Chainalysis: Decentralize's DAO is not so decentralized

Original compilation: Aididiao

Original compilation: Aididiao

Decentralized Autonomous Organization (DAO) is the main organizational mode of operation in the Web3 era. DAO based on the Internet and blockchain technology provides a unique democratized management structure for enterprises, projects and communities, any member of which can participate in governance by purchasing governance tokens to vote on decisions.

The way a DAO works can be summarized as follows:

DAO founders create governance tokens;

Distribute governance tokens to users, supporters and other stakeholders;

Each governance token corresponds to a certain number of voting rights, and governance tokens can be bought and sold in the secondary market.

While this process is considered a form of decentralization, data suggests that DAO ownership is highly centralized.

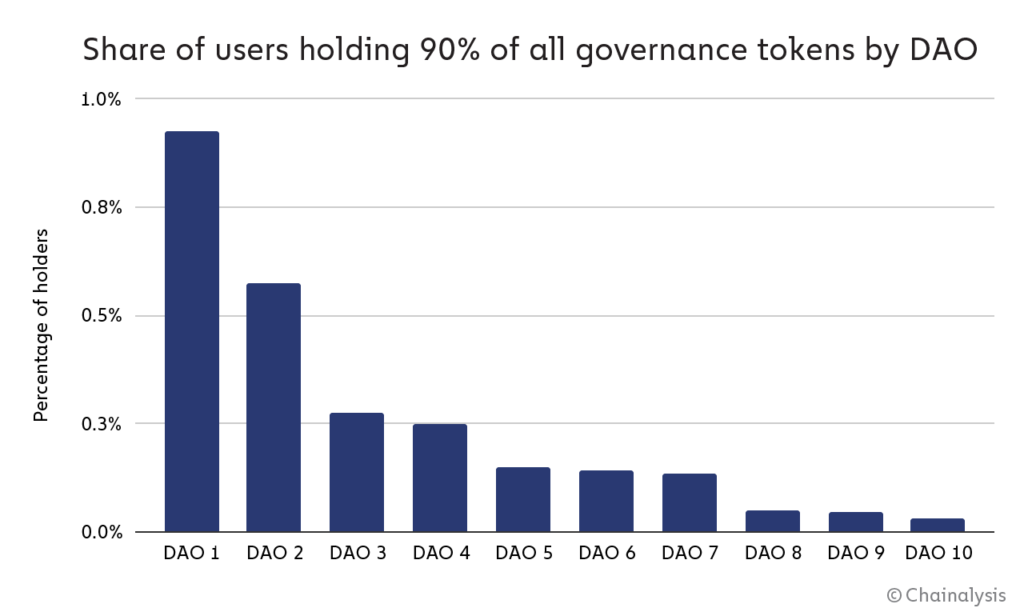

Degree of Governance Token Centralization

image description

Proportion of users holding 90% of governance tokens in DAO

The highly concentrated distribution of governance tokens has a great impact on DAO governance. If only a small number of top 1% holders initiate voting, their decision-making power will theoretically exceed the remaining 99%. Small investors may not be able to meaningfully contribute to the proposal process.

The Impact of High Centralization on DAO Governance

For governance token holders, there are three key governance steps. Voting is simple and any holder can do it, but not all holders can create and pass proposals.

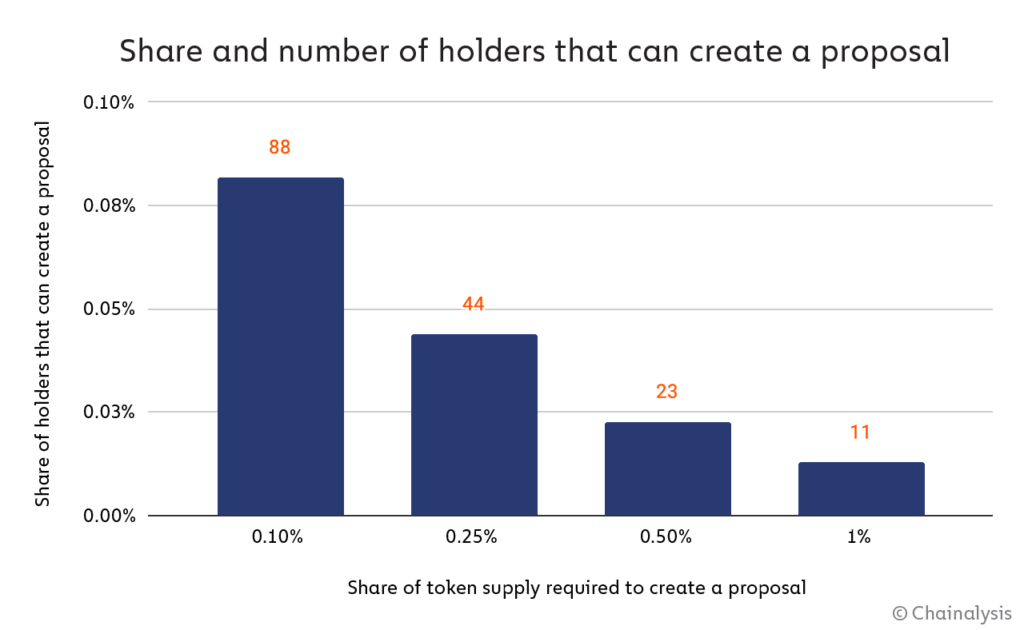

According to these ten DAO proposal requirements, it can be found that:

Users must hold between 0.1% and 1% of the token supply to create proposals.

Users must hold between 1% and 4% of the token supply for a proposal to pass.

image description

The number and proportion of holders in the DAO who can create proposals

If too many holders can create proposals, the quality of the average proposal could drop, and the DAO could become littered with governance garbage. But if too few people can create proposals, community members may question the authenticity of "decentralized governance".

When it comes to individuals creating proposals individually, it is reasonable for 1/10,000 to 1/3,000 holders to have enough tokens to complete.

Excessive concentration of voting power can lead to a decision-making process that contradicts the principles of decentralization upon which web3 was built.

image description

The proposal passed easily, with more than 1.1 million "Yes" votes to 30,000 "No" votes. However, more than 1 million of these votes came from a single user with a significant amount of governance tokens. Without the votes of ordinary participants, the proposal will fail because the participation rate is less than 1%.

The situation has sparked a backlash from the cryptocurrency community, with many questioning how platforms claiming to be decentralized are serving the interests of a few and controlling users' funds against their will. Although Solend DAO later voted down the proposal again, it will be questioned whether the DAO can act in the best collective interest of all participants when a small number of holders control a very large share of governance tokens.

How exactly is a DAO governed?

Different DAOs have very different actual governance processes. Here we use a practical case to illustrate. We start with Uniswap.

Example: Uniswap Governance

any hold Uniswap Those who govern the token UNI are members of the DAO. They can use their own addresses, or delegate voting rights to others' addresses, publish their proposals or submit their own proposals to participate in governance. Proposals vary widely, such as recent proposals,Whether to fund a donation program;Whether to integrate a new blockchainandwait.wait.

Before a proper proposal can be submitted, the first two phases must pass: the Willingness Check and the Consensus Check.

Will checks determine whether there is sufficient will in the community to change the status quo. The period is two days and the threshold is 25,000 UNI votes.

Consensus checks build formal discussions around potential proposals. The period is five days and the threshold is 50,000 UNI votes.

If both checks pass, the official governance proposal can be voted on. There will then be a seven-day deliberation period during which community members can discuss the merits of the proposal in the governance forum. After the deliberation period, if there are at least 40 million votes in favor and a minority against, the proposal will pass and will be finalized for publication within two days.

Example: Dream DAO Governance

Not all DAOs have the same governance process as Uniswap, but most operate on similar foundations, such as Snapshot's voting system and Discord chat server. Dream DAO is no exception, although its vision and governance process are unique.

Dream DAO was created by Civics Unplugged, a 501 (c)(3) charity, to provide training, funding and community to Gen Z around the world, helping Gen Z youth use Web3 to change some of the habits and thinking of the past to adapt to the future .

Holders of SkywalkerZ run the DAO community, and the SkywalkerZ NFT serves as both a governance token and a fundraising incentive for those who donate to the initiative. When donors purchase SkywalkerZ NFT, they can transfer their voting rights to future Generation Z youths, and Generation Z youths can obtain voting rights in DAO without purchasing NFTs. Buyers of the NFT can apply to join the DAO and become a voting member, or they can leave it to the Gen Z students they sponsor, either way the NFT belongs to the buyer.

By gifting NFT voting rights, the financial barriers for Generation Z to participate in the DAO governance process can be removed, allowing them to immerse themselves in Web3 and actively use blockchain technology.

Where are DAOs most common and well-funded?

DAO will become an important organizational mode of operation of web3, they manage:

Social Club:Friends With Benefits wait. Bored Ape Yacht Club ($APE) wait.

Game Guild:Good GamesGuild ($GGG) andYield Guild Games($YGG) etc.

NFT generator:Nouns(1 NFT = 1 vote).

wait.MetaCarteland Orange DAO wait.

andBig Green DAO andDreamDAOetc. (1 SkywalkerZ = 1 vote).

Chain game:Decentraland ($MANA) andSandbox($SAND) etc.

More。

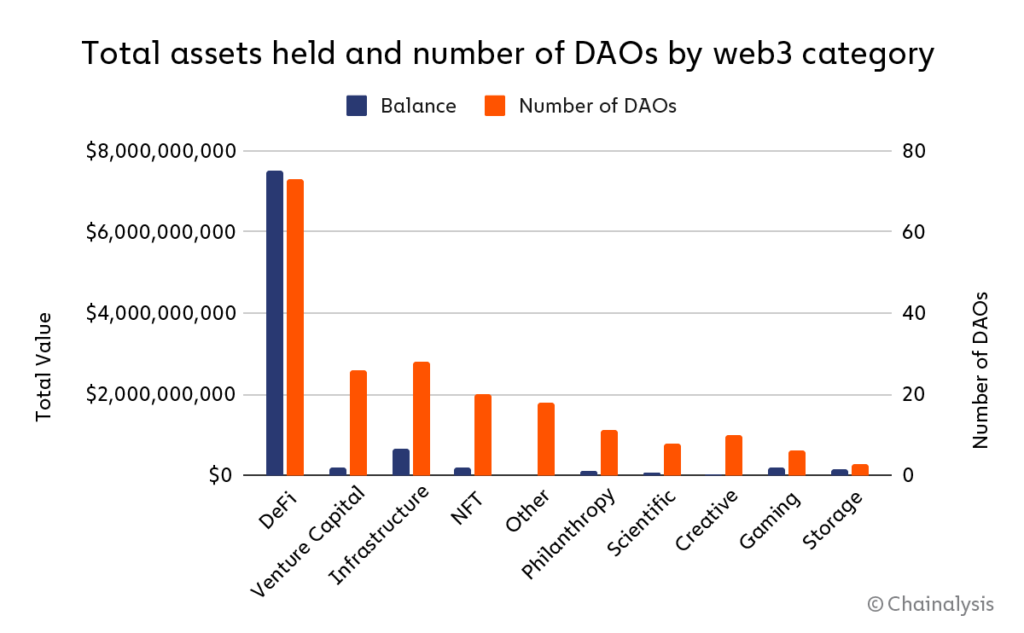

image description

Asset ratio and quantity ratio of various DAOs

DAOs focused on venture capital, infrastructure, and NFTs also had a larger share, suggesting that DAOs are attractive to investors, developers, and artists alike. But their on-chain asset value is relatively small.

The boundaries between different kinds of DAOs are blurred. Gaming DAOs are often related to NFTs, VC fund DAOs typically fund DeFi, and infrastructure DAOs support all of the above categories.

Fund Management: What assets does the DAO hold?

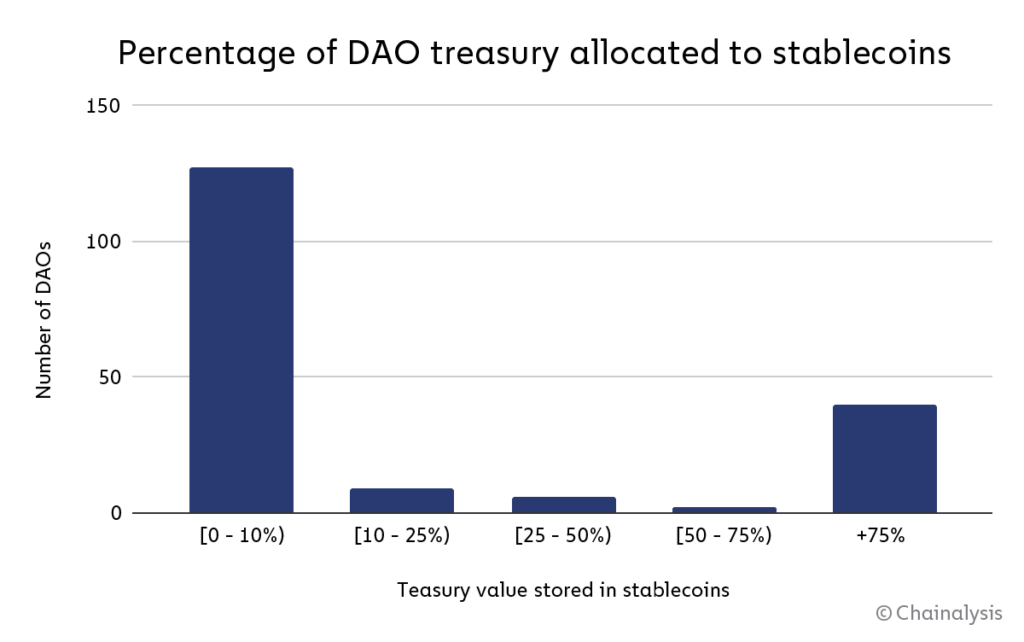

image description

Cryptocurrencies most commonly held by The DAO

image description

Distribution of the number of DAOs with different proportions of treasury stablecoins

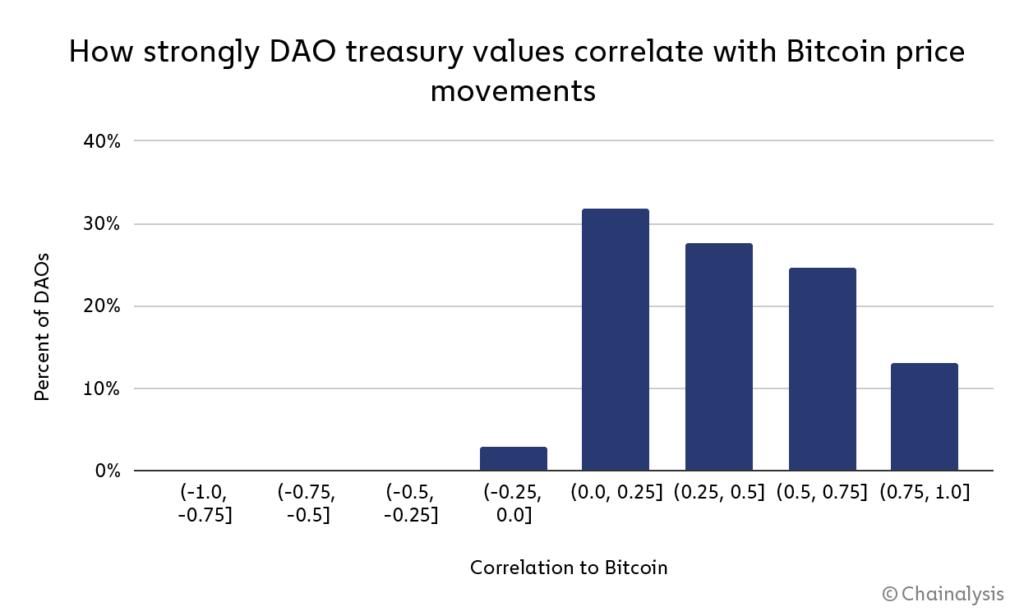

The on-chain treasury value is roughly as volatile as Bitcoin. Assuming the DAO's current holdings are their historical portfolio over the past year, we find that:

DAOs with over $1 million in assets have an average annualized volatility of 82%, compared with 69% for Bitcoin.

DAOs with over $1 million in assets have seen an average maximum retracement of 51% over the past year, compared to Bitcoin’s 72%.

image description

Correlation distribution map of DAO treasury and BTC price

One of the most interesting areas of smaller DAO money management is M&A (M&A). Mergers and acquisitions allow DAOs to move into other related areas without having to develop internal tools. As the DAO model matures, DAO mergers will become more common.

So far, the financial instruments and related laws and regulations that DAO can use are quite limited. For example, probably due to their uncertain legal status, few DAOs use loans or credits. As the DAO model matures, we may see more standardized regulations, governance strategies, and practices.

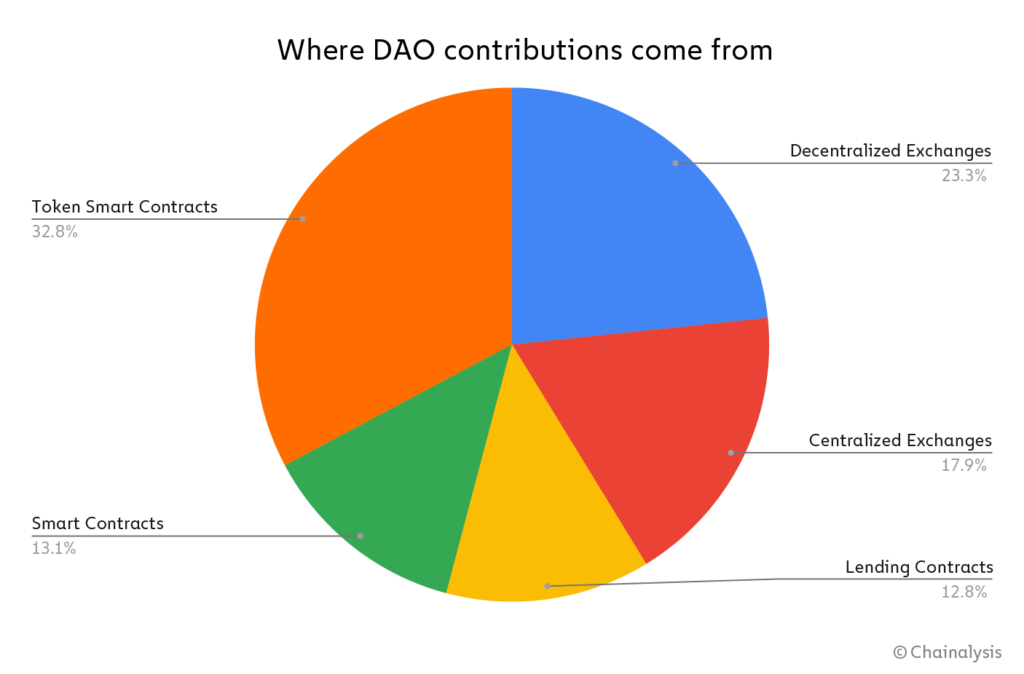

Who contributed to the DAO?

image description

Token smart contract = project specific ERC-20 or layer 1 token contract

As expected, DAO participants are power users of cryptocurrency services. Only 17.9% of the DAO treasury funds come from centralized services, and the remaining 82.1% comes from decentralized services. This shows that most DAO contributors also use DeFi platforms to host their cryptocurrencies.

The future of DAOs

Original link