Hashed Research: Starting from the price performance of token airdrops, talk about the future airdrop model

Original title: "We need to rethink Airdrops next cycle…》

Original author: cpt n3mo, Hashed Research

Original compilation: Biscuit, chain catcher

Original compilation: Biscuit, chain catcher

Airdrops help projects distribute tokens to community users and may be part of a marketing plan to increase user awareness of their core product or a new product.

Users usually receive airdrops when the protocol is about to go online or during a retroactive period after using the protocol. They do not need to spend money but must meet certain criteria to be eligible to receive them.

But how much impact do these airdrops have on the project’s native token?This study looks at the growth in Uniswap ($UNI) from September 2020 to Evmos ($EVMOS) in April 2022.

Price performance of 31 different token airdrops over a year and a half.

This is not an exhaustive list of all airdrop events in that time frame, but attempts to cover as many airdrop events as possible that meet these parameters:

Native tokens and genesis airdrops are launched at the same time (for example, airdrops are not carried out after TGE)

The project has a roadmap based on Gitbook/public documentation

The project has announced its intention to reward existing users/further market its product/decentralize token supply ownership through airdrops

Airdrop tokens have been around long enough to provide meaningful data points

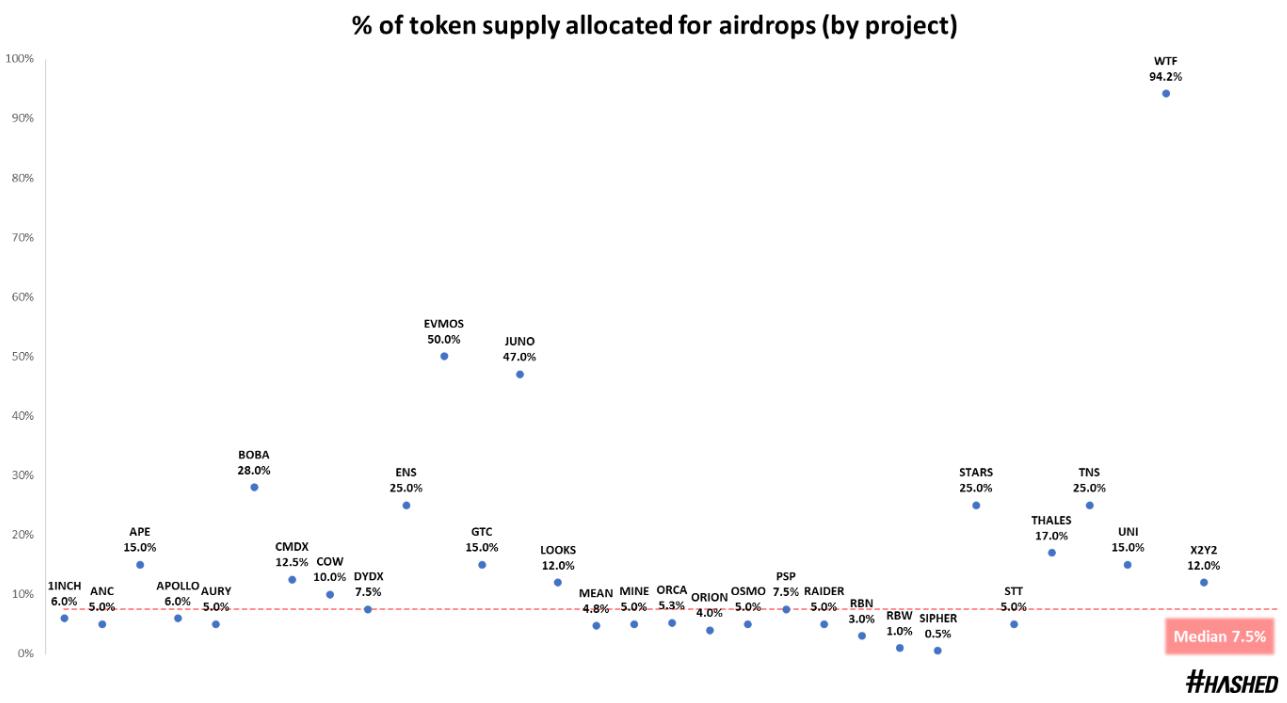

First, let's look at the distribution of the percentage of supply allocated to airdropped tokens for each project:On average, projects allocate 7.5% of their token supply to airdrops

First, let's look at the distribution of the percentage of supply allocated to airdropped tokens for each project:On average, projects allocate 7.5% of their token supply to airdrops

- Use the median calculation to prevent outlier interference.

In contrast, projects tend to allocate around 10% of the total token supply to investors and around 15% to team members, so for a project that decides to do an airdrop, leave 7.5% of the token supply is a large proportion.

first level title

So why is such a large percentage allocated for the airdrop?

Token airdrops have multiple benefits for projects:

If the project has been running for a while, airdrops are a great way to reward early adopters and community members, while incorporating token mechanics into the day-to-day governance process. (e.g. COW, DYDX, ORCA)

first level title

Price performance after token airdrop (100 days)

Although the airdrop strategy may realize the intentions of the above-mentioned project parties in the short term (such as increasing DAU, increasing TVL, new wallet interaction), the long-term incentive effect on native tokens may not be consistent.

Let’s take a look at the price performance of each token after the genesis airdrop:

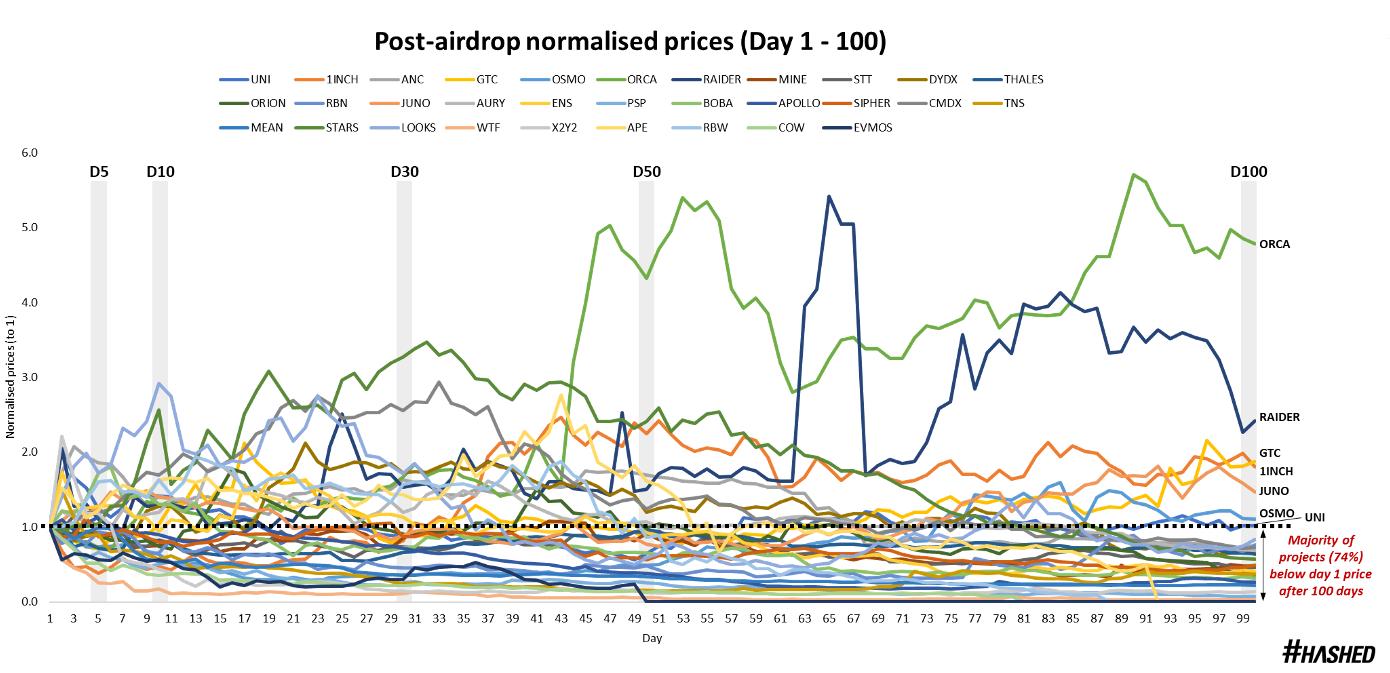

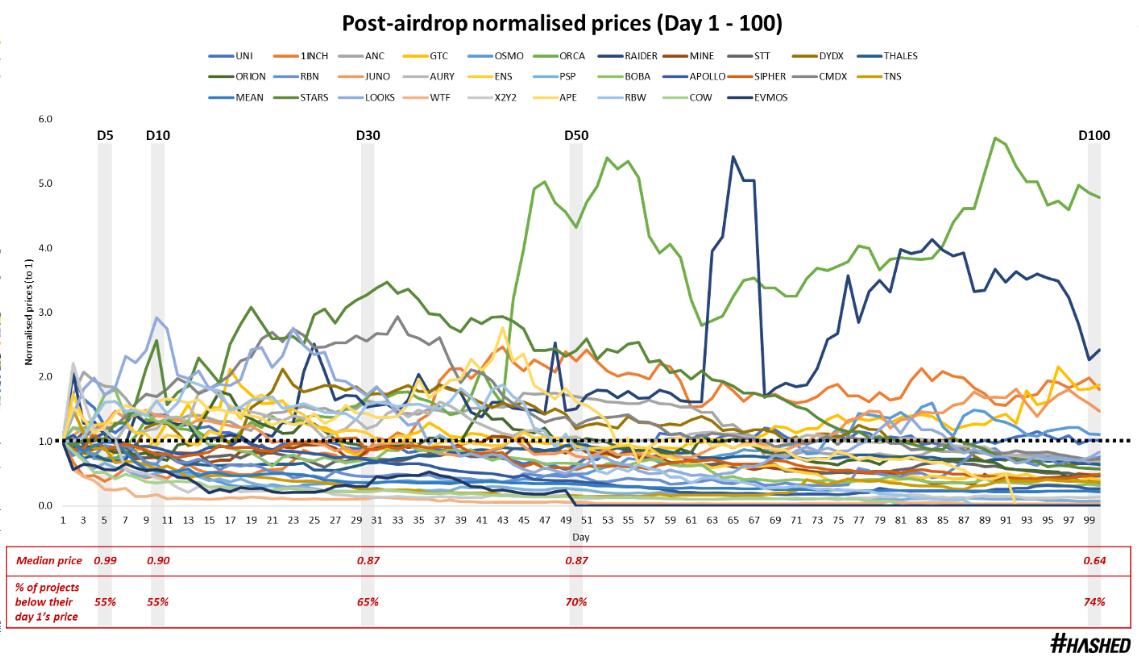

This looks like a crowded chart with token prices normalized to 1.0 (y-axis) and scaled by the number of days since each project’s genesis airdrop (x-axis).If the price of the airdrop token is 1.0 on day 1. The graph shows that after 100 days,

A whopping 74% of projects have their native tokens trading below their Day 1 price.

Only 7 projects were trading above their launch price, with $ORCA (a DEX on Solana) outperforming at 4.8x launch price and $RAIDER (a utility-based NFT RPG game) at 2.4x launch price.

Other projects — $GTC, $1INCH, $JUNO, $OSMO, and $UNI — are trading at less than 2x their issue price.

The chart below further details over time: (i) the average price performance of airdropped tokens deteriorated, and (ii) an increasing number of airdropped tokens in the sample traded below their first-day prices.

On day 5, the average price of airdropped tokens was 0.99 (-1% deviation from day 1), and 55% traded below the issue price.

On day 100, the average price of airdropped tokens was 0.64 (-36% deviation from day 1), and 74% traded below the issue price.

first level title

Price performance after token airdrop (200 days)

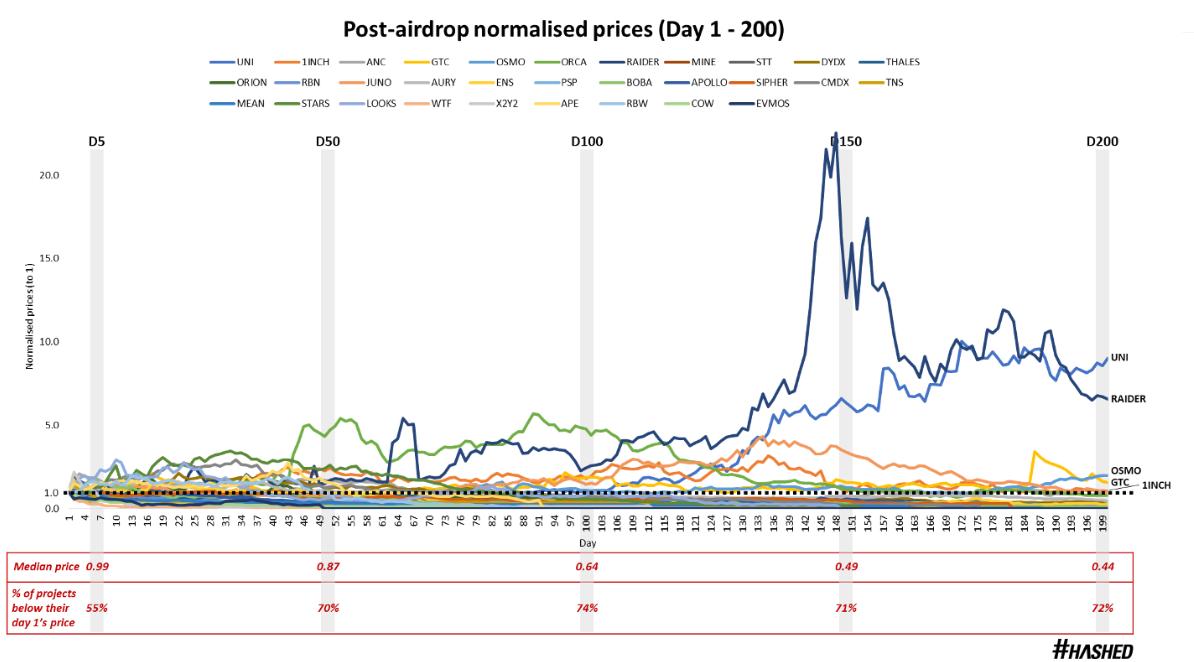

Over a longer timeframe (200 days after the airdrop), the results were no different.The chart below shows the downward trend in the price of airdrop tokens over a longer period,

The average price dropped from 0.99 on day 5 to 0.44.The average price of most projects (72%) continues to be lower than their launch price

, though a few notable projects performed well.

$UNI was released in September 2020. Compared with the second quarter of 2021 (day 200), it has become the most mainstream DEX among all public chains in terms of daily transaction volume.

Token holders can participate in governance proposals, which is a positive factor for the price of the token after the airdrop

While not shown on the chart, $UNI is currently trading at 1.5x its original airdrop price

$RAIDER took an unconventional airdrop approach in August 2021, the team kicked off with a successful NFT sale and released the first version of the P2E RPG game on Polygon a few weeks later.

By Q1 2022 (Day 200), the project has built a strong community and a large active player base, leading to $6 million in funding co-led by Delphi, DeFiance, 3AC and Polygon

Here’s why the token’s price jumped 6.5x after the token airdrop

However, the external environment of the declining crypto market has hit the crypto gaming industry the hardest, resulting in a constant decrease in its user metrics, with the current token price falling to 0.44 times its original airdrop priceWhile $UNI and $RAIDER have shown that airdropped tokens have the potential to perform well over longer time spans,

But the overall sample shows that airdrops generally do not have a favorable impact on the long-term price of tokens.

Founders want to distribute project tokens to community members participating in governance, staking, or using it.

Airdrops based on initial on-chain data or through user metrics can effectively airdrop tokens, and if there are rumors that a project is about to airdrop, it will attract many speculative airdrop hunters (eg Paraswap, Hop Protocol, Optimism).

The graph below shows the average price combination over a 200-day period for each airdropped token.

Based on historical average data, only two days in the 200-day time frame have the average price outperformed the issue price - day 4 (+1%) and day 18 (+4%).

This suggests that the best time for users to sell airdropped tokens would be as early as possible, preferably between day 1 and day 5 (red shaded area), as price fluctuations are minimal during this period.

Selling airdropped tokens as soon as possible seems to be the optimal strategy if users don’t want to participate in the project themselves or don’t like its token economics.

But in some cases, the team airdropped tokens before gaining enough traction, and users might not like the project and decide to sell airdropped tokens on the day of the airdrop. Later, when the project party improved, these users realized that they had participated in the project and owned shares.

first level title

in conclusion

in conclusion

If you are a developer/project founder, you should consider distributing tokens or raising product awareness differently than airdrops.Historically, airdrops have been detrimental to the long-term price movement of project tokens. This article does not explore the effectiveness of airdrops on other project parameters, such as user growth metrics, new wallet interactions, TVL increments, etc. But even if airdrops work in these ways,

Are you willing to take selling pressure from early airdrop holders to make this happen at the expense of token price?

Alternative Airdrop Scheme:

Release airdrops based on time (distribute airdrops linearly within 3 months, and let users apply weekly)

Issue airdrops based on tasks (allow users to issue airdrops after completing certain milestone tasks)

Airdrops are issued based on a combination of time and milestones (airdrops are issued within a specific period based on user participation in the protocol)

If you are a retail holder receiving an airdrop, the following aspects need to be considered:Is the token required to interact with this protocol?

If yes, HODL.Will selling it now make a big difference to me?

If not, HODL.