A detailed count of Maji’s brother Huang Licheng’s “Ten Deadly Sins” in the encryption field: misappropriating 22,000 ETH, pushing 10 garbage projects in 4 years

Compilation of the original text: Paimon

Compilation of the original text: Paimon

Jeffrey Huang, known by netizens as Machi Big Brother, is a former Taiwanese-American musician and technology entrepreneur. He misappropriated 22,000 ETH from Formosa Financial in 2018, and in the four years since its collapse, he has successively launched more than a dozen failed coin issuance and NFT projects. This article will introduce Huang Licheng's many "black histories" in the field of cryptocurrency, including the introduction of Formosa and his many subsequent projects, other participants, and other factual basis.

background

background

Jeffrey Huang, aka "Michi Big Brother" is a Taiwanese-American musician and tech entrepreneur living in Taiwan. Huang Licheng first came to attention as a founding member of the pop/rap trio LA Boyz formed in 1991. Active in the early to late 90s, LA Boyz released 13 albums and rose to prominence in Asia before disbanding in 1997.

After the success of LA Boyz, Huang Licheng formed the hip-hop group MACHI in 2003, and took this opportunity to make another fortune. Subsequently, Huang Licheng and his friends began to form a multi-dwelling Asian hip-hop/rap record company called MACHI, which was owned by Warner Music. Eventually, Huang Licheng transitioned from the music industry to the technology field, founding 17 Media (M17) in 2015 and gradually becoming one of the most popular live streaming apps in Asia.

In 2017, Huang Licheng began to enter the cryptocurrency field through Mithril. This is also the beginning of his participation in the launch of the "leek cutting project". The team members of these projects have more or less professional ethics issues, and they often have the practice of pumping up and selling. The following article will give an in-depth introduction to these "cutting leek" projects.

Item 1: Mithril

image description

https://research.binance.com/en/projects/mithril

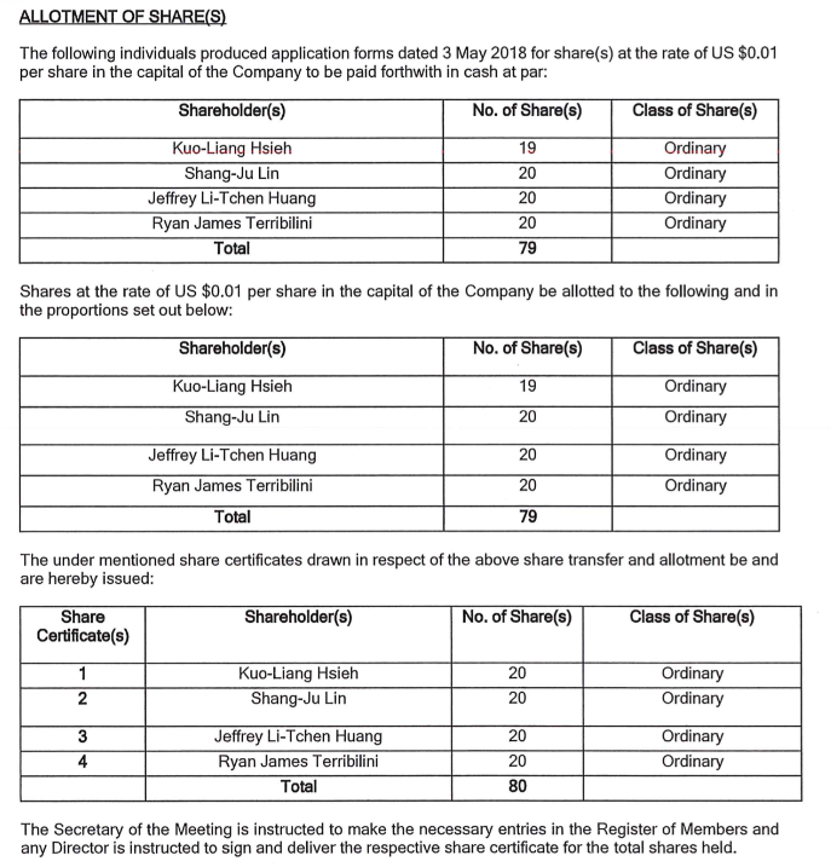

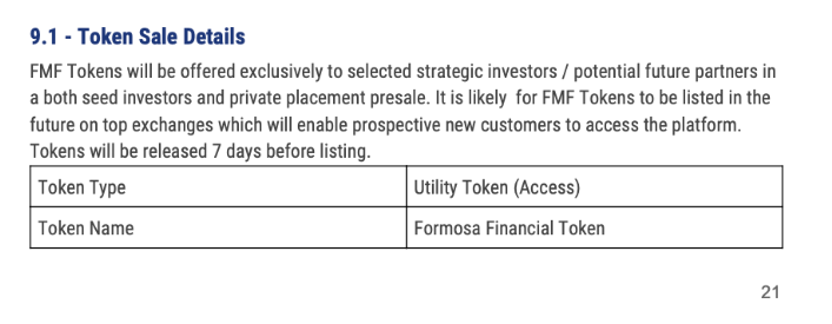

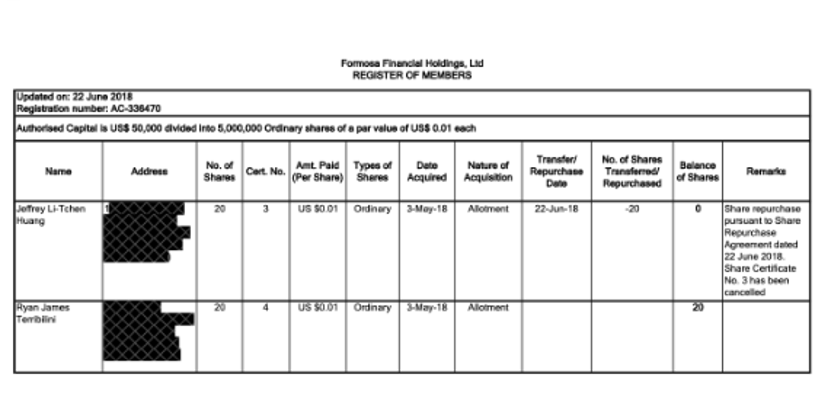

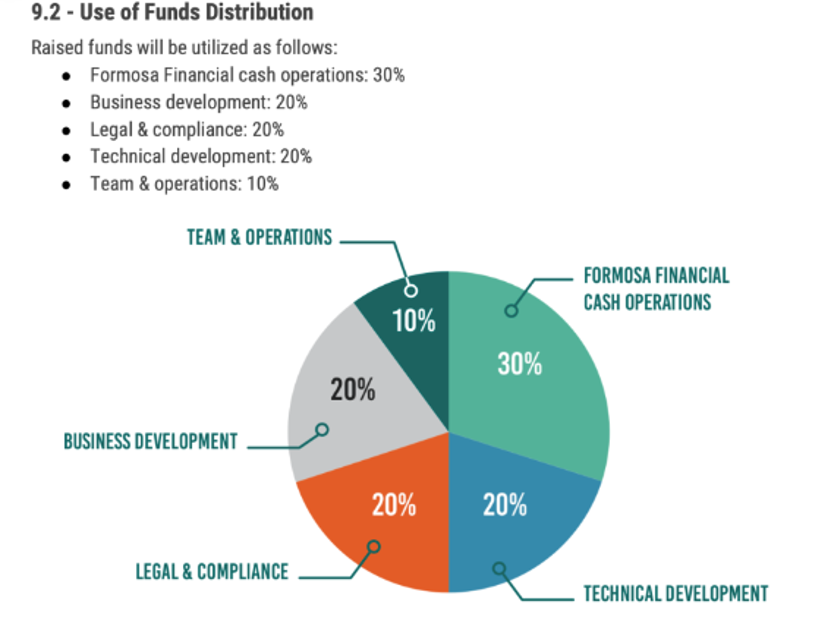

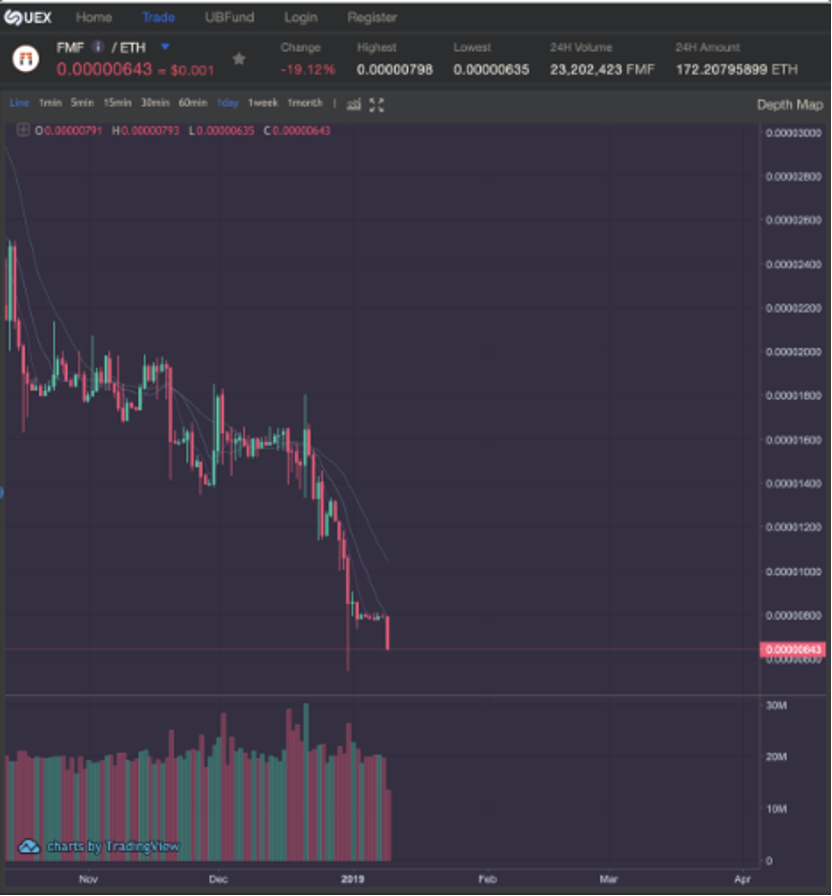

Project 2: Formosa

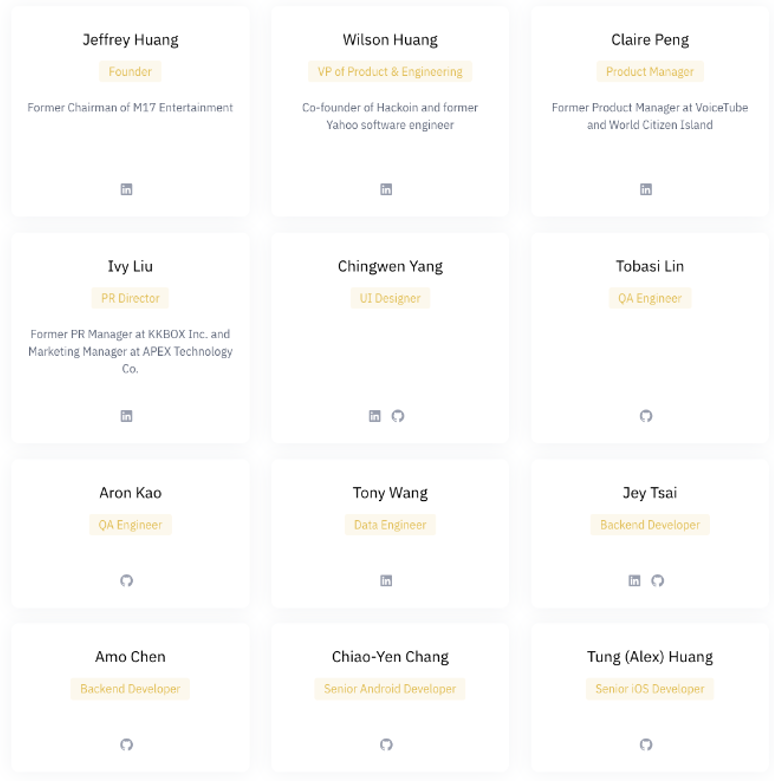

image description

image description

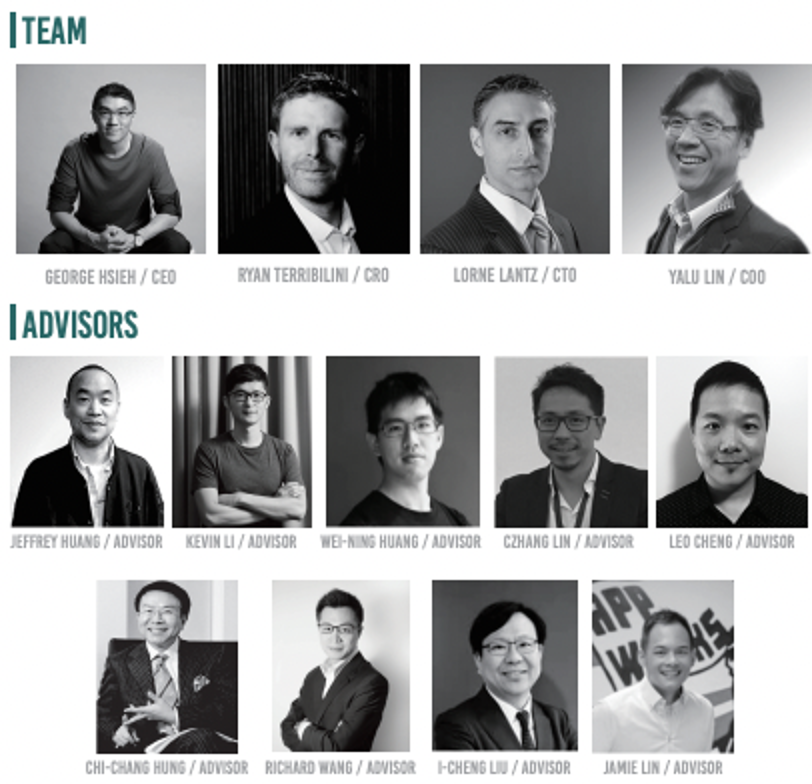

Formosa team

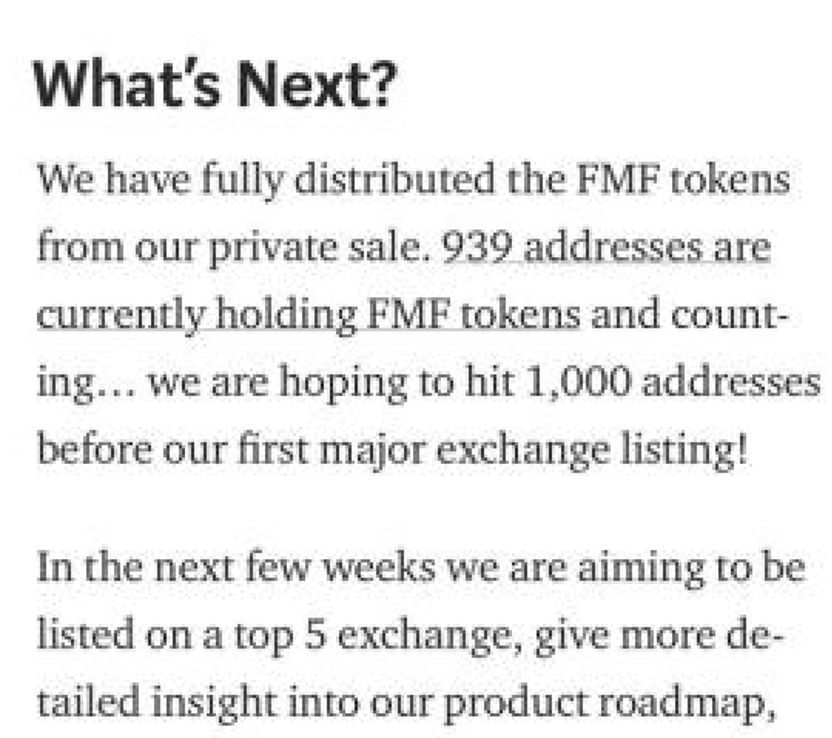

The team has vowed to assure investors that FMF is on the fast track to be listed on the top CEX.

"Our next step?

All FMF tokens from our private sale have been distributed to users. There are currently 939 addresses holding FMF tokens and counting, hoping to add 1000 addresses before the first big exchange listing.

Over the next few weeks, we aim to list on the top five exchanges and give you a more detailed look at our product roadmap. "

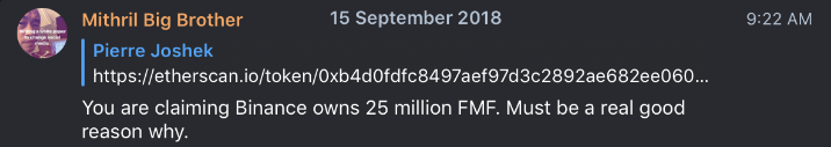

image description

image description

image description

Machi later denied this

image description

FMF's transaction on IDEX

Additionally, 17 Media was originally scheduled to launch an IPO on the New York Stock Exchange on June 7, 2018, but the IPO launch was delayed after plans to raise $115 million fell through due to undisclosed settlement issues with investors up. ZachXBT contacted an unnamed source familiar with the matter and revealed the secret behind it: "M17's suspension of trading has little to do with its being a private entity and regulatory restrictions or Citibank's wrong operations. The reason for the failure should be attributed to M17's inability to Meeting auditing and reporting requirements and not being able to overcome the threshold bidding flaw also means that people cannot adapt to this business model.”

After the failure of the listing, Huang Licheng expressed his frustration on Facebook and reprimanded Citibank and Deutsche Bank for participating in the IPO.

image description

image description

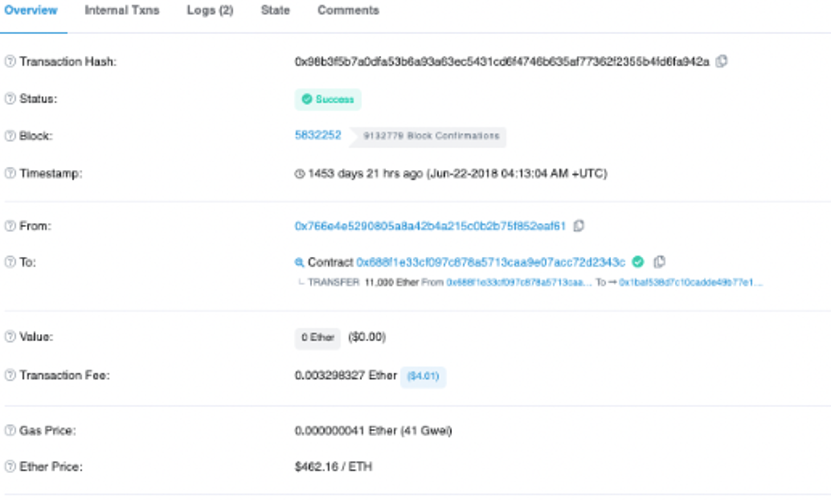

https://etherscan.io/tx/0x98b3f5b7a0dfa53b6a93a63ec5431cd6f4746b635af77362f2355b4fd6fa942a

image description

https://www.breadcrumbs.app/reports/1163

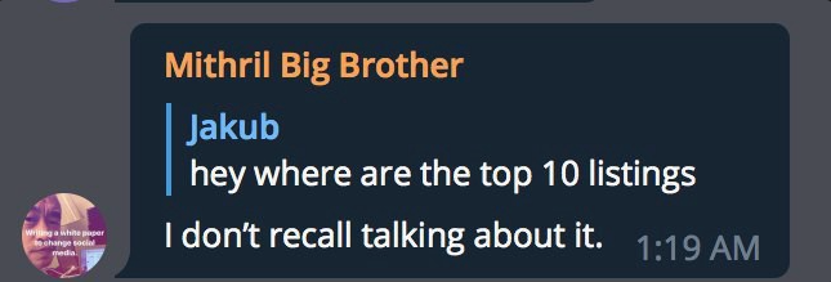

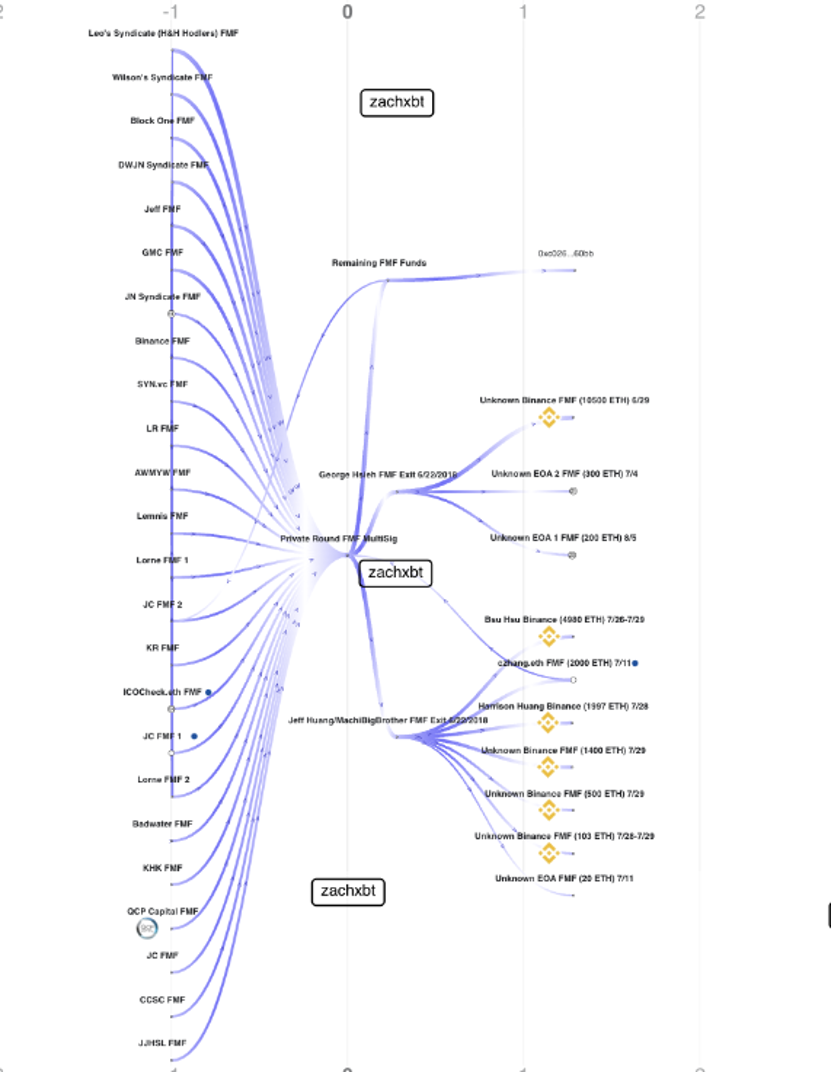

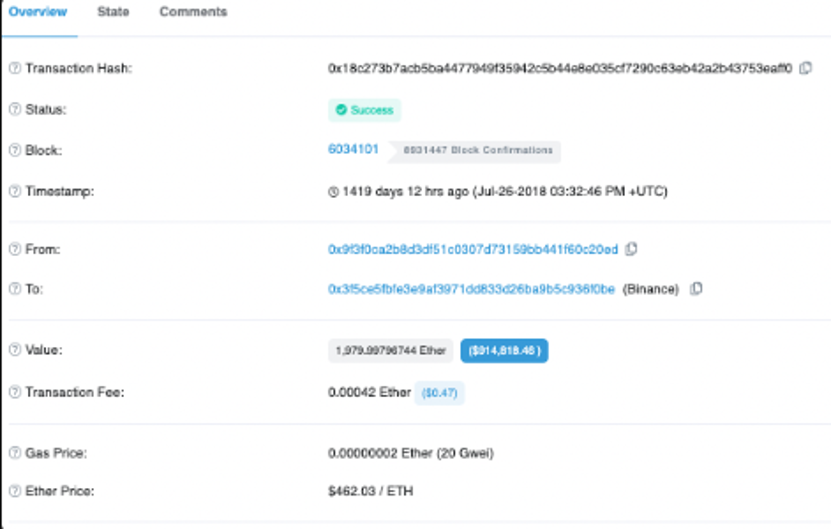

This figure shows the inflow of ETH through multi-signatures from angel and private equity round funds before Huang Licheng and George withdrew 11,000 ETH twice on June 22, 2018.

On June 29, 2018, George transferred 10,500ETH to his Binance account. Currently, the KYC authenticity of the Binance account is unclear.

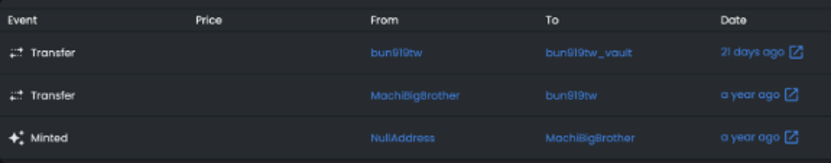

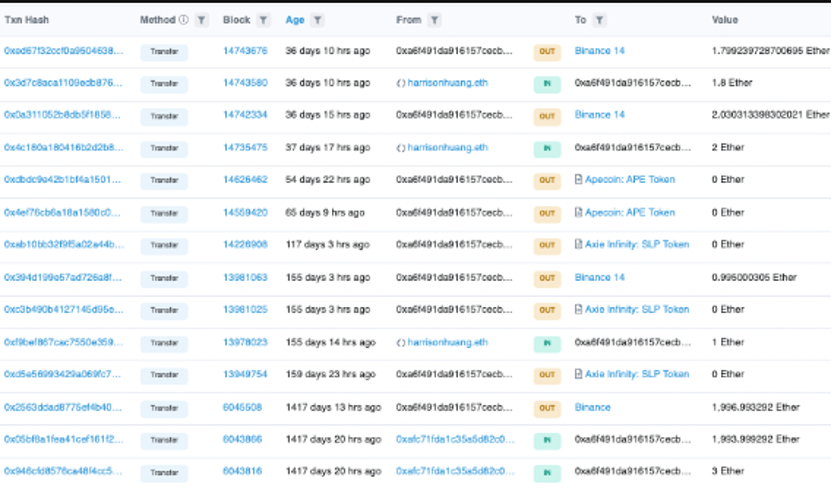

As for Huang Licheng, his 11,000 ETH had not been moved in one wallet until he transferred 4,980, 1997, 1,400, 500, and 103 ETH to different Binance accounts at the end of June and early July. 2000 ETH was transferred to czhang.eth, and 20 ETH was transferred to an EOA wallet.

The above questions remain unresolved. Regarding the attribution of these Binance accounts and wallets, let's take a step down from the beginning of the ETH flow:

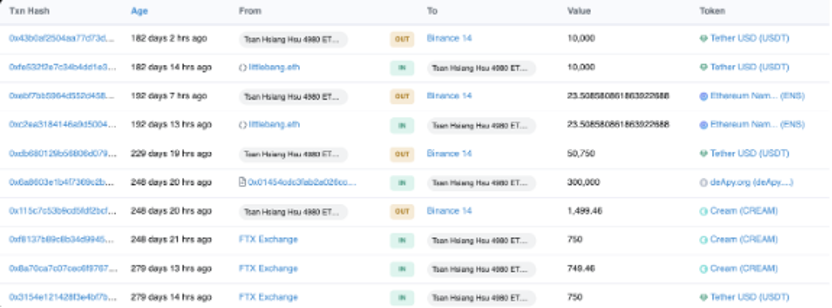

1. From July 26 to July 29, 2018, 4,980 ETH were transferred. Records show that this Binance account has frequent funding from two sources – FTX and littlebang.eth

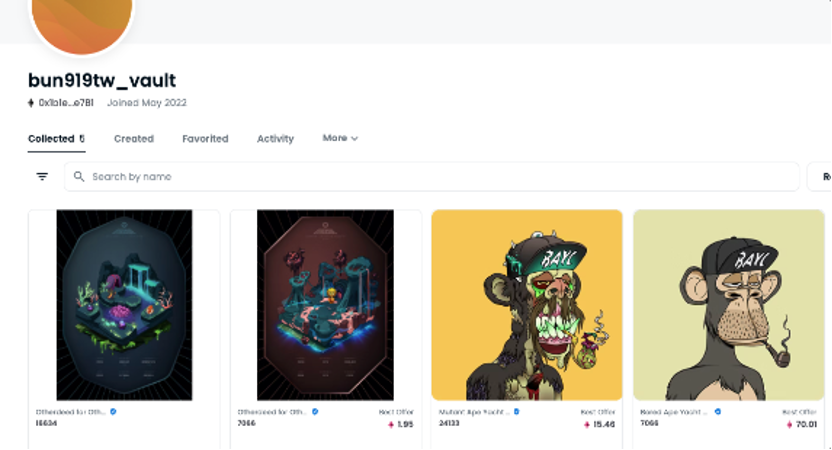

a) Looking up the owner of littlebang.eth on OpenSea will find the username is "Bun919tw"

image description

https://medium.com/cream-finance/c-r-e-a-m-project-update-9d4fd484482f

image description

https://opensea.io/assets/ethereum/0xbc4ca0eda7647a8ab7c2061c2e118a18a936f13d/7066

d) Bun Hsu happened to have deals in various projects under Licheng Huang such as FMF, SWAG, CREAM, SQUID, PHOON, MCX and MIS/MIC.

Then why did a person not in the Formosa Financial team receive 4,980 Ethereum just 3 weeks after the ICO, and have "money transactions" with the project in Huang Licheng's hands and even himself?

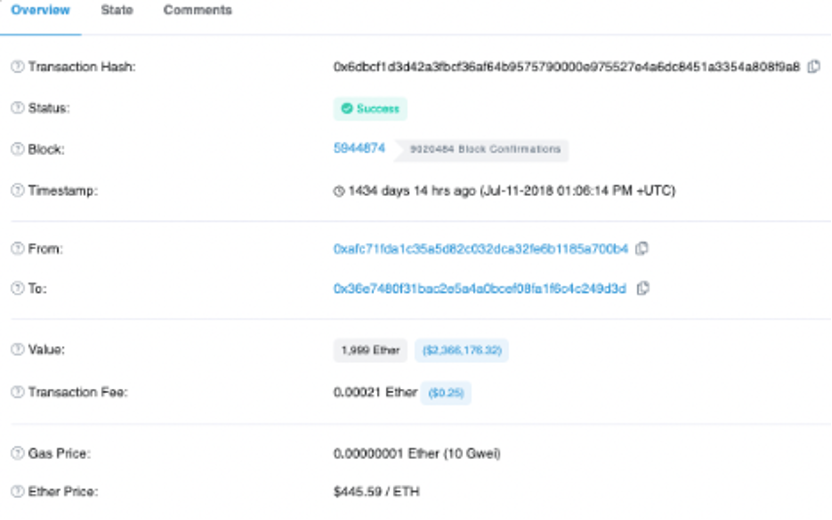

2. On-chain records show that the 2000ETH transferred out on July 11, 2018, finally flowed to Czhang Lin (czhang.eth), who had been a consultant of Formosa Financial until June 22.

a) Three weeks after receiving 2000 ETH, Czhang sent 150 ETH to his brother Yalu Lin (Formosa COO) on July 22, 2018.

Or a similar question, why are Formosa Financial's consultants and COO receiving project construction funds?

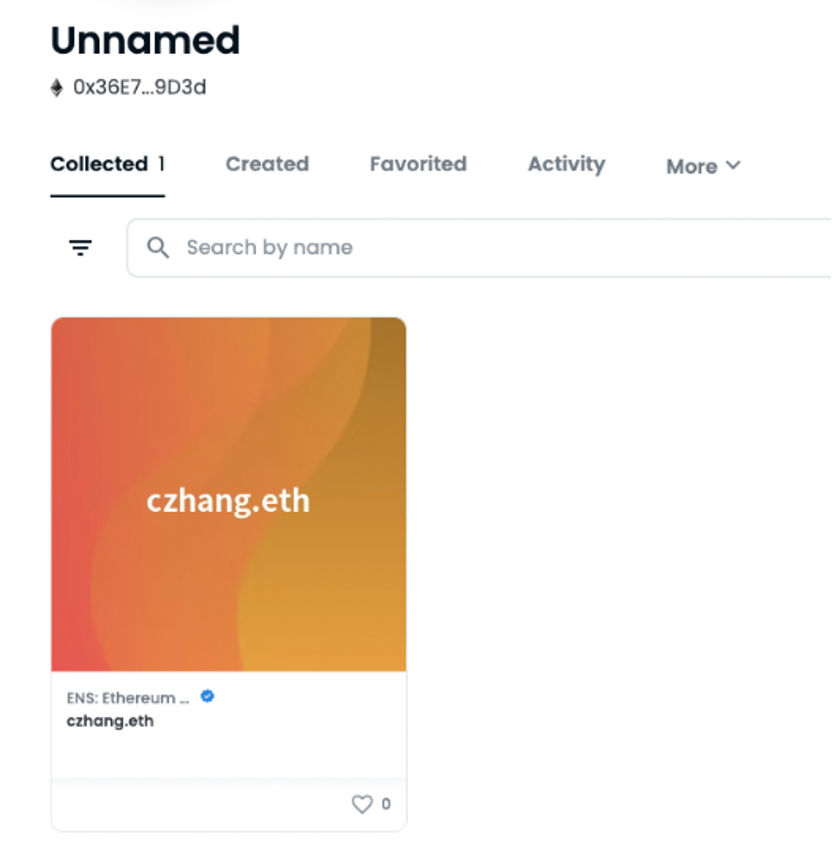

3. Regarding the outflow of 1997 ETH on July 28, 2018: The only income stream for this Binance account comes from harrisonhuang.eth, a wallet that works with Mithril's VP of Engineering and current founder of XY Finance and GalaXY Kats w9g.eth (Wilson Huang) have frequent interactions.

image description

image description

And Harrison presented MAYC to Wilson

a) Do a quick search for harrisonhuang.eth on Twitter, and you can guess his Twitter account by tweeting his ENS address and replying to Wilson.

Harrison is not publicly listed as a team member on the Formosa Financial white paper or website. Here again, an individual account not publicly associated with Formosa received funding for the project.

The rest of the Binance accounts that received funds from Huang are a backwater: these accounts have not had any recent interaction with other external or personal addresses, and the transactions are merely CEX-to-CEX movements.

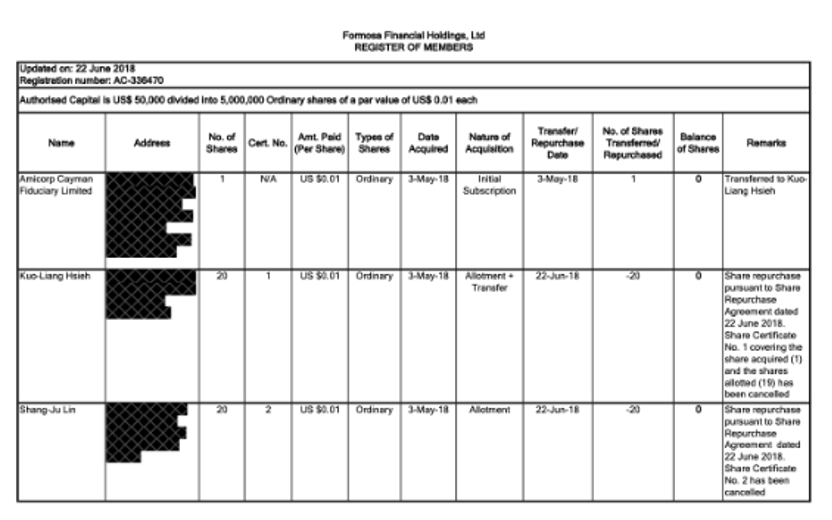

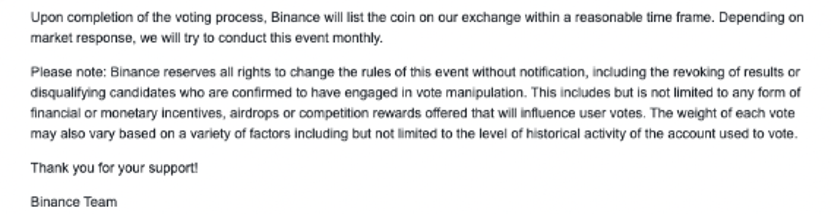

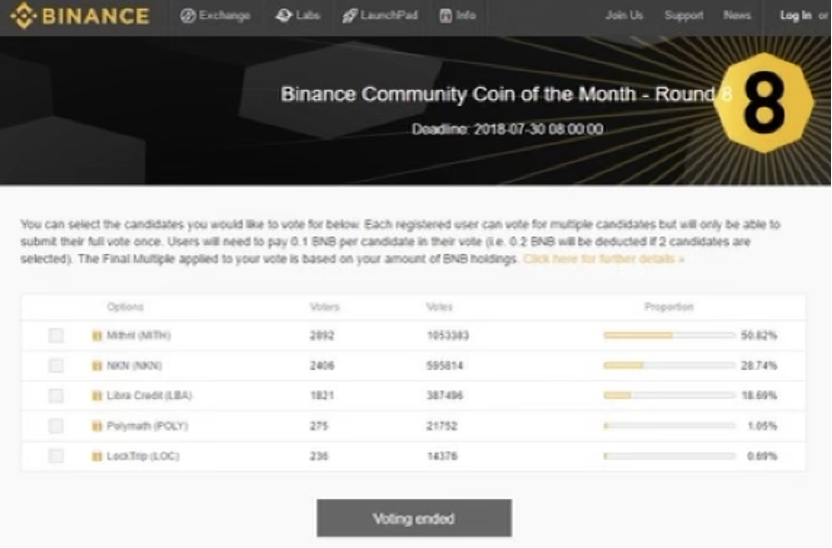

On July 26, 2018, Huang Licheng and Mithril were caught trying to defraud Binance of monthly community currency votes. A user named Lucky found evidence that Mithril had received more than 80,000 ballots, mostly from just two or three addresses. The principle of community currency voting is that 1 BNB is equal to 1 vote, and the maximum vote limit for each account is 500 BNB. Therefore, a voter can get a maximum of 500 votes as long as he holds 500 BNB. However, Binance pointed out in the rules that creating fake accounts is equivalent to mass distribution of BNB, and offenders will be disqualified from the competition.

Huang Licheng was still using the same address at the time of the Formosa ICO, which was closely related to amateur Mithril and held $8.6 million in MITH. The figure below shows that a large number of BNB transfer accounts at that time received fees from the largest Mithril whale wallet.

https://www.breadcrumbs.app/reports/1994

What is even more shocking is that the large number of BNB transfer records used to scam votes coincided with the day when Bun Hsu received 1980 ETH, which was in fact deposited into his Binance account less than 1 hour before voting.

When checking on-chain transactions, even more BNB was distributed to additional Binance accounts in volumes of less than 500, a timeline that coincides with the theft of FMF funds.

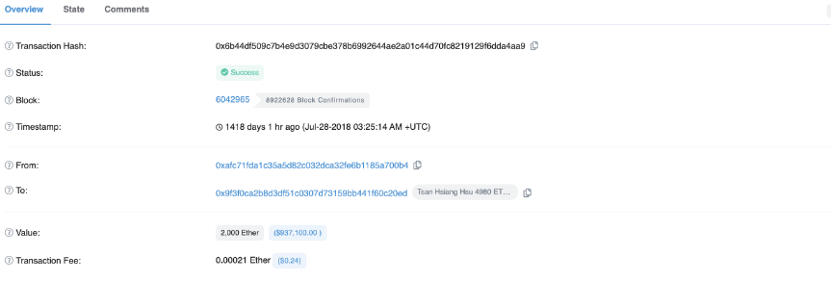

1a) At 3:25 am on July 28th, Bun Hsu’s Binance account received a transfer of 2000 ETH

1b) At 4:43 am (UTC time) on July 28, 43.8k BNB was transferred from the Binance account (it is estimated that Bun did it too)

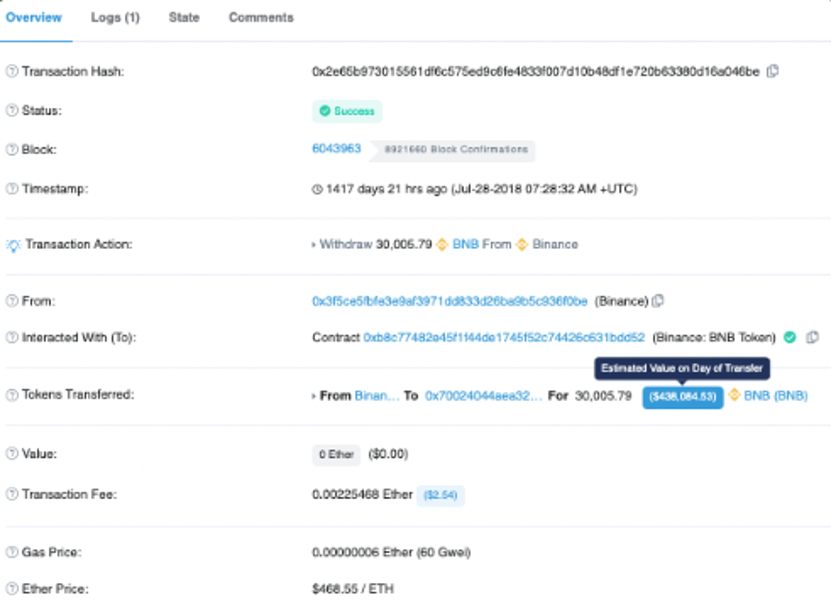

2a) Harrison Huang's Binance account deposited 1994 ETH at 7:08 am on July 28

2b) At 7:28 am on July 28, 30k BNB was withdrawn from the Binance account

image description

image description

POLY Wins After Binance “Cleans Up”

Again, maybe that's what Formosa is raising money for.

image description

Crazy wash trades on IDCM

Project 3: Machi X

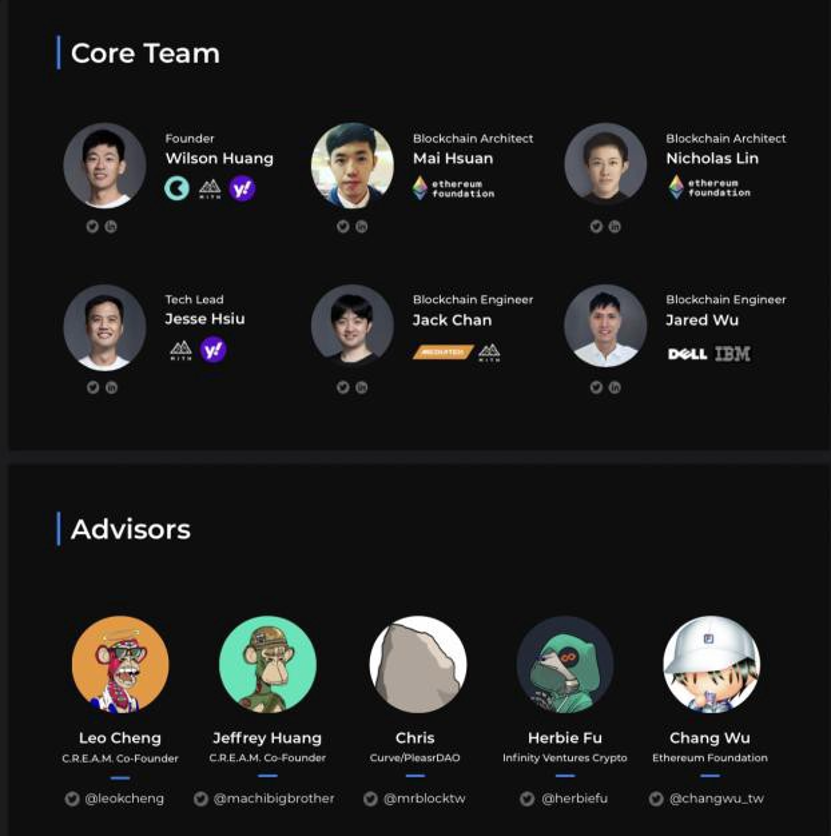

In October 2018, Huang Licheng and Leo Cheng launched Machi X, an intellectual property social market. However, due to the performance of the previous project Mithril and the Formosa incident, his reputation plummeted, making it difficult for Machi X to obtain funding.

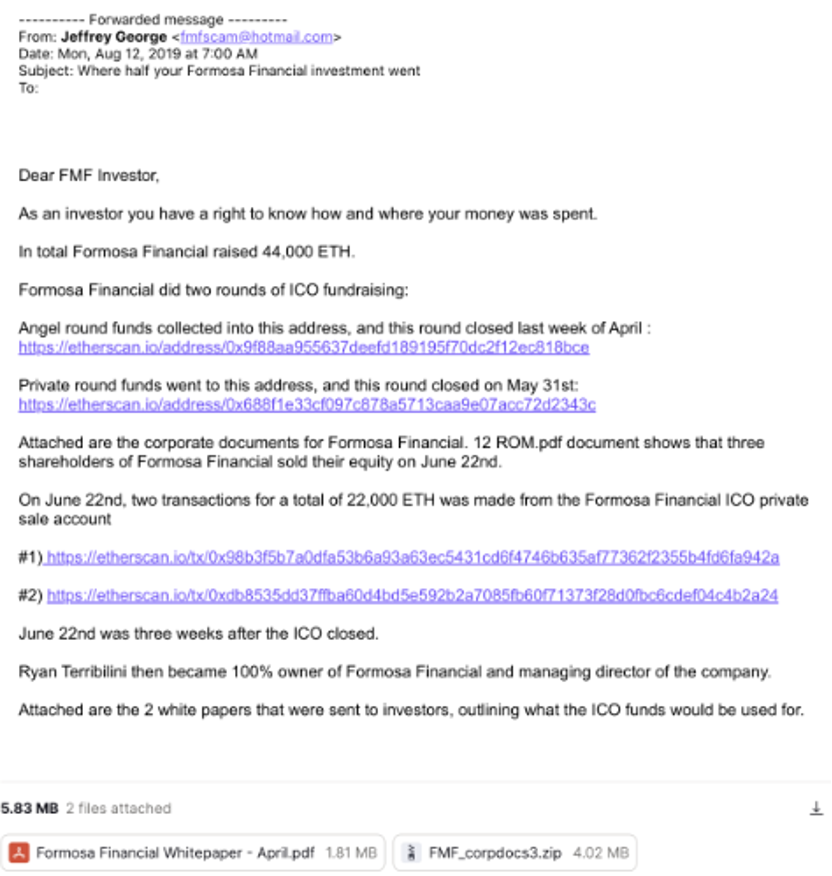

It wasn't until more than a year after the Formosa incident that investors finally knew what had happened to their money. On August 12, 2019, Formosa investors received an anonymous email containing internal documents for supporting purposes, which stated that only three weeks after the end of the 2018 ICO, 22000/44000ETH was withdrawn from the Formosa Financial ICO private sale wallet stolen. Various internal documents were attached to the mail to prove this.

In this leaked audio from 2019, former Formosa CEO Ryan Terribilini shares his thoughts on the misappropriation of funds by Huang Licheng and George and the events that followed.

As for why no legal measures were taken against Huang Licheng and George at that time, the answers given by many venture capital companies and angel investors who invested in the project were that Huang Licheng and George were really prominent figures in Taiwan, and the incident happened in Taiwan at the same time. In multiple jurisdictions, investors have reached an agreement to simply deal with this incident and avoid some unnecessary troubles.

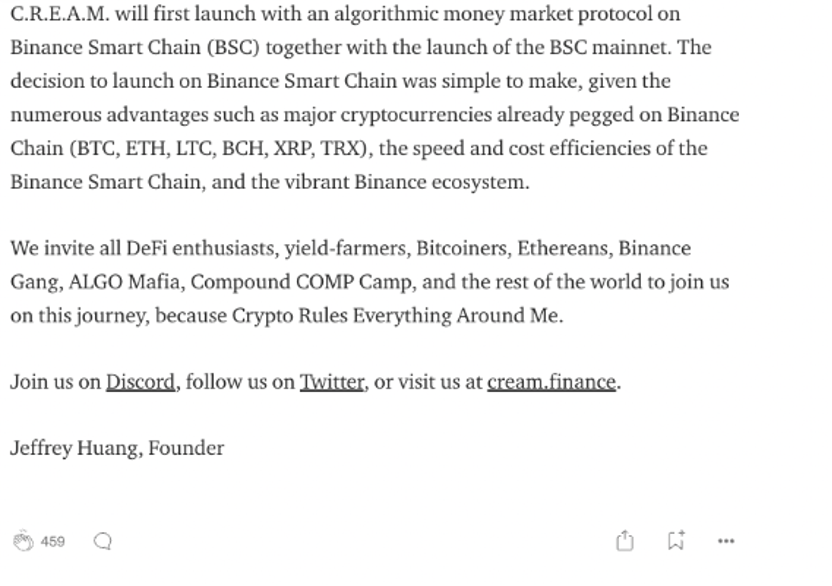

Project 4: Cream Finance

text

Translator's Note: Item 5 is missing (or deleted?) from the original text here

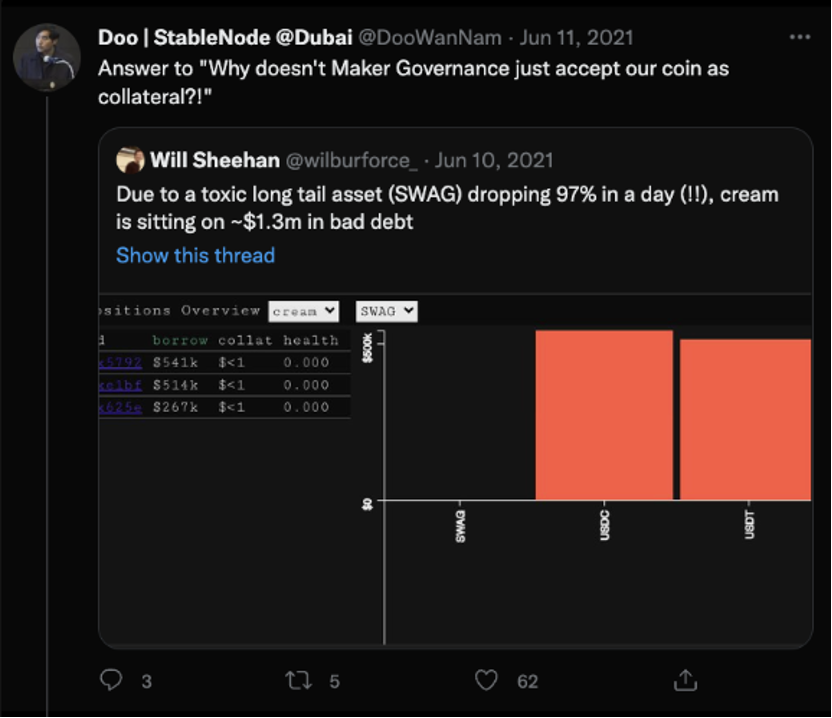

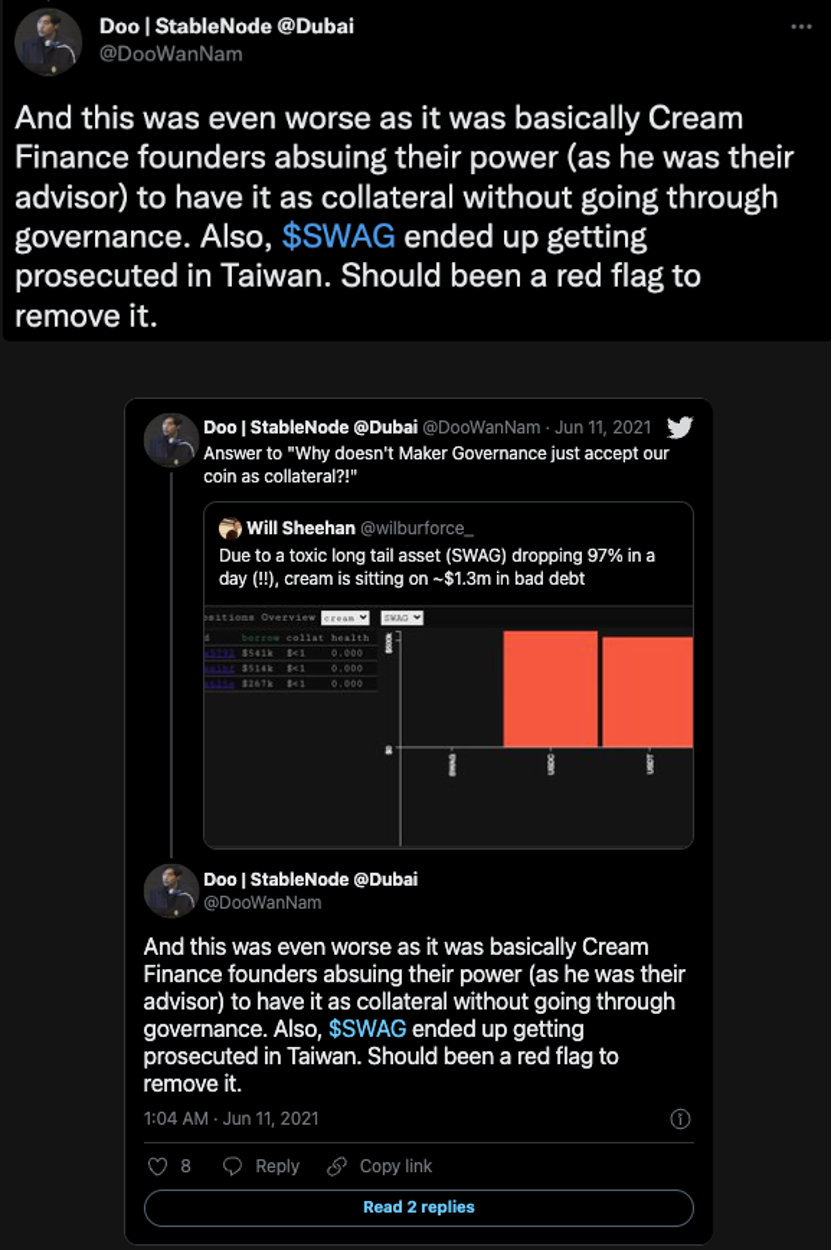

Project 6: Swag Finance

image description

https://www.dextools.io/app/ether/pair-explorer/0x2059024d050cdafe4e4850596ff1490cfc40c7bd

A month and a half after the token launch, Swag was delisted from Cream.

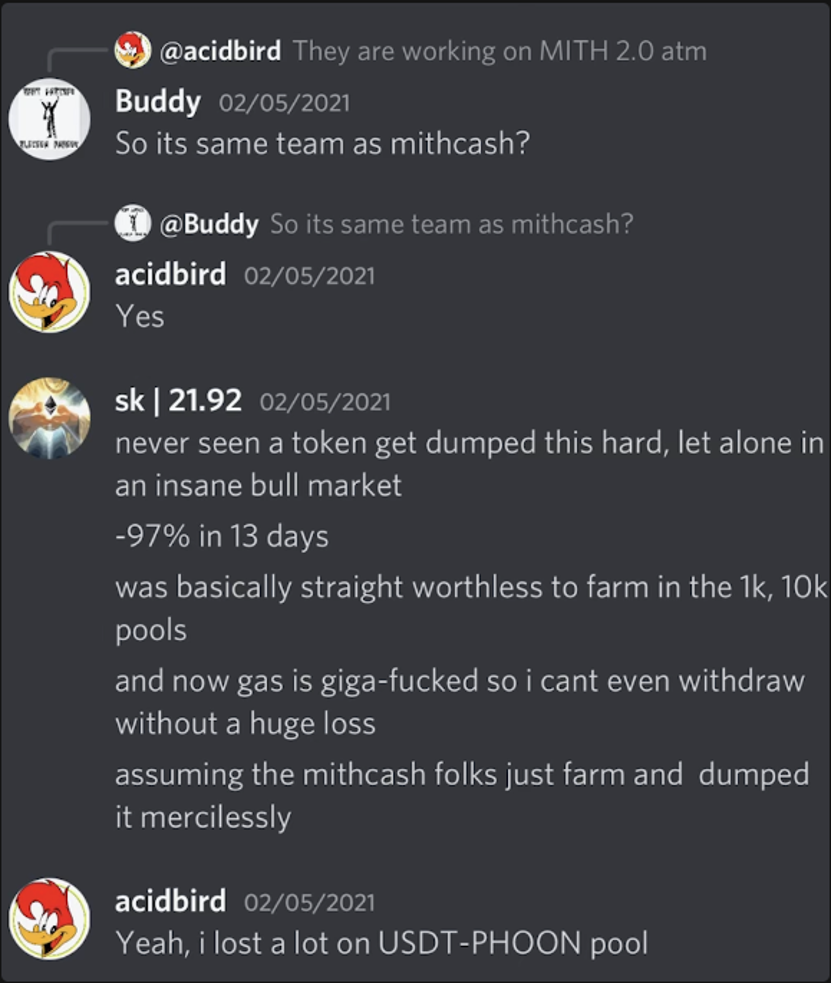

Item 7: Mith Cash

image description

https://coinmarketcap.com/currencies/mith-cash/

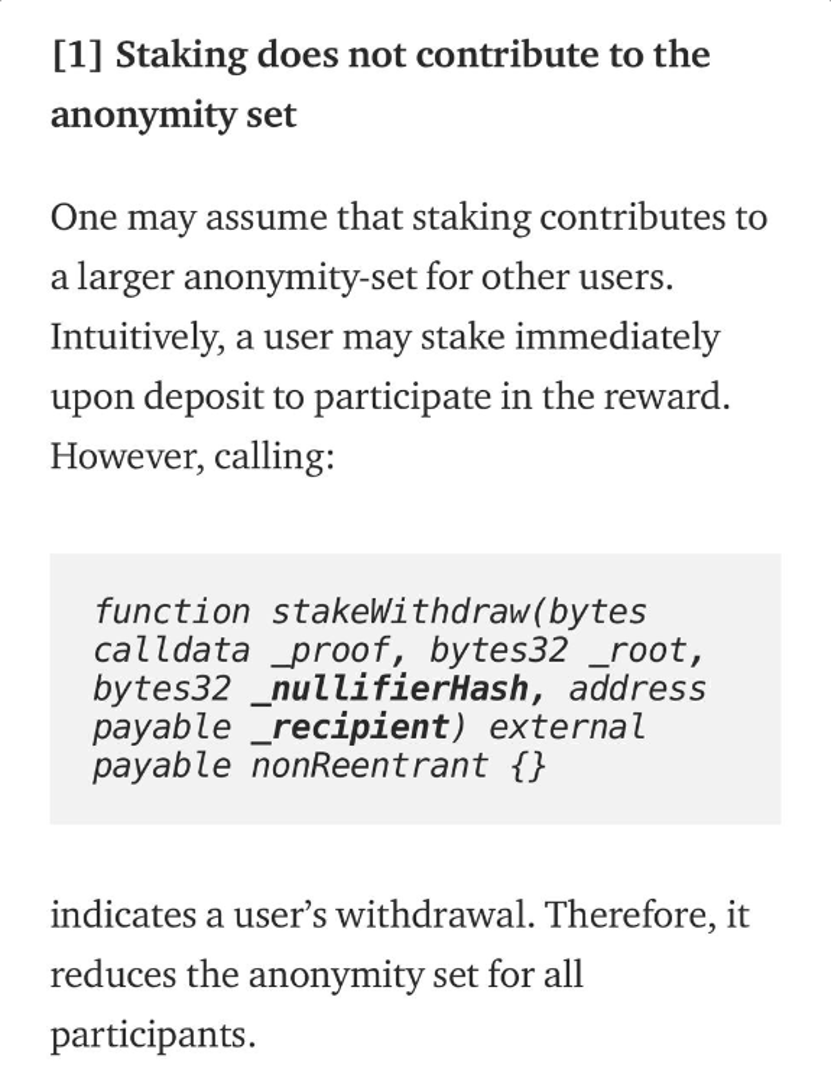

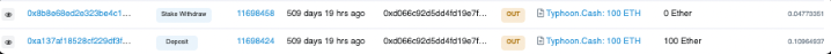

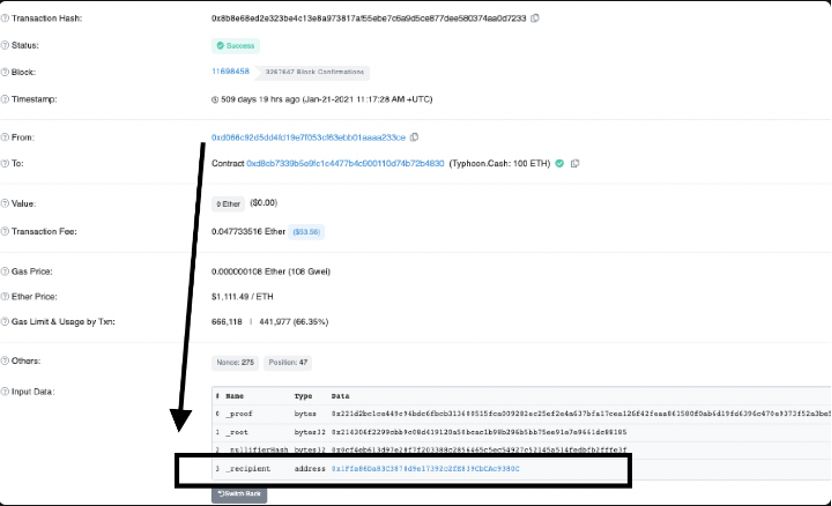

Item 8: Typhoon Cash

image description

image description

image description

For example:

https://etherscan.io/tx/0x8b8e68ed2e323be4c13e8a973817af55ebe7c6a9d5ce877dee580374aa0d7233

image description

The second address unstakes and exits

Since February 2021, there have been no deceptive updates posted on Discord, Telegram, or Twitter.

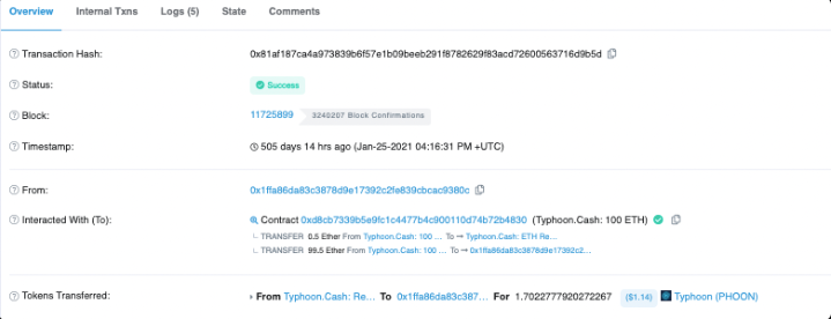

Project 9: Mud Games

image description

Team members Huang Licheng & penguin cast No. 2 and No. 3.

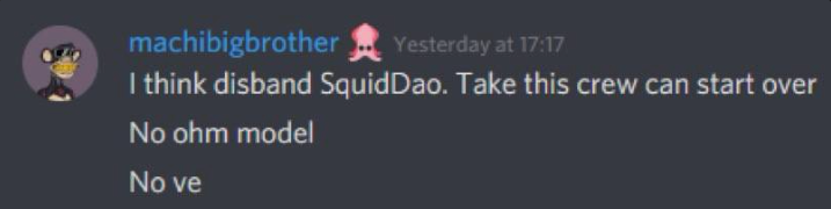

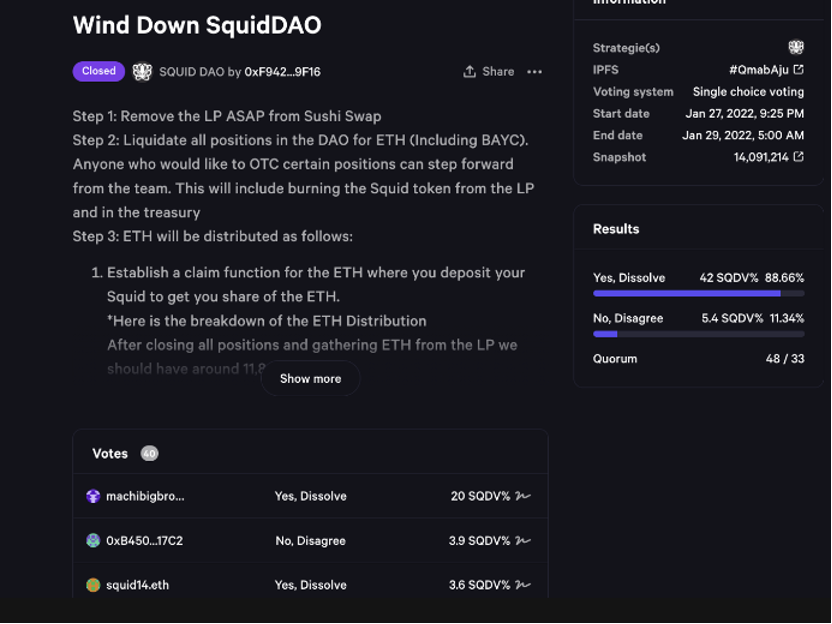

Project 10: Squid DAO

image description

https://vote.squid.xyz/#/

image description

image description

image description

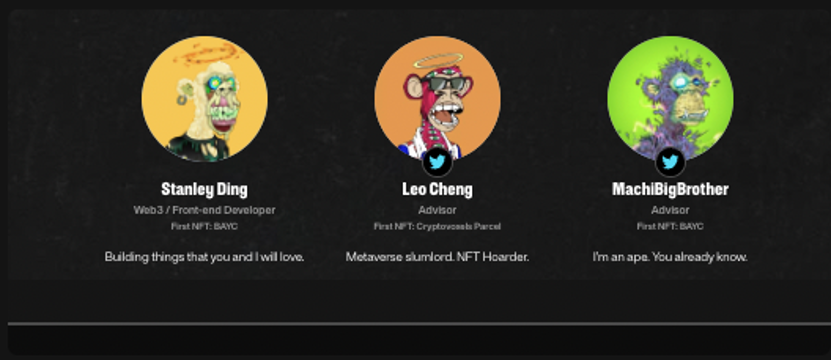

Ape Finance

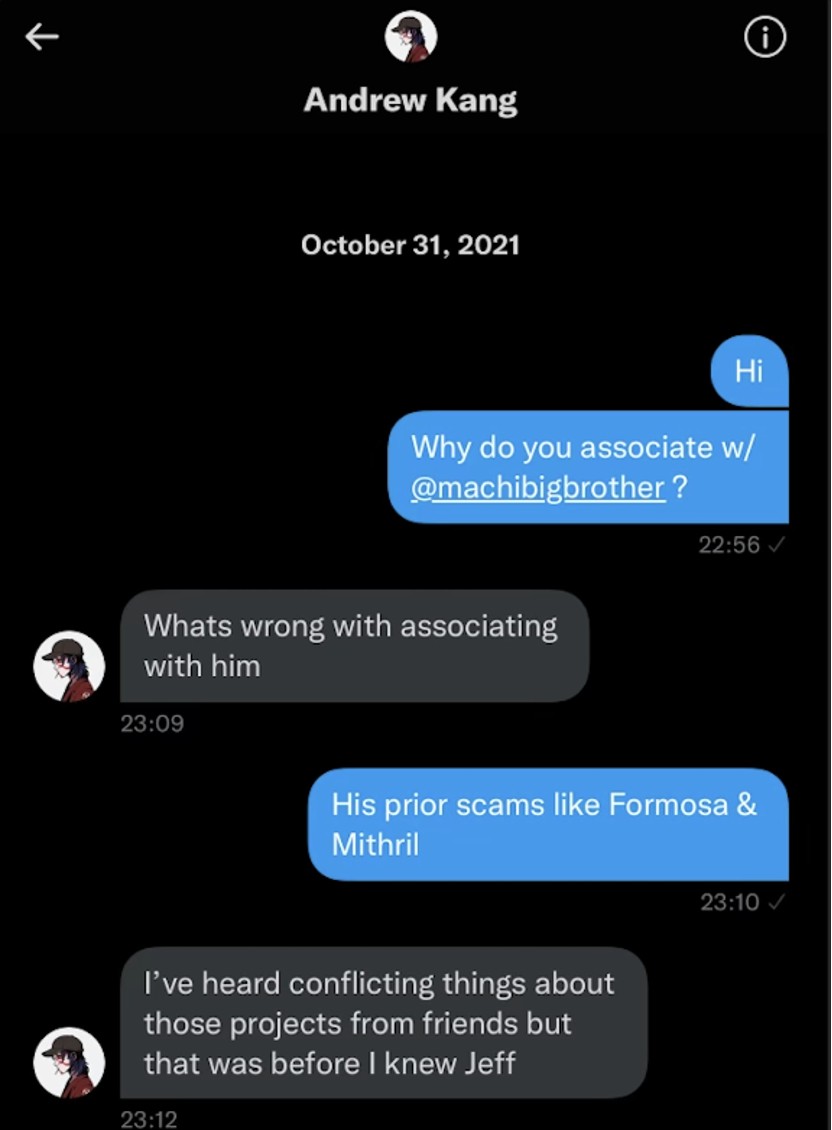

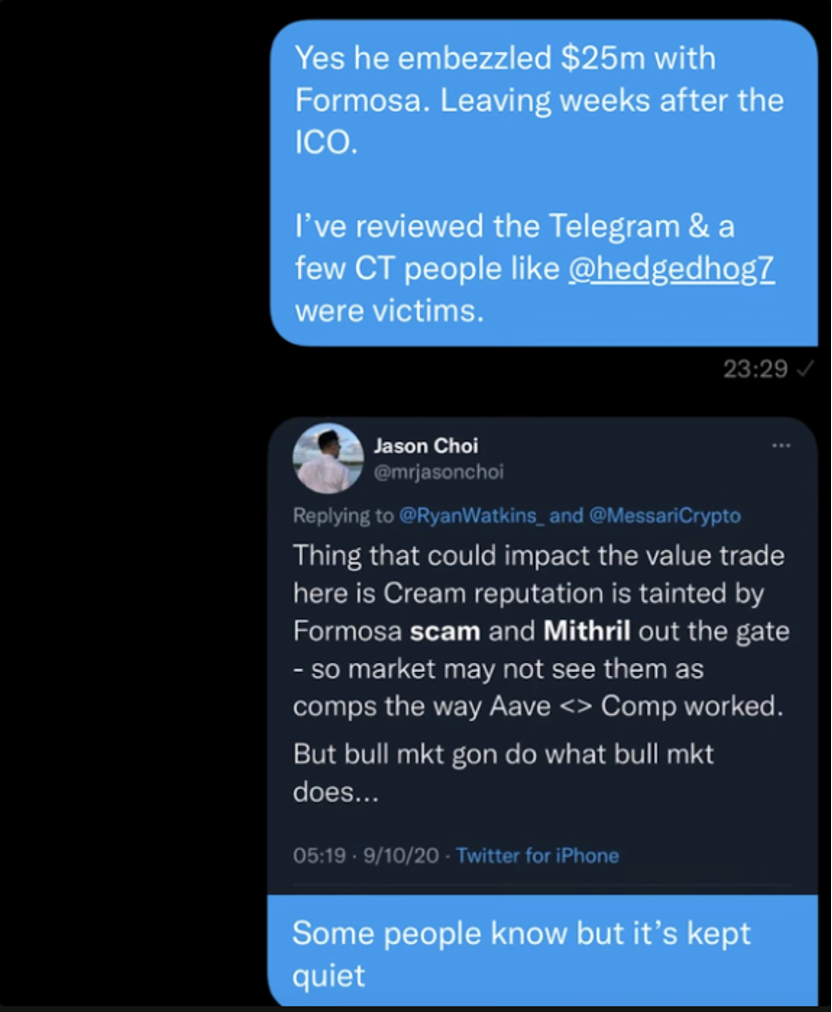

In Huang Licheng's many projects, the same keywords are always the same: anonymous team, imitation project, new wallet funded through FTX and short life cycle. And the same few participants in each project: Wilson, Leo, Huang Licheng. As for why VCs like Andrew Kang turn a blind eye to this matter, he himself said:

image description

Message from pleasantDAO Telegram

After the wrongdoing was made public, Huang Licheng spoke out to respond to the bad influence on Taiwan, but he and his "anonymous team" continued to shame Taiwan and the encryption space. I hope that one day, all those who suffered losses due to Huang Licheng's project will see justice.

Original link