2022 Q2 Encryption Market Investment and Financing Report: GameFi has become an investment keyword

Produced | Odaily (ID: o-daily)

Editor | Hao Fangzhou

Produced | Odaily (ID: o-daily)

The cryptocurrency market experienced large fluctuations in the second quarter.

At the macro level, the Federal Reserve has decided to raise interest rates by 75 basis points to 1.75%. In the context of interest rate hikes, investors' trading sentiment has been frustrated, and they are likely to sell risky assets before the economy slows down, which also brings bearish sentiment to the encryption market.

From the perspective of the encryption market itself, the collapse of Luna in May and the unanchoring of UST not only brought the narrative of algorithmic stablecoins into a dead end, but also brought a series of chain reactions. In the case of a sharp drop in currency prices, a large number of mortgage assets of institutions are facing liquidation, and the lending market has shrunk sharply. Sanjian, Celsius, Jump, Hashed, Delphi and other institutions have suffered heavy losses, and some CeFi platforms are also facing user redemption pressure.

From a numerical point of view, the entire DeFi TVL has plummeted from more than US$240 billion to the current US$72 billion, a loss of 70%. The performance of the NFT market was also unsatisfactory, with the market value falling from $35 billion at the beginning of the year to $22.3 billion, a drop of 36%. In terms of GameFi, Axie Infinity, the former king of P2E chain games, its game token AXS has fallen by 92% from the highest point.

It can be said that in the second quarter of 2022, the encryption market is in chaos.

However, although the secondary market has repeatedly hit new lows, investment trends and themes in the primary market are taking shape. Established institutions and new investors are quickly entering the market, looking for the best investment opportunities in various vertical fields. The primary market is often in ambush in hot spots before the secondary market, which also indicates the investment trend of the secondary market after a period of "time difference". Therefore, grasping the investment and financing situation in the primary market is equivalent to planning ahead for future investment in the secondary market.

Looking back at the investment and financing activities in the primary market in Q2, Odaily found that:

The number of financing in Q2 was 511, and the number of transactions exceeding US$100 million reached 28;

Encrypted financial service providers are closely connected with the traditional financial industry, and continue to innovate in areas such as custody, settlement, and payment, so they have received more attention from capital;

From the perspective of the amount and amount of financing, GameFi is the preferred theme for the layout of major investment institutions;

In the Q2 quarter, 11 institutions participated in more than 10 investments;

Animoca Brands participated in 41 investments, making it the institution with the most investment projects;

The layout of traditional institutions and enterprises in Web3 is more inclined to transaction payment, Metaverse and DAO.

first level title

The number of financings in Q2 was 511, with a total disclosed amount of US$12.713 billion

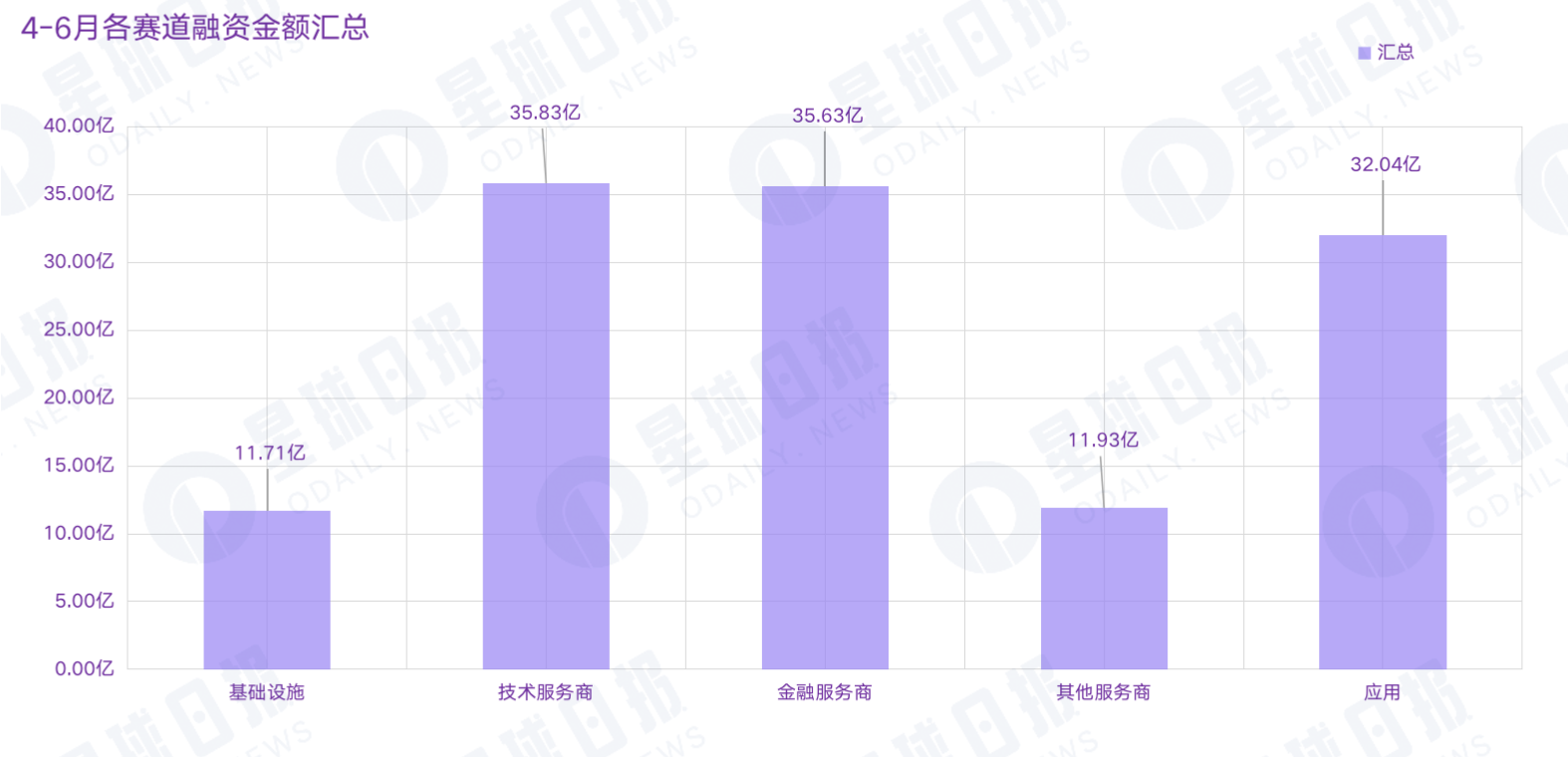

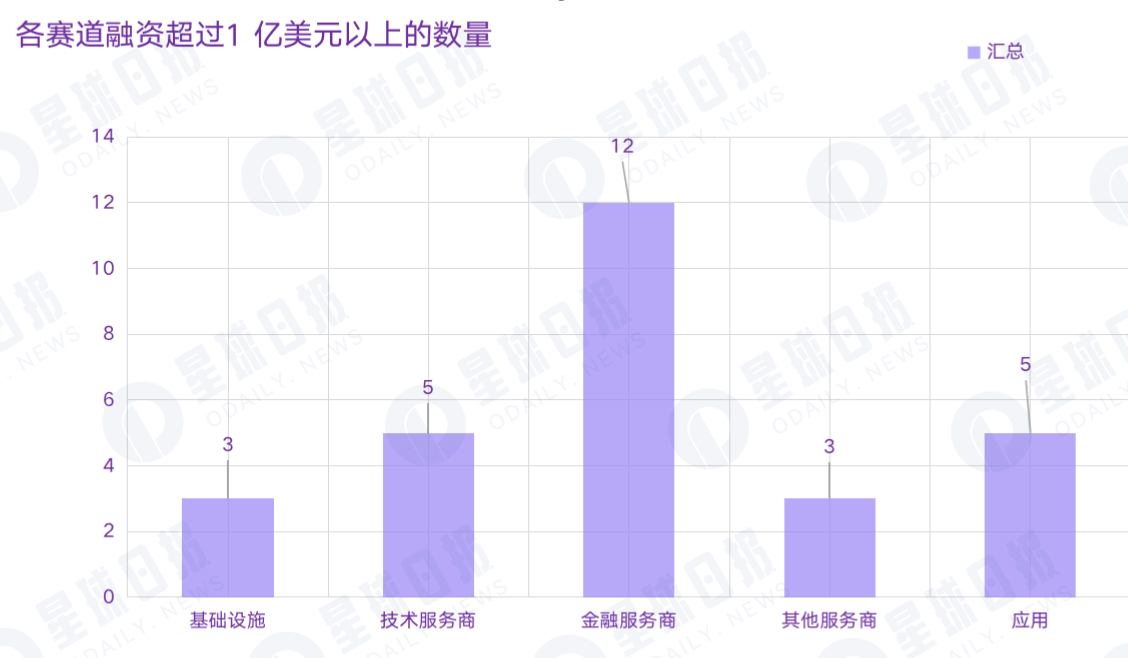

According to incomplete statistics from Odaily, a total of 511 investment and financing events (excluding fund raising and mergers and acquisitions) occurred in the global encryption market from April to June 2022, with a total disclosed amount of 12.71 billion US dollars, concentrated in infrastructure and technology service providers , financial service providers, applications and other service provider tracks, among which the technology service provider track received the largest amount of financing, which was 3.583 billion US dollars.

Among all financing events, the number of transactions with a financing size of more than US$100 million reached 28. Among them, there are 3 deals in the infrastructure track, 5 deals in the technology service provider track, 12 deals in the financial service provider track, 3 deals in the other service provider track, and 5 deals in the application track.

According to the blockchain report for the first quarter of 2022 released by CB Insights, the financing scale of the blockchain industry reached US$9.2 billion in the first quarter of this year, and the number of blockchain investment and financing transactions totaled 461, of which the financing scale exceeded US$100 million. There are 28 transactions in total.

first level title

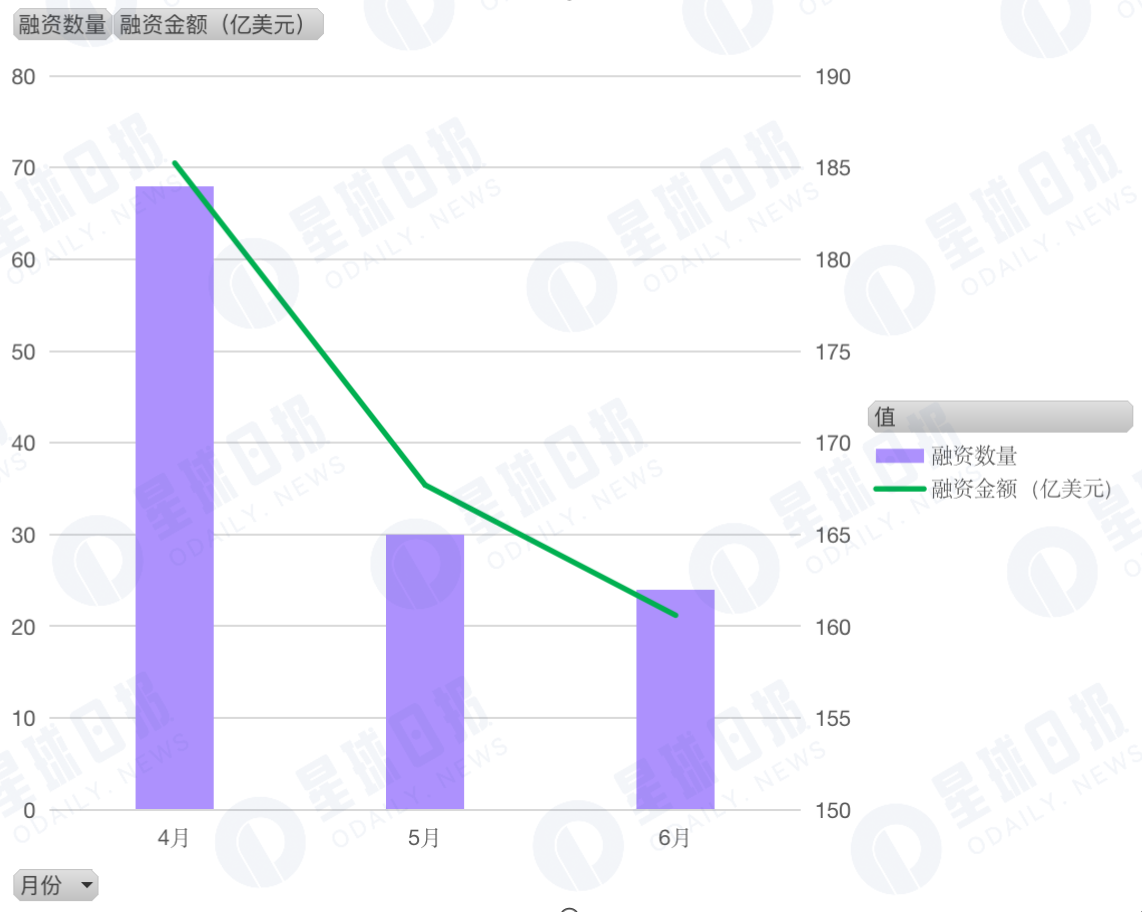

Affected by the secondary market, financing activity dropped sharply in May and June

first level title

GameFi and NFT are more favored by capital

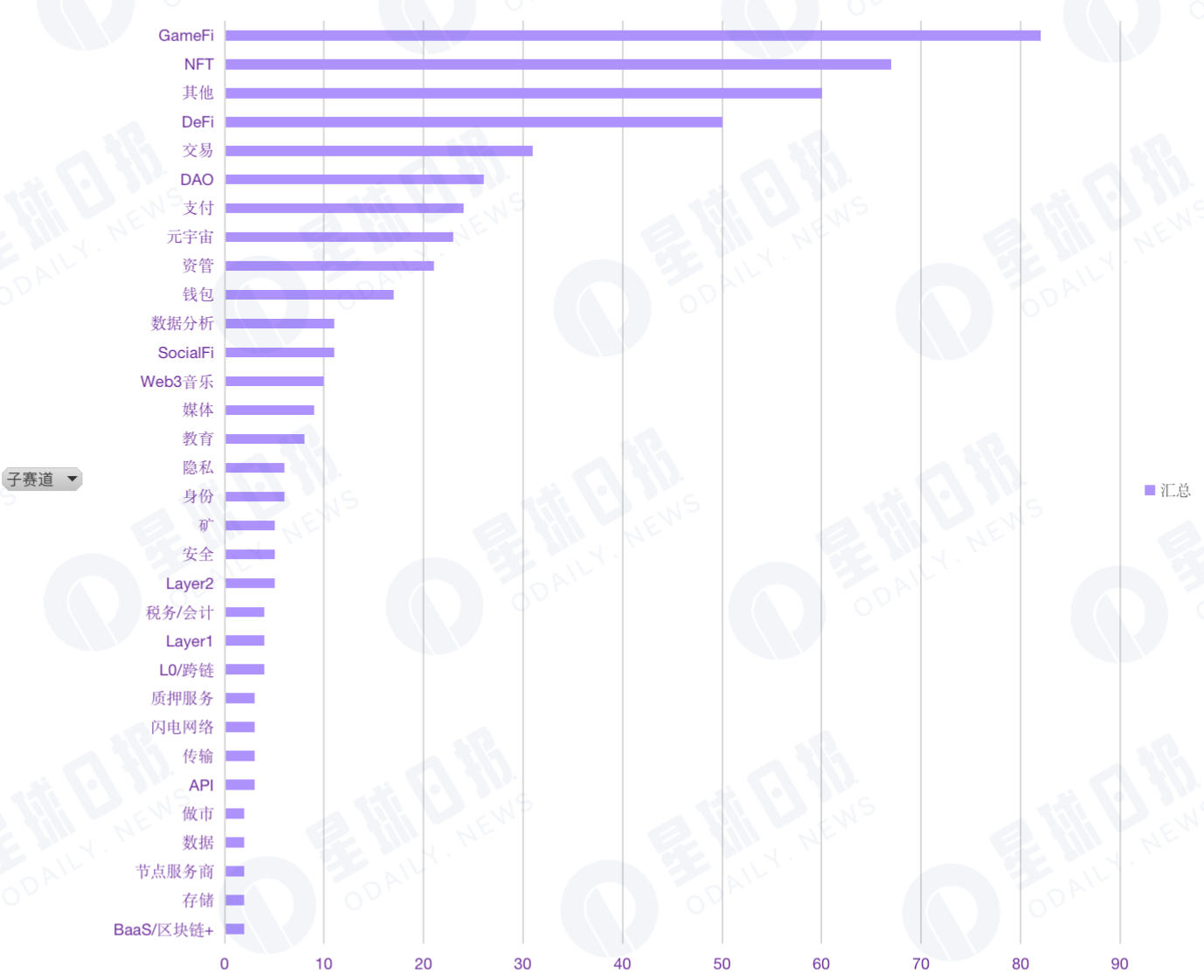

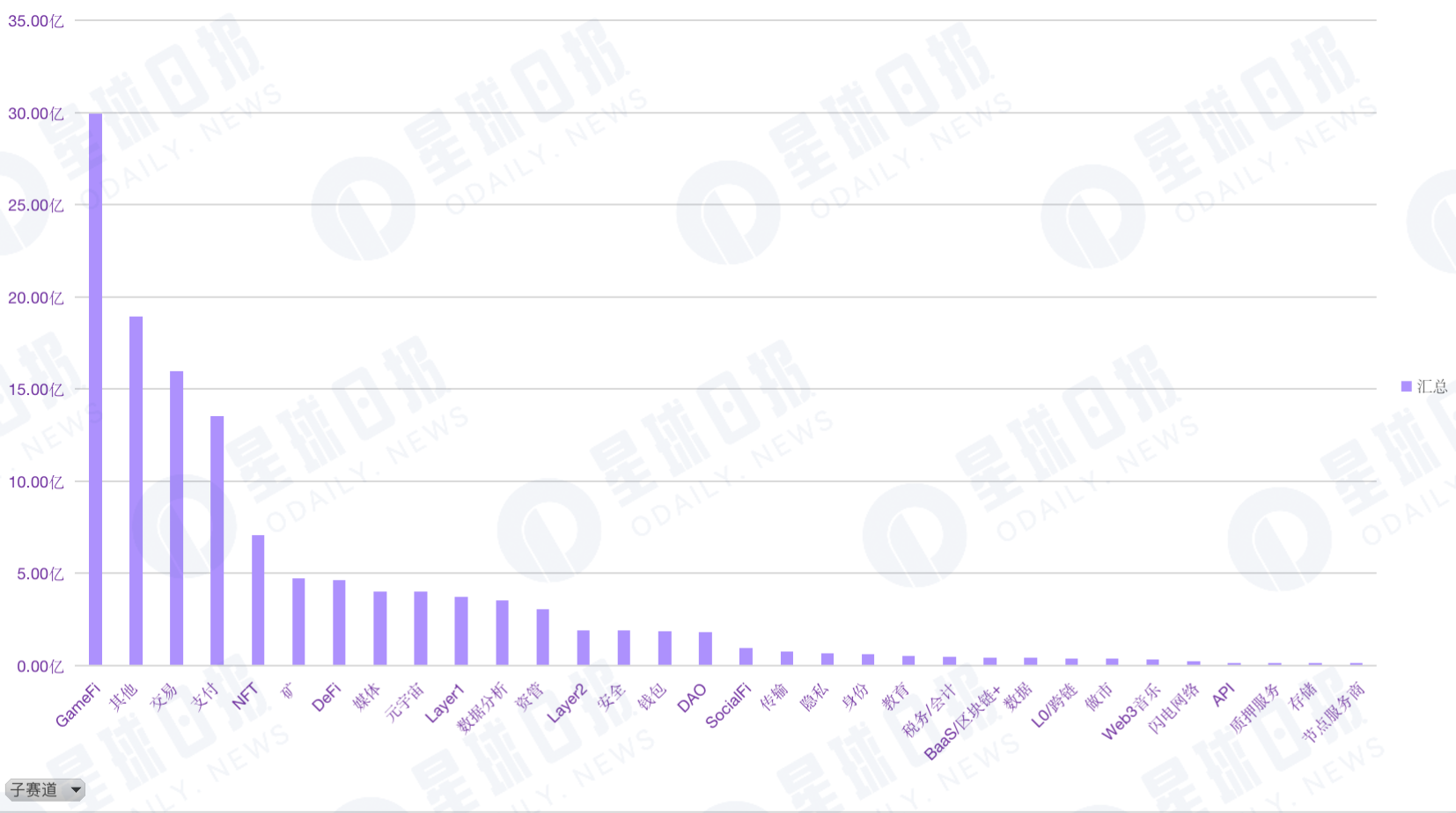

Judging from the distribution of sub-track financing, GameFi's related application scenarios, infrastructure and technical solutions have attracted the attention and layout of many large institutions, and it is also the track most favored by capital parties. It has received a total of 82 financings. Accounting for 16% of the total financing, ranking first. Among them, there are 9 investments in GameFi technical services.

Although GameFi has a large number of capital projects after the short-term prosperity, which gives people the illusion of "flash in the pan", but from the perspective of financing, the heavy investment in GameFi applications and infrastructure also indicates that capital still has a high investment in GameFi. expect.

Also favored by capital is the NFT track, which has received a total of 67 financings, ranking second. As the NFT market continues to expand, its ecosystem is also constantly improving. Especially when NFT is combined with IP incubation and copyright commercialization, NFT has also become an important means of institutional brand marketing and external publicity. And since the outbreak of digital collections, consumers have become more and more accepting of digital collections, a new collection method, and NFT is also ushering in a period of accelerated development.

In addition, the financing news of other sub-tracks is also very active, with a total of 60 transactions, ranking third. This category includes incubation, consulting, marketing, technology development platforms, on-chain monitoring, carbon credits, point rewards and other fields. It can also be seen a positive and obvious feature: investment institutions are actively expanding new directions, constantly expanding the usage scenarios of Web3 and the dialogue opportunities with end users.

Judging from the financing amount of sub-tracks, GameFi’s financing amount is far ahead, as high as 2.996 billion US dollars, accounting for 23.5% of the total industry financing. The transaction and payment fields also performed well, ranking third and fourth with USD 1.6 billion and USD 1.353 billion respectively, while technical services such as on-chain storage, data, and chain reform received less attention.

In addition, before the upgrade of Ethereum, Layer 2 was considered to be the main way to achieve faster transaction speed and greater transaction throughput without sacrificing decentralization and security. Therefore, the Layer 2 field has been highly anticipated. However, according to the data, the financing performance of Layer 2 in this quarter was not satisfactory. Only 5 projects were invested, and the investment amount was 190 million US dollars.

first level title

The largest single investment amount is 2 billion US dollars (Epic Games)

When a large amount of funds poured into the market, the valuation of leading projects was also continuously raised, and the highest single financing record in the industry was repeatedly broken. According to specific tracks, the projects with the largest single investment amount in each vertical field are as follows:

In the infrastructure track, in the mining field, Crusoe Energy, a start-up company focused on bitcoin mining business, completed a US$350 million financing led by G2 Venture Partners.

Technology service provider circuit, in the field of GameFi, game developer Epic Games completed a financing of US$2 billion at a valuation of US$31.5 billion to build the Metaverse, which is currently the largest single financing in the encryption market. (Odaily Note: Strictly speaking, Epic Games is still a traditional game technology service track. It is not clear whether blockchain and cryptocurrency (including NFT) will play a role in its plan.)

As a financial service provider, Circle, the USDC issuer, has completed a financing of US$400 million and continues to work hard to promote the transformation of the global economy.

For other service provider tracks, football media start-up OneFootball completed a US$300 million D round of financing and established a new joint venture OneFootball Labs with Animoca Brands and Liberty City Ventures to explore the development of sports + NFT.

first level title

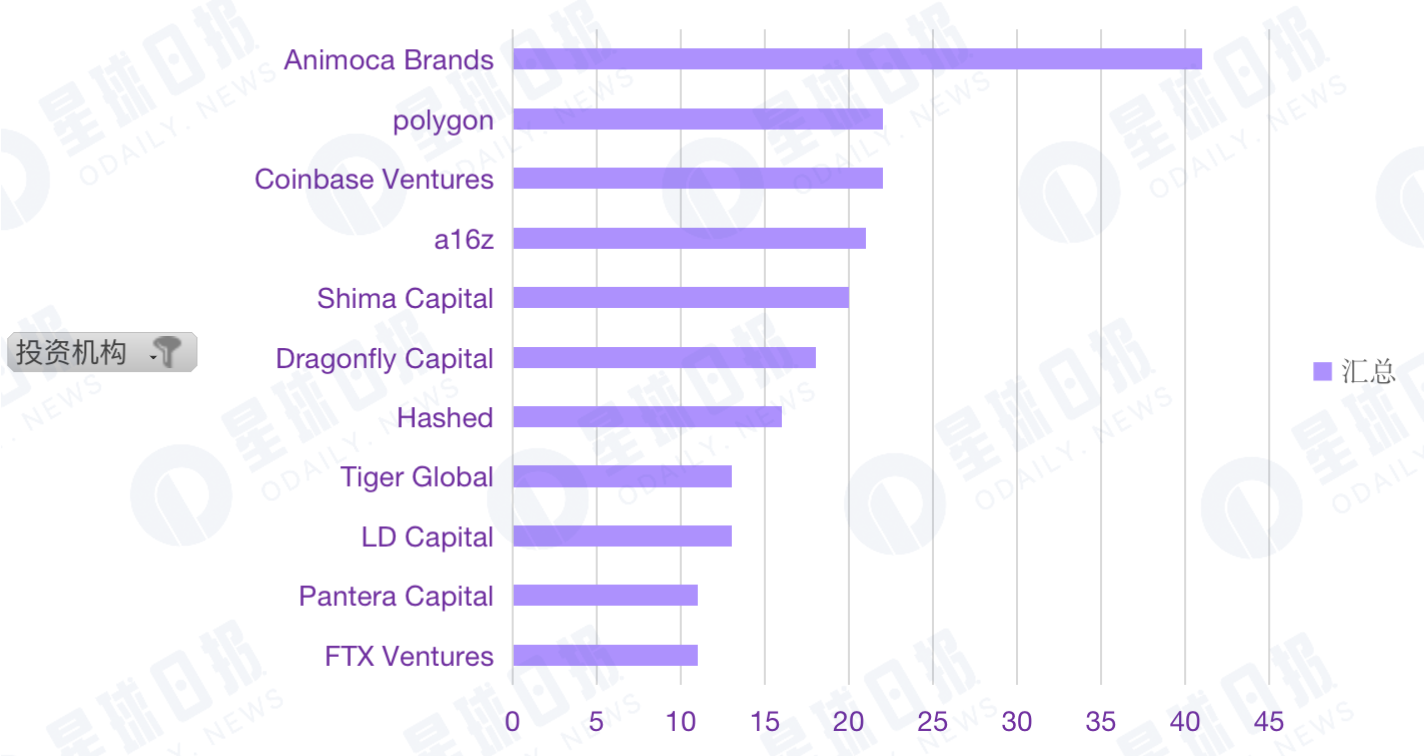

There are 11 institutions with more than 10 shots

As the amount of financing increases, the pattern of investment institutions is also changing. In the Q2 quarter, a total of 11 institutions made more than 10 investments, of which Animoca Brands participated in 41 investments, ranking first. Other investment institutions included Polygon 22, Coinbase Ventures 22, a16z 21, Shima Capital 20, Dragonfly Capital 18 pens, Hashed 16 pens, Tiger Global 13 pens, LD Capital 13 pens, FTX Ventures 11 pens, Pantera Capital 11 pens.

It is worth noting that Polygon, as a new competitive ecology, has accelerated its investment layout in first-level projects, and is relatively optimistic about payment, GameFi and DAO tracks.

In addition, in Q2, many traditional institutions and enterprises participated in the financing of the encryption market, including Tencent, Softbank, Fidelity International, BlackRock, Goldman Sachs, Sequoia Capital, etc. Their investment areas are mainly concentrated in transaction payment, metaverse and DAO is more inclined to areas with strong compliance.