Bitcoin Drops to $20,000, Is the Market Bottom?

Over the past two days, the crypto market has continued to decline.

but,

but,GlassnodeThe analysis report pointed out that a large number of macro indicators indicate that the encryption market is entering the darkest stage of this bear market cycle; Mike Novogratz, founder and CEO of digital currency company Galaxy Digital Holdings, believes that cryptocurrencies are closer to the "bottom" than US stocks, and the bottom of Ethereum should be at Around $1,000, Bitcoin is around $20,000.

Of course, this does not mean that it is suitable to buy bottoms at this stage. After all, encrypted finance is inseparable from the macro economy. Unless the Fed stops raising or lowering interest rates, it will be difficult for Bitcoin to go out of an independent upward market.

1. Market review: Bitcoin fell for 11 weeks in a row

On May 12, Bitcoin fell below $25,000 to hit a new low for the year, and has been consolidating and fluctuating around $30,000 since then; on June 7, the shock ended and started to go down again.

In the past week, Bitcoin has continued to fall from $31,500, and its decline has accelerated in the past 48 hours, falling as low as $20,800, with a maximum drop of 22%, the lowest level since December 2020. On the daily chart, Bitcoin has always been suppressed by the bull-bear boundary line (200-day moving average); and, from the weekly chart, Bitcoin has closed negatively for 11 consecutive weeks, the highest record since 2018.

In addition to Bitcoin, other cryptocurrencies such as Ethereum have also been hit hard. Among them, ETH once fell to $1074, with a maximum drop of 41% in a week; the top ten cryptocurrencies in the market, such as BNB, SOL, XRP, and ADA, generally had a maximum drop of about 30% in a week; other altcoins generally fell by more than 50%, which needs to be emphasized OP, affected by the coin loss incident and the overall trend of encryption, the largest drop in the past week reached 62%.

Affected by this, the market value of the entire encryption market has also shrunk by more than US$100 billion in the past 48 hours, once falling below the US$1 trillion mark; since the beginning of the year, the total market value of encryption has shrunk by US$1.3 trillion, a cumulative drop of 55%.

According to Coin data, in the past 24 hours, a total of US$1.55 billion has been liquidated across the network, and a total of 190,000 people have become liquidated victims, with the largest single liquidation being US$150 million; in the past 30 days, a total of US$8.5 billion has been liquidated.

In terms of on-chain transactions, according to data from Oukeyun’s on-chain masters, the liquidation volume of DeFi mortgage loans on the entire network reached 188 million US dollars in the past 24 hours, a new high for the year; The highest point of the year fell by more than 40%. According to Paidun’s monitoring, the MakerDAO treasury sold a total of 93,000 ETH twice yesterday to repay debts and reduce risks. The first batch of 65,000 ETH was sold at an average price of $1,155, and the second batch of 28,000 ETH was sold at an average for $1187.

In addition, users' enthusiasm for trading has dropped significantly. Today's panic and greed index is 8 (11 yesterday). The degree of panic has dropped compared with yesterday, and the level is still extremely panic.

Encryption-related listed companies have also been affected by the falling market, and their stock prices have generally fallen by more than 10% in the past two days. Among them, Argo Blockchain, a mining company, fell more than 18% on the London Stock Exchange and more than 16% on Nasdaq. The stock prices of Core Scientific, Iris Energy and TeraWulf fell 12.87%, 12.66% and 11.32% respectively; Canaan Technology (NASDAQ: CAN) fell 12.8% to $3.25 temporarily; the stock price of the encryption platform Coinabse fell 23% in 48 hours, hitting a record low of $46, and is currently maintained at around $50, down 80% from the IPO issue price ($250). %; the stock of MicroStrategy, the listed company with the largest Bitcoin holdings, fell by 25.1% in 48 hours, temporarily reported at $152.

In addition, cryptocurrency ETFs in Canada and Brazil also fell sharply on Monday, with Purpose Bitcoin ETF (BTCC), Evolve Bitcoin ETF (EBIT), CI Galaxy Bitcoin ETF (BTCX.B) opening down about 17%, while Ethereum ETFs generally fell more than 25% at the open.

2. Reasons for the decline: expectations of interest rate hikes, institutional reductions

On June 10, Vitalik, the founder of Ethereum,changed his Twitter nickname to "Yu Lin vitalik.eth", and some crypto communities began to spoof with pictures, rumors that "Ethereum is a Chinese fund, and it has been taken over by the police." .

Of course, jokes are jokes. It is undeniable that in this round of falling market, the decline of Ethereum, which is currently the largest encryption ecosystem, far exceeds that of other mainstream currencies, which is indeed unexpected. Behind the downturn in the market, there are not only macro unfavorable factors, but also related to the reduction of holdings by institutions.

At the macro level, the latest U.S. CPI data was 8.6%, and the 2-10-year U.S. Treasury yield curve was inverted in the early hours of Monday. In addition, the Federal Reserve’s FOMC interest rate resolution will be officially announced this Thursday. The market generally expects to raise interest rates by at least 50 basis points, and the probability of raising interest rates by 75 basis points will reach 20%. The interest rate was raised by 50 basis points in July and November, and by 25 basis points in December.

In the context of interest rate hikes, investors’ trading sentiment has been frustrated, and it is common for Bitcoin and U.S. stocks to fall at the same frequency. And, as monetary policy tightens in many parts of the world, cryptocurrencies have become a symbol of flight from speculative investments.

Susannah Streeter, senior investment and market analyst at Hargreaves Lansdown, said: "Bitcoin and Ethereum continue to be hit hard as inflation proves to be a tougher opponent than expected as investors weigh in on high inflation and fears that central bank rate hikes will hamper growth. Under the circumstances, higher risk assets will be abandoned.”

From the perspective of the encryption market itself, some leading institutions are not optimistic about the future trend, and have reduced their holdings of encrypted assets, especially ETH.

Take Three Arrows Capital as an example. Since late May, its address has continuously transferred ETH to the exchange, with a total of more than 120,000 ETHs. Zhu Su, the co-founder of Three Arrows Capital, also deleted ETH from his personal introduction on Twitter. , AVAX, LUNA, SOL, NEAR, MINA and other Token words. According to the data of Okey Cloud Chain masters, in the past month, the net inflow of BTC and ETH to centralized exchange addresses continued to increase, which also verified the intense market selling sentiment.

In addition, with the recent market downturn, some listed companies holding Bitcoin have also suffered heavy losses. The average purchase price of MicroStrategy’s bitcoins is US$30,700 per piece. Based on the current market price, it has lost nearly US$1 billion; Tesla owns about 42,000 bitcoins, with an average purchase price of US$31,600, a floating loss of 27% ; Jack Dorsey's Block (formerly known as Square) holds 8,027 bitcoins, with an average purchase price of $27,400 and a current floating loss of 16%. El Salvador has 2,301 bitcoins, with an average purchase price of 45,000, and a floating loss of more than 50%.

3. Future market expectations: close to the bottom, cautiously buy bottom

Regarding the market outlook, the market generally expects that $20,000 will become the most important support level for Bitcoin, and once it falls below it, it will cause a series of stampedes and trigger large-scale panic selling.

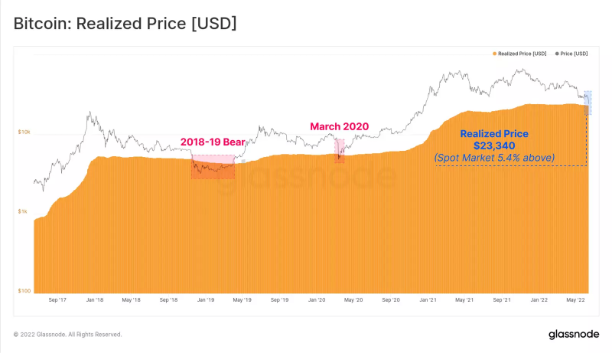

The Glassnode analysis report pointed out that a large number of macro indicators indicate that the encryption market is entering the darkest phase of this bear market cycle. At present, the market price of Bitcoin has fallen below the "realized price" and has a negative value. The last time this happened was the bear market in 2018 and March 2020, which means that Bitcoin has entered the "bottom of the bear market." Of course, that doesn't mean the bear market will be over anytime soon. (Note: Realized price represents the average price of each token in circulation, calculated at the value when it was last spent on-chain.)

Cryptocurrencies are closer to a "bottom" than U.S. stocks, according to billionaire investor Mike Novogratz, founder and CEO of digital currency company Galaxy Digital Holdings. Novogratz said at the Morgan Stanley Financial Conference that ethereum should be around $1,000 and bitcoin around $20,000, so cryptocurrencies are much closer to the bottom.

MicroStrategy said in a conference call in May of this year that if the price of Bitcoin fell to $21,000, they would need to invest more than the original $820 million pledged, implying bottom-selling.

In addition, a recent study by PricewaterhouseCoopers showed that while the overall cryptocurrency market is quite bearish, managers remain extremely bullish on BTC; most of the cryptocurrency fund managers surveyed believe that by the end of this year, the price of Bitcoin will be between Between $75,000 and $100,000.

Of course, this does not mean that it is suitable to buy bottoms at this stage. After all, encrypted finance is inseparable from the macro economy. Unless the Fed stops raising or lowering interest rates, it will be difficult for Bitcoin to go out of an independent upward market.