The real reason dYdX is moving from Ethereum to Cosmos

This article comes from BanklessThis article comes from

, the original author: Donovan Choy, compiled by Odaily translator Katie Koo.

, the original author: Donovan Choy, compiled by Odaily translator Katie Koo.

Last week, derivatives giant dYdX, one of Ethereum’s largest L2-integrated Dapps, announced plans to break away from Ethereum in the upcoming V4 release.

The new destination is a fully autonomous blockchain based on the Cosmos Byzantine consensus protocol, built using the Cosmos SDK (Software Development Kit).

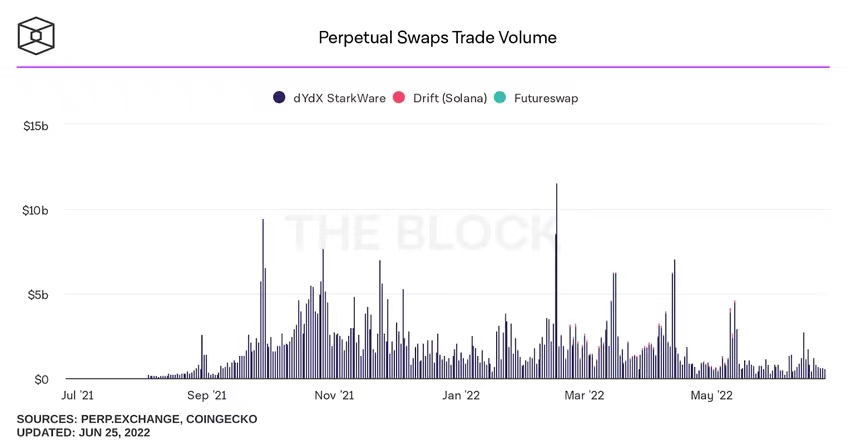

dYdX is a perpetual derivatives exchange built on Ethereum L2. dYdX offers standard spot and margin trading, but is best known for its leadership in the Perpetual Swap trading market. A perpetual contract is a synthetic trading product that allows traders to place speculative bets on the future prices of various commodities, including cryptocurrencies, commodities, ETFs and government bonds.

What does this move mean for dYdX and Ethereum?

secondary title

Reasons why dYdX “off-fan” Ethereum

For those paying attention, dYdX's de-fandom is no surprise. The protocol's founder, Antonio Juliano, hinted last November that the protocol is actively looking for other deployment points.

Unlike most DeFi DEXs that use an Automated Market Maker (AMM) model, dYdX deploys a traditional order book system that maintains outstanding trades off-chain. This setup has worked smoothly so far. But the massive growth of the protocol in recent months means it could soon be entering entirely new territory.:

As stated in its official statement, the main motivation for moving to Cosmos is to increase transaction speed while maintaining decentralization

“The fundamental problem with every L1 or L2 we can develop is that none of them can handle even close to the throughput required to run a state-of-the-art order book and matching engine. The existing dYdX product handles about 10 trades per second and 1000 trades per second order/cancellation with the goal of scaling transaction sizes to higher orders of magnitude.”

Currently, dYdX is slow and there is no existing L2 that would allow dYdX to execute orders faster while offering more reasonable fees. Also, their current StarkEx L2 setup forces them to run a centralized order book instead of decentralizing to a network of validators.

Cosmos provides an SDK that allows developers to build a sovereign blockchain with full control over its validation set, which will increase scalability by an order of magnitude:

“In dYdX V4, each validator will run an in-memory order book that never commits to consensus (i.e. off-chain). Similar to normal blockchain transactions, placing and canceling orders will be done via Network propagation, ensuring that orders placed and canceled are always propagated across the network. The order books stored by each validator eventually agree with each other.

On a real-time basis, orders will be matched together across the network. The resulting transactions are then submitted to each block on the chain. This allows dYdX V4 to have extremely high order book throughput (needing 100x higher transaction throughput) while remaining decentralized. "

NOTE: The current StarkEx setup has other drawbacks.

dYdX's current setup on StarkEx relies on a centralized sequencer. Like all Rollups currently (Starkware hinted at its plans for a future decentralized sequencer in a recent post). The current sequencer standard works, but has a large centralization effect, as only one participant can submit block batches to the Ethereum mainnet. Therefore, Cosmos sets up its own validator set, which can theoretically make the protocol decentralized.

Cosmos removes these limitations while allowing dYdX to scale in a way that maintains decentralization on the surface.

secondary title

dYdX Tradeoffs

Migrating to Cosmos as an independent L1 chain, dYdX has its own tradeoffs.

First, it needs to set up its own set of validators. This imposes significant costs on the dYdX protocol and brings new considerations to the dYdX token economy.

Unlike most chains built within Cosmos' signature hub-and-spoke model on the Cosmos cross-chain protocol IBC, dYdX's plan is to build an independent L1 public chain. This means that it will not rely on the validators in the Cosmos cross-chain protocol IBC center, but on the platform's own centrally designed validator set, although it intentionally decentralizes the validator set.

This introduces important security considerations from the user's perspective.

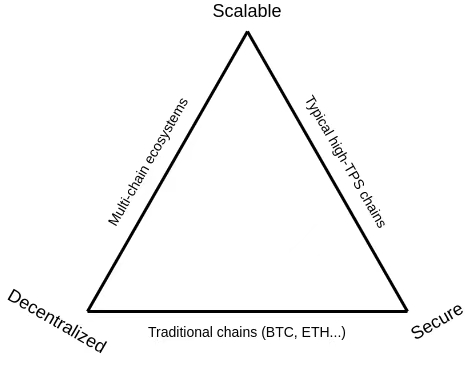

The biggest advantage of deploying on an L2 Rollup like StarkEx is that it allows for improved scalability relative to the Ethereum mainnet, while still relying on Ethereum's strong security and avoiding incurring huge costs for its own security.

If you trust the underlying base chain of Ethereum, you can have confidence in the security of transactions on dYdX. Users now need to trust a whole new set of validators on the dYdX chain. And what is the number of validators? What are the staking parameters? These are still unknowns.

On the future dYdX chain, users will pay transaction fees in DYDX tokens instead of ETH. dYdX chain validators will also be paid in DYDX, which fundamentally changes the current nature of DYDX. This creates a security cost as some form of token needs to be sent to validators, the cost of which is borne by the protocol.

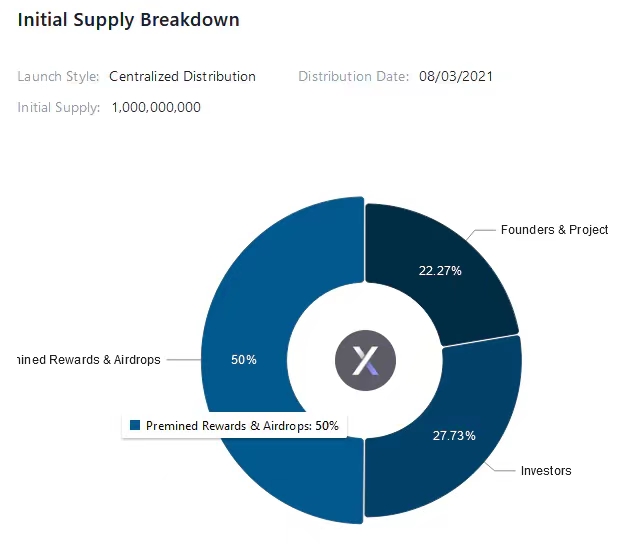

It also takes DYDX's token economy into consideration. A look at its token economy reveals that at least 50% of the native tokens are allocated to insiders.things get more complicated

. Setting it up as a new L1 chain with its own set of validators means users need to use a cross-chain bridge to log into the dYdX chain.

V God once wrote an analysis on cross-chain bridges:

If your BTC is included in the Bitcoin network, then it only relies on the security verification of the Bitcoin network. When BTC is wrapped, locked, and transferred across different chains via cross-chain bridges, the security of your BTC depends not only on the original Bitcoin network, but also on the other chains your BTC is passing through.

The security risks of cross-chain bridges are well known, and there have been a number of high-profile cross-chain bridge hacks in the past year:

Axie Infinity's Ronin Cross-Chain Bridge

Solana's Wormhole cross-chain bridge

Nearest Harmony cross-chain bridgeOf course, this is not to say that the dYdX cross-chain bridge is insecure, it is just that the dYdX cross-chain bridge introduces new attack vectors compared to staying in Ethereum.So dYdX

This is the blockchain trilemma. dYdX is decentralized and secure on Ethereum/StarkEx, but lacks scalability. The direction of development of dYdX is to sacrifice security for scalability.

secondary title

Is dYdX leaving Ethereum just for scalability?

The current transaction speed of dYdX is about 10 TPS, which is far from StarkNet's maximum transaction speed of about 100,000 TPS. It's unclear whether transaction speed is a priority.

It's not just a matter of scalability. First, Starkware charges users of its Rollup technology an undisclosed fee. With dYdX's phenomenal growth over the past year, dYdX is at liberty to interrupt undisclosed fees from an economic standpoint.

Second, there is a guess that dYdX's departure from the public chain is based on legal requirements. So far, dYdX has been very cautious about regulatory issues in the US, as its services are not available to US residents.

As an exchange that handles billions of dollars in daily trading volume, moving to its own public chain would create better regulatory outcomes than the current setup. Having a decentralized set of validators on a new chain would prevent regulators from labeling the platform as running a “centralized exchange.”

secondary title

Is centralization better suited for certain platforms?dYdX may prioritize control issues and end results over its on-chain.

Despite dYdX’s high transaction volume, most of it is controlled by whales. For dYdX, code is law, and complete decentralization is not a priority for users.

Is this bearish/bullish on dYdX, Starknet, Cosmos or Ethereum? Finally, how will this affect the growth of dYdX?