Liquidity crisis emerges, DeFi counterattacks crypto whales

Original Author: Jasmine

Original Author: Jasmine

The market panic caused by the unanchor of UST and the zero return of LUNA in May eventually spread to June along with the low pressure of the crypto bear market. Another group of crypto assets stETH and ETH with an "anchor" relationship experienced changes.

The regular exchange ratio between these two assets is 1:1. Since last week, this balance has been broken.

stETH is the ETH 2.0 pledge certificate launched by the DeFi platform Lido. On this platform, every time a user deposits 1 ETH, he can get 1 stETH pledge certificate token. The two form a 1:1 exchange rate relationship. Since stETH was later widely introduced into the DeFi market, the token can not only be exchanged for ETH on the decentralized exchange platform (DEX), but also be regarded as collateral for lending other encrypted assets by some decentralized lending platforms.

Currently, on the DEX "Curve" with the largest trading volume of stETH-ETH, 1 stETH can only be exchanged for 0.95 ETH, and stETH has become a discounted version of ETH. With the experience of the UST incident, the first thing crypto users can think of is: someone is selling stETH in large quantities.

The first seller to be discovered was Alameda Research, an encrypted asset market maker. Last Friday alone, the institution withdrew nearly 50,000 stETH within a few hours. During the same period, the exchange rate of stETH to ETH was decoupled by 5%. But then the agency bought back stETH again.

If this is just a routine operation carried out by market makers based on market conditions, then the following two market roles have made unconventional actions.

On Monday, the centralized encrypted asset lending platform Celsius suddenly announced the suspension of customer withdrawals and transfers. It was found that the platform is a large pledger of ETH2.0, holding at least 409,200 stETH, accounting for 9.69% of the supply of stETH. Celsius's sudden suspension made it a potential seller of stETH.

The two crypto whales are surrounded by crises, and they are also deep participants in DeFi. Both parties have invested their managed crypto assets on a large scale in DeFi scenarios, including algorithmic stablecoins and lending markets. During the bull market of the encrypted asset market, DeFi Lego was the accelerator of investment income. Now that the bear market has emerged, DeFi has begun to backlash, and the giant whales with strong funds are the first to bear the brunt.

first level title

Two encryption giant whales have exposed the crisis

If it were not for the unanchoring of stETH and ETH, people may not immediately notice the plight of the giant whales and the market risks they may bring.

On June 13, Celsius, an encrypted asset lending platform, suddenly announced that it would suspend withdrawals, transactions, and transfers between all accounts. Better fulfillment of exit obligations to clients".

Celsius is headquartered in London, England. It was established in 2017. It is mainly engaged in the deposit and loan business of encrypted assets. It absorbs encrypted assets of users, and the APY (annual deposit yield) is as high as 17%. At the same time, it also supports users to use encrypted assets as collateral. Get loans in USD stablecoins or even USD for 1% APR.

Celsius has suspended user withdrawals, clearly stating that it is for "stable liquidity". In other words, it has fallen into a liquidity crisis, and the current encrypted assets currently available to it may not be able to meet the needs of users to redeem at any time.

Where does this crypto whale, which claims to "own 150,000 BTC" and "provide the community with more than $1 billion in revenue", invest its "money"?

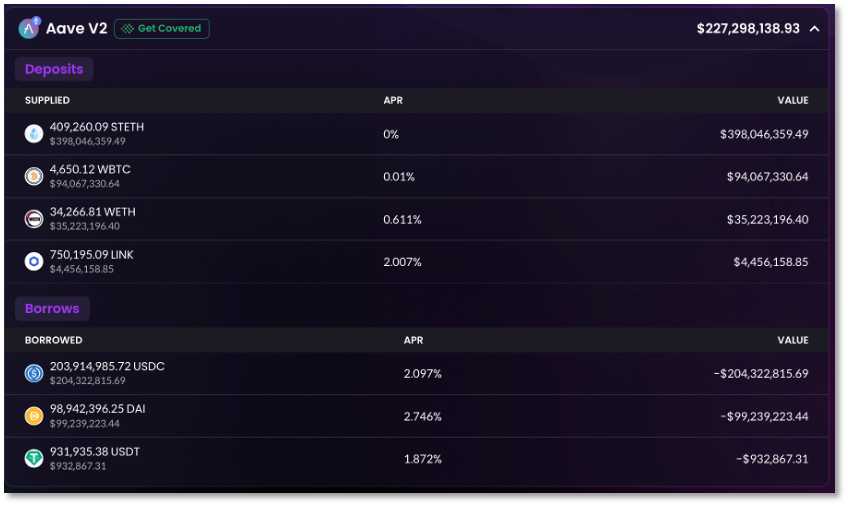

In addition, a wallet address of Celsius marked by blockchain data analysis service provider Nansen shows that the total value of encrypted assets owned by this address is 916 million US dollars, mainly including stETH, ETH, WBTC, WETH, LINK, COMP, etc., of which only The value of 802,000 US dollars is still lying in the wallet, and the rest of the value is used as collateral on the DeFi lending platforms Aave and Compound, and 688 million worth of various US dollar stablecoins are loaned out, including USDC, DAI and USDT.

image description

Celsius pledged a large amount of assets to the DeFi lending platform

In other words, the encrypted assets in the Celsius address are temporarily unable to flow, but it has borrowed a large amount of USD stable coins, and it is likely that it wants to use this to solve its redemption problem. However, there are greater risks in this method of "removing the east wall to pay the west wall". Once the value of the collateral drops, the lending platform will initiate a liquidation mechanism. If Celsius cannot replenish the collateral, it will face the risk of being liquidated.

Of course, this is just a wallet address of Celsius, and the outside world is still unable to know the payment gap of the platform, so it is impossible to judge how big its "thunder" is, but the withdrawal operation has exposed it to the liquidity crisis. Another company surrounded by crises is Three Arrows Capital.

On June 15, the media The Block quoted sources as saying that the total liquidation of Three Arrows Capital on Deribit, an encrypted asset derivatives trading platform, and BlockFi, a lending platform, was as high as US$400 million. relation.

Soon, Zhu Su, the founder of Three Arrows Capital, sent a tweet with vague information, "We are communicating with relevant parties and are committed to solving the problem." As for what problem he is solving, Zhu Su did not specify.

Founded in 2012 and registered in Singapore, the encrypted asset hedge fund has begun to expose problems, and the investment targets related to it are showing abnormalities. Starry Night, an NFT fund supported by Three Arrows Capital, has emptied a total of 70 NFT collections on the SuperRare platform, and these collections have consumed more than 21 million US dollars from the fund.

Both Celsius and Three Arrows Capital are facing a problem similar to "insolvency". The urgent liquidity of assets on hand is a symptom, but what is pushing them to the brink of danger?

first level title

Both giant whales are involved in the thunderstorm project Terra

For market veterans like crypto whales, the downside of the bear market is easy to predict, but some unpredictable "thunders" are likely to be planted early.

Take Celsius as an example. In the past 4 years, it has become a unicorn in the European and American markets of encrypted assets, attracting 1.7 million users. Last year, the scale of its B round of financing expanded from 400 million US dollars to 750 million US dollars. , valued at $3.5 billion. In addition to the lending business, Celsius began to expand into the bitcoin mining industry, with an investment scale of 300 million to 500 million US dollars.

But Celsius stepped on a lot of pitfalls, and stepped on the DeFi field, its main profit-making position.

In December last year, BadgerDAO was hacked and lost $120 million in encrypted assets, of which more than $50 million came from Celsius, including 2100 BTC and 151 ETH.

In June last year, ETH2.0 pledge solution company Stake Hound lost its private key and lost more than 38,000 ETH deposited by customers. The data analysis agency pointed out that 35,000 ETHs came from Celsius, but this was denied by the company.

These negative events continue to consume customers' trust in Celsius: Does a so-called professional encryption institution have a sound risk control mechanism? As a result, Terra's UST and LUNA thunderstorms once again crushed the customer's trust in Celsius.

After the decoupling of UST, blockchain data analysis agency Nansen pointed out that seven large encrypted wallets withdrew UST liquidity from Anchor (the lending platform on the Terra chain) and sold it on Curve (DEX on the Ethereum chain), which triggered UST The original reason for the decoupling, one of these 7 wallets belonged to Celsius.

This means that Celsius has arbitraged in Anchor, but the CEO of the company said that "we did not cause the LUNA crash and did not benefit from it", and the data analysts on the chain still found evidence that the wallet controlled by Celsius was at least in the past 5 At least 261,000 ETH ($535 million at the time) were sent to Anchor mid-month.

Judging from the results, Celsius’s withdrawal seems to have allowed it to escape from the UST thunderstorm, but the institution’s repeated risk-taking style in DeFi has made its users uneasy. Withdrawing from Celsius, panic began to spread, and an unmanageable run may be coming. This may be the reason why Celsius recently closed customer withdrawals.

The "thunder" of UST and LUNA hit the head of Three Arrows Capital. The fund is one of the investors of Terraform Labs, the issuer of this group of sister coins. It also led the investment of 500 million in the financing before the project collapsed. Dollar. According to the outside world's analysis of ZhuSu's actions that are still on the platform after the collapse of LUNA, there is a high probability that Sanjian Capital wants to recover losses from the reconstruction of the project.

After the fork of Terra created LUNC, the forked currency of LUNA, Three Arrows Capital purchased 10.9 million LUNCs with USD 559.6 million and pledged them on nodes to obtain rewards. Shrunk to $660.

The deficit of Three Arrows Capital is not limited to this.

On Bitfinex, an encrypted asset trading platform, Three Arrows Capital ranked second on the money-losing list, with a loss of US$31 million in May alone. In addition to losing money, an encrypted asset trader broke the news that Three Arrows Capital has lending positions on centralized lending platforms including BlockFi, Celsius, and Nexo, and there is a risk of liquidation.

Since May this year, Sanjian Capital has transferred 100,000 ETH to the exchange FTX, and it is not ruled out that it is cashing out ETH. In addition, in the past two days, Sanjian Capital has begun to exchange stETH for USD stablecoins through various methods at any cost.

image description

Three Arrows Capital recently transferred a large amount of stETH

Encrypted asset trader MoonOverload analyzed on Twitter that Sanjian Capital's move to sell stETH is more like repaying their debts in the DeFi lending application to avoid being liquidated.

Whether Celsius, which claims to be a "bridge between CeFi and DeFi", or Three Arrows Capital, which invests funds in DeFi on a large scale, the rise of the two giant whales is inseparable from the acceleration of DeFi in the bull market. In other words, the bull market magnifies the impact of DeFi on The catalytic effect of encrypted asset returns, Celsius and Three Arrows Capital have both ridden the wind of the trend and surfed in the bull market.

When the bear market came, the magnification effect of DeFi was gradually reflected in the risk. StETH was sold off due to the liquidity crisis of institutional giant whales, and it was de-anchored from ETH. Position-holding institutions with improper risk management are also involved, not only throwing more and more losses in the losses, but may also pass the risk to the wider market.

At present, Celsius has mortgaged at least 409,200 stETH on Aave. These stETH are still collateral and have not been sold, but there is a risk of liquidation. Because even if Celsius does not sell it himself, it cannot prevent other giant whales from selling stETH, such as the difficult Three Arrows Capital. Once stETH triggers liquidation, Celsius’s collateral will be liquidated if it cannot be replenished.

If Celsius chooses to sell stETH in order to restore users’ demand for withdrawals, this giant whale will also trigger the liquidation price, and spread the panic, attracting a wave of stETH selling, and then triggering a series of liquidations.

The situation faced by Three Arrows Capital is also the same. The crypto whales who once benefited from circular arbitrage are in a dilemma. DeFi Lego began to counterattack the giant whales when the liquidity crisis appeared.

The problem is that there are not a few such giant whales in the market. Celsius has many competing platforms, including BlockFi, Nexo, etc. Their business models are roughly the same. They are all CeFi platforms that grab profits from the DeFi market and are translucent. The way of application also conceals risks. For example, it is difficult for their users to know which DeFi project their assets flow to, whether the smart contract of the project is safe, and whether the liquidity of the platform is normal.....