What is Web3? How the decentralized internet is disrupting the digital economy

Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

Imagine an internet built, run and controlled by users rather than a few big tech companies. Social media users can monetize their data, content creators can receive direct payments in cryptocurrency every time someone views their latest post; ride-sharing platforms can be owned by drivers.

This is the promise of Web3 - to build a decentralized internet based on an open, permissionless blockchain network.

The Internet as we know it now is centralized — data is stored in data centers owned by a handful of tech companies. But in Web3, data is stored and flowed on the blockchain network, and no single entity can control them. From e-commerce to social media to gaming, it is maintained and controlled by a democratic group of developers, creators, and users.

Today, three use cases for Web3 have gained traction:

Decentralized Finance (DeFi): A financial ecosystem powered by smart contracts that allows participants to access financial services on a peer-to-peer basis without relying on traditional intermediaries such as banks, credit unions, or brokerage firms

Non-Fungible Tokens (NFTs): Represent digital assets—ranging from images to songs to videos—verified through blockchain technology

Decentralized games: based on token economy and virtual world driven by blockchain technology. Most decentralized games integrate NFTs in some way.

While a fully decentralized internet may still be a distant vision — critics say the idea is little more than hype — its implications could be far-reaching.

first level title

first level title

How does Web3 work?

- dApps are designed to remove the middle man

- DAO to manage Web3 applications and communities

- Decentralized network owns and controls data on Web3

first level title

What does Web3 look like today?

- DeFi powers Web3 financial products and services

first level title

What impact will Web3 have in the future?

- Metaverse

- digital content

- Dispute Resolution

first level title

What challenges does Web3 face?

- Web3 is currently a digital "Wild West"

- DAOs are vulnerable to abuse and centralized control

- Full decentralization is hard to achieve - and could make Web3 crumbling

secondary title

How does Web3 work?

Decentralized applications (dApps) aim to remove the middle man

The main goal of Web3 is to "remove the middle man," and it's a goal of great significance.

For example, an idealized Web3 ride-sharing app could connect riders directly with drivers. Payments are sent directly to the driver and the app does not take a cut.

The middleman will be replaced by decentralized applications (dApps). These applications run on the blockchain and use code-based smart contracts to facilitate agreement between parties without pre-establishing trust. Theoretically, these applications do not belong to any individual or company.

To be considered decentralized, an application must meet the following criteria:

- It is completely open source, data is stored on an open blockchain, and no entity owns a majority of the app's tokens.

- Ability to generate tokens, which are necessary to use the application and rewarded to users in exchange for their contributions.

- It can change/upgrade the agreement only after obtaining the majority agreement of the users.

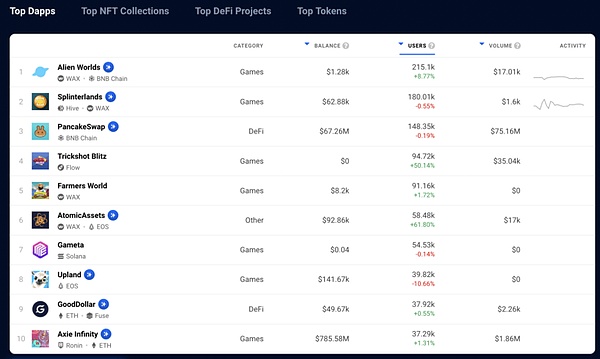

image description

Image source: DappRadar

Likewise, dApps cannot all run on the Ethereum blockchain, as this can be complex, time-consuming, and expensive. The "network congestion crisis" triggered by CryptoKitties in December 2017 illustrates this point.

Today, many dApp developers either keep the main user interface on the traditional website and only send transaction requests to the blockchain via an API; or they build on "sidechains" - independent small blockchain.

Nonetheless, dApps offer some benefits that traditional applications cannot. For example, they may be more resistant to control or censorship by governments or other organizations. They are also open source, which removes barriers for developers to build dApp ecosystems. Since dApps use blockchain technology, cryptocurrencies can be easily integrated.

DAO to manage Web3 applications and communities

But how will dApps (and other Web3 activities) be managed if no one controls them?

Answer: Decentralized Autonomous Organizations (DAOs).

DAO is a blockchain-based organization. The organization's rules are written into smart contracts -- which can include self-executing code in relation to certain events or conditions.

DAOs embody the collective ownership and decentralized aspects of Web3. In the full Web3 vision, DAOs will replace corporations and become the main body running on the blockchain. Many Web3 startups have roadmaps for transitioning to a DAO structure.

An example of a DAO is Opolis, which was created for independent workers and evolved from a digital employment cooperative.

Opolis provides its members with automatic payroll, health insurance, retirement plans, and other benefits. Its members voted to create a DAO in 2021 and fund a liquidity pool of its token $Work on exchanges. Although Opolis received $5 million in seed funding, only cooperative members have voting rights.

Decentralized web changes how data is handled

The Web3 platform hosts data on a distributed network rather than centralized servers. The idea is to decentralize data, preventing a handful of companies from controlling the internet.

One of the most popular peer-to-peer storage networks is the Interplanetary File System (IPFS). Computers all over the world can connect to the system and act as nodes that store data and provide data to users. IPFS is not based on a blockchain, and its records are neither immutable nor permanent.

Filecoin is similar to IPFS, but it's built on top of a blockchain-based protocol. Anyone can join the network, contribute their open hard drive space to storage, and earn Filecoin tokens for doing so.

However, one downside of decentralizing data is that it can cause bottlenecks in application usage. Retrieving data from large networks like IPFS or blockchains takes time, which limits the usability of Web3 applications. Therefore, developers are looking for a workaround.

An example is The Graph, a protocol for indexing and querying blockchains and distributed file storage networks such as IPFS. The Graph is designed to make Web3 applications run smoothly even when querying distributed data.

Decentralized Identity (DID) to authenticate Web3 users

Another challenge of Web3 is how to authenticate users. This is where decentralized identity (DID) comes into play.

A DID is a string of numbers and letters that forms the basis of an application called an "identity wallet". These wallets contain verified credentials and other data generated by users on the blockchain. Identity wallets grant their owners access to applications and can also be used to prove ownership of NFTs, social media accounts and other assets on the blockchain.

Spruce allows users to create DIDs on blockchains including Ethereum, Polygon, and Solana. Synaps allows users to create and manage identity documents, such as ID cards and passports, and store them on the blockchain, which is especially useful for applications with KYC requirements.

secondary title

What does Web3 look like today?

DeFi Powers Web3 Financial Products and Services

While a fully decentralized internet is still a distant vision, DeFi (decentralized finance) has already gained ground.

DeFi refers to a financial ecosystem powered by smart contracts that allows participants to access financial services on a peer-to-peer basis without relying on traditional intermediaries such as banks, credit unions, or brokerage firms.

DeFi uses dApps to do this.

Types of DeFi protocols include:

- Decentralized Exchange (DEX) - users can trade cryptocurrencies

- Lending platform - users deposit assets that can be lent and earn rewards/interest on fees paid by borrowers

- Asset management and yield - depositors are rewarded for holding tokens and contributing to the liquidity pool

- Derivatives - smart contracts derive their value from the underlying asset for hedging or speculation

- Payments - users pay each other with cryptocurrencies

- Insurance - Users get protection for the crypto wallets, DeFi and other smart contracts they use

- NFT lending - users use NFT as loan collateral

Trading is one of the most popular use cases for DeFi. PancakeSwap, a decentralized exchange (DEX) on Binance Smart Chain, is one of the most popular DeFi applications with 2.4 million active users in June 2022 alone.

Another popular DEX is Uniswap, which has a total historical transaction volume of more than $1T in May 2022 — less than 4 years after launch.

NFTs may have use cases beyond art and games

Non-Fungible Tokens (NFTs) are another well-known Web3 use case.

NFTs provide blockchain-based proof of ownership of digital assets — ranging from images to songs to videos. Each NFT represents a unique and immutable proof in the blockchain, sort of like a land deed.

Creators can sell NFTs directly to their fans to help monetize their creations, or on NFT marketplaces like Opensea or Rarible.

There is an NFT embedded in a smart contract, and the creator can add some extra conditions, such as the NFT automatically earning royalties when it is traded-no matter how many times it is purchased and resold.

While early use cases have focused on art and games, NFTs can be used in many different ways.

Web3 game models often involve NFTs and play-to-earn (P2E). Users can purchase game assets in the form of NFTs, such as skins, weapons, characters, and avatars. Unlike traditional games, players can sell or trade in NFT marketplaces, or exchange them for cryptocurrencies in DEXs.

One of the most popular NFT games is Axie Infinity created by Vietnamese studio Sky Mavis. The game will reportedly generate $1.3 billion in revenue in 2021. Users buy NFTs of creatures called Axies in the game, which are then used in battle and can also be freely traded. The most expensive, the Axie, sold in July 2021 for a whopping $820,000.

secondary title

Metaverse

Metaverse

Another technical concept that is often discussed alongside Web3 is the Metaverse.

The Metaverse is a shared virtual world driven by highly immersive and interactive virtual products and digital experiences.

The Web3 metaverse, on the other hand, is blockchain-based and built on open standards, sometimes referred to as an “open metaverse” — no single entity controls it.

image description

Image credit: Decentraland

Gaming and fashion companies were early adopters of the Metaverse, often collaborating on limited-edition game skins and character accessories. In the open-ended metaverse game Blankos Block Party, you can socialize at a Burberry-themed resort and shop for Burberry-branded accessories.

Tech giants are also betting on the metaverse track. Facebook's parent company Meta is investing heavily in the development of immersive 3D virtual worlds as well as virtual reality (VR) and augmented reality (AR) glasses. Apple also seems poised to join the race, with the company reportedly working on a headset that will offer users AR and VR experiences.

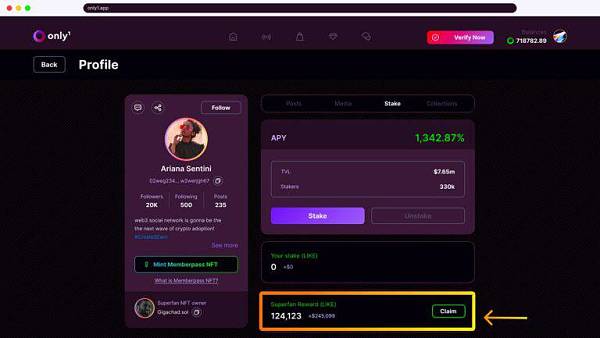

digital content

One of the main promises of Web3 is to empower content creators to control, distribute and monetize their content.

LBRY is a protocol that allows users to post content, set prices and receive payments directly without going through social media sites. Users also have the option to share their content for free. Likewise, Dtube is a blockchain-based social media platform focused on enabling creators to publish and share content.

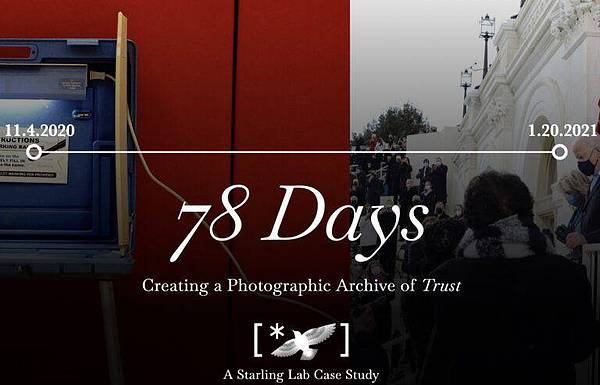

Other content-driven Web3 use cases focus on preserving history. For example, The Starling Lab uses cryptography and blockchain to preserve verified photos, articles and datasets documenting war crimes, human rights violations and genocide. One of its initial projects was to replicate the Holocaust archives of the USC Holocaust Foundation and upload them to Filecoin.

The company is also working with a human rights group to encrypt and verify social media content documenting the Russia-Ukraine conflict and keep its records on the blockchain.

Dispute Resolution

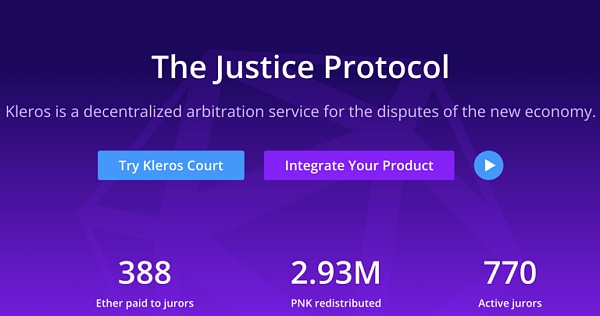

Some proponents argue that Web3 could even have an impact in resolving disputes, such as a breach of contract between a freelancer and a company or a conflict of interest within a DAO.

The best known in this space is Kleros, a decentralized dispute resolution protocol based on the Ethereum blockchain. Kleros selects a group of "jurors" to decide disputes, the entire process -- including the final decision -- is recorded on the blockchain, and jurors receive PNK tokens as rewards for their services.

social media

social media

Some of today's popular social networking platforms are already making the transition to Web3. Reddit, for example, is testing Karma points, a virtual currency that allows users to govern the Reddit subcommunities they belong to. Still, there is centralization here, as Reddit owns and controls the platform.

New decentralized social networks are also emerging. Aether is called Reddit's Web3 alternative. It is open source and user-governed. Users have the right to elect and impeach moderators by voting. Users can also review whether the content on the platform is compliant, and obtain tokens through this contribution.

secondary title

text

Web3 is a digital "Wild West"

One of the main challenges of Web3 is the lack of regulation and increasing cybercriminal activity.

Because Web3 is blockchain-based, it is easier for transactions to remain anonymous. While this protects users' privacy, it also makes it harder to track cybercriminal groups -- while making it easier for them to sell their ill-gotten gains.

Billions of dollars in cryptocurrency have already been stolen this year. From January to April alone, $1.7 billion worth of cryptocurrencies were stolen — 97% of which occurred on DeFi protocols, according to Chainanalysis.

According to Cointelegraph, most of the hacks targeting DeFi protocols that occurred between June 2020 and June 2021 were made possible due to vulnerabilities overlooked by developers. In projects where rapid deployment is a priority, smart contracts can carry serious vulnerabilities. These contracts are often open source and public, so it is easy for hackers to review them for ways to manipulate the protocol. It is also easier to make a profit, as hackers can directly attack the protocol and withdraw funds.

DAOs are vulnerable to abuse and centralized control

Similar concerns exist around the oversight and security of DAOs.

Supporters of DAOs say their structure promotes democracy and transparency in decision-making, while critics say it is more like a pyramid scheme (pyramidal selling) that can concentrate power among a few extract wealth from wary members.

In October 2021, just 20 hours after AnubisDAO launched, $60 million worth of ETH in its liquidity pool disappeared and reappeared in an encrypted wallet. Some investors accused the project's creators of fraud, while others suspected a phishing scam.

Aside from malicious attacks, another problem with DAOs is that participants can buy more tokens to increase their influence over decisions. This has led to the concentration of power in many DAOs.

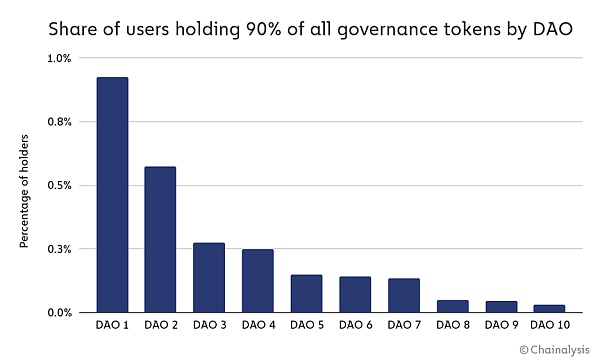

According to Chainalysis, the distribution of governance tokens for 10 major DAOs shows that 90% of voting power goes to less than 1% of users.

At the same time, the threshold for creating proposals related to DAO governance is higher. The same study found that in 10 DAOs, only 1 in 1,000 to 1 in 10,000 token holders had enough tokens to submit proposals.

Gitcoin, a crowdfunding platform managed by a DAO, aims to solve this problem with quadratic funding, where each additional token you cast for the same vote is worth less than the previous one. However, quadratic financing does not eliminate the possibility that decisions are controlled by a single actor or by several coordinating actors.

Full decentralization is hard to achieve — and could make Web3 crumbling

Even if complete decentralization of the internet could be achieved, it would pose significant problems.

For example, blockchains are very slow due to the consensus mechanism. Ethereum is currently only capable of 30 transactions per second — although an upcoming "The Marge" upgrade aims to increase this.

Using blockchain can also be expensive. As of March 2022, the average cost (also known as "gas fee") of conducting a transaction on Ethereum is $15. In 2021, the average Gas fee tends to be as high as $50, while some complex transactions cost upwards of $200.

Also, crypto wallets, dApps are cumbersome to interact directly with the blockchain itself, so they often don't. Instead, they rely on APIs built and controlled by a handful of companies. But this approach increases the likelihood of potential cyberattacks and involves handing over power to third-party governors—a direct defeat of the noble goal of a "trustless" internet.

Cryptocurrencies Still Face Huge Hurdles

Since cryptocurrencies are an integral part of dApps and DAOs, Web3 is vulnerable to the weaknesses of cryptocurrencies, as revealed by the cryptocurrency market crash in May 2022.

It started with the unpegging of Terra's algorithmic stablecoin UST from the U.S. dollar, with the value of UST's sister coin Luna plummeting to $0. Confidence in the cryptocurrency market has been shattered amid sluggish stock markets, rising inflation and heightened regulatory scrutiny — and undercut assertions that cryptocurrencies provide a natural hedge against broader market turmoil. In one day, the entire cryptocurrency market lost more than $200 billion. Bitcoin prices fell to 16-month lows.

The prices of cryptocurrencies related to utility tokens also fell sharply. Within a month of the market crash, the prices of Filecoin and Solana dropped nearly 50%, while ETH dropped from over $2,700 to about $1,900 — and they’re still falling. For dApp builders and users, this means less value for their contributions.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.