The decline of the P2E model is irreversible. How to design a sustainable blockchain game?

This article comes from SubstackThis article comes from

With most of the P2E economies collapsing, coupled with a 60-90% drop in token prices across the board, the notion that “gaming” will be the next phase of cryptocurrency user growth has been challenged. Let's take a look at the opportunities and problems of the current structure of blockchain games, and how to build sustainable games in the future that attract organic users.

secondary title

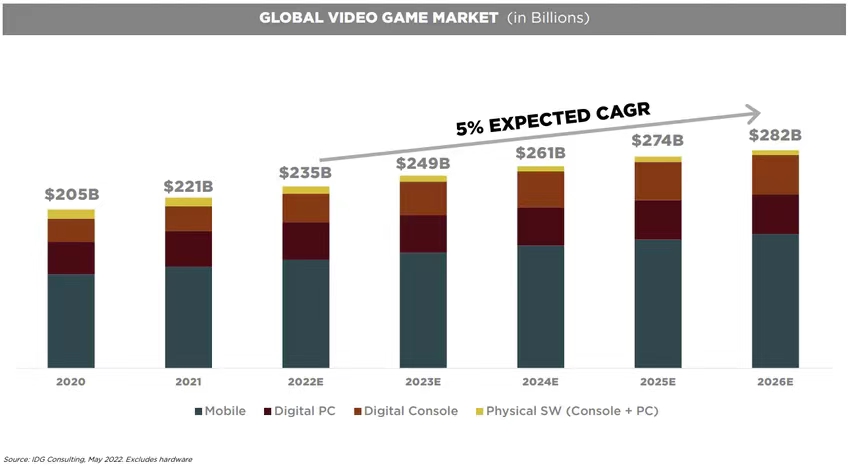

According to Take Two, the global video game market size is $235 billion per year (2022). Most of these are mobile games, which account for 60% of total revenue.

image description

Source: TTWO latest investor presentation

Compared to the current total game crypto market cap of ~$11 billion, there is at least a lot of potential from a size/valuation perspective.

image description

From the perspective of pure user growth, 3 billion monthly active users of video games is slightly higher than the 870,000 of our chain games today (3400 times more than now). Why didn't blockchain games experience more explosive growth? Let's analyze the current problems of the game.

secondary title

Problems in blockchain gamesFirst of all, what I think a lot of people miss is that compared to traditional games,Chain games are too expensive

. Players who "want to experience being lost in another world" can play any current online traditional game and get a better experience than in Decentraland. In order for blockchain games to be widely used, designers need to focus more on the game, making the game fun, sustainable and profitable, and creating an ecosystem with a high retention rate.

So far, the problems encountered by chain games are mainly concentrated in the following three aspects:Really Active Cryptocurrency Investors Are Profit-Driven

, does not emphasize whether the game is "fun", the team solves the problem through incentives to make money instead of game mechanics, and it is easier to make games under this structure;Most chain games are;

Not as fun and/or addictive as traditional gamesMost blockchain games。

economic structure is unsustainable

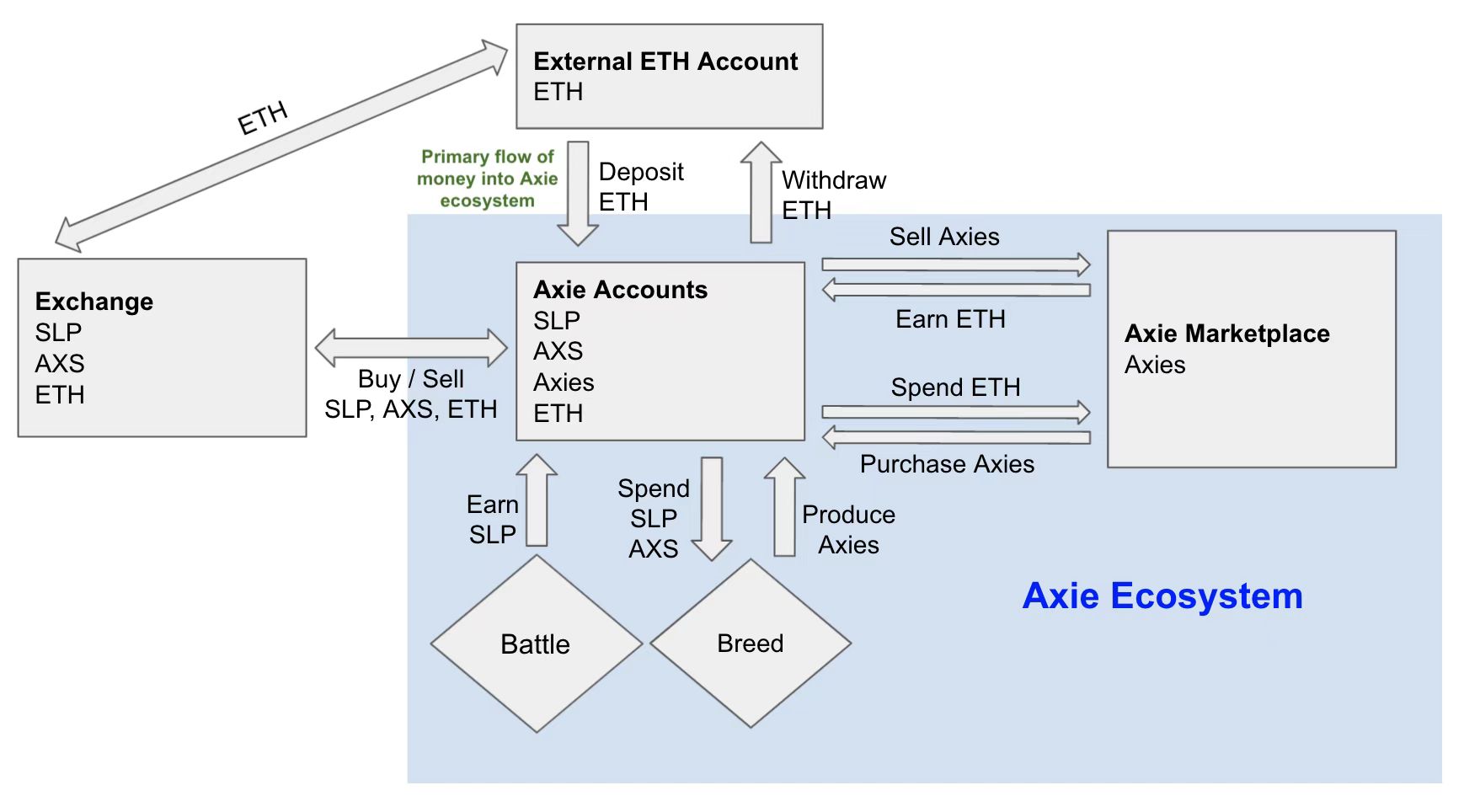

In addition to the lack of fun games, there are also problems with the core model used by most popular blockchain games-earn while playing. Let's take AXS as an example (it used to be the largest gaming token by revenue and market cap). Users can buy an Axie (NFT character for fighting in the game), or they can use AXS (government token) + SLP (game currency) to breed Axie. Players use Axies to engage in battles and earn SLPs when they win.

From the perspective of game economy, when the demand for Axie is high → the price of Axie increases → the incentive to breed (sell) Axie is increased, which in turn increases the price of SLP + AXS. Conversely, if the demand for Axie falls, SLP+AXS will also fall. This model comes into play when new users enter the system, as Axie demand continues to rise (supporting SLP+AXS), and NFT sales (AXS earning revenue) also rise (supporting AXS' price). But the return in this case is highly dependent on new users, which is very similar to many DeFi Ponzi returns. Think about if there are zero new users in this case. Now there is no increased demand for Axie, which also reduces the need for SLP+AXS (for breeding). But for the SLP market, if only the core user group continues to play, SLP will continue to face the pressure of only selling, pushing the user economy to the brink of collapse.

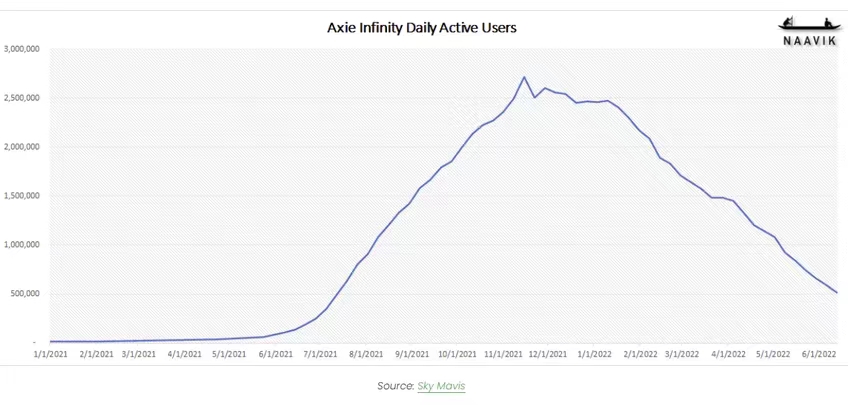

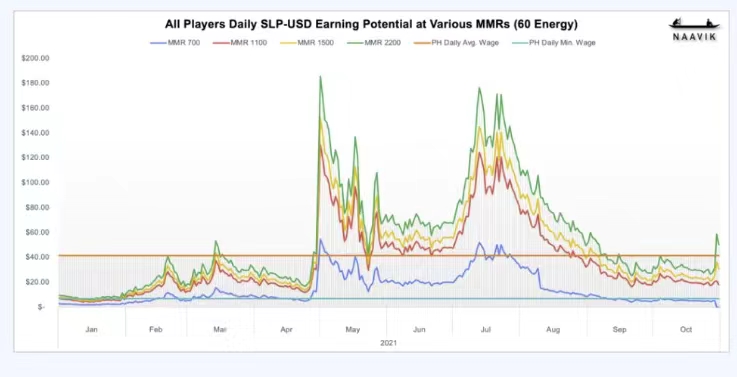

This is the general situation of chain games at present. At the peak of AXS, players could earn over $100 a day ($3,000/month), and players in countries like the Philippines quit their jobs to play the game full-time. The price of the in-game currency shot up from 2 cents in early 2021 to 35 cents in summer 2021.

But as daily active user growth starts to slow in fall 2021, SLP drops to 7 cents and starts to drop to about 2 cents (before the hack in March 2022) as user growth continues to be negative (SLP market enters selling pressure).

For example, in the Philippines, daily earnings fell from very high to below the minimum wage as SLP prices fell.From the example of AXS, P2E looks a bit like a glorified Ponzi scheme. This model is not sustainable and relies on new users to keep the game going. As you can see from this data, the only reason people play this game is to make money.In order for the chain game project to continue to develop, I think it needs to be closer to the function of traditional games: earn more money than spend.

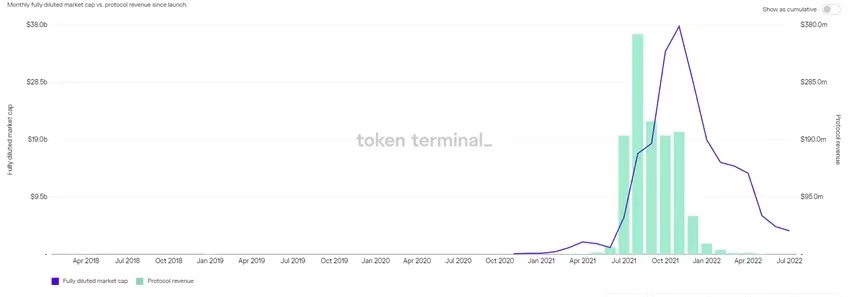

In the case of AXS, the SLP's returns are not coming from their coffers, they earn a lot of revenue during peak times. But fundamentally, players are making money with the game, and the less money they make, the less they play the game. The fewer players, the lower the value of Axie, which leads to less buyer demand for SLP + sell pressure from current players. From an AXS perspective, this revenue model worked very well at its peak ($200M/month), but as new demand for AXS declined, revenue essentially dwindled to $60K/month.

Through this example, you can understand why traditional game developers do not use the P2E model. Traditional games with in-game currencies usually keep you in the game economy by tightly controlling what you use the currency for, and usually don't let you convert game tokens to fiat currency (compared to P2E, which is exactly the case. on the contrary).

The structure for most games is that if you spend $1000 on in-app purchases, upgrades, etc., you don't get your money back, you have to spend it on the game. Typically, players are incentivized to spend money to make their characters cooler and better. So in order to stimulate the development of the chain game field, we need to completely shift the focus to games.So how will the next generation of crypto games create more sustainable content?

secondary title

How did chain games reach a market value of 100 billion US dollars?

Game fun:

First, we need the real game to enter the crypto space. Enough fun games to keep people who don't care about cryptocurrencies or hate NFTs interested in playing. Players will always flock to interesting games, and the number of players is huge (3 billion per month). I predict that in the next 6-12 months there will be a AAA game that focuses on encryption technology and shows the possibility of a pure game perspective.

Game Threshold:

To see mass adoption of crypto games, the user experience of starting to play needs to be seamless, closer to traditional games. Allows users to play the game first without launching a MetaMask wallet. If the game is attractive enough, users will have a deeper understanding of blockchain games.

Monetization:

The sustainable development model in the encryption field is roughly pay-to-play, staking and free-to-play. The simplest sustainable game structure would be a free-to-play game with built-in payment features to help players complete the game's quests, while also allowing players to fight (and stake in-game) against other players in PvP-style matches.

Income opportunities this way are:

Sell NFTs (for new characters);

Earnings in the betting pool.

Token economy:

Token economy:

This is not just for games, basically any encryption protocol now needs to find a net profit business model (including Token emissions).

The most sustainable way to achieve this in the game is to choose a stablecoin or ETH as the token for the transaction in the game, and all project benefits are distributed to token holders.

At the beginning of the game, maintain a certain token inflation space to encourage game usage and player retention.

secondary title

Summarize

Summarize

A quick look at the current gaming landscape reveals that only a handful of projects seem to be moving towards this "sustainable" game model. So far, blockchain games have always adhered to the principle of earning first and playing later. In order to promote more users to accept blockchain games, this theme will have to change.