IOSG Ventures: The battle between the application chain and L2 Rollup under the dYdX departure event

text

Original editor: Olivia

Original source: IOSG Ventures

TL;DR

The main reasons for dYdX to leave Starkware:The development cycle of Stark technology is long, the L2 solution Node Operator network will take time to fully decentralize, dYdX explores future composability, and the Cosmos SDK provides a friendly development soil

In addition to the considerations of transaction speed and cost, the imagination space of Lisk is also reflected in token empowerment.

Primer

New multi-chain narrative changes: High-quality applications show a weak attachment relationship to the underlying chain, while the underlying chain/network shows a strong attachment relationship to high-quality applications. In the past, applications would think about how to retain users, but now it is the public chain's turn to think about the issue of "app retention".

Primer

On June 22, dYdX announced that its v4 version will be launched as an independent blockchain based on the Cosmos SDK and Tendermint consensus, featuring a fully decentralized off-chain order book and matching engine capable of increasing throughput by orders of magnitude. Also, $DYDX is proposed as the native token of dYdX v4 (subject to community opinion). The team plans to open-source dYdX v4 by the end of 2022.

first level title

secondary title

Trading volumes in the decentralized derivatives market hit a bottleneck

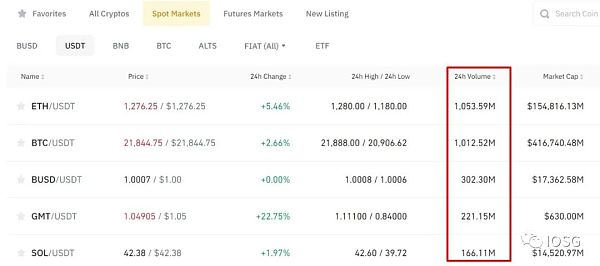

Taking Binance, the largest centralized exchange, as an example, the trading volume of its derivatives far exceeds its spot trading volume. (Taking the data of 2022.6.26, taking BTC/USDT as an example, its contract trading volume is about 8 times the spot trading volume)

Binance spot market trading volume

Binance Derivatives market trading volume

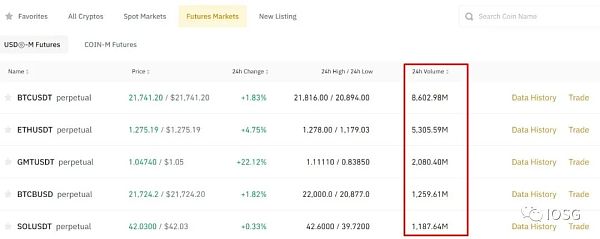

The situation in the decentralized exchange market is different. Comparing the data of spot and derivatives trading volume, Uniswap V3, the largest long-tail asset spot trading market on Ethereum, has surpassed mainstream derivatives trading protocols such as dYdX/Perpetual protocol.

This means that there is still a lot of untapped potential for on-chain decentralized derivatives. At present, the biggest obstacle to decentralized derivatives trading, that is, the reason why pro traders tend to use centralized exchanges is mainly because the infrastructure on the chain cannot support the throughput required for derivatives transactions. This is also the reason why dYdX chose starkware at the beginning - from the perspective of the protocol, the mechanism of off-chain zero-knowledge proof generation + on-chain proof can ensure the high-frequency trading requirements required by the derivatives protocol. From the perspective of users, rollup can provide Ethereum L1 fees are much lower (about $0.03 in fees per transaction).

And starkware has indeed done it. Taking advantage of its validity rollup, it has achieved real-time reporting in terms of oracle updates and separated logic/execution, which greatly improves the advantages of dydx's trading model. Compared with L1, the L2 version has leverage A huge leap from 10x to 25x has been achieved. -In fact, it is also the reason for our Long-term bullish rollup.

So since starkware has brought a lot of performance advantages to dYdX, what caused it to leave starkware?

We believe in four things:

Stark technology development cycle is long

It will take time for the L2 solution Node Operator network to be fully decentralized

dYdX's exploration of future composability

Cosmos SDK provides a developer-friendly soil

1. The development cycle of Stark technology is long

Zero-knowledge proof has always been the most difficult subject in cryptography, not just crypto. One of the biggest difficulties of zero-knowledge proof lies in the generation of zero-knowledge proof - how to translate a computational integrity (provable statement) into a verifier- The proof of friendliness has always been what the academic community has been striving to achieve. (Yes, the succinct/scalable and transparent here describe Stark, which is the underlying technology of starkware's rollup.) STark is considered to be the end of zero-knowledge proof, but it is naturally the most time-consuming and labor-intensive development at the practice level. .

When it comes to practice, it seems that the fact is the same - dYdX founder hinted that the node performance of rollup is not enough to support the required tps (throughput is crucial for orderbook)

It is very interesting that the original sentence quoted in the blog is off-chain and decentralized, but it can basically be both off-chain and decentralized only by relying on zk technology, so whether dYdX will completely break away from starkware in the future, and even return to the same zk faction zksync is also a question mark. Or go to cosmos to build a zk chain, but it is not logical.

2. It will take time for the L2 solution Node Operator network to be fully decentralized

At present, the Rollup network has the problem that the Node Operator/Sequencer is not decentralized enough, and Vitalik has also proposed some solutions, such as: sequencer auction, random selection from PoS set, DPoS voting, etc. (see: An Incomplete Guide to Rollups for details) .

This problem also exists in the Starkware network. At present, the number of sequencers is very small, and they are all deployed by starkware labs. Although this is the current general status of rollup, referring to the downtime of arbitrum sequencers some time ago, the dYdX team does not Don't worry about this very centralized sequencer setting, because it means a huge risk for both traders and the agreement that downtime occurs: traders are all profit-seeking, and once there are any security concerns, Then the user retention rate of the platform will face great challenges. Of course, in the long run, the security brought by zk rollup+Ethereum L1 is much higher than that of cosmos. But one understanding is that although such security is guaranteed, it depends entirely on starkware's face (development progress).

At the beginning of this year, dYdX expressed its determination and confidence to achieve decentralization in the roadmap outlook at the beginning of the year. This explains why dYdX did not go to another currently relatively centralized rollup solution.

3. dYdX's exploration of future composability

At present, dYdX is built on starkEx, and starkEx does not support the composability between dapps, while starkNet is a universal virtual machine, which not only allows dapps in the ecosystem to be composable, but also allows the integration of smart contracts on Ethereum L1. Interaction (currently known forms of interaction include relatively simple asset interaction), but dYdX has not yet migrated to starkNet.

In addition, with the development of defi, a series of combinable products based on the decentralized derivatives trading market, such as structured products, are new directions in the future. Naturally, dYdX does not want to because of the limitations of starkware’s current technology miss out on such an opportunity. (Currently there are some arguments that the derivatives market relies more on oracle machines to provide real-time value updates rather than composability. This theory has a certain logical support, and composability may not be as high a priority for the derivatives trading market as tps)

4. Cosmos SDK provides a friendly development soil

Tendermint is regarded by developers as a very complete set of tools for developing L1, which greatly helps developers lower the threshold for developing public chains. There are also some excellent L1s developed based on this, whether it is the relatively independent Terra or EVMOS within the cosmos ecosystem. Moreover, IBC has opened up a bridge for communication between heterogeneous chains, and established a foundation for dYdX to use btc as collateral on the cosmos chain in the future.

image description

Clearly pointed out its needs for customized nodes in the blog published earlier

Moreover, from the perspective of token value capture, the value positioning of L1 tokens far exceeds the value positioning of a dapp. At the same time, nodes can capture a large amount of mev value, and these mev values are all captured in the L2 economic model. Captured by starkware's native node, it has no value for dYdX tokens.

Another possible reason:The original sense of belonging to the starkware ecology is not strong

Cairo and solidity are two completely different programming languages, and there is no interoperability in logic (one is mainly for writing ZK circuits, the other is for writing smart contracts, the status quo is to attract more developers starkware has created a third-party compiler, It can help complete the compilation from solidity to cairo), and at that time, starkware labs basically helped dYdX complete the writing of the entire cairo code (cairo is the language developed by starkware itself). Therefore, from the perspective of the project party, there is not much sense of belonging to the language and even the ecology.

image description

Image source: https://finematics.com/yearn-vaults-eth-vault-explained/

In addition to the first-mover advantage, the strong gravity of Ethereum lies in its "combinability" and "network externalities".

Composability is a system design principle that deals with the interrelationships between components.A highly composable system provides components that are optional and can be combined in various ways to meet specific user requirements.

Different from the walled gardens established by traditional Web2 oligarchs, composability endows the core innovation of DeFi.For example, yield aggregation protocols like Yearn rely on complex composability (borrowing, liquidity mining, yield farming, etc.) to build strategies that optimize capital efficiency. Imagine that if these agreements are distributed on different chains, the complexity and risk of the strategy will increase exponentially.

The main product of dYdX is a perpetual contract platform, and its external dependence is limited to price feeds from oracles.We can think of the composability use case of dYdX is that some derivatives aggregators will appear in the future, based on some existing derivatives DEX to build structured products, such as using dYdX’s order book to launch new products, just like Perpetual Protocol refers to Uniswap The transaction information is the same. However, composability is not integral to dYdX compared to yield aggregators such as Yearn, or more basic lending protocols and DEXs.

Network externality means that the utility each user gets from using a product is positively related to the total number of users.same,

same,Considering transaction depth and slippage, dYdX itself has network externalities, and the more users there are, the better depth and low slippage it will bring; but it does not rely on the network externalities of Ethereum.As a leading perpetual contract DEX, dYdX has accumulated a certain user base, and Trader is a relatively fixed group, which can maintain a good user retention. Therefore, it is speculated that after migrating to Cosmos, with the further optimization of transaction speed and cost, in addition to the original user migration, dYdX may gradually attract more users.

Having said that, it is precisely because of the huge volume of Ethereum that every small step forward needs to be carefully demonstrated, and the development progress is often unknown. After Vitalik proposed the "Rollup-centered Ethereum Roadmap" and "Endgame", the Ethereum roadmap has turned to focus on optimizing the base layer to serve Rollup, and proposed a new sharding scheme Danksharding (expected Will be realized in 18-24 months) and the intermediate program Proto-Danksharding (realized in 6-9 months). In the crypto world, time is money. This time is obviously too long, and the development process is still accompanied by many uncertainties.

Due to the wide and deep involvement of the general public chain, it is impossible to take too many steps too fast in upgrading and optimization, which constitutes a constraint for projects that need to be quickly updated and iterated. The application chain is more flexible. Compared with relying on the underlying chain, the project side can more freely make a fuss around the application chain.

By the same logic, games are another application scenario that does not depend on composability.The game has its own operating ecosystem, and the external requirements are often only deposits and withdrawals between systems. Moreover, user experience is the top priority of the game. If the underlying chain cannot meet the performance requirements, the game itself has the motivation to leave.

Talking about Layer 2 again, let’s look back at the basic logic of its narrative: the throughput of Ethereum itself is not enough to support large-scale applications, and poor transaction costs and speeds damage user experience. However, under the market conditions of the bear market, the gas fee and transaction speed remain in a relatively reasonable range, which weakens users' demand for Layer 2 to a certain extent.

In addition, dYdX was originally the leading native project of Ethereum, and as an application that was invested in Layer 2 in the early stage, its practice of building application chains will naturally be seen by other projects: since it can be done on Ethereum, why use it? to Layer2?first level title

Where will the application chain go in the future?

Before dYdX, some projects were already exploring the direction of application chain.

As early as June 2020, Axie Infinity proposed the idea of establishing the Ronin chain in a Medium blog post, and officially launched Ronin in February of the following year, and its peak TVL since then was close to 1.5 billion US dollars. But in April of this year, the Ronin Bridge was hacked for $625 million worth of assets.

In March of this year, DeFi Kingdoms launched the DFK Chain based on Avalanche, which is verified by Avalanche's subnet and compatible with EVM.

In addition to the considerations of transaction speed and cost, the imagination space of Lisk is also reflected in token empowerment.

Dan Elitzer, co-founder of Nascent, mentioned UNIChain’s vision in a tweet: the current cost of Uniswap users is mainly on transaction fees, Gas fees and potential MEV costs, the latter two of which are paid to Ethereum miners. If UNIChain is launched, can these two expenditures be assigned to $UNI? Although Uniswap has a TVL of more than $5 billion and occupies an absolute leading position among DEXs, the performance of $UNI has been tepid. It is indeed a good idea to realize the value capture of $UNI through the application chain.

Of course, as a DEX, Uniswap still has a lot of dependence on Ethereum. After all, most tokens are still based on the ERC-20 standard. Unless the cross-chain facilities are perfect enough, UNIChain may only stay at the conception stage.

But this idea can be extended to other protocols. The DeFi Kingdoms we mentioned above have taken the lead, further extending the use case of $JEWEL from governance tokens to gas payment on DFK Chain. Among them, 25% of the $JEWEL collected as Gas fees will be rewarded to validators, 50% will be burned, and the remaining 25% will be rewarded to the community. It can be seen that the adoption of application chain has made the project's native token have a wider space.

In addition, security is an issue that the application chain has to consider.For example, the TVL of Aave is nearly 7 times the market value of its tokens. If it breaks away from the security guarantee of Ethereum, it will bring great risks to the funds on the chain.

Therefore, for applications with strong security requirements, joining the multi-chain ecology of Polkadot or Cosmos is an option. At the same time, Polkadot and Cosmos also provide integrated security guarantees compared to the potential security risks brought about by their own chains.

Developers can develop blockchains based on Substrate. If they want to join the Polkadot ecosystem, they need to pledge DOT to participate in the auction of Polkadot parachain slots, or rent parathreads to enjoy the shared security provided by the relay chain.

first level title

Application retention problem: weak attachment of high-quality applications to the underlying platform

image description

Image source: https://www.dapp.com/dapps/

From the above figure, apart from games, there are still a few applications that have captured more than 1,000 users on Ethereum.For the application, it needs to have a certain volume and user accumulation first, and then it is more appropriate to do the application chain.For small-scale applications, many current public chains can meet their throughput requirements. For new applications, relying on the public chain can provide a certain degree of exposure and convenience (in terms of user learning costs and deposits and withdrawals). Doing application chain before a certain scale also increases unnecessary cost burden.

If the native application on Ethereum is used as an application chain, the migration cost needs to be considered—are users willing to migrate while the application is being migrated? What is the substitutability of the product on the original chain?(For example, users of Uniswap as an application chain can turn to Sushiswap.) If more application chains start to emerge in the future, the entire ecology will become fragmented compared with the original, and a good cross-chain infrastructure is also required.

Further, we jump out of the context of Ethereum and dYdX to look at the relationship between the underlying chain and the application. The best situation is: the application is backed by a powerful underlying chain and enjoys the composability it provides; and high-quality applications will also Feed back the underlying chain and bring user growth to it.

However, we thinkHigh-quality applications are weakly dependent on the underlying chain, while the underlying chain is strongly dependent on high-quality applications.First of all, in the current multi-chain structure, if the application is good enough, it is not difficult to find a foothold; secondly, the intersection point between the underlying chain and the user is mainly reflected in the application layer. The perception is only reflected in speed and cost. If there is only good infrastructure but no high-quality applications, the value of the underlying chain will not be fully reflected.

In the past, applications would think about how to do user retention. After dYdX, maybe it is time for the public chain to think about the issue of "application retention".