Fundamental Insights: An article to understand the cross-chain trading market

This article comes fromFundamental LabsThis article comes from

TL;DR

, original author: King Tuts and 0xPhillan, compiled by Odaily Maxlion.

secondary title

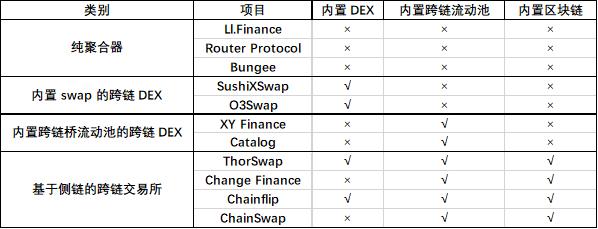

The pure aggregator project is designed to be very lightweight. They do not have their own swap and cross-chain bridges, which reduces risk. In addition, these protocols are not restricted by integrated switching and bridging, have maximum flexibility, can search for the best routing path for users, and can share all path information. However, these agreements are difficult to collect fees. Increasing fees means increasing transaction costs for users and potentially pushing users away.

Sidechain-based cross-chain DEX is also a good business model. Tokens can be endowed with multiple functions, such as gas fees for Layer 1 blockchains, MEV withdrawals, transaction fees, and bridge fees. The problem is that building layer 1 blockchains is much harder than building applications. The difficulty lies not only in the technology, but also in the development of the ecosystem, community and developers.

1. Background

first level title

1. Background

With the increasing number of public chains and aggregation layers in Web3, many applications are built on different isolated ecologies. Although some of these applications are deployed on multiple blockchains and aggregation layers, their liquidity is inevitably fragmented, causing inconvenience to users. In addition, it is cumbersome for users to transfer assets to different ecosystems through centralized exchanges or clumsy cross-chain bridges. To solve this problem, decentralized exchanges may have to embrace a shift to a cross-chain ecosystem. Since last year, many cross-chain exchanges have been launched one after another. Even SushiSwap and Ren Project have released their own cross-chain swap applications.

The cross-chain exchange application is a very complex product that integrates DEX, cross-chain bridge and routing into one application. In this post, we will take a closer look at various cross-chain DEX offerings.

Two, the project

Some cross-chain bridges only support the exchange between stablecoins. For example, Stargate Finance can help users transfer USDT on the Ethereum mainnet to USDC on Polygon. These types of cross-chain bridges are not the subject of this article. Instead, this article focuses on assets that enable users to seamlessly move them between different blockchains and tokens. According to whether the project party builds its own DEX, cross-chain bridge or blockchain, we divide the products into the following 4 categories:

secondary titleUniswap 、PancakeSwapA pure aggregator is a cross-chain DEX that does not have its own blockchain, bridging or exchange functionality. Unlike 1inch, this product not only aggregatesConnext 、HopandOr DEX such as SushiSwap, also aggregatedand

2.1.1 Li.Finance

Li.FinanceCross-chain liquidity pools such as ThorChain. It searches the best path for users through its routing algorithm, and executes the transaction by calling the protocol in the path.It is a cross-chain bridge and DEX aggregator. supply

“bridge&DEX” SDK and Widget

, to help developers build their own cross-chain applications based on Li.Fi. It also released its own cross-chain DEX: TransferTo.xyz. The product aggregates 10 bridges, 18 exchanges and 16 EVM chains or aggregations.

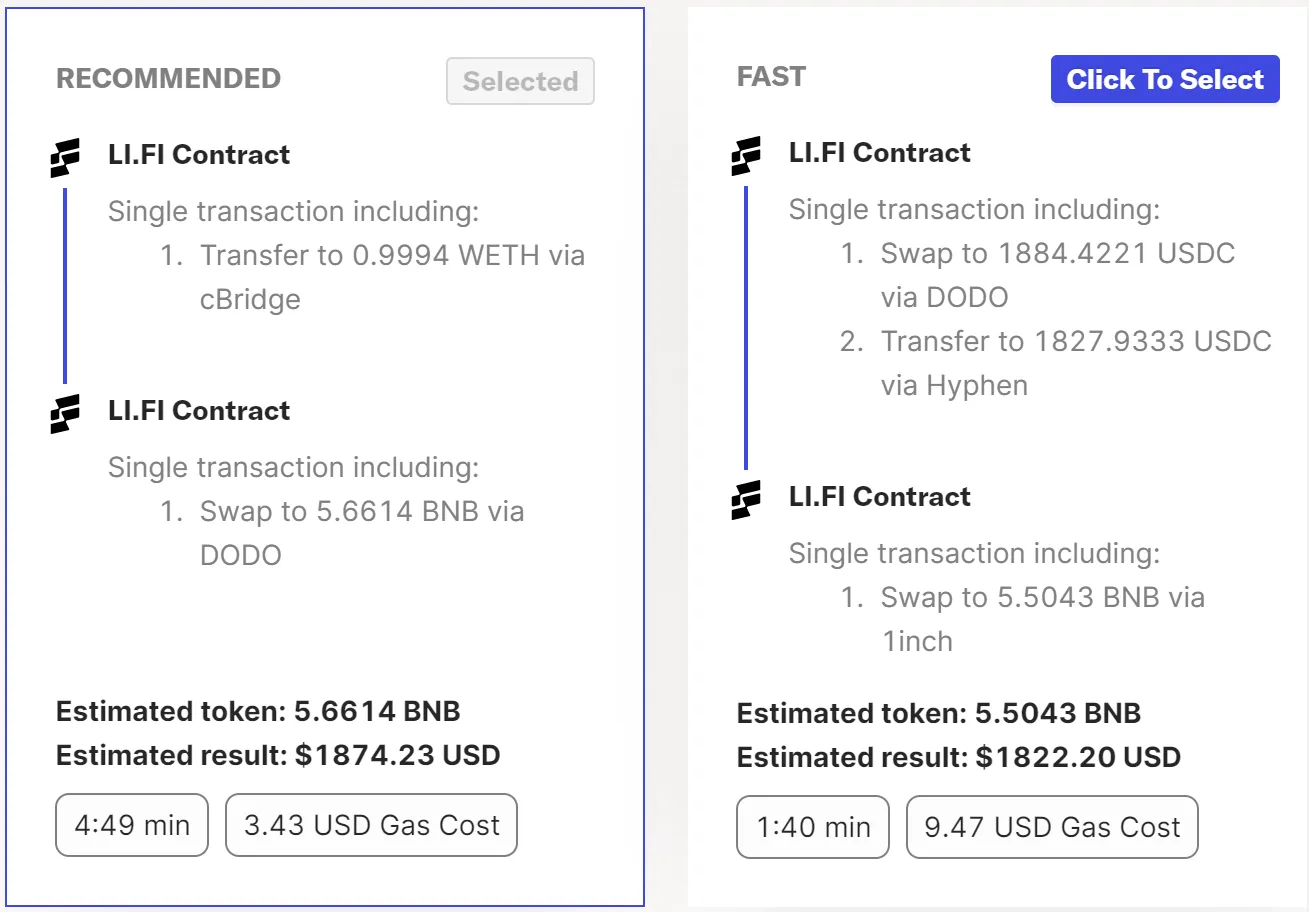

The transaction function enables users to exchange or aggregate any token from any blockchain to another. Details of all routing paths are displayed to the user, such as cross-chain bridges and exchange routes used, expected time and gas costs, and estimated outcomes. In addition, the protocol also provides a variety of path options for users to choose. More advanced users can even exclude protocols they deem risky.

2.1.2 Bungee

Bungee The dashboard clearly shows the user's portfolio across all EVM blockchains and rollups supported by Li.Fi. This feature comes in handy as sometimes users may forget about assets they hold across various blockchain networks.Launched late last year, Li.Fi was funded by Gitcoin and invested by Coinbase, Dragonfly Capital, 1k(x) and many other institutions. As of this writing, the tool is free to use and has achieved $250 million in transaction volume. Although the Li.Fi team published the token contract on Github, the tokens have not yet been issued.(formerly known as FundMovr), very similar to Li.Fi. Bungee by

Socket provides support

, an interoperability protocol for secure and efficient transfer of data and assets across chains. Socket is not a cross-chain bridge, nor is it a cross-chain application. It is an infrastructure tool that allows developers to easily build interoperable applications. Developers can use Socket to build interoperable applications as a core part of the application infrastructure. SocketLL and SocketDL are the main products of Socket.

SocketLL enables efficient asset transfer across chains. It unifies liquidity across bridges and DEXs and routes funds through them based on user preferences such as fees, speed, or security. SocketDL supports cross-chain data transmission. As of last month, SocketLL processed over 400,000 transactions and a transaction volume of over $400 million. Data transfer via SocketDL will be introduced later.

Bungee moves assets between chains by plugging into the Socket Liquidity Meta-Layer. It allows users to seamlessly exchange and transfer funds on any chain through its routes.

2.1.3 Router Protocol

Router ProtocolLike Li.Fi, Bungee gives users a variety of options and shows all the details. Bungee jumping is also free to use. The difference is that in Bungee, users cannot choose which bridge or DEX to use, they can only choose a routing path to execute. Additionally, Bungee allows users to receive assets on another address than the one where the exchange was initiated. Refuel is a handy tool that is also part of Bungee. When a user sets up a new address without any tokens to pay for gas, they can easily purchase the required tokens with assets they hold on other blockchains through Bungee.Li.FiSocket has received investments from Framework Capital, Nascent, and Lightspeed, among others. According to DappRader, Bungee processed only $5.65 million in transaction volume. As of this writing (8.16), neither Bungee nor Socket have released tokens.

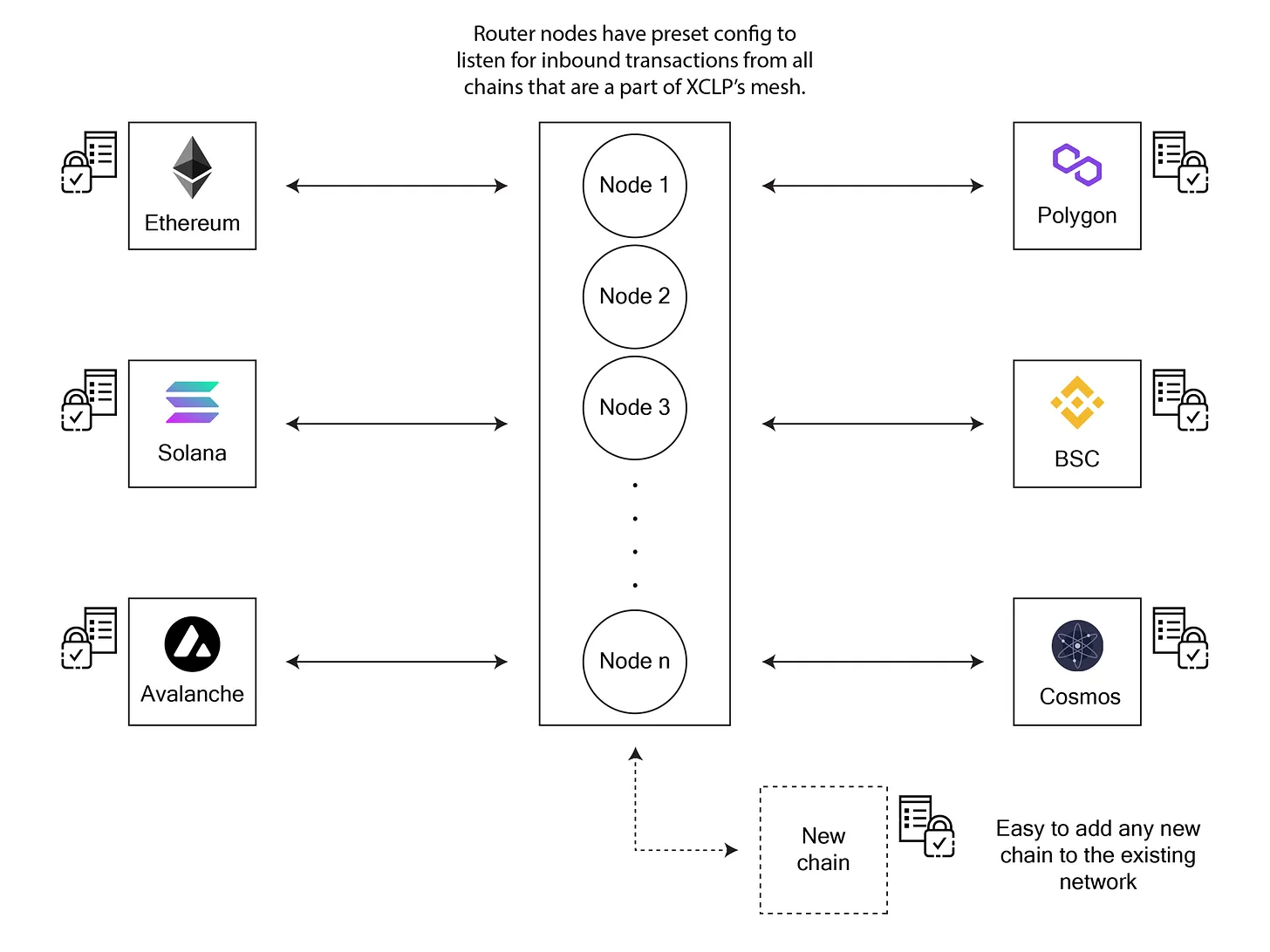

is one with

A very different cross-chain bridge than Bungee. It is a scalable multi-directional bridge connecting current and emerging layer 1 and layer 2 blockchains to allow contract-level data or tokens to flow between them. Router's XCLP (Cross-Chain Liquidity Protocol) provides seamless liquidity migration across chains, coupled with intelligent order routing, which can be executed efficiently according to customizable parameters.

Voyager's UI is very different from Li.Fi and Bungee: it does not display any information about routing paths, but is more similar to Uniswap's exchange interface.

Router Protocol has received investments from Coinbase Ventures, QCP Capital and Alameda Research. It connects 9 blockchains and has accumulated over $300 million in transaction volume since its launch. It issued the token ROUTE, with a market cap of about $30 million and an FDV of $78 million.

secondary title

2.2.1 SushiXSwap

2.2 Cross-chain DEX with built-in swap

Unlike a pure aggregator, a cross-chain DEX with an internal exchange function has its own exchange application. They first build exchanges on multiple chains, and then integrate with external cross-chain liquidity pools to process transactions.

Based on the liquidity of these blockchains, SushiSwap launched its cross-chain product

2.2.2 O3Swap

. SushiXSwap is integrated with Stargate Finance which acts as a cross-chain bridge. Stargate Finance only supports cross-chain transactions of stable coins. Therefore, SushiXSwap first converts customers' assets into stable coins, then transfers them to the target chain, and then converts these assets into customers' target assets.

SushiXSwap was launched on July 21st, and by August 8th, the transaction volume reached 500,000 US dollars. It seems that the data is not high, but the time is short. We can expect it to perform better over time.

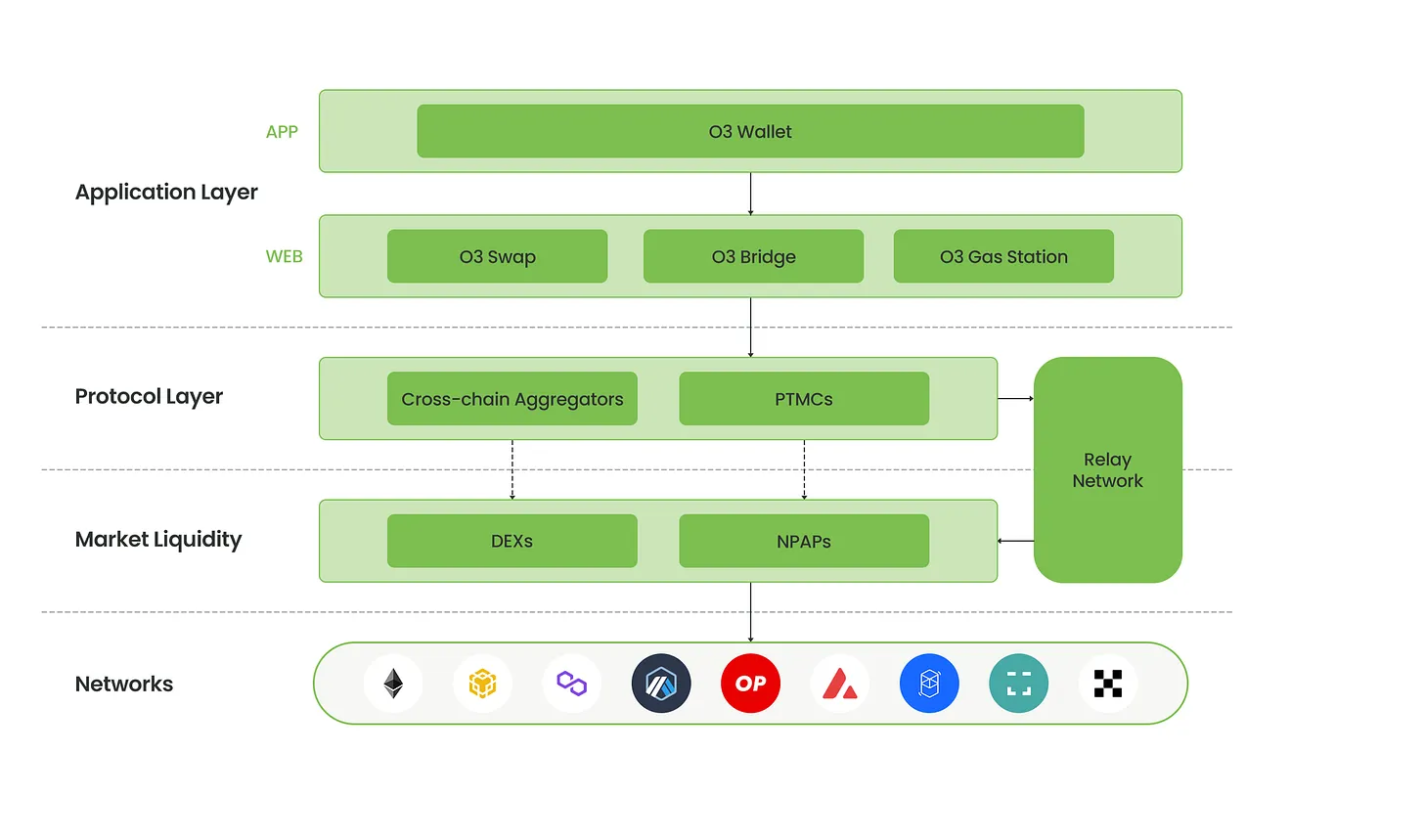

Although both O3Swap and SushiXSwap are DEXs with internal swap functions, they are actually quite different under the hood. Generally speaking, the internal exchange in the O3Swap project is more like a cross-chain liquidity pool than an exchange pool.

O3Swap is integrated with Poly Network as a cross-chain bridge. Poly Network is a leading cross-chain bridge, which locks the client's assets in the source chain and sends the corresponding encapsulated ptoken on the target chain to the client. In order to ensure that customers can obtain native tokens instead of ptokens, O3Swap has established a stable swap (ie O3 Hub) on each blockchain to help users exchange between ptokens and native tokens. However, stable exchanges do not necessarily support users in exchanging their tokens for target assets. This means that O3Swap needs to integrate with at least one external exchange platform to handle the last leg of transactions that its O3 Hub cannot cover.

For example, when a user wants to exchange his USDC on Polygon for ETH on the Ethereum mainnet, the protocol will first issue pUSDC equal to the USDC to be exchanged, then bridge the pUSDC to the Ethereum mainnet, and then exchange it back USDC, and finally integrate with Uniswap or 1inch to convert USDC into ETH.

According to DefiLlama, O3Swap's TVL is only around $10 million, which is not enough to support a huge transaction volume. O3Swap built a routing algorithm to integrate with other DEXs to increase liquidity. O3Swap V1 supports the routing exchange of the source chain, and V2 supports the routing exchange of the source chain and the target chain, providing users with more choices to reduce transaction costs.

The teams of O3Swap and Poly Network are both from the Ontology ecosystem. They have good business experience in the crypto industry. O3Swap has partnerships with many blockchains and rollups to facilitate their TVL. However, Poly Network’s major hack hurt O3Swap badly. O3 Swap's TVL has dropped from around $700 million to $200 million in just one month and continues to drop. The current TVL is only $10 million.

The project issued O3 tokens with a market cap of approximately $5 million and an FDV of approximately $13.8 million.

2.3.1 XY Finance

XY Finance2.3 Cross-chain DEX with built-in cross-chain liquidity pool

If a cross-chain DEX executes transactions through an external cross-chain liquidity pool, it must pay for this service. Some products decide to build their own liquidity pools to eliminate this cost. Additionally, large internal liquidity pools can help maintain the protocol’s economic moat to maintain a competitive advantage over competitors.

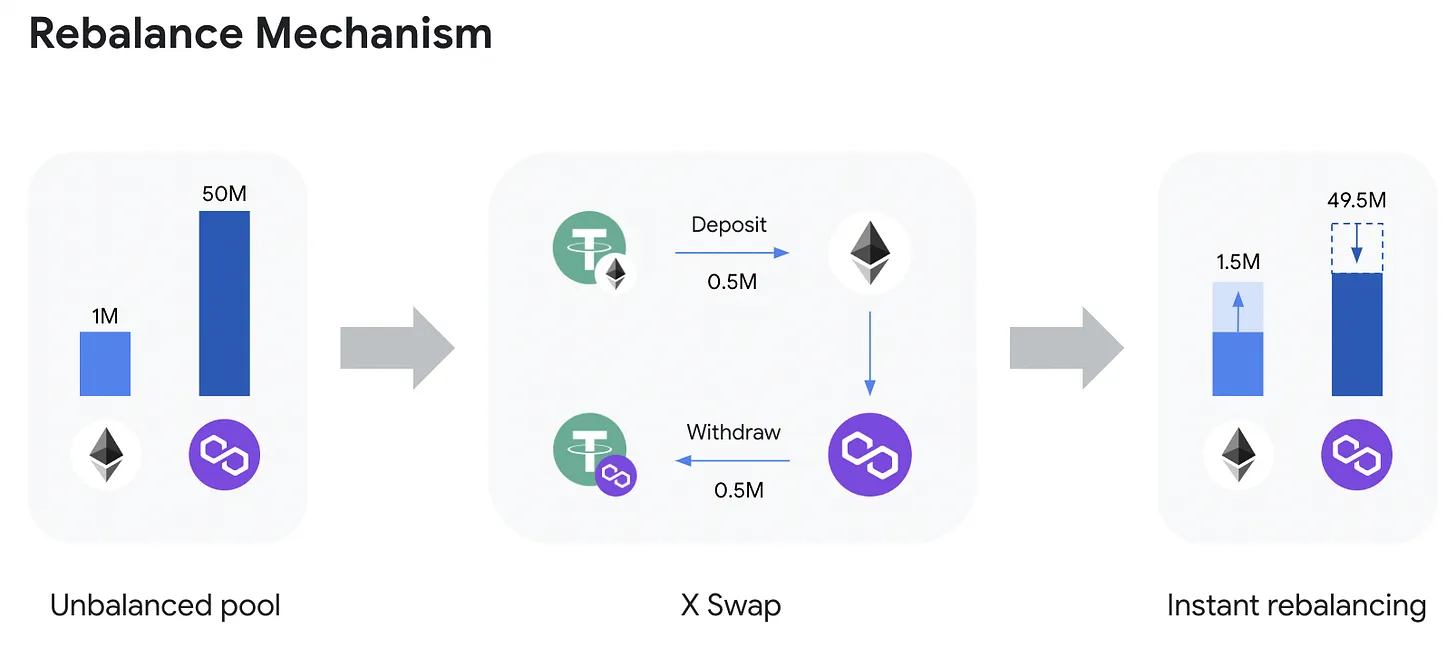

It is a one-stop cross-chain aggregator for DeFi and Metaverse. XY Finance consists of two parts, X Swap and Y Pool, to facilitate cross-chain swaps and reward liquidity.

2.3.2 Catalog

X Swap is a DEX aggregator, while Y Pool incentivizes all liquidity providers through swap fees between chains. The issued XY governance tokens are used to incentivize liquidity providers who deploy liquidity in specific pools. In the Y Pool, sometimes the tokens supported by a certain pool are swapped and used up, and this token is constantly swapped to another, which leads to what is called an "unbalanced pool" on the chain "" (unbalanced pool) situation. The following flowchart shows a scenario where an unbalanced pool occurs due to a shortage of a certain cryptocurrency. The rebalancing algorithm rewards XY tokens to users who restore the rebalancing pool through X Swap.

XY Finance received investments from Animoca Brands, YGG and Circle. Token XY is issued with a market cap of $2.5 million and an FDV of $28 million. Y Pool's TVL is only around $3.3 million, which means that XY Finance has to settle most of its transactions through an external bridge pool. Since launch, XY Finance has processed $152 million in transaction volume, compared to approximately $558,000 in 24-hour volume.

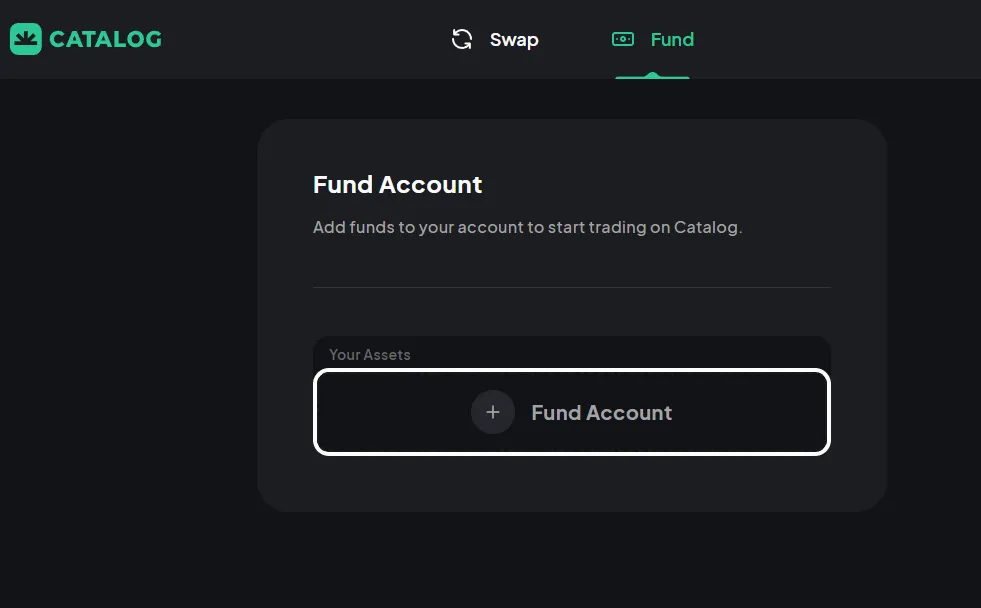

Catalog is a decentralized gateway for users to discover and trade crypto assets across multiple chains. Catalog is built on Ren, one of the most secure cross-chain protocols. It uses the first-ever unlimited liquidity mechanism, allowing users to simply trade assets in DeFi Metaverse. This is the first consumer application developed by Ren Labs based on the Ren protocol.

Ren is one of the most successful cross-chain bridges in the industry. Since its launch, it has processed approximately $12 billion in transaction volume, backing Catalog with exceptional liquidity.

Catalogs are quite different from the projects mentioned above. In the directory, users must deposit assets into their accounts before trading, and they can then be withdrawn. This is very similar to how centralized exchanges work. The advantage is that transactions can be performed immediately after depositing, but the deposit and withdrawal process still takes time.

The product is still in testing and technical details have not been disclosed. We'll have to wait until the product is officially launched for more information. However, the biggest difference between Catalog and SushiXSwap is that Catalog will have its own token. Catalog announced in February that it had raised $7.5 million, with participation from Amber Group, Multicoin Capital and Cumberland DRW.

2.4.1 ThorSwap

2.4 Cross-chain DEX based on side chain

Similar to DEX aggregator 1inch, most cross-chain DEXs are currently free to use, making it difficult to support the intrinsic value of their tokens. Even internal liquidity pools cannot generate good profits due to low bridge fees and high risk. In this case, some projects build their own sidechains to enhance the security of their products and the value of their tokens.

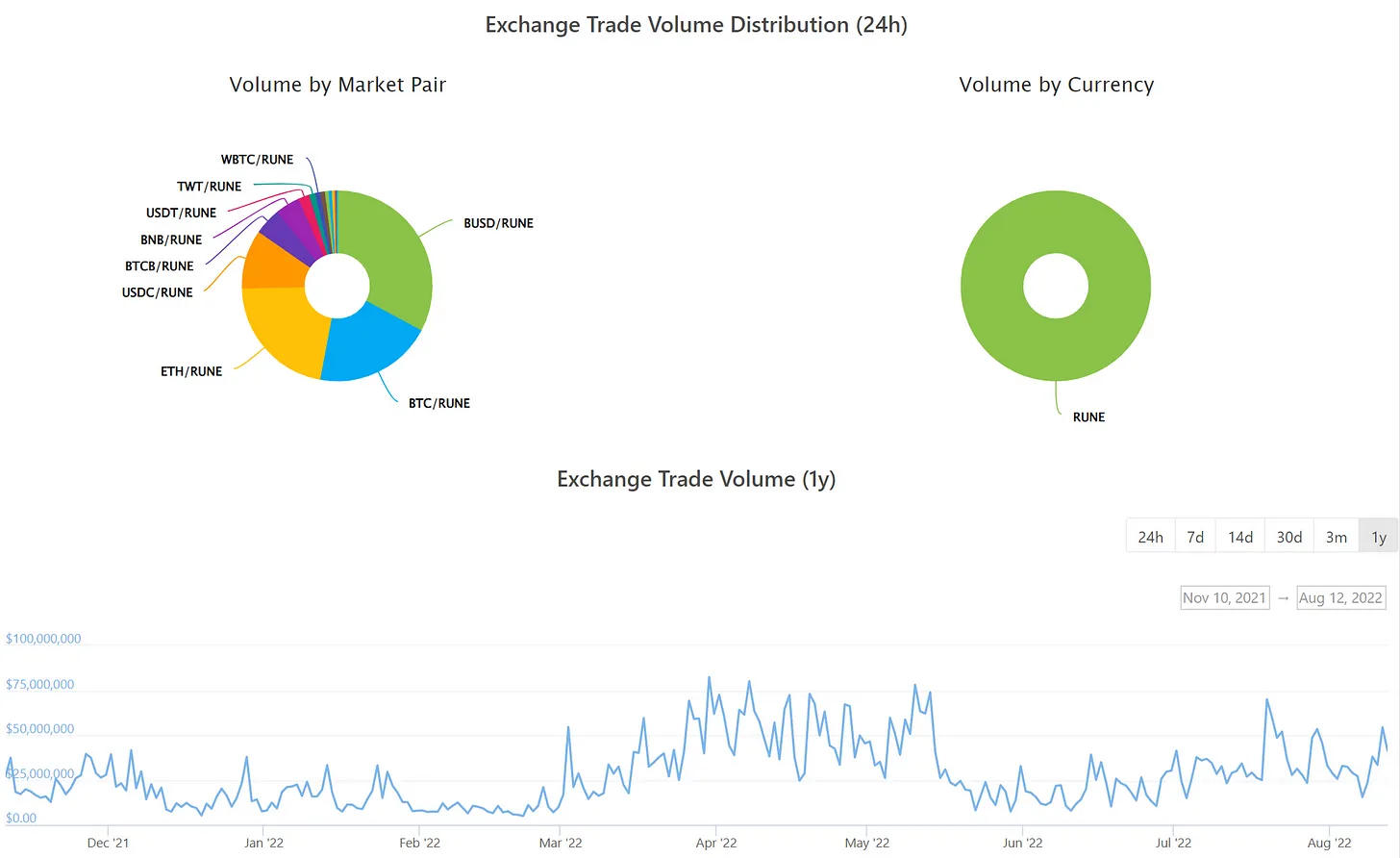

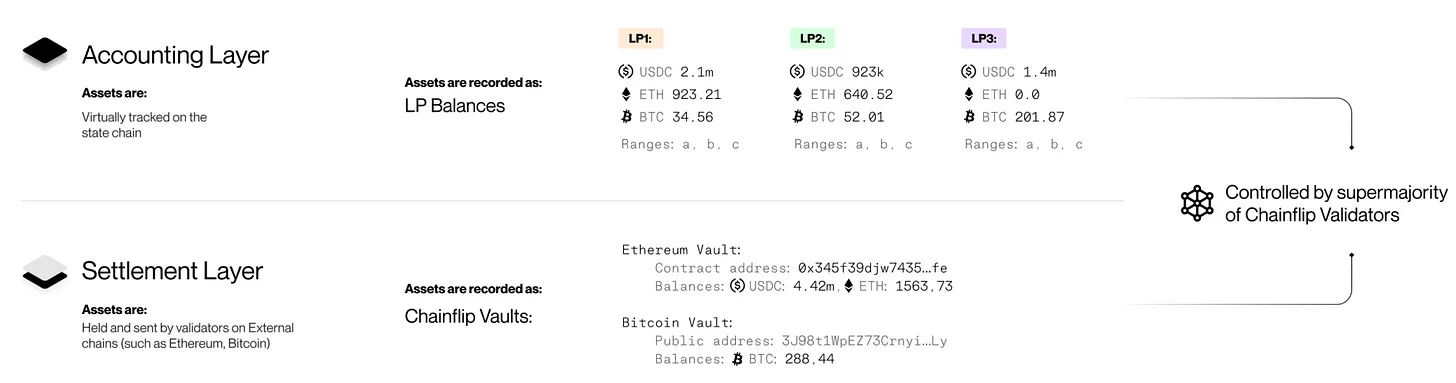

ThorChain is a decentralized cross-chain liquidity protocol based on Tendermint and Cosmos-SDK, which utilizes Threshold Signature Scheme (TSS) technology to secure assets. It doesn't fix or wrap assets, it just determines how to move them in response to user actions. ThorChain observes user deposits entering the vault, executes business logic (exchange, add/remove liquidity), and processes related outbound transactions.

Many interfaces are built on top of ThorChain. ThorSwap is the most commonly used function and does not require KYC.

Based on Tendermint, ThorChain can not only support the interaction between EVM chains, but also support the interaction between non-EVM chains. Therefore, in order to obtain the best user experience, full-chain wallets such as xDEFI should be used instead of EVM wallets such as Metamask.

2.4.2 Chainflip

ChainflipInstead of aggregating liquidity from external DEXs, ThorSwap built its own exchange on top of ThorChain. Liquidity TVL is about $171 million. Like Bancor, in ThorSwap, all liquidity pools should be built on trading pairs between RUNE (ThorChain's native token) and other tokens. This mechanism increases the demand and intrinsic value of RUNE, but limits the size of the liquidity TVL.

ThorChain token RUNE has a market cap of $873 million and a FDV of $1.45 billion. Since its launch, ThorSwap has processed over $6.8 billion in transaction volume and currently has a daily transaction volume of approximately $51 million.

It is a decentralized and trustless protocol that enables cross-chain exchanges between different blockchains, which is very similar to ThorSwap. The difference is that Chainflip is built on Substrate in the Polkadot ecosystem, while ThorSwap is built on Tendermint in the Cosmos ecosystem. According to the white paper, Chainflip is building its own liquidity pools on every major blockchain ecosystem and is also building its own AMM-based exchange. According to the white paper, Chainflip AMM will be based on Uniswap V3 design.

2.4.3 Chainge Finance

Chainge FinanceLike Catalog, Chainflip's user experience appears to resemble that of a centralized exchange, requiring users to deposit assets before trading and then letting them withdraw those assets. However, Chainflip has not yet launched a public beta, so we don't have enough information to comment further.Anyswapandis an interesting project, founded by DJ Qian, who is alsoand

Co-founder of Fusion

. Similar to Anyswap, Chainge Finance is built on the Fusion blockchain, but uses a completely different mechanism than other cross-chain DEXs that have their own sidechains.

First, Chainge Finance itself is a mobile wallet. Users must use the Chainge Finance app directly, not through other blockchain wallets such as Metamask.

2.4.4 ChainSwap

Second, when a centralized exchange or project such as Osmosis receives a user's deposit, they lock the asset and put a wrapped token in the user's account, or just add a number to the user's account without actually letting the user custody of its assets. Users can then start transacting with these numbers. Therefore, ETH from Polygon or from the Ethereum mainnet will appear exactly the same in such a system. However, in Chainge Finance, the token will show exactly which chain the token is on. Moreover, users can trade tokens from multiple chains to a target chain with one click, which is very convenient.Third, Chainge Finance has no internal exchange on the Fusion blockchain, but it builds liquidity pools on each connected blockchain. When a user makes a transaction, the project will obtain liquidity supply from the DEX on the target chain and complete the transaction. This is similar to DEX aggregators.Launched in March 2021, ChainSwap is ambitious.

ChainSwap and Li.Fi

Very similar: it does not have its own liquidity pool or bridge. Instead, it integrates with the likes of AnySwap, PolyNetwork, and cBridge to perform cross-chain swaps for users. However, the product only shows a single routing path that cannot be adjusted. As of this writing, supported assets are also limited. For example, there are no ETH trading pairs on ChainSwap. However, ChainSwap enables users to move NFTs across chains.

According to Gitbook, the ChainSwap team hopes to build a cross-chain bridge and application hub that will allow projects to seamlessly bridge between blockchains. They are planning to build an internal sidechain and a cross-chain bridge liquidity pool on top of it. With this infrastructure, it can not only support cross-chain DEX, but also support lending, NFT market and real-time statistics.

ChainSwap has received investments from Alameda Research, CMS, and NGC. It issued the token $ASAP, which currently has a market cap of $554,000 and an FDV of $2.7 million. The protocol has a cumulative transaction volume of $185 million. However, it was hacked in July, causing users around $800,000 in losses, severely damaging user confidence in the platform.

3. Market structure

Cross-chain DEXs are usually built on top of existing DeFi and multi-chain ecosystems. Since these ecosystems have only recently matured, the latest cross-chain DEXs are still young. Most web3 users are still used to using centralized exchanges or cross-chain bridges to transfer their assets. However, as more and more users enter web3 and more and more encrypted assets are distributed in the multi-chain ecosystem, the demand for cross-chain DEX will increase.

3.1 Market Data

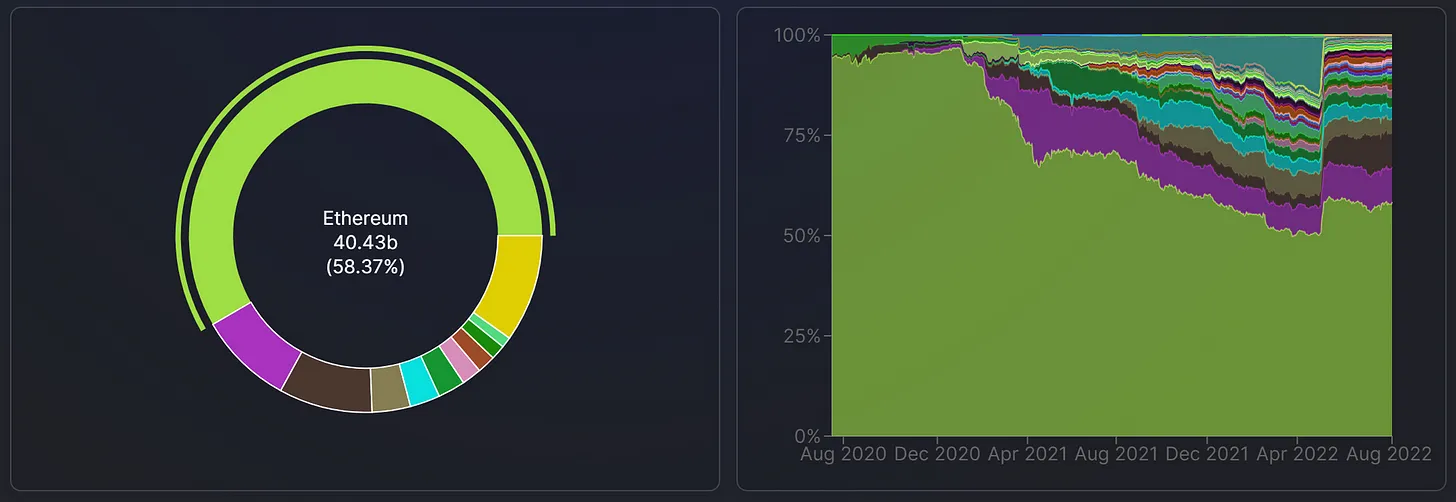

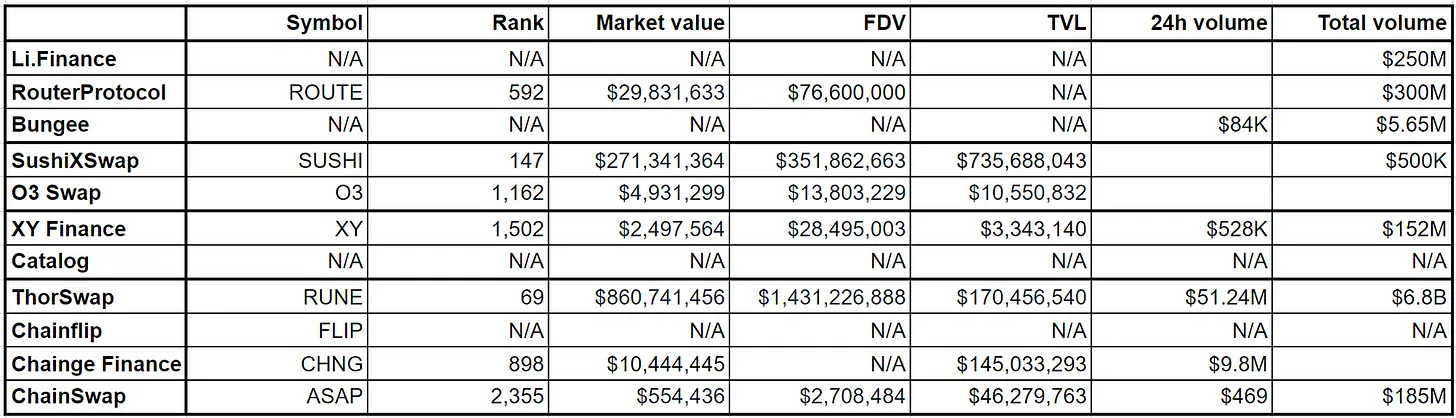

Judging from the market cap data below, RUNE is doing very well, with a market cap of around $860 million. As one of the leading DEXs, SUSHI has a market cap of around $270 million. The market caps of other protocol tokens are all below $30 million.

In terms of transaction volume, ThorSwap occupies the largest share of the cross-chain DEX business. It has processed more than $6.8 billion in transaction volume, with a daily transaction volume of approximately $51 million. Router Protocol, Li.Finance, ChainSwap, and XY Finance have aggregated transaction volumes of $15-300 million. Bungee's total turnover was only about $5.65 million. SushiXSwap went live on July 21, and as of August 8, the transaction volume was only $500,000. Finally, neither O3Swap nor Chainge Finance disclosed this information.

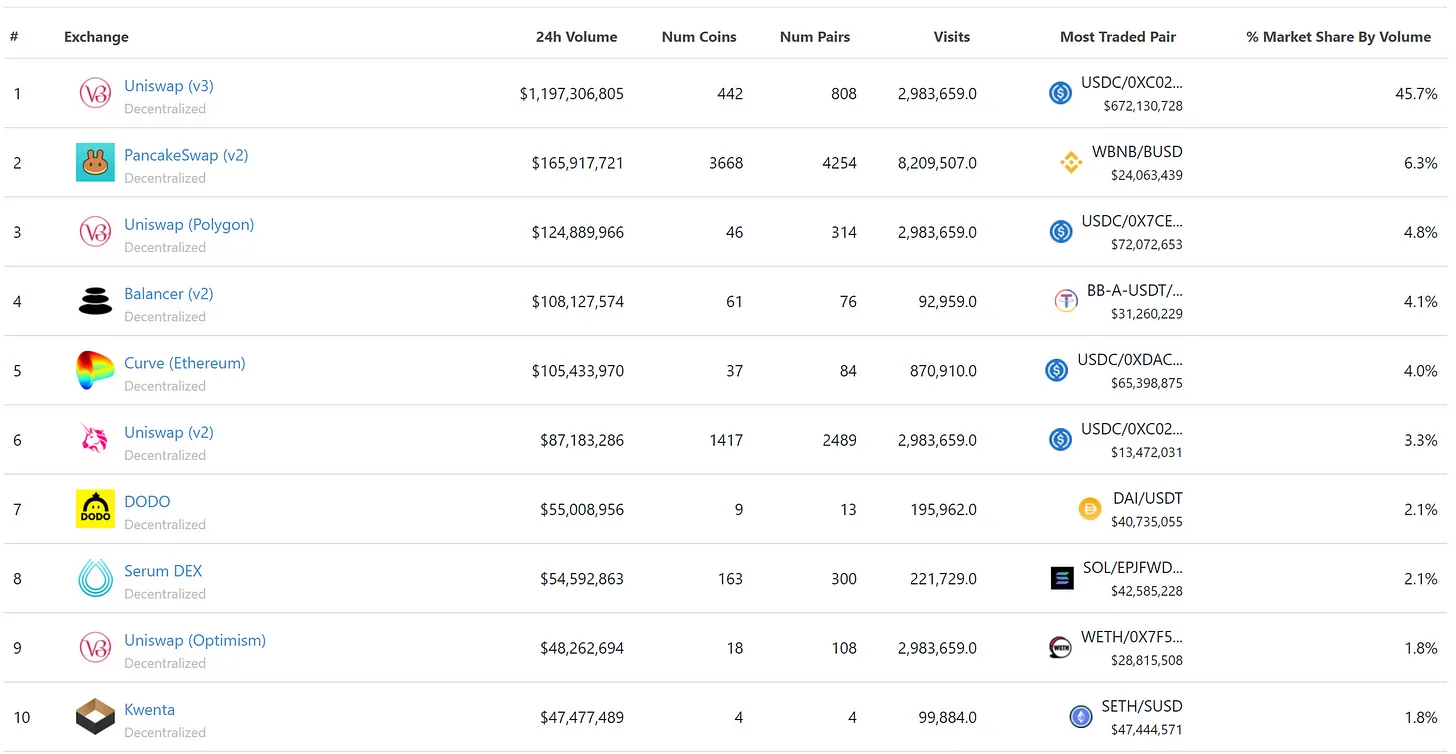

However, the transaction volume of the cross-chain DEX industry is still small compared to other DEX protocols: Uniswap processes about $1.2 billion in daily transaction volume, which is about 10 times the total daily transaction volume of all cross-chain DEXs combined.