What would happen to the crypto world if DAI were attacked?

This article comes from TwitterThis article comes from

, Original author: Adam Cochran, compiled by Odaily translator Katie Koo.

I'm curious what DAI will look like if it suffers a doomsday attack. Under the current structure, possible attack situations will have corresponding avoidance methods.

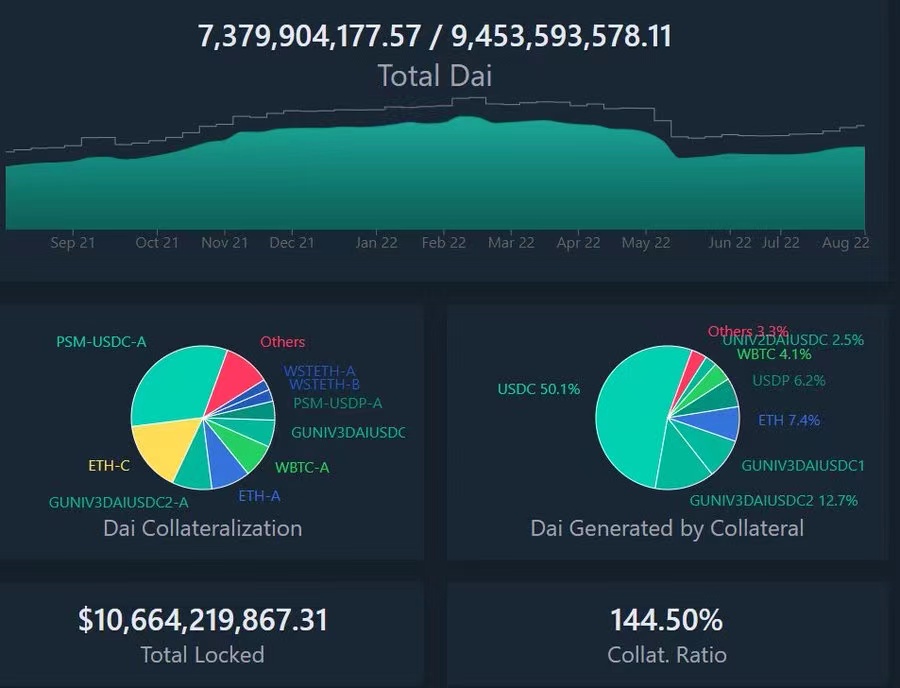

Currently, there are approximately $7.3 billion in DAI in circulation. Only about $1 billion of that is backed by volatile assets. That's about 13.7%. But we have seen that when assets are decoupled from fixed exchange rates, they tend to be conditioned. When they reach 0.95%, there is a tendency to accelerate.

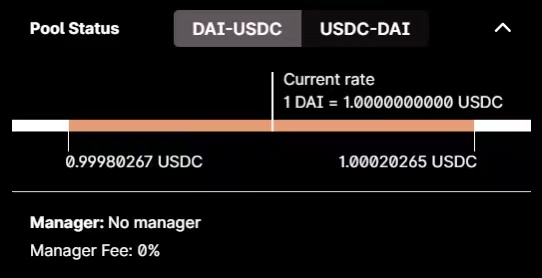

About 20% of the positions on Uniswap are also USDC/DAI range positions, most of which are managed by the automated treasury on Arrakis Finance, which has managers responsible for its range, but the range of this position is currently very narrow.

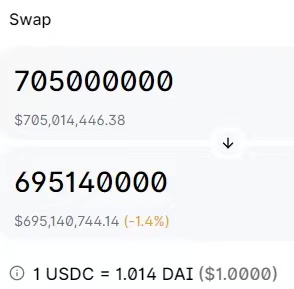

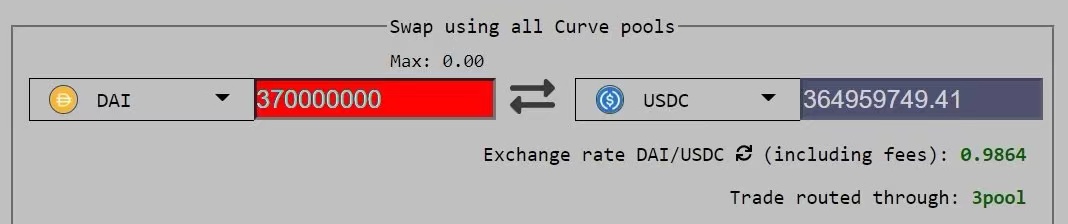

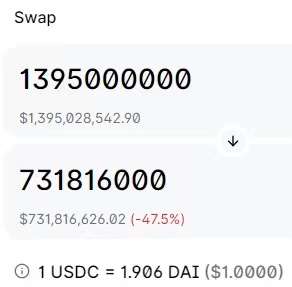

On Uniswap V3, a $705m trade started out of position, but would still return $695m, so a 1.4% loss would push it over the edge. On Curve, the same would cost about $370 million.

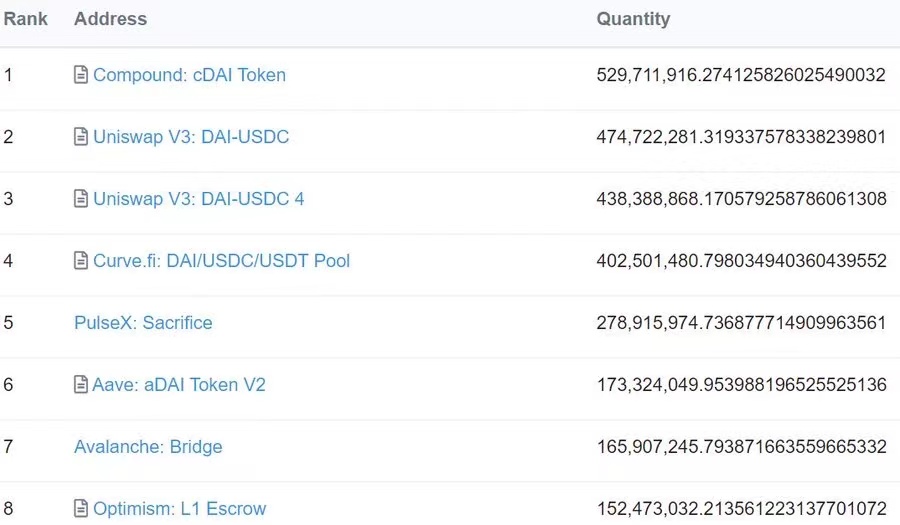

When it starts to outgrow the position, the next catalyst point will be a >17% deviation in price as Compound has DAI as collateral for 83%. It only takes an additional $195 million in DAI to reach this level.

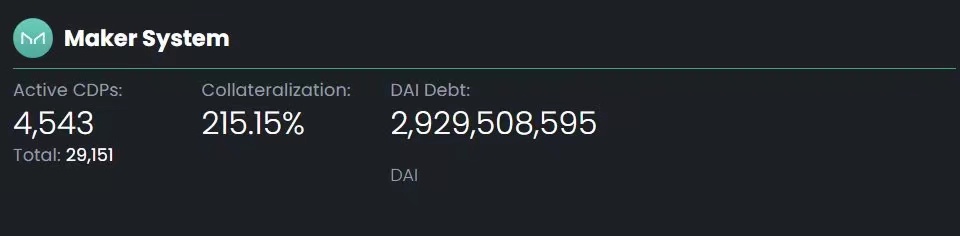

The question is, can you get to that level with the amount of DAI and the buying pressure of people wanting to close their positions? Because most of the DAI in circulation comes from the PSM, only 2.9 billion DAI debt actually exists.

Odaily Note: The Peg-Stability Module (PSM, Peg-Stability Module) of the Maker system allows users to directly exchange other stablecoin collaterals for DAI at a 1:1 exchange rate instead of pledged casting. The main purpose of PSM is to help keep DAI pegged to the dollar.

So we do not expect upward buying pressure to exceed this level. Currently, the total value of available DAI in the ETH-A, ETH-C, WBTC-C, and WBTC-B treasuries is approximately $444.6 million. USDC has $1.2 billion available in PSM and Compound has about $530 million available.

An attacker could open ETH-A, ETH-C, WBTC-C, and WBTC-B treasuries at $400 million, using Compound to borrow $400 million (maximum APY of 34% per annum, which could remove DAI from other positions Attracted to Compound for a day or two, making it easier to steal), exchange USDC for $350 million in DAI via PSM.

At this point, the attacker will sell against the UniV3 position and 3Pool. At $1.07 billion, they will receive about $10.5 billion in USDC. PSM injected 250 million USDC into DAI and traded again. The loss in this regard will be US$ 25 million. But that would trigger another $650 million in DAI trades to enter the market as liquidity.

As liquidation looms, most liquidation bots are trying to buy and sell, but thin liquidity will mean they either pull back their offers or drive the price down even further. It's hard to predict how low the price will be as the arbitrage continues, but if it's a single transaction (which you can do with bundled transactions), then it's at the 47% point where there will be other collateral liquidations, treasuries and Users will face greater pricing pressure to dump DAI.

An attacker can slowly start buying assets at a discount. If they lose $35 million, that's not too bad. A 10% drop in the price of liquid Ethereum alone would allow them to recover $40 million in treasury debt.

With the DAI rung down 47%, they can also use DAI to pay down some of their PSM or Compound debt. But probably not because they're all cash and don't want to add upward pressure. DAI may recover from a situation like this, and the attack needs to be done very quickly (probably one transaction + flash loan) and requires additional funds to prevent arbitrage bots from hitting hard.However, even if one of these happens, any confidence in DAI will be completely destroyed, and you would see it as a decline in collateral, or at least a large drop in its collateral value will reduce its demand.Getting this done would require billions of dollars and detailed coordination, but it's not impossible under these market conditions.

In large part, this is because a lot of DAI is issued with PSMs, illiquid assets, and non-diversified collateral. If we calculate the Uniswap position as 50/50, that means about 10% of DAI is backed by DAI as collateral. This is the main problem that creates reflex risk.The main drivers of DAI usage today are: leveraged transaction fee mining and usage of the Curve base pool. Too much risk is built on leverage and a lack of diversity. To prevent such risks,

Maker may take the following measures: minimize governance in the protocol to increase confidence; reduce reliance on PSM, which creates scale risk; further limit the upper limit size of each collateral type; do not use DAI pairs as collateral.

Under current market conditions, other protocols should probably also consider lowering DAI's LTV (total lifetime value)/collateral factor to ensure that it is more difficult to reach the liquidation point until the tail risk is reduced. I wish DAI continued success and growth. However, it should do so in a responsible, secure, and decentralized manner, not just constantly piling risk on top of risk. Unless a large institutional hacker decides to attack DAI for a specific reason, such an attack is unlikely to happen, but what happens when there are other ecosystem adjustments?

What if DAI is decoupled, or if support for USDC is turned off as discussed on the Internet? What would happen if Curve wanted to replace DAI with crvUSD? We built so much on top of DAI because it started out as a simple, decentralized, pure-play stablecoin. As this changes, we need to decentralize the use of stablecoins, or address the core issues that create tail risk. We should never be able to create a centralized, zero-slip, 1:1 backed multi-billion scale asset without diverse backing. Otherwise you're just reinventing the same broken monetary system we want to replace.