Bankless Report: The Best Investment Strategies for the Ethereum Merger Process

This article comes from BanklessThis article comes from

, Original author: Ryan Sean Adams, compiled by Odaily translator Katie Koo.The merger would cause ethereum to undergo a massive structural shift, as fees would effectively drop to zero.

This shift will give rise to the first massive structural demand asset in cryptocurrency history. This article highlights the favorable aspects of Ethereum’s core model, and some key fundamentals such as supply reduction and combined collateralization ratios.

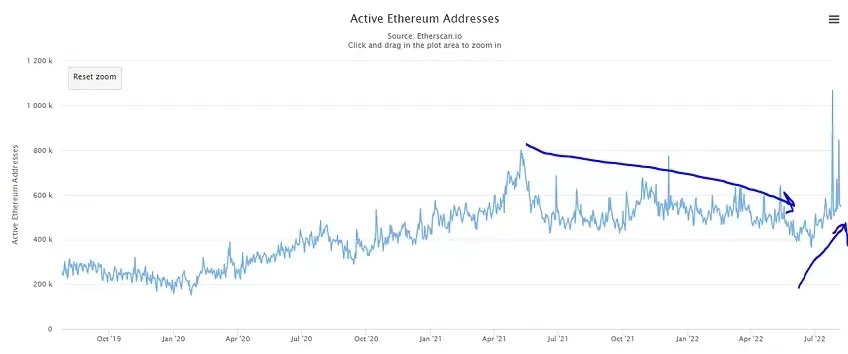

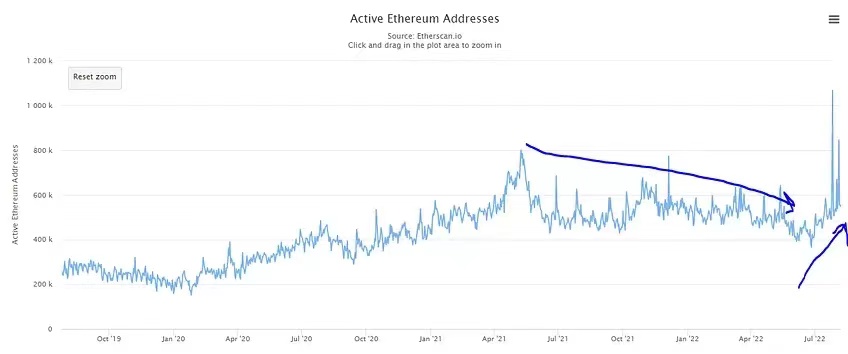

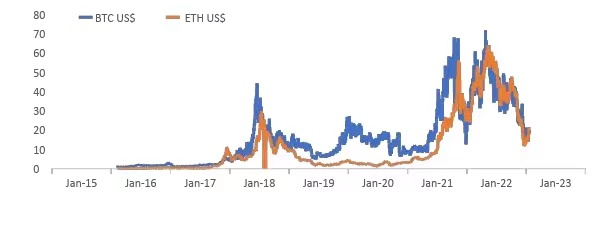

The biggest change since December is the massive drop in ETH-denominated fees. However, while fees have declined, active users have been on a steady upward trend since late June.This might seem inconsistent since more users should result in higher gas fees. However, we believe that this dynamic is driven byEfficiency optimization of various popular Ethereum applications recently

caused. For example, Opensea, which increased the gas efficiency by 35% when migrating the Seaport protocol. This resulted in a reduction in gas, but was not related to a drop in on-chain activity.

In fact multiple indicators show that despite the low gas readings, on-chain activity has been increasing recently. This leads to an interesting question: what is the optimal operating fee rate for Ethereum? Higher fees mean more ETH is burned and when combined are also associated with higher collateralization ratios, but these higher fees also limit Ethereum adoption.

As we've seen in 2021, when fees become too high, some users will migrate to other L1 ecosystems. When properly scaled, Ethereum should be able to achieve high fees and continued adoption. It's interesting to think about the optimal portfolio in the current environment. We believe that the biggest advantage should be that the fees are high enough to burn all newly issued tokens. This will stabilize the ETH supply while keeping fees low enough not to inhibit adoption. Interestingly, recently, fees have found a balance. The lower fees also appear to be having a positive impact on the game's adoption, with active users starting to increase after a long-term downward trend.

Although we appear to be close to the optimal fee run rate, the reduced fee does have a negative impact on the output of various models. But this effect is not important, because at the current operating rate, the burn is still large enough that ETH will be slightly deflationary after the merger. Importantly, the current run rate will continue to drive structural demand, as the majority of issued tokens are unlikely to be dumped and used fees must be purchased on the open market.

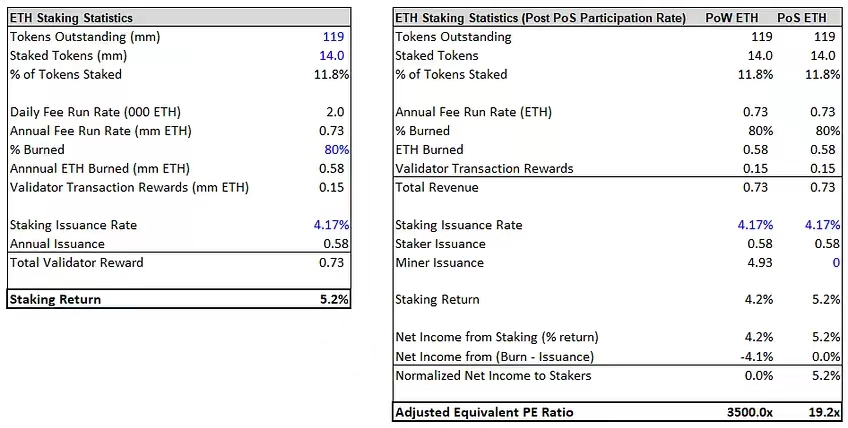

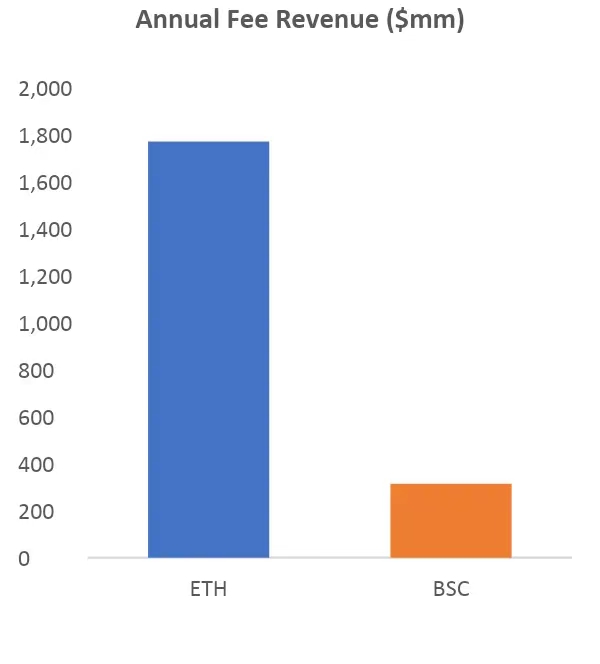

The combined stake ratio will increase by about 100 basis points, from 4.2% to 5.2%. However, this does not properly account for the real impact. To fully appreciate this shift, we must assess real, not nominal, rates of return. While the current nominal yield is around 4.2%, the real yield is close to zero, as 4.4% of new ETH is issued each year. In this case, the effective yield is currently about 0%, but would increase to about 5% post-merger. This is a massive shift that will go a long way toward creating some of the highest real yields in cryptocurrencies. The only other comparable yield is BNB with a real yield of 1%. A 5% yield on ETH would be market leading. What is the significance of this rate of return?

Stakers will earn a net 5% interest rate, which equates to 100/5 = about 20 times the return. This multiple is much lower than the earnings multiple because the staking participation rate is low, meaning stakers receive a disproportionate share of the total rewards. This is one of the key advantages of ETH from an investment perspective.

There are many other uses for ETH throughout the crypto ecosystem, and most ETH ends up locked in these applications rather than being staked. This, in turn, allowed investors to earn super-high real yields.

In terms of liquidity, ETH will transition from a sustained structural outflow of about $18 million/day to a structured inflow of about $300,000/day. Our estimate of ETH-denominated supply reduction is actually larger than before. This is due to the price drop from the highs not being accompanied by a corresponding drop in hash rate. As a result, the profitability of miners has dropped significantly, and they may be selling close to 100% of their ETH.

For the sake of calculation, I assume that 80% of the tokens issued by miners have been sold. In this case, ETH has found an equilibrium, with miners selling about 108,000 ETH ($18 million) per day. Considering that the average fee is about US$2 million, this would result in a net outflow of US$16 million. After the merger, this selling pressure will drop to zero, and it is expected that there will be a structural inflow of about 300,000 USD/day after the merger.

In summary, while many of the numbers have changed significantly over the last 8 months, the conclusion remains largely the same, ETH will go from needing $18 million of new money coming into the asset to keep the price from falling, to needing $300,000 of it Exit to prevent price increases.

To sum up, the pledge rate and structural demand have decreased compared to 6 months ago. However, this is to be expected in a period of slowing economic activity, and these rates will rise if economic activity continues to rebound. The main investment rationale remains the same, there is a huge opportunity to get ahead of the biggest structural shift in cryptocurrency history.

Finally, there are two more factors worth discussing.

secondary title

1. Yield and the power of time

Before addressing the merger's relationship to ETH, some background groundwork must first be laid.

Why has the S&P 500 (SPX) or pretty much any US/global stock index been a long-term profitable and stable investment vehicle? Most agree that this trend is driven almost entirely by earnings growth and P/E expansion. They will assume that if economic growth slows, or if multiples stop expanding, these investments are unlikely to earn positive returns in the future. This is not correct.

The main and most reliable source of price growth for these indices is time.

There is an example to illustrate this point. Lemonade Stand = Business, Lemon Token = Lemon Shares, Earn $1 a Year. There are 10 shares of lemon stock outstanding. The lemonade stand has no cash or debt on its balance sheet. The market is currently valuing $1 growth stocks at 10x earnings. How much is a lemonade stand worth now? What about lemons per share?

If we assume the lemonade stand will continue to make $1 per year next year, and the market is the same multiple, what is the lemonade stand/lemon token worth a year from now? Take a minute to think about the answer.

If you answered $10/$1 on the first pair of questions, you got it right. If you answer the second group as $10/$1, you are wrong. In the first part, the lemonade stand is worth $10 because the market values its $1 earnings at 10 times, and its value on the balance sheet is 0. The second part, the market is still trading at 10 times earnings on $1, but importantly, it also allocates $1 to the $1 of cash on the lemonade stand's balance sheet. The lemonade stand is now worth $11, and each share is worth $1.10. When a company makes money, the money doesn't disappear, it flows into the company's balance sheet, and its value flows to the owners of the business (equity holders). Despite zero growth and zero multiple expansion, Lemon tokens appreciated 10% in a year thanks to the yield they generated.

This is the power of yield and time.

Cryptocurrencies have not benefited from this dynamic at all. In fact, cryptocurrencies have actually been affected in the opposite direction. Since nearly all crypto projects spend more than they earn, they must dilute their holders to generate the funds necessary to cover their negative net income. Therefore, unless earnings grow or its multiples expand, the price per token will drop. The most notable exception I can think of is BNB, which is currently the only L1 whose revenue is greater than its expenses.

It's no surprise that the BNB/BTC chart is inherently ascending, having recently broken its high (ATH).

It will also change the psychology of holders, incentivizing them to adopt a stronger long-term buy-and-hold strategy, effectively locking in more illiquid supply. Additionally, the "real yield" theory and the fact that ETH will be the first mass real yield crypto asset will be of particular interest to many institutions and should help accelerate institutional adoption.

secondary title

2. Merger Panic

Over the past few months, investors have been extremely skeptical of technical risks, edge cases and timing risks.

A fringe case that has recently attracted attention is the possibility that Ethereum’s PoW fork may survive the merger. Some PoW maximalists (miners, etc.) prefer to use PoW ETH, and believe that the current forked version of ETH is superior to ETC, which already exists as a PoW replacement. We don't think there's much value in forking, but our views on the issue aren't particularly relevant.

The important point is that this fork will not have an impact on the merged PoS ETH. All potential risks are either easily managed or not risks at all. For example, Replay Attacks (Replay Attacks) will most likely not be a problem, since PoW chains are unlikely to use the same chain ID. Furthermore, even if they maliciously choose to use the same chain ID, it can be managed by not interacting with the PoW chain or sending assets to the split contract first.

Finally, even if a user suffers a replay attack, it will only affect that user's personal assets and not the health of the entire chain. What PoW forks do is provide dividends to ETH holders, further increasing the value of the merger. If the fork has any value, ETH holders will be able to send it to exchanges and sell it for additional capital, most of which will be recycled back into PoS ETH. While we think this is good for the merger-related investment case, many are concerned about potential risks and a host of other fringe cases. We weighed each risk and concluded that the benefits far outweigh the risks.

Still, these concerns have sidelined many long-time Ethereum believers.

Many of these issues will be resolved as we get closer to the merger. Eventually, many Ethereum skeptics will "come around," creating momentum for continued inflows as the merger looms, and eventually a large number of buyers will buy ETH on the day the merger succeeds. This should help offset any "sell-off" dynamics.

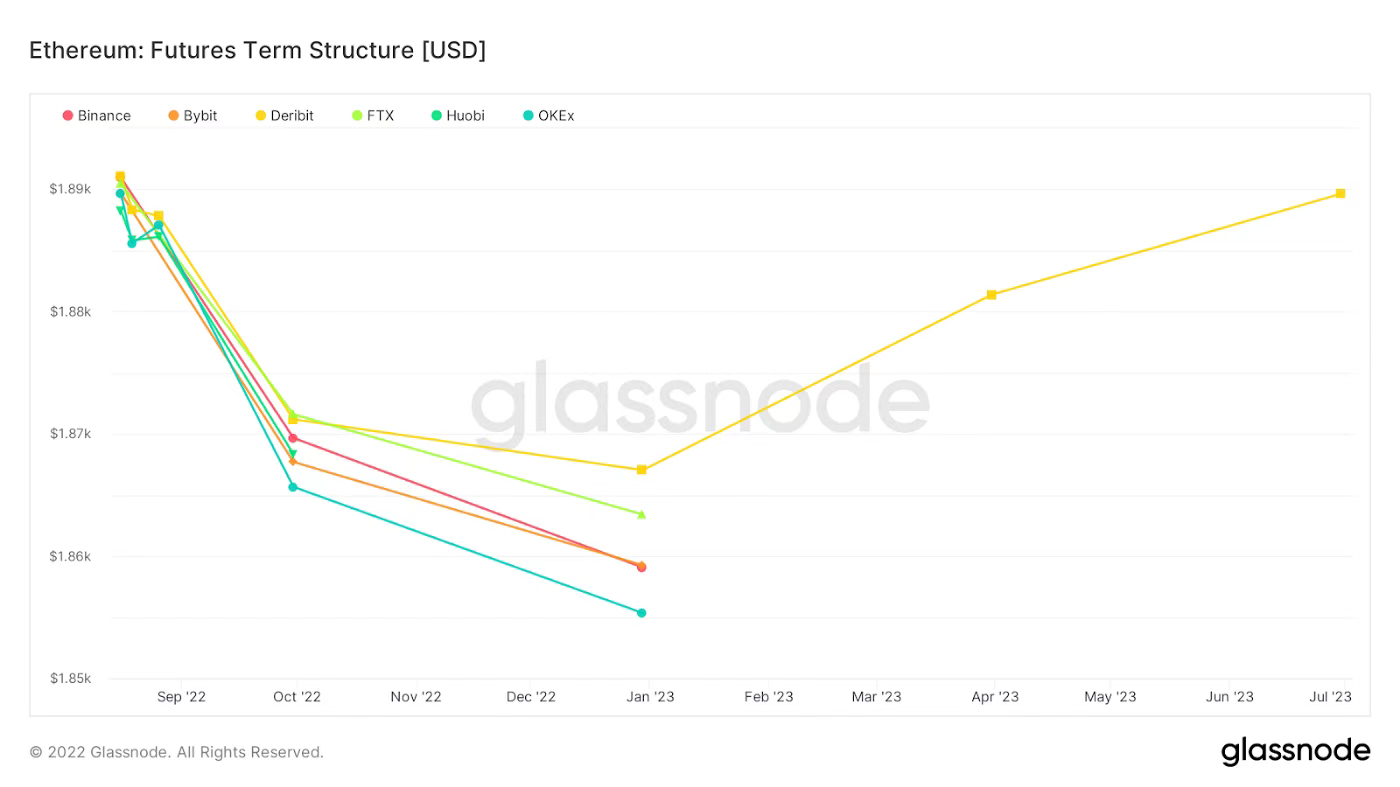

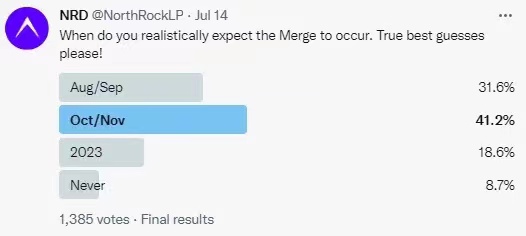

Just last month, less than a third thought a merger would happen before October. Now, that date has been confirmed as mid-September, but the market still sees only a two-thirds chance of it happening by October.

First, we acknowledge that despite consolidation, macroeconomics will still have a significant impact on absolute price levels. However, it is also important to consider how the merger-related alpha will develop in the coming weeks. It is always difficult to take the first step, but it is natural to pass to the bridge.

secondary title

short term trader

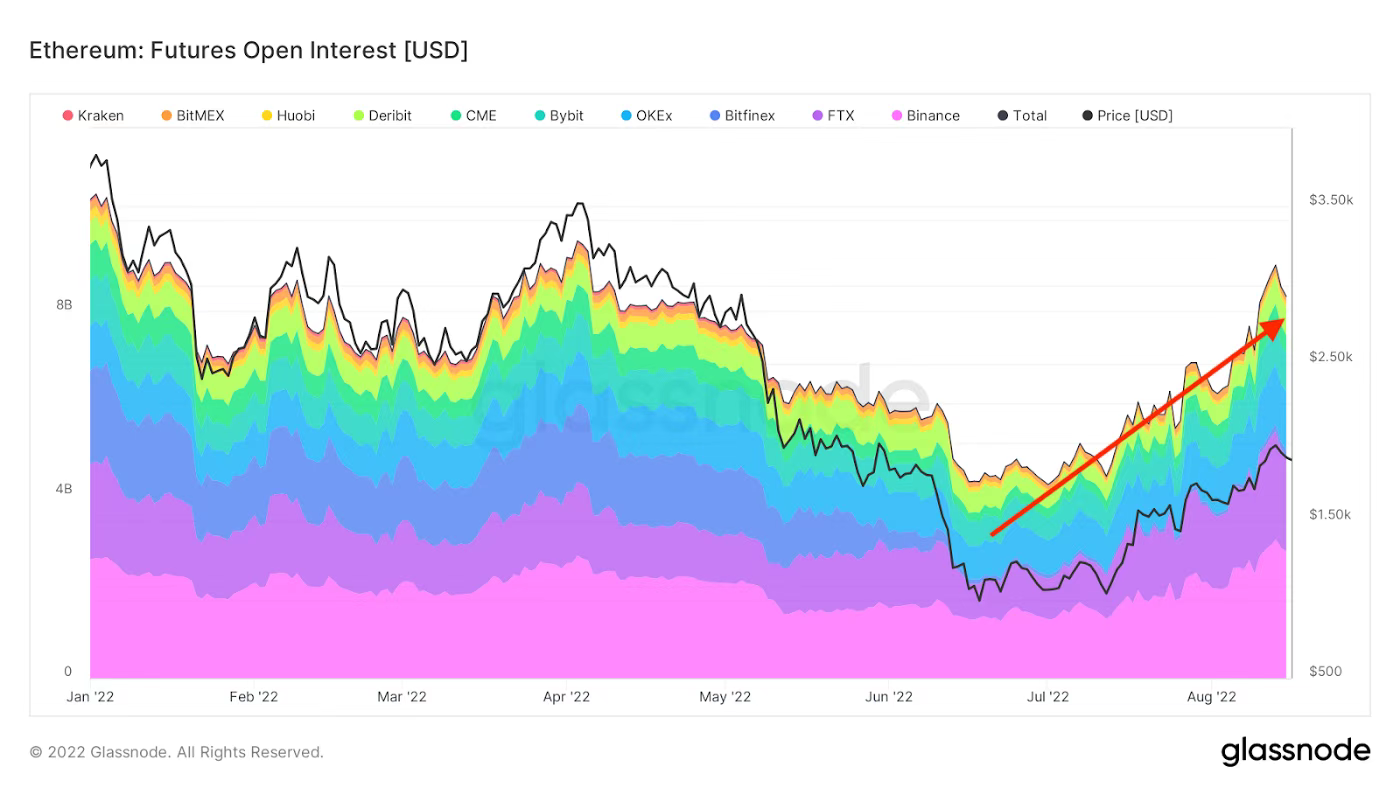

While the narrative has built up around the merger, positioning remains fairly loose among the more casual segments of the market. Perpetual funding has been negative for most of the rally since June, suggesting more bears than bulls in the perpetual market.

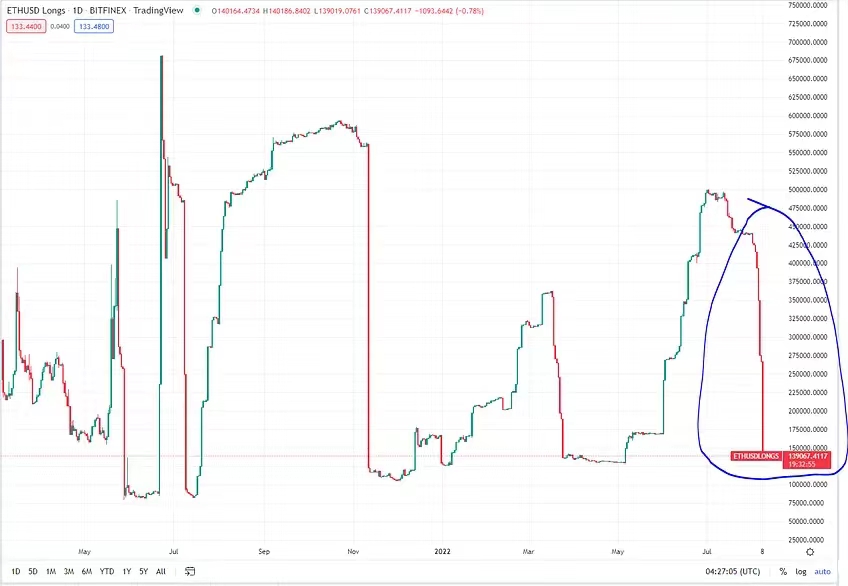

Recently, another notable discretionary ETH exposure long position on Bitfinex was reduced to lows.

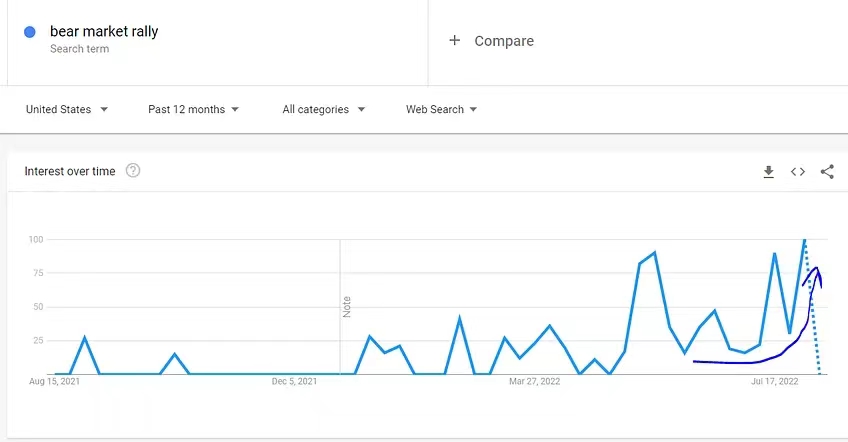

It seems to me that this lower positioning is likely due to the fact that many of the larger players see this as a "bear market rally" and therefore want to hedge as we continue higher.

Historically, there has been a large group of investors leaning in the direction of BTC maximization and always looking to downplay the merger narrative. Their arguments revolve around one of two central points.

The first is: "6 years and 6 months into the merger." The second is about technical/execution risk. Earlier this week, core developers set a goal for a mainnet merger on September 15-16 after the final testnet Goerli was successfully merged. The rest is coordination.

While many were concerned about execution risk, the upgrade had been extremely rigorously "stress tested" over many years and cross-checked by many teams. Furthermore, one of the core pillars of Ethereum is resilience. That's why there are so many different clients - like a secure network against a single corner case or bug. Multiple (usually more than two) unrelated fluke events need to happen simultaneously to affect the protocol.

With this built-in resilience, the most accomplished development team in the space, and years of preparation, technical issues (though risky) are less likely to arise.

I expect the next four weeks to follow similar market conditions to the previous four weeks, given investors' cautious positioning and continued desire to "fade" trades. There are periods of palpable fear when people overanalyze extreme situations. However, I don't expect the price declines to be significant during these periods, as there are many underexposed institutions looking to increase exposure in any weakness. Additionally, almost everyone who sold ETH in the next few weeks was doing so only strategically, with the plan to buy it back at some point before or after the merger occurred.

This dynamic implies measuring net outflows. On the other hand, I hope that the hype surrounding the merger will be amplified as the merger date gets closer and the mainstream media reports it. I believe this paper is very convincing for both institutional and retail capital, and I expect inflows to accelerate as the merger nears, creating higher highs and higher lows.

We expect a lot of buying and follow through after the merger, as the merger effectively "de-risks".

secondary title

mid-term trader

We expect a period of range-bound trading by short-term traders selling, with this sell-off flow being absorbed by structural demand and larger, less liquid institutional accounts. Price action during this period is less predictable and depends on the macro environment. As I said before, the macro is unpredictable.

The macro environment for cryptocurrencies is driven by one core metric: whether adoption is growing, stabilizing, or declining. This metric is influenced to some extent by the broader macro environment, but ultimately what matters most is the adoption metric. The reason this metric affects prices is that adoption in the space also drives long-term inflows or outflows of money. Simply put, when users adopt cryptocurrencies, they often also put new money into the crypto ecosystem, which is what drives the macro. Macro is hostile when adoption is declining, macro is neutral when adoption is flat, and macro is adaptive when adoption is growing. So, what is the macroeconomic situation today?

For the better part of the past 8-9 months, we've been in a declining adoption environment with a net exodus of users leaving the ecosystem.

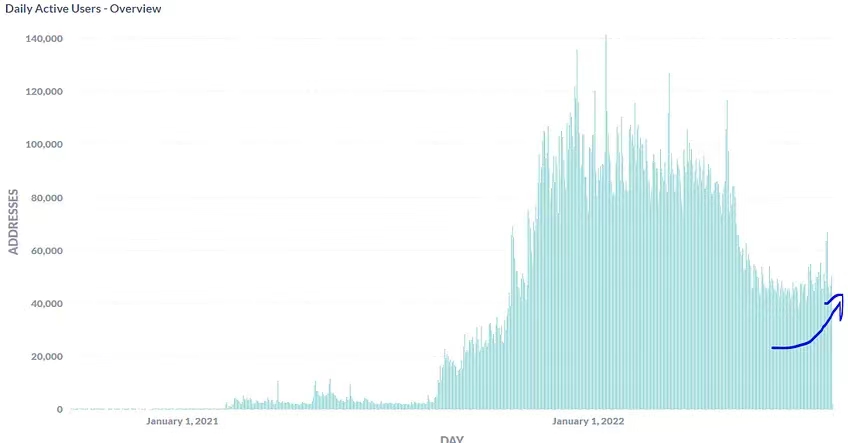

Daily active users showed a downward trend from May 21 to the end of June. Over the past 6 weeks, we have seen a nascent resurgence with a steady increase in user numbers. These are the green shoots of an economic recovery, suggesting a possible thaw in the macro environment. We were in a phase of declining adoption, and now, we're at least in a phase of steady adoption, and probably a phase of increasing adoption. A number of other "buds" have emerged recently.

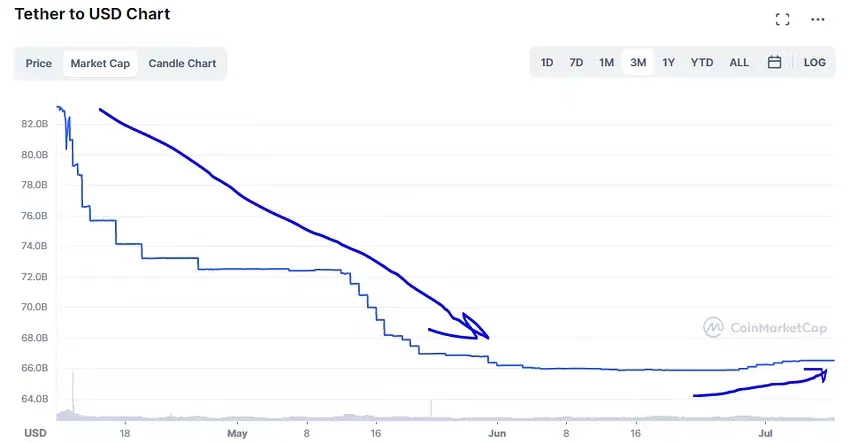

After weeks of redemptions, Tether began slowly minting new tokens. After a long period of money outflows, new money is starting to come in again.

This effect is not unique to the Ethereum ecosystem, AVAX has also recently seen an increase in daily active users.

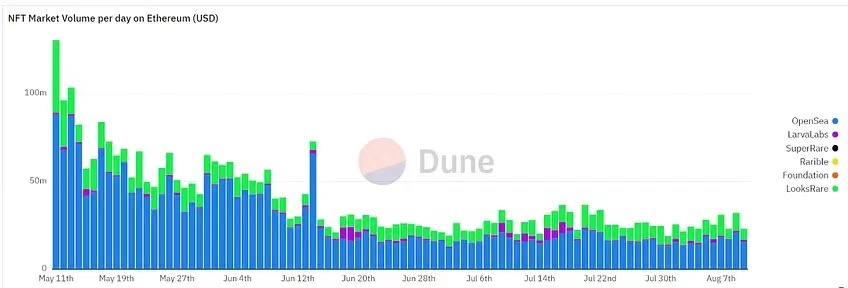

NFT users and transactions have been stable recently.

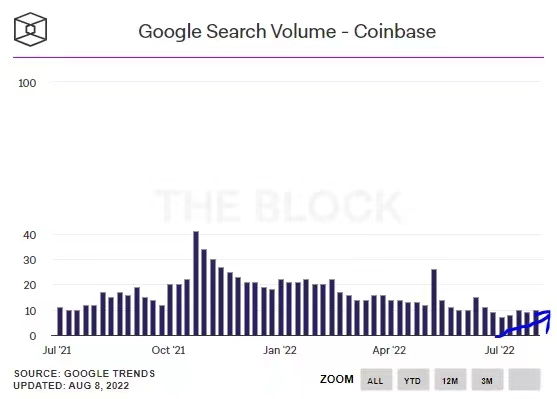

Search results for cryptocurrencies on certain networks are already starting to turn positive.

This is not a dramatic increase, unlike the exponential growth we saw at the beginning of the bull market in 2021. That's why I call them "buds". Because they are still young and fragile. Easy to perish at any time, but can become influential if cultivated carefully.

We believe the broader macro environment will play a key role in determining whether these "buds" live or die. For us, inflation is the most important macroeconomic variable. So there is a good chance that these "buds" will grow stronger if inflation slows and the Fed is allowed to adjust and ease monetary policy. However, if inflation remains high and the Fed is forced to continue to tighten policy, they will likely "suffocate". After assessment, we believe that moderating inflation is the most likely outcome, which should give these "buds" a chance to blossom.

Another advantage in favor of a more durable bottom is that a significant amount of investment in project launches over the past 24 months has now been absorbed. In addition, all future vested dollar notional amounts outstanding have also been significantly reduced as most projects are down 70-95%. These two dynamics combine to help meaningfully reduce the total daily supply that the crypto space has to absorb.

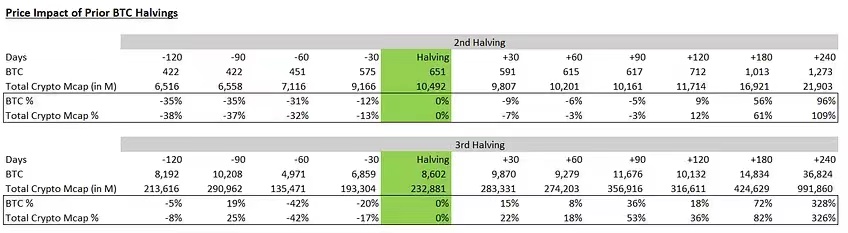

Finally, we think the last variable that affects this equation is merging. Investors are underestimating the impact of the merger on the macro environment across the space. There is some uncertainty as to the extent to which supply reductions resulting from previous Bitcoin halvings drove subsequent price action rather than coincidentally matching the natural cycles of human sentiment and monetary policy. We sympathize with these uncertainties and believe there is an element of luck in the timing. However, we believe that reduced supply also has an effect, and the truth may be somewhere in between. Another common criticism is that changes in supply do not drive prices, it is changes in demand that matter. We disagree with this thinking. A decrease in supply is no different from an increase in demand.

Let's assume miners sell 10k ETH per day, instead of getting rid of this selling pressure, we just add 10k ETH/day of buying pressure. This would have the exact same effect as removing miner selling pressure, but would be a change in demand, not supply. Clearly, both options have the same impact, so we don't see why one is more important than the other.

If we believe that the Bitcoin halving has affected the macro of cryptocurrencies, the merger will also affect the macro situation. While Ethereum’s dominance was significantly lower than BTC’s at the last halving, the impact of the consolidation was almost as large as the previous BTC halving’s impact on the total cryptocurrency market capitalization, as a percentage of total market capitalization, and significantly larger on an absolute basis.

The combined cryptocurrency will reduce the daily supply by approximately $16 million. This is not an insignificant number. To realize this, cumulative effects need to be considered.

Then there's a good chance that what started as a capititive bottom bounce will evolve into a more sustainable and organic recovery, and the consolidation should help that process.

secondary title

long term traderIn the long run, the future becomes easier to predict because structural flows are most important and easier to predict in this time frame. This is where the impact of the merger is most pronounced. We believe that as long as Ethereum continues to adopt the network, structural demand will continue to exist, as will further capital inflows. This should lead to sustainable and sustained appreciation for many years to come, especially compared to other coins.

BNB/BTC has steadily grown in this bear market and created multiple new paths, despite the lack of narrative momentum. We think this is mainly because BNB is the only L1 with structural needs. The combined Ethereum will have greater structural demand than BNB on both an absolute and market cap weighted basis.

Investment Strategies for Winning Mergers

1. ETH/BTC

secondary titleWe believe PoS is fundamentally a more secure system. First, PoS has a lower cost per unit of security.

To understand why PoS provides more effective security than PoW, we first need to explore how these consensus mechanisms generate security. The security of the consensus mechanism is equivalent to the cost of 51% attacking it. The efficiency of the system can then be measured by the cost required to generate a unit amount of security (token issuance).

In other words, how many dollars would a network have to pay to be protected from a 51% attack for $1. For PoW, the cost of a 51% attack is mainly the hardware required to obtain 51% of the hash rate. A related metric is how much it takes a miner to invest $1 in mining hardware. The calculation tends to be close to 1 to 1, meaning that miners need a 100% annual return on their investment, or in other words, for every $1 they spend on hardware and utility, they need to issue $1 in tokens per year. In this case, the network would need to issue approximately $1 of supply per year to generate $1 of security.

In the case of PoS, stakeholders do not need to buy hardware, so the question becomes what reward do stakeholders need to lock up their stake in the PoS consensus mechanism?

Generally speaking, the rate of return required by stakers is much lower than the 100% rate of return usually required by miners.

The main reason is that there is no added cost, and their assets do not depreciate (mining hardware usually depreciates close to 0 after a few years). The required interest rate should generally be in the range of 3-10%. As we calculated earlier, the current estimated combined ownership of 5% falls right in the middle of that range. This means that to obtain a $1 security, PoS needs to issue $0.03-$0.10 tokens. This is 10-33x more efficient than PoW (and 20x more efficient in Ethereum's PoS).

Taken together, this means that a PoS network can issue about 1/20 of a PoW network and be just as secure. Taking Ethereum as an example, they will actually issue about one-tenth of the supply, and the network will be twice as secure as it was during PoW.

This efficiency is not the only advantage. Both of these consensus mechanisms have a common problem, which is that the security of the chain is related to the price of the token. This has the potential to create a self-reinforcing negative feedback loop, where a decrease in token price leads to a decrease in security, which leads to a decrease in confidence, which drives a further decrease in token price, and then repeats. PoS has natural defenses against this dynamic, PoW does not. The attack vector of PoS is much more secure than that of PoW.

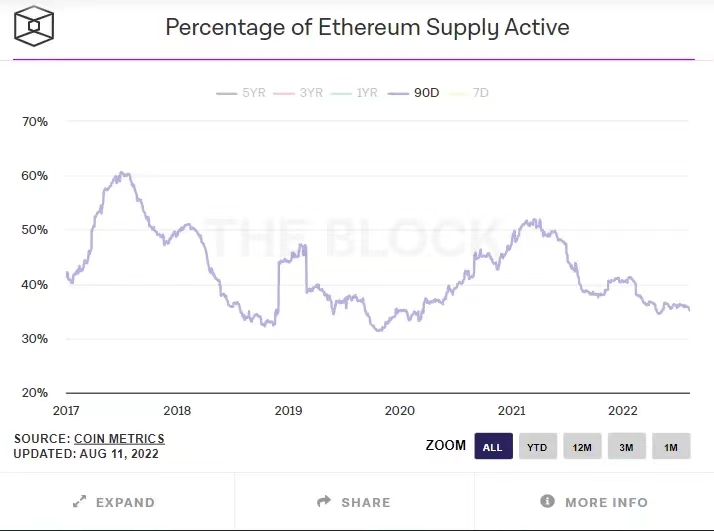

First, to attack a PoS system, you must control a majority of the stake. To do this, at least the same amount of tokens as are held in the market must be purchased. However, not all tokens are available for sale. In fact, most of the supply has never been traded and is effectively illiquid. Also, on top of that, with every token earned, the next token gets harder and more expensive.

In the case of Ethereum, only about 1/3 of the tokens are liquid (moved in the last 90 days). This means that once a steady state collateralization rate of close to 30% is reached, it will be very difficult to attack the network no matter how much money one has. An attacker would need to purchase the entire liquidity supply, which is impractical and nearly impossible.

Another important feature of this defense mechanism is that it is relatively independent of price. Because the limiting factor for attacks is the liquidity supply, not the currency, it is not easy to attack the network at a lower price. If there isn't enough liquidity supply (measured as a percentage of total tokens) to buy it, it doesn't matter how cheap each token becomes because the limiting factor is not price. This price-insensitive defense mechanism is important to stop the potential negative feedback loop that a price drop could create.

In the case of PoW, there is no such defense mechanism except that it is 20 times less efficient. Each hardware unit may be more difficult to obtain than the next, but there is no direct relationship between them, and if there is a correlation, the correlation is weak. Importantly, it becomes easier to attack at lower prices as the number of hardware units required decreases linearly with price and the supply of hardware units does not change.

It is not as "reflexive" as PoS liquidity supply defense.

Other advantages of PoS like better energy efficiency and better recovery mechanisms / Another misconception about PoS is that it drives centralization by rewarding large stakers instead of small stakers. We don't think this is correct.

While large stakers receive more staking rewards than small stakers, this does not drive centralization. Centralization is the process by which large stakeholders increase their stake percentage over time.

This is not the case in PoS systems. Since large stakers have more stakes to begin with, larger rewards do not increase their proportion in the pool. For example, if there are 10 ETH between two counterparties, counterparty X has 9 ETH and counterparty Z has 1 ETH. Company X controls 90% of the stake. After one year, X will receive 0.45 ETH and Z will receive 0.05 ETH. X gets 9 times as much reward as Z, but X still controls 90% of the stake and Z still controls 10% of the stake. The proportions have not changed, so no "centralization" has occurred.

Most people think ETH and BTC are completely different assets because they think ETH is a decentralized SoV (replacing gold) and BTC is like gold. We believe Ethereum is a better long-term SoV than Bitcoin in a number of important ways. Before we compare the two, it is first necessary to assess Bitcoin's current security model, and how it will evolve over time.

As mentioned earlier, the security of the system comes from the cost of a 51% attack. As a PoW network, this cost is determined by the amount required to purchase enough hardware platforms and other equipment/electricity to control 51% of the hashing power.

This is roughly equivalent to the cost required to recreate the mining hashrate that currently exists on the network. In an efficient market, the total hash rate is a product of the issued value earned by miners. Bitcoin is as safe as its issue price. As mentioned earlier, this security is both inefficient and lacks the reflexive defense capabilities of PoS systems.

What would happen if Bitcoin's issuance was halved every four years? Assuming all other variables remain constant, the security of the system drops by 50%. Historically, this has not been a huge problem because the value of the issue (and therefore the security) is a function of two variables: the number of tokens issued and the value of each token.

This makes up for the reduction in issuance on an absolute basis, as the price of the token more than doubles every half-cycle. The absolute security of the network increases with each cycle despite the halving of the number of tokens issued. However, this is not a sustainable dynamic long-term for a number of reasons. First, it is unrealistic to expect the value of each token to continue to more than double each cycle. Mathematically speaking, exponential price increases cannot be sustained in the long run.

To put this into perspective, if Bitcoin's price doubles every time, then after about 7 more cycles, Bitcoin's price will exceed global M2. Eventually, the BTC price will stop rising at this rate. When it does, each halving significantly reduces its security.

If the price of Bitcoin falls around the halving cycle, the decrease in security will be even more significant and could trigger the negative feedback loop mentioned earlier. This security system is fundamentally unsustainable as long as prices are capped. The only way to solve this problem is to generate meaningful fee income.

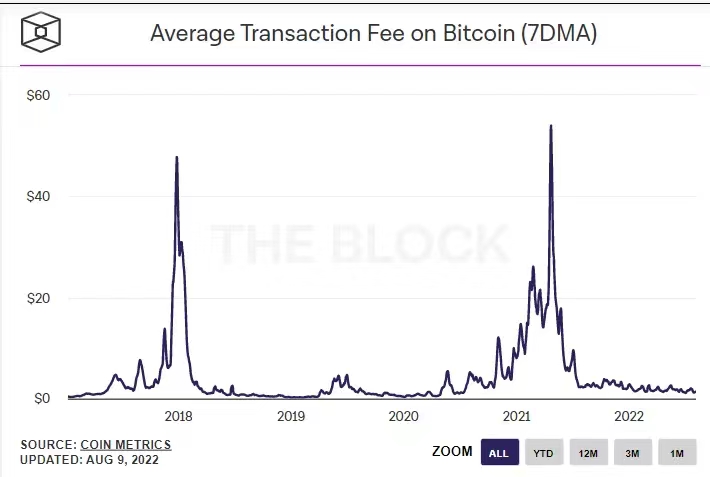

This fee income can replace part of the issuance and continue to provide incentives for miners, thus providing security even after issuance decreases. The problem with Bitcoin is that fee income has been negligible and has been declining for a long time.

In our opinion, the only viable way to gain long-term security is through substantial fee income. Therefore, to be a sustainable SoV (alternative to gold), a system must generate fees. The other option is emissions, which would certainly cause inflation to hurt the utility of the SoV.

Long-term security is the most important characteristic of SoV. For example, as long as almost all market participants believe that gold will remain legal for a long time to come, then gold accounts for the majority of the SoV market.

For an encrypted asset to be a successful SoV, it must also convince the market that it is extremely safe and its legitimacy is guaranteed. This is only possible if the protocol's security budget is sustainable in the long run, which in essence favors PoS systems with a large and persistent pool of fees. We think the most likely candidate for this system is ETH. It is one of only two L1s with a sizable fee pool. Another BNB is extremely centralized.

Reliable neutrality is the second critical characteristic of a successful SoV. Gold is not loyal or dependent on anything. This independence has contributed to its success as an SoV. For another asset to gain widespread adoption as a SoV, it must also be credibly neutral. For cryptocurrencies, trusted neutrality is achieved through decentralization. Today, the most decentralized cryptocurrency is undoubtedly Bitcoin. This is mainly because Bitcoin has very little development work and the protocol is mostly rigid, but despite this, it is by far the most decentralized protocol. If you want to wipe out Bitcoin today, it will be extremely difficult. If you tried to kill ETH today, it would still be very difficult, but probably easier than BTC.

However, Ethereum has a clear roadmap. We believe that while we are currently only in the middle of this roadmap, eventually (8-12 years I estimate) this roadmap will be complete and the core development team will become less important.

At this point, ETH will be more decentralized than BTC, in addition to having far superior long-term security.

Contrary to popular belief, PoS naturally promotes decentralization more than PoW. Larger PoW miners gain clear benefits from economies of scale, which drives centralization. For PoS, scale is much less relevant, as the cost of setting up nodes is much lower than for PoW devices, and since PoS requires more than 99% less electricity than PoW devices, there is no real benefit to large-scale electricity. Economies of scale are an important factor in PoW, but not PoS.

There are currently 400,000 unique ETH validators, and the top 5 holders only control 2.33% of the stake (excluding smart contract deposits). This level of decentralization and diversity separates ETH from all other PoS L1. Also, the top 5 mining pools control 70% of the hash rate today compared to BTC.

While some critics will point out that liquidity staking providers control the vast majority of staking on Ethereum, we believe these concerns are overblown. In addition, we hope that these issues will be resolved through the liquidity staking protocol, and that additional checks will be introduced to further guard against these issues.

In summary, PoS is fundamentally a better consensus mechanism for crypto SoV. That's why the merger will represent a major milestone on Ethereum's roadmap, marking a key node in its journey to becoming the most attractive crypto SoV.

The underlying reason discussed above is why we have long supported ETH/BTC trading, especially before and after the merger. However, liquidity, especially structural liquidity, will be the most important factor in determining prices. It's the tectonic shift in deal flow triggered by mergers that makes such deals so appealing, and why mergers are such a big catalyst. Historically, BTC and ETH have had very similar structural processes.

Although ETH has a smaller market cap, its issuance has grown roughly 3x on a market cap-weighted basis. This larger issuance makes it difficult for Ethereum to overtake Bitcoin in market capitalization, as it would require Ethereum to absorb 3x the daily dollar-denominated supply. There is clearly a strong relationship in the graph above. The values on the chart are the result of token issuance and token prices. What happens if you reduce the token issuance variable, but want to preserve that correlation? This causes you to have to increase the token price.

All in all, post-merger, the passage of time will always be a tailwind for Ethereum and a headwind for Bitcoin. We believe that this immediate reality will be the main driver of the eventual reversal.

secondary title

2. Pledge Derivatives

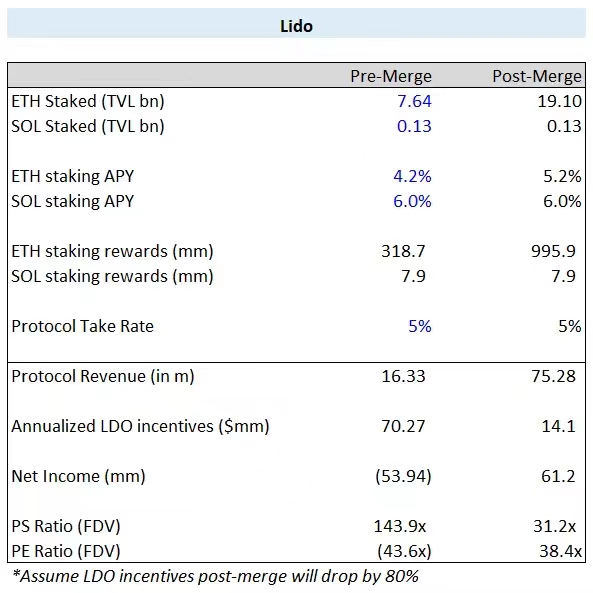

Since Ethereum is a large ecosystem, many other areas will be indirectly affected by the merger. As an investor, consider the second and third order effects of certain catalysts to look for opportunities that may not be effectively priced in the market. Regarding mergers, there are many options such as L2, DeFi and Liquid Staking Derivatives (LSD) protocols.After a comprehensive review of different alternatives, we have concluded that,

Liquidity staking protocols will be the biggest fundamental beneficiaries of this merger (even more than ETH).

The argument is simple. The income of the LSD protocol is directly affected by the price of ETH, as well as related to multiple mergers. Furthermore, shortly after the merger, their biggest expense, the cost of subsidizing their liquidity pool between holding derivative tokens and native ETH, dropped to effectively zero. At a high level, I expect 4-7x consolidation to drive growth in ETH protocol revenue (assuming only modest ETH price growth) and a 60-80% reduction in max payouts. This is a unique and powerful fundamental influence.

We have to look at the revenue and fee models of these agreements. Take Lido as an example, since it is the biggest one in the LSD protocol.

Note that these principles apply to other players as well, as they are often very similar. Lido earns its income as a percentage of staking rewards from its liquid staking derivative, stETH. Lido gets 5% of all generated staking rewards. If the user deposits 10 ETH in exchange for 10 stETH, and generates an additional 0.4 stETH within one year. Users keep 90% of 0.4, validators keep 5%, and Lido keeps the remaining 5%. It can be seen that Lido's income is purely a function of the staking returns generated by its LSD.

These staking rewards are a function of four independent variables: total ETH staked, ETH staked ratio, LSD market share, and ETH price.

Importantly, staking rewards are a product of all four variables. If more than one variable is affected, it will affect the output. In other words, if you double one and triple the other, the effect on staking returns is 600%. With the exception of market share, all variables are directly affected by the merger.

The total stake of ETH may increase significantly from the current 12% to close to 30%, which is a 150% increase. As mentioned earlier, the pledge rate may increase from 4% to 5%, which is a 25% increase. There is no reason to think that the merger will significantly affect LSD's market share, so we can assume this is constant and has no impact. Finally, let's assume that the price of ETH increases by 50%. The combined effect of these different variables is 250%*118%*150%= 444%, which is about a 4.4-fold increase in returns.

Spending has also fallen sharply. The biggest overhead of these LSD protocols is incentivizing the liquidity pool between LSD and native ETH. Given that no withdrawals have occurred yet, it is extremely important to create deep liquidity to manage large-scale flows between LSD and native ETH.

However, once withdrawals are available, these incentives are no longer required. If the two diverge significantly, then there will be arbitrage and natural market forces will keep them relatively linked as arbitrageurs buy LSD on dips. This will allow the LSD protocol to drastically reduce its issuance (fees), which will also greatly reduce sell pressure on the token.

In the pre-merger figure, LDO trades at about 144 times revenue, but in the combined figure, this drops to about 31 times. While that's not cheap by traditional measures, it's attractive for a high-growth strategic asset in the crypto space, where valuations are often high. Importantly, this is the actual revenue that the protocol will receive.

A common concern among LDO critics is that these revenues are not returned to holders. For this reason, they often compare the protocol to Uniswap.

While it's true that benefits are not being passed on to token holders at the moment, we don't think that's a valid concern, nor do we think the Uniswap comparison is correct - simply because token holders don't receive cash flow today and Doesn't mean they won't receive it in the future either.

We believe that one day these incomes will be returned to the holders. We also know that multiple large stakeholders agree on this issue. Also, we don't think Lido should be giving cash back at this point, Lido would actually be very concerned about management's ability to do so if they did. This is a very early stage business, still in its early growth stages. They need to raise cash on a regular basis and are currently burning cash on a run rate basis (this will change after the merger).

It is unwise to raise funds from investors to cover losses and then distribute protocol revenue to token holders, adding to losses. It’s akin to a startup paying out early earnings to investors even though revenue isn’t enough to cover expenses. This situation will never happen in the traditional capital market, because it is irrational.

Many cryptocurrency players are also concerned about Lido's dominant market share. They have 90% of the LSD market share, while stETH accounts for 31% of the total ETH staked. While we believe concerns around centralization are overblown, we still believe Lido should remain below 33% share to remove any doubts about Ethereum's credible neutrality. In terms of the agreement's investment case, we don't think the 33% market share cap is worrisome. In our view, Lido has many other growth vectors to pursue besides market share, and the investment is already quite compelling in terms of current share.

All in all, Lido is a key piece of infrastructure in the Ethereum ecosystem that has established product market fit and dominant market share, and will continue to grow incredibly fast in the market. Concerns about the agreement are either misplaced or untrue, in our view. Moreover, considering its past and projected future growth prospects, it is reasonably priced and thus one of the best assets to invest in this space.

While Lido is the market leader and the largest player, there are two other LSD protocols Rocketpool (RPL) and Stakewise (SWISE) that are also worth considering. Each LSD has many unique aspects, and intricate details that can be expanded upon. However, for ease of understanding, we will mainly focus on the main differences and further refine them in the discussion that follows.

Both RPL and the SWISE liquid staking protocol should benefit from any share ceded by Lido due to centralization concerns. While we think any loss in Lido shares will be modest, even a modest loss would equate to a huge gain for a smaller company.

For example, if LDO loses 4% market share, RPL will gain 2.5% of it and SWISE gains 1.5%, LDO will lose about 12% market share, but RPL will gain about 50% and SWISE will gain about 125%

Rocketpool (RPL), the second largest player in the market, has a unique staking mechanism and token economy. To stake via RPL, validators must pair RPL with native ETH and need to maintain a minimum ratio between the two. This dynamic creates predictable and guaranteed demand for RPL as ETH staking participation increases and more validators adopt the solution.

Another benefit of RPL is the practice that validators share with other users, allowing the ETH required to set up a staking node to be reduced from the normal 32 ETH to just 16 ETH. This lowers the minimum, allows smaller operators to build nodes, and further incentivizes decentralization. This makes RPL a perfect complement to LDO, which should be a catalyst for RPL's market share, as they will be the main beneficiaries of Lido's effective market share.

Finally, risk management is another interesting alternative to LDOs. Their model is very similar to LDO's, but their increasing focus on institutional adoption should position them well in the combined market. They also benefit from a highly driven and professional team that consistently executes well. Notably, they discussed plans for an eventual “tokenholder-friendly” token economy, where tokenholders would directly receive additional protocol revenue.

Additionally, SWISE has gained traction with larger clients looking to diversify their staking offerings (DeFi insurance project Nexus Mutual alone recently approved a proposal that would increase their TVL by 20-25%). Because they are the smallest players with the highest valuations, they are probably the highest risk/reward investment in the category.In short, it is difficult for us to distinguish the value within the team.

LDOs are the cheapest and safest, but have seen the smallest increase in market share. SWISE is the most expensive, but has the largest market share gains, while RPL is in between, with the advantages of a unique token economy and a decentralized staking mechanism. Relative valuations are reasonable, which shows us that the market is effectively pricing in different opportunities.