Foresight Ventures: Decentralized NFT Trading Protocol Will Beat OpenSea

Summary:

Summary:

The decentralized NFT trading protocol is to the NFT Market, just like AMM is to DEX.

The core needs in NFT transactions are liquidity and price, so the real moat of NFT exchanges should be based on the liquidity and price advantages when commodities are sold.

The aggregator that changed the pattern only solved the problem of scattered NFT pending orders as a front-end traffic entrance, but did not fundamentally solve the liquidity problem.

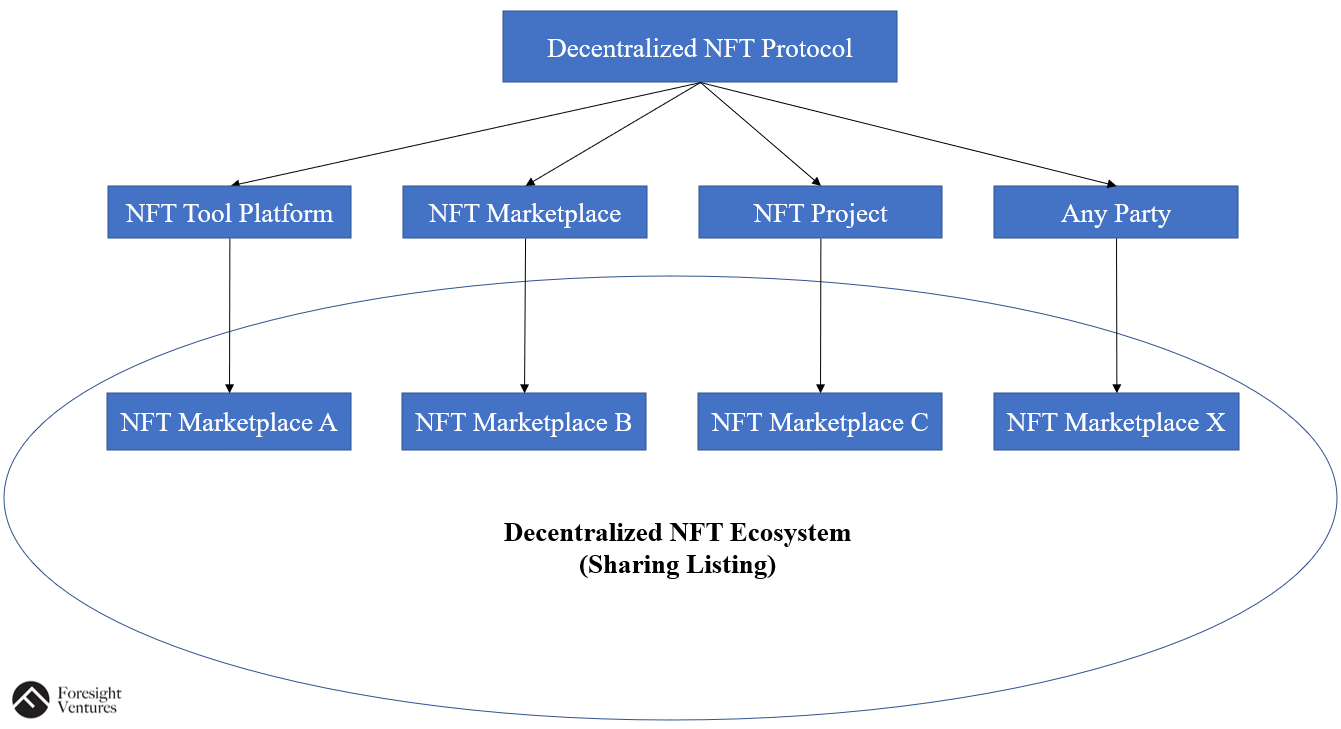

What is most likely to solve the liquidity monopoly is not the next exchange or aggregator, but a protocol that can support shared pending orders, thus breaking the boundaries between NFT tool platforms and NFT exchanges, so that every traffic front-end can become a trading platform And share its pending orders to form a decentralized NFT trading ecology and solve the problems of decentralization and liquidity of NFT pending orders.

first level title

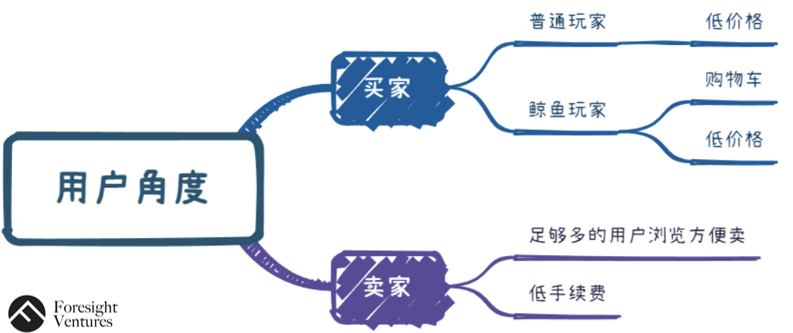

1. Market environment and user needs

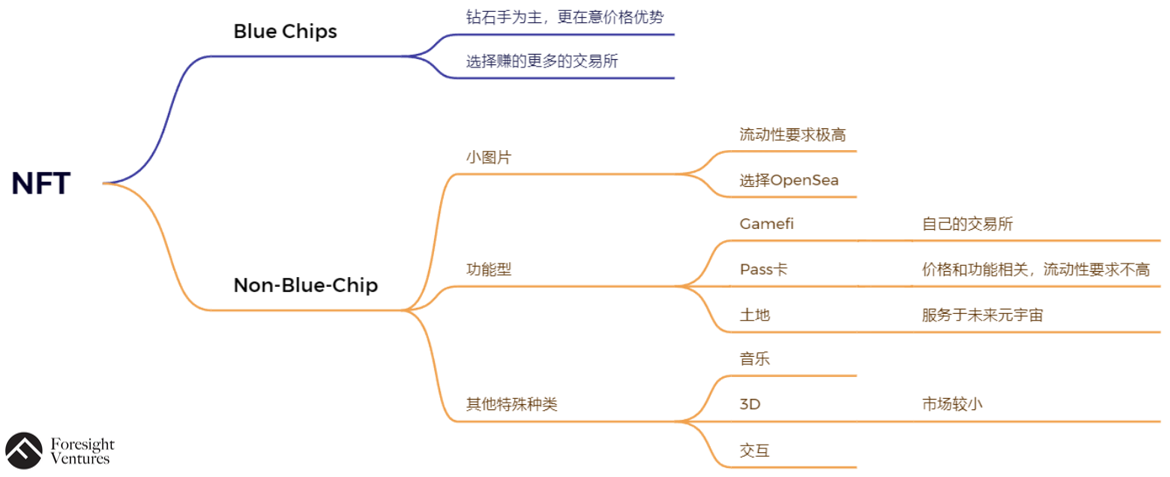

At present, NFTs in mainstream transactions can be divided into blue chips and non-blue chips, and non-blue chips can be roughly divided into three categories: PFP, functional and other special types. (Individual blue chips also belong to functional or special types)

For blue chips, due to their high prices, and most blue chip holders prefer diamond hands, so the requirements for liquidity are not so high, but the price is more important. Functional NFTs with practical application scenarios such as Pass cards and Gamefi do not have much demand for liquidity, so they are more price-oriented.However, more than 90% of the NFTs on the market are small pictures without empowerment, which are essentially a game of drumming and passing flowers.This places extremely high demands on liquidity.At this time, users will choose to use the most liquid exchange OpenSea instead of others. For other special types of NFT, there are no application scenarios and requirements for the time being, and the market is still mainly around PFP for the time being, so it is not meaningful to discuss.

first level title

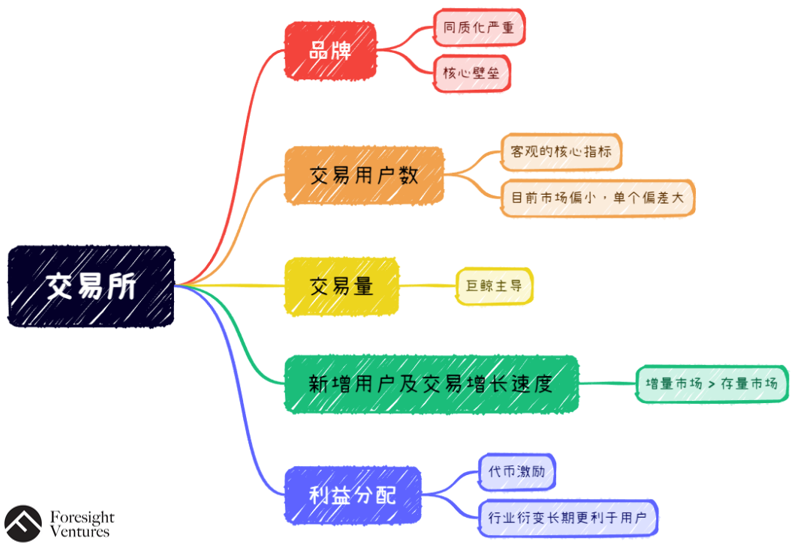

2. NFT exchange - build your own core competitive advantage to meet the demand

We need to explore what kind of exchange is excellent, and discuss it from the following five dimensions:

brand

Most exchanges are highly homogeneous, and the core barrier is the traffic brought by the first-mover advantage, forming a brand effect and a positive cycle.OpenSea uses it to attract most of the NFT market liquidity and form a moat.

Number of trading users

Trading volume

Trading volume

Users are also divided into high-quality users and non-quality users.The transaction volume contributed by high-quality users may be dozens or even hundreds of times that of ordinary users, so currently giant whales dominate the market.

New users and transaction growth rate

At present, the NFT market is still a market with obvious Matthew effect, so we can directly see the future development of the exchange by paying attention to the growth rate of new users and transaction volume.The future NFT market is a huge incremental market rather than a stock market.

profit distribution

Through the medium of tokens, all participants and platforms in the two-sided market have become a community of interests, using tokens to reasonably motivate holders, instead of cutting users and their own interests to earn more benefits like traditional platforms, can win the trust and support of users. The platform will gradually evolve into a form that is more beneficial to users, and the speed of evolution will vary according to the industry in which it is located.

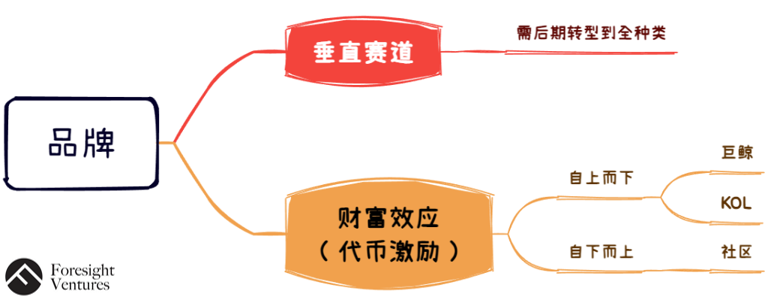

From the analysis of the above five points, we can get: At present, if the NFT exchange wants to break through, it must take the vertical track and the wealth effect.

The first-mover advantage of the brand is huge, which also makes the OS enduring, but there are still rising stars who can vertically cut into the market

At the very beginning, SuperRare’s entry point was the artist’s NFT. Its strict invitation system created a high-end brand image, while the entry point of NBA Top Shot used a dedicated group like the basketball NBA, which made it gain a lot of attention. Great exposure. But what we need to pay attention to is that if you choose a vertical track, you may only be able to establish your own core advantages on that track, which is not enough to compete with OS. In addition, the NFT world is still in its early stages.The number of users is too small to support a too narrow vertical track. **This is also the main reason why some NFT exchanges that have become popular in 2021 have disappeared.

In addition to cutting into the vertical track, another more feasible way is to use the wealth effect.

One of the characteristics of Web3 is that it can change the distribution of profits, and this is also a controversial point of the OS, unwilling to share the results with Web3 users. LooksRare launched a "vampire attack" and transaction mining model, and joined forces with giant whales and KOLs to start a top-down journey. Although it was criticized by fake transactions, it eventually robbed it of its prey; and X2Y2 also passed Launched the "vampire attack" and pending order mining mode, and joined the community to make bottom-up efforts. Although there were several twists and turns in the code, it finally succeeded in achieving good results, and even surpassed Looks recently to become the second largest transaction in the world. Place.

From the success stories of two Challenger rookies,Early incentives for C-end users are essential, either by attracting upper-level KOLs and whales to use the platform, or by attracting the bottom-level people to use the community to publicize. Both models have eventually formed a certain influence in their respective fields, rather than being limited to a certain group and The small circle eventually allowed them to gain a lot of trading volume and new users, and then slowly made the cake of the entire NFT market bigger.first level title

3. NFT tools - the inflection point that changes the competitive landscape

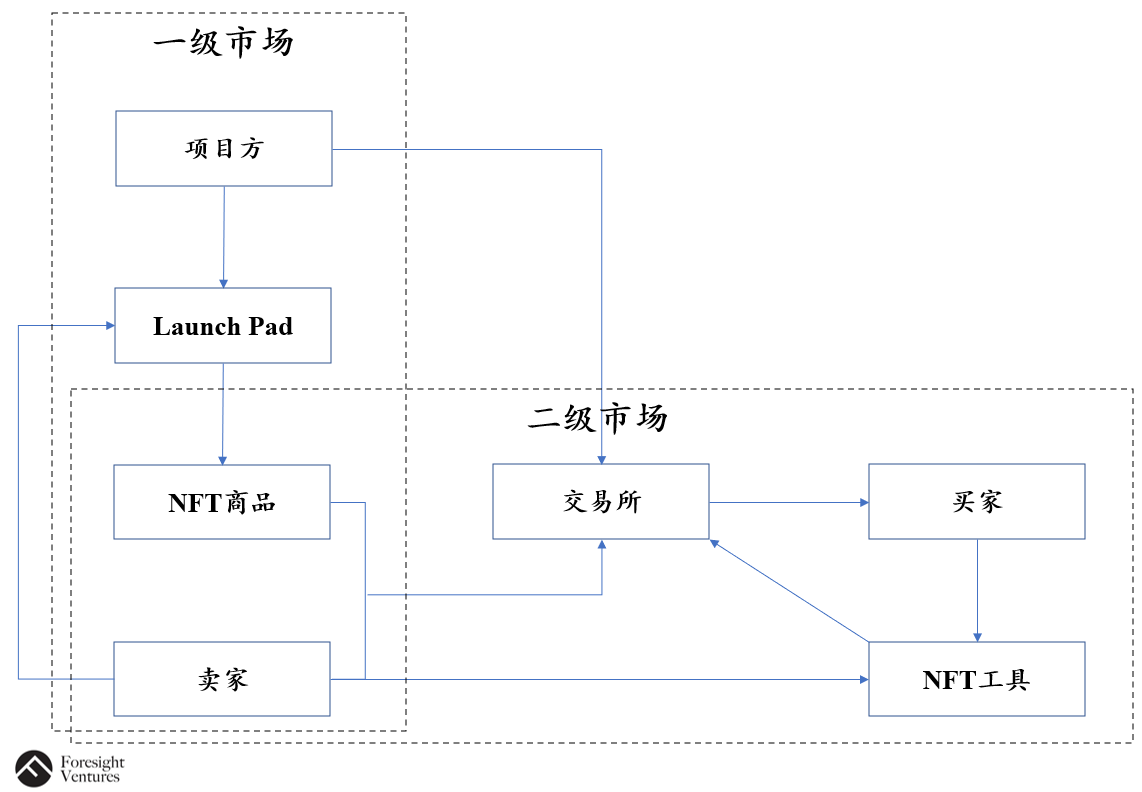

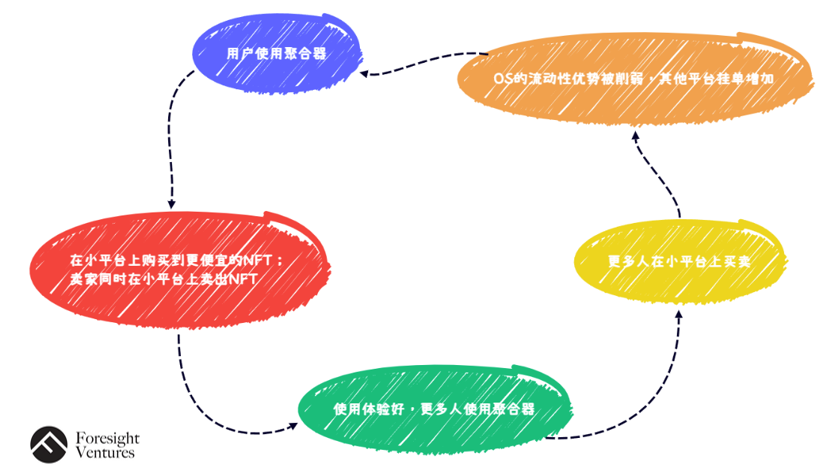

With the emergence of more NFT exchanges, NFT pending orders are scattered in various exchanges. The core appeal of users is to buy the cheapest NFT. The unexpected winner in the war changed the market pattern.

It may not be another desktop that beats the desktop, but more convenient and faster laptops and phones.

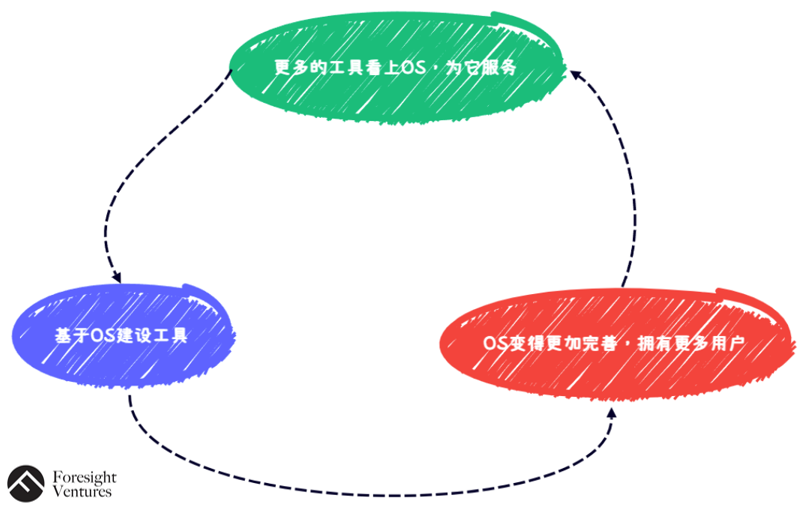

The launch of Genie and Gem meets the needs of players for multi-market shopping, making it easier for users to find the cheapest NFT faster, and forms a positive cycle with small platforms (as shown in the figure below).At this time, the exchange has become the backend for providing orders, and the aggregator is the frontend for interaction, and both sides have added users.When users buy cheaper NFTs on the aggregator, more users will come to the aggregator; users of small platforms will be more willing to use small platforms because of the increased liquidity of NFT, because they save money. With aggregators and other The number of platform users increased,The liquidity advantage brought by OS as a leading monopoly is gradually being broken, which will further accelerate the development of other platforms and aggregators.This is why the 4 platforms X2Y2 and Looks as well as Gem and Genie can achieve results.

But other established platforms, such as Rarible and Foundation, have not been so lucky.Because the timing of the birth was wrong, there was no aggregator platform that could occupy the market at that time, so that most trading platforms are short-lived or even born to die, there is no way to gather the power of everyone to fight against OS;Moreover, in the process of its own transformation, it has not successfully advanced to the whole category. The product change speed is too slow to retain users, and it will only gradually lose market share due to liquidity problems., into the "flywheel effect" of the OS. (As shown below)

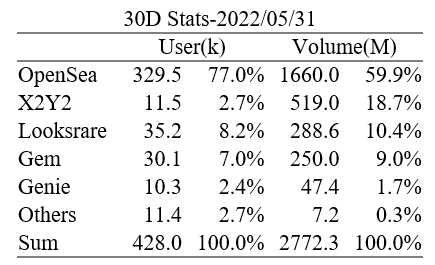

Therefore, the aggregator, a tool platform for NFT transactions, has become the new favorite of NFT users, breaking the liquidity monopoly and reshaping the competitive landscape. Under the positive cycle of aggregators, Top3 exchanges and two aggregators have already occupied 99.7% of the market share (assuming the top 10's transaction volume is the total market), and OS only accounts for 63.5% of the market share, breaking the myth of invincibility.(Note: The impact of brush trading in Looks and X2Y2 is not excluded)

Resource: 2022/5/31 https://dappradar.com/rankings/protocol/ethereum/category/marketplaces

first level title

4. Imagine the future - the possible solution for NFT transactions: a truly decentralized NFT transaction protocol

After analyzing the brand effect brought about by the liquidity monopoly, the real pain point in NFT transactions, we might as well imagine what is the solution that may subvert the future competition pattern? One of the thoughts I give here is: instead of being an upstream traffic port, it is more feasible to be an underlying protocol.

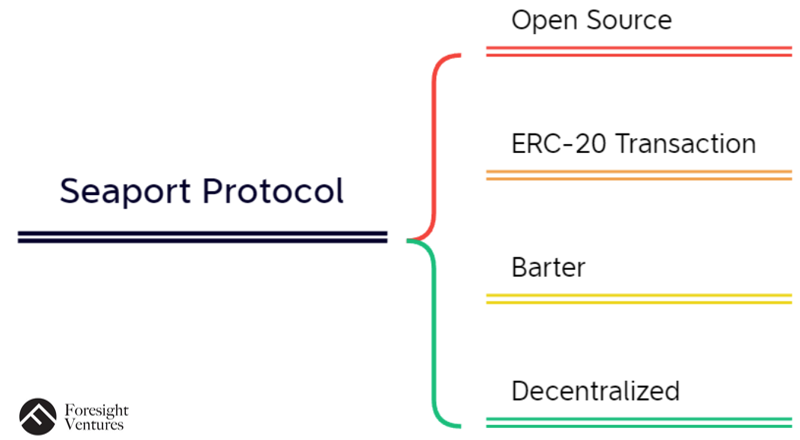

First of all, it can be seen that the market has already had this trend. The decentralized protocol Seaport Protocol officially launched by OpenSea in May 2022 intends to make the NFT trading market more decentralized. Its main features are shown in the following figure:

In essence, Seaport only lowers the threshold for NFT exchanges, enabling most platforms to easily establish NFT exchanges without being coerced by original exchanges such as OpenSea, but it does not solve the problem of NFT transaction liquidity, so Core needs remain.

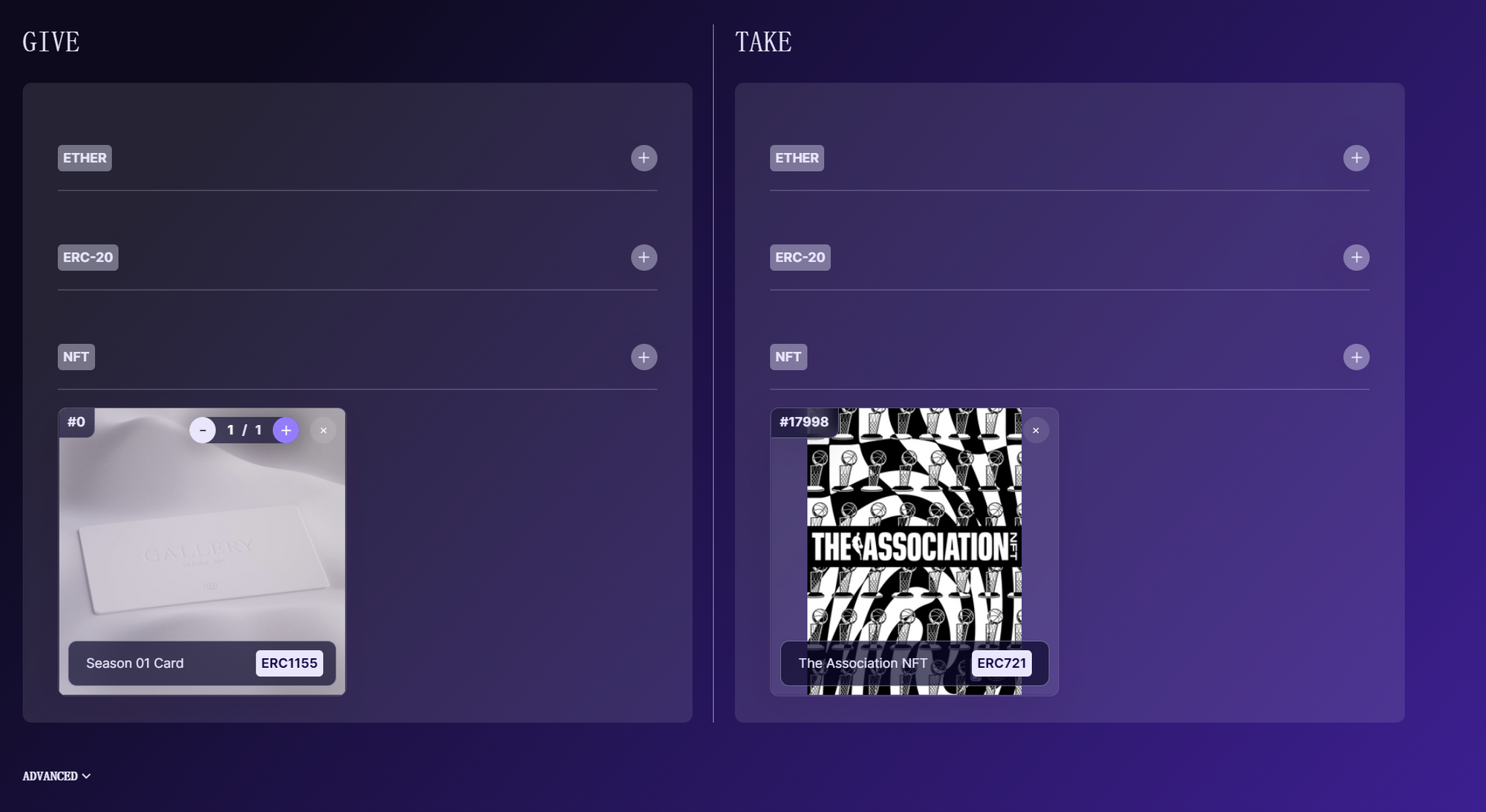

Its barter function will not make NFT, which is already poor in liquidity, more liquid, but only gives users one more choice. In fact, some platforms have already implemented this function: NFT Protocol (https://app.nft.org/ethereum) (as shown in the figure below), but its utilization rate is extremely low, and it has almost no market share, which proves that this demand is just a beautiful pseudo-demand.

The use of ERC-20 tokens is not limited to ETH payment, and there are quite a few supporters in the market, which is closer to the shopping habits of traditional users and benefits NFT newcomers.I think this is indeed an innovation, but at the technical level, the threshold is not high, and it does not have core competitiveness.Existing NFT exchanges can be iteratively updated very quickly, but the reason for not changing is more because this demand has not been verified by the market at present. (NFT Protocol also has this function, but the performance is still not good) and this also explains why the traditional currency circle exchange has not entered the picture circle smoothly——The people in the picture circle think of the ETH currency standard, and the standard of the currency circle is mostly stable coins such as USDT, which is also one of the moats of the NFT exchange itself.However, we look at NFT as an incremental market from a changing perspective. Assuming that a large number of people in the currency circle will enter the graph circle in the future, then exchanges without such a step of converting ETH will definitely be more favored by the market; plus At present, ETH is in a bear market decline, and NFT will also fall accordingly. The demand for using stablecoins for settlement is getting higher and higher, so we have a positive attitude towards this function.

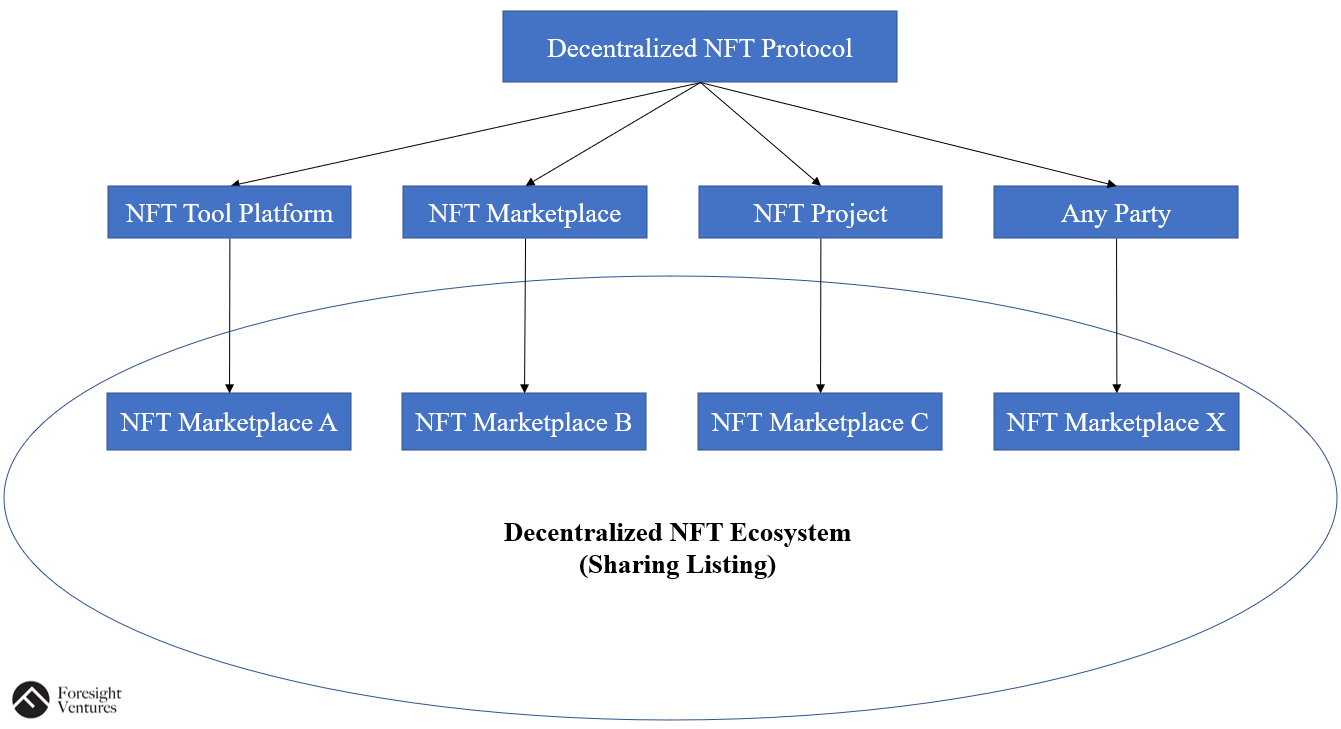

Inspired by Seaport, I personally think that onlyThe real decentralized NFT trading protocol (Decentralized NFT Protocol) can fundamentally solve the liquidity problem. It enables the traffic front-end of each market, whether it is an exchange, a tool platform or even a project party, to become an exchange by itself, and then share the pending orders of each subject, so that they together form the front-end of this decentralized trading ecosystem. Every order can have an equal opportunity to be seen and purchased.

Its main core is as follows:

order sharing mode

The ecology of order sharing enables each pending order to appear on multiple platforms at the same time. OpenSea monopolized most of the orders by taking advantage of the first-mover advantage, while other platforms did not form their own ecology to fight vertically and horizontally. The liquidity of pending orders is not what users want to see. So if it is possible to share NFT orders on multiple platforms from the technical level, for example, from the protocol layer (Protocol), then I believe users will be more willing to try these small platforms, because the accumulation of a small amount can also form enough liquidity sex.

A real example is the emergence of Gem and Genie, which has changed the competitive landscape. People are more willing to use such an aggregator than a single platform, because the pending orders of multiple platforms have value, but the platforms do not communicate with each other, so there are many needs to be able to view NFT pending orders on different platforms at the same time. And Gem and Genie put forward a solution to this point, solved the pain point, and gained users. However, the solutions of Gem and Genie still rely on traditional NFT trading platforms such as OpenSea. The API interface may be coerced by the platform, and the refresh rate of orders will also be controlled by others, making it difficult to achieve real-time updates.

In order to further improve the model of the aggregator, it is better to be the underlying protocol of the exchange than to be the upstream of the exchange.When placing an order, multiple platforms can be shared, so that users do not have to switch back and forth. Any platform has the same pending order, and the liquidity of NFT will also be improved. andIt solves the risk of being coerced by large platforms, and can unite with small platforms to jointly resist large platforms; at the same time, it also solves a considerable part of the liquidity problem of long-tail assets hanging on small platforms.It is quite possible that Uniswap back then.

Co-constructing ecological composability - breaking boundaries

The current NFT transactions are still limited to NFT exchanges. There are many excellent NFT tool platforms, but there is no way to realize them, and there are no users. However, when customers find a certain NFT Alpha through the tool, in most cases, they can only jump to a trading platform with one click for trading. The tool platform can only do free traffic import interface, make wedding dress for others,However, if the NFT tool platform can also directly trade NFT and share profits from it, the efficiency of NFT transactions will be greatly improved. The NFT tool platform itself no longer needs to find a new monetization model, and can realize traffic through transaction fees.Make the ecology form a complete closed loop, which is conducive to the healthy development of the tool platform.

Combined with the first point "order sharing model", because most users of tool platforms are also NFT users, the liquidity of orders combined with these traffic will also be greatly increased, thereby enriching the ecology.Instead of splitting the exchange and the tool platform, this is unfair to the tool platform. They should get a share of income after diverting traffic for the exchange, but currently the exchange does not reward the tool platform for the credit for this part of the traffic. So this also addresses the need for a tool platform.It can also be seen from the acquisition of Genie by Uniswap,When the traffic platform enters the NFT world in the future, the mode of traffic + trading agreement may be a better combination.

low price

There is still room for price reduction in handling fees. OpenSea’s handling fee is 2.5%, and from the path of rising stars, it can be seen that lower handling fees will be sought after by the market. For example, X2Y2 currently only has a handling fee of 0.5%, and this is also the firm choice of many PFP short-term hype players One of the reasons for the platform.Therefore, future solutions are more likely to be cut in with a lower handling fee, giving players more profits, which will motivate people to try new solutions.

protect royalties

The current right to set royalties is delegated to the platform layer, so if the project party wants to collect full copyright fees, it needs to go to each platform to set its own royalties, which is obviously very troublesome. However, through the mode of sharing pending orders, the royalties set by the project party will be directly synchronized to multiple platforms, so there is no need to worry about missing royalties. This is a huge benefit for the project party, and it will also urge them to switch from the original platform to the new one. The platform sets up and encourages its users to place pending orders.

V. Conclusion

V. Conclusion

For NFT exchanges, people are always envious of their vast market and the market share of a single exchange, so countless people have risen up, one after another with the help of pseudo-demand shells to draw big pies one after another. Finally, when the tide receded, we knew who was swimming naked. If 2021 is the first year of the NFT market boom, then 2022 will be a year of turbulent competition in the NFT market. Only by grasping the core needs in the current environment can we go upstream in the bear market and wait for the bull market to bloom .About Foresight Ventures

About Foresight Ventures

Foresight Ventures bets on the innovation of cryptocurrency in the next few decades. It manages multiple funds: VC fund, secondary active management fund, multi-strategy FOF, special purpose S fund "Foresight Secondary Fund l", with a total asset management scale of more than 4 One hundred million U.S. dollars. Foresight Ventures adheres to the concept of "Unique, Independent, Aggressive, Long-term" and provides extensive support for projects through strong ecological forces. Its team comes from senior personnel from top financial and technology companies including Sequoia China, Google, Bitmain, etc.

Website: https://www.foresightventures.com/

Twitter: https://twitter.com/ForesightVen

Medium: https://foresightventures.medium.com

Resource:

https://www.defidaonews.com/media/6681680

https://sfl.global/news_post/yiwenzonglanzhuliu-nft-shichangpingtaibanshuifuwufeisheji/

https://www.nfx.com/post/demand-shocks

https://dune.com/votan/X2Y2-NFT-Marketplace

https://www.nfx.com/post/marketplace-expansion-framework

https://opensea.io/blog/announcements/introducing-seaport-protocol/