligations and income mismatch issues, as well as the numerous and complicated control rights issues of participating institutions, etc.; all of these create friction and collisions in pursuit of the goal of sustainable finance.

The complexity of governance depends on how clear or obvious it is to define what is "best" for the organization. The less obvious the definition, the more likely groups will form around their own interpretations, which is one of the root causes of conflict within MakerDAO.

The first big thing for MakerDAO is Real World Assets (RWA). Using RWA as collateral is actually not a sudden idea of MakerDAO. As early as December 20, the Maker Foundation and the American real estate company UPRETS launched a discussion on the model and possibility of real asset mortgage lendingResearchResearch

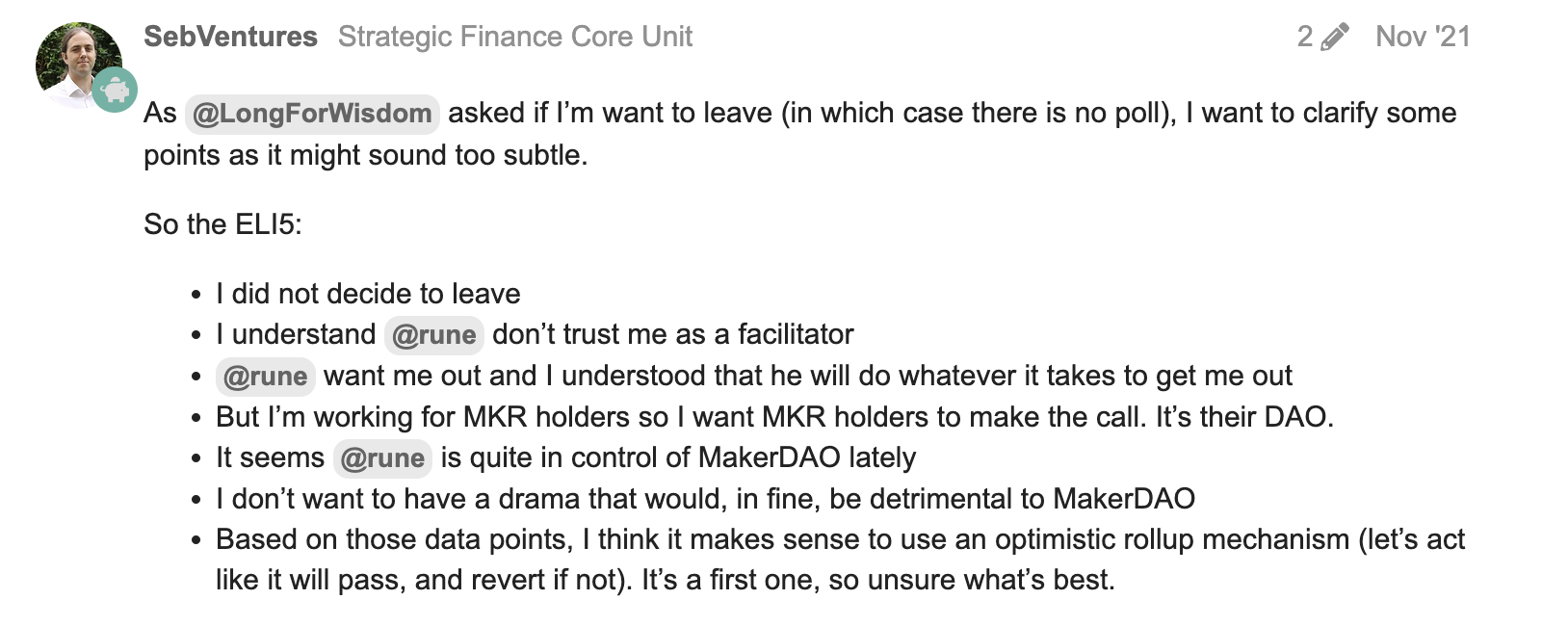

. On April 21, Maker began issuing loans backed by Real Assets (RWA) — in the form of tokenized real estate, invoices, and receivables — to New Silver, a lending service provider for real estate investors.In October of the same year, Rune proposedRWF 001 Proposal, proposing the removal of Sébastien Derivaux, the coordinator of the original RWF group. Sébastien responded at the time that he did not leave voluntarily, and Rune, as the founder, "is quietly trying to control MakerDAO." ashleigh_schap also commented belowto tell

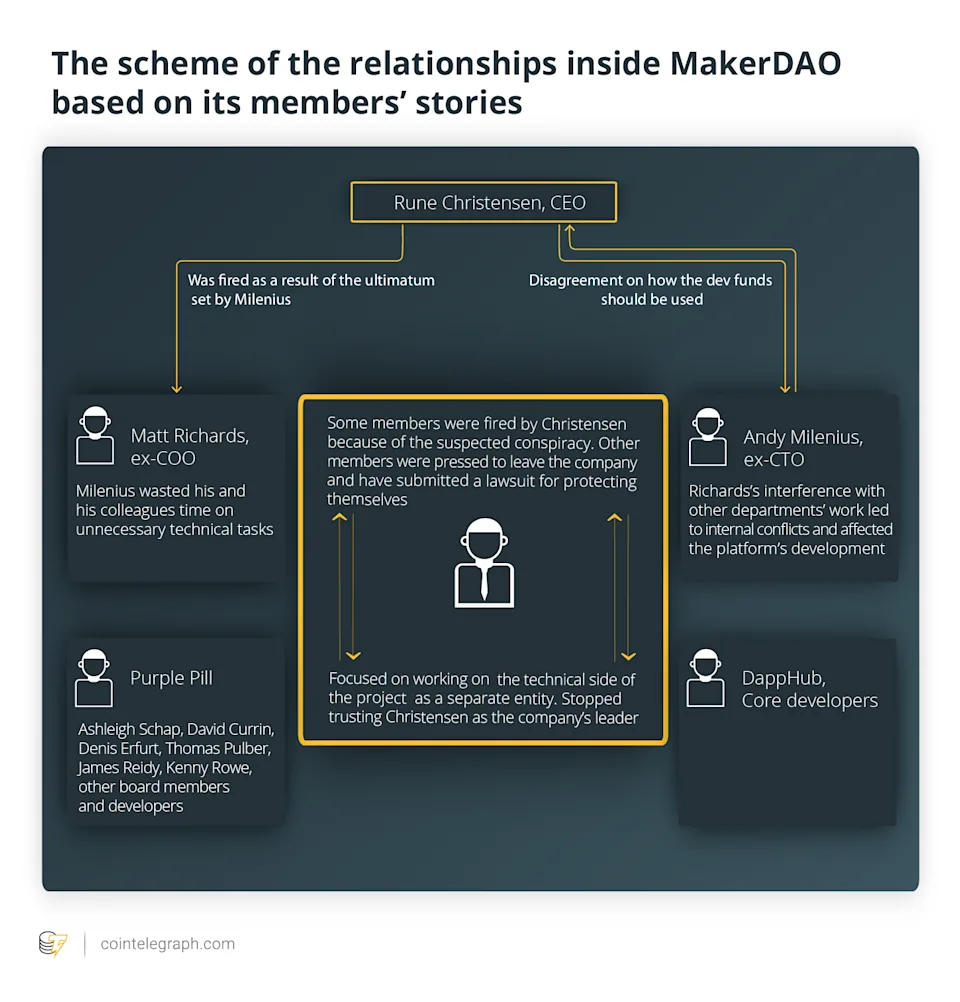

Internal conflicts began as early as 19 years after the departure of CTO Andy Mileniusopen letteropen letter

image description

Image Source:Internal Power Struggle at MakerDAO: When Coding and Personal Interests Collide

Image Source:

The RWF 001 proposal revealed a farce-like power struggle. Behind this is the "perennial" and "series" melee between MakerDAO participants and Rune, as well as the "rule" of democracy, equality, and "ruler" represented by DAO. Desire" collision.

Under the internal conflicts, undercurrents are still surging under the long-term development goals of the MakerDAO protocol. All conflicts come from "people". Internal operators have been challenged to "centralized" governance in the event of changes in the market environment and the capitalization of RWA, and MakerDAO's governance has entered a new round of chaos.

Dark War for Governance Goals: Reshaping the Road to Financialization

The market environment in 22 years has not gotten better. Suanwen, represented by UST, collapsed in the outbreak; the cryptocurrency circle entered a bear market; in the global macro market, rising interest rates have caused investors' demand for safe-haven assets to rise rapidly. And MakerDAO continues to start by choosing real assets in reshaping finance and entering the new world.RWA.COFrom a governance perspective, MKR holders have the right to vote on the collateral assets for lending DAI loans. exist

With the help of the company, in 2022, Huntingdon Valley Bank (HVB) obtained Maker's loan limit of approximately US$100 million through RWA; HVB became the first US bank to connect to DeFi.Under this 6-month deal, the MakerDAO team worked side by side for the needs of the DAO. Less than 2 months after the completion of the transaction, under the background of Tornado Cash being under the impact of strong supervision in the United States, Rune Christensen published an article "The Road to Compliance and the Road to Decentralization: Why Maker Has to Prepare to Free-Float DAI

Zhong described all this as MakerDAO Drama. He explained the separation of powers within the team:

Futurists represented by Rune are driving the development of Maker;

Centralists produce work-oriented output;

Decentralists are the only group that symbolizes the ideological right of the DAO.

The HVB deal was the straw that broke the surface of calm. The most obvious reason is undoubtedly the downturn in the macro market, and MakerDAO's book profits have declined. Under the bear market, the three genres have begun to make their own calculations. The centrist pay is considered "corrupt and wasteful" by the futurists; the futurist vision is considered "unrealistic and unplanned" by the centrists. The first step in the conflict is the LOVE series vote.Adding Lending Oversight Core Unit (LOVE-001)Just look at the LOVE proposal. This proposal by Luca on May 11, 2022:

, it is suggested to create a loan supervision core unit (Oversight Core Unit) to provide guidance, process audit and other professional services to supervise Maker's development strategy, and the rights of $MKR holders have not changed.

On June 27th, members of MakerDAO discussed two other proposals beyond LOVE-001:Adding a Special Purpose Fund(MIP55c3-SP4Governance Proposal #2:

); proposed on April 15, 2022; proposed to create a $10 million fund pool, Makershire Hathaway SPF, to manage stable currency reserves and obtain diversified income through investment.Onboard Task Force - Growth Task Force(MIP75c3-SP1)Governance Proposal #3:

; Proposed on May 1, 2022; Establish a Growth Task Force (Growth Task Force) to raise funds, manage and supervise to develop the Maker ecosystem.

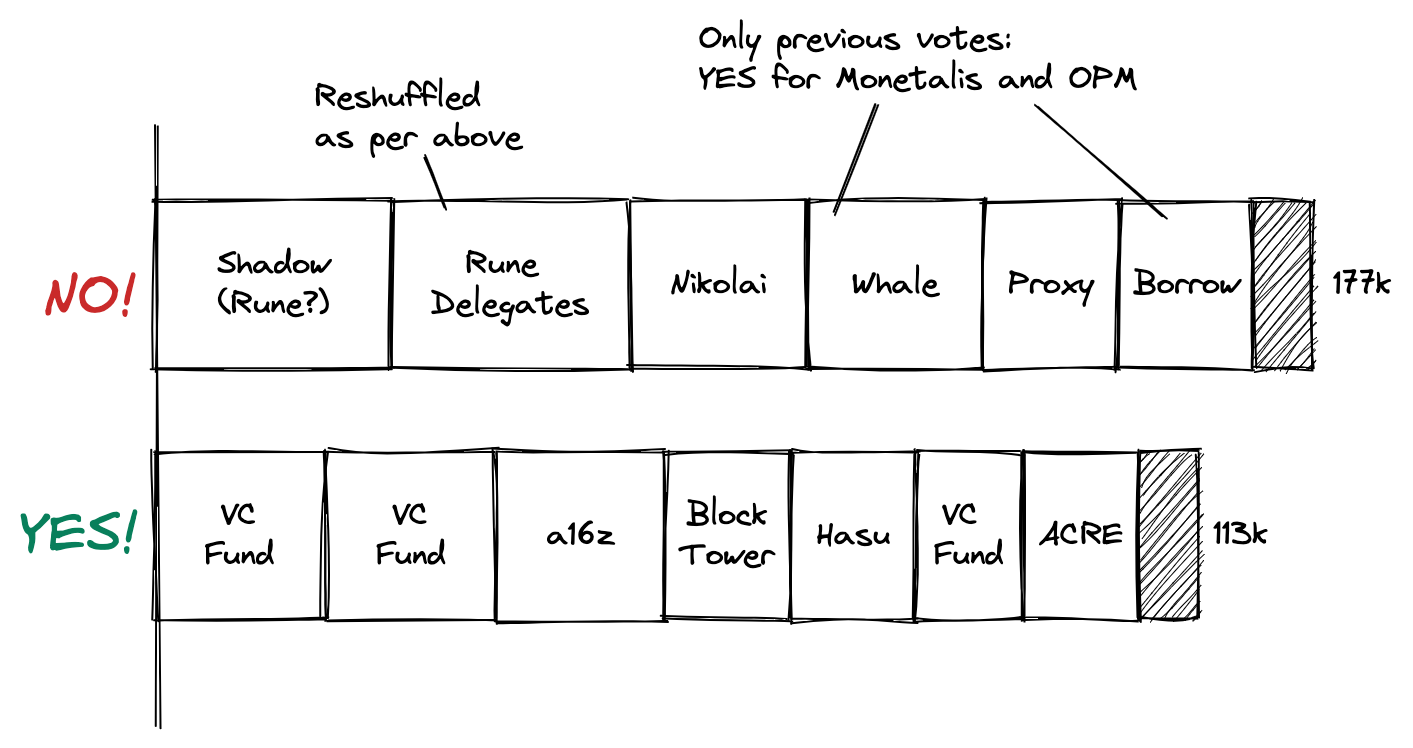

In summary, these three proposals all have a common goal: to reorganize the leadership of MakerDAO; to use a more professional, but also more "traditional" operating model, such as investing to increase the company's revenue, and setting up a special team to manage and supervise the development of the protocol. Take MakerDAO away from the chaos of decentralization for a centralized, but "efficient" solution. In the end, all three proposals failed to pass.g_dipfrom Insider@ofangle of view@hasuDown voted with @ElProgreso. When institutional giant whales such asa16z through Porter Smith,Kevin MiaoandKianga DaveringtonandAfter publicly expressing their support, anonymous people began to "tucao" about the VC industry in Maker's discord channel. But the momentum of opposition is still weak and has not overcome the proportion of votes in favor. Nikolai, who had been excluded from the game, suddenly returned to Maker'son the forum

image description

Image Source:MakerDAO and Our Side of History

Image Source:

This is a DeFi protocol governance voting battle with about 310K votes. But can the de-dollarization of DAI gain more value in the function of "utility"; or will the anchoring of "stable" off-chain assets make stablecoins more "unstable"? The headlines and sudden downfall of UST and other stablecoins seem to have left some revelations behind.

So which school of thought does the "revealer" represent? It's hard for us to confirm. But the only thing he knows is that he does not support the de-dollarization of DAI. It is precisely because of the high degree of disapproval of Rune's ideas that he decided to stand up and reveal the secret war behind MakerDAO around governance goals, as well as the instability and contradictions of its own governance structure. Behind the LOVE proposal is also a DAO dilemma: it is not only a dilemma about the direction of Maker's development, but also a "political game". The internal power forces make plans for Maker's development direction out of different ideas, trying to make decisions in DAO Seeking a new organizational structure to break the monopoly of the "oligarch represented by Rune".

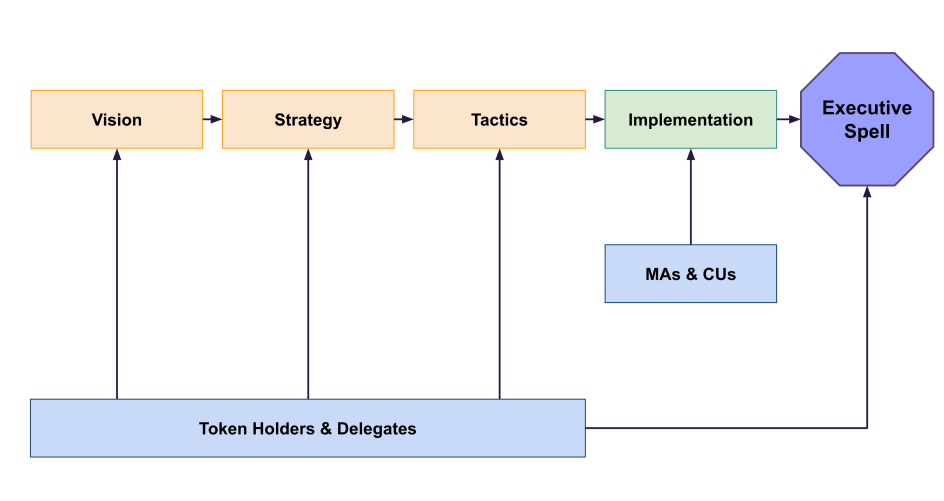

Clash of Governance Models: Imbalance of Obligations and InterestsSimple MakerDAO — Governance from first principlesOn MakerDAO governance issues, @hasufl in the

"It's not just a MakerDAO problem, it's a lot of problems in governance today." These include a general lack of vision and strategy, and a low sense of accountability to MKR holders. "

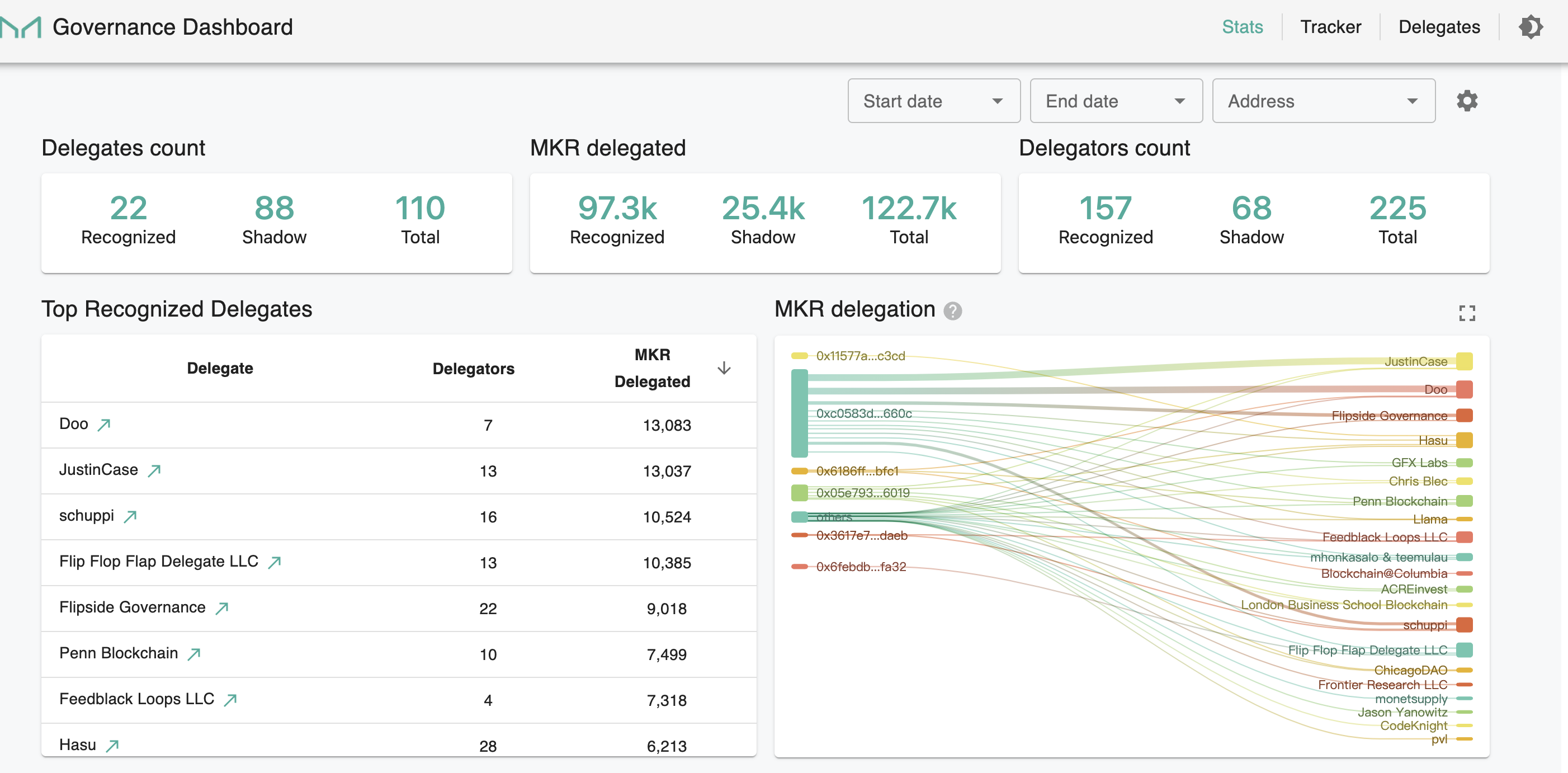

Back to voting. As mentioned before, $MKR holders determine the subsequent development of the Maker protocol by voting, which is the most decentralized and equal measure. However, the lack of benign incentives and proxy voting rights system in $MKR tokens weakens its decentralized characteristics to a certain extent.The Ethereum community is one of the most successful organizations so far. People are the most precious wealth of the community, and they are connected by a common sense of mission and values. However, in Maker or the existing DAO governance model, the governance participation of $MKR holders is low; according to, as of September 14th, 225 delegators (Delegators) have handed over their $MKR voting rights to 110 proxies, and more than 2/3 of the proxies' identities are not transparent. For the MakerDAO governance model with an on-chain voting system, this seems to be a signal of "centralized" management, and it is more prone to "bribing" campaigns when voting.

image descriptionMakerDAO

image description

Image Source:Governance from first principles

" to face this malicious governance attack. However, how to prevent risks through governance and set up firewalls to reduce the uncertainty of preventing such incidents in a more efficient and rapid manner still needs to be resolved.

The DAO solution

After reviewing the governance process of MakerDAO so far, you will find that some of these risks come from the design of MakerDAO's governance structure, and on the other hand, they come from the inherent vulnerability of DAO itself.

Other protocol DAOs on the DeFi track, such as Uniswap and Lido, have tried different governance structures: Uniswap is governed by the smallest unit, and Lido's innovative dual governance method brings both LDO and stETH to the governance layer. How Maker allocates the ownership of the agreement, and will fully decentralize to all participants in the ecosystem, such as users, investors, partners, etc., to maintain this huge ecosystem for self-rotation.The Endgame PlanRune raised thisA roadmap detailing MakerDAO's new governance plan. This part of the content of CYC Labs "The central bank stabilizes MakerDAO, subverting the governance paradigm again (Part 2)

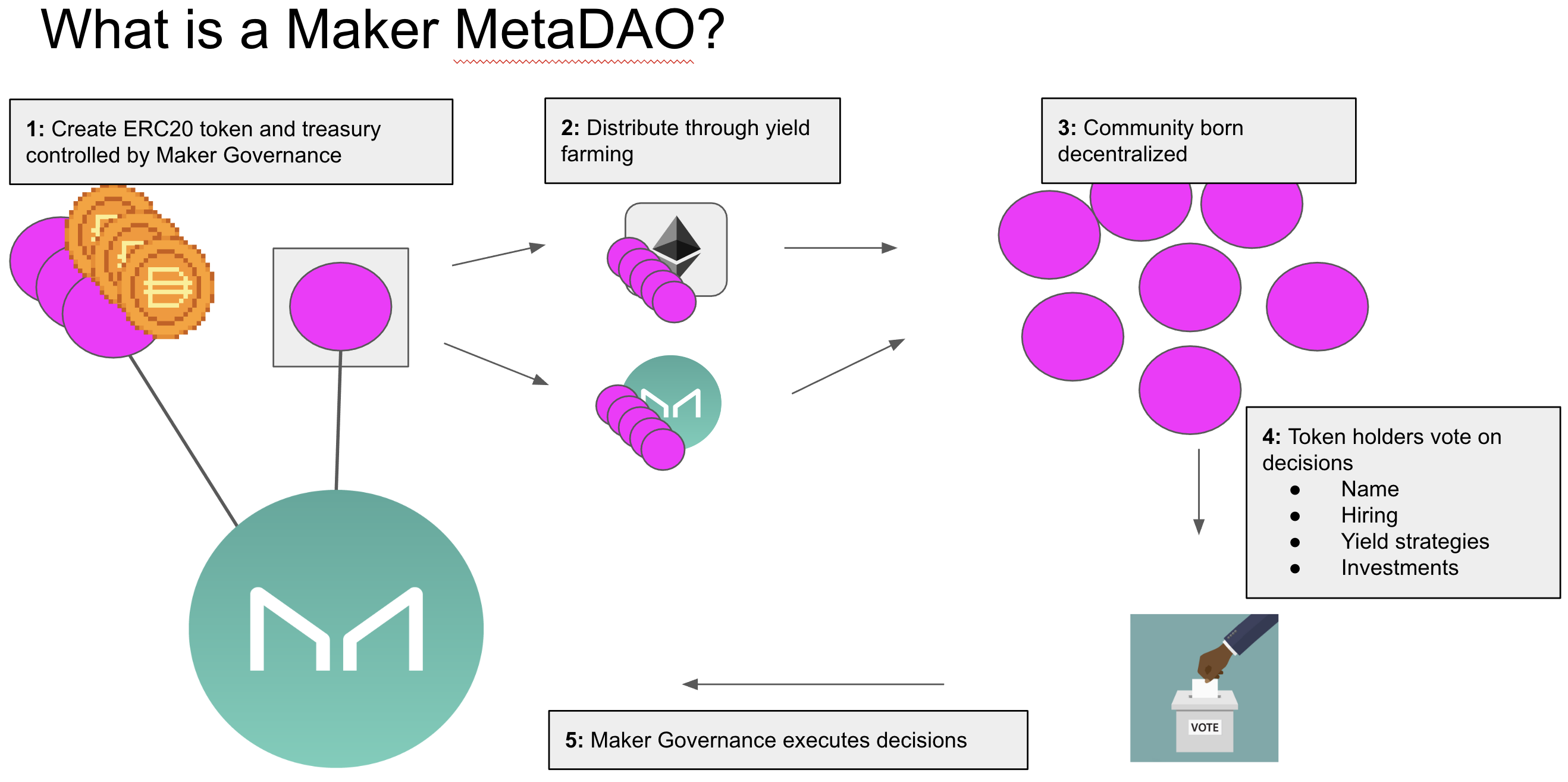

"The article made a very detailed introduction; the article will not elaborate too much here.Simply put, MakerDAO introduces the concept of MetaDAO. This and ourimage description

Image Source:The Endgame Plan parts 1&2

Image Source:But as mentioned earlier, MakerDAO's governance issues are not the only ones of its kind. The DAO model is inherently fragile. One of the difficulties in DAO governance comes from tokenization. In these DAO-governed agreements, currency rights theoretically replace ownership and agreement "property rights". Owning the governance token of the protocol does not equal owning the protocol itself. exist"DAO governance history and evolution

Freedom needs to be checked and balanced, and so is the size of the DAO's power. As with all new growth, MakerDAO cannot completely escape governance battles. When the protocol expands rapidly and the number of currency votes increases, it becomes more difficult to reach a consensus. MakerDAO is arguing about the introduction of a more professional team to make more professional decisions, and whether the future development path of the agreement should be linked to the will of the founder. Behind these issues, there is a war between "centralization" and "decentralization". Will blind decentralization be overkill? It's hard to say for sure, but it's clear that other DAOs are looking for a better governance framework to realize Internet Nation's vision.

Reference:

https://blog.makerdao.com/makerdao-governance-risk-framework/

https://blog.makerdao.com/makerdao-governance-risk-framework-part-2/

https://blog.makerdao.com/makerdao-governance-risk-framework-part-3/

https://twitter.com/DefiIgnas/status/1564502950034042880?utm_source=substack&utm_medium=email

https://blog.makerdao.com/foundation-proposal-v2/

https://forum.makerdao.com/t/the-path-of-compliance-and-the-path-of-decentralization-why-maker-has-no-choice-but-to-prepare-to-free-float-dai/17466

https://dirtroads.substack.com/p/-42-valkyrie-makerdao-and-our-side

https://messari.io/report/makerdao-s-dive-into-real-world-assets?utm_source=twitter_messaricrypto&utm_medium=organic_social&utm_campaign=makerdao_dive_real_world

https://cointelegraph.com/news/internal-power-struggle-at-makerdao-when-coding-and-personal-interests-collide

https://dirtroads.substack.com/p/-42-valkyrie-makerdao-and-our-side

disclaimer

"DODO Research Institute" led by the dean "Dr.DODO" led a group of DODO researchers to dive into the Web 3.0 world, doing reliable and in-depth research, aiming at decoding the encrypted world, outputting clear opinions, and discovering the future value of the encrypted world. "DODO" is a decentralized trading platform driven by the Proactive Market Maker (PMM) algorithm, which aims to provide efficient on-chain liquidity for Web3 assets, allowing everyone to issue and trade easily.

Copyright Notice

Without the authorization of DODO Research Institute, no one may use without authorization (including but not limited to copy, disseminate, display, mirror, upload, download, reprint, excerpt, etc.) or allow others to use the above intellectual property rights. If the work has been authorized to be used, it shall be used within the scope of authorization, and the source of the author shall be indicated. Otherwise, its legal responsibility will be investigated according to law.

about Us

"DODO Research Institute" led by the dean "Dr.DODO" led a group of DODO researchers to dive into the Web 3.0 world, doing reliable and in-depth research, aiming at decoding the encrypted world, outputting clear opinions, and discovering the future value of the encrypted world. "DODO" is a decentralized trading platform driven by the Proactive Market Maker (PMM) algorithm, which aims to provide efficient on-chain liquidity for Web3 assets, allowing everyone to issue and trade easily.

More information

Official Website: https://dodoex.io/

GitHub: https://github.com/DODOEX

Telegram: t.me/dodoex_official

Discord: https://discord.gg/tyKReUK

Twitter: https://twitter.com/DodoResearch

Notion: https://dodotopia.notion.site/Dr-DODO-is-Researching-6c18bbca8ea0465ab94a61ff5d2d7682

Mirror:https://mirror.xyz/0x70562F91075eea0f87728733b4bbe00F7e779788