After the rebound after cooperating with BlackRock, can Coinbase usher in a "second spring"?

This article comes from The Wall Street JournalThis article comes from

, Original author: Gregory Zuckerman & Caitlin Ostroff, compiled by Odaily translator Katie Ku.

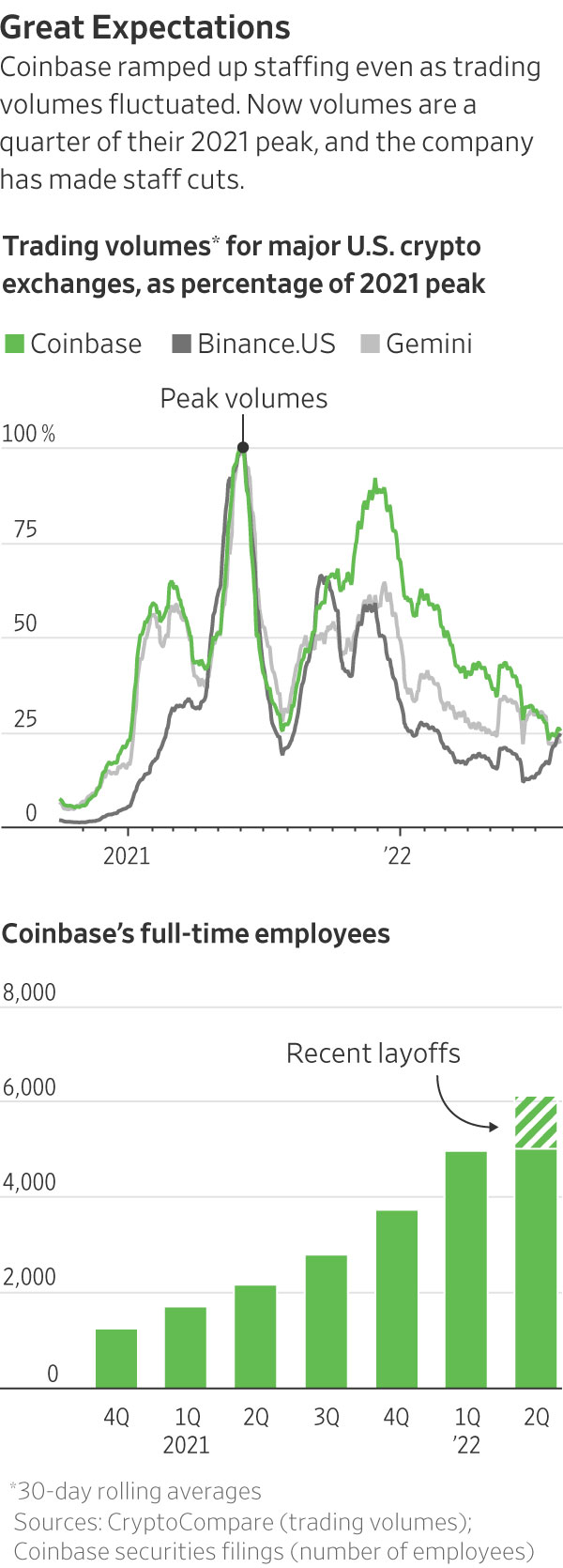

Coinbase CEO Brian Armstrong was an early enthusiast of blockchain technology. He built the cryptocurrency exchange Coinbase into a large-scale encryption empire and became the largest cryptocurrency exchange in the United States. It will be listed in the spring of 2021 with a market value of nearly 860 million One hundred million U.S. dollars. The crash across the board this year has brought its value down to roughly $21 billion. It also left Brian Armstrong wrestling with a sprawling business that now faces high fees, dwindling cash flow and, most recently, challenges from federal regulators.

Just about every crypto company is struggling, and Coinbase's woes mirror those of many others in the industry. The company's stock rose sharply last weekend following its partnership with BlackRock, which may indicate investor confidence in its future. But after rapid growth, Coinbase, one of the most important players in the cryptocurrency space, faces new challenges in the downturn.

Coinbase is currently at odds with the SEC (United States Securities and Exchange Commission), which considers several cryptocurrencies traded on the Coinbase platform to be securities. Coinbase does not have a license to operate as a stock exchange, which it denies. But the possibility of future lawsuits from securities regulators could take some tokens offline and make it more difficult for the platform to decide whether to add new tokens in the future.

Brian Armstrong focuses on ways to make it easy for investors to stake cryptocurrencies. He wants Coinbase to become a brand trusted by regulators, consumers, and investors. In 2017, Coinbase launched Bitcoin Cash, a derivative of the Bitcoin code. User demand was so high that Coinbase had to freeze transactions. Brian Armstrong and other executives rushed to expand their team to keep pace with the growing interest in cryptocurrencies, hiring from leading tech and financial firms. Inside the company, the employees who gain power tend to be those who focus on recruiting, according to some people who work at the company. Coinbase sometimes sets difficult hiring targets when it doesn’t know exactly what it wants from new hires, these people said. Employees spent most of the day in meetings, sometimes as many as 15 times a day, according to former employees. Some say internal debate, competition, and criticism hinder employee productivity. Employees launching new products sometimes worry about the opinions of "naysayers" (employees who try to block new ideas).

Coinbase executives said they realized they were having too many meetings and had begun taking steps to reduce them. The company may take longer than others to make a decision because it analyzes all aspects of new products and is more focused on security and compliance than others in the encryption space, one executive said. Another feature of Coinbase’s culture, according to former employees, is that executives, including President and Chief Operating Officer Emilie Choi, regularly review employees’ LinkedIn pages and sometimes order employees to adjust descriptions on the pages. Choi believes that scanning LinkedIn lists to see if employees are exaggerating their responsibilities is part of building a culture of accountability.

While Coinbase has plans for expansion, it has sometimes been slow to execute. Coinbase said last October that it would launch an NFT marketplace and transfer some of its top engineers to the project. According to Dune Analytics, it wasn’t until April, when it launched its beta version, that the NFT market reached $4.2 million in transaction volume. Coinbase executives disputed that figure, but did not provide other figures on the NFT platform. They said it was too early to roll out new initiatives, including NFT marketplaces.

When Coinbase went public 16 months ago, investors enthusiastically responded to the Coinbase CEO's vision of bringing bitcoin to the masses. According to the post-IPO valuation of Coinbase, Brian Armstrong's 20% stake is worth about $17 billion. Nine months later, he bought a $133 million estate in Los Angeles, one of the most expensive homes ever sold in the Los Angeles area, according to people familiar with the matter.

image description

Nasdaq stock exchange screens in Times Square, New York, April 14, 2021, as Coinbase goes public.

Coinbase more than doubled its headcount in the last year. While Coinbase has historically been slower to add new tokens to its platform than rivals such as Binance and FTX, it accelerated its listings in the first half of last year. Brian Armstrong said a year ago that Coinbase would eventually "offer every reputable (non-scam and legitimate) cryptocurrency to our users." As of the end of 2021, Coinbase supports custody of 172 tokens and trading of 139 tokens. The company has continued to add employees this year despite the weak value of cryptocurrencies. This summer, the company hit 6,000 employees, compared with roughly 300 at rival FTX.

Coinbase shares fell as the value of digital currencies slipped this year and trading volumes shrank. At one point, an employee launched a petition calling for the removal of three executives, not including Brian Armstrong. Its CEO responded on Twitter that the petition was "stupid on multiple levels" and wrote: "If you don't have confidence in a company's executives or CEO, why would you be here Quit and find a job at a company you believe in.” In June, Coinbase laid off 1,100 employees, or 18% of its workforce. The move came as a surprise to many. A Coinbase spokesperson said the decision to lay off staff was difficult, but the company worked hard to make the transition as smooth as possible, paying severance packages and helping people find new jobs.Late last month, federal prosecutors filed insider trading charges against a former Coinbase manager, who has denied the allegations. Meanwhile, the U.S. Securities and Exchange Commission (SEC) claimed that seven crypto assets traded on the Coinbase platform qualify as securities. While Coinbase is known as an exchange, it is not regulated like the NYSE and Nasdaq. Coinbase said it does not trade securities and criticized the SEC for failing to communicate with digital asset companies or adapt the agency's oversight to the cryptocurrency market.

Coinbase’s business model relies heavily on revenue from retail trading, so if these seven cryptoassets were identified as securities, it could upend part of that model.If the court agrees with the SEC that some digital tokens are securities, Coinbase may have to stop trading on its exchange. If the SEC ultimately sues Coinbase for its decision to list assets, Coinbase itself could face fines and other liabilities. Both moves could have a chilling effect on Coinbase's future listing decisions, leaving its overseas rivals less constrained to grow.

Earlier this week, Binance’s U.S. subsidiary, Binance.US, delisted one of its assets as an alleged security. A spokesperson for Coinbase said that in 2018, the company obtained the licenses needed to operate a securities trading platform, although the company had not done the necessary preparations to use those licenses. Coinbase may take steps to become a licensed securities exchange if deemed necessary, the spokesperson said.