The sanction of Tornado will be a watershed in DeFi regulation

Original Author: Daniel Li

Original Author: Daniel Li

So what impact will Tornado Cash being sanctioned have on the industry? How will decentralized finance (DeFi) develop in the future? Let's explore it through this article.

secondary title

What is Tornado and how does it work?

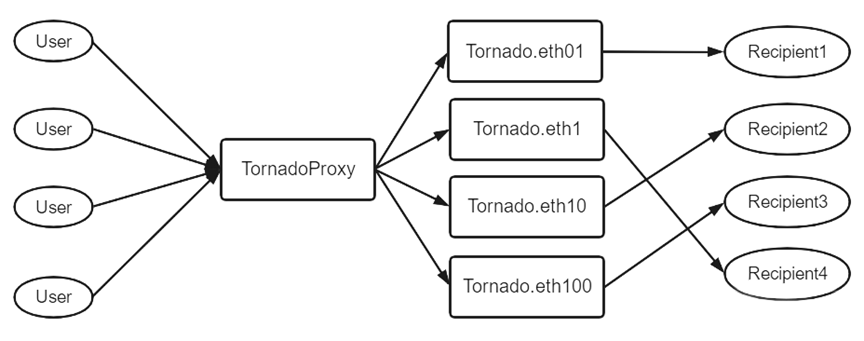

To understand the impact of Tornado Cash being sanctioned, let's first figure out what Tornado Cash is and how it works. Tornado Cash is a type of Coin Shuffle, which is a decentralized privacy and anonymity service that allows users to quickly and efficiently mix funds with other users, in existing user accounts and A random mapping relationship is created between the new accounts after currency mixing to achieve complete anonymity.

As the leader among coin mixers, Tornado Cash can stand out among many coin mixers because it uses ZK-SNARK (also known as zero-knowledge succinct non-interactive proof of knowledge) technology, which makes Tornado Cash both block Chain decentralization and non-custodial. The biggest feature of Tornado Cash is that there is no connection between the source wallet address and the target wallet address. Users deposit funds into Tornado Cash, and then use a new address to withdraw funds, and there is no connection between the new address and the old address. Therefore, it becomes a difficult problem for data analysis companies to trace funds through chain transfer records, so as to achieve the purpose of privacy. According to statistics from Dune Analytics, the amount of funds on the platform has maintained rapid growth since January 2020. At present, nearly 3.48 million ETHs have been deposited in this privacy pool, with a total deposit of 7.6 billion US dollars. Tornado Cash has become Become Ethereum's largest privacy solution.

In the face of this hidden danger, although the Tornado Cash project team has made many efforts, they have not achieved obvious results, because Tornado Cash is a decentralized protocol, and once the contract code is deployed on the blockchain, it will automatically run It cannot be stopped, which also gives hackers and criminals an opportunity. In the eyes of outsiders, the current Tornado Cash can no longer solve this problem by itself, which is the fundamental reason why the US government finally had to take action to rectify it.

secondary title

Unprecedented sanctions - far more deterrent than practical

The sanctions against Tornado Cash this time is a milestone event in the history of decentralized blockchain finance, and even in the history of the Internet. It is not an exaggeration to describe it as unprecedented. The enforcement agency for the sanctions is the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC). OFAC is the most important government department in the United States for economic and trade sanctions against specific countries, regions and individuals. Its mission is to manage and implement all economic and trade sanctions based on US national security and foreign policy, including financial sanctions against terrorism, transnational drug and narcotics trade, and proliferation of weapons of mass destruction.

Obviously, OFAC will not only be satisfied with banning a Tornado Cash when it is so aggressive. After Tornado Cash, Monero (XMR), Zcash (ZEC) and other privacy tokens may also face a very large risk of being sanctioned, and with Tornado Cash behind The development team is arrested, and some developers and project parties in the industry will no longer be safe. Even organizations with loose anonymity will face legal sanctions once they are found to be engaged in the development of projects prohibited by the government. Therefore, the deterrent significance of OFAC's series of measures is far greater than the actual significance.

secondary title

What is the impact of Tornado being sanctioned?

Although more than half a month has passed since the Tornado Cash sanctions incident, the turmoil caused by it has continued to spread in the blockchain industry. Regulators and decentralized communities seem to be silently launching a "confrontation". In the process, the encryption market is also undergoing some subtle turns.

(1) Large-scale "poisoning" incidents staged

OFAC's sanctions on Tornado Cash produced a series of chain reactions, and large-scale "poisoning" incidents began to take place. The so-called "poisoning" refers to sending encrypted assets in Tornado Cash mixed addresses to Vb 3, Justin Sun, The ENS wallets of sifu.eth, Brian Armstrong, Beeple, Ukrainian encrypted donations and centralized exchanges and other industry celebrities or exchanges are aimed at polluting these wallets. As of the evening of August 10, about 440 addresses received Arrived 0.1 ETH sent via Tornado Cash. This has resulted in a large number of addresses being banned from front-end interaction by the DeFi protocol. The move is considered some sort of counter to the Tornado Cash sanctions.

(2) Centralized stablecoins are questioned

Circle, the issuer of USDC, freezes the USDC funds in the Tornado Cash wallet address approved by the U.S. Department of the Treasury in accordance with OFAC regulatory requirements, which is considered to be a naked violation of personal encrypted assets by centralized institutions. It has also caused people to question centralized stablecoins such as USDT and USDC. Rune, the founder of MakerDAO, is worried that the Maker protocol will be blocked and cause MakerDAO to collapse. He is planning to sell all the USDC in MakerDAO and exchange them for ETH as collateral assets.

(3) Privacy and anonymous projects are transferred to underground operations

Following the Tornado Cash sanctions, Monero (XMR), Zcash (ZEC) and other privacy coins may also face a very large risk of being sanctioned. Technological development related to the concept of privacy may have stagnated for a long time at this point. Before the policy on blockchain privacy and anonymity has not been clearly supervised, related projects involving privacy and anonymity will be transferred to underground operations, and it will no longer be difficult for ordinary users to use.

(4) Unable to prevent money laundering

The URL front end of Tornado Cash is blocked, but the smart contract still runs on Ethereum and cannot be banned. The ban on the website only raises the threshold of use and prevents some ordinary users from using Tornado Cash, but it has no effect on criminals who know how to use blockchain technology to launder money. They can still use mirrors or the Tornado Cash website running on Ipfs for money laundering.

The sanction of Tornado Cash will make DeFi move towards a more decentralized path. Facing the intervention of strong supervision, some people think that only more decentralization can avoid repeating the mistakes of Tornado Cash. However, this idea is a bit naive. As Ethereum merges PoS to replace PoW, the government can control the main body of the node operator Supervision, once the validators with more than 66% of the rights and interests of the beacon chain are supervised by OFAC, it means that OFAC can arbitrarily sanction any address on Ethereum, and the more decentralized road is still difficult to escape government supervision.

secondary title

Sanctions against Tornado kick off crypto market privacy battle

OFAC’s sanctions on the Tornado Cash privacy mixing protocol, a protocol running on the blockchain, is the first time the U.S. government has imposed sanctions on a DeFi protocol. The sanctions this time are historic, and it means the start of a war on privacy and anonymity in the encryption market.

The right to privacy has always been valued in the traditional centralized financial field, and even the protection of user privacy has become a necessary condition for the survival of Internet financial companies. Hidden danger. Before Tornado Cash was sanctioned, some related currency mixers such as the centralized currency mixing service provider Blender received OFAC’s ban in May this year, but it did not cause a large-scale industry panic at that time, because Blender, as a centralized In the blockchain industry, which is dominated by decentralization, most people do not regard it as an enterprise within the industry. But Tornado Cash is different. It is a decentralized currency mixing service provider, and it is a leading company in the currency mixing service industry. The US government’s sanctions against Tornado Cash are more like a campaign against privacy and anonymity in the blockchain industry declaration of war. At the same time, the sanction of Tornado Cash also shows that the decentralized blockchain industry is still difficult to get rid of centralized supervision.

Hayden Adams, founder of Uniswap, tweeted his views on the Tornado Cash sanctions: "Privacy is crucial to a normal and safe society, and it is ridiculous and dangerous to focus only on privacy to facilitate illegal activities. Sanctioning companies to comply with the law is often not as effective as coming up with sound laws or policies."

In the future, we still don’t know how to solve people’s needs for privacy tools in the context of compliance in the decentralized blockchain, but the sanction of Tornado Cash is prompting more and more people to start thinking How to solve this problem is a challenge faced by the encryption track, and it is also an opportunity for the future.

secondary title

How will DeFi develop after Tornado is sanctioned?

The aftermath of the Tornado Cash sanctions has not yet dissipated. Strong regulatory intervention seems to be the sword of Damocles hanging over the head of every DeFi. How will DeFi develop in the future? No one has a clear direction. How to determine a suitable one for most The development path of DeFi has become an urgent matter for blockchain practitioners.

After the Tornado Cash sanction incident, someone launched a vote in the Ethereum community. What should OFAC do if it regulates Ethereum through verification nodes?

Option 1: Treat this review system as an attack on Ethereum, and burn the rights and interests of these nodes through broad consensus

Option Two: Tolerate Censorship

The vote gave two options, one is to resist the review, which regards the review as an attack on Ethereum. Many people have chosen this option. For example, Vitalik, the founder of Ethereum, expressed his position below that Ethereum will Seeing this kind of review as an attack on Ethereum, and punishing these verifiers to avoid the situation of Ethereum being "controlled", Vitalik also said that the encrypted world should be free and have private property rights, not by those who take The man with the "gun" decided to blow up other people's houses and steal other people's refrigerators.

Compared with large institutions and platforms that have the confidence to fight back in the face of strong government regulatory intervention, some small and medium-sized DeFi seem to have only the second option, otherwise they will suffer devastating sanctions like Tornado Cash.

Both of these two solutions seem to have their own limitations. The anti-trial route is only suitable for large institutions and platforms, and it is blindly opposed to government supervision. Even the best result can only be a lose-lose situation, and The current DeFi is unlikely to completely get rid of government supervision. Choosing the second tolerance policy review means accepting the rules formulated by the government. In the long run, it is difficult to ensure that with the continuous invasion of policies, whether the essence of DeFi decentralization is still there.

The future development of DeFi should have infinite possibilities, not just the current choice of one or the other. Choosing the first option does not necessarily mean standing on the opposite side of the government. Basically, there has been almost no supervision in the past few years of DeFi development. The lack of supervision has led to DeFi liquidity mismatches, high-leverage financial risks, and anonymous crimes. It has not been governed for a long time, and DeFi has become more and more not safe. It is in the interests of both inside and outside the industry to let DeFi move towards a benign distribution path and reduce financial risks. And on whether DeFi needs to formulate industry guidelines, everyone actually has a consensus. We might as well cooperate on the basis of consensus, let the government draw the red line, and then the public chain or industry leaders will formulate a DeFi industry standard on this basis. We call on everyone to abide by this principle. Only by solving the problems of DeFi itself and letting DeFi move towards a healthy development path is the most fundamental way to avoid the intervention of strong government regulation.

first level title

Summarize

Summarize

Let’s go back to Tornado Cash being sanctioned. Judging from the results, OFAC’s sanction against Tornado Cash was not very successful. First, Tornado Cash itself is a decentralized smart contract, and it has been linked to the chain. Even if the front end is blocked, the chain The second is that Tornado Cash has a wide range of privacy demand markets behind it. If a Tornado Cash is banned, there will be more projects similar to Tornado Cash in the future. Banning cannot solve the root of the problem, leaving the blockchain industry With the support of the government, the government wants to combat blockchain crime and money laundering, but it can only treat the symptoms but not the root cause. In the future, cooperation between the government and the blockchain industry is the best way out for DeFi.